Fed December Rate Cut: Mortgage Rate Impact Analysis for US Homeowners

The projected Federal Reserve December rate cut is anticipated to lower short-term funding costs, potentially influencing the benchmark 10-year Treasury yield and subsequently easing 30-year fixed mortgage rates, offering relief to prospective US homebuyers.

Understanding How the Federal Reserve’s December Rate Cut Affects Your Mortgage Rate requires dissecting the intricate transmission mechanism of monetary policy into the housing finance system. While the Federal Reserve directly controls the federal funds rate—a short-term benchmark for bank lending—it does not directly set mortgage rates. However, the market’s reaction to the Federal Open Market Committee (FOMC) decision, particularly concerning the future path of interest rates and inflation expectations, rapidly translates into changes in the long-term yields that underpin the 30-year fixed mortgage product. The anticipation of a December rate reduction, following a prolonged period of inflation-fighting hikes, has already begun to price in potential relief for borrowers, impacting housing affordability and market liquidity across the United States.

The mechanics of monetary policy transmission to mortgage markets

The relationship between the Federal Reserve’s policy decisions and consumer mortgage rates is often misunderstood. The federal funds rate primarily influences short-term lending rates, such as credit card APRs and home equity lines of credit (HELOCs). Conversely, 30-year fixed mortgage rates are largely tied to the yield of the 10-year US Treasury note. This benchmark reflects long-term economic expectations, including inflation and growth prospects, over the next decade. When the Fed signals a shift toward monetary easing, market participants interpret this as a potential reduction in future inflation and a slowing economy, causing bond yields—and consequently mortgage rates—to decline.

The anticipation of the December rate cut, assuming it is the first in a series of cuts, is crucial. Bond traders often move rates in advance of the actual Fed action. For example, if the market has already factored in a 25 basis point (bp) cut, the actual announcement might lead to minimal immediate change. However, the forward guidance—the ‘dot plot’ and accompanying statement on future rate expectations—is what truly dictates the long-term trajectory of the 10-year Treasury. According to analysis by strategists at Goldman Sachs, a sustained easing cycle typically leads to a 50-80 bp drop in 30-year fixed rates within three quarters, assuming economic data supports the shift.

