HELOC Rates at 7.81%: Should You Tap Home Equity Before Rates Rise?

With average Home Equity Line of Credit (HELOC) rates settling around 7.81%, homeowners must critically assess whether leveraging their accrued home equity now is prudent, given the looming possibility of further Federal Reserve tightening cycles aimed at curbing persistent inflation.

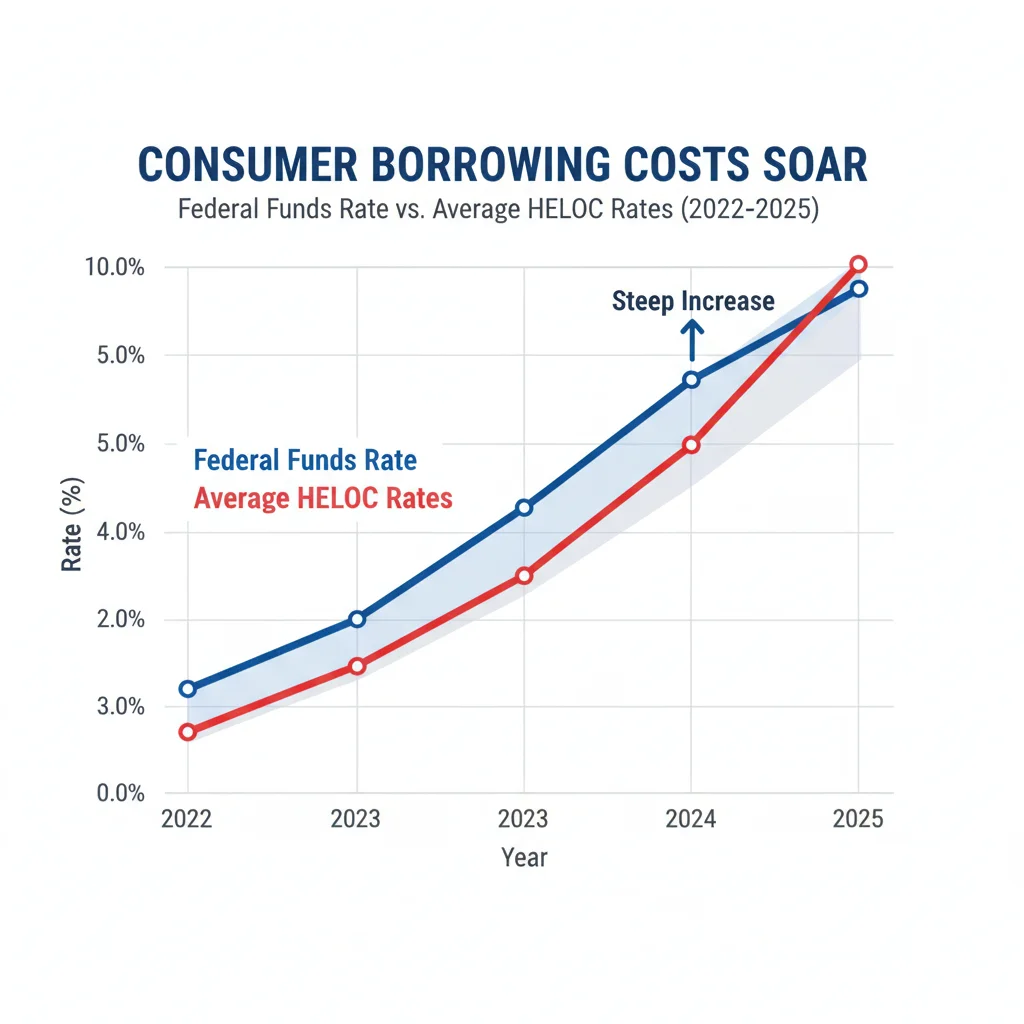

The financial landscape for homeowners in the United States has fundamentally shifted since the end of the zero-interest-rate era. As of the latest reporting period, the average rate for a Home Equity Line of Credit (HELOC) has climbed to approximately 7.81%, a stark increase from the rates observed just three years prior. This elevated borrowing cost, directly tethered to the Federal Reserve’s aggressive rate hiking cycle, forces millions of Americans with substantial home equity—estimated by CoreLogic to exceed $30 trillion collectively as of Q4 2024—to confront a crucial strategic decision: utilize that equity now, or risk paying even more later.

