Tax-Loss Harvesting Strategies: Optimizing Portfolios for 2026

Tax-loss harvesting strategies are critical year-end maneuvers; strategic utilization of realized losses against capital gains can potentially reduce investors’ taxable income by up to $3,000 annually, maximizing after-tax returns for the 2026 tax year and beyond.

As market cycles accelerate and volatility remains persistent—evidenced by the S&P 500 experiencing three corrections exceeding 10% between 2021 and 2024—the importance of proactive financial engineering has grown. Implementing robust tax-loss harvesting strategies is not merely a reactive measure but a sophisticated year-end portfolio optimization move essential for maximizing after-tax wealth accumulation heading into the 2026 fiscal cycle. This process, often overlooked until the final weeks of December, directly impacts an investor’s net capital gains liability, translating into tangible savings and increased investment capital.

Understanding the mechanics of tax-loss harvesting

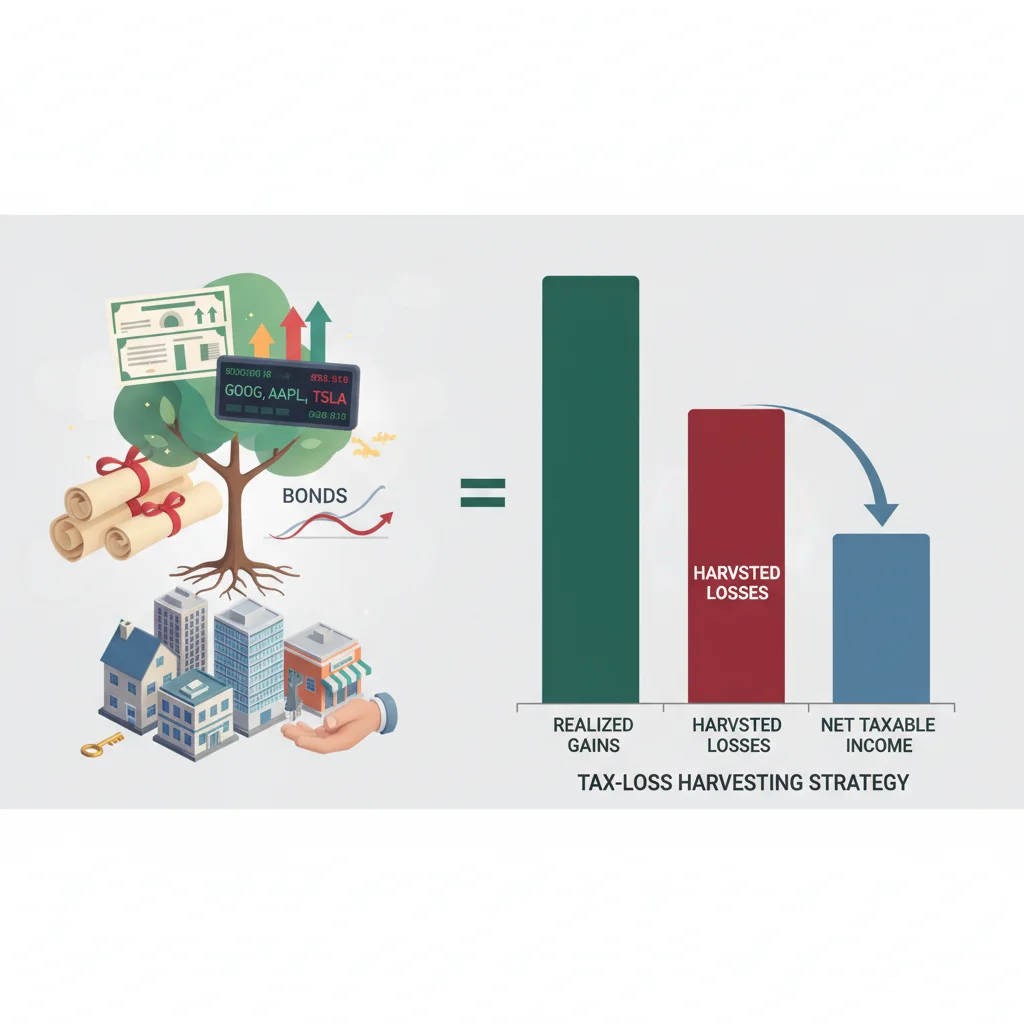

Tax-loss harvesting (TLH) is the process of selling investments that have declined in value to realize a loss, which can then be used to offset capital gains realized from the sale of profitable investments. This strategy is particularly valuable in years of high market dispersion, where, even if overall indices show positive returns, individual holdings may be underwater. The fundamental goal is to reduce the overall tax burden on investment earnings.

According to data from the Internal Revenue Service (IRS), realized net capital losses can first offset realized capital gains dollar-for-dollar. If the losses exceed the gains, the investor can deduct up to $3,000 ($1,500 if married filing separately) of the net loss against ordinary income per year. Any remaining loss can be carried forward indefinitely to offset future gains. This carryforward provision is a powerful tool, providing a deferred tax asset that can shield future profits. For example, if an investor realizes $50,000 in gains and $60,000 in losses in 2025, they offset the gains entirely, deduct $3,000 against ordinary income, and carry forward $7,000 into 2026.

The critical role of the wash sale rule

A central constraint in executing tax-loss harvesting strategies is the IRS’s wash sale rule. This rule prohibits an investor from claiming a loss on a security if they buy, or buy a substantially identical security, 30 days before or 30 days after the sale date. This 61-day window (the sale date plus 30 days before and 30 days after) is critical. Violating the rule disallows the claimed loss, making the harvesting effort counterproductive. Compliance requires meticulous tracking and the strategic selection of replacement assets.

