Property Taxes Rose 10.4%: How to Challenge Assessments

Property taxes across the United States have increased by an average of 10.4% since 2021, forcing homeowners to confront rapidly escalating valuations; understanding the appeal process is crucial for mitigating this significant financial burden.

The recent surge in housing valuations, fueled by pandemic-era migration shifts and constrained supply, has translated directly into higher public revenue demands, exemplified by the average property taxes rose 10.4% since 2021: how to challenge your assessment becoming a critical financial maneuver for millions of US homeowners.

The economic driver: Unprecedented housing appreciation

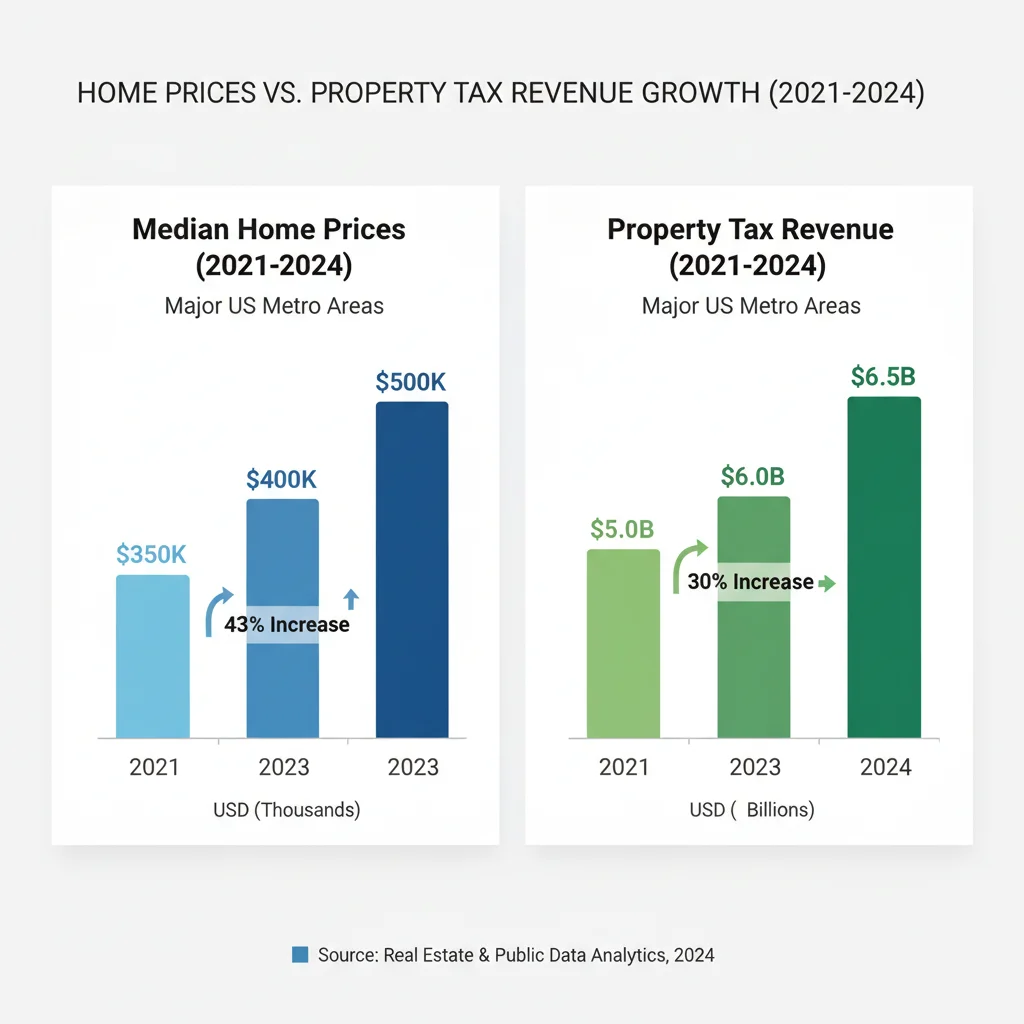

The 10.4% average increase in property tax revenue since 2021 is not an arbitrary figure but a direct consequence of the extraordinary appreciation witnessed in the US residential real estate market during the same period. According to data compiled by the Federal Reserve and various state revenue departments, the median sale price for existing homes in the US climbed by over 30% between Q1 2020 and Q4 2022. While market activity has moderated since the Federal Reserve began its aggressive interest rate hike cycle in 2022, the lag effect in property tax assessments means that many jurisdictions are now basing current tax calculations on peak-market valuations from one or two years prior.

