40-Year-Olds Struggle: Housing Affordability Crisis Deepens

The confluence of Federal Reserve rate hikes driving 30-year fixed mortgage rates above 7%, coupled with persistent low housing inventory and real wage stagnation, has rendered homeownership inaccessible for many 40-year-olds relying on first-time buyer market conditions.

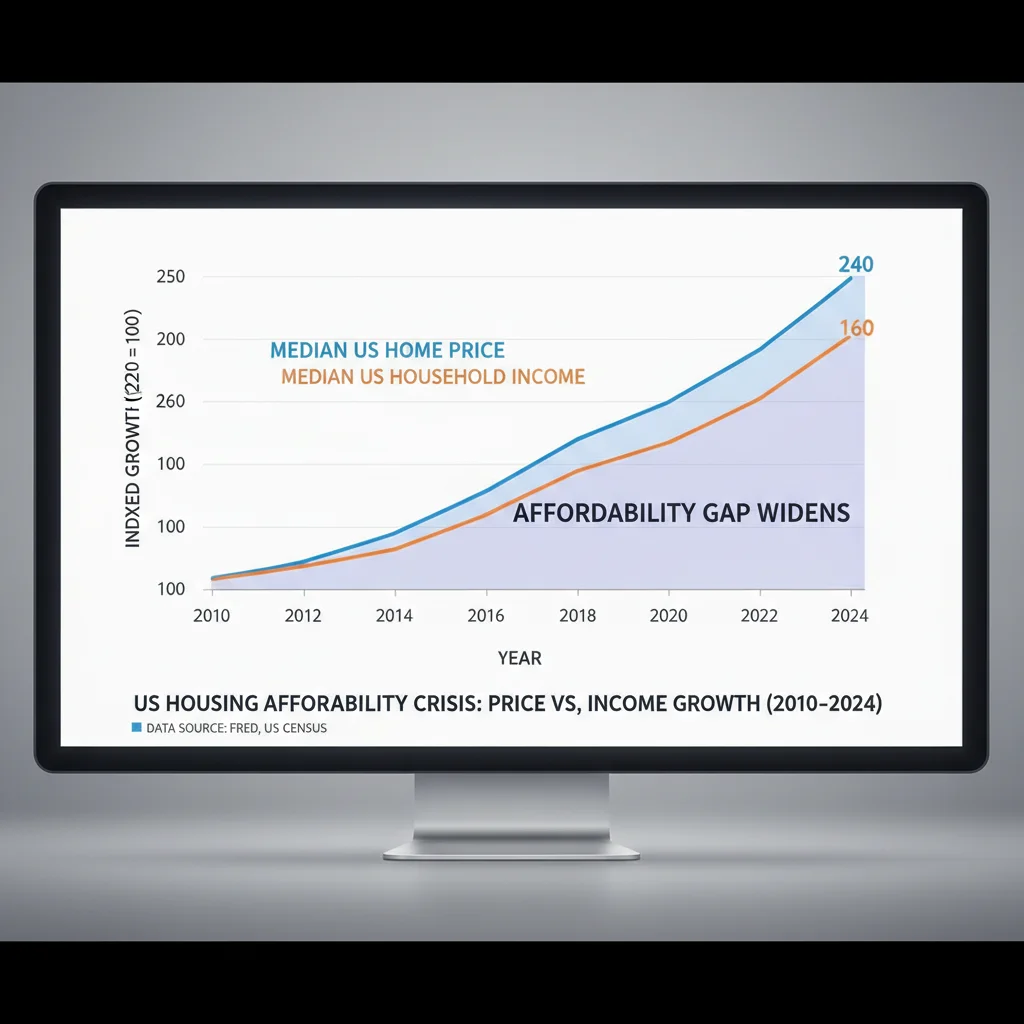

The American dream of homeownership is increasingly receding for the demographic cohort aged 40 to 49, a group traditionally characterized by peak earning potential and established career paths. This demographic now confronts a severe housing affordability crisis, driven by a perfect storm of macroeconomic forces that have fundamentally altered the cost structure of residential real estate since the pandemic. Data from the Federal Reserve Bank of St. Louis indicates that the median price of houses sold in the U.S. has surged nearly 40% since the start of 2020, while the effective mortgage rate for a 30-year fixed loan has jumped from historical lows near 3% to levels consistently above 6.5% as of Q3 2024, effectively doubling the monthly carrying cost for a median-priced home.

