PCE Inflation Data December 5: Why It Matters Most to the Fed

PCE inflation data released on December 5 is paramount for global markets because it provides the Federal Reserve’s preferred measure of underlying price pressures, dictating the necessity and timing of future interest rate adjustments.

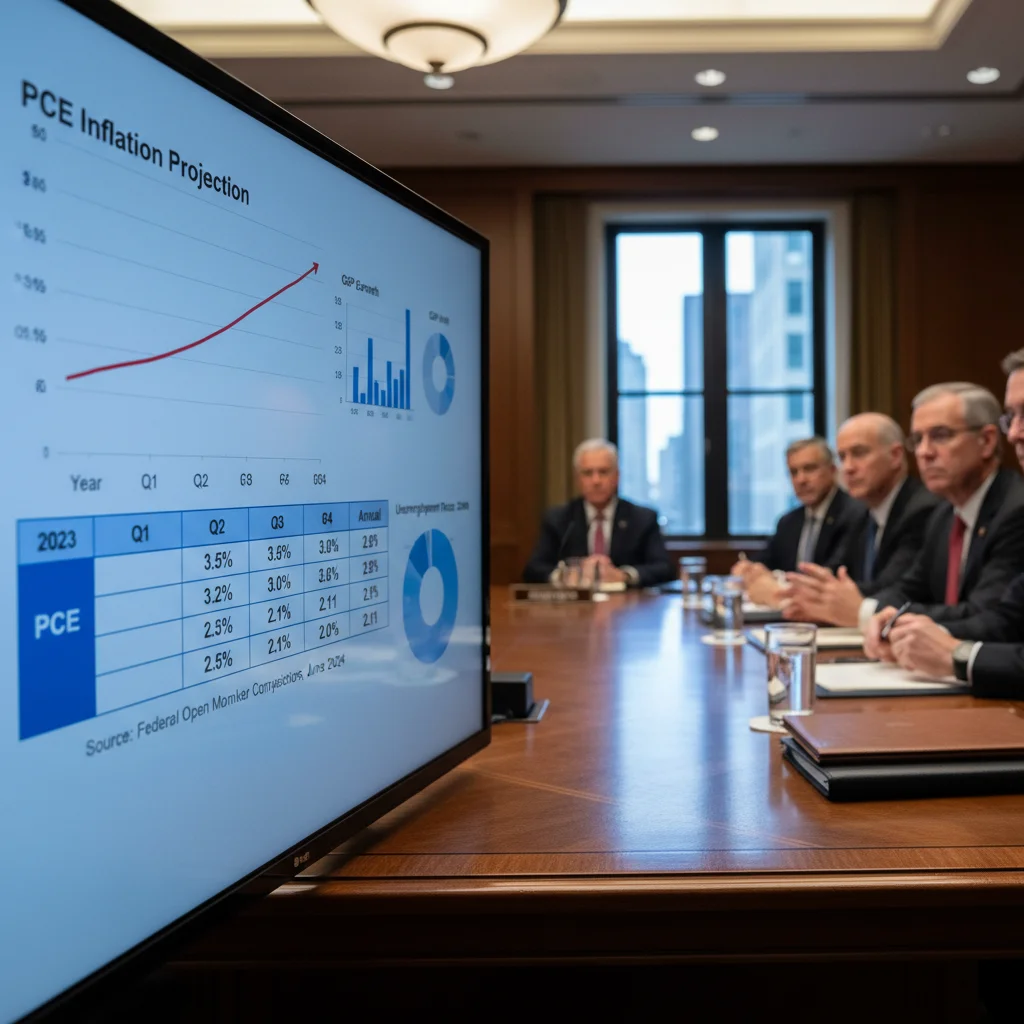

The release of the PCE inflation data on December 5 marks a critical juncture for U.S. monetary policy and global market stability. Unlike the more widely reported Consumer Price Index (CPI), the Personal Consumption Expenditures (PCE) price index is the Federal Reserve’s primary gauge for assessing progress toward its long-term 2% inflation target. This specific report, covering the previous month’s price movements, will directly inform the Federal Open Market Committee (FOMC) on whether current restrictive policies are sufficiently cooling the economy or if further action is warranted, making it arguably the most consequential economic data point of the quarter for fixed income and equity investors.

