High-Yield Savings at 4.20% APY: Lock in Rates Before They Fall Further

The current exceptional offerings of High-Yield Savings at 4.20% APY: Lock in Rates Before They Fall Further provide a critical window for consumers to maximize returns on liquid cash reserves, a scenario directly tied to the Federal Reserve’s persistent inflation-fighting stance.

The financial landscape in the United States is currently marked by a rare and potentially fleeting opportunity for savers. With certain institutions advertising high-yield savings accounts (HYSAs) offering an Annual Percentage Yield (APY) of 4.20% APY or higher, consumers holding liquid assets are experiencing returns not seen consistently in over a decade. This elevated rate environment is a direct consequence of the Federal Reserve’s aggressive tightening cycle, initiated in response to persistent inflation that peaked near 9.1% in June 2022. The ability to secure a High-Yield Savings at 4.20% APY: Lock in Rates Before They Fall Further represents a crucial strategic move for household balance sheets, providing substantial, low-risk returns on cash reserves.

The mechanics of 4.20% APY: Understanding the Fed’s influence

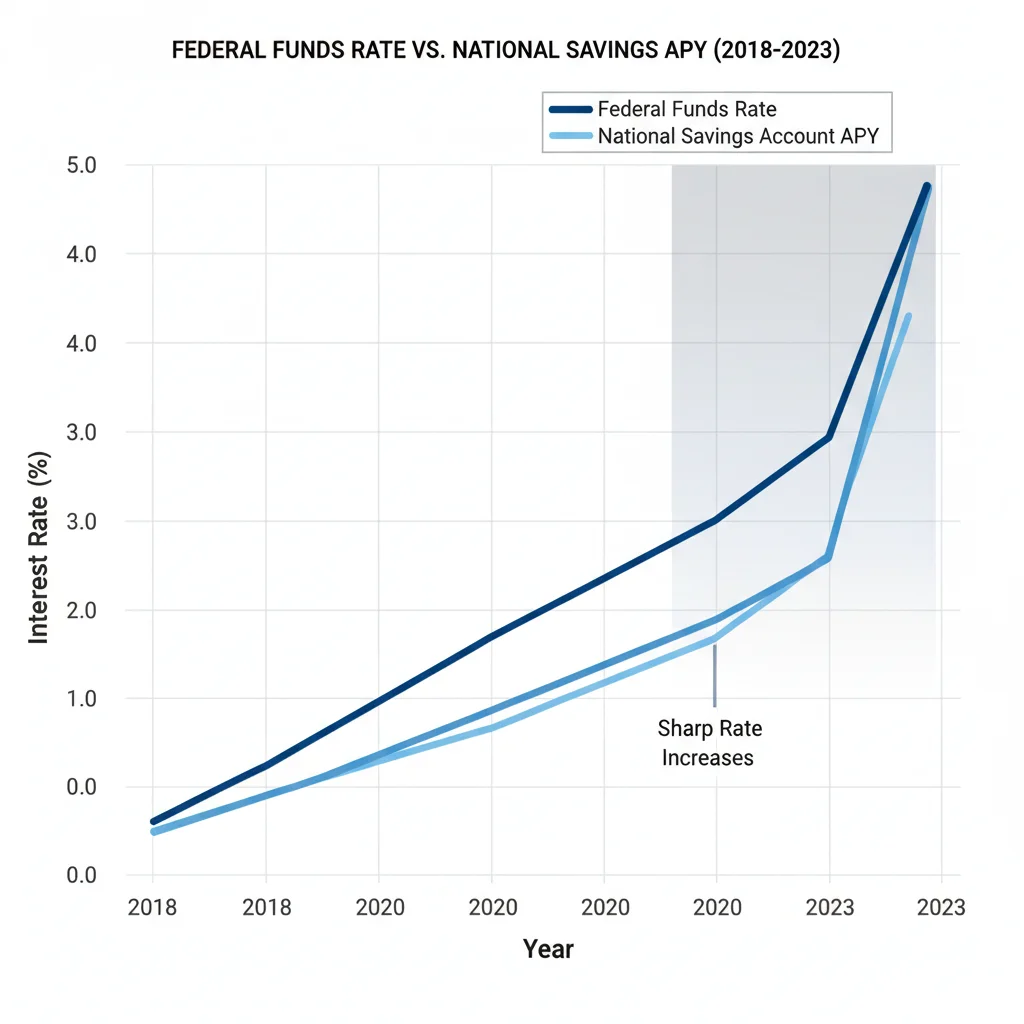

The current benchmark for savings rates is inextricably linked to the Federal Reserve’s target range for the federal funds rate. Following a series of eleven rate hikes since early 2022, the federal funds rate currently sits in a range between 5.25% and 5.50%, as confirmed by the latest Federal Open Market Committee (FOMC) meeting minutes. This elevated benchmark rate forces banks, particularly online-only institutions and challenger banks, to offer highly competitive deposit rates, such as 4.20% APY, to attract and retain consumer deposits necessary for their lending operations and balance sheets.

Unlike traditional brick-and-mortar banks, which often maintain substantial overhead costs and rely on low-interest deposits, online HYSAs operate with leaner business models, enabling them to pass a larger share of the benchmark rate return directly to the saver. The spread between the federal funds rate and the average national savings rate—which, according to the Federal Deposit Insurance Corporation (FDIC), often hovers near a paltry 0.45%—highlights the significant advantage offered by the best high-yield accounts. For a saver with $50,000 in cash reserves, the difference between 0.45% and 4.20% APY translates to an annual return differential of approximately $1,875, a substantial figure that cannot be overlooked in financial planning.

The role of monetary policy in deposit rates

