PCE Inflation at 2.8%: Tax Planning Strategies for 2025

The stabilization of the Personal Consumption Expenditures (PCE) index at 2.8% signals a decelerating inflationary environment, which mandates a pivot in year-end tax planning to leverage anticipated changes in tax brackets and optimized retirement contribution limits for the 2025 tax year.

The deceleration of inflation, as measured by the Personal Consumption Expenditures (PCE) price index—the Federal Reserve’s preferred inflation gauge—to approximately 2.8% marks a critical juncture for financial decision-making. This environment demands that investors and high-net-worth individuals immediately review their year-end strategies, as the macroeconomic backdrop shifts from aggressive inflation hedging to tactical tax efficiency. The current 2.8% reading, while still above the Fed’s 2.0% target, suggests stability that allows for more predictable planning regarding investment income, capital gains, and strategic deductions. This analysis details crucial steps for implementing effective PCE inflation tax planning strategies for the 2025 tax cycle, maximizing tax-advantaged savings, and mitigating potential liabilities.

The economic backdrop: understanding 2.8% PCE inflation

The PCE index, which measures the prices of goods and services purchased by consumers, provides a comprehensive view of domestic inflationary pressures. The 2.8% rate, confirmed by the Bureau of Economic Analysis (BEA) data for the most recent period, contrasts sharply with the peak inflation observed in 2022, signaling that the Federal Reserve’s restrictive monetary policy has achieved significant disinflationary progress. This moderation has profound implications for tax planning, primarily through the mechanisms of inflation adjustments to tax parameters.

The Internal Revenue Service (IRS) adjusts dozens of tax provisions annually, including tax brackets, standard deductions, and retirement contribution limits, based on inflation metrics, often using the Consumer Price Index (CPI) rather than PCE, but the overall disinflationary trend impacts projected adjustments. Economists at Goldman Sachs project that a stable 2.8% PCE environment, coupled with decelerating CPI, will lead to moderate, yet meaningful, increases in standard deduction amounts for 2025. For a married couple filing jointly, for example, the standard deduction is expected to see an increase, potentially saving thousands in taxable income, depending on how itemized deductions stack up.

Inflation adjustments and bracket creep mitigation

When inflation is high, tax brackets are adjusted upward to prevent ‘bracket creep,’ where inflation pushes taxpayers into higher tax brackets even if their real income hasn’t increased. While the 2.8% PCE rate is manageable, taxpayers must still assess how their projected 2025 income interacts with the new IRS thresholds. Strategic timing of income realization is paramount in this context.

- Marginal Tax Rate Review: Analyze where projected 2025 income falls within the new tax brackets. If income is close to the threshold of a higher bracket, consider deferring income (e.g., year-end bonuses, stock option exercises) until January 2026.

- Standard Deduction Optimization: For taxpayers whose itemized deductions hover slightly below the standard deduction, the slightly elevated 2025 standard deduction might push them toward taking the standard deduction, simplifying filing while still providing significant tax relief.

- Alternative Minimum Tax (AMT) Thresholds: The AMT exemption amounts are also indexed for inflation. Financial planners must calculate whether a client’s projected income and deductions trigger AMT liability, especially when exercising incentive stock options (ISOs) or claiming large state and local tax (SALT) deductions.

The stability afforded by the 2.8% PCE reading allows for more accurate forecasting of taxable income for the coming year. Unlike years where inflation volatility made future planning highly uncertain, current conditions support precise strategies aimed at optimizing the timing of gains and losses, a core component of effective year-end tax management.

Strategic capital gains and tax-loss harvesting in a stable inflation environment

The primary focus of year-end tax planning for investors is managing capital gains exposure. With the S&P 500 having delivered strong returns through Q3, many portfolios hold unrealized gains. The 2.8% PCE rate, by reducing the urgency of immediate inflation-driven spending, allows investors to concentrate on long-term tax efficiency rather than short-term liquidity needs.