Understanding the PCE vs. CPI: The Fed’s Preferred Metric

While both the CPI and the PCE measure changes in the prices of goods and services purchased by consumers, they differ fundamentally in methodology and scope. The CPI, produced by the Bureau of Labor Statistics, measures what urban consumers are paying for a fixed basket of goods. Conversely, the PCE, compiled by the Bureau of Economic Analysis (BEA), uses a broader, dynamically weighted basket that accounts for substitution effects—meaning consumers switch to cheaper alternatives when prices rise. This methodological difference is why the PCE tends to register lower inflation rates historically and why the Federal Reserve considers it a more accurate reflection of actual consumer behavior and underlying inflationary trends.

The crucial distinction lies in how they handle housing costs and weighting. CPI gives a much heavier weight to owner’s equivalent rent (OER), often leading it to lag real-time housing market shifts. PCE, however, incorporates a wider range of expenditures, including those paid for by employers (like health insurance), providing a more comprehensive view of the economy. For the FOMC, achieving the 2% target is explicitly defined in terms of the total PCE price index, and more specifically, the core PCE index, which strips out volatile food and energy components.

Why Core PCE is the Central Focus for Monetary Policy

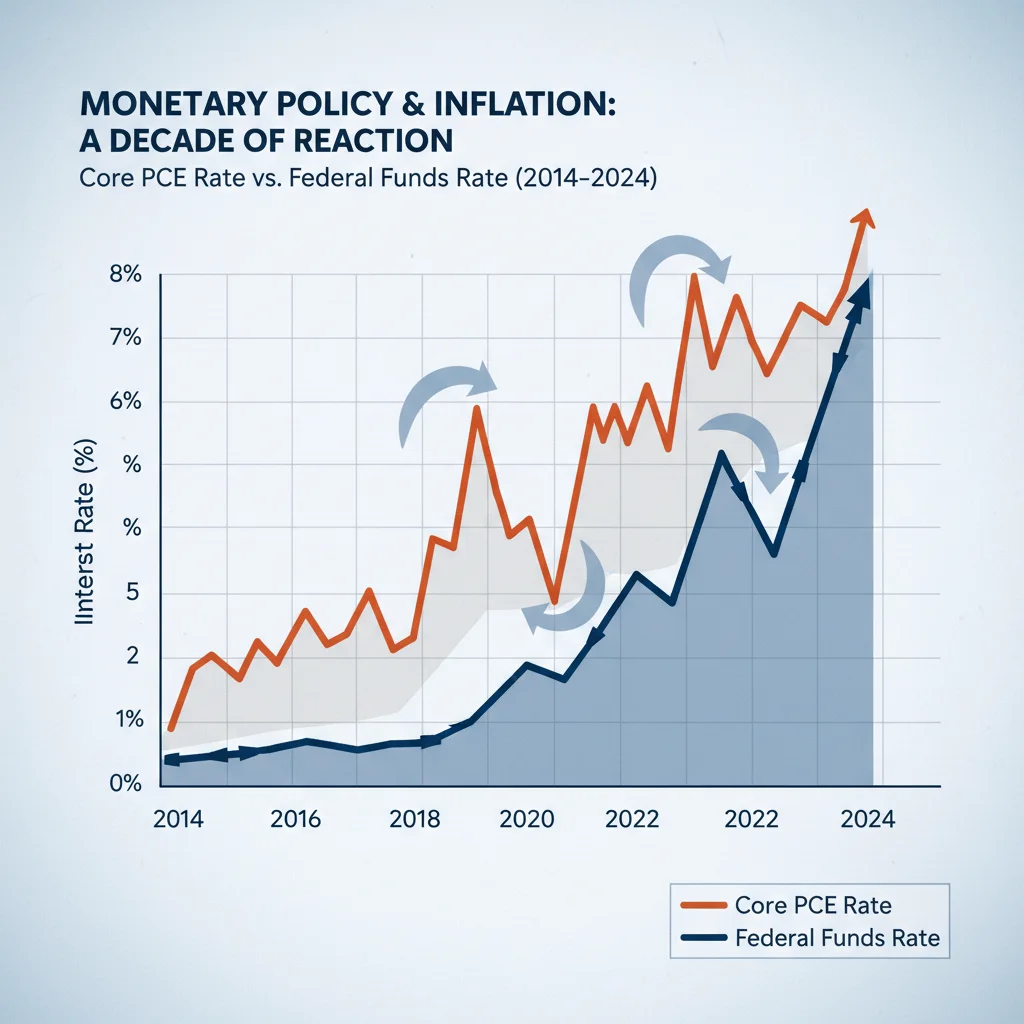

The core metric is the signal the Fed listens to most intently. Volatility in energy and food prices, often driven by geopolitical events or supply shocks, can distort the overall inflation picture. By focusing on the Core PCE inflation data, policymakers aim to isolate persistent, demand-driven price pressures that monetary policy can effectively address. According to the Federal Reserve Bank of St. Louis data, in recent quarters, the gap between core CPI and core PCE has narrowed but remains significant, emphasizing the importance of tracking the Fed’s preferred gauge. A substantial year-over-year decline in core PCE toward the 2.5% range would be interpreted as a major victory, while an unexpected uptick could trigger serious market volatility.

- Substitution Bias: PCE uses dynamic weights, accounting for consumers substituting cheaper goods, making it a lower bound estimate of inflation compared to CPI.

- Scope of Coverage: PCE includes non-household expenditures, such as employer-sponsored health care, providing a broader economic measure.

- Target Alignment: The Federal Reserve’s official mandate is explicitly tied to the overall PCE index, making this December 5 release the authoritative report.

The market consensus leading up to the December 5 release typically projects a marginal month-over-month increase in the headline PCE, primarily due to seasonal consumption patterns, but the year-over-year Core PCE rate is the number that will move the needle. Analysts at firms like Goldman Sachs and JPMorgan Chase are closely watching the trajectory of services inflation within the PCE, particularly in sectors sensitive to wage growth, as this remains the primary barrier to reaching the Fed’s target.