The macroeconomic triple threat: rates, inventory, and cost of capital

The current struggle faced by 40-year-olds is not merely a localized housing phenomenon but a direct consequence of coordinated macroeconomic shifts. The Federal Reserve’s aggressive monetary tightening cycle, initiated in early 2022 to combat inflation, raised the federal funds rate from near zero to a range between 5.25% and 5.50% by mid-2024. This action, while necessary for price stability, directly translated into higher borrowing costs across the economy, most notably impacting long-term fixed-rate mortgages. For a buyer seeking a $400,000 mortgage, moving from a 3% rate to a 7% rate increases the monthly principal and interest payment by approximately 67%, transforming previously manageable housing costs into prohibitive financial burdens.

Furthermore, the inventory crisis continues to compound the problem. Approximately 60% of outstanding U.S. mortgages carry an interest rate below 4.5%, according to estimates by the Federal Housing Finance Agency (FHFA). This has created a significant ‘lock-in’ effect, where existing homeowners are highly reluctant to sell their current homes and forfeit a low interest rate, thereby starving the market of available properties. The resulting scarcity of listings pushes prices higher despite diminished buyer demand at elevated interest rates, sustaining the steep entry barrier for 40-year-old buyers who often need to sell an existing property or are transitioning from long-term rentals.

The erosion of purchasing power through inflation and wage stagnation

While nominal wages have increased for many professionals in their 40s, real wage growth—adjusted for inflation—has often lagged behind the cost of essential goods and services, particularly housing. The Consumer Price Index (CPI) rose sharply between 2021 and 2023, eroding the disposable income necessary for large down payments and higher monthly mortgage payments. This cohort, many of whom faced delayed career establishment or higher student loan burdens compared to previous generations, finds their savings critically insufficient to meet the demands of the current market. According to the Bureau of Labor Statistics (BLS), while average hourly earnings saw positive nominal growth, the cumulative effect of high inflation means that the effective purchasing power for non-discretionary items like housing has declined significantly over the last five years.

- Interest Rate Shock: The jump from sub-4% mortgage rates to over 6.5% has reduced the maximum affordable loan amount for the same monthly payment by 25% to 35%, a crucial factor for 40-year-olds with fixed savings timelines.

- Inventory Constraint: Low existing-home inventory, fueled by the ‘lock-in’ effect, keeps prices artificially high, forcing buyers into highly competitive bidding wars or new construction markets with even higher price tags.

- Real Wage Decline: Inflation has diminished the real value of accumulated savings and current earnings, making it harder to amass the required 20% down payment, especially in high-cost metro areas.

The aggregate effect of these factors means that 40-year-olds, who often have established families and require larger, more expensive homes than first-time buyers in their 20s, are disproportionately affected by the current affordability metrics. This creates a bottleneck in the housing market, potentially impacting labor mobility and broader consumer spending patterns, as housing costs consume a larger share of household budgets.

The lingering burden of student debt and delayed wealth accumulation

A significant headwind unique to this generation of 40-year-olds is the persistent weight of student loan debt. Unlike previous generations, many individuals in this cohort graduated into a tight labor market following the 2008 financial crisis, accumulating substantial educational debt that has curtailed their ability to save and invest in the subsequent decades. Data from the Federal Reserve shows that Americans aged 35 to 49 hold the largest share of outstanding student loan debt, which directly impacts their debt-to-income (DTI) ratio—a critical metric for mortgage qualification.