Tax-loss harvesting (TLH) remains a powerful tool. TLH involves selling investments that have lost value to offset realized capital gains, thereby reducing the net taxable gain. For highly appreciated assets, careful consideration of the long-term capital gains rates—which are significantly lower than short-term rates—is essential. The thresholds for these preferred rates are also subject to inflation adjustments, making the timing of realization critical before December 31.

Executing tax-loss harvesting before year-end

To effectively utilize TLH, investors must execute sales before the end of the calendar year to ensure the transactions settle within the 2025 tax year. Furthermore, strict adherence to the IRS ‘wash sale’ rule is mandatory. The wash sale rule prohibits deducting a loss if the investor acquires ‘substantially identical’ securities within 30 days before or after the sale. Failure to comply can invalidate the loss deduction.

- Identifying Loss Candidates: Focus on investments that have declined relative to their original cost basis. Analysts at Fidelity suggest reviewing sector funds or individual stocks that underperformed the broader market, such as specific regional banks or technology companies that faced regulatory headwinds in Q4 2025.

- Offsetting Short-Term Gains: Prioritize using harvested losses to offset short-term capital gains, which are taxed at ordinary income rates (potentially up to 37% for high earners). Offsetting these gains yields the highest tax savings.

- Long-Term Gain Strategy: If net losses exceed short-term gains, the excess can offset long-term gains (taxed at 0%, 15%, or 20%). Up to $3,000 of net capital losses can also be used to offset ordinary income annually, with any remainder carried forward indefinitely.

A stable economic environment, characterized by 2.8% PCE inflation, encourages investors to focus on long-term portfolio positioning rather than reactive trading. Managing the tax implications of gains and losses proactively ensures that investment performance is not eroded by unanticipated tax liabilities come April 2026.

