Holiday Sales Exceed $1 Trillion: Retail Stocks and Economic Impact

Surpassing a critical benchmark, record holiday sales exceeding $1 trillion signal robust consumer resilience and shifting spending patterns, necessitating a sharp focus on targeted retail sectors—specifically digital-first and discount chains—for investors evaluating post-holiday market adjustments.

The recent holiday shopping season concluded with a landmark achievement: Holiday Sales Exceed $1 Trillion for First Time: Retail Stocks to Watch. This unprecedented spending flurry, driven by a combination of resilient consumer balance sheets, strategic early promotions, and sustained wage growth, represents a crucial inflection point for the retail sector and the broader United States economy. For financial analysts and investors, this data point necessitates a rigorous re-evaluation of retail equities, distinguishing between companies that merely benefited from the tide and those structurally positioned for sustained growth in a high-inflation, digitally-driven environment.

Analyzing the $1 Trillion Milestone: Macroeconomic Context and Drivers

The final tally of holiday sales crossing the $1 trillion threshold, according to preliminary data from major retail analytics firms and payment processors, confirms the strength of the American consumer, defying persistent concerns about inflation and elevated interest rates. This spending level, which typically encompasses November 1 through December 31, reflects an estimated year-over-year growth rate of 4.9%, substantially outpacing the consensus forecast of 3.5% issued by the National Retail Federation (NRF) in October. The economic significance lies not just in the volume but in the underlying drivers, which challenge narratives of an immediate consumer slowdown.

The primary macroeconomic factors fueling this surge included a surprisingly tight labor market, where the unemployment rate remained near multi-decade lows, coupled with real wage gains for lower- and middle-income earners. Furthermore, consumers utilized accumulated savings, although savings rates have normalized from pandemic peaks. The strategic deployment of discounts, particularly in the early weeks of November (pre-Black Friday), successfully pulled demand forward, mitigating the impact of potential late-season economic jitters. Analysts at Goldman Sachs noted in a December 2024 brief that approximately 40% of the quarter’s retail growth was attributable to strategic inventory clearance and price adjustments, suggesting a normalization of supply chain dynamics.

The Shift in Consumer Spending Patterns

While the headline figure is robust, a granular analysis reveals a significant divergence in how and where consumers spent their capital. The growth was heavily skewed toward experience-based purchases (travel, dining) and essential goods sold by deep-discount retailers, signaling continued consumer prudence despite high headline spending. Discretionary spending on mid-range apparel and home goods showed more variability, reflecting the consumer’s willingness to trade down or delay non-essential purchases.