This lag creates a significant discrepancy, often referred to as ‘assessment sticker shock,’ where homeowners receive bills reflecting market highs that may no longer accurately represent current market realities, particularly in regions where housing prices have experienced recent softness. The economic impact extends beyond the individual household budget; higher property taxes contribute to inflationary pressures on housing costs and reduce disposable income, potentially slowing consumer spending growth despite robust employment figures.

The mechanism of assessment lag

Most local governments operate on an assessment cycle that does not instantaneously reflect current market shifts. For instance, an assessment notice sent in early 2024 might be based on comparable sales data from as far back as mid-2022. This temporal misalignment is the primary source of homeowner frustration and the central pillar for many successful appeals. When the market is cooling, as seen in many major metropolitan areas during 2023 and 2024, the assessed value may significantly overshoot the home’s true fair market value (FMV).

- Market Peak Valuation: Assessments often utilize sales data from the peak of the 2021-2022 housing boom.

- Tax Rate Multiplier: Local jurisdictions often maintained or slightly increased millage rates, compounding the effect of higher valuations.

- Disparity with Current FMV: The assessed value may exceed the price at which the property would realistically sell today, providing grounds for an appeal.

Economic analysts at Moody’s Analytics suggest that property tax increases are likely to remain elevated through 2025 as taxing authorities maximize revenue capture from past appreciation. This structural reality makes challenging an assessment not merely an optional budgetary exercise but a necessary defense against overstated fiscal liabilities.

Understanding your property tax notice and valuation methods

Before initiating any challenge, it is imperative to dissect the official property tax notice. This document typically outlines three critical components: the assessed value (the figure the tax is based upon), the equalization factor (a multiplier used in some states to ensure uniformity), and the millage rate (the actual tax rate applied). The goal of the appeal process is almost always to reduce the assessed value, as the millage rate is generally fixed by local legislative bodies.

Assessors primarily use three valuation approaches: the sales comparison approach, the cost approach, and the income approach (primarily for commercial properties). For residential homeowners, the sales comparison approach is overwhelmingly dominant. This method involves examining recent sales of similar properties—known as ‘comparables’ or ‘comps’—within the immediate neighborhood. Errors often arise from assessors using non-comparable properties (e.g., properties with vastly superior amenities, recent major renovations, or significantly larger lots) or failing to account for physical deterioration or adverse external factors affecting the subject property.

Identifying assessment errors

A systematic review of the assessor’s data sheet on your property is the first step. Discrepancies regarding square footage, number of bathrooms, lot size, or stated condition (e.g., listing a finished basement as unfinished) are factual errors that are relatively easy to correct. More complex, yet highly effective, grounds for appeal include proving that the assessed value violates uniformity standards or exceeds the property’s true fair market value.

The principle of uniformity dictates that properties of similar type and value should be taxed similarly. If your property is valued at $500,000, but five identical, recently sold homes on your street are assessed at an average of $450,000, a strong case for non-uniformity exists. The burden of proof rests squarely on the homeowner to identify and present these comparable sales data points, typically requiring the use of official county records or professional appraisal reports.

The data-driven strategy: Gathering comparable sales evidence

The foundation of a successful property tax appeal is objective, verifiable data. Emotion and anecdotes about household budgets hold no sway in the appeal board room; only hard evidence of market value matters. The most compelling evidence is a list of three to five recent sales (ideally within the last 6 to 12 months) of highly similar properties that sold for significantly less than your current assessed value. These sales must be arm’s-length transactions, meaning they were not foreclosure sales, family transfers, or distressed sales, which can skew the data.

Accessing accurate comparable sales data requires leveraging resources often available through local tax assessor websites, county recorders’ offices, or utilizing professional real estate databases. The key is strict comparability. A comparable property should mirror the subject property in terms of location (preferably within the same subdivision or block), age, size (square footage), and overall condition. Any differences must be quantified and adjusted—for example, if a comparable home lacks a two-car garage that your home possesses, the sale price of the comparable must be adjusted upward to reflect the missing feature’s value, thereby strengthening the argument that your property is over-assessed.

The role of a professional appraisal

In cases where the assessed value is severely inflated, or the property is unique, obtaining a full, independent appraisal from a licensed professional appraiser is often a worthwhile investment. An appraiser will conduct a thorough physical inspection and generate a detailed report utilizing the Uniform Standards of Professional Appraisal Practice (USPAP). This document provides an expert opinion of the property’s fair market value, explicitly tailored to stand up to scrutiny during an appeal hearing.

