Immigration Decline 1 Million in 2025: Housing Market Impact

The projected 1 million reduction in US immigration for 2025 is set to significantly decelerate housing demand growth, potentially easing rental price pressures in key gateway cities like New York and Los Angeles, according to economic models.

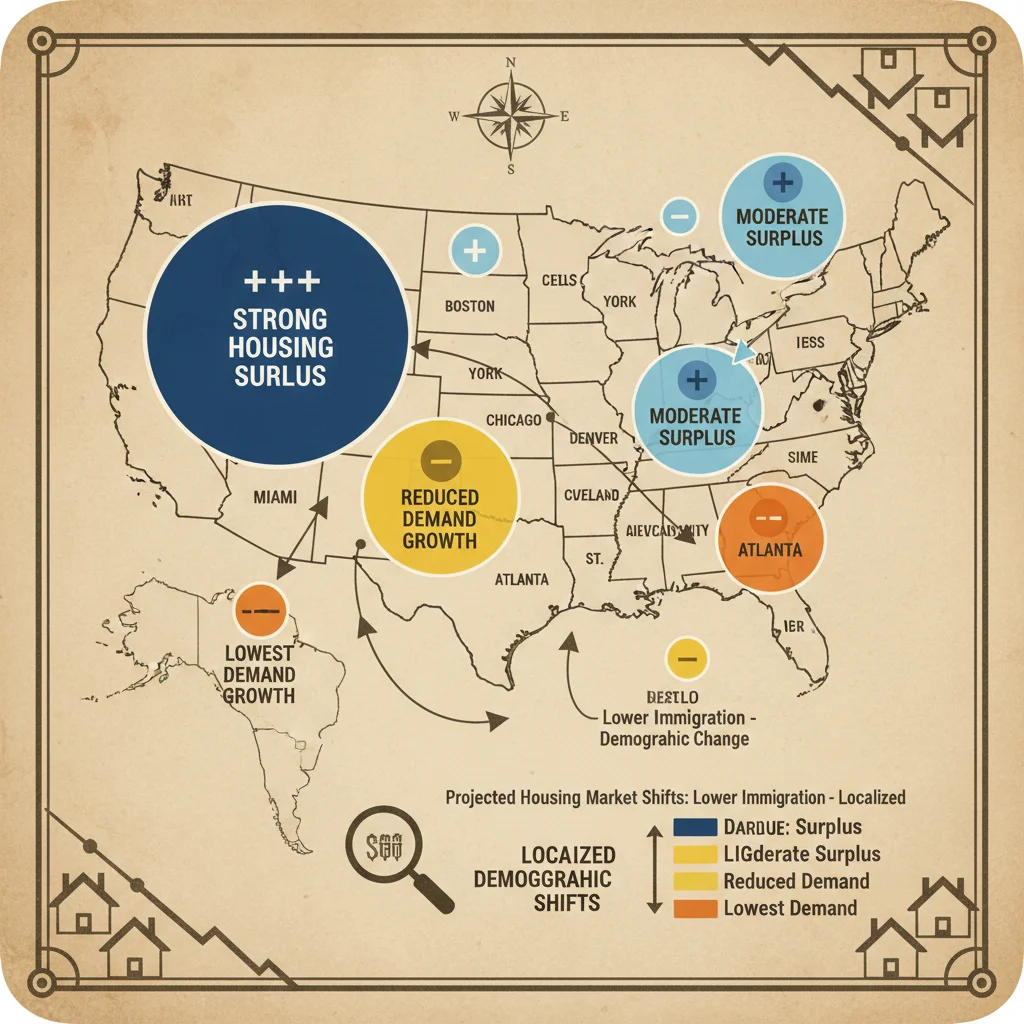

The US economic landscape for 2025 is being reshaped by significant demographic shifts. Projections indicate a crucial reduction in net immigration, estimated at approximately 1 million fewer arrivals compared to baseline forecasts. This projected decline in net migration, formalized in various institutional reports, directly impacts the housing sector, creating a distinct scenario where the perennial issue of under-supply might meet a sudden, localized deceleration in demand. The critical question for developers, investors, and policymakers is how the theme, Immigration Declined 1 Million in 2025: Housing Demand Impact by City, will manifest across diverse metropolitan statistical areas (MSAs), particularly those historically reliant on foreign-born population growth for housing absorption.

