Credit Card Rates Exceed 22%: Three Strategies to Escape Debt Now

Record-high credit card APRs, now exceeding 22%, necessitate immediate and aggressive action; implementing strategies like balance transfers or debt consolidation loans can significantly mitigate the crushing effect of compounding interest on consumer liabilities.

The financial landscape for American consumers is defined by elevated borrowing costs, with average credit card Credit Card Rates Exceed 22%: Three Strategies to Escape Debt Now, according to Federal Reserve data as of the latest reporting period. This environment of sustained high interest rates, driven by the Federal Reserve’s prolonged campaign against inflation, is generating unprecedented pressure on household budgets, making effective debt management crucial for financial stability.

The Economic Context: Why Rates Climbed Past 22%

The current surge in credit card Annual Percentage Rates (APRs) is not an isolated event but a direct consequence of the Federal Reserve’s aggressive tightening cycle initiated in 2022. As the Federal Open Market Committee (FOMC) raised the federal funds rate from near-zero levels to the current target range, the cost of borrowing across the economy, including variable-rate consumer products like credit cards, followed suit. Since most credit card APRs are tied to the prime rate, which moves in lockstep with the federal funds rate, consumers have absorbed the full force of monetary policy aimed at cooling demand and curbing inflation.

This sustained period of high rates compounds the challenge for consumers already grappling with persistent inflation, particularly in essential categories such as housing and food. Data from the New York Fed indicates that total household debt exceeded $17.5 trillion in the first quarter of 2024, with credit card balances alone hovering near $1.13 trillion. The confluence of high balances and high rates creates a powerful headwind, where minimum payments often cover little more than the accrued interest, trapping borrowers in a cycle of diminishing principal reduction.

The Mechanics of Variable APRs and Prime Rate Linkage

Credit card agreements typically stipulate a variable interest rate calculated by adding a margin determined by the issuer to the financial industry’s prime rate. When the Federal Reserve adjusts the federal funds rate, the prime rate responds almost immediately, usually within days. For consumers carrying an average balance of $6,000, a movement from 15% to 22% APR translates into hundreds of dollars in additional annual interest expenses, severely eroding disposable income. Bank analysts at major institutions like JPMorgan Chase and Goldman Sachs have noted a corresponding increase in credit card delinquency rates, suggesting that the strain is now reaching critical levels for a significant segment of the population.

- Federal Funds Rate Influence: The Federal Reserve’s target rate dictates the base for the prime rate, which is the benchmark for most variable consumer loans.

- Compounding Effect: High APRs mean interest accrues daily on the outstanding balance, leading to exponential growth of debt if only minimum payments are made.

- Profitability for Issuers: While consumers suffer, high credit card rates contribute significantly to the profitability of major card issuers, offsetting potential losses from rising delinquencies.

The implication for households is clear: relying on minimum payments in a 22%+ APR environment is financially unsustainable. The priority must shift from simply managing debt to aggressively eliminating it through strategic maneuvers that reduce the effective interest rate paid. Economic projections suggest that while the Fed may eventually pivot to rate cuts, high consumer rates are likely to persist well into 2025, demanding immediate, proactive debt management.

Strategy 1: The Zero-Percent Balance Transfer Maneuver

The most immediate and impactful defensive strategy against soaring credit card APRs is the targeted use of 0% introductory balance transfer offers. This move involves shifting high-interest debt from existing cards to a new card offering a promotional period—typically 12 to 21 months—during which no interest accrues on the transferred balance. This effectively creates a temporary interest-free window, allowing 100% of the monthly payment to go toward principal reduction.

Financial advisors often characterize the balance transfer as a triage tool, providing critical breathing room. However, this strategy is only effective if executed with precision and discipline. Card issuers typically charge a balance transfer fee, ranging from 3% to 5% of the transferred amount. For instance, transferring a $10,000 balance with a 4% fee adds $400 to the total debt. This fee must be weighed against the interest savings achieved over the promotional period. If a consumer is currently paying 22% interest, saving that rate for 18 months usually far outweighs the one-time 4% fee.

Execution and Pitfalls of Balance Transfers

Successful implementation requires a rigorous repayment plan. The consumer must calculate the monthly payment necessary to eliminate the entire transferred balance before the 0% APR period expires. Failure to do so results in the remaining balance reverting to the card’s standard variable APR, which might be equally high or higher than the original card’s rate. According to a recent analysis by Credit Karma, only about 60% of consumers who utilize balance transfers manage to pay off the entire balance before the promotional period ends, highlighting the need for strict adherence to the repayment schedule.