The Significance of Services Inflation and Wage Dynamics

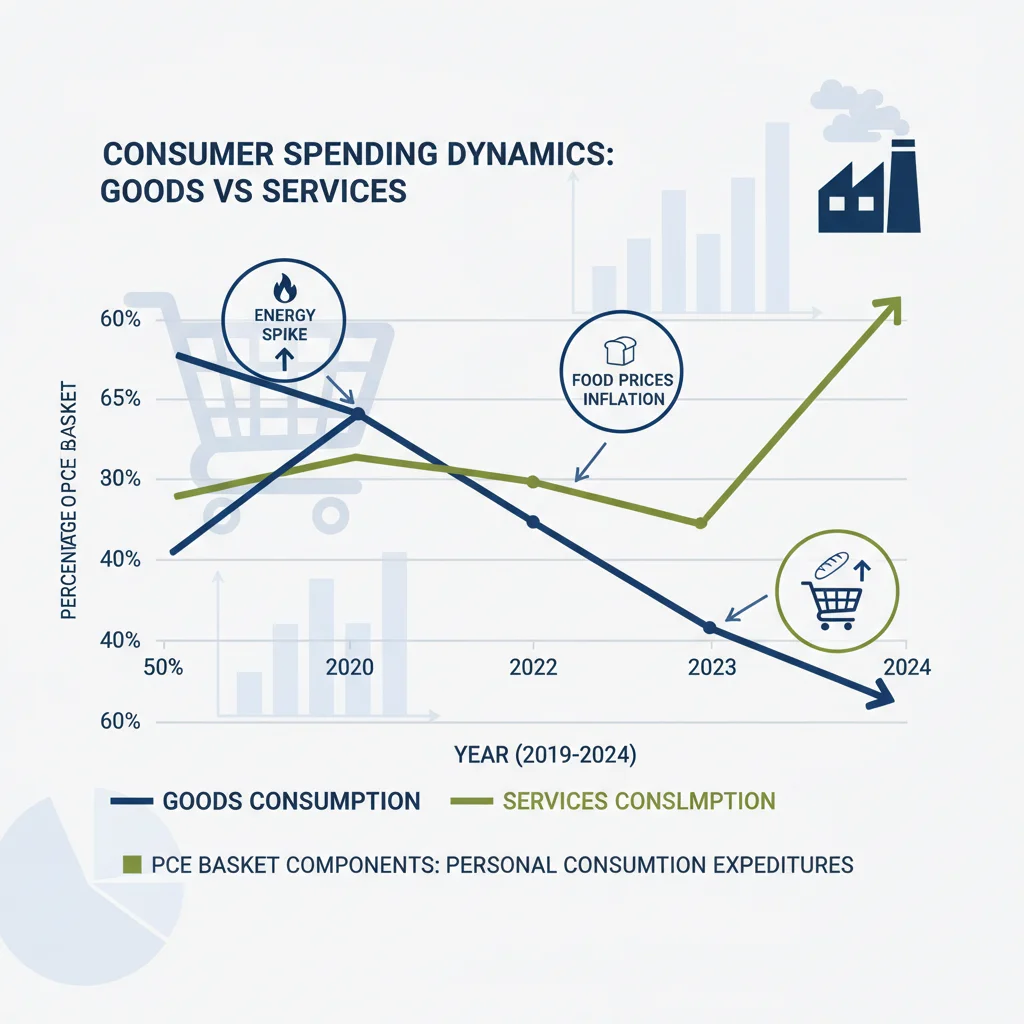

The current inflation fight has largely shifted from goods to services. Early in the tightening cycle, supply chain normalization rapidly brought goods inflation down from its peaks. However, services inflation, deeply tied to the labor market and wage growth, has proven far stickier. This is why the December 5 PCE inflation data will be scrutinized for details on non-housing services, often referred to by Fed Chair Jerome Powell as the ‘supercore’ inflation measure.

The ‘supercore’ metric generally excludes housing, food, and energy, focusing on services like transportation, healthcare, and leisure. These sectors are highly labor-intensive, meaning their costs are directly influenced by the rate of wage increases. If the supercore PCE shows continued acceleration, it implies that the labor market, despite some cooling, is still too tight to allow inflation to sustainably return to 2%. A tight labor market allows workers to demand higher wages, which businesses then pass on through higher service prices—a self-reinforcing cycle the Fed seeks to break.

Analyzing the Recent Trend in Wage Growth

Recent Bureau of Labor Statistics data shows that average hourly earnings growth, while slowing from its peak, remains above the level consistent with a 2% inflation target. Economists generally estimate that wage growth needs to settle around 3.0% to 3.5% annually to align with the Fed’s goal, assuming productivity growth holds steady. If the underlying data for the PCE report suggests that compensation costs are rising faster than this threshold, the FOMC will have less confidence in the disinflationary path.

- Labor Market Input: The tight relationship between wages and services costs means the December PCE report is effectively a proxy reading on the current health and restrictiveness of the labor market.