While an appraisal can cost between $400 and $700, the potential multi-year tax savings often justify the expense, especially if the tax reduction exceeds the appraisal cost in the first year alone. The appraisal should specifically focus on the valuation date used by the local assessor for the current tax cycle, ensuring the data is temporally relevant. Analysts at the National Taxpayers Union estimate that approximately 60% of property tax appeals that utilize a professional, targeted appraisal result in a reduction of the assessed value.

Navigating the formal appeal process and deadlines

The process for challenging a property tax assessment is strictly governed by local statutes and involves rigid deadlines that cannot be missed. Typically, the process involves three stages: an informal review with the assessor’s office, a formal hearing before a local board of review or equalization, and judicial review (a court appeal). Homeowners must first exhaust the administrative remedies before pursuing litigation.

The initial informal review is the most critical and often the most successful stage. This involves presenting your evidence directly to an assessor or a field representative, often before the formal assessment rolls are finalized. Success rates are high here because the assessor’s office may prefer an amicable resolution over the administrative burden of a formal hearing. If this fails, the homeowner must file a formal petition or protest form, usually within 30 to 60 days of receiving the assessment notice, depending on the jurisdiction.

Preparing for the board of review hearing

The formal hearing before the Board of Review or Equalization is a quasi-judicial proceeding where the homeowner presents their case and evidence. Preparation is key. Homeowners should arrive with multiple copies of all documentation:

- The official assessment notice being challenged.

- The detailed property data sheet from the assessor, highlighting any factual errors.

- Three to five highly relevant comparable sales, including photos and sale prices.

- A professional appraisal, if one was obtained.

- A brief, written summary outlining the core argument (e.g., ‘Assessment exceeds FMV by 12% based on comparable sales’).

It is vital to maintain a professional, objective tone throughout the hearing. The focus must be solely on the financial data and the property’s market value, not on the homeowner’s financial situation or the perceived unfairness of taxation. The Board’s decision is based on the weight of the evidence presented, specifically whether the homeowner has successfully demonstrated that the current assessed value is inaccurate or inequitable relative to similar properties.

Macroeconomic implications of rising property tax revenue

The aggregate 10.4% increase in property tax revenue across the US since 2021 represents a significant fiscal injection into local government budgets. This revenue stream, which funds essential services like schools, police, and infrastructure, provides a critical buffer against potential economic downturns and fluctuations in state or federal funding. However, the reliance on surging property values creates a regressive tax burden, disproportionately affecting fixed-income seniors and long-term homeowners whose incomes have not kept pace with housing appreciation.

Economists tracking housing affordability metrics are increasingly concerned that the rising property tax component, alongside elevated mortgage rates, is pushing the total cost of homeownership out of reach for middle-income families. According to the National Association of Realtors (NAR), the average monthly tax payment has increased nearly 15% in high-growth states like Texas and Florida, contributing to a measurable decline in housing affordability indices.

The political and fiscal headwinds

In response to taxpayer pressure, some states are exploring legislative caps on assessment increases, often limiting annual growth to 3% or 5%, irrespective of actual market appreciation. While these measures offer immediate relief, they can create long-term fiscal challenges for local municipalities reliant on predictable revenue growth. Furthermore, such caps can exacerbate inequities, leading to vastly different tax burdens for newer homeowners versus long-term residents, a phenomenon known as ‘tax portability’ issues.

The financial journalist must recognize that this dynamic tension—the need for local governments to fund services versus the homeowner’s capacity to pay—is a defining feature of the current housing market. The successful appeal of a property assessment is therefore not just a personal financial victory, but a direct market adjustment against potential governmental overreach based on transient market peaks.

Mitigating future tax burdens: long-term planning and exemptions

While challenging a current assessment addresses the immediate financial pressure, proactive long-term planning is essential for mitigating future property tax increases. Homeowners should familiarize themselves with all available local and state property tax exemptions, which can significantly reduce the taxable portion of their home’s value. Common exemptions include the homestead exemption, senior citizen exemptions, veteran exemptions, and sometimes exemptions for properties with specific energy-efficient improvements.

The homestead exemption, a cornerstone of property tax relief in many states, typically shields a fixed dollar amount or a percentage of the home’s value from taxation. Failure to file for this exemption is a common oversight that permanently inflates the tax bill. Furthermore, homeowners should closely monitor local government discussions regarding millage rates. While individual appeals focus on valuation, community advocacy and engagement regarding the millage rate (the rate applied to the valuation) can provide broad-based relief.

Timing renovations and improvements

Home improvements often trigger reassessments, as they increase the property’s market value. Strategic financial planning dictates timing significant, visible renovations—such as additions, major kitchen remodels, or new pools—until after the current assessment determination date, or phasing improvements to avoid crossing thresholds that might prompt an immediate reassessment. Maintenance and necessary repairs, which maintain the current value without adding new amenities, are less likely to trigger substantial assessment boosts.