Furthermore, consumers must be vigilant about the terms. Most 0% APR deals apply only to the transferred balance, not to new purchases made on the card. Utilizing the new card for everyday spending can complicate the repayment strategy and potentially negate the interest savings. Key criteria for selecting a balance transfer card include the length of the introductory period, the transfer fee percentage, and the standard APR that will apply post-promotion.

- Calculate Payoff: Divide the total transferred balance (including the fee) by the number of months in the promotional period to determine the required monthly payment.

- Credit Score Requirement: The most favorable 0% APR offers are typically reserved for consumers with FICO scores above 720, underscoring the importance of maintaining strong credit health.

- Avoid New Debt: The primary goal of the balance transfer is debt elimination; new spending on the card must be avoided during the promotional window.

For those with excellent credit and disciplined budgeting capabilities, the 0% balance transfer is a powerful economic tool that transforms high-cost revolving debt into a manageable, time-bound liability. It provides a structural advantage against the current high-rate environment by temporarily decoupling personal debt from the Federal Reserve’s monetary policy decisions.

Strategy 2: Debt Consolidation Through Personal Loans

When the debt load is too substantial to be managed effectively with a balance transfer, or if the consumer’s credit score prohibits qualifying for the best 0% APR offers, debt consolidation via a personal installment loan becomes the preferred strategic alternative. A fixed-rate personal loan allows the borrower to pay off multiple high-interest credit card debts with a single loan, ideally at a significantly lower interest rate—often ranging between 8% and 15% for qualified borrowers, depending on credit profile and market conditions.

The primary advantage of the personal loan approach is the conversion of variable, compounding credit card debt into fixed-rate, amortizing debt with a predictable payoff date. This stability is invaluable for budgeting and long-term financial planning. Unlike credit cards, which offer endless revolving credit, a personal loan has a defined term (e.g., 36 or 60 months) and a fixed monthly payment that cannot fluctuate, forcing systematic principal reduction.

Evaluating Loan Terms and Credit Impact

Lenders, which include traditional banks, credit unions, and online fintech platforms, assess risk based on the applicant’s creditworthiness. While a 22%+ credit card rate applies universally to the consumer’s revolving balance, a personal loan rate is highly personalized. A consumer with a strong credit history and stable income might secure a rate half that of their credit card APR, generating substantial savings. Conversely, those with poor credit may find personal loan rates comparable to, or only marginally better than, their current credit card rates, making the consolidation less beneficial.

The application of a debt consolidation loan typically results in a short-term dip in the borrower’s credit score due to the inquiry and the opening of a new credit line. However, the subsequent payoff of credit card balances significantly reduces the credit utilization ratio—the amount of debt owed versus the total available credit—which is a major factor in FICO score calculation. As utilization drops, the credit score tends to rebound quickly and often improves substantially, reflecting a healthier debt structure.

- Fixed Rate Security: Personal loans lock in an interest rate, insulating the borrower from future Federal Reserve rate hikes.

- Lower Interest Floor: Even a loan at 12% represents a 10 percentage point savings compared to the average 22% credit card APR.

- Streamlined Payments: Consolidating multiple monthly payments into one simplifies household budgeting and reduces the risk of missed payments.

Choosing the right personal loan requires careful comparison of origination fees, prepayment penalties (which should ideally be zero), and the final effective Annual Percentage Rate (APR), which includes all associated costs. For consumers burdened by multiple cards and high balances, the debt consolidation loan offers a robust, structural solution to regain control over their liabilities.

