Goldman Sachs: US Housing Shortage Requires 3-4 Million More Homes by 2030

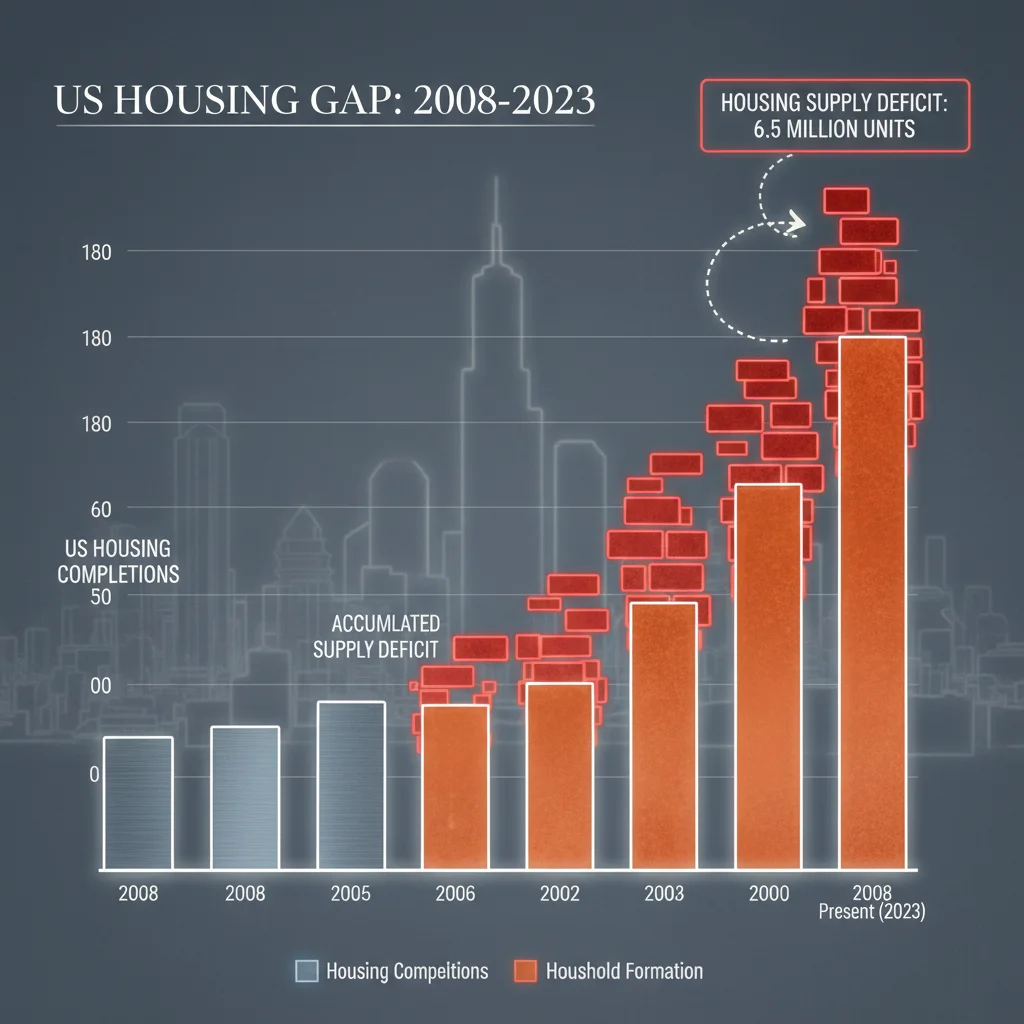

Goldman Sachs research indicates that the structural deficit in the US housing market requires the construction of 3 to 4 million additional housing units by 2030 to restore historical balance between supply and household formation, a necessity driven by prolonged underbuilding since the 2008 financial crisis.

The US housing market faces a profound structural supply imbalance, a challenge that Goldman Sachs analysts have quantified with striking precision: the nation requires an estimated US housing shortage of 3 to 4 million more homes by the end of the decade. This deficit, accumulated over more than a decade of insufficient construction activity relative to demographic needs, continues to exert significant upward pressure on home prices and rents, fueling inflationary concerns and deepening the affordability crisis for first-time buyers and renters alike. For investors, policymakers, and industry participants, this projection is not merely an academic exercise; it represents a critical macroeconomic constraint that dictates investment strategies, regulatory priorities, and the trajectory of US economic growth through 2030. The implications span from municipal fiscal health to the Federal Reserve’s ongoing efforts to manage inflation.

