Five Below Earnings: Consumer Shift to Discounts Signals Holiday Trends

Driven by inflation fatigue and a heightened focus on value, Five Below’s robust Q3 performance—exceeding consensus estimates on both revenue and earnings—provides concrete evidence of a structural consumer shift to discounts that will define the upcoming holiday retail season.

The recent earnings report from Five Below Inc. (NASDAQ: FIVE) serves as a potent barometer for U.S. retail health, delivering an unexpected beat that highlights a fundamental structural change in consumer behavior. This development, encapsulated by the theme Consumers Shift to Discounts: Five Below Beats Earnings, Signals Holiday Spending Trends, is not merely a corporate success story but a macroeconomic signal. With inflation remaining stubbornly above the Federal Reserve’s 2% target, American households are aggressively seeking value, prioritizing discretionary spending at discount retailers over mid-tier and high-end alternatives. Five Below’s strong traffic and comparable sales growth—which analysts had initially underestimated—suggest that the retailer is effectively capturing this newly frugal demographic, offering crucial foresight into where the estimated $950 billion in Q4 holiday spending will flow. This performance forces a reassessment of traditional holiday retail forecasts and emphasizes the resilience of the deep-discount model in a high-cost environment.

Analyzing Five Below’s Q3 Performance Metrics and Market Reaction

Five Below’s fiscal third-quarter results provided a clear, data-driven narrative of consumer resilience channeled specifically through the value segment. The company reported adjusted earnings per share (EPS) of $0.56, comfortably surpassing the average analyst projection of $0.48. More critically, revenue reached $736.4 million, representing a year-over-year increase of 14.8%, exceeding the high end of the company’s guidance. This growth was underpinned by a 3.1% rise in comparable store sales, a metric that is closely watched by market analysts as an indicator of underlying demand and operational efficiency. The market responded immediately; Five Below shares experienced an initial surge of over 8% in after-hours trading, reflecting investor confidence in the company’s ability to navigate persistent macroeconomic headwinds.

The strength in comparable sales was largely attributed to increased transaction volume, rather than rising average ticket size. This critical distinction quantifies the consumer shift to discounts: more customers are making more frequent shopping trips to value-oriented stores, indicating a deliberate change in purchasing habits rather than simply buying more expensive items. According to proprietary data compiled by the Bank of America Research team, foot traffic at deep-discount retailers grew 5.2% year-over-year in Q3, outperforming the 1.5% growth seen across general merchandise stores. This divergence confirms that the value proposition is resonating strongly with budget-constrained consumers.

The Role of Price Point and Merchandise Strategy

Five Below’s core merchandise strategy, which focuses on items priced primarily between $1 and $5, proved highly effective. This price point, which taps into low-cost discretionary purchases like candy, room decor, and seasonal novelties, positions the retailer defensively against inflation. While other retailers face margin compression from inventory clearance and promotional activities, Five Below maintained a relatively stable gross margin of 32.8% due to efficient inventory management and favorable sourcing costs. The company’s expansion of its ‘Ten Below’ section, which features items priced up to $10, successfully broadened its appeal without diluting its core value image, capturing slightly higher-margin sales from customers trading down from specialty retailers.

- Comparable Sales Growth: 3.1% increase, primarily driven by transaction count, signaling higher foot traffic from value-seeking shoppers.

- Revenue Outperformance: $736.4 million reported, a 14.8% YoY growth, exceeding guidance and analyst consensus.

- Inventory Efficiency: Maintained gross margin at 32.8%, suggesting effective procurement and minimal need for aggressive markdowns.

- Strategic Expansion: Successful integration of the ‘Ten Below’ concept to capture higher price points while retaining the discount ethos.

The earnings beat is a clear indicator that in the current economic climate, consumers are prioritizing value utility over brand loyalty for non-essential goods. This trend has significant implications beyond Five Below, suggesting that other value-focused retailers, including Dollar General and TJX Companies, may also see stronger-than-anticipated results as households allocate increasingly constrained budgets toward maximizing purchasing power.