Analyzing the 1 Million Immigration Deficit and Shelter Demand

Demographic trends are the bedrock of long-term housing market analysis. Historically, net international migration contributes significantly to household formation, particularly in high-cost coastal markets and rapidly expanding Sun Belt cities. A reduction of 1 million planned or expected immigrants in the 2025 fiscal year represents a material shock to the demand curve. To quantify this, the average household size for recent immigrants is often smaller than the national average, suggesting that 1 million people could translate into 350,000 to 450,000 fewer newly formed households needing shelter in the short term, according to estimates by the Joint Center for Housing Studies at Harvard University.

The Economic Multiplier of Population Inflow

Immigrants typically enter the housing market through the rental sector before transitioning to homeownership. This makes the immediate impact of the deficit most visible in multi-family and entry-level single-family rental markets. The sudden reduction in population inflow disrupts the equilibrium, especially in cities where vacancy rates are already critically low, defined as below 5% for rentals. The resulting environment shifts the negotiating power, albeit marginally at first, back toward the tenant.

- Rental Vacancy Rates: Analysts project a potential 50 to 80 basis point increase in overall urban rental vacancy rates in gateway cities by Q3 2025, reversing some of the tightness observed in 2023 and 2024.

- Household Formation Deceleration: The expected rate of new household formations nationally may drop from a projected 1.2 million to closer to 800,000 in 2025, largely attributed to this demographic variable.

- Construction Pipeline Risk: Developers with large, unleased multi-family projects scheduled for completion in late 2025 or early 2026 face higher lease-up risk and potentially lower initial effective rent growth.

The implication is that while total housing demand remains robust due to structural under-supply, the pace of growth—the critical variable for real estate investors—will slow markedly. This effect is not uniform; it is geographically concentrated, tied directly to historical immigrant settlement patterns.

Differential Impact on Gateway Cities vs. Sun Belt Hubs

The geographical distribution of the housing impact is highly uneven. Gateway cities, which historically absorb a disproportionately large share of new immigrants, are expected to feel the cooling effect first and most acutely. Conversely, high-growth Sun Belt metros, which rely more on domestic migration and corporate relocations, may experience less severe deceleration, though still noticeable.

Gateway City Housing Market Correction

Cities like New York, Los Angeles, and Chicago rely heavily on population growth to maintain housing price momentum due to limited land and high regulatory costs. These markets typically see immigrants filling crucial roles in the service and healthcare sectors, generating demand for high-density, often rent-controlled or rent-stabilized, housing units. The reduction in new arrivals means fewer tenants available to backfill units vacated by residents moving to the suburbs or other states.

In New York City, for instance, where housing stock is notoriously inelastic, a substantial portion of recent demand pressure, particularly in the outer boroughs, was linked to rapid demographic changes. Goldman Sachs analysts estimate that a sustained 1 million reduction nationally could translate into a 1.5% to 2.5% decrease in effective rent growth in New York MSA rental markets in 2025, a stark contrast to the 4.1% average growth rate seen between 2021 and 2023.

Sun Belt Resilience and Demand Diversification

Sun Belt cities—including Phoenix, Dallas, and Tampa—have benefited from robust domestic migration, attracting residents from higher-tax states. While these areas also attract international migrants, their housing demand is more diversified. The impact of the immigration housing impact is thus buffered. However, the multi-family construction boom in these areas, driven by optimistic absorption forecasts, now faces increased scrutiny. Data from Costar indicates that Dallas-Fort Worth is slated to receive over 40,000 new rental units in 2025. If immigration-driven demand evaporates, the absorption schedule for these units could stretch, potentially leading to increased owner concessions and slower rental appreciation rates, even if absolute rents do not fall.