Lenders scrutinize the DTI ratio closely. High student loan payments reduce the amount of monthly income available for a mortgage payment, even if the buyer possesses a strong credit score and a stable job. This delayed entry into the housing market means they missed the substantial equity gains realized by older generations who purchased homes between 2012 and 2019, further widening the generational wealth gap. The average student loan balance for borrowers in their 40s significantly impedes their capacity to qualify for loans large enough to purchase median-priced homes in desirable school districts, a common priority for this age group.

The role of institutional investors and private equity in market distortion

The rise of institutional investors in the single-family rental market has introduced a new layer of competition, particularly in rapidly growing Sun Belt cities. Firms specializing in ‘build-to-rent’ or bulk purchases of existing homes have utilized lower costs of capital and efficient operational scaling to acquire properties, often bidding above traditional owner-occupiers. While these institutional purchases represent a small fraction of the total housing stock, their concentration in certain desirable neighborhoods can significantly inflate entry-level and mid-range home prices, directly competing with the target market of 40-year-old buyers.

- Capital Advantage: Institutional buyers often operate with cash or highly leveraged financing structures unavailable to individual buyers, allowing them to close quickly and waive contingencies, creating an unfair advantage in competitive bidding scenarios.

- Inventory Reduction: By converting traditionally owner-occupied homes into permanent rental stock, institutional investors further restrict the already limited supply available for purchase, exacerbating the housing affordability crisis.

- Market Concentration: Areas with high institutional presence have seen faster appreciation rates, according to analysis by the National Association of Realtors (NAR), pressuring the budgets of prospective 40-year-old homeowners.

Addressing this market distortion requires policy solutions that either increase residential construction dramatically or implement regulatory measures to level the playing field between large corporate buyers and individual families. Without intervention, this capital advantage will continue to push home prices out of reach for middle-aged buyers who rely on traditional financing and market stability.

Geographic divergence: The affordability gap between coastal and inland markets

The severity of the housing affordability crisis for 40-year-olds is highly dependent on geographic location. Major coastal metropolitan areas, such as San Francisco, New York, and Boston, have long been characterized by restrictive zoning laws and limited land availability, leading to persistently high median home prices. However, the post-pandemic shift saw massive price increases in previously affordable secondary markets, including Boise, Austin, and Phoenix, driven by remote work and migration patterns. This convergence means that even relocating to a lower-cost area no longer guarantees affordability.

For example, while the median home price in San Jose, California, exceeded $1.5 million in early 2024, requiring an income far beyond the median 40-year-old’s earnings, the median price in Boise, Idaho, which was once considered highly accessible, surged past $450,000. When factoring in property taxes and the current 6.8% average mortgage rate (as of Q3 2024), the monthly payment for a median-priced home in these secondary markets often exceeds 30% of the median household income, pushing buyers into financial stress. This phenomenon undermines the traditional strategy of seeking affordability through geographic arbitrage.

The challenge of saving for a down payment in a high-rent environment

A critical barrier for prospective 40-year-old buyers is the ability to save the required down payment while simultaneously paying escalating rental costs. Rental inflation has been historically high across the U.S. since 2021, driven by competition, limited apartment construction, and the institutional shift toward renting. High rents consume a significant portion of disposable income, severely limiting the capacity of renters in their 40s to accumulate the necessary funds for a 20% down payment, which, on a $500,000 home, equates to $100,000 plus closing costs.

This dynamic creates a vicious cycle: high rents prevent saving for a down payment, and the inability to save forces continued renting, exposing the individual to further rent increases. The average time required for a middle-income household to save a 20% down payment has stretched from roughly five years a decade ago to nearly 10 years in some major markets, according to estimates by Zillow. This prolonged saving period pushes first-time buying further into the 40s and 50s, constraining retirement savings and overall financial planning.