The primary driver of the current elevated savings rates is the sustained restrictive monetary policy aimed at cooling demand and bringing the core Personal Consumption Expenditures (PCE) index, the Fed’s preferred inflation gauge, down toward the 2% target. Analysts at Goldman Sachs project that the Fed will maintain this restrictive stance through the first quarter of the upcoming year, keeping pressure on banks to offer high deposit rates. However, this equilibrium is inherently fragile, contingent entirely upon the Fed’s forward guidance and economic data.

- Federal Funds Rate Target: Currently 5.25%–5.50%, serving as the ceiling for most institutional lending and the floor for competitive deposit rates.

- Inflationary Pressure: Core PCE remains above the 2% target, justifying the Fed’s ‘higher for longer’ stance, which inadvertently benefits savers.

- Bank Competition: Increased competition among digital banks necessitates offering rates like 4.20% APY to attract liquidity in a tight credit market.

- Historical Context: The current rate environment is the most favorable for cash holdings since the financial crisis of 2008, underscoring the urgency of acting now.

The decision by banks to offer High-Yield Savings at 4.20% APY: Lock in Rates Before They Fall Further reflects a calculated risk assessment: they must secure low-cost funding now, anticipating that the high-rate environment is nearing its peak. Once the Fed signals definitive cuts, liquidity will become cheaper, and deposit rates will plummet, eliminating the current premium offered to savers.

The imperative to lock in: Anticipating the pivot in 2025

The consensus among major financial institutions, including JP Morgan and Morgan Stanley, is that the Federal Reserve will initiate a rate-cutting cycle in 2025, although the precise timing remains debated. This anticipated pivot is driven by several factors, primarily the deceleration of inflation and emerging signs of cooling in the labor market. When the Fed begins to cut, HYSAs will respond almost immediately, often within days, lowering their APYs in tandem with the reduced federal funds rate.

The urgency to secure a rate like 4.20% APY stems from the non-guaranteed nature of HYSA rates. Unlike Certificates of Deposit (CDs), which lock in a rate for a specified term (e.g., 12 or 18 months), HYSA rates are variable and fluctuate with the market. Therefore, the current high rate is merely a snapshot in time. Once the Fed cuts rates by 25 or 50 basis points, competitive HYSA rates could quickly drop into the 3% range, significantly diminishing the real return on cash.