Strategy 3: The Debt Avalanche Method for Accelerated Payoff

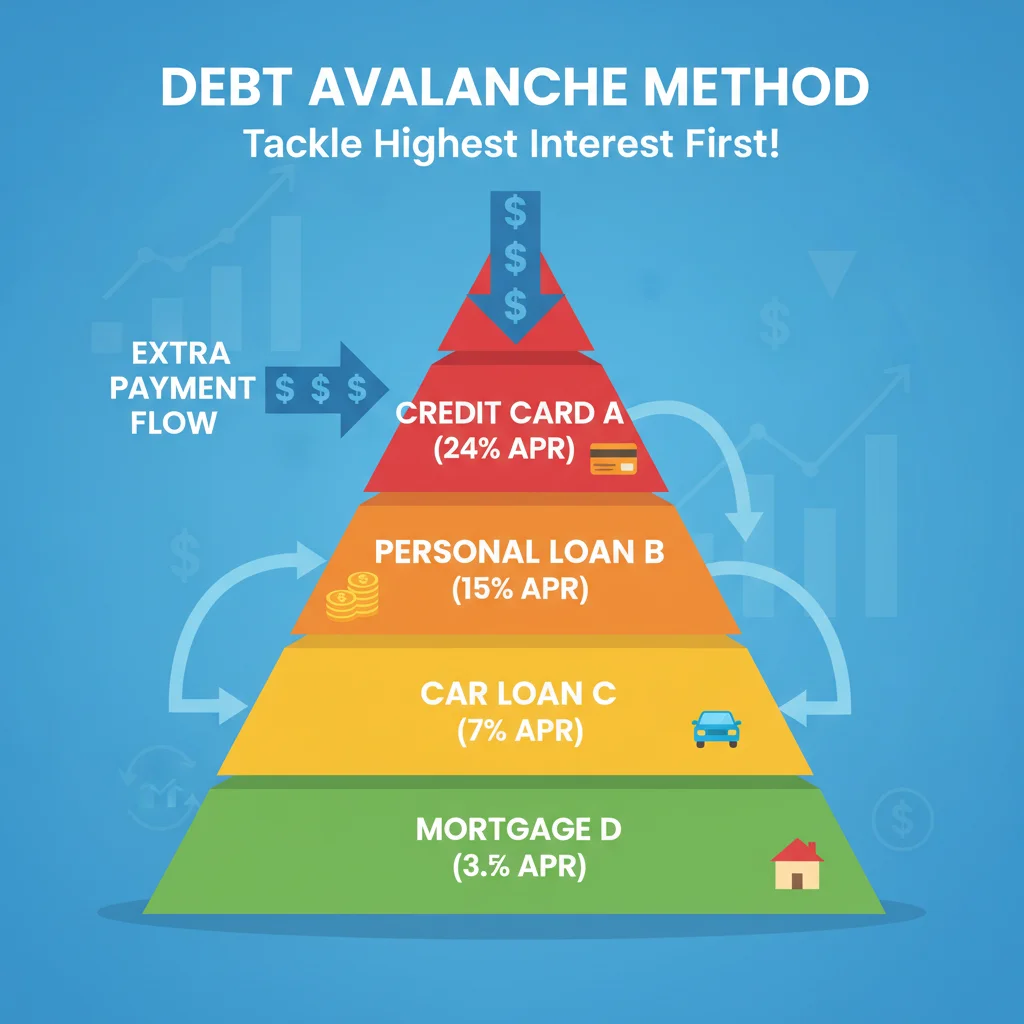

For consumers who cannot or choose not to access external credit products like balance transfers or personal loans, the most powerful internally driven strategy is the Debt Avalanche method. This approach maximizes mathematical efficiency by prioritizing the debt with the highest interest rate, regardless of the balance size. The core principle is simple: attack the most expensive debt first, thereby minimizing the total interest paid over the life of the debt.

In the current environment where the average credit card APR is above 22%, it is highly likely that credit card debt will be the primary target of the avalanche method. The consumer continues to make minimum payments on all debts but directs any extra cash flow—derived from budget cuts, side income, or bonuses—exclusively toward the principal of the account with the highest APR. Once that debt is fully extinguished, the consumer rolls the entire previous payment amount (the minimum payment plus the extra payment) onto the next highest-rate debt, creating a snowball of increasingly large payments focused on principal reduction.

Comparing Avalanche to Snowball: Maximizing Financial Efficiency

The Debt Avalanche method contrasts sharply with the popular Debt Snowball method, which prioritizes the smallest balance first for psychological wins. While the snowball provides emotional momentum, the avalanche provides maximum financial efficiency. When credit card rates are 22% or higher, the mathematical benefit of the avalanche far outweighs the psychological payoff of the snowball. For every dollar saved in interest, that dollar becomes available to pay down principal faster, creating a virtuous cycle of debt reduction.

To implement the avalanche successfully, a detailed inventory of all consumer debts is required, ranked strictly by APR. This requires precise data collection from credit card statements and loan documents. The focus must be unwavering, resisting the temptation to divert extra funds to lower-rate debts or savings until the highest-rate liability is neutralized. This disciplined approach is critical to escaping the excessive interest charges inherent in the 22%+ APR environment.

- Ranking Criteria: Debts must be ranked exclusively by their Annual Percentage Rate (APR), from highest to lowest.

- Extra Payment Allocation: All surplus funds must be directed to the principal of the top-ranked (highest APR) debt.