The roots of the US housing shortage: A post-2008 structural deficit

The current lack of housing inventory is not a cyclical phenomenon driven solely by recent interest rate hikes or pandemic-era migration patterns; rather, it is the result of deep-seated structural failings in the construction pipeline following the 2008 financial crisis. According to Goldman Sachs’ economic research division, the average pace of residential construction completions in the decade following the crisis fell dramatically short of the historical average necessary to keep pace with US household formation rates. This prolonged period of underbuilding created a compounding deficit that now requires aggressive intervention to correct.

Prior to 2008, the US typically completed between 1.5 million and 2 million new housing units annually, including both single-family and multi-family structures. Post-crisis, this pace dropped significantly, often hovering around 1 million to 1.2 million units annually for several years. Even as demographics surged—driven by millennial household formation and sustained immigration—production lagged. This gap is the fundamental driver behind the 3 to 4 million unit deficit projected by Goldman Sachs. The long-term equilibrium necessary for price stability requires not just meeting current demand but aggressively compensating for past shortfalls.

Demographic pressures and household formation rates

The demand side of the equation remains robust, anchored by demographic shifts. The largest cohort of Americans, the millennials, are now entering their prime home-buying years (ages 35 to 45). This demographic wave ensures sustained demand for ownership and high-quality rental properties, regardless of short-term economic fluctuations. Furthermore, household formation, which slowed immediately after the 2008 recession, has normalized and, in specific high-growth regions, accelerated.

- Millennial Cohort Influence: The peak home-buying age group is expected to drive elevated demand through at least 2035, maintaining pressure on entry-level and mid-range housing stock.

- Immigration Impact: Sustained net international migration contributes significantly to household formation, particularly in major metropolitan areas like Miami, New York, and Dallas, increasing the need for multi-family units.

- Aging Inventory: A substantial portion of existing US housing stock is aging, requiring replacement or significant capital expenditure, further tightening the effective supply of desirable, modern units.

This confluence of structural underbuilding and robust demographic demand explains why the US housing market has shown resilience in price appreciation even amidst climbing mortgage rates. For the supply deficit to be closed, construction must exceed the trend rate of household formation for a sustained period, likely requiring annual completions substantially above 1.7 million units through 2030, according to analysis derived from the Goldman Sachs report.

Economic implications of the persistent supply deficit

The failure to close the 3-4 million unit gap has far-reaching economic consequences, extending beyond the real estate sector itself. Housing costs—both rents and owner-equivalent rent—are major components of the Consumer Price Index (CPI), making the supply shortage a key structural driver of inflation. Persistent high housing inflation complicates the Federal Reserve’s mandate and potentially necessitates a longer period of restrictive monetary policy.

Goldman Sachs economists emphasize that until supply substantially improves, housing inflation will remain sticky. As of Q3 2024, shelter inflation continues to run hot, even as goods inflation moderates, keeping the overall CPI elevated. Furthermore, the lack of affordable housing acts as a constraint on labor mobility. Workers are less likely to relocate to high-productivity, high-wage areas if housing costs consume an outsized portion of their income, potentially dampening overall US economic productivity growth, a key concern for long-term GDP projections.

The impact on home price appreciation and affordability

The most immediate and visible consequence is the accelerated home price appreciation (HPA). Despite mortgage rates peaking above 7% in late 2023, the national median home price has remained near record highs. This resilience is a direct testament to the foundational supply shortage. When inventory is severely limited, even reduced demand due to high financing costs is insufficient to trigger meaningful price declines.

For the average American household, affordability has plummeted to levels not seen since the 1980s. The combination of elevated prices and high interest rates means the monthly payment required to finance a median-priced home has increased by over 50% compared to pre-pandemic levels. This severely limits the ability of first-time buyers to enter the market, creating a wealth gap and exacerbating inequality. Addressing the US housing shortage is therefore seen by many analysts as a prerequisite for restoring middle-class financial stability.

Institutions like Moody’s Analytics and Wells Fargo echo the Goldman Sachs findings, suggesting that while multi-family construction has surged in certain areas, single-family production remains constrained. The supply response has been uneven, focusing heavily on higher-density rental units rather than owner-occupied single-family homes, further straining the inventory available for traditional families.