The role of the 10-year Treasury yield

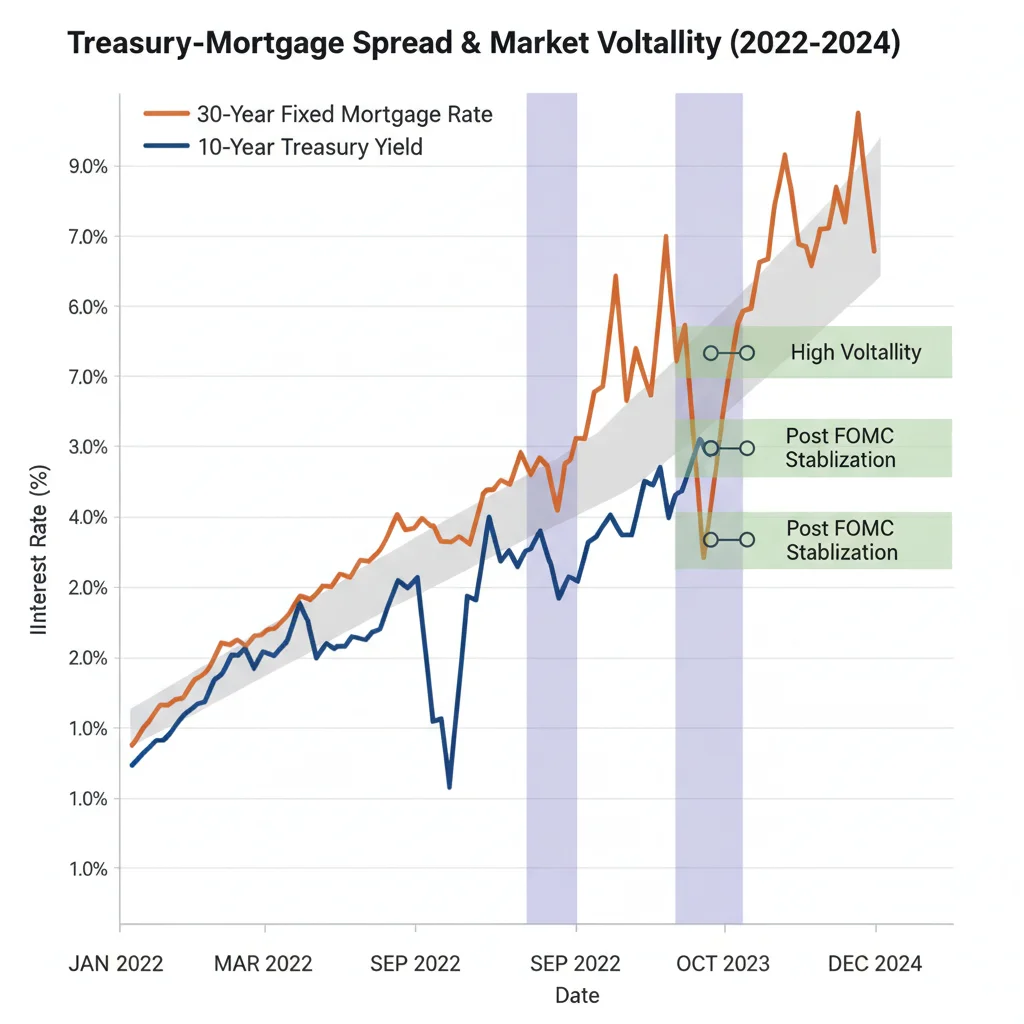

The 10-year Treasury yield serves as the primary gauge for long-term borrowing costs. Mortgage rates typically maintain a spread above the 10-year yield, reflecting lender risk, servicing costs, and market liquidity. Historically, this spread has averaged around 170 basis points. During periods of high volatility or quantitative tightening (QT), this spread often widens, sometimes exceeding 250 basis points, as lenders demand a higher premium to offset uncertainty. A December rate cut, coupled with an end to quantitative tightening, could help normalize this spread, providing an additional downward force on mortgage rates beyond the direct Treasury yield movement.

- Yield Impact: A 25 bp reduction in the federal funds rate typically correlates with a 10-15 bp decline in the 10-year Treasury yield, although the effect is often muted if the cut is widely anticipated.

- Spread Normalization: Increased stability post-cut could narrow the mortgage-Treasury spread from recent highs (e.g., 230 bp in Q3) back towards the historical average of 170 bp.

- Inflation Expectations: The success of the rate cut in lowering mortgage rates depends heavily on sustained evidence that core inflation is trending toward the Fed’s 2% target, anchoring long-term bond investor sentiment.

- Market Liquidity: Easing monetary policy generally improves liquidity in the mortgage-backed securities (MBS) market, making it cheaper for lenders to originate loans and pass savings to consumers.

In summary, the December rate cut acts as a market signal, reducing the cost of short-term financing for banks, but its most profound effect on the 30-year mortgage rate is mediated through its influence on long-term bond yields and the subsequent normalization of the risk premium demanded by mortgage lenders.

Dissecting the housing affordability crisis and the potential relief

The US housing market has suffered significantly under the weight of high interest rates. According to the National Association of Realtors (NAR), housing affordability reached a 40-year low in Q3 of the current year, driven by elevated median home prices and 30-year fixed rates hovering near 7.5%. The anticipated December rate cut is viewed by many market participants as the necessary catalyst to inject life back into the transactional volume, which has been stagnant due to the ‘lock-in effect’—homeowners holding onto mortgages secured at 3% or 4% rates and unwilling to trade up.

A hypothetical 50 bp drop in the 30-year fixed mortgage rate, moving it from 7.5% down to 7.0%, significantly alters monthly payments. For a median-priced home requiring a $400,000 mortgage, this reduction translates to approximately $135 in monthly savings. While this relief is incremental, it is substantial enough to bring borderline buyers back into the market, particularly in high-cost metro areas. Economists at Morgan Stanley project that every 25 bp sustained drop in mortgage rates could stimulate a 3% increase in existing home sales volume over the subsequent two quarters.