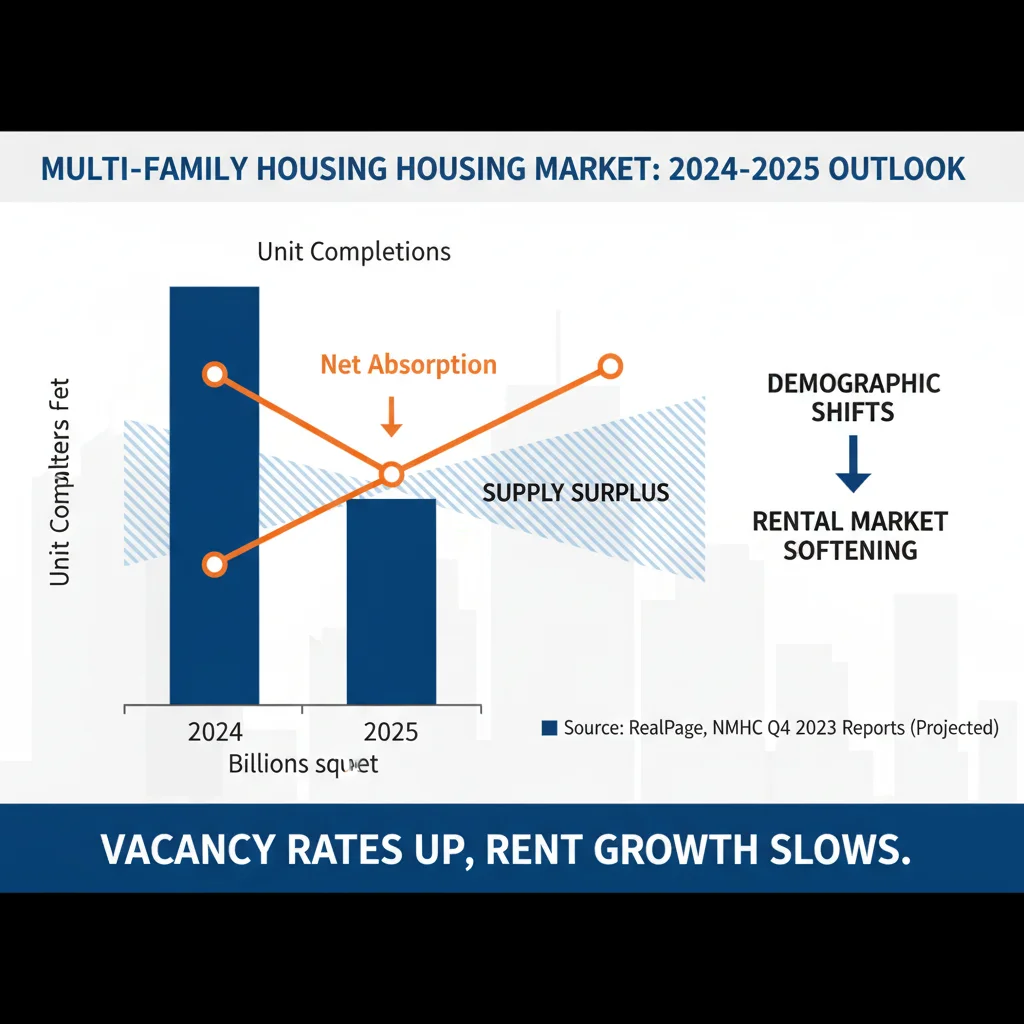

The Multi-Family Sector: Supply and Absorption Dynamics

The multi-family housing sector is the most sensitive to immediate demographic shifts. The period between 2022 and 2024 saw aggressive capital investment in apartment construction, predicated on strong, continuous population growth. The projected 2025 immigration shortfall fundamentally alters the risk profile for investors holding newly constructed assets.

