Unemployment at 4.4%: Labor market cooling and investment implications

The increase in the US unemployment rate to 4.4% suggests a decisive shift in the labor market cooling narrative, potentially paving the way for Federal Reserve rate cuts and creating distinct opportunities in interest-rate sensitive investment sectors.

The latest Bureau of Labor Statistics (BLS) report, revealing a jump in the unemployment rate to 4.4%—up from 3.9% just three months prior—has sent a clear signal across global financial markets: the long-anticipated period of labor market cooling is accelerating. This critical shift moves the economy closer to the Federal Reserve’s target of softening demand without triggering a severe contraction, but it simultaneously introduces new dynamics for investors. This deceleration in employment growth, coupled with moderating wage inflation, fundamentally alters the calculus for monetary policy, suggesting that the central bank may pivot toward easing sooner than previously projected, thereby generating potential investment opportunities in rate-sensitive sectors like housing, durable goods, and technology.

The 4.4% unemployment threshold: implications for federal reserve policy

The move to a 4.4% unemployment rate is a pivotal data point, crossing what many economists consider the threshold for meaningful labor market slack. For the Federal Reserve, which manages its dual mandate of maximum employment and price stability, this figure provides essential cover to shift its focus. Historically, increases of 0.5 percentage points or more above the cycle low (often referred to as the ‘Sahm Rule’ trigger) have been closely associated with the onset of recessions. While the current 4.4% remains below the typical recessionary peak, the speed of the ascent is what captures the attention of the Federal Open Market Committee (FOMC).

Analysts at Goldman Sachs noted in a recent client brief that the unemployment rate is now 50 basis points higher than the consensus estimate for the natural rate of unemployment (Non-Accelerating Inflation Rate of Unemployment, or NAIRU), which they place near 4.0%. This growing gap suggests that the labor market is no longer a primary driver of inflationary pressure. Consequently, market expectations for the timing and magnitude of interest rate cuts have been significantly revised. As of the end of Q3 2024, futures markets priced in an 85% probability of at least one 25-basis-point rate cut by the March 2025 FOMC meeting, up from 55% only a month earlier, according to CME Group data.

Deciphering the monetary policy pivot

The central bank’s recent rhetoric has emphasized data dependence, and the 4.4% unemployment reading is perhaps the most compelling evidence yet that restrictive policy is working through the economy. The cooling is not isolated; it is mirrored by a decline in average hourly earnings growth, which slowed to 3.8% year-over-year in the latest report, down from a peak of 5.6% observed during the post-pandemic surge. This deceleration is crucial because the Fed views wage growth as a key metric for sticky services inflation.

- Rate Cut Probability: The perceived easing of the labor market pressure increases the likelihood of an earlier start to the rate-cutting cycle, aiming to achieve a ‘soft landing’ rather than a hard recession.

- Inflationary Buffer: Slower wage growth reduces the risk of a wage-price spiral, allowing core Personal Consumption Expenditures (PCE) inflation—the Fed’s preferred gauge—to converge toward the 2% target more rapidly.

- Real Interest Rates: As inflation declines while nominal rates remain high, real interest rates become increasingly restrictive, further slowing economic activity and reinforcing the need for policy adjustment.

The immediate market response has been a rally in US Treasury bonds, with the 10-year yield dropping 18 basis points on the day the unemployment data was released, reflecting decreased expectations for future short-term rates. This yield compression is a direct signal that the bond market anticipates lower funding costs, a key factor for sectors reliant on borrowing. The consensus among fixed-income strategists at JPMorgan Chase is that the 10-year yield could test 3.8% if unemployment continues its upward trajectory toward 4.7% in the first half of 2025.