Understanding the 7.81% HELOC Rate Environment

The current HELOC rates rise is not an isolated event but a direct consequence of monetary policy designed to combat inflation. HELOCs are typically variable-rate products tied to the Prime Rate, which moves in lockstep with the Federal Funds Rate established by the Federal Open Market Committee (FOMC). When the FOMC raises its target rate, the Prime Rate increases, and consequently, the cost of borrowing via a HELOC rises almost immediately.

The current average rate of 7.81% reflects a market pricing in prolonged elevated policy rates. Economists at Goldman Sachs project the Fed will maintain the Federal Funds Rate above 5% well into the next fiscal year, suggesting that the pressure on variable-rate products like HELOCs will persist. This environment creates a time-sensitive window for homeowners considering financing large expenditures, such as substantial home renovations or high-interest debt consolidation.

The risk inherent in the 7.81% rate is twofold: first, the immediate cost of nearly 8% is significant; second, the variable nature means this cost is not fixed. Any future FOMC decision to hike rates further—perhaps due to persistently tight labor markets or geopolitical supply shocks—would immediately translate into higher monthly payments for existing HELOC users. For a homeowner accessing $100,000, a move from 7.81% to 8.5% could add hundreds to the annual interest burden.

The Mechanics of Variable Rate Exposure

HELOCs operate on a draw period, typically 10 years, during which borrowers can access funds, followed by a repayment period, usually 15 or 20 years. The rate volatility is concentrated during the draw period. Understanding the underlying index and margin is critical for managing this exposure. Most lenders use the Wall Street Journal Prime Rate as the index. The borrower’s rate is calculated as the Prime Rate plus a margin, determined by the lender based on the borrower’s credit profile and loan-to-value (LTV) ratio.

- Prime Rate Sensitivity: Every 25 basis point hike by the Fed adds 0.25% to the HELOC rate almost instantly, impacting the minimum monthly payment.

- Margin Determination: A strong credit score (e.g., FICO above 760) typically secures a lower margin, mitigating some of the rate shock.

- Payment Shock Risk: Borrowers must model their budgets to withstand potential increases of 100 to 200 basis points over the life of the draw period.

- Rate Cap Consideration: Many HELOC agreements include a lifetime ceiling (cap) on the interest rate, often 16% to 18%, providing a theoretical maximum risk boundary.

In summary, the 7.81% rate is a high watermark in recent history, urging caution but also demanding strategic consideration. Homeowners must analyze their immediate financial needs against the backdrop of an interest rate environment that remains biased toward further increases, according to consensus forecasts from major investment banks.

Analyzing the Urgency: Why Tap Equity Before the Next Hike?

The primary driver for accelerating the decision to utilize home equity is the expectation of sustained or increased monetary tightening. The Federal Reserve has clearly communicated that its primary focus remains bringing inflation down to its 2% target, even if it means keeping rates restrictive for longer. This “higher for longer” mantra directly translates to elevated and potentially increasing HELOC costs.

For homeowners planning essential, high-value projects—such as roof replacement, HVAC upgrades, or extensive remodeling that significantly boosts property value—delaying the borrowing decision could prove costly. If the Fed implements another 25 basis point hike, the average HELOC rate could quickly jump to over 8.0%. Over a $150,000 draw, this seemingly small increase compounds significantly over the 10-year draw period.

Debt Consolidation vs. Capital Improvement

The decision to utilize equity at 7.81% depends heavily on the intended use of the funds. When used for debt consolidation, the 7.81% rate must be compared directly against the current interest rates on existing obligations. Average credit card interest rates currently exceed 22%, according to data from Bankrate, making a 7.81% HELOC substantially cheaper, even with variable rate risk. The savings realized from shedding 22% debt can often absorb the risk of minor future HELOC rate increases.