Maximizing retirement contributions for 2025 tax efficiency

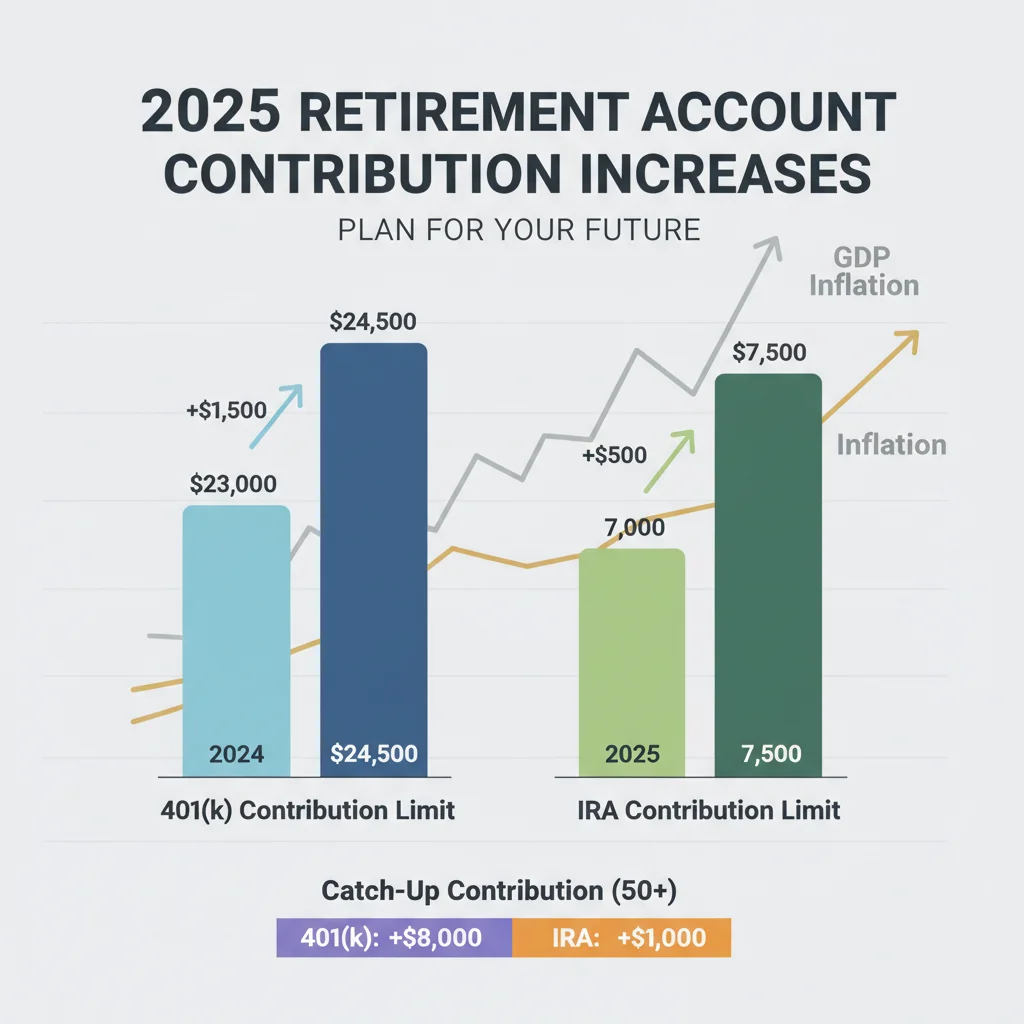

Retirement accounts offer some of the most powerful tax advantages, allowing taxpayers to reduce 2025 taxable income through deductible contributions or benefit from tax-free growth. The IRS typically announces the official 2025 contribution limits in October or November, reflecting the past year’s inflation data. Given the 2.8% PCE rate, expectations are for modest but important increases across 401(k)s, IRAs, and Health Savings Accounts (HSAs).

For 2025, it is projected that the 401(k) elective deferral limit could rise to approximately $24,500 (up from the 2024 limit), with the catch-up contribution for those aged 50 and over also increasing. Maximizing these contributions before year-end is a non-negotiable step for high-income earners seeking immediate tax deductions.

Deductible contributions and the Roth conversion decision

Traditional 401(k) and IRA contributions are generally made pre-tax, reducing current taxable income. However, the decision between Traditional and Roth accounts—especially regarding Roth conversions—is complex and highly dependent on future income expectations. Analysts at Vanguard suggest that with inflation cooling, the likelihood of significantly higher future tax rates due to expiring tax cuts increases, making Roth conversions potentially more appealing now.

- Self-Employed Retirement Plans: Business owners should consider establishing or maximizing contributions to SEP IRAs or Solo 401(k)s. A Solo 401(k) allows for contributions as both an employee and employer, offering substantial tax deferral opportunities that must be planned before the end of the business’s fiscal year.

- HSA Optimization: Health Savings Accounts (HSAs) offer a triple tax advantage: contributions are tax-deductible, growth is tax-free, and withdrawals for qualified medical expenses are tax-free. The 2025 HSA contribution limits are expected to increase, making them an essential vehicle for tax-advantaged savings, particularly for younger employees planning for future healthcare costs.

- Timing of IRA Contributions: While 401(k) contributions must be made by December 31, IRA contributions for the 2025 tax year can be made up until the April 2026 filing deadline. However, planning the cash flow for these contributions now is crucial to ensure funds are available.

The cooling inflation environment, consistent with the 2.8% PCE reading, supports aggressive tax deferral strategies. By maximizing pre-tax contributions now, taxpayers effectively ‘lock in’ tax deductions at potentially higher current marginal rates, benefiting from tax-free growth until withdrawal.

Advanced deduction strategies for high-net-worth individuals

For individuals exceeding the income thresholds for many tax benefits, year-end planning revolves around managing complex deductions and specialized tax provisions. The stability in the economic outlook, driven by the 2.8% PCE rate, allows for more precise forecasting of Adjusted Gross Income (AGI), which determines eligibility for many deductions, including those related to medical expenses and investment interest.