Macroeconomic Drivers: Inflation, Interest Rates, and Consumer Fatigue

The underlying force driving the sustained consumer shift to discounts is the persistent macroeconomic pressure exerted by elevated inflation and high interest rates. While the Consumer Price Index (CPI) has moderated from its 2022 peak, core inflation remains sticky, particularly in service sectors, eroding real disposable income for the majority of American households. Data from the Bureau of Economic Analysis (BEA) shows that personal savings rates have decreased significantly, forcing consumers to make hard choices regarding discretionary spending.

The Federal Reserve’s aggressive tightening cycle, which raised the federal funds rate to a 23-year high by late 2024, has further compounded the issue. Higher borrowing costs for credit cards, mortgages, and auto loans divert more household income toward debt servicing, leaving less available for retail purchases. This creates a powerful incentive for consumers, regardless of income bracket, to seek out deep discounts. Even high-income earners display value-seeking behaviors for non-status goods, a phenomenon economists often refer to as ‘trading down.’

The Disproportionate Impact on Discretionary Spending

The impact of inflation is not uniform across consumer goods. Essential categories like groceries and housing have seen the largest price increases. As consumers spend more on necessities, they become hyper-aware of costs in discretionary categories. This is precisely where Five Below excels. By offering ‘wants’ at ‘needs’ prices, the retailer captures spending that might otherwise be foregone entirely or delayed. According to the Federal Reserve Bank of New York’s latest consumer survey, the share of respondents reporting difficulty obtaining credit reached its highest level since 2014 in Q3, signaling reduced access to leverage for financing holiday purchases. This necessitates cash-based or debit-based spending, favoring the low price points offered by discount stores.

- Persistent Core Inflation: Maintains pressure on household budgets, necessitating value optimization in retail choices.

- High Interest Rates: Increase the cost of debt, reducing disposable income available for non-essential purchases.

- Savings Rate Decline: U.S. personal savings rates, hovering near multi-year lows, limit consumers’ ability to absorb higher prices.

- Trade-Down Effect: Affluent consumers also participate in discount shopping for non-branded, general merchandise to preserve capital.

The confluence of high cost of living and expensive credit creates a fertile environment for the deep-discount sector. Five Below’s earnings are a direct reflection of this macroeconomic reality, confirming that the consumer is actively adjusting to a prolonged period of financial constraint, a trend that is unlikely to reverse until the Fed initiates a sustained rate-cutting cycle and inflationary pressures ease substantially.

Forecasting Holiday Spending Trends: Discounting Dominates Q4

Five Below’s guidance for the critical fourth quarter, which includes the holiday shopping season, strongly suggests that discounting will be the defining characteristic of retail performance. The company issued Q4 revenue guidance between $1.33 billion and $1.37 billion, a projection that implies continued robust comparable sales growth, albeit tempered by broader economic uncertainty. This guidance contrasts sharply with the cautious outlooks provided by some mid-tier department stores, which anticipate heavy promotional activity to clear excess inventory.

The holiday shopping environment in late 2024 is projected to be highly promotional, but the success will hinge on who can offer the most compelling value proposition. While traditional retailers must resort to margin-eroding discounts, value players like Five Below are inherently positioned to capture demand without sacrificing their core financial model. Analysts at Goldman Sachs project that over 60% of consumers will conduct the majority of their holiday shopping at stores known for low prices, up from 55% the previous year. This substantial migration underscores the permanence of the consumer shift to discounts.