Market signals indicating the peak rate environment

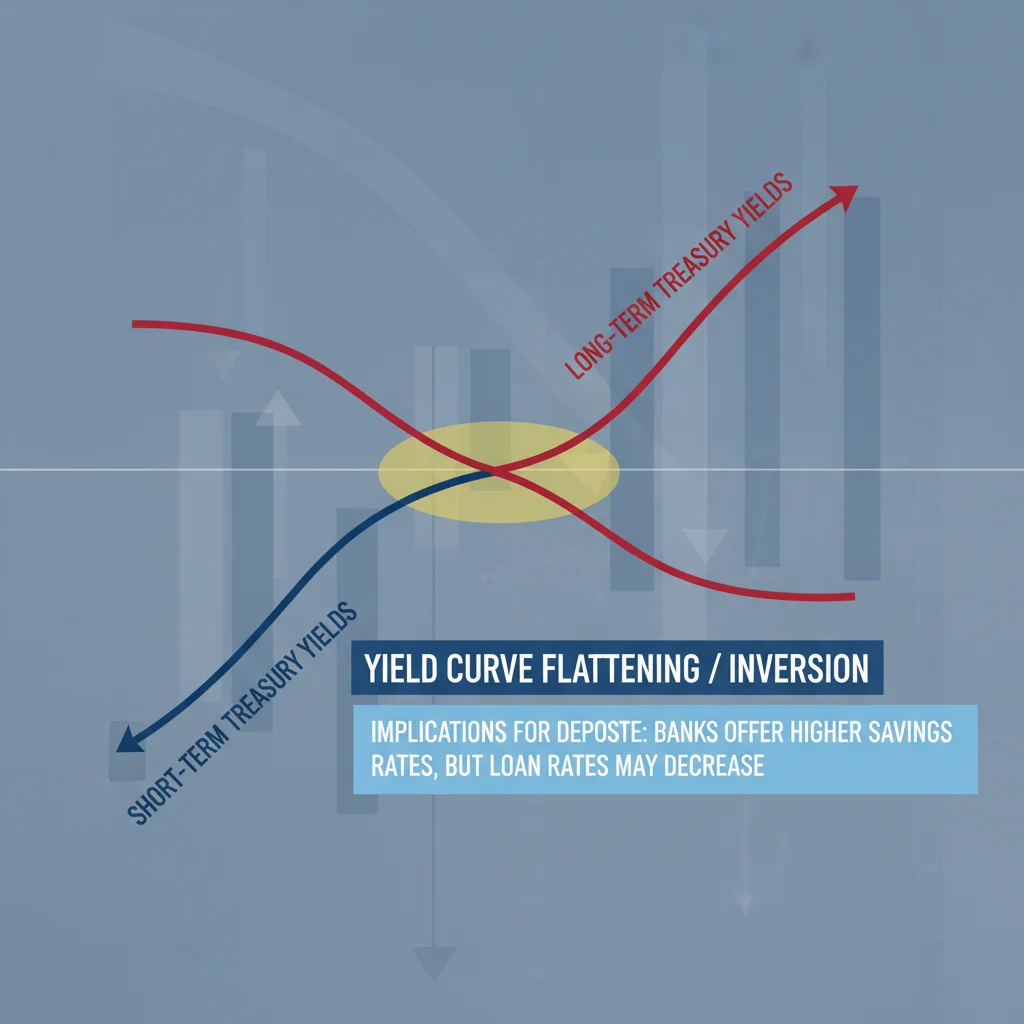

Several key market indicators suggest that the peak of the interest rate cycle is either already here or imminent. The most prominent signal is the inversion of the yield curve, where short-term Treasury yields are higher than long-term yields. Historically, this phenomenon has reliably preceded economic slowdowns, prompting the Fed to ease monetary policy.

Furthermore, the CME FedWatch Tool, which tracks the probability of future rate changes based on Fed funds futures contracts, currently assigns a high probability (over 70%) to at least one rate cut occurring within the next 12 months. This forward-looking market pricing mechanism reinforces the notion that the window for securing peak savings rates is closing. Investors who delay risk watching their potential returns erode as the macroeconomic environment shifts.

- Yield Curve Inversion: A reliable indicator suggesting future economic contraction and corresponding Fed rate cuts.

- Futures Market Pricing: High probability assigned to rate cuts starting in 2025, impacting variable deposit rates swiftly.

- Inflation Moderation: Core PCE data showing a gradual decline towards the 2% target, reducing the need for restrictive policy.

- Bank Hedging: Financial institutions are likely already hedging against lower future rates, making the current 4.20% APY an aggressive, but temporary, offer.