- Substantially Identical Securities: This term extends beyond the exact same stock. It includes options, futures, and sometimes even mutual funds or exchange-traded funds (ETFs) that track the same index or sector. Analysts frequently recommend switching to a similar but distinct asset—for instance, selling an S&P 500 ETF from Provider A and immediately purchasing an S&P 500 ETF from Provider B, provided their underlying holdings and structures are deemed non-identical by standard market interpretation.

- Timing Constraints: The 30-day window applies to both the sale date and the repurchase date, emphasizing the need for transactions to be executed well before the final trading days of December to ensure the 31st day falls within the next calendar year.

- Impact on Basis: If a wash sale occurs, the disallowed loss is added to the cost basis of the newly acquired security, effectively deferring the tax benefit rather than eliminating it entirely, but disrupting the immediate year-end optimization goal.

The strategic implication is clear: investors must ensure portfolio continuity while respecting the tax code. The replacement asset must offer similar market exposure to maintain the desired risk profile, but distinct enough to avoid the wash sale declaration. This balancing act requires sophistication, often involving deep dives into ETF prospectus details and index tracking methodologies.

Strategic asset substitution and diversification in TLH

Effective tax-loss harvesting strategies rely heavily on the intelligent substitution of assets. Simply selling a losing stock often means missing out on any subsequent recovery. Therefore, the immediate reinvestment into a functionally similar, yet legally distinct, asset is paramount. This preserves the investor’s exposure to the target market segment.

Consider a portfolio holder who sells shares in a large-cap technology ETF (T-Fund) at a loss. To maintain exposure to the technology sector and large-cap growth, they might immediately purchase a different technology ETF (S-Fund) managed by a different firm or one that tracks a slightly different, though highly correlated, index. The key metric analysts monitor here is the R-squared value between the sold and purchased assets; while high correlation is desired for market continuity, the legal definition of “substantially identical” must be avoided.

ETFs versus mutual funds in harvesting

ETFs have generally streamlined the TLH process for individual investors. Unlike many traditional mutual funds, which can surprise investors with unexpected year-end capital gains distributions, ETFs typically manage their capital gains internally, offering greater control over the timing of tax events. However, mutual funds, especially those tracking broad indices, can be tricky. Selling a mutual fund at a loss and immediately buying another fund from the same provider tracking the same index is highly likely to trigger a wash sale violation.