First-time buyers and the rate sensitivity

First-time homebuyers are particularly rate-sensitive, as their purchasing power is directly constrained by monthly payment affordability. They lack the equity cushion or low existing mortgage rate that current homeowners possess. The December rate cut, if followed by further easing early next year, provides a critical window of opportunity. However, potential rate relief must be weighed against continued supply constraints.

- Payment-to-Income Ratio: A rate decline improves the debt-to-income ratio for many potential buyers, qualifying more households for mortgages under stringent underwriting standards.

- Market Inventory: While lower rates increase demand, the inventory deficit remains a structural impediment. Data from Freddie Mac shows that the US housing market currently faces a shortfall of approximately 1.5 million units relative to demand.

- Price Elasticity: Analysts at JP Morgan suggest that in the current environment, housing prices are less elastic to rate changes than sales volume; price appreciation may slow, but outright declines are unlikely without a severe economic downturn.

The relief provided by the December rate cut will be felt most acutely in transaction volume rather than dramatic price reductions. It provides a much-needed psychological boost to the market, signaling the potential end of the steepest rate hike cycle in decades and offering tangible improvements in monthly payment schedules for new borrowers.

Adjustable-rate mortgages (ARMs) and short-term debt

While the focus often remains on the 30-year fixed rate, the Federal Reserve’s direct influence is strongest on short-term rates, which govern adjustable-rate mortgages (ARMs), particularly hybrid ARMs like the 5/1 or 7/1 products, and other consumer debt instruments. The federal funds rate directly affects the Secured Overnight Financing Rate (SOFR) and the prime rate, which are common indices used to calculate ARM adjustments after the initial fixed period.

For borrowers currently holding ARMs or considering them, the December rate cut yields more immediate and predictable relief than for fixed-rate borrowers. A 25 bp reduction in the federal funds rate translates almost immediately to a similar reduction in the index rate for ARMs. This is particularly relevant for the estimated 1.5 million US homeowners whose ARMs are scheduled to reset in the next 18 months, often facing payment shock due to the elevated rate environment of the past two years.

Impact on refinancing volume and HELOCs

Refinancing activity, which had plummeted to multi-decade lows when rates peaked, is expected to pick up following the December cut. Mortgage Bankers Association (MBA) data indicates that a sustained drop below 6.5% is the critical threshold for widespread refinancing to become economically viable for homeowners who secured loans between 2021 and 2023. Even a 25 bp move closer to this threshold sparks interest among lenders and borrowers.

Home Equity Lines of Credit (HELOCs), which are typically pegged to the prime rate, will see immediate benefit. Since the prime rate is directly tied to the federal funds rate (Prime Rate = Federal Funds Rate + 300 bps), a 25 bp cut means the interest rate on existing HELOC balances drops by 25 bp the following month. This reduction enhances consumer discretionary income and reduces the cost of tapping into home equity for renovations or debt consolidation.

- ARM Resets: Immediate relief for ARM holders whose adjustment period coincides with the rate cut, mitigating the severity of potential payment increases.

- Refinance Threshold: The cut brings the 30-year fixed rate closer to the 6.5% level, which analysts consider the psychological and economic trigger point for a significant increase in refinance applications.

- HELOC Savings: Direct, immediate interest rate savings for the approximately 7 million US households utilizing HELOCs, improving cash flow.

The Fed’s action in December provides tangible, immediate financial benefits for holders of short-term, variable-rate debt, underscoring the direct path of monetary policy transmission outside the long-term fixed mortgage market.

Investor sentiment and the mortgage-backed securities market

The health of the mortgage market is intrinsically linked to the performance and demand for Mortgage-Backed Securities (MBS). Agency MBS, primarily guaranteed by Fannie Mae, Freddie Mac, and Ginnie Mae, are highly sensitive to interest rate movements. A projected rate cut in December signals to institutional investors—pension funds, insurance companies, and central banks—that the value of existing, higher-coupon MBS is likely to increase, boosting demand.

