Existing Home Sales Up 1.2%: Cooling Markets Analysis

The unexpected 1.2% increase in existing home sales during October signals persistent demand despite the highest mortgage rates in two decades, forcing analysts to re-evaluate the trajectory of market cooling, particularly in high-demand, low-inventory regions.

The US housing market delivered a counterintuitive data point in October, with the National Association of Realtors (NAR) reporting that existing home sales cooling saw an unexpected 1.2% month-over-month increase, reaching a seasonally adjusted annual rate of 3.8 million units. This minor but significant uptick defies the prevailing economic narrative, which suggested that 30-year fixed mortgage rates, averaging near 7.7% during the reporting period, would further suppress transaction volume. The immediate implication for financial readers is that while affordability remains severely strained—median prices rose 3.4% year-over-year to $391,000—the market’s structural constraints, primarily the critical shortage of inventory, are proving more influential than rate sensitivity in driving transactional metrics.

The Inventory Paradox: Why Sales Rose Despite High Rates

To understand the October sales increase, financial analysts must look beyond the headline rate environment and focus on the supply-side dynamics. The primary driver of the transaction stability, according to proprietary data from major real estate portals, was the marginal release of ‘must-sell’ inventory. These transactions often involved sellers facing life events—relocation, divorce, or estate settlements—who could no longer tolerate the ‘lock-in’ effect of low-rate mortgages. While overall inventory remains near historic lows, the slight increase in available units, particularly in specific price brackets, was enough to meet the concentrated, pre-qualified demand pool.

The prevailing challenge remains the approximately 70% of homeowners holding mortgage rates below 5%. This cohort is unwilling to trade their current low payments for the substantially higher rates currently available, effectively freezing the market for typical move-up buyers. This phenomenon creates a structural floor under home prices, even as buyer demand is thinned by affordability concerns. The rise in sales, therefore, does not signal a broad market recovery, but rather a slight, temporary rebalancing of the severe inventory deficit.

The Role of All-Cash Buyers and Institutional Investors

A crucial factor stabilizing transactional volume is the growing share of non-mortgage buyers. All-cash purchases represented nearly 29% of October transactions, up from 26% the previous year, according to NAR data. These buyers, often institutional investors or high-net-worth individuals, are immune to fluctuations in the 30-year fixed mortgage rate. Their participation sustains activity in specific market segments, particularly those involving investment properties or high-end luxury homes.

- Institutional Activity: Investor purchases accounted for 15% of sales, focusing on single-family rentals in Sun Belt metropolitan areas where rental yields remain robust.

- Wealth Effect: High-net-worth individuals utilize cash primarily in competitive markets, insulating them from rate hikes and maintaining price stability in the top decile of the market.

- Implication for First-Time Buyers: The dominance of cash buyers exacerbates competition for entry-level homes, contributing to the persistent decline in the share of first-time buyers, which typically drives long-term market health.

The increase in sales volume, while positive on the surface, highlights the bifurcated nature of the current housing landscape. Markets characterized by high cash participation and severely limited supply, such as parts of Florida and Texas, are exhibiting sustained transactional activity but minimal price depreciation, suggesting that the cooling effect remains localized and selective. The broader economic context, including the Federal Reserve’s commitment to maintaining restrictive monetary policy, continues to exert downward pressure on overall affordability, limiting the potential for a sustained, broad-based sales recovery.