Conversely, when funds are used for capital improvements, the calculation incorporates the potential return on investment (ROI) through increased home value. According to the National Association of Realtors (NAR), certain projects, like a new garage door (ROI often exceeding 100%) or minor kitchen renovations (ROI often near 80%), can justify the borrowing cost, particularly if the homeowner plans to sell in the medium term. The immediacy of the project often dictates the urgency of locking in the current rate.

For those holding substantial equity—many of whom refinanced their primary mortgages at record low rates (3% or less) during 2020–2021—a HELOC provides access to liquidity without disturbing the low-rate primary mortgage. This preservation of the low fixed-rate primary mortgage is a compelling financial argument for using a HELOC, even at 7.81%, rather than pursuing a cash-out refinance at current fixed mortgage rates, which often exceed 7.0%.

The Economic Headwinds Affecting Home Equity Borrowing

The housing market’s response to high interest rates introduces additional variables into the HELOC decision. While home prices have shown resilience in many metropolitan areas, the pace of appreciation has slowed significantly. Slower appreciation limits further equity accumulation, making the existing pool of equity a finite resource that may not grow as rapidly as it did between 2020 and 2022. This deceleration is evident in housing data from the S&P CoreLogic Case-Shiller U.S. National Home Price Index, which, while still positive year-over-year as of Q3 2024, shows cooling momentum.

Furthermore, lenders are becoming more conservative. Higher rates increase the risk of default, leading financial institutions to tighten underwriting standards. Homeowners may find that while they theoretically qualify for a large HELOC based on their LTV ratio, lenders are capping the amount they are willing to extend, or demanding higher credit scores and lower debt-to-income (DTI) ratios than they did a year ago. This stricter loan environment means that delaying an application could result in less favorable terms, or even rejection, if the economic outlook deteriorates.

Lender Behavior and Underwriting Changes

Major banks, including Wells Fargo and JPMorgan Chase, have recently adjusted their risk models in response to macroeconomic uncertainty. This translates to practical changes for HELOC applicants:

- Maximum LTV Reduction: Many institutions have lowered the maximum combined loan-to-value (CLTV) ratio they will accept from 90% in some cases down to 80% or 85%.

- Minimum Credit Score Increase: The threshold for the best rates is effectively moving higher, requiring FICO scores often above 740 to secure rates near the 7.81% average.

- Increased Documentation Requirements: Banks are demanding more rigorous proof of income stability, particularly for self-employed borrowers, to mitigate default risk in a potentially slowing economy.

- Focus on Debt Service Coverage: Lenders are scrutinizing the borrower’s ability to handle the HELOC payment in addition to the primary mortgage, stress-testing DTI ratios against higher future interest rate scenarios.

The tightening credit conditions suggest that the 7.81% rate, while high, might represent the most accessible borrowing term available before further economic contraction or rate hikes force lenders to become even more restrictive. Access, in this environment, can be as crucial as cost.

The Fixed-Rate Alternative: HELOANs and Rate Locks

Given the inherent volatility of a HELOC, homeowners sensitive to budgeting uncertainty should explore fixed-rate options, primarily Home Equity Loans (HELOANs), or the fixed-rate conversion features offered by some HELOC providers. A HELOAN provides a lump sum at a fixed interest rate, typically slightly higher than the initial HELOC rate, but eliminates the risk of future rate increases.

As of Q4 2024, fixed-rate second mortgages (HELOANs) are averaging around 8.2% to 8.5%, according to mortgage data providers. While this is higher than the 7.81% initial HELOC rate, it provides certainty. For a borrower funding a long-term expense, such as a child’s college tuition over the next four years, the predictability of the HELOAN payment might outweigh the slightly higher initial cost.

Mitigating HELOC Volatility

Some advanced HELOC products offer a feature allowing borrowers to convert a portion of their outstanding variable balance into a fixed-rate loan segment. This is often referred to as a “rate lock” or “fixed-rate option.” This mechanism allows the borrower to draw funds as needed on the variable rate, and then, if the Federal Reserve signals another rate increase, lock in the current rate on the drawn balance.

This hybrid approach offers the best of both worlds: the flexibility of a line of credit during the draw period and the security of a fixed payment once the funds are utilized. However, these conversion features often come with a fee or a slightly higher margin on the fixed portion than a traditional HELOAN. Homeowners must meticulously review the terms regarding minimum lock amounts, conversion fees, and the number of fixed-rate tranches permitted.