Sector rotation opportunities: the shift to rate-sensitive industries

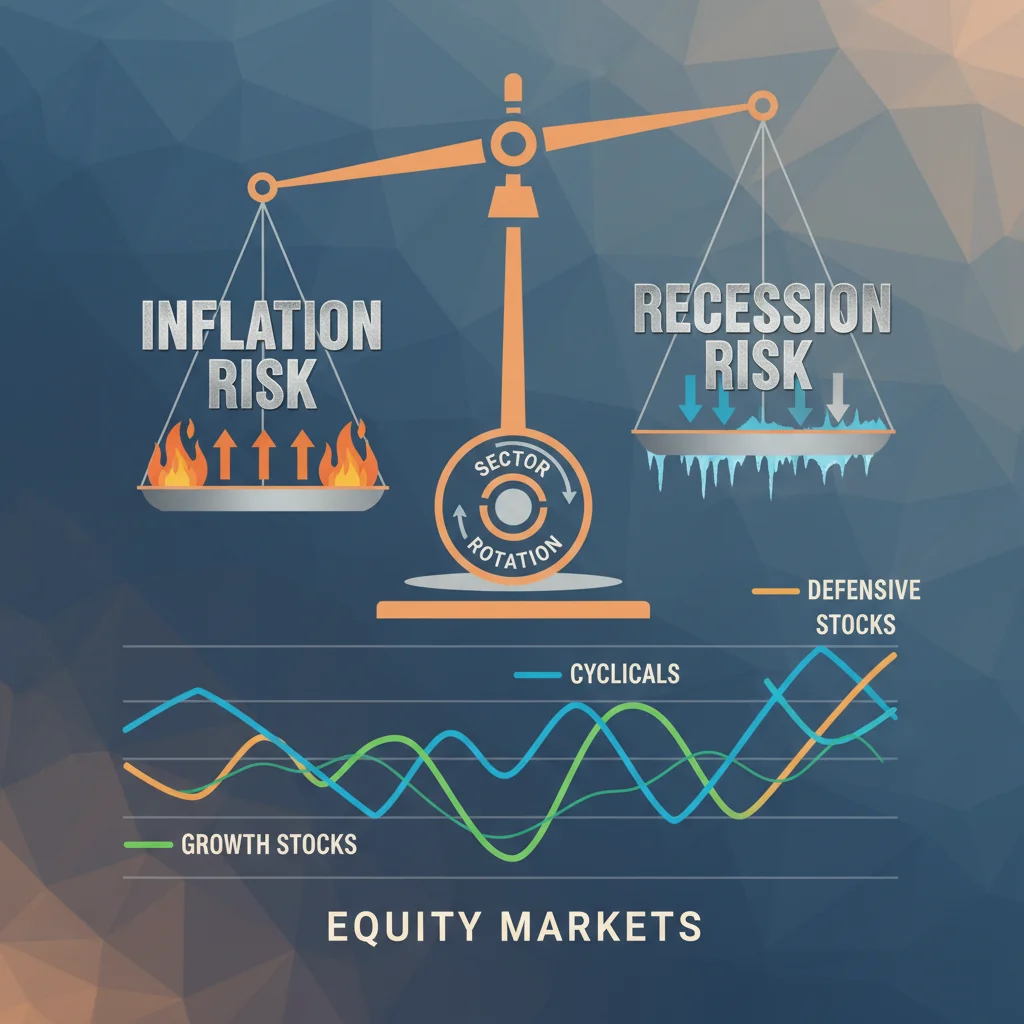

A significant shift in the employment landscape demands a corresponding rotation in investment strategy. When the labor market tightens, investors typically favor cyclical stocks and commodities. However, as the economy slows and the prospect of lower interest rates materializes, capital tends to rotate into sectors that benefit most from cheaper credit and increased consumer purchasing power, specifically housing, technology, and utilities.

Housing and construction: recovering from peak rates

The US housing market has been severely constrained by mortgage rates that peaked near 8% in the previous year. The drop in Treasury yields following the 4.4% unemployment report immediately translated into lower 30-year fixed mortgage rates, which fell to an average of 6.6%, according to Freddie Mac data. This reduction in borrowing costs is the single most important catalyst for housing market recovery.