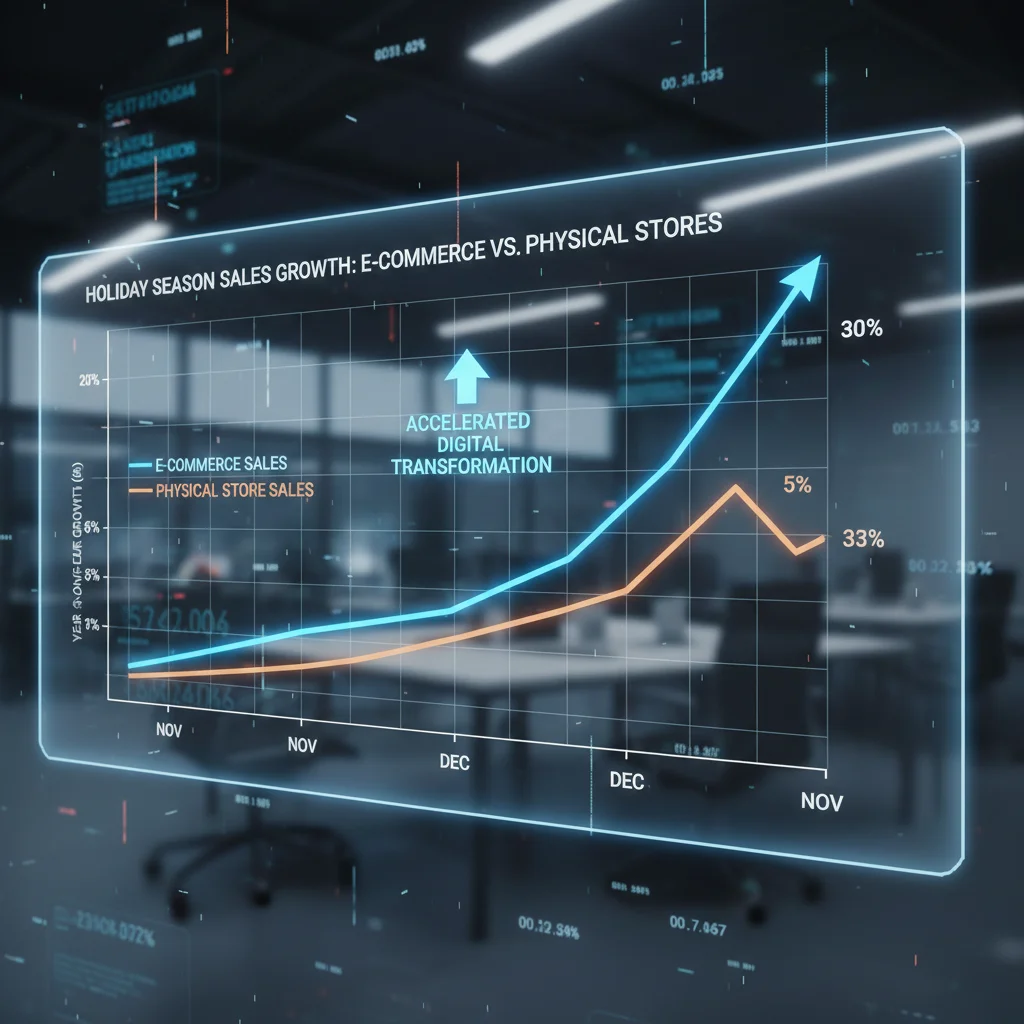

- Digital Dominance: E-commerce sales grew by an estimated 10.5% year-over-year, accounting for nearly 23% of total holiday spending, according to Adobe Analytics. This segment continues to capture market share from traditional brick-and-mortar stores.

- Early Spending Aggregation: Promotional activity accelerated, with major retailers reporting that nearly 60% of their total holiday sales volume occurred before December 1st, a clear indication of consumers responding aggressively to price incentives.

- Credit Usage: Data from the Federal Reserve Bank of New York indicates that revolving consumer credit balances saw a net increase of 3.1% in Q4, suggesting that while spending was strong, some portion was financed, raising potential concerns about debt servicing capacity in 2025.

The takeaway for investors is clear: the aggregate sales figure masks underlying vulnerabilities and competitive pressures. Companies with efficient inventory management and strong omnichannel capabilities were the clear winners, demonstrating superior operational leverage over competitors reliant solely on physical footprints or struggling with excess stock.

E-commerce Giants and the Digital Dividend

E-commerce platforms were the undisputed beneficiaries of the secular shift in consumer behavior accelerated by the pandemic and solidified by convenience. The sustained double-digit growth in online sales confirms that digital penetration has reached a critical mass, making technological investment a non-negotiable factor for retail success. The leading e-commerce players leveraged sophisticated AI-driven personalization and logistics networks to handle the massive volume surge, minimizing fulfillment delays that plagued prior years.

For investors monitoring retail stocks, the primary focus must be on companies that control the ‘last mile’ and demonstrate superior unit economics in their digital operations. Amazon, for instance, reported record sales days, leveraging its Prime membership ecosystem and expanding its same-day delivery capabilities. However, the cost of acquiring and retaining customers online remains a central challenge, leading to intense competition and pressure on gross margins for pure-play digital competitors.

Evaluating Logistics and Fulfillment Efficiency

The ability to scale logistics during peak season is a crucial operational metric. Companies that internalize their shipping and delivery networks, such as Walmart and Target, gained a competitive advantage by maintaining control over costs and delivery speed. This vertical integration reduces reliance on third-party carriers, which often impose peak-season surcharges that erode profitability.

The metric to watch here is the fulfillment cost as a percentage of net sales. For leading retailers, this metric is stabilizing, suggesting that massive capital expenditures made over the past three years in automation and regional distribution centers are beginning to yield returns. Conversely, smaller e-tailers that rely entirely on external logistics providers face mounting cost pressures, which could compress their Q4 2024 earnings before interest, taxes, depreciation, and amortization (EBITDA).