The impact of monetary policy cycles on long-term housing access

The current housing affordability crisis is fundamentally linked to the volatility of Federal Reserve policy. The period of ultra-low interest rates following the 2008 crisis artificially inflated asset prices, including housing, without commensurate growth in underlying economic productivity or real wages. When the Fed rapidly reversed course in 2022, the shock to borrowing costs was immediate and severe, particularly for rate-sensitive assets like housing.

This monetary whiplash has created two distinct classes of homeowners: those who secured low rates pre-2022 and are financially insulated, and the 40-year-old cohort attempting to enter the market now at punitive rates. The long-term implication is a transfer of wealth and stability toward older generations who benefited from low rates, while younger generations, including those in their 40s, face historically high barriers to entry. Analysts at Goldman Sachs project that mortgage rates will remain elevated, likely settling above 5% for the foreseeable future, suggesting that the current affordability metrics are not a temporary spike but a new structural reality.

Navigating the high-rate environment: strategies for prospective buyers

For 40-year-olds determined to achieve homeownership, the strategy must pivot from waiting for a return to pre-2022 rates to mitigating current high costs. This involves aggressive DTI management and exploring alternative financing structures. Strategies include:

- DTI Optimization: Aggressively paying down non-mortgage debt, such as auto loans or credit card balances, to free up capacity for higher monthly mortgage payments and improve lending eligibility.

- Adjustable-Rate Mortgages (ARMs): While riskier, ARMs often offer lower introductory rates for the first 5 or 7 years, providing a temporary reprieve and the possibility of refinancing if benchmark rates decline in the medium term.

- Geographic Flexibility: Expanding the search radius to exurban or smaller, emerging markets where price-to-income ratios remain below the national average, accepting a longer commute or reduced access to major city amenities.

- Down Payment Assistance Programs: Utilizing state and local government programs designed to provide financial aid for down payments and closing costs, particularly beneficial for individuals with strong income but limited accumulated savings.

The crucial insight is that the market requires a fundamental recalibration of expectations. The era of cheap money financing affordable housing is over, and successful entry now demands higher leverage on income or significant compromise on location and property size.

The generational wealth transfer and future market segmentation

The current housing affordability crisis is intensifying the generational wealth gap. Older generations, primarily Baby Boomers and early Gen X, who own homes with low fixed rates and substantial accumulated equity, are seeing their net worth increase rapidly, even as their 40-year-old children and colleagues struggle to enter the market. This disparity suggests that future homeownership rates for the current middle-aged cohort will increasingly rely on intergenerational transfers of wealth, such as inheritances or substantial financial gifts from family members.

This reliance on family wealth creates a segmented market: those with financial backing from established homeowners will continue to access ownership, while those without such support will be locked into the rental market, regardless of their professional success or earning potential. This structural shift moves the U.S. housing market closer to models seen in highly stratified global cities, where property ownership is largely determined by inherited capital rather than earned income.

The long-term economic consequence of this segmentation is reduced social mobility and potentially higher levels of economic inequality. Policymakers must consider that restricting homeownership for this crucial demographic not only impacts individual financial stability but also limits the broader economic stimulus traditionally provided by the middle class through home improvements and related consumption.

Policy responses and the path to structural housing change

Addressing the challenges faced by 40-year-olds requires a multi-faceted approach centered on increasing supply and stabilizing the cost of capital. Simply waiting for the Federal Reserve to reduce rates may alleviate some pressure, but it will not resolve the underlying structural deficit in housing inventory, which is the primary driver of price appreciation.

Supply-side solutions and regulatory reform

Economists widely agree that substantial increases in housing supply, particularly in high-demand, high-cost areas, are essential. This necessitates challenging restrictive local zoning ordinances, often referred to as ‘NIMBYism’ (Not In My Backyard), which limit density and mandate large minimum lot sizes. Policy focus should shift to incentivizing the construction of ‘missing middle’ housing—duplexes, townhouses, and small apartment buildings—that offer greater affordability than detached single-family homes.

- Zoning Reform: Federal and state incentives to preempt overly restrictive local zoning that hinders high-density construction near job centers.