One key strategy is ‘bunching’ itemized deductions. Since the 2017 Tax Cuts and Jobs Act (TCJA) significantly increased the standard deduction, fewer taxpayers itemize annually. Bunching involves concentrating deductible expenses (such as property taxes, charitable contributions, and medical costs) into a single year to exceed the higher standard deduction threshold, thereby maximizing tax benefit in that year, and then taking the standard deduction in the subsequent year.

Managing state and local tax (SALT) and charitable giving

The $10,000 limitation on the deduction for State and Local Taxes (SALT) remains a significant constraint for residents in high-tax states like New York, California, and New Jersey. While legislative efforts to repeal or raise this cap are ongoing, high-net-worth individuals must continue to plan around this ceiling. Prepaying the estimated state income tax installment due in January 2026 before December 31, 2025, can ensure the payment is deductible in the current tax year, provided the taxpayer is itemizing.

- Qualified Charitable Distributions (QCDs): For taxpayers aged 73 and older who must take Required Minimum Distributions (RMDs) from their retirement accounts, a QCD allows direct transfer of up to $105,000 (subject to future inflation adjustments) from an IRA to a qualified charity. This transfer is excluded from taxable income, a significant advantage over taking the RMD and then donating, which only results in a deduction if the taxpayer itemizes.

- Donor-Advised Funds (DAFs): DAFs are increasingly popular for bunching charitable contributions. By contributing a large sum to a DAF in 2025, the donor receives an immediate tax deduction while retaining the ability to grant the funds to charities over several future years. This strategy is particularly effective when anticipating a high-income year in 2025.

- Investment Interest Expense: Deductibility of investment interest (interest paid on loans used to purchase taxable investments) is limited to net investment income. Reviewing investment loan balances and projected investment income before year-end is crucial to ensure maximum deductibility.

The effective management of itemized deductions, particularly through bunching and strategic charitable giving vehicles like DAFs and QCDs, is essential for minimizing the tax burden on high-AGI individuals in the wake of stabilized PCE inflation tax planning conditions that offer clear visibility into 2025 AGI levels.

Navigating the implications of the SECURE Act 2.0 and RMDs

The Setting Every Community Up for Retirement Enhancement (SECURE) Act 2.0, enacted in late 2022, continues to reshape retirement planning, especially concerning Required Minimum Distributions (RMDs). For 2025, the RMD age is set to remain at 73, though future increases are scheduled. Taxpayers approaching or already subject to RMDs must ensure compliance by the year-end deadline to avoid the severe 25% penalty on missed distributions.

The SECURE Act 2.0 also introduced provisions for certain excess 529 plan funds to be rolled over into a Roth IRA, subject to lifetime limits and account duration requirements. While this provision offers a valuable new avenue for tax-advantaged savings, the complexity requires careful consultation with a tax professional to ensure compliance with the specific rules regarding the age of the 529 account and the maximum annual rollover limit.

The complexity of RMDs and qualified longevity annuity contracts (QLACs)

RMD planning in a 2.8% PCE environment focuses on managing the distribution amount efficiently. Since RMDs are taxed as ordinary income, controlling the distribution amount can prevent pushing the taxpayer into a higher marginal tax bracket. Strategies include utilizing QCDs, as mentioned, or strategically delaying distributions if allowed.

- QLACs and RMD Reduction: Qualified Longevity Annuity Contracts (QLACs) allow individuals to use a portion of their retirement savings (up to $200,000, indexed for inflation) to purchase an annuity that begins payments later in life. The amount used to purchase the QLAC is excluded from the RMD calculation, offering a method to reduce current taxable RMD income while providing future income security.

- Inherited IRA Rules: The SECURE Act 1.0 eliminated the ‘stretch’ IRA for most non-spouse beneficiaries, requiring them to deplete the inherited account within 10 years. Beneficiaries must understand the specific rules governing their inherited accounts to plan for the accelerated tax liability created by this 10-year rule, often involving careful withdrawal scheduling.

- Small Business Tax Credits: SECURE 2.0 significantly enhanced tax credits for small businesses that establish retirement plans, covering up to 100% of start-up costs for smaller employers. Business owners should explore taking advantage of these provisions before year-end to reduce operating tax liability.