Homebuilders, who saw their order backlogs shrink and cancellation rates rise during the peak interest rate environment, are positioned to benefit substantially. Companies with strong balance sheets and land positions in high-growth areas, such as Texas and Florida, are particularly attractive. Furthermore, the ancillary industries—building materials suppliers, home improvement retailers, and mortgage originators—are expected to see a revival in activity. Analysts at Bank of America project a 12% increase in new housing starts in 2025, provided the 30-year fixed mortgage rate stabilizes below 6.5%.

- Mortgage Demand: Lower rates stimulate both refinancing activity and new purchase applications, boosting profitability for financial institutions specializing in mortgages.

- Builder Sentiment: The National Association of Home Builders/Wells Fargo Housing Market Index (NAHB/Wells Fargo HMI) is expected to rise from its current level (45) back toward the expansionary threshold (50) as rates decline.

- Durable Goods Spending: Increased home sales typically precede higher consumer spending on durable goods, benefiting appliance manufacturers and furniture retailers.

Technology stocks: the dual benefit of lower rates and deflationary pressure

Technology stocks, particularly those in the high-growth, long-duration segment, are highly sensitive to interest rate fluctuations. Their valuations often rely on discounted future cash flows, making them significantly more valuable when the discount rate (i.e., interest rate) declines. The signal of labor market cooling and potential Fed easing provides a strong tailwind for the technology sector, especially for firms that require external financing for aggressive expansion or research and development.

The Nasdaq Composite, heavily weighted toward technology giants, has historically outperformed the S&P 500 during periods when the 10-year Treasury yield is trending downward. Moreover, many large-cap technology companies have recently focused on efficiency gains and cost reduction, often involving workforce optimization, which aligns with the broader theme of economic deceleration. This strategic pivot, combined with falling interest rates, offers a dual benefit: reduced operating expenses and higher valuation multiples.

Navigating the small-cap resurgence

While large-cap tech often leads the charge, the most dramatic performance gains may be found in small-cap technology and biotech firms, which are often more debt-reliant. The Russell 2000 index, which tracks small-cap performance, has lagged behind the S&P 500 significantly during the high-rate environment. However, a pivot toward lower rates could unlock substantial value in these smaller companies, reducing their debt servicing costs and making their growth trajectories more viable. Data from Bloomberg Intelligence shows that small-cap companies with high leverage ratios could see their weighted average cost of capital (WACC) drop by as much as 150 basis points if the Fed executes three 25-basis-point cuts by mid-2025.

Investors focused on this area must exercise careful due diligence, prioritizing firms with clear paths to profitability and sustainable competitive advantages, as opposed to those relying purely on speculative growth. The risk remains that if the economic slowdown turns into a full recession, even lower rates may not compensate for dramatically reduced corporate earnings.

The downside risks: corporate earnings and recessionary fears

While the prospect of lower rates is generally bullish for asset valuations, the underlying cause—a weakening labor market—introduces significant risk to corporate earnings. The 4.4% unemployment rate is a leading indicator of reduced consumer health and decreased corporate pricing power. Companies that rely heavily on discretionary consumer spending, or those with high fixed labor costs, are likely to face substantial headwinds in the coming quarters.

The deceleration in job creation means fewer paychecks and a more cautious consumer base. According to the Conference Board’s latest survey, consumer confidence dropped by 7 points in the month following the unemployment report, driven largely by pessimism regarding future job availability. This sentiment shift translates directly into slower sales growth for retailers and manufacturers of non-essential goods. Earnings estimates for the S&P 500 for Q1 2025 have already been revised downward by 2.1% in the wake of the labor data, according to FactSet data.

Analyzing margin compression

The cooling labor market paradoxically creates margin pressure for some firms. While wage growth is slowing, companies cannot immediately adjust their existing workforce or restructure operations without incurring significant severance costs. Furthermore, if demand weakens faster than expected, companies may be forced to offer deep discounts to move inventory, leading to gross margin compression. This risk is particularly acute in the manufacturing and retail sectors, where inventory management is critical.

- Cyclical Downturn: Sectors like industrials and materials, which thrive on strong global demand, face reduced forward guidance as global growth projections are tempered by US economic slowing.