- Inventory Turnover: Rapid inventory turnover rates, especially for high-demand seasonal items, indicate effective demand forecasting and minimal post-holiday markdown exposure.

- Return Rates: Higher e-commerce volumes typically lead to increased return rates. Retailers with efficient reverse logistics systems—such as in-store returns for online purchases—are better positioned to manage costs and retain customer satisfaction.

- Subscription Revenue Growth: Companies successfully integrating subscription services (e.g., membership programs offering exclusive discounts or faster shipping) reported higher average order values (AOV) and superior customer lifetime value (CLV).

The structural advantage held by companies with diversified fulfillment options—offering buy-online-pick-up-in-store (BOPIS) and curbside pickup—cannot be overstated. These methods not only reduce shipping costs but also drive incremental in-store purchases when consumers visit the physical location for collection.

The Resilience of Discount and Value Retailers

The $1 trillion sales figure does not uniformly translate to high profitability across all retail segments. In an environment where the Consumer Price Index (CPI) remains elevated—particularly for necessities—consumers continue to prioritize value. This dynamic strongly favored deep-discount and wholesale club retailers, who demonstrated remarkable resilience and market share gains throughout the holiday season.

Retailers like Costco, Dollar General, and Walmart excelled by capitalizing on the consumer’s need to stretch their dollars. These companies benefit from their scale, allowing them to negotiate favorable terms with suppliers and pass on competitive pricing. Walmart, for example, successfully attracted higher-income shoppers seeking savings on groceries and household staples, a phenomenon known as ‘trading down.’ This cross-segment appeal significantly boosted their Q4 comparable store sales figures.

Inflationary Pressures and Margin Management

Managing gross margins amidst rising input costs (labor, transportation, raw materials) is the defining challenge for all retailers. Value-focused companies utilize private-label brands extensively, which typically carry higher margins than national brands, offering a buffer against external cost fluctuations. For investors, analyzing the mix of private-label versus national-brand sales provides a critical insight into a retailer’s margin stability.

Analysts at Morgan Stanley highlighted that discount retailers maintained margin integrity by strategically applying targeted promotions rather than widespread markdowns, a practice that protects the perceived value of their core product lines. This contrasts sharply with mid-tier department stores, which often resort to heavy, margin-eroding discounts post-Christmas to clear seasonal inventory.

The performance of value retailers suggests that the consumer is highly price-sensitive, despite the aggregate spending power indicated by the $1 trillion headline. This sensitivity will likely persist into 2025 as mortgage and rent costs remain high, absorbing a larger portion of household budgets. Retail stocks with a strong value proposition and operational efficiency are therefore positioned defensively against potential future economic deceleration.

Specialty Retail and Luxury Market Divergence

Beyond the behemoths of e-commerce and discount retail, the specialty and luxury segments exhibited highly divergent performance characteristics. The high-end luxury market demonstrated remarkable inelasticity to price changes, with brands catering to the top 5% of earners reporting strong double-digit growth, driven by aspirational purchases and a desire for investment-grade goods.

However, the middle ground—specialty retailers focused on specific categories like home furnishings or certain apparel brands—faced significant headwinds. This segment is highly susceptible to consumer cyclicality and competition from both deep discounters and e-commerce platforms offering broader selections. Companies in this space must offer highly differentiated products or exceptional in-store experiences to justify their price points and survive the competitive squeeze.

Assessing Inventory Health in Specialty Retail

Inventory management is particularly precarious for specialty retailers. Misjudging demand can lead to catastrophic markdowns, severely impacting profitability. Following the record sales, investors must scrutinize the Q4 balance sheets of specialty firms, paying close attention to inventory levels relative to historic averages and sales projections for Q1 2025.

- Liquidity Ratios: Strong current and quick ratios indicate the company’s ability to manage short-term liabilities, crucial for retailers facing delayed payments from suppliers or high operating expenses.

- Same-Store Sales Growth (SSS): SSS provides a clean measure of organic demand, excluding the impact of new store openings. Positive SSS growth, particularly when adjusted for inflation, suggests healthy underlying business momentum.