Challenges to achieving the 3-4 million unit goal

While the required production target is clear—an average of approximately 1.8 million to 2.0 million units annually through 2030—the path to achieving it is fraught with significant logistical and regulatory hurdles. The building industry faces persistent constraints related to labor, materials, and local zoning requirements, often referred to as Not-In-My-Backyard (NIMBY) policies.

Labor and supply chain constraints

The residential construction sector has struggled with a chronic shortage of skilled labor since the Great Recession. Many workers left the industry during the downturn and did not return, leading to higher labor costs and slower construction timelines. Data from the Bureau of Labor Statistics (BLS) consistently shows high job openings in construction trades. Furthermore, supply chain disruptions, though easing since 2022, continue to affect material costs, particularly lumber, steel, and specialized components like electrical equipment.

- Skilled Labor Deficit: The average age of construction workers continues to rise, and insufficient vocational training pipelines limit the influx of new talent needed for large-scale projects.

- Material Cost Volatility: While spot prices for some materials have normalized, geopolitical risks and energy costs maintain volatility, making project budgeting difficult for developers.

- Productivity Lag: Unlike manufacturing, construction industry productivity gains have been minimal over the last two decades, contributing to higher overall housing costs.

These constraints mean that simply increasing capital availability is insufficient. Solutions must involve policy initiatives aimed at vocational training, streamlining permitting processes, and potentially leveraging modular or prefabricated construction techniques to boost efficiency, an area where investment banks are increasingly focused for private equity deployment.

The role of zoning and regulatory reform

Perhaps the most significant non-economic challenge is the complex web of local land-use regulations and exclusionary zoning policies. These policies, which often mandate minimum lot sizes or restrict multi-family development, effectively limit density and increase the cost of land per unit, making construction prohibitively expensive in high-demand areas. Goldman Sachs’ analysis notes that regulatory barriers account for a substantial portion of total development costs in major US metros.

Progress toward the 3-4 million unit target requires significant shifts in local policy. States like California, Oregon, and Washington have begun implementing statewide reforms to override local restrictions on multi-family housing near transit hubs, a trend that may accelerate as the affordability crisis deepens. The concept of “upzoning”—rezoning areas for higher density—is a crucial component of any effective strategy to address the US housing shortage.

Financial market response and investor focus

Financial markets have responded to the structural deficit by channeling capital into sectors positioned to benefit from the sustained demand for housing and associated infrastructure. Homebuilders, particularly those focused on entry-level and build-to-rent (BTR) segments, have seen robust equity performance, often trading at a premium to historical valuations. Institutional investors, including private equity funds and Real Estate Investment Trusts (REITs), are heavily allocating capital to BTR communities and specialized housing finance.

The BTR market, in particular, has emerged as a high-growth area. Recognizing that many households are priced out of ownership, institutional capital is funding the construction of entire neighborhoods designed specifically for long-term rental, providing a partial solution to the supply problem while generating stable cash flows for investors. However, this trend also raises concerns about the increasing institutionalization of single-family housing, potentially further removing starter homes from the reach of individual buyers.

Furthermore, investment in housing technology (PropTech) aimed at reducing construction costs and improving efficiency is accelerating. Venture capital is flowing into companies specializing in modular construction, advanced robotics for site work, and digitized permitting platforms, all intended to break through the productivity barriers detailed in the Goldman Sachs report.

Policy levers and potential solutions for closing the gap

Addressing a deficit of this magnitude requires a coordinated policy response at federal, state, and local levels. Simply relying on market forces, especially with high interest rates, has proven insufficient to spur the necessary construction volume to meet the 3-4 million unit goal. Policy interventions must focus on both reducing regulatory friction and offering financial incentives.

Federal and state initiatives for supply acceleration

At the federal level, proposals often center on conditioning federal transportation or infrastructure funding on local governments undertaking zoning reform. This “carrot and stick” approach encourages localities to embrace higher-density housing. State governments, recognizing the economic drag of expensive housing, are increasingly intervening directly. For instance, several states have adopted legislation aimed at streamlining the environmental review process for housing projects or allowing for the construction of Accessory Dwelling Units (ADUs) in areas traditionally reserved for single-family homes.

The focus is shifting from demand-side subsidies (like tax credits for buyers) to supply-side incentives. These include low-interest loans or tax abatements for developers who commit to building affordable or workforce housing, particularly in areas near major employment centers. The objective is to make the economics of high-volume construction viable despite elevated material and labor costs.