- Credit Risk: As unemployment rises, credit card defaults and loan delinquencies historically increase, posing a risk to regional banks and financial services firms with high exposure to consumer lending.

- Defensive Shift: Investors seeking resilience are likely to favor companies with inelastic demand, such as healthcare providers, essential utilities, and consumer staples, which offer predictable cash flows regardless of the unemployment rate.

Fixed income strategy: duration and credit quality focus

The fixed income market is perhaps the clearest beneficiary of the labor market cooling trend. Lower expected inflation and the anticipation of Fed rate cuts increase the value of existing bonds, especially those with longer durations. The flattening, and subsequent inversion, of parts of the yield curve earlier this year signaled economic stress, but the current data suggests the potential for a ‘bull steepening’—where long-term yields fall less than short-term yields, driven by lower Fed expectations.

Portfolio managers are increasingly emphasizing duration extension. Moving from short-term Treasury bills to intermediate-term notes (5- to 7-year maturities) allows investors to lock in higher yields before the expected rate cuts take full effect. Furthermore, the spread between corporate bonds and risk-free Treasuries (credit spread) is widening slightly, reflecting increased economic uncertainty and default risk. This suggests a strategic focus on high credit quality is warranted.

The appeal of municipal bonds and investment-grade corporate bonds

Municipal bonds, which offer tax-advantaged income, become particularly attractive in a lower interest rate environment, especially for high-net-worth individuals facing higher tax brackets. Similarly, investment-grade corporate bonds (rated BBB or higher) offer a yield premium over Treasuries without excessive default risk. High-yield (junk) bonds, however, carry elevated risk in a slowing economy, as rising unemployment increases the probability of corporate distress and bankruptcy.

According to analysis from BlackRock, the current environment favors a barbell approach in fixed income: maintaining a core allocation in ultra-safe, short-duration assets for liquidity, while strategically extending duration in high-quality government and corporate bonds to capture capital appreciation from falling rates. This strategy balances safety with the potential for rate-linked gains, mitigating the risk associated with a sharp economic downturn.

Global economic context: trade-offs and currency implications

The US unemployment increase to 4.4% does not occur in a vacuum; it has significant ramifications for the global economy and currency markets. A cooling US economy typically means less demand for imports, affecting trading partners, particularly those in Asia and Europe heavily reliant on US consumption. Conversely, the prospect of earlier Fed rate cuts weakens the US dollar (USD) against major currencies, which can alleviate financial stress in emerging markets that hold US dollar-denominated debt.

The US Dollar Index (DXY) has shown volatility, dropping 1.2% in the week following the employment report. This weakening dollar makes US exports cheaper, potentially benefiting multinational corporations and manufacturers. Furthermore, a weaker dollar typically boosts commodity prices, as raw materials—denominated in USD—become more affordable for buyers using other currencies. This factor supports investments in gold and certain industrial metals, which often serve as hedges against monetary policy shifts and currency devaluation.

Divergence in global central bank policy

The US deceleration contrasts with the economic performance of regions like the Eurozone, where inflation remains stubbornly high and labor markets, while softening, have not cooled as rapidly as in the US. This divergence creates a policy gap. If the Fed begins cutting rates while the European Central Bank (ECB) or the Bank of England (BoE) remain on hold, the interest rate differential will narrow, further pressuring the USD and potentially strengthening the Euro and Pound Sterling. This scenario creates opportunities in foreign exchange markets and for US investors seeking diversification through international equities.

- Emerging Markets: A weaker dollar and lower global interest rates reduce debt servicing costs and attract capital flows back into emerging market equities and bonds, particularly in countries with stable fiscal policies.

- Commodity Prices: Gold and silver are highly responsive to falling real interest rates and a weakening dollar, acting as a potential store of value amid economic uncertainty.

- International Equities: Non-US developed markets, which may be earlier in their economic cycle recovery, could offer better relative returns if the Fed’s easing prevents a global recession.