The decision between a variable-rate HELOC at 7.81% and a fixed-rate HELOAN at 8.5% is essentially a bet on the future trajectory of the Federal Funds Rate. If the Fed manages a soft landing and begins cutting rates within 18 months, the HELOC will prove cheaper. If inflation remains sticky and the Fed is forced to hike rates another 50 or 75 basis points, the fixed-rate product will offer superior long-term savings and stability.

Macroeconomic Indicators and Future Rate Projections

The Federal Reserve’s decisions hinge on three key factors: inflation, employment, and economic growth. Recent data suggests persistent inflationary pressures, particularly in the services sector, while the labor market remains resilient, with unemployment near historic lows. This combination fuels the necessity for the Fed to maintain restrictive policy, supporting the argument that HELOC rates are unlikely to drop significantly in the near term and possess meaningful upside risk.

Specifically, the Consumer Price Index (CPI) has consistently remained above the 3% threshold, far exceeding the Fed’s 2% target. Analysts at Morgan Stanley predict that if core CPI fails to decelerate below 3.5% by the end of Q2 2025, the FOMC could be compelled to implement at least one more rate hike, potentially pushing the Prime Rate—and thus the average HELOC rate—past the 8.0% mark. This forecast underscores the time-sensitive nature of the current 7.81% offering.

The Impact of Quantitative Tightening (QT)

Beyond the Federal Funds Rate, the Fed’s balance sheet reduction, known as Quantitative Tightening (QT), also exerts upward pressure on long-term rates. By allowing its bond holdings to mature without reinvestment, the Fed reduces liquidity in the financial system. This reduction in demand for long-term Treasury and mortgage-backed securities increases the yield demanded by private investors, indirectly influencing all consumer lending rates, including HELOCs.

The steady pace of QT, currently running at up to $95 billion per month, acts as a continuous, subtle force keeping borrowing costs elevated. While the immediate impact is less dramatic than an FOMC rate hike, QT ensures that the underlying cost of capital for banks remains high, preventing a rapid return to the lower rate environment enjoyed pre-2022. This structural factor suggests that rates near 7.81% may be the “new normal” for the foreseeable future, rather than an anomalous peak.

Given the persistent inflation and the Fed’s commitment to restrictive policy, the window for securing home equity financing below 8% is closing. Homeowners should proceed under the assumption that the probability of a rate increase is greater than the probability of an immediate, significant rate decrease in the next 12 months, based on current macroeconomic projections.

Calculating the True Cost and Risk Tolerance

Before committing to a HELOC at 7.81%, a rigorous financial stress test is mandatory. Borrowers should calculate their projected monthly payments not just at the current rate, but also at hypothetical rates of 9.0% and 10.0%. This stress test reveals the maximum sustainable payment and helps determine the overall risk tolerance for variable rates.

The true cost of the HELOC must also factor in closing costs, which, while generally lower than a primary mortgage, still exist. These can include appraisal fees, title insurance, and application fees, potentially adding 1% to 3% of the total credit limit to the upfront costs. Some lenders offer no-closing-cost HELOCs, but these typically compensate by charging a higher interest rate (margin) throughout the life of the loan.

Risk Management Strategies for HELOC Borrowers

Managing a variable-rate product in a high-rate environment requires discipline and strategic planning. The goal is to minimize the exposure to future rate hikes.

- Aggressive Principal Paydown: During the draw period, pay more than the interest-only minimum. Reducing the principal balance faster limits the portion of the loan exposed to rate changes.

- Utilize Fixed-Rate Locks: If the HELOC offers a fixed-rate conversion feature, use it strategically when rates appear to peak or before an anticipated Fed meeting.

- Establish an Interest Rate Buffer: Allocate a portion of savings into a high-yield account equivalent to 6-12 months of the maximum projected payment increase, acting as an emergency buffer against sharp rate shocks.

- Minimize Draw Period Utilization: Only draw the necessary amount. Unlike a mortgage, the interest is only charged on the utilized portion of the line of credit.