Lease-Up Challenges and Concessions

For decades, the US housing market has operated under the assumption of continuous, strong population growth, fueled in part by immigration. This assumption justified rapid development, particularly in the high-density apartment category. Now, the reduced influx means developers must compete more fiercely for a smaller pool of new renters. This competition is manifesting in the form of increased lease concessions.

- Concession Trend: In Q4 2024, the median concession offered for new leases in multi-family buildings in major metros stood at 1.5 months of free rent. Projections for Q3 2025 suggest this could rise to 2.0 to 2.5 months in oversupplied markets like Austin and Charlotte.

- Net Effective Rent (NER): The primary metric for investors, NER (rent minus concessions), is expected to stagnate or decline slightly (0.5% to 1.0% year-over-year) in these oversupplied markets, even if face rents remain stable.

- Cap Rate Pressure: Slower rent growth and increased operational costs due to tenant retention efforts will pressure capitalization rates, potentially leading to downward valuation adjustments for multi-family assets acquired at peak 2022 valuations.

The market is transitioning from a period of high rent growth driven by scarcity to one where supply, coupled with reduced demographic tailwinds, requires more cautious underwriting. The impact of immigration housing impact is a direct challenge to the high-growth thesis that dominated the rental market narrative in the early 2020s.

Impact on Single-Family Housing and Entry-Level Buyers

While multi-family units see the immediate effect, the single-family housing market, particularly the entry-level segment, experiences a delayed but consequential ripple effect. Immigrants, after establishing financial stability, often transition into homeownership, typically focusing on affordable suburban areas adjacent to major employment centers.

Suburban Market Dynamics and First-Time Buyers

The reduction in future demand for homeownership means that the expected pipeline of first-time buyers will shrink, potentially offering a slight reprieve for domestic buyers struggling with high interest rates and low inventory. However, the overall inventory constraints remain the dominant factor, mitigating any sharp price declines.

Data from the National Association of Realtors (NAR) consistently shows that foreign-born buyers constitute a significant, though regionally varying, portion of the homeownership market. The projected 2025 deficit suggests that the rate of growth in demand for starter homes in areas like Riverside, California, or the suburbs of Washington D.C., will moderate. This effect is compounded by the persistent high cost of capital, with 30-year fixed mortgage rates hovering near 7.0% as of late 2024.

Analysts at Moody’s Analytics suggest that the primary impact on the single-family segment will be slower price appreciation, rather than outright depreciation. Instead of the 5% to 7% annual price growth projected under baseline demographic scenarios, the market may see 2% to 3% growth in 2025, essentially moving sideways after accounting for inflation. This sluggish growth reflects the cooling demographic engine.

Policy Response and Future Demographic Trajectories

The immigration housing impact scenario is not purely an organic market shift; it is influenced by policy decisions regarding border management, visa processing, and economic conditions globally. The projections for the 1 million decline are based on current policy stances and global migration patterns observed through 2024.

Monitoring Key Policy Indicators

Investors must monitor legislative and executive changes that could rapidly alter net migration figures. Any policy shift that accelerates legal immigration pathways could quickly reintroduce demand into the housing market, particularly given the speed at which many immigrants seek housing upon arrival.

- Labor Market Demand: If the US labor market remains exceptionally tight (unemployment below 4.0%), pressure to increase skilled worker visas (H-1B) could counteract some of the overall demographic decline, particularly in tech hubs like Seattle and San Francisco.

- Global Economic Instability: Unforeseen geopolitical events or economic crises abroad could lead to increased spontaneous migration, potentially offsetting formal quota reductions.

- Federal Reserve Stance: While not directly linked to immigration, the Fed’s management of interest rates affects the affordability threshold. Lower rates could boost domestic buyer demand, partially masking the demographic slowdown.

The key takeaway for financial planning is that policy uncertainty amplifies demographic forecasting risk. The current projection of a 1 million deficit demands a cautious approach to housing development and acquisition in demand-sensitive urban core areas.