A recent trend observed by institutional money managers involves the use of factor-based ETFs as substitutes. For instance, selling a broad-market index fund at a loss and replacing it with a minimum volatility or value-tilted factor ETF. While both offer broad market exposure, the underlying construction and selection methodologies are distinct enough to generally satisfy the IRS requirement. This move not only facilitates the tax benefit but can also subtly rebalance the portfolio’s factor exposure heading into a new economic cycle.

- Sector Rotation: Selling a losing energy sector fund and rotating temporarily into a materials sector fund. Both are cyclical but typically utilize different underlying indices and company compositions.

- Fixed Income Adjustments: Harvesting losses on municipal bonds from one state and replacing them with municipal bonds from a different state, or replacing a corporate bond ETF with a high-quality government bond ETF of similar duration.

- International Diversification: Selling a developed market international ETF (EAFE index tracking) and temporarily replacing it with an emerging market ETF, or vice-versa, depending on the desired risk profile.

The strategic decision to substitute assets must be documented thoroughly. Financial advisors frequently employ specialized software to track the basis, holding period, and wash sale windows across all client accounts, including taxable and retirement accounts, as the wash sale rule applies across all accounts controlled by the taxpayer.

Integrating TLH with long-term portfolio rebalancing

While the immediate benefit of TLH is tax mitigation, the most sophisticated investors integrate harvesting into their broader, long-term portfolio rebalancing strategy. The end of the year offers a natural checkpoint to assess asset allocation drift and make necessary corrections, often utilizing the realized losses as a catalyst.

For example, if a portfolio’s equity allocation has drifted from 60% to 65% due to market gains, and the bond portion has declined, selling the underperforming bond assets for TLH purposes allows the investor to realize the loss while simultaneously injecting fresh capital (the proceeds plus the tax savings) back into the bond allocation to restore the target weight. This dual action—tax optimization and risk recalibration—maximizes efficiency.

Quantifying the value of tax deferral

The true economic benefit of TLH extends beyond the immediate tax deduction. It lies in the time value of money. By realizing losses today, investors secure a current tax benefit, allowing the capital that would have been paid in taxes to remain invested and potentially generate future returns. This is essentially an interest-free loan from the government, compounding the overall portfolio growth.

Consider an investor in the 32% marginal tax bracket who harvests $10,000 in losses, offsetting $10,000 in short-term capital gains. The immediate savings is $3,200. If that $3,200 is reinvested and yields an average annual return of 8% over ten years, the compounded gain is substantial. Furthermore, by carefully managing asset sales, investors can convert short-term capital gains (taxed at higher ordinary income rates, up to 37%) into long-term gains (taxed at preferential rates, 0%, 15%, or 20%).

The optimal time for TLH is not necessarily just at year-end. Analysts at major wealth management firms often advocate for continuous harvesting throughout the year, especially during periods of market stress or high volatility, such as the sharp downturns seen in early Q1 2022 or during the regional banking crisis of early 2023. Delaying the harvest until December risks missing opportunities or facing potential recovery in the asset price, reducing the available loss.

Advanced considerations for 2026: Tax law uncertainty and state implications

Planning for 2026 requires acknowledging potential shifts in the tax landscape. Current legislative discussions surrounding capital gains tax rates and deductions could impact the net present value of harvested losses. While the core mechanics of TLH are robust, the marginal benefit could change if, for example, preferential long-term capital gains rates are adjusted upward, or if the $3,000 ordinary income deduction limit is altered.

Investors must model scenarios based on anticipated tax legislation. For instance, if analysts project an increase in the top capital gains rate from 20% to 25% starting in 2026, the incentive to realize losses in late 2025 (to offset gains that would otherwise be taxed at 20%) is slightly less compelling than realizing gains in 2025 (to avoid the higher 2026 rate). However, the benefit of the $3,000 ordinary income deduction typically outweighs minor rate fluctuations for most retail investors.