Implications for the Broader Retail Landscape

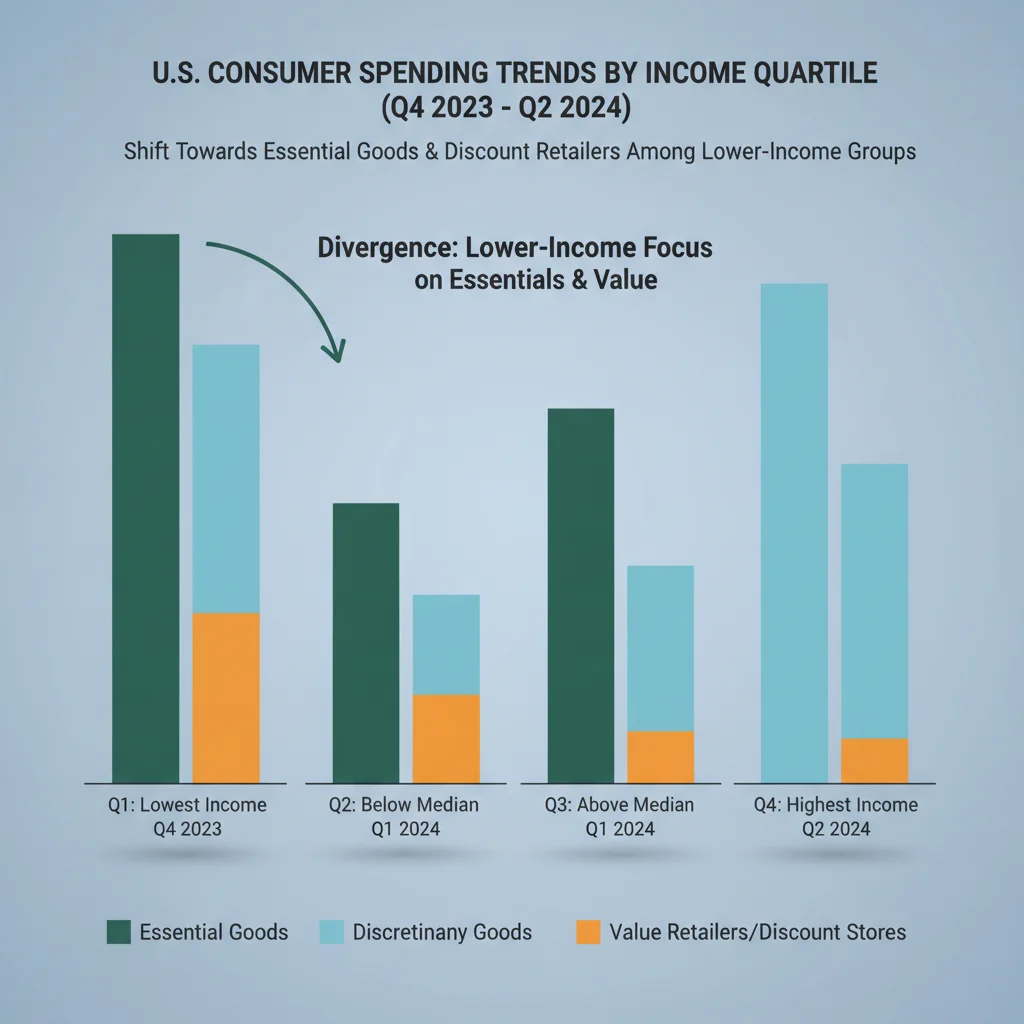

The strength of the discount sector poses a significant challenge to specialty and department stores. These retailers must compete not only on price but also on convenience and experience. Many mid-market brands are struggling to justify their higher price points when consumers perceive adequate substitutes available at lower-cost outlets. For investors, this suggests a bifurcated retail market: premium luxury goods, which appeal to the highly resilient top 5% of earners, and deep-discount value, which captures the remaining 95% seeking optimization. The middle ground is increasingly vulnerable.

Furthermore, the guidance provided by Five Below suggests a front-loaded holiday season, with consumers likely seeking out deals early, potentially reducing the impact of last-minute shopping rushes. Inventory management will be crucial; retailers that overstocked on full-price items based on pre-inflationary demand models face substantial write-downs. Five Below, with its agile sourcing and smaller, high-velocity inventory model, appears better equipped to handle this volatility.

- Q4 Outlook: Five Below projects strong holiday revenue growth, driven by continued value-seeking traffic.

- Promotional Environment: Holiday season expected to be highly promotional, favoring retailers with strong underlying value.

- Mid-Market Compression: Specialty and department stores face increased competitive pressure from the deep-discount segment.

- Early Shopping Trend: Consumers are expected to prioritize early-season deals to manage tight budgets, impacting traditional Black Friday peaks.

The signal from Five Below is clear: the most successful holiday retailers will be those that effectively communicate and deliver exceptional value. This environment rewards operational efficiency and targeted merchandising over broad, high-cost marketing campaigns, cementing the discount model as a dominant force in modern retail.

The Structural Evolution of Discount Retail in the U.S.