- Interest Savings: This method ensures the lowest possible total interest expenditure over the debt payoff period, accelerating financial freedom.

The financial rigor of the Debt Avalanche is the optimal internal mechanism for consumers to combat the high-rate regime, turning the compounding power of interest against the debt itself rather than letting it work against the borrower.

The Critical Role of Credit Utilization and Score Management

Regardless of which debt strategy is employed—balance transfer, consolidation loan, or Debt Avalanche—the management of credit utilization remains paramount. Credit utilization, defined as the ratio of outstanding credit card balances to total credit limits, is the second most important factor in FICO score calculations, trailing only payment history. Maintaining utilization below 30% is generally recommended, but elite financial health requires keeping this ratio below 10%.

When consumers carry high balances, particularly above the 50% utilization mark, their credit scores suffer significant damage, making it extremely difficult to qualify for the low-interest external debt solutions (like 0% APR cards or low-rate personal loans) discussed above. The high-rate environment creates a feedback loop: high utilization causes low scores, which prevents access to low rates, thus keeping interest payments high, and sustaining high utilization.

Breaking the Utilization Feedback Loop

Aggressively paying down principal, which is the goal of all three strategies, directly addresses the utilization problem. When a consumer uses a debt consolidation loan to pay off $20,000 in credit card debt, the utilization ratio immediately drops to zero percent (assuming the cards are not used again), resulting in a rapid credit score increase. This improved score then opens doors to better financial products, such as lower mortgage rates or cheaper car loans, generating long-term wealth benefits.

Moreover, consumers should consider requesting credit limit increases on their existing, low-balance cards, provided they have the discipline not to use the additional credit. A higher total credit limit, with the same outstanding balance, instantly lowers the utilization ratio. However, financial prudence is key; this action is only advised if the consumer is firmly committed to the debt reduction process and avoiding new debt accumulation.

The strategic management of credit utilization is not just about securing a better score; it is a financial defense mechanism that reduces perceived risk by lenders, thereby lowering the cost of future essential borrowing. In an economy defined by high interest rates, maximizing credit health is synonymous with minimizing unnecessary financial expenditure.

Macroeconomic Outlook: Interest Rate Persistence and Consumer Resilience

The sustained high level of credit card APRs is tied inextricably to the Federal Reserve’s commitment to achieving its 2% inflation target. While the pace of inflation has moderated from its peak, the persistence of core inflation metrics means that the ‘higher for longer’ interest rate narrative remains dominant among central bank watchers. Analysts at institutions like Morgan Stanley and Bank of America project that significant, sustained relief in the federal funds rate is unlikely before late 2025, suggesting that credit card rates above 20% will be the norm for the foreseeable future.

This macroeconomic backdrop elevates the importance of the three strategies outlined. Consumers cannot afford to wait for a broad market correction or a Fed pivot to lower their debt costs; immediate, individual action is required. The economic pressure is evident in the rising charge-off rates reported by major credit card issuers, signaling increased financial distress among lower- and middle-income segments. These charge-offs represent uncollectible debt, putting further pressure on issuers to maintain high APRs to compensate for rising risk.

Implications for Household Savings and Wealth

The high cost of debt fundamentally impedes household wealth creation. Every dollar spent on 22%+ interest is a dollar that cannot be allocated to retirement savings, emergency funds, or investment vehicles. The opportunity cost of carrying high-interest debt is substantial, often exceeding the expected returns from conservative investment portfolios in the current market. Therefore, the return on investment (ROI) of debt elimination—guaranteed savings equivalent to the APR—is often the highest available for consumers.

Financial planning experts consistently advise that paying off high-interest consumer debt should be prioritized over almost all other financial goals, second only to establishing a basic emergency fund. The 22% rate acts as a high hurdle for any other financial effort, effectively demanding a 22% guaranteed return on investment just to break even against the debt cost. This mathematical reality underscores the urgency of implementing strategies one, two, or three effectively.

Consumer resilience in this high-rate environment will depend heavily on the adoption of proactive financial strategies. Those who successfully transition their high-APR revolving debt into either 0% introductory periods or lower fixed-rate loans will be best positioned to weather the current economic climate and begin rebuilding their financial foundations.

Implementing the Strategies: A Decision Framework

Deciding which of the three strategies—Balance Transfer, Personal Loan Consolidation, or Debt Avalanche—is best depends entirely on the consumer’s specific financial profile, including their credit score, total debt load, and repayment discipline. A structured decision framework can guide the choice, ensuring the most financially optimal path is selected.