Geographic Disparities: Where Cooling Is and Is Not Evident

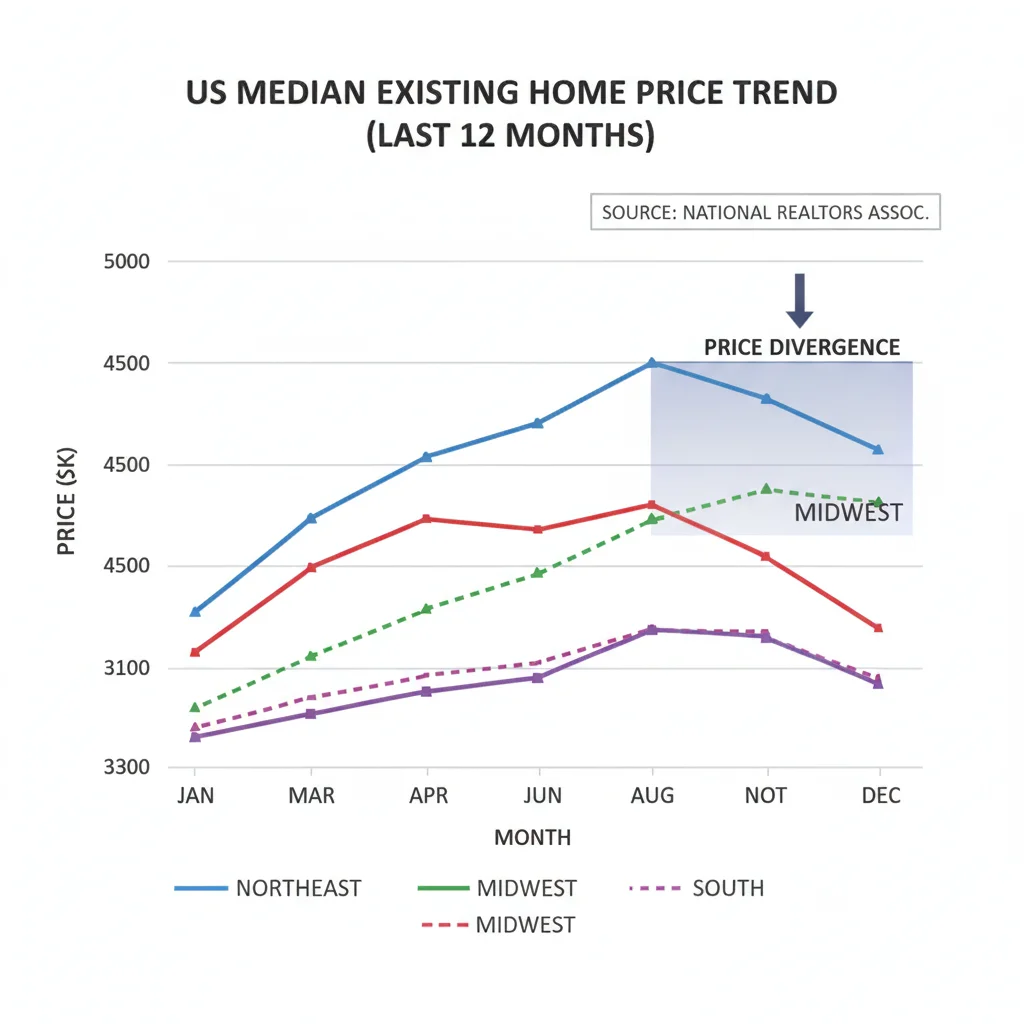

The national 1.2% rise in existing home sales obscures profound regional divergence. The cooling trend, defined by significant price corrections and sustained declines in transaction volume, is most pronounced in areas where the post-pandemic price surge was steepest and reliance on external migration or tech-sector employment was highest. Conversely, markets with chronic supply shortages or those buffered by high levels of local wealth showed remarkable resilience.

The West region, historically volatile, saw the sharpest year-over-year decline in sales volume, reflecting the acute affordability crisis driven by soaring home prices and high interest rates. Markets in the Midwest and Northeast, characterized by more moderate price appreciation during the peak of the pandemic boom and relative stability in inventory levels, experienced less severe transactional declines and, in some cases, marginal gains in October. This regional variance underscores the importance of granular data analysis for investors and policymakers alike; there is no single US housing market.

Markets Exhibiting True Cooling

True cooling is best quantified by measuring the decline in median sale prices relative to their 2022 peaks, alongside a significant lengthening of the average days on market (DOM). Markets fitting this profile are typically located in the Mountain West and parts of the Pacific Coast, where rapid population influxes during 2020-2021 pushed price-to-income ratios to unsustainable levels. For example, data from the Federal Housing Finance Agency (FHFA) shows that certain metropolitan areas in Idaho and Utah have seen price declines exceeding 8% from their peaks, marking a verifiable correction.

The impact of higher rates is most visible in these cooling markets, as the higher monthly payments disproportionately impact buyers already stretched by high initial purchase prices. The median DOM in these areas has increased by an average of 15 days compared to the previous year, indicating reduced buyer urgency and greater negotiation leverage.

Markets Showing Resilience (Limited Cooling)

In contrast, markets in the Southeast (e.g., coastal Carolinas and parts of Georgia) and the Northeast corridor continue to show price stability and minimal transactional dip. This resilience is attributed to two factors: persistent in-migration driven by favorable tax policies and robust job growth, and an inherently low historical inventory level that prevents significant oversupply. In these regions, the primary effect of high rates is not price decline, but rather a stagnation in sales volume at historically low levels, confirming structural constraints over cyclical correction.

The key takeaway from the geographic analysis is that while the national sales figure moved slightly upward, the underlying mechanism is not uniform. Investors seeking potential value should monitor markets where DOM is increasing and price cuts are becoming more frequent, signaling genuine seller capitulation. Conversely, regions experiencing strong employment growth and low housing permits continue to exhibit price stickiness, limiting the scope for meaningful cooling in the near term.