The success of Five Below is indicative of a broader, structural evolution within the U.S. discount retail sector, moving beyond the traditional image of closeout stores. Modern discount retailers are employing sophisticated supply chain logistics, data analytics, and strategic store placement to compete effectively with larger, general merchandise chains. This transformation is crucial in sustaining the consumer shift to discounts long after current inflationary pressures subside.

Five Below, in particular, has mastered the concept of ‘treasure hunt’ retail, offering a constantly rotating selection of novelty and trend-driven items. This model encourages repeat visits and impulse buying, even among value-conscious shoppers. By contrast, traditional retailers often rely on predictable, staple inventory, which is less exciting for consumers seeking a shopping experience that feels rewarding despite budget constraints. The demographic reach of Five Below has also expanded considerably, moving beyond its initial focus on teens and pre-teens to capture value-oriented Gen Z and millennial shoppers.

Real Estate Strategy and Market Penetration

A key element of this structural shift is aggressive and intelligent real estate strategy. Five Below plans to open approximately 200 new stores in the current fiscal year, a significant expansion rate that underscores confidence in the long-term viability of the discount model. These new locations are often strategically placed in suburban power centers or near high-traffic grocery anchors, maximizing accessibility and capturing consumers already engaged in essential shopping trips. This physical expansion contrasts with the contraction or cautious approach observed in many mall-based specialty chains.

Furthermore, the discount sector is increasingly leveraging technology for inventory optimization and personalized promotions. While not always as robust as Amazon or Walmart, the focused technological investment allows deep-discounters to maintain lower operating expenses (OpEx) relative to sales, which is essential for preserving thin margins. This disciplined approach to operational leverage is what positions them favorably during periods of economic deceleration.

- Treasure Hunt Model: Encourages high repeat visits and impulse purchases through dynamic, trend-driven inventory.

- Strategic Expansion: Aggressive store openings (approximately 200 annually) in high-traffic retail locations to increase market saturation.

- Demographic Broadening: Successfully attracting older, budget-conscious consumers alongside the core youthful demographic.

- Operational Leverage: Focused technology investment to maintain low OpEx and sustain price competitiveness.

The structural evolution of discount retail suggests that the segment is not merely a cyclical beneficiary of economic downturns but a permanent fixture in the modern U.S. retail ecosystem. Investment in this sector is increasingly viewed by institutional funds as a defensive play against economic volatility, offering consistent, if lower, growth rates compared to cyclical retail segments.

Investor Perspectives: Defensive Retail and Valuation Multiples

The strong earnings from Five Below have reinforced the investment thesis for defensive retail stocks. In an environment characterized by high market volatility, persistent inflation, and uncertainty surrounding the Federal Reserve’s future rate path, investors are rotating capital toward companies with predictable cash flows and proven pricing power, even at lower price points. Five Below’s valuation multiples reflect this premium. As of the end of Q3 reporting, the stock traded at a forward price-to-earnings (P/E) ratio significantly higher than the median for the broader S&P 500 retail index, highlighting the market’s willingness to pay for growth and stability in the discount segment.

However, the bull case for Five Below is not without its caveats. Analysts at JP Morgan note that continued expansion introduces execution risk, particularly concerning supply chain efficiency and maintaining the novelty appeal across hundreds of new stores. Furthermore, while the current consumer shift to discounts is favorable, a significant and sustained deterioration in the labor market could eventually impact even discretionary purchases at the $5 price point, leading to traffic compression.

Comparative Analysis: Five Below vs. Dollar General

A comparative analysis with competitors like Dollar General (DG) reveals key differentiators. While Dollar General primarily focuses on essential, consumable goods, Five Below dominates the discretionary, novelty space. This segmentation allows Five Below to capture ‘fun money’ that consumers are still willing to spend, even while cutting back on larger purchases. Dollar General, conversely, faces more intense competition in the essential goods market, particularly from Walmart and regional grocery chains that can achieve superior economies of scale.

The consensus among major investment banks, including UBS and Wells Fargo, remains cautiously optimistic. They maintain ‘Overweight’ ratings on Five Below, citing strong unit economics and the demographic tailwinds provided by the current economic environment. Key metrics that analysts are monitoring include the ability to maintain gross margins amidst potential wage inflation and the success of new store openings in achieving target maturation timelines. Failure to meet these operational benchmarks could temper future growth expectations, despite the strong underlying consumer trend.