Framework for Selection

The initial assessment requires a clear, objective look at the household balance sheet. Total credit card debt relative to annual income provides a crucial metric. If the total debt is less than 30% of annual income and the consumer has an excellent credit score (740+), the 0% Balance Transfer is often the fastest and cheapest solution, provided the debt can be paid within the promotional window (typically 18 months). The low one-time fee is usually preferable to the interest charges of a personal loan.

If the debt load is higher (30% to 50% of income), or if the credit score is good but not excellent (680-740), a Personal Loan Consolidation offers better stability and a longer runway for repayment (3 to 5 years). The fixed rate provides certainty, which is a significant psychological benefit when managing large liabilities. The personal loan is also superior for borrowers with high debt across many cards, simplifying the repayment landscape.

Finally, for consumers with lower credit scores (below 680) or those prioritizing maximum financial efficiency without incurring new loan applications or fees, the Debt Avalanche is the necessary path. It requires the most rigorous budgeting and determination but delivers the highest mathematical savings by attacking the highest-cost debt first. Success in this strategy is purely a function of internal discipline and cash flow management.

- Credit Score > 740 & Debt < 30% Income: Focus on 0% APR Balance Transfer for rapid payoff.

- Credit Score 680-740 & Debt 30%-50% Income: Opt for Debt Consolidation Loan for fixed-rate stability and manageable term length.

- Credit Score < 680 or Max Efficiency Required: Implement the Debt Avalanche method, prioritizing the 22%+ APR cards.

By applying this framework, consumers can move beyond reacting to the high-rate environment and proactively select a strategy that maximizes their ability to escape the compounding interest of 22%+ credit card debt, transforming a financial liability into a defined, manageable problem.

| Key Factor/Metric | Market Implication/Analysis |

|---|---|

| Average Credit Card APR | Exceeds 22%; necessitates immediate debt restructuring to mitigate crippling compounding interest costs tied to the prime rate. |

| Debt Consolidation Loan Rates | Typically 8% to 15% for qualified borrowers, providing significant savings (7-14 percentage points) compared to credit card debt. |

| Credit Utilization Ratio | Should be targeted below 10%; aggressive debt payoff (Strategies 1-3) is the fastest way to raise FICO scores and unlock better credit terms. |

| Balance Transfer Fee | Ranges from 3% to 5%; must be offset by the interest savings achieved during the 12-21 month 0% promotional period. |

Frequently Asked Questions about High Credit Card Rates

Credit card APRs are variable and linked to the prime rate, which moves almost instantly with the Fed’s federal funds rate. When the Fed raises rates to combat inflation, the prime rate increases, and card issuers automatically pass these higher costs onto consumers, resulting in APRs climbing above 22%.

Not always. A balance transfer is superior if you can pay off the debt within the 12-to-21-month promotional window, minimizing interest costs beyond the 3%-5% transfer fee. If a longer repayment term (3-5 years) is needed, a fixed-rate debt consolidation loan, even at 10-15% APR, offers better long-term predictability and stability.

The fastest way is by reducing your credit utilization ratio, which is the second most important credit factor. Paying off high balances instantly lowers utilization, often leading to a rapid and significant increase in your FICO score within one to two reporting cycles, improving access to favorable future credit.

In a high-rate environment where APRs exceed 22%, the Debt Avalanche method is mathematically superior. It prioritizes the highest interest rate debt first, minimizing the total interest paid and accelerating the overall timeline for debt freedom, despite the potentially slower psychological satisfaction.

Success requires addressing the underlying spending habits. Implement a rigorous zero-based budget, maintain a fully funded emergency savings account, and consider reducing credit limits on old cards. The newly freed cash flow should be directed toward savings and investments, not renewed consumption.

The Bottom Line

The persistence of average credit card APRs above 22% represents a significant headwind for American household finances, demanding immediate, calculated counter-measures. This high-rate environment transforms consumer debt into a high-cost liability that actively erodes wealth accumulation. The three strategies—the 0% balance transfer, the fixed-rate personal loan, and the disciplined Debt Avalanche—each offer a viable, data-driven pathway to mitigate the financial damage. The optimal choice depends on individual variables like credit health and debt magnitude, but the imperative remains the same: proactive restructuring of debt is now synonymous with financial survival. As the Federal Reserve maintains its cautious stance against inflation, consumers must operate under the assumption that high borrowing costs are the new normal, making debt elimination the highest-yield investment available today.