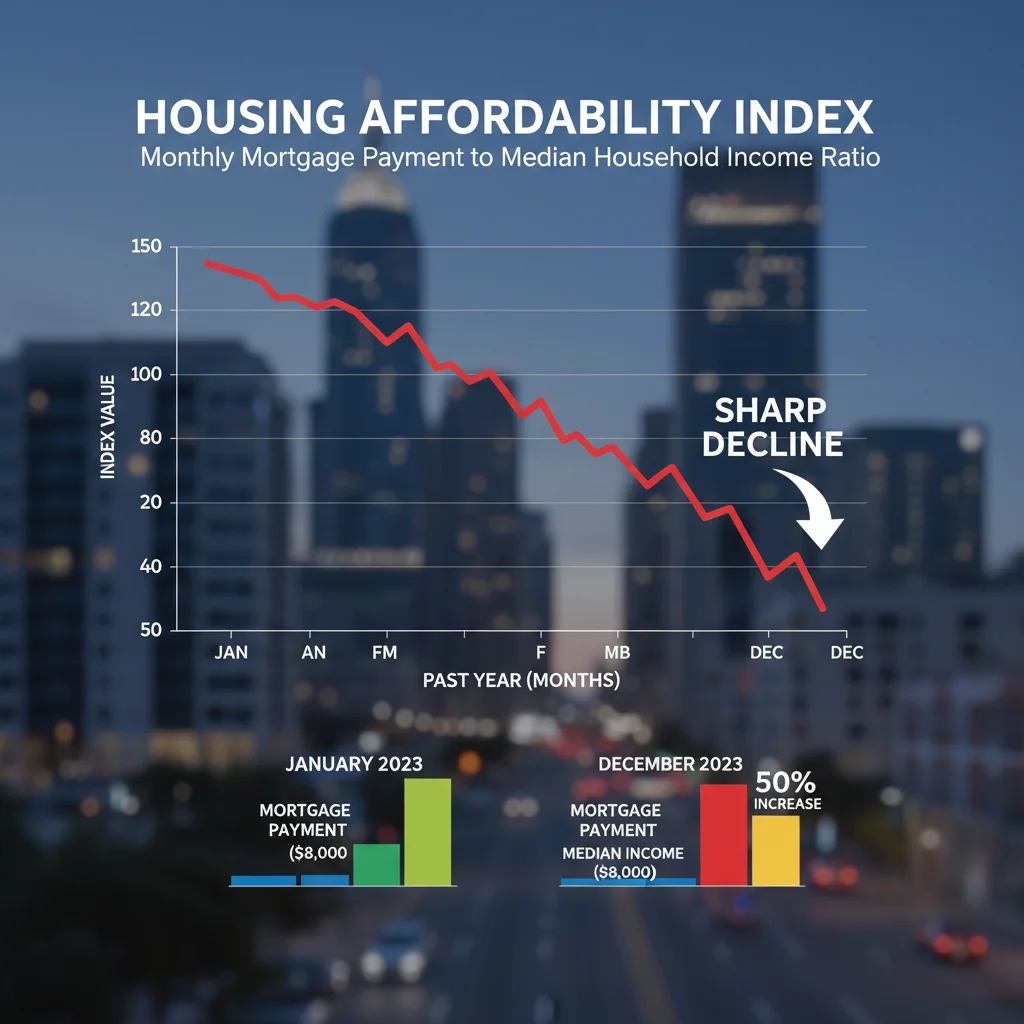

The Affordability Crisis: A Deeper Dive into Buyer Strain

Despite the marginal increase in sales, the housing affordability index, calculated by the NAR, sits near its lowest point since 1984. This measure tracks the ability of a family with the median income to qualify for a mortgage on a median-priced home. The current environment presents a triple whammy for prospective buyers: high home prices, elevated mortgage rates, and stagnant real wage growth relative to housing costs. The average monthly payment for a median-priced home with a standard 20% down payment has risen by over 50% since the beginning of 2022, according to proprietary data compiled by Freddie Mac.

This severe strain means that the 1.2% rise in sales is likely driven by a demographic shift towards higher-income households or those receiving substantial financial assistance, rather than a generalized improvement in market accessibility. The financial barrier to entry has never been higher for the average American family, restricting the buyer pool predominantly to those with significant equity from prior sales or substantial accumulated wealth.