- Supercore Watch: Investors will specifically isolate non-housing services inflation within the PCE data. A reading above 4.0% year-over-year in this category would signal persistent inflationary risks.

- Demand Destruction: The Fed needs to see evidence that higher interest rates are dampening consumer demand for services, leading to slower price increases in sectors like travel and entertainment.

The December 5 release will therefore be parsed for any deceleration in high-contact service prices. A marginal cooling here would provide significant reassurance to markets that the current policy stance is working, increasing the probability of a rate hold at the subsequent FOMC meeting. Conversely, a reacceleration would immediately reintroduce the probability of a future rate hike, regardless of recent dovish commentary from some regional Fed presidents.

Market Expectations and Potential Volatility Triggers

Financial markets have largely priced in a scenario where the Federal Reserve is nearing the end of its tightening cycle, with expectations shifting toward potential rate cuts in the latter half of the following year. However, these expectations are highly fragile and entirely dependent on incoming inflation data. The December 5 PCE inflation data, therefore, holds the power to either validate or completely derail current market positioning, leading to significant volatility across asset classes.

If the Core PCE year-over-year figure comes in significantly below the consensus forecast of, for example, 3.5%, it would likely trigger a strong rally in risk assets. Lower inflation implies less need for restrictive policy, driving down Treasury yields and boosting equity valuations, particularly growth stocks that benefit from lower discount rates. Conversely, an upside surprise—a Core PCE reading above 3.8%—would force a rapid repricing of rate expectations. This would likely cause a sharp sell-off in bonds, pushing the 10-year Treasury yield higher, and trigger equity market declines as investors anticipate a ‘higher for longer’ rate regime.