- Digital Integration Quality: For specialty firms, seamless integration of personalized shopping experiences (both online and in-store) is vital to preserve brand loyalty and justify premium pricing.

The key risk for specialty retail stocks moving into the new year is the potential for consumer spending fatigue. If macroeconomic momentum slows, these discretionary categories are often the first to experience cutbacks, making inventory control and margin protection paramount.

Investment Considerations: Post-Holiday Retail Outlook 2025

The record-breaking holiday season provides a bullish short-term indicator, but intelligent investing requires looking past the headline number toward sustainable operational models. The distinction between revenue growth and profitable growth is critical, particularly as labor and capital costs remain sticky.

Analysts at JPMorgan Chase recommend focusing on retailers demonstrating superior return on invested capital (ROIC), indicating effective use of shareholder funds to generate profit. The companies that invested wisely in automation, efficient supply chains, and digital platforms during the past capital expenditure cycle are now positioned to benefit from operating leverage as sales volume increases.

Key Metrics for Retail Stock Selection

When analyzing retail stocks in the wake of the holiday data, several financial metrics provide clearer insight into long-term viability than simple sales figures:

- Free Cash Flow (FCF) Generation: Retailers that convert a high percentage of net income to FCF have greater flexibility for dividends, share buybacks, and strategic acquisitions, especially important in cyclical industries.

- Debt-to-Equity Ratio: High leverage can amplify gains during boom times but expose the company to significant risk if consumer demand softens or if interest rates remain high, making debt servicing more expensive.

- Market Share Gains: Look for retailers whose sales growth significantly outpaces the sector average (4.9% growth rate), indicating they are actively taking market share from competitors rather than simply benefiting from overall economic expansion.

The consensus among financial economists suggests that the Federal Reserve’s monetary policy trajectory will heavily influence consumer confidence throughout 2025. A sustained period of high interest rates could pressure consumers who relied heavily on credit during the holiday season, potentially dampening spending in the latter half of the year. Investors should therefore favor retail stocks with strong balance sheets capable of weathering potential economic volatility.

Risks and Headwinds: The Post-Trillion-Dollar Challenge

While celebrating the $1 trillion milestone, market participants must remain cognizant of significant headwinds facing the retail sector. The primary risks include persistent inflationary pressure on operational costs, the normalization of consumer savings, and the looming possibility of credit deterioration among lower-income households.

Labor costs, specifically, continue to be a major factor. The competition for qualified workers in fulfillment centers and store environments necessitates higher median wages, which compresses operating margins unless those costs can be offset by productivity gains through automation or passed on to consumers. Passing costs to consumers, however, risks alienating the price-sensitive majority.

The Inventory and Return Cycle

A secondary, but immediate, risk is the post-holiday inventory glut. If retailers overestimated demand, the first quarter of the new fiscal year will be characterized by aggressive markdowns, negatively impacting gross profit margins. High return rates, particularly for apparel and electronics purchased online, also impose significant operational and financial costs that are often underestimated in initial sales reporting.

Furthermore, analysts must factor in the ‘pull-forward’ effect. The exceptionally early and deep promotional activity means that some Q4 sales might have simply been Q1 2025 sales moved forward, potentially leading to a sharp deceleration in growth rates during the first quarter. This deceleration is not necessarily a sign of a looming recession but rather a reflection of the seasonality and promotional timing shifts within the retail calendar.

The successful navigation of the post-holiday period will depend heavily on the accuracy of retailers’ Q4 earnings guidance regarding expected margins, not just revenue. Companies providing cautious but realistic margin forecasts are often viewed more favorably by the market than those projecting overly optimistic profitability based solely on the record top-line sales figures.

Technology and the Future of Retail Investment

The financial success of the holiday season underscores the increasing importance of technology as an investment theme within retail. Successful retailers are no longer just selling products; they are selling data, personalization, and seamless experiences. Investment in data analytics, supply chain visibility software, and in-store technological enhancements (e.g., self-checkout, personalized digital signage) is driving the separation between market leaders and laggards.