How Mortgage Rates Impact Transactional Velocity

Mortgage rates, dictated by the yield on the 10-year Treasury note and influenced by Federal Reserve policy, are the primary variable impacting affordability month-to-month. When rates surpassed 7.5% in October, many potential buyers saw their debt-to-income ratios exceed conventional lending limits, forcing them to pause their search or drastically reduce their target purchase price. This sensitivity confirms that while inventory is the structural problem, interest rates are the immediate transaction inhibitor.

- Rate Lock-In Effect: High rates discourage existing owners from selling, further tightening supply and contributing to price resilience.

- ARM Product Revival: There is a slight but noticeable increase in the utilization of Adjustable-Rate Mortgages (ARMs), particularly among high-income borrowers betting on future rate cuts to refinance out of the higher initial rate.

- Lender Adjustments: Mortgage originators are tightening credit standards, focusing on borrowers with higher credit scores (FICO scores above 740) and larger down payments, further narrowing the accessible buyer cohort.

The marginal increase in sales in October should be viewed with caution; it represents a temporary absorption of minimal new inventory by the most resilient segment of the buyer population. Sustained sales growth would require either a significant, unexpected drop in mortgage rates, or a substantial increase in available housing stock, neither of which appears imminent based on current Federal Reserve guidance and building permit data.

The New Construction Factor: A Slow Rebalancing Mechanism

While existing home sales dominate the market (typically accounting for 85-90% of transactions), the new construction sector is playing an increasingly vital role in capturing demand that cannot be met by limited existing inventory. Builders, unlike existing homeowners, are not locked into low rates and have the flexibility to offer incentives, such as rate buydowns and closing cost assistance, effectively subsidizing the cost of financing for buyers.

New home sales data for October showed resilience, driven largely by these targeted incentives. Builders are strategically absorbing the financing pain for the consumer, allowing transaction volumes to stabilize even as the underlying capital cost remains high. This strategy is particularly effective in master-planned communities in the South and Southwest, where land acquisition costs are lower and construction pipelines are more established.

Builder Incentives vs. Price Cuts

The distinction between price cuts and rate buydowns is critical for market analysis. A builder offering a 2-1 temporary rate buydown (reducing the initial rate by 2% in the first year and 1% in the second) is effectively lowering the buyer’s initial monthly payment without formally reducing the home’s list price. This avoids setting a lower comparable sale price (comp) in the neighborhood, preserving overall asset valuations.

This dynamic means that while existing home sales may appear stable in price, the effective transaction cost for new homes is declining due to generous builder financing incentives. This competition pressures existing home sellers, especially those who cannot tolerate a long marketing period, to eventually drop their prices, contributing to the true ‘cooling’ effect in competitive submarkets.

Monetary Policy Outlook and Future Housing Trajectories

The trajectory of the housing market in 2024 is inextricably linked to the Federal Reserve’s monetary policy decisions. The Fed’s dual mandate—achieving maximum employment and price stability—has prioritized the fight against inflation, which necessitates maintaining a restrictive federal funds rate. This, in turn, keeps upward pressure on long-term Treasury yields and, consequently, mortgage rates.

Economists at Goldman Sachs and Morgan Stanley project that significant rate relief is unlikely until mid-2025, barring a severe economic downturn. Therefore, the housing market must adjust to a ‘higher for longer’ rate environment. This means that any future cooling will likely manifest not through a sharp, crisis-like drop in prices, but through prolonged transactional stagnation and localized, gradual price erosion in overvalued areas.

The October sales data, showing resilience at 7.7% mortgage rates, suggests the market has found a temporary equilibrium. However, this equilibrium is characterized by low volume and high cost. For institutional investors, this environment favors cash-rich strategies focused on acquiring single-family rentals or distressed assets in markets where localized cooling is most evident, such as parts of the Pacific Northwest.

Key Indicators to Watch for Deeper Cooling

- Forbearance Rates: An increase in mortgage forbearance or delinquency rates could signal financial distress among homeowners, potentially releasing more inventory onto the market.

- Unemployment Data: A significant rise in the national unemployment rate (above 4.5%) would reduce overall housing demand and force price adjustments.

- 10-Year Treasury Yield: Sustained movement below 4.0% in the 10-year yield would translate directly into lower 30-year fixed mortgage rates, stimulating transactional volume and potentially stabilizing prices through renewed demand.

The current environment requires financial stakeholders to adopt a highly localized and data-driven approach. National statistics mask the reality that some markets are experiencing genuine, albeit gradual, price cooling, while others remain constrained by supply, leading to continued price stability despite high financing costs. The October sales rise is a testament to the market’s inventory-driven floor, not a signal of broad affordability improvement.