State and local tax variations

A crucial, often-overlooked element of tax-loss harvesting strategies in the U.S. context is the variation in state and local tax laws. While federal rules govern the wash sale and the $3,000 deduction, some high-tax states, such as California or New York, may have different rules regarding the treatment of capital losses, or they may apply their own high marginal income tax rates to the capital loss deduction, amplifying the effective saving.

- State Conformity: Verify whether your state fully conforms to the federal tax code regarding capital gains and losses. Non-conforming states may require separate calculations.

- Municipal Bond Considerations: Losses harvested from municipal bonds must be carefully tracked, as their tax-exempt status at the federal level does not always extend to state and local levels, depending on the issuer’s geography.

- Net Investment Income Tax (NIIT): High-income earners (above $250,000 for married couples) are subject to the 3.8% NIIT on investment income. Reducing net capital gains through TLH directly reduces the basis for this tax, providing an additional layer of savings for these taxpayers.

The complexity introduced by state and local taxes underscores the necessity of professional guidance, especially for investors with multi-state tax obligations or substantial portfolios. Failure to account for these nuances can significantly erode the expected benefits of the harvesting strategy.

Managing behavioral biases and avoiding common TLH pitfalls

Effective financial management requires overcoming inherent behavioral biases. In the context of TLH, two common pitfalls emerge: the disposition effect and the failure to consider transaction costs. The disposition effect refers to investors’ tendency to sell assets that have gained in value too soon while holding onto assets that have lost value for too long, hoping for a recovery. TLH directly counteracts this bias by forcing the realization of losses, turning a psychological burden into a tax benefit.

Another pitfall is the underestimation of transaction costs. While trading commissions have largely moved toward zero at major brokerages, investors must still account for bid-ask spreads, especially when dealing with less liquid securities or fixed-income products. The tax benefit must sufficiently outweigh the cost of executing the sales and purchases, including any potential market impact from large trades.

The importance of tax lot identification

A sophisticated element of tax-loss harvesting strategies is the precise identification of tax lots. When an investor buys the same security at different times and prices, they hold multiple tax lots. When selling, they can choose which specific lot to liquidate: LIFO (Last-In, First-Out), FIFO (First-In, First-Out), or specific share identification.

For TLH, specific share identification is usually the optimal method. If an investor holds 1,000 shares of Company X, some bought at $50 and some at $70, and the current price is $60, they would choose to sell the lot bought at $70 to maximize the realized loss, while retaining the lot bought at $50, which is still profitable (a gain that they might defer). Brokerage platforms typically allow this level of granular control, but the investor must actively specify the lots before the trade settles.

Failure to specify the tax lot defaults to the brokerage’s standard procedure (often FIFO), which could inadvertently lead to the realization of a gain (if the oldest shares are sold) instead of the intended loss, severely compromising the year-end optimization effort. This attention to detail is the hallmark of professional portfolio management.

Year-end checklist for 2025 and preparation for 2026

As the calendar year concludes, ensuring all harvesting transactions are completed accurately and timely is paramount for the 2026 tax filing cycle. The deadlines for trade execution are strict, typically falling on the final market day of December, but investors are advised to complete transactions one to two weeks prior to account for settlement times and unexpected market closures.

A comprehensive year-end checklist for executing tax-loss harvesting strategies should involve reviewing all taxable accounts for unrealized losses. This includes individual brokerage accounts, joint accounts, and potentially even certain trust accounts. Losses in tax-advantaged retirement accounts (like 401(k)s or IRAs) generally cannot be harvested.

Key action items for investors

The following steps are recommended by financial planning experts for maximum year-end efficiency:

- Review Unrealized Losses: Identify all securities with a cost basis higher than the current market value. Focus particularly on short-term losses, which offset short-term gains (taxed at the highest rates).