The combination of stable PCE inflation tax planning conditions and the evolving SECURE Act 2.0 mandates a comprehensive review of all retirement account structures, focusing on RMD compliance and maximizing the newly available tax-advantaged savings opportunities for 2025.

Real estate and high-value asset tax considerations

Real estate investors face unique year-end tax planning challenges, particularly regarding depreciation, passive activity losses, and the potential impact of future tax legislation on carried interest and like-kind exchanges (1031 exchanges). While the 2.8% PCE inflation rate suggests stability, the housing market remains sensitive to interest rate policy, impacting property values and mortgage interest deductibility.

The bonus depreciation rate is scheduled to phase down over the coming years. For 2025, taxpayers should evaluate whether accelerating equipment or property purchases before year-end maximizes the current bonus depreciation percentage. This is particularly relevant for businesses investing in machinery or significant capital improvements.

Managing passive activity losses and depreciation

Real estate losses are often classified as passive activities, limiting their deductibility against ordinary income unless the taxpayer qualifies as a Real Estate Professional (REP). Year-end planning is critical for REP qualification, requiring documentation of material participation (e.g., spending more than 750 hours in real estate activities and more hours in real estate than in any other profession).

- Cost Segregation Studies: These studies reclassify certain components of a building (e.g., land improvements, electrical systems) into shorter depreciation schedules (5, 7, or 15 years) instead of the standard 39 years. Executing a cost segregation study before year-end can generate substantial accelerated depreciation deductions for the 2025 tax filing.

- Like-Kind Exchanges (1031): Real estate investors must adhere strictly to the 1031 exchange rules for deferring capital gains tax on the sale of investment property. The identification of the replacement property must occur within 45 days of the sale, and closing must occur within 180 days. Year-end timing is crucial to ensure these deadlines do not overlap awkwardly with the holiday season and filing deadlines.

- Qualified Business Income (QBI) Deduction: The QBI deduction (Section 199A) allows eligible business owners and real estate investors to deduct up to 20% of their qualified business income. However, the deduction is subject to complex income limitations and phase-outs, requiring careful income management before December 31 to maximize eligibility.

For owners of high-value assets, the stable economic environment provided by the 2.8% PCE reading allows for focused planning on asset depreciation and passive loss utilization, ensuring maximum benefit from complex provisions like cost segregation and QBI.

The critical role of estimated tax payments and withholding adjustments

A common pitfall in year-end tax management is the failure to properly adjust estimated tax payments or income withholding, leading to underpayment penalties. As investment income (capital gains, dividends, interest) often spikes in the fourth quarter, taxpayers relying solely on salary withholding may face a shortfall. This is especially true for those who executed successful tax-loss harvesting early in the year and now face substantial realized gains.

The IRS requires taxpayers to pay at least 90% of the current year’s tax liability or 100% (110% for high-income earners) of the prior year’s liability to avoid penalties. Given the stability suggested by the 2.8% PCE, accurate projection of 2025 AGI is more feasible, enabling precise adjustments to the final estimated tax payment due in January 2026.

Avoiding underpayment penalties before the deadline

Financial professionals recommend a comprehensive review of all income sources—W-2 wages, K-1 partnership income, and investment distributions—before the end of Q4. If necessary, taxpayers can increase their final estimated tax payment or, alternatively, request an increase in income tax withholding from their employer for their final paychecks of the year.

- Annualized Income Installment Method: For taxpayers whose income fluctuates significantly throughout the year (e.g., business owners or those receiving large year-end bonuses), the annualized income installment method may be beneficial, allowing payments to be based on the income earned during specific periods, rather than assuming income is earned evenly.

- Safe Harbors: High-income taxpayers (AGI exceeding $150,000) must ensure they meet the 110% prior-year liability safe harbor. If 2024 was a significantly lower income year than the projected 2025, meeting the 110% threshold may be a simpler route than accurately estimating the 90% current year liability.