The decision to tap equity at 7.81% is highly personal, requiring a careful weighing of the immediate benefit (debt relief, property enhancement) against the long-term risk of variable rate exposure. For creditworthy borrowers with stable incomes and high-ROI projects, the current rate may be acceptable, especially when compared to the double-digit rates of unsecured debt.

The Bottom Line on Tapping Equity Now

The current average HELOC rate of 7.81% represents a crucial inflection point for homeowners. It is substantially higher than the rates of 2021, yet potentially lower than future rates if the Federal Reserve is forced to continue its fight against persistent inflation. The strategic advantage of acting now lies in securing funds before potential further tightening and capitalizing on the wide differential between HELOC rates and unsecured consumer debt (e.g., credit card debt exceeding 22%).

Homeowners must prioritize their financial goals. If the funds are intended for immediate, value-enhancing home improvements or high-interest debt elimination, the 7.81% rate offers a tangible benefit that outweighs the risk of a modest future rate increase. Conversely, those without an urgent need or with limited tolerance for variable payment risk should wait for clearer signs of disinflation and potential Fed rate cuts, which are not widely anticipated until late 2025 or early 2026. The key is to approach the HELOC rates rise environment requires precision and a clear understanding of the macroeconomic forces at play.

| Key Financial Metric | Market Implication/Analysis |

|---|---|

| Current Average HELOC Rate | 7.81%. Directly tied to the Prime Rate, reflecting restrictive Fed policy. High cost but potentially lower than future rates. |

| Consumer Credit Card Rates | Averaging over 22%. Makes the 7.81% HELOC an attractive option for debt consolidation despite variable rate risk. |

| Federal Reserve Policy Outlook | ‘Higher for longer’ stance. Probability of further rate hikes (up to 50 bps) is greater than immediate cuts, increasing future HELOC costs. |

| Lender Underwriting Standards | Tightening, with lower LTV maximums and higher credit score requirements, suggesting access may become more restricted later. |

Frequently Asked Questions about HELOC Rates at 7.81%

Realistically, HELOC rates could rise 100 to 150 basis points from the current 7.81% average, potentially reaching 9.31% or more, depending on the Fed’s terminal rate and inflation persistence. Most HELOCs have a lifetime cap, typically between 16% and 18%, but short-term projections focus on the immediate 12-month policy outlook.

For homeowners with a primary mortgage rate below 5%, a HELOC at 7.81% is often superior. It preserves the low fixed rate on the primary loan. A cash-out refinance would replace the entire mortgage balance with a new loan currently priced above 7.0%, potentially costing significantly more over the long term.

To qualify for rates near the 7.81% average and secure a favorable margin, borrowers typically need a FICO credit score of 740 or higher. Scores below 700 will likely result in rates exceeding 8.5% and may face stricter LTV requirements from lenders seeking to minimize default risk exposure.

Many modern HELOC products include a fixed-rate conversion option, allowing borrowers to lock in the current rate on the drawn balance. This feature is crucial for managing variable rate risk but often involves a small fee (e.g., 50 basis points) or requires a minimum conversion amount, typically $10,000 or more.

Financial analysts strongly advise against using a HELOC for speculative investments like the stock market. HELOCs are secured debt, meaning your home is collateral. If the investment fails, you risk foreclosure. Funds are best reserved for high-ROI home improvements or consolidating unsecured high-interest debt.

The Bottom Line: Precision and Prudence in Home Equity Strategy

The decision to access home equity at an average rate of 7.81% is a finely balanced calculation defined by urgency, intended use, and risk tolerance. Financial markets indicate that while the most aggressive phase of rate hikes may be over, the likelihood of a near-term pivot to rate cuts is low, keeping upward pressure on variable-rate products. For homeowners with specific, high-value financial objectives—particularly those seeking to escape credit card debt above 20% or fund necessary, value-accretive renovations—the current rate represents a viable and possibly transient opportunity before lending conditions potentially harden further. Prudence dictates that any borrower stress-test their finances against a scenario where the rate temporarily hits 9.5%, ensuring long-term payment sustainability and avoiding unnecessary exposure to the inherent volatility of the current economic cycle. The strategic use of the HELOC rates rise environment requires precision and a clear understanding of the macroeconomic forces at play.