Localized Market Analysis: Case Studies in Vulnerability

To understand the granular effects of the immigration housing impact, a city-by-city examination is necessary, focusing on the ratio of new supply to historically immigrant-driven demand.

Miami and Houston: Contrasting Resilience

Miami, a historically strong gateway for Latin American migration, has seen its housing market bolstered by high net worth individuals and substantial foreign investment. While the general housing demand may slow, the high-end luxury segment is relatively insulated from the broader 1 million decline, which primarily affects lower- and middle-income housing. However, the rental market in working-class neighborhoods of Miami-Dade County is highly exposed to reduced labor migration.

Houston, conversely, benefits from a diverse, energy-driven economy and ample land for expansion. While Houston is a major magnet for immigrants, its robust domestic migration pipeline and lower overall housing costs provide a stronger buffer. The challenge for Houston is managing the pace of apartment construction; the reduced immigration forecast means that the time required to stabilize occupancy in new developments may extend from 12 months to 18 months or more, impacting developer returns.

The analysis reveals that cities with high barriers to entry (NYC, LA) will see demand deceleration lead to slower rent growth, whereas cities with low barriers to entry (Houston, Phoenix) will see the effect manifest as prolonged lease-up times and increased concessions due to excess supply meeting moderated demand.

| Key Demographic Factor | Market Implication/Analysis |

|---|---|

| 1 Million Immigration Decline (2025) | Translates to approximately 350,000 fewer household formations, decelerating overall housing demand growth. |

| Gateway City Exposure (NYC, LA) | Projected 1.5% to 2.5% reduction in effective rent growth in 2025 due to high reliance on international migration. |

| Multi-Family Lease-Up Risk | Increased concessions (potentially 2.0+ months free rent) and longer absorption periods in oversupplied Sun Belt metros. |

| Single-Family Price Growth | Moderation from baseline forecasts (e.g., 5-7% down to 2-3% annual appreciation) in entry-level suburban markets. |

Frequently Asked Questions about Housing Demand and Immigration

The projected decline is expected to temper rental price inflation, particularly in high-cost, high-density gateway cities. Analysts anticipate slower growth in net effective rents (rent minus concessions), possibly stagnating or declining slightly year-over-year in metros like Boston and San Francisco, offering a brief reprieve to renters.

MSAs with the highest historical reliance on international migration for population growth and those currently experiencing high levels of new multi-family construction supply are most vulnerable. These include parts of New York, Los Angeles, and certain rapidly expanding Sun Belt hubs like Austin and Charlotte, where absorption rates may slow considerably in 2025.

Yes. Investors should prioritize assets with stable, diversified demand drivers. Underwriting new multi-family projects should incorporate conservative assumptions regarding lease-up timelines and effective rent growth for 2025-2026. Focusing on tertiary markets or specialized housing sectors less reliant on immediate population growth may mitigate risk.

The impact on single-family home builders will be less immediate but noticeable in the entry-level segment. Reduced household formation pressure may slow the pace of sales, leading builders to moderate planned construction starts in 2025. This could extend the time required to sell newly completed inventory, slightly pressuring margins.

No. While the 1 million decline decelerates growth, it does not erase the structural housing deficit accumulated over the last decade. The market is shifting from hyper-growth to moderation. National collapse is unlikely unless compounded by a severe recession or sudden spike in unemployment, as underlying demand remains strong.

The Bottom Line

The anticipated reduction of 1 million immigrants in 2025 represents a significant, quantifiable headwind for US housing demand, particularly in the rental sector of major metropolitan areas. This demographic shock, combined with high interest rates and a peaking multi-family supply pipeline, necessitates a recalibration of real estate investment expectations. Investors should move away from broad-based growth assumptions and adopt granular, city-specific analyses. While the long-term structural shortage of housing prevents a national market collapse, the short-term impact will be felt through slower effective rent appreciation and increased pressure on developers to offer concessions to fill newly completed units. Monitoring policy changes regarding migration and absorbing the localized data on supply absorption rates will be crucial for navigating the evolving market dynamics throughout 2025 and beyond.