- State Estimated Taxes: Do not overlook state estimated tax obligations, which often mirror federal requirements. Failure to pay adequate state estimated taxes can result in separate state-level penalties, eroding the benefits of careful federal PCE inflation tax planning.

Proactive adjustment of estimated payments is the final, critical step in year-end tax planning. By reconciling projected income and deductions against existing payments, taxpayers can ensure full compliance and avoid unnecessary penalties, safeguarding the optimized tax position achieved through strategic capital gains and deduction management.

The stability in the economic outlook, driven by the 2.8% PCE rate, emphasizes the need for a comprehensive, data-driven approach to year-end tax strategy. From maximizing retirement contributions to executing complex tax-loss harvesting, every decision made before December 31, 2025, will significantly impact the ultimate tax liability for the year.

| Key Tax Strategy for 2025 | Implication/Actionable Step |

|---|---|

| PCE Inflation at 2.8% | Signals stable tax bracket adjustments; focus shifts from hedging to optimizing timing of income and deductions. |

| Tax-Loss Harvesting (TLH) | Crucial for offsetting realized Q4 capital gains. Must be completed by December 31, avoiding the 30-day wash sale rule. |

| Retirement Contributions | Maximize 401(k), IRA, and HSA contributions (expected to increase for 2025) to reduce current year AGI. |

| Deduction Bunching | Concentrate itemized expenses (charity, medical) into 2025 to exceed the increased standard deduction threshold. |

Frequently Asked Questions about PCE Inflation and 2025 Tax Planning

The 2.8% PCE rate, relative to the CPI used by the IRS, implies moderate inflation adjustments for 2025 tax brackets and standard deductions. This adjustment prevents severe bracket creep, ensuring that taxpayers’ real income losses due to inflation are somewhat mitigated by higher deduction thresholds and wider income ranges for each bracket.

The most effective strategy is aggressive tax-loss harvesting (TLH). Short-term gains are taxed at ordinary income rates, which can be as high as 37%. Utilizing losses from underperforming investments to offset these gains provides the highest marginal tax savings. Ensure all TLH trades settle by December 31, 2025, to report on the current year’s return.

Yes, many analysts suggest considering Roth conversions now. With inflation cooling and potential future tax rate hikes anticipated after the TCJA provisions expire, converting traditional IRA assets to Roth (paying tax upfront) may hedge against substantially higher tax rates in retirement, maximizing long-term tax-free growth.

DAFs are excellent tools for deduction bunching. By making a large, single contribution to a DAF in 2025, the donor gains an immediate tax deduction for the full amount, potentially exceeding the standard deduction. The funds can then be distributed to charities over subsequent years, maintaining philanthropic goals while optimizing tax benefits.

Required Minimum Distributions (RMDs) must be taken by December 31 for the relevant tax year. Failure to take the full RMD results in a steep 25% penalty on the amount not withdrawn. Taxpayers aged 73 and older must calculate and withdraw their RMDs carefully to avoid this significant financial penalty.

The bottom line: navigating tax complexity in a disinflationary cycle

The stabilization of the PCE index at 2.8% provides a crucial element of predictability that was absent during the peak inflationary period of 2022-2023. This stability shifts the focus of year-end financial management from macroeconomic risk mitigation to granular tax optimization. For 2025, successful PCE inflation tax planning hinges on meticulous execution of defined strategies: maximizing tax-advantaged retirement savings (especially 401(k) and HSA contributions), aggressively utilizing tax-loss harvesting to offset portfolio gains, and strategically timing itemized deductions through bunching. As the political landscape evolves and the potential for significant tax law changes looms beyond 2025, locking in current tax benefits and deferring income where appropriate are prudent measures. Investors should consult with qualified tax advisors before December 31 to finalize these critical adjustments, ensuring their financial structure is resilient against both current economic trends and future legislative uncertainty. The difference between passive and proactive planning in this environment can equate to thousands of dollars in tax savings.