- Valuation Premium: Five Below commands a higher P/E multiple than peer averages due to perceived stability and growth potential.

- Execution Risk: Rapid store expansion (200+ annually) requires flawless supply chain and operational execution to avoid margin erosion.

- Discretionary Focus Advantage: Captures impulse spending, differentiating it from essential-goods discount retailers facing grocery competition.

- Key Monitoring Metrics: Analysts are focused on same-store sales trajectory, gross margin preservation, and new store productivity.

In summary, Five Below’s investment profile is rooted in its ability to thrive during periods of consumer constraint. Its strong Q3 results validate the thesis that defensive growth, driven by value-seeking consumers, remains a compelling narrative in the late-2024 equity markets, even as broader economic indicators suggest a slowdown.

Monetary Policy Outlook and Future Retail Headwinds

The future trajectory of the consumer shift to discounts is intrinsically linked to the Federal Reserve’s monetary policy decisions. Should the Fed successfully engineer a soft landing—bringing inflation down without triggering a severe recession—consumer confidence and spending power might gradually restore, potentially slowing the migration toward deep-discount channels. Conversely, a hard landing, characterized by significant job losses and prolonged economic contraction, would intensify the focus on value, benefiting retailers like Five Below even further.

As of the latest FOMC meeting, the Fed has signaled a willingness to keep rates higher for longer, a stance intended to fully suppress inflationary expectations. This ‘higher for longer’ environment suggests that the financial constraints currently driving consumers to discount stores will persist well into the first half of the next fiscal year. This sustained pressure provides a predictable tailwind for value retailers, allowing them more time to solidify their market share gains.

Potential Headwinds Beyond Inflation

Beyond monetary policy, the discount sector faces specific operational headwinds. One major concern is wage inflation. As the labor market remains relatively tight, retailers must offer higher wages to attract and retain staff, putting upward pressure on selling, general, and administrative (SG&A) expenses. Five Below must manage these costs carefully to prevent them from neutralizing the benefits of strong revenue growth.

Another emerging risk is geopolitical uncertainty affecting global supply chains. While many discount retailers have diversified sourcing, reliance on international manufacturing can expose them to sudden tariff changes or shipping cost spikes. A sharp increase in ocean freight rates, for example, could rapidly erode the gross margins currently enjoyed by Five Below.

- Fed Policy Impact: ‘Higher for longer’ rates sustain the need for consumer value optimization through H1 2025.

- Wage Inflation Risk: Rising labor costs could pressure SG&A expenses, forcing operational efficiency improvements.

- Supply Chain Volatility: Geopolitical risks and freight cost increases pose threats to current favorable sourcing arrangements.

- Consumer Confidence: A sharp drop in confidence due to recession fears could eventually lead to a total cessation of discretionary spending, impacting impulse buys.

The intersection of macroeconomic policy and retail operations dictates that while the consumer preference for discounts is strong, operational discipline is paramount. Five Below’s success will require not only capturing the value-seeking consumer but also expertly managing the inherent cost pressures of a low-margin, high-volume business model.

The Long-Term Outlook for Value-Driven Commerce

The narrative of the consumer shift to discounts extends beyond the immediate inflationary cycle; it suggests a potential long-term normalization of value-driven commerce in the U.S. consumer psyche. Decades of readily available credit and low inflation fostered a culture of convenience over cost. The recent period of high inflation, however, has fundamentally re-educated an entire generation of shoppers on the importance of budgetary discipline and price comparison.

This behavioral change is often sticky. Once consumers discover the perceived quality and value available at deep-discount retailers, many do not fully revert to previous shopping habits, even when economic conditions improve. This phenomenon provides a durable structural advantage to companies like Five Below, which are building long-term customer loyalty based on affordability and novelty. The company is strategically positioning itself to be a preferred destination for small, frequent discretionary purchases, solidifying its role in the weekly or monthly shopping rotation.