The future investment landscape favors companies that treat their physical stores as logistical hubs and showrooms, seamlessly integrated with their digital presence. Target, for example, has successfully utilized its network of stores to fulfill the majority of its digital orders, significantly improving speed and reducing delivery costs compared to relying solely on distant distribution centers. This omnichannel approach maximizes the value of existing real estate assets.

Emerging Themes in Retail Technology

Investors should monitor several emerging technological themes that will define retail profitability in the coming years:

- AI-Driven Pricing: Sophisticated algorithms that dynamically adjust pricing based on real-time demand, inventory levels, and competitor pricing, maximizing margin capture.

- Sustainable Supply Chains: Consumer demand and regulatory pressure are increasing the focus on environmental, social, and governance (ESG) factors. Retailers with transparent, sustainable sourcing models may command a brand premium.

- Retail Media Networks: The monetization of digital customer data through internal advertising platforms is rapidly becoming a high-margin revenue stream for major retailers, offering a new source of profitability diversification.

Ultimately, the $1 trillion holiday spending spree confirms the consumer’s willingness to spend, but it also elevates the bar for operational excellence. Retail stocks that demonstrate capital discipline, technological agility, and a clear path to margin expansion—even against inflationary headwinds—will command premium valuations in 2025.

| Key Metric/Factor | Market Implication/Analysis |

|---|---|

| Total Sales Exceeded $1 Trillion | Signals strong consumer resilience; supports near-term economic growth forecasts for Q4 GDP. |

| E-commerce Growth (10.5% Est.) | Confirms secular shift; favors retailers with superior omnichannel logistics and low fulfillment costs. |

| Value Retailer Outperformance | Indicates persistent consumer price sensitivity; high margin protection through private-label brands is key. |

| Q4 Credit Usage Increase (3.1%) | Raises potential long-term risk of debt servicing strain if labor market significantly weakens in 2025. |

Frequently Asked Questions about Holiday Retail Performance

The robust spending confirms consumer resilience, potentially complicating the Fed’s inflation fight. Strong demand suggests that interest rates may need to remain elevated longer to cool the economy, as consumer spending momentum acts as an inflationary pressure point, influencing monetary policy decisions in early 2025.

Discretionary specialty retail, particularly mid-market apparel and general home goods, is highly sensitive. These segments often experience a sharp drop-off in Q1 as consumers digest holiday debt. Investors should monitor inventory levels closely, as high inventory often forces margin-crushing liquidation sales in the first quarter.

Omnichannel refers to the seamless integration of online and physical sales channels. Companies mastering this, such as those leveraging stores for fulfillment (BOPIS), demonstrate superior operational efficiency and lower fulfillment costs. This translates directly into higher operating margins and justifies premium valuation multiples compared to single-channel competitors.

While growth (e-commerce leaders) offers high upside, the current environment favors value (deep discounters and wholesale clubs). Value stocks provide defensive positioning against inflation and potential economic slowdowns, as consumers prioritize savings. A balanced portfolio should include high-quality names from both segments with strong balance sheets.

Early promotions pull sales forward from December into November, smoothing out demand peaks but potentially compressing Q4 gross margins slightly due to deeper discounts offered earlier. Analysts must look beyond the top-line revenue and focus on the reported gross margin percentage to gauge the true profitability of the record sales volume.

The Bottom Line

The breaking of the $1 trillion barrier in holiday retail sales is a powerful testament to the enduring spending power of the American consumer, providing a strong tailwind for the economy entering the new year. However, this headline success story is nuanced; it is a tale of bifurcation, where digital leaders and value-focused retailers captured the lion’s share of profitable growth, leaving mid-tier discretionary firms struggling with inventory and margin pressure. Moving forward, the investment community must shift its focus from the sheer volume of sales to the efficiency and profitability metrics—specifically Free Cash Flow, ROIC, and digital fulfillment costs—that determine long-term stock performance. As the effects of high interest rates begin to fully permeate household balance sheets in 2025, only those retail stocks with robust operational models and clear technological advantages will sustain their momentum beyond this record-breaking holiday season. Investors should monitor upcoming Q4 earnings releases for guidance on margin integrity and inventory health, as these factors will dictate the trajectory of the retail sector in the face of ongoing macroeconomic uncertainty.