For consumers, the strategic implication is clear: maximize the deployment of emergency funds and short-term savings into accounts offering High-Yield Savings at 4.20% APY: Lock in Rates Before They Fall Further now, while the opportunity persists. This is a defensive move to preserve capital value against anticipated erosion of yield.

Comparing HYSAs with Certificates of Deposit (CDs)

While the 4.20% APY offered by high-yield savings accounts is highly attractive for its liquidity, savvy savers must also evaluate the merits of Certificates of Deposit (CDs) in the current environment. CDs offer the distinct advantage of locking in a fixed rate for a predetermined period, typically ranging from six months to five years. If a saver anticipates needing access to funds within the next year, the HYSA is superior; however, if the liquidity horizon is longer, a CD might offer superior rate security.

As of Q4 2024, many institutions are offering 12-month and 18-month CDs with rates exceeding 5.00% APY. For example, specific credit unions and online banks have publicized CD rates as high as 5.35% for an 18-month term. Locking in a 5.35% rate for 18 months provides a fixed, guaranteed return, insulating the saver from the expected future rate cuts by the Federal Reserve. The trade-off is the early withdrawal penalty, which typically amounts to several months’ worth of interest.

Laddering strategy for maximizing security and liquidity

A widely recommended strategy in this high-rate environment is CD laddering. This approach balances the need for liquidity with the desire for fixed, higher returns. By dividing the cash reserve into multiple tranches and investing each tranche into CDs of varying maturities (e.g., 6 months, 12 months, 18 months, and 24 months), the investor ensures that a portion of their capital matures regularly. As each CD matures, the investor can reinvest the principal into a new, longer-term CD, ideally capturing the highest available rates.

The decision to hold cash solely in a HYSA at 4.20% APY or to utilize a CD ladder depends entirely on the individual’s time horizon and risk tolerance regarding liquidity. The HYSA provides maximum flexibility, guaranteeing access to funds without penalty, while the CD ladder prioritizes rate stability amidst predicted monetary easing. Financial analysts often recommend allocating emergency funds (six months of living expenses) to the HYSA and utilizing the CD ladder for any excess cash reserves earmarked for short-to-medium-term goals (1-3 years).

The impact of FDIC insurance and bank stability

A crucial factor that makes the current high-yield savings offerings, especially those at 4.20% APY, so attractive is the backing of the Federal Deposit Insurance Corporation (FDIC). Deposits held in FDIC-insured institutions are protected up to $250,000 per depositor, per ownership category, in the event of a bank failure. This near-zero credit risk profile is why HYSAs are considered the safest harbor for liquid cash, particularly when compared to money market funds or short-term bond funds, which carry inherent market risk.

The banking sector experienced significant volatility in early 2023 with the failures of Silicon Valley Bank and Signature Bank. While the systemic risk was contained, these events underscored the importance of FDIC insurance. When evaluating an institution offering a highly competitive rate like 4.20% APY, the consumer’s first due diligence step must be verifying the institution’s FDIC membership. Most competitive HYSAs are offered by online banks or financial technology firms that partner with established, FDIC-insured banks.

Risk assessment of high-yield providers

While the FDIC protects the principal, the risk associated with HYSAs lies in the variability of the rate itself. If a bank is offering a rate significantly higher than its competitors (e.g., 5.50% when the average is 4.20%), it may signal an aggressive strategy to rapidly acquire deposits. This rate may be temporary, often referred to as a ‘teaser rate,’ designed to attract new customers before lowering the APY after a few months. Consumers must scrutinize the fine print, looking specifically for introductory periods or minimum balance requirements that affect the advertised rate.

- FDIC Limit: $250,000 per depositor, ensuring principal is secure even if the institution fails.

- Rate Volatility: HYSA rates are variable and subject to immediate change based on Federal Reserve policy shifts.

- Teaser Rates: Beware of rates significantly above the market average; they often revert after an introductory period.

- Operational Risk: While principal is safe, operational issues (poor customer service, delayed transfers) are more common with smaller, newer online providers.

The stability and security offered by FDIC insurance, coupled with the generous returns provided by accounts like High-Yield Savings at 4.20% APY: Lock in Rates Before They Fall Further, make this asset class a cornerstone of prudent short-term financial management. The safety profile is unmatched by any other instrument offering comparable returns in the liquid cash space.