The Fed’s Reaction Function and Forward Guidance

The Federal Reserve operates under a dual mandate: maximum employment and price stability. In the current environment, price stability takes precedence. The December 5 data will be the final crucial inflation print before the next FOMC decision. The Fed’s reaction function is not linear; it is driven by the perceived sustainability of the disinflationary path. If the data suggests a ‘two steps forward, one step back’ pattern, the Fed may maintain elevated rates for longer, even if the headline inflation number is technically lower.

- Fixed Income Impact: Higher-than-expected PCE data would steepen the yield curve as long-term inflation fears resurface, while lower data would flatten or invert the curve further, signaling economic slowing.

- Equity Sector Sensitivity: Technology and high-growth sectors are highly sensitive to rate expectations; unexpected high PCE could lead to profit-taking and rotation into defensive sectors.

- Dollar Movement: A strong PCE print (higher inflation) could temporarily strengthen the U.S. dollar, as it signals the Fed maintaining higher relative interest rates compared to other central banks.

Major financial institutions, including Bank of America and Citi, have issued warnings regarding the potential for sharp market movements if the core inflation numbers deviate even slightly from consensus. Their models indicate that a 10 basis point surprise in the monthly Core PCE could translate into a 15-20 basis point move in the two-year Treasury yield within hours of the release, underscoring the report’s immediate market power.

The Role of Housing and Energy in the PCE Calculation

While the focus remains heavily on Core PCE, the headline PCE inflation data includes energy and food, and the housing component, though weighted differently than in CPI, still plays a substantial role. Housing costs, represented primarily by owner’s equivalent rent (OER) and rent of primary residence, are measured by the PCE using data from the CPI, but with a different formula that tends to dampen volatility.

The lagging nature of housing data in inflation metrics means that cooling in real-time rent measures and home price appreciation takes several months to filter into the official PCE figures. Analysts are looking for confirmation that the deceleration seen in new lease agreements is finally translating into lower inflation readings within the PCE framework. If the housing component remains stubbornly high, it will offset disinflationary progress in other areas, making it harder for the overall index to fall.

Energy Price Swings and Geopolitical Risk

Energy prices, heavily influenced by global oil supply, OPEC+ decisions, and geopolitical tensions, introduce significant noise into the headline PCE. A spike in crude oil prices during the measurement period (the month preceding the December 5 release) could push the headline PCE higher, even if underlying core inflation is easing. Although the Fed focuses on the core measure, a high headline PCE can still influence consumer and business sentiment, potentially raising inflation expectations—a factor the Fed monitors closely.

- Housing Lag: The PCE housing component typically lags real-time market rents by 9 to 12 months, meaning current PCE data reflects housing market conditions from the previous year.

- Commodity Volatility: Recent fluctuations in global crude oil and natural gas prices will directly impact the headline PCE, potentially masking encouraging trends in the core measure.

- Expectations Management: If the headline PCE is high due to energy, the Fed must use its communication to guide market expectations back toward the underlying Core PCE trend to prevent unwarranted tightening of financial conditions.

The overall context of the December 5 report must factor in these lagged and volatile components. Market participants should look past initial headline noise and focus on the Core PCE reading, particularly the three-month annualized rate, which offers a clearer view of the short-term momentum of underlying inflation.

Historical Context: PCE and the Path to Policy Normalization

The Federal Reserve’s reliance on the PCE dates back to 2000, when it formally adopted the index as its primary inflation measure. Historically, the PCE has been instrumental in guiding policy shifts, notably during the post-2008 recovery and the subsequent periods of low inflation. The current cycle, marked by the highest inflation in four decades, highlights the PCE’s centrality in determining the endpoint of the hiking cycle and the timeline for policy normalization.

During the 1970s and 80s, the Fed struggled with high, volatile inflation. Lessons learned from that era emphasize the need for credible commitment to the target. Today, the December 5 PCE inflation data serves as a measure of the Fed’s credibility. If the data shows inflation becoming entrenched, it might necessitate a return to more aggressive rhetoric or even further rate increases, risking a recession. Conversely, a sustained decline toward the 2% target (or slightly above, with a clear trajectory downward) would allow the Fed to transition from inflation fighting to risk management, balancing the inflation mandate with the employment mandate.