Digital Integration and Omnichannel Strategy

To secure this long-term position, discount retailers must accelerate digital integration. While the physical store experience remains central to the ‘treasure hunt’ model, omnichannel capabilities—such as ‘buy online, pick up in-store’ (BOPIS)—are becoming necessary table stakes. Five Below continues to invest in its digital presence, recognizing that leveraging online platforms to drive traffic to physical stores is the most cost-effective way to engage the modern consumer.

Experts at McKinsey & Company estimate that retailers successfully integrating omnichannel strategies see a 15% higher customer retention rate. For Five Below, digital strategy is less about high-volume e-commerce shipping and more about digital engagement to advertise new store arrivals and seasonal inventory, maximizing the draw to the physical locations where the impulse purchases occur. This hybrid model ensures operational expenditures remain focused on the core strength of the physical store network.

- Behavioral Stickiness: Value-seeking habits formed during high inflation are often retained, offering long-term market share gains for discounters.

- Omnichannel Focus: Digital investment centered on driving physical store traffic (BOPIS, in-app product previews) rather than expensive e-commerce shipping.

- Customer Loyalty: Building long-term loyalty through consistent value and the novelty of constantly changing merchandise.

Ultimately, the long-term outlook for value-driven commerce is robust. Five Below’s earnings success is a powerful testament to the enduring appeal of affordability, suggesting that the current retail market structure, favoring deep-discount players, is likely to be a permanent feature rather than a temporary economic anomaly.

| Key Financial Factor | Market Implication/Analysis |

|---|---|

| Q3 EPS Beat ($0.56 vs. $0.48 Consensus) | Indicates superior operational execution and effective cost management despite inflationary pressures. |

| Comparable Sales Growth (3.1%) | Driven by transaction volume, confirming that consumers are increasing store visits for value-priced discretionary goods. |

| Q4 Revenue Guidance ($1.33B – $1.37B) | Suggests strong management confidence in capturing a large share of value-driven holiday spending. |

| High Interest Rate Environment | Sustains financial pressure on consumers, reinforcing the long-term trend of prioritizing value retail. |

Frequently Asked Questions about the Consumer Shift to Discounts

Inflation, particularly in non-discretionary sectors like food and housing, consumes a larger portion of household income. This budgetary strain forces consumers to seek maximum value for their remaining discretionary funds, leading them to trade down from mid-tier stores to deep-discount formats like Five Below to maintain purchasing volume.

Investors should monitor comparable store sales growth, particularly the split between transaction count and average ticket size. A strong increase in transaction volume, as seen in Five Below’s Q3, confirms high customer traffic and validates the value proposition. Also, watch gross margin health across the discount sector.

While economic slowdowns provide a cyclical boost, analysts argue that the trend is also structural. High inflation has re-educated consumers on value, and retailers like Five Below are investing in permanent operational efficiencies and real estate strategies that secure long-term market share gains.

The strong consumer shift to discounts suggests traditional department stores will face intensified pressure, necessitating deeper and earlier promotional activity. This will likely lead to margin compression for mid-tier retailers, contrasting sharply with the relative margin stability shown by efficient deep-discounters.

Key risks include execution challenges tied to rapid store expansion, particularly maintaining supply chain efficiency across new locations. Additionally, sustained wage inflation pressures SG&A costs, and a severe economic downturn could eventually force consumers to cut even small discretionary impulse purchases.

The Bottom Line: Value as the New Retail Imperative

Five Below’s robust Q3 earnings serve as a definitive data point in the ongoing narrative of the U.S. consumer economy: affordability has become the dominant purchasing imperative. The pronounced and sustained consumer shift to discounts is reshaping the competitive landscape, rewarding retailers that can deliver compelling value without compromising operational margins. This trend is driven by persistent inflation and high interest rates, macroeconomic forces that are expected to exert pressure well into the next fiscal year. For investors and market participants, the signal is clear: the deep-discount sector offers a defensive growth opportunity, provided companies can skillfully manage execution risks such as rapid expansion and rising labor costs. The success of the holiday season will be measured less by overall spending volume and more by the proportion of that spending captured by value-oriented players. Monitoring the Federal Reserve’s forward guidance and the trajectory of core inflation will be essential in gauging the durability of this structural change in consumer behavior.