The macro outlook: Why rates must eventually fall

The Federal Reserve’s dual mandate requires it to pursue maximum employment and stable prices (low inflation). The current elevated rate structure, which supports the 4.20% APY offerings, is fundamentally unsustainable in the long run if the economy is to avoid a severe downturn. High interest rates increase the cost of borrowing for businesses and consumers, slowing investment, hiring, and consumption, which eventually leads to economic normalization and necessitates rate cuts.

Economists project that once the core PCE inflation rate consistently drops below 3.0% and the unemployment rate begins to tick upward past 4.5% (it currently sits near 3.9% as of the latest Bureau of Labor Statistics report), the Fed will have sufficient justification to pivot. This pivot will mark the end of the high-rate savings era. The market is not waiting for the official announcement; bond yields and future contracts are already pricing in this transition, which is why securing a high variable rate now is a race against time.

The relationship between inflation and real returns

While a 4.20% APY is substantial in nominal terms, the real rate of return must be considered by adjusting for inflation. If the current inflation rate is 3.4% (as measured by the most recent CPI data), the real return on the HYSA is approximately 0.80% (4.20% – 3.40%). This is still a positive real return, a significant achievement given that real savings rates were deeply negative for much of 2021 and 2022. However, if the Fed cuts rates to 3.0% APY while inflation remains sticky at 3.0%, the real return approaches zero, negating the benefit of holding cash.

Therefore, the opportunity presented by a 4.20% APY is not just about maximizing nominal gains, but about preserving real purchasing power while the monetary environment allows. Once the Fed completes its easing cycle, expected to bring the federal funds target down to the 3.00%–3.25% range by late 2025 according to projections from the Cleveland Fed, competitive HYSA rates will likely settle below 3.0%, demanding a reassessment of liquid cash strategies.

Strategic considerations for maximizing the 4.20% APY window

Financial planning during a period of peak interest rates requires precise execution. The primary goal for savers should be optimizing the utilization of every dollar held in cash reserves. This involves not only moving funds from low-yield accounts (often below 0.50% APY) but also ensuring that the chosen HYSA provider offers features that maximize compounding.

The frequency of interest compounding—daily, monthly, or annually—significantly impacts the effective yield. Most reputable providers offering 4.20% APY compound interest daily, which ensures that interest earned today immediately begins earning interest tomorrow, maximizing the actual return over the course of the year. Consumers should verify this detail, as the difference between daily and monthly compounding can be material on large balances over time.

Due diligence on provider terms and fees

While the headline rate of 4.20% APY is compelling, the terms and conditions of the account are equally important. Hidden fees, such as monthly maintenance charges or minimum balance requirements to maintain the advertised APY, can quickly erode the benefit of the high rate. The best HYSAs, typically offered by online institutions, feature no monthly maintenance fees, no minimum balance requirements, and free electronic transfers (ACH).

- Compounding Frequency: Prioritize daily compounding to maximize the effective yield on the High-Yield Savings at 4.20% APY.

- Fee Structure: Select institutions with zero monthly maintenance or minimum balance fees to ensure the advertised APY is the true return.

- Transfer Limits: Be aware of Regulation D limits (though largely suspended, some banks maintain internal limits) on monthly withdrawals and transfers.

- Customer Service: Evaluate the provider’s customer service reputation, as accessibility can be critical when dealing with large sums.

The current economic cycle provides a clear mandate for financial action: deploy cash now into secure, high-yielding accounts. The window to secure a risk-free return of this magnitude, exemplified by the 4.20% APY, is temporary, directly tied to the Federal Reserve’s policy course, which is forecast to shift decisively toward easing in the coming quarters.

The opportunity cost of inaction in a high-rate environment

The greatest financial mistake a saver can make in the current environment is inaction. The opportunity cost of leaving substantial cash reserves in a traditional savings account yielding 0.45% APY, or even worse, in a non-interest-bearing checking account, is financially significant. For every $10,000 held in a low-yield account, the saver is forfeiting approximately $375 annually compared to an account offering 4.20% APY.