The Asymmetric Risks Facing the FOMC

The FOMC currently faces asymmetric risks. The risk of prematurely declaring victory and allowing inflation to reaccelerate (the 1970s mistake) is weighed against the risk of overtightening and causing an unnecessary economic contraction. The December PCE report provides crucial input for this risk assessment. If the data is soft, the risk of recession becomes more salient, and the Fed might pivot to a neutral stance sooner. If the data is hot, the inflation risk dominates, demanding continued vigilance.

- Credibility Test: The PCE result validates the effectiveness of the cumulative 525 basis points in rate hikes implemented since the start of the tightening cycle.

- Policy Lag: Monetary policy operates with significant lags, typically 12 to 18 months. The December data reflects the delayed impact of earlier tightening actions.

- Future Guidance: The data will directly shape the language used in the FOMC Summary of Economic Projections (SEP), particularly the ‘dot plot’ forecasts for future interest rates.

Market participants should look beyond the headline numbers to the underlying components, especially the trend in medical and financial services within the PCE, as these are less volatile than energy but highly indicative of persistent domestic price pressures. Analysts at institutions like Morgan Stanley emphasize that the three-month annualized Core PCE rate must be consistently below 3.0% to signal a true shift in policy stance.

Implications for Consumer Spending and Corporate Earnings

The PCE inflation data is derived from the net results of consumer spending, meaning it offers indirect but critical insights into the strength and resilience of the U.S. consumer. High inflation erodes real purchasing power, forcing consumers to prioritize essential spending and cut back on discretionary purchases. If the December 5 report shows that price increases are still outpacing wage growth, it signals ongoing pressure on household budgets, which negatively impacts corporate earnings, particularly for companies reliant on discretionary consumer demand.

Retail and consumer discretionary sectors are particularly vulnerable to persistent inflation. Companies like Target, Amazon, and various hospitality groups have already reported shifts in consumer behavior—trading down to cheaper brands or delaying large purchases. The PCE data provides the macroeconomic backdrop for these microeconomic trends. If disinflation is confirmed, it could ease the financial strain on consumers, potentially leading to a rebound in discretionary spending in the subsequent quarters, thereby boosting sales forecasts for Q1 and Q2 of the following year.

Corporate Pricing Power and Margin Pressure

For corporations, the PCE report helps gauge pricing power. If the rate of inflation for inputs (Producer Price Index or PPI) is rising faster than the PCE, it indicates that businesses are unable to fully pass on higher costs to consumers, leading to margin compression. If the December 5 data shows consumer price deceleration, it suggests that companies may face challenges in maintaining high price points, requiring them to focus on cost efficiencies to protect profitability. This dynamic is central to the current earnings season narrative.

- Discretionary Spending: Persistent high PCE inflation acts as a headwind for companies in the leisure, apparel, and electronics sectors.

- Margin Analysis: Investors compare PCE trends with corporate earnings releases to assess the sustainability of profit margins in a slowing pricing environment.

- Sector Rotation: Confirmation of disinflation might encourage rotation out of defensive sectors, which performed well during peak inflation, back into cyclicals and growth stocks.

In summary, the December 5 PCE release is not merely an academic exercise; it is a direct input into corporate financial planning, influencing everything from inventory management to capital expenditure decisions. A favorable report provides a more stable horizon for business planning, while an unfavorable one necessitates a defensive posture and tighter cost control.

The Global Impact of U.S. PCE Data

Given the U.S. dollar’s role as the global reserve currency and the interconnectedness of financial markets, the December 5 PCE inflation data has profound implications far beyond domestic borders. The Federal Reserve’s monetary policy trajectory, heavily influenced by this report, directly affects global liquidity, capital flows, and the financial stability of emerging markets.

When the PCE data suggests the Fed must maintain higher interest rates, it strengthens the U.S. dollar. A stronger dollar makes dollar-denominated debt more expensive to service for foreign governments and corporations, potentially triggering financial stress in highly indebted emerging economies. Furthermore, higher U.S. rates tend to pull capital out of international markets and into U.S. assets (the ‘safe haven’ effect), leading to currency depreciation and tighter financial conditions abroad. Central banks in Europe, Asia, and Latin America watch the PCE release closely as it informs their own policy decisions regarding exchange rate management and inflation containment.