Risk Factors and Market Uncertainty in the Housing Sector

While the 1.2% rise in existing home sales suggests underlying market resilience, several significant risk factors continue to cloud the outlook for the US housing sector. The primary uncertainty stems from the duration of the current interest rate regime. If inflation proves stickier than anticipated, forcing the Fed to maintain high rates deeper into 2025, the compounding effect of sustained high borrowing costs could eventually erode the market’s price floor.

Another major risk is the potential for a broader economic downturn. Although the labor market remains resilient (unemployment rate near 3.9% as of the latest report), corporate earnings forecasts indicate slowing growth. A significant contraction in employment, particularly in high-wage sectors like technology and finance, would directly impact the high-end buyer pool that currently props up transaction volumes. Such an event would trigger a more aggressive cooling phase, characterized by forced sales and accelerated price depreciation.

The final risk involves the behavior of institutional investors. Should rental yields deteriorate or capital costs rise significantly, these large-scale buyers could pull back, removing a key source of cash liquidity and transactional stability, thereby intensifying competition among traditional, mortgage-dependent buyers.

Assessing Liquidity and Volatility

The current market suffers from low liquidity, defined by low transaction volume relative to historical norms. This low liquidity amplifies volatility; any minor shift in inventory or mortgage rates can lead to disproportionately large movements in regional prices or sales figures. The 1.2% increase in October sales, while statistically modest, highlights this volatility—a small influx of inventory generated a noticeable upward blip in transactions because demand, though thin, is highly concentrated and reactive.

Investors must recognize that the market is currently priced for perfection in terms of economic stability. Any deviation from the soft landing narrative—such as a reacceleration of inflation or an unexpected spike in unemployment—will likely trigger a rapid reassessment of housing valuations, especially in markets where price-to-rent ratios are already stretched thin. The resilience shown in October should not be mistaken for market health, but rather as a reflection of structural scarcity in a highly constrained environment.

| Key Metric/Factor | Market Implication/Analysis |

|---|---|

| October Sales Change | +1.2% month-over-month. Driven by minimal inventory release, not affordability improvement. |

| Median Existing Price | $391,000 (+3.4% YoY). Price stickiness persists due to inventory constraints and limited distressed selling. |

| All-Cash Buyer Share | ~29% of transactions. Insulates the market from rate sensitivity, sustaining high-end and investment activity. |

| Cooling Indicators | Increased Days on Market (DOM) and elevated price cuts, mainly observed in Mountain West and specific Californian metros. |

Frequently Asked Questions About Housing Market Dynamics

The modest 1.2% rise was primarily inventory-driven. A small volume of newly listed homes, often from ‘must-sell’ situations, was quickly absorbed by a concentrated pool of highly qualified buyers, including those utilizing significant cash, dampening the expected rate-induced sales decline.

The most pronounced cooling, defined by longer Days on Market and verifiable price declines exceeding 5% from peak, is evident in the Mountain West (e.g., Utah, Idaho) and specific parts of the Pacific Coast, where pandemic-era price appreciation was most aggressive and unsustainable.

The ‘lock-in’ effect occurs because approximately 70% of current homeowners have mortgages below 5%. Selling now means trading that low rate for a 7%+ rate on a new purchase, severely discouraging listings and creating the chronic inventory shortage that supports current high prices.

Yes. New home builders often utilize rate buydowns and closing cost credits to reduce the buyer’s effective monthly payment without lowering the list price. This financing flexibility gives them a competitive edge over existing home sellers, who typically lack the capital to offer similar incentives.

Investors should closely track the 10-year Treasury yield, as it dictates mortgage rates, and regional unemployment figures, particularly in major metros. Additionally, watch the Months’ Supply of Inventory, where an increase above 4.0 months typically signals a shift toward a buyer’s market.

The Bottom Line

The October report showing a 1.2% rise in existing home sales represents a minor statistical anomaly driven by structural inventory shortages, rather than a definitive reversal of the cooling trend. For financial market participants, the crucial takeaway is that the US housing market remains hyper-localized. While affordability metrics scream caution—with median payments severely straining median incomes—the lack of available homes acts as a strong price floor nationally. True cooling, characterized by price depreciation, is confined to specific, previously overheated Western markets. Looking forward, the market’s trajectory hinges entirely on the Federal Reserve’s timeline for rate normalization. Until sustained lower rates or a significant recession forces inventory onto the market, investors should anticipate continued transactional stagnation, high price stickiness in resilient regions, and heightened focus on new construction as the primary source of relative value and transaction volume. The housing sector maintains its status as an inventory crisis wrapped in an affordability crisis.