- Calculate Net Gain/Loss Position: Determine the total realized capital gains and losses for the year to date. This calculation dictates the maximum effective loss that can be harvested.

- Execute Substitution Trades: Sell the loss-generating asset and immediately purchase a non-substantially identical replacement asset to maintain market exposure. Document the substitution rationale clearly.

- Verify Wash Sale Compliance: Implement a strict 31-day waiting period before repurchasing the original security or a substantially identical one. Use automated tracking tools provided by major financial institutions.

- Adjust Basis for Carryovers: Ensure that any loss carryforwards from previous years are correctly accounted for, calculating the remaining deduction available against ordinary income for the current year.

The transition into 2026 marks a new cycle where the benefits of current year optimization decisions are realized. Maximizing the tax shield now ensures that more capital remains invested, compounding future returns and strengthening the portfolio’s net worth position. This proactive, data-driven approach separates passive market participants from sophisticated financial engineers.

| Key Optimization Factor | Market Implication/Analysis |

|---|---|

| Wash Sale Rule (61-Day Window) | Strict compliance is mandatory; repurchase of substantially identical assets within 30 days voids the loss deduction, deferring the tax benefit. Use distinct replacement ETFs. |

| $3,000 Ordinary Income Deduction Limit | Net capital losses exceeding gains can offset up to $3,000 of ordinary income annually, providing immediate tax relief for high-income earners. |

| Tax Lot Identification | Specific identification of the highest-cost basis shares ensures maximum loss realization, preventing accidental realization of gains during the harvesting process. |

| Loss Carryforward Provision | Any net loss exceeding the $3,000 deduction can be carried forward indefinitely, creating a valuable future tax shield against subsequent capital gains. |

Frequently Asked Questions about Tax-loss harvesting strategies

The wash sale rule applies across all taxable and non-taxable accounts (like IRAs or 401(k)s) owned by the taxpayer or their spouse. If you harvest a loss in a taxable account and repurchase the same security in an IRA within 30 days, the loss is disallowed, and the basis adjustment occurs in the IRA, which is highly disadvantageous.

Yes, and this is highly beneficial. Losses are first netted against gains of the same type (short-term losses against short-term gains). Since short-term gains are taxed at higher ordinary income rates (up to 37%), using harvested losses to offset them provides the greatest marginal tax savings.

The IRS does not provide a precise definition, but it generally refers to an asset that is virtually interchangeable. Selling a company stock and buying its call option is typically identical. However, selling an S&P 500 ETF from Vanguard and buying one from iShares is generally considered non-identical due to differences in structure and management.

Prioritize harvesting short-term losses (assets held one year or less) if you have short-term gains, as this offsets income taxed at the highest rates. If you only have long-term gains, use long-term losses first. Strategic investors match the loss type to the gain type to maximize tax efficiency.

The 3.8% NIIT applies to the lesser of net investment income or the excess of modified adjusted gross income over statutory thresholds. By successfully reducing net capital gains through TLH, high-income investors directly lower their net investment income, resulting in a reduction of their overall NIIT liability.

The bottom line: Maximizing compounding through tax efficiency

The sophisticated execution of tax-loss harvesting strategies transcends simple tax reduction; it is a core component of maximizing the rate of compounding returns. By strategically realizing losses against gains, investors effectively convert a tax liability into a cash flow event, keeping capital invested and working for them. Data consistently shows that over multi-decade investing horizons, even marginal improvements in tax efficiency can translate into significant differences in terminal portfolio value. As markets continue their volatile and high-dispersion patterns, the need for continuous, automated TLH, integrated with dynamic rebalancing, will only increase. For investors looking ahead to 2026, the mandate is clear: meticulous planning, strict compliance with the wash sale rule, and proactive engagement with portfolio structure are non-negotiable requirements for optimizing after-tax performance. Market participants must monitor potential congressional action on capital gains rates, ensuring their year-end moves are positioned not just for today’s tax code, but for the anticipated fiscal environment of the future.