International Trade and Commodity Pricing

Inflation in the U.S. also impacts global trade dynamics. If U.S. inflation remains elevated, the sustained strength of the dollar can make U.S. exports more expensive, affecting trade balances. For commodity producers, the relationship is complex: while higher U.S. inflation might signal strong demand, the corresponding rise in U.S. interest rates can put downward pressure on commodity prices (like gold and copper) by increasing the cost of holding non-yielding assets.

- Emerging Markets Risk: Sustained high PCE data increases the risk of capital flight and debt distress in countries with large dollar-denominated liabilities.

- Currency Valuation: The PCE reading is a primary driver for the U.S. Dollar Index (DXY); a hawkish interpretation strengthens the dollar against the Euro, Yen, and other major peers.

- Global Central Bank Coordination: Foreign central banks adjust their own rate decisions based on the U.S. PCE trend to manage imported inflation and maintain competitive exchange rates.

Therefore, the December 5 data release is a global event. A benign report, confirming disinflation, would likely ease global financial conditions, providing relief to international borrowers and potentially stabilizing volatile emerging market currencies. Conversely, a negative surprise would propagate tightening throughout the global financial system, amplifying existing economic headwinds worldwide.

| Key Metric | Market Implication/Analysis |

|---|---|

| Core PCE (Y/Y) | The Fed’s primary focus. Reading above 3.8% risks further rate hikes; below 3.5% validates pause. |

| Supercore Services | Measures sticky, wage-driven inflation. Persistent acceleration signals insufficient labor market cooling. |

| 3-Month Annualized Rate | Indicates short-term momentum. Must sustain below 3.0% for the Fed to consider policy loosening. |

| Headline PCE (M/M) | Highly sensitive to energy and food. Can create market noise but is secondary to the Core metric for long-term policy. |

Frequently Asked Questions about PCE inflation data released December 5: Why this report matters most to the Fed

The PCE (Personal Consumption Expenditures) index uses a dynamic basket of goods and services, accounting for consumer substitution effects, whereas the CPI (Consumer Price Index) uses a fixed basket. The PCE also covers a broader range of expenditures, including those paid by third parties, making it the Federal Reserve’s preferred, generally lower, measure of price pressure.

A higher-than-expected Core PCE reading signals persistent inflation, increasing the likelihood that the Federal Reserve will maintain or raise interest rates. This would typically lead to a sharp sell-off in U.S. Treasuries, particularly in shorter-term yields (2-year), as bond prices fall when interest rate expectations rise. Analysts project potential 15-20 basis point movements.

Investors should focus intensely on the Core PCE (excluding food and energy) and, specifically, the non-housing services component, often termed ‘supercore’ inflation. This area is highly sensitive to labor market tightness and wage growth, representing the stickiest part of the inflation problem that monetary policy is currently targeting.

If the PCE data confirms disinflation, it alleviates pressure on consumer purchasing power, potentially supporting future discretionary spending and improving the earnings outlook for retail and consumer cyclical companies. Conversely, sticky PCE suggests ongoing margin pressure, as companies struggle to pass on costs to inflation-weary consumers.

The December 5 release is pivotal because it is the last comprehensive inflation data point the FOMC receives before its critical final policy meeting of the year. It serves as the ultimate test of the effectiveness of the current restrictive monetary policy stance and dictates the tone for the Fed’s forward guidance into the new fiscal year.

The Bottom Line: Policy Path and Market Stability

The December 5 PCE inflation data release is far more than a routine economic statistic; it is the definitive policy input for the Federal Reserve’s next crucial decision. The market has priced in a delicate equilibrium—a ‘soft landing’ where inflation retreats without a significant recession. This equilibrium hinges entirely on the Core PCE rate continuing its downward trajectory towards the 2% target.

If the data confirms a sustained deceleration in core services inflation, particularly with the three-month annualized rate dropping below 3.0%, it will provide the FOMC with the necessary confidence to maintain the current pause and potentially begin discussing the timing of future policy normalization. This outcome would likely stabilize fixed-income markets and support risk assets into the year-end. However, investors must remain vigilant. Any unexpected rebound in the Core PCE metric, driven perhaps by persistent wage growth, would immediately shatter market complacency, forcing a recalibration of rate expectations and signaling a prolonged period of restrictive monetary policy. The integrity of the disinflationary narrative rests on this single report, making its components and trajectory the most important feature for financial market participants to monitor in the coming weeks.