For investors owning rental properties, challenging assessments is even more crucial, as property taxes are a substantial operating expense directly impacting net operating income (NOI) and overall capitalization rates. Utilizing the income approach to valuation, presenting evidence of high vacancy rates, or demonstrating that the property’s rental income potential does not support the assessed value, becomes the primary appeal strategy in the investment property context.

The legal and procedural risks of challenging an assessment

While the focus is predominantly on the potential financial rewards of a successful challenge, homeowners must be aware of the procedural risks involved. The most significant risk is the possibility of the assessment being raised rather than lowered. Although rare and usually prevented by jurisdictional rules that limit the scope of the appeal, it is technically possible that the assessment review process uncovers data suggesting the property was significantly under-assessed, leading to an increase in the tax burden.

Therefore, a prerequisite for any appeal should be a thorough, objective analysis of comparable sales, confirming that the current assessed value is indeed an outlier. If the property’s valuation is only marginally higher than comparable sales, the cost (in terms of time or professional fees) and the minimal risk of a higher assessment may outweigh the potential savings. Legal experts often advise against appealing unless the assessed value is demonstrably 8% to 10% above the true market value.

Cost-benefit analysis of professional representation

Homeowners facing complex appeals, or those with high-value properties where the tax savings could be substantial, often engage professional tax consultants or attorneys specializing in property valuation. These professionals possess deep knowledge of local codes, access to proprietary sales data, and expertise in presenting evidence effectively before the appeal board. Their fees typically range from a flat rate to a percentage (often 30% to 50%) of the first year’s tax savings.

A cost-benefit analysis should weigh the expected tax reduction against the professional fees. If a successful appeal is projected to save $2,000 annually, and the attorney charges a $700 flat fee or 40% ($800) of the first year’s savings, the investment is generally sound. However, for smaller potential savings, the homeowner may be better served by conducting the research and appeal independently, relying on publicly available data and the structured guidance provided by the local assessor’s office.

| Key Factor/Metric | Analysis/Implication |

|---|---|

| 10.4% Tax Increase Since 2021 | Reflects the lag effect of 2021-2022 housing market peaks on current tax assessments, often resulting in overvaluation today. |

| Sales Comparison Approach | The primary method for residential valuation; challenging requires 3-5 verifiable comparable sales below assessed value. |

| Need for Independent Appraisal | Recommended when assessed value is severely inflated; strengthens the appeal case significantly, despite initial cost ($400-$700). |

| Assessment Deadline Strictness | Appeal deadlines (often 30-60 days post-notice) are non-negotiable; missing them forfeits the right to challenge for the current cycle. |

Frequently Asked Questions about Property Tax Challenges

The increase is primarily driven by the substantial appreciation in US home values during the 2021-2022 housing boom. Assessors are now applying tax rates to these peak valuations, creating significantly higher assessed values even if the local market has recently cooled, based on the assessment lag effect.

The most compelling evidence consists of recent comparable sales data. You need 3 to 5 recent, arm’s-length sales of highly similar homes in your immediate area that sold for less than your current assessed value. This directly refutes the assessor’s valuation.

It is statistically rare, but possible. If the appeal process reveals your property was significantly under-assessed based on current market data, the board might raise the valuation. Only challenge if you are confident your current assessment is an outlier compared to genuine comps.

While not strictly necessary for every case, a professional, USPAP-compliant appraisal significantly increases the likelihood of success, especially for high-value or unique properties. It provides objective, expert evidence that legally outweighs simple homeowner opinions.

Appeal deadlines are jurisdiction-specific but generally fall within 30 to 60 days after the annual assessment notice is mailed. These deadlines are rigid; homeowners must confirm the exact date with their local assessor’s office immediately upon receiving their notice.

The bottom line: Financial defense in a high-valuation market

The 10.4% rise in property tax revenues since 2021 underscores a fundamental shift in the cost structure of US homeownership, migrating substantial wealth from private hands to public coffers. For the individual homeowner, this trend necessitates a proactive, data-driven defense against potentially inflated valuations. Success in challenging a property assessment hinges on recognizing the assessor’s reliance on historical market peaks and presenting irrefutable evidence—primarily comparable sales data—reflecting current market realities or demonstrating a lack of uniformity. As local governments continue to capitalize on past housing gains, homeowners must treat the assessment notice not as a final decree but as a financial document requiring critical review and, often, formal protest. Monitoring local millage rates and ensuring full utilization of available exemptions remain crucial long-term strategies for stabilizing the total cost of housing in an era of persistent inflationary pressure and constrained housing supply.