Economists at the Brookings Institution suggest that while federal incentives are helpful, the most potent lever remains local zoning reform, as nearly 80% of residential construction costs are determined by factors outside the direct control of the builder, such as land use and permitting timelines. The ability to build more units on less land is the most direct way to reduce the cost per unit, thereby improving affordability.

Forecasting the housing market trajectory through 2030

If the US fails to meet the Goldman Sachs projection and falls short of the 3-4 million unit target by 2030, the financial consequences are predictable: continued high rates of HPA, sustained shelter inflation, and further erosion of homeownership rates. Conversely, a successful acceleration in building could lead to a normalization of the price-to-rent ratio and a moderation in housing cost inflation, easing pressure on the Federal Reserve.

Goldman Sachs models suggest that if annual completions reach and sustain 1.9 million units, the accumulated deficit could be largely erased by 2032. This scenario would imply a significant deceleration in national HPA, potentially aligning with overall CPI inflation, rather than exceeding it by several percentage points as has been the case recently. However, regional disparities will persist. High-barrier-to-entry markets like coastal California and the Northeast will likely continue to experience acute shortages and high prices, even if national aggregates improve, due to deeply entrenched regulatory environments.

The trajectory of the housing market over the next six years is thus fundamentally tied to the construction industry’s capacity and policymakers’ willingness to address the structural impediments. Financial analysts are watching building permits, housing starts, and zoning reform initiatives as key forward-looking indicators of progress against the projected US housing shortage.

| Key Metric/Factor | Market Implication/Analysis |

|---|---|

| Required Unit Increase by 2030 | 3 to 4 million units (Goldman Sachs estimate). Failure to meet this prolongs inflation and affordability crisis. |

| Target Annual Completions | Must exceed 1.7 million units consistently to both meet current demand and erase the accumulated deficit. |

| Primary Constraint | Local zoning restrictions (NIMBYism) and shortage of skilled labor are the largest non-financial barriers to production. |

| Investor Focus | Increased capital allocation to Build-to-Rent (BTR) segments and PropTech aimed at construction efficiency. |

Frequently asked questions about the US housing shortage

The primary cause is the prolonged period of underbuilding that occurred between 2008 and 2020. Residential construction completions lagged significantly behind the rate of household formation, leading to an accumulated structural deficit, which subsequently drives up prices and reduces inventory across most US metros.

The shortage keeps shelter inflation, a key component of the CPI, persistently high. Until the supply deficit is meaningfully reduced, housing costs will exert upward pressure on overall inflation, potentially forcing the Federal Reserve to maintain restrictive interest rates for a longer duration to meet its 2% inflation target.

The deficit is most acutely felt in high-growth metropolitan areas and coastal, high-cost-of-living regions where regulatory barriers are highest. Cities in California, the Northeast corridor, and rapidly expanding Sunbelt metros like Austin and Phoenix face severe affordability pressures due to limited available housing stock.

Investors are focusing on publicly traded homebuilders with strong land positions, companies specializing in multi-family and Build-to-Rent (BTR) housing, and firms developing construction technology (PropTech) aimed at improving efficiency and reducing the cost and time required to build new units.

Policy changes, particularly local zoning reform allowing for greater density and streamlined permitting, are essential. While the 3-4 million unit goal is ambitious, accelerated construction combined with regulatory easing could significantly moderate price growth and begin to close the gap by the early 2030s.

The bottom line: A long-term challenge requiring structural reform

The Goldman Sachs projection that the US needs 3-4 million more homes by 2030 serves as a stark metric defining the scale of the nation’s housing crisis. This deficit is not a temporary market fluctuation; it is a structural imbalance requiring deep, sustained policy commitment and technological innovation within the construction sector. For financial markets, the implication is clear: housing-related assets will likely retain a fundamental floor of demand, but the ultimate health of the real estate market hinges on the capacity of builders and policymakers to overcome regulatory and labor constraints. Investors must monitor not only mortgage rates and macroeconomic indicators but also local and state progress on zoning reform. Until substantial progress is made toward the 1.8-2.0 million annual completion rate, the high cost of housing will continue to weigh on US economic productivity and act as a persistent source of inflationary pressure, challenging the Federal Reserve’s path to price stability.