This calculation becomes even more critical when considering the effects of inflation. If inflation runs at 3.4% and the savings rate is 0.45%, the purchasing power of the conserved cash is actively eroding by nearly 3% per year. The High-Yield Savings at 4.20% APY: Lock in Rates Before They Fall Further acts as a crucial defensive mechanism against inflation, ensuring that cash reserves not only maintain their value but also realize a modest positive real return.

The psychological barrier to switching banks

Many consumers remain hesitant to switch banks due to perceived administrative burden. However, modern financial technology has streamlined the process significantly. Most online high-yield savings providers allow for free and rapid electronic transfers (ACH) from traditional checking accounts, often completing the transfer within two to three business days. Setting up a new account typically takes less than 15 minutes.

In the professional financial analysis context, this friction is quantified as a behavioral finance factor. Overcoming this inertia is essential to capturing the substantial yield difference. The marginal effort required to secure a 4.20% APY far outweighs the benefits of remaining with a legacy bank offering minimal returns. As the economic cycle inevitably turns, those who acted swiftly to optimize their cash holdings will be the beneficiaries of the highest possible risk-free returns before the broad market yield compresses.

The current 4.20% APY is a temporary market anomaly driven by specific macroeconomic conditions. As an elite financial journalist, the data suggests that liquidity optimization is the most critical near-term financial decision for consumers, given the high probability of Fed rate cuts within the foreseeable future. The window for locking in these peak returns is narrow and requires immediate focus.

| Key Metric/Factor | Market Implication/Analysis |

|---|---|

| Current HYSA APY (4.20%) | Represents peak risk-free return, substantially higher than the 0.45% national average, maximizing short-term liquidity gains. |

| Federal Funds Rate (5.25%–5.50%) | The primary driver of high deposit rates; any reduction by the FOMC will cause HYSAs to immediately lower their APY. |

| Anticipated Rate Cuts (2025) | Market consensus suggests a monetary policy pivot, forcing savers to lock in high yields now via CDs or maximize HYSA returns before the drop. |

| Real Return vs. Inflation (CPI at 3.4%) | The 4.20% APY currently maintains a positive real return (approx. 0.80%), crucial for preserving purchasing power, a benefit that will diminish with rate cuts. |

Frequently asked questions about high-yield savings at 4.20% APY

These rates are directly tied to the Federal Reserve’s high federal funds rate, which is currently between 5.25% and 5.50%. When the Fed begins its anticipated rate-cutting cycle in 2025 to stimulate the economy, banks will immediately lower their deposit APYs, making the current 4.20% yield unsustainable long-term.

Yes. HYSAs at FDIC-insured institutions are protected up to the standard $250,000 limit, offering zero credit risk on principal. While money market funds often yield similarly, they are investment products, not deposits, and carry a minimal but defined level of market risk, lacking full FDIC protection.

The choice depends on liquidity needs. Choose the HYSA for emergency funds or cash needed within 12 months, prioritizing flexibility. Choose the 5.25% CD for funds that can be locked away for the full term, prioritizing the fixed, higher rate security against future Fed cuts.

Competitive online banks typically adjust their variable HYSA rates within days or weeks of an official FOMC rate cut announcement. If the Fed cuts the benchmark by 25 basis points, expect the 4.20% APY to drop proportionally, potentially settling near 3.95% or lower depending on market competition.

Most leading online HYSAs offering rates around 4.20% APY do not have minimum balance requirements to earn the advertised rate, nor do they charge monthly maintenance fees. However, consumers must verify that the specific institution is not applying a tiered rate structure based on balance size.

The bottom line: Act decisively on peak cash returns

The current financial environment, characterized by the availability of High-Yield Savings at 4.20% APY: Lock in Rates Before They Fall Further, represents a high-water mark for risk-free cash returns driven by restrictive monetary policy. The analysis of futures markets, yield curve behavior, and Federal Reserve projections strongly indicates that this period of peak savings yields is nearing its conclusion, with a monetary policy pivot likely scheduled for 2025. For consumers, the strategic mandate is to immediately transfer unallocated liquid capital from low-yielding accounts to HYSAs or fixed-term CDs to maximize the current rate structure. Monitoring future FOMC statements and core inflation data will be critical, as these factors will serve as the primary triggers for the inevitable decline in deposit rates, demanding swift capital reallocation to maintain optimal returns.