- Construction Cost Mitigation: Targeted policies to address the persistent high costs of labor and materials, perhaps through tax credits or streamlined permitting processes.

- Investor Regulation: Consideration of capital gains taxes or transfer fees specifically targeting institutional investors who purchase large quantities of single-family homes, aiming to reduce speculative pressure on the owner-occupier market.

Without bold structural changes to supply, any temporary relief from lower interest rates will likely be quickly absorbed by renewed price appreciation, leaving 40-year-olds perpetually chasing an unattainable benchmark. The solution is rooted in increasing the elasticity of housing supply to meet demand, a political and economic challenge that spans federal, state, and local jurisdictions.

| Key Financial Factor | Market Implication/Analysis |

|---|---|

| 30-Year Mortgage Rate (Q3 2024) | Rates exceeding 6.5% have doubled the carrying cost of homes compared to 2021, severely limiting borrowing capacity for 40-year-olds. |

| Median Home Price Increase (2020-2024) | Prices surged nearly 40% nationally, outpacing real income growth and making down payment accumulation significantly more challenging. |

| Inventory Shortage (The ‘Lock-in’ Effect) | Existing homeowners with sub-4.5% mortgages are not listing, keeping housing supply artificially low and sustaining high price competition. |

| Student Debt Burden (Ages 35-49) | High debt-to-income ratios due to student loans prevent many 40-year-olds from qualifying for mortgages large enough for median-priced homes. |

Frequently Asked Questions about the Housing Affordability Crisis

While rate cuts would lower monthly mortgage payments, they are unlikely to solve the crisis alone. Lower rates typically increase buyer demand, which, given the persistent inventory shortage (the ‘lock-in’ effect), would likely lead to rapid home price appreciation, negating the affordability gains from reduced interest costs, as seen historically.

Many 40-year-olds carry higher student loan or consumer debt balances than younger buyers, increasing their DTI ratio. Lenders generally prefer a DTI below 43%. A high ratio limits the maximum mortgage amount they can qualify for, forcing them to purchase less expensive properties or remain renters, despite strong credit history.

Institutional buyers, leveraging large capital pools, compete directly with owner-occupiers, particularly for mid-range homes. Their ability to pay cash and close quickly inflates prices in targeted markets and removes valuable inventory from the homeownership pool, exacerbating the structural supply problem for middle-aged buyers.

Prospective buyers may consider 5/1 or 7/1 Adjustable-Rate Mortgages (ARMs), which offer lower initial rates than 30-year fixed rates. This strategy is predicated on the expectation of refinancing before the adjustment period, mitigating the immediate shock of high rates while allowing market entry and initial equity accumulation.

Maximizing savings requires minimizing other debt service and non-essential spending. Exploring state or local down payment assistance programs, which often supplement savings or reduce required closing costs, can bridge the gap. Additionally, considering a smaller initial home purchase (a ‘starter home’) with a lower down payment requirement can facilitate earlier market entry.

The bottom line: A structural shift demanding new financial paradigms

The contemporary housing affordability crisis for 40-year-olds is a complex financial problem rooted in structural supply deficits, aggressive monetary policy normalization, and generational debt burdens. The financial reality is that the required income to comfortably afford a median-priced home far exceeds the median income for this age group in most major U.S. markets. For this cohort, the traditional path to homeownership—saving a down payment while renting and leveraging moderate income growth—is largely broken. The market’s current equilibrium suggests that housing costs will remain high, supported by persistent low inventory and the expectation that the Federal Reserve will not return to the zero-rate environment seen in the 2010s. Market participants should monitor the pace of regulatory reform concerning zoning and institutional home purchases, as these policy levers hold the greatest potential for structural relief. Absent significant supply increases, the wealth divergence between homeowners and renters, particularly in the 40-to-49 age bracket, is projected to accelerate, making intergenerational wealth transfer an increasingly dominant factor in future homeownership statistics.