The investment playbook for a soft landing scenario

The current economic narrative hinges on the Federal Reserve achieving a ‘soft landing’—slowing inflation and the labor market sufficiently to avoid a recession. The 4.4% unemployment rate is a strong indicator that the economy is on this path, albeit with increased risk. For investors, the playbook demands dynamic portfolio management, shifting from defensive positioning to strategic growth allocation in anticipation of the rate pivot.

The strategic allocation should prioritize sectors most leveraged to lower borrowing costs, while maintaining exposure to high-quality defensive assets to hedge against the possibility that the cooling accelerates into a hard landing. This involves a calculated move out of cash and short-duration instruments into longer-duration assets and high-growth equities that have been suppressed by the high-interest-rate environment of the past two years. The focus should be on companies with pricing power, regardless of the economic climate, and those with demonstrated operational efficiency to weather the temporary consumer slowdown associated with higher unemployment.

Maintaining a diversified portfolio across fixed income, real assets, and equities, with a tactical overweighting toward interest-rate sensitive industries, remains the most prudent approach. The key risk to monitor is the rate of unemployment increase; a rapid jump toward 5.0% would signal a recession is imminent and necessitate a sharp shift back toward extreme defensive positioning.

| Key Metric/Factor | Market Implication/Analysis |

|---|---|

| Unemployment Rate at 4.4% | Signals sufficient labor market slack for the Fed to consider earlier rate cuts, boosting rate-sensitive sectors. |

| Average Hourly Earnings (3.8% YOY) | Decelerating wage growth reduces sticky services inflation risk, supporting the disinflation narrative. |

| 10-Year Treasury Yield Drop | Lower long-term borrowing costs directly benefit housing, technology, and high-growth equity valuations. |

| Increased Recessionary Risk | Requires defensive positioning in staples and healthcare, and careful selection within high-yield credit. |

Frequently asked questions about labor market cooling and investments

The 4.4% unemployment rate, demonstrating significant labor market cooling, increases the probability of earlier rate cuts. This figure provides the FOMC with the necessary evidence that their restrictive policy is effectively tempering demand, potentially leading to the first 25-basis-point cut as early as Q1 2025, according to futures market pricing.

Sectors highly sensitive to interest rates, such as housing (homebuilders, real estate investment trusts), technology (particularly high-growth, long-duration stocks), and utilities, are expected to benefit most. Lower borrowing costs improve financing conditions and boost valuation multiples for future cash flows.

The main risk is that the cooling transitions into a recession, leading to corporate earnings contraction. Rising unemployment reduces consumer spending and increases credit defaults, negatively impacting consumer discretionary stocks and regional banks with high consumer loan exposure.

Yes, the anticipation of lower Fed rates makes duration extension strategically advantageous. Investors may consider shifting from short-term Treasury bills to intermediate-term (5-7 year) investment-grade corporate and municipal bonds to capture potential capital appreciation as yields decline.

The cooling labor market weakens the US dollar, as the need for restrictive policy diminishes. A weaker dollar benefits US multinational exporters and emerging markets by easing debt burdens. It also typically supports commodity prices, such as gold, which are dollar-denominated assets.

The bottom line

The US economy’s trajectory, marked by the unemployment rate hitting 4.4%, confirms that the Federal Reserve’s restrictive monetary policy has successfully engineered a moderation in the labor market. This development shifts the primary economic risk from persistent inflation to potential demand erosion, compelling investors to re-evaluate their portfolio allocations. The transition period offers a crucial window for strategic investment: fixed income should emphasize duration and quality, while equity portfolios should tactically overweight rate-sensitive growth sectors like technology and housing, which were severely penalized during the peak of the hiking cycle. Conversely, vigilance regarding corporate earnings is paramount, as the slowing consumer environment will inevitably challenge companies reliant on discretionary spending. The success of the ‘soft landing’ hinges on the pace of the labor market cooling; portfolio managers must remain nimble, prepared to pivot defensively if the unemployment rate accelerates toward 5.0% or higher, signaling a full-blown recession.