Increased demand in the MBS market is critical because it lowers the effective yield lenders must offer to attract capital, which is the mechanism that translates into lower consumer mortgage rates. The market had been suppressed due to the risk of prepayment (borrowers refinancing early) when rates were volatile. With rates potentially stabilizing at lower levels, investor confidence in the duration and cash flow of MBS improves.

The impact of Quantitative Tightening (QT) cessation

Beyond the federal funds rate, the Fed’s balance sheet policy—specifically the pace of Quantitative Tightening (QT)—also affects the MBS market. QT involves the Fed allowing its holdings of Treasury bonds and MBS to mature without reinvestment, drawing liquidity out of the market. While the December decision focuses on rates, the commentary regarding the future pace of QT is equally important. If the Fed signals an early end to QT, or a reduction in the runoff cap, it effectively reduces the supply of MBS that the market must absorb, thereby supporting MBS prices and helping to lower mortgage rates further.

Analysts at PIMCO suggest that the cessation of QT could shave an additional 10-15 bp off the 30-year fixed mortgage rate, independent of the federal funds rate decision. This combination of an explicit rate cut and a policy adjustment on the balance sheet provides a powerful dual mechanism for easing financial conditions in the housing sector.

Investor sentiment is shifting from risk-off to cautious optimism. The December rate cut validates the market’s expectation of a soft landing, making long-duration assets like MBS more appealing. This renewed interest from large institutional buyers is essential for sustaining lower mortgage rates throughout the next year.

Regional variations and housing market heterogeneity

It is crucial to recognize that the impact of the Federal Reserve’s rate cut will not be uniform across the United States. Housing markets exhibit significant heterogeneity based on local supply dynamics, job growth, and state regulations. High-cost markets, such as those in California (San Francisco, Los Angeles) and the Northeast (Boston, New York), where median home prices exceed $800,000, are highly sensitive to even marginal changes in mortgage rates because the absolute dollar savings are larger.

Conversely, in lower-cost markets in the Midwest or South, where the median home price is closer to $300,000, the benefit of a 25 bp rate drop may be less impactful on monthly cash flow, and the market response might be dominated by local inventory levels and migration patterns. For instance, markets experiencing high inward migration, like Austin, Texas, or Raleigh, North Carolina, may see the rate relief quickly absorbed by continued price appreciation due to unrelenting demand.

The luxury and entry-level segment divide

The rate cut is likely to stimulate different segments of the market at varying speeds. The entry-level segment, dominated by first-time buyers relying on maximum leverage, will see immediate benefit in terms of qualification and affordability. This is the segment most likely to see increased bidding wars if inventory does not expand quickly.

The luxury segment, often less reliant on conventional financing and sometimes involving cash transactions or jumbo loans, is less sensitive to small rate fluctuations. However, lower overall rates can free up capital for wealthy buyers by reducing the opportunity cost of borrowing versus holding cash, potentially boosting high-end sales volume. The jumbo loan market, which historically has higher liquidity costs, will also benefit from improved MBS market conditions, potentially narrowing the spread between jumbo and conforming loan rates.

Data from Redfin shows that during the last major rate decline period, markets with the highest median incomes saw the fastest subsequent increase in sales volume, indicating that purchasing power, even with lower rates, remains a defining factor in recovery.

Therefore, while the federal monetary policy sets the national backdrop, local economic conditions, particularly inventory levels and income demographics, will ultimately dictate the realized benefit of the December rate cut on localized mortgage and housing market activity.

Strategic considerations for potential borrowers and homeowners

For individuals planning to buy a home or refinance an existing mortgage, the Federal Reserve’s December action provides a critical signal for timing and strategy. Prospective buyers should monitor not only the published 30-year fixed rate average but also the spread between the rate and the 10-year Treasury yield, looking for normalization toward the historical 170 bp average as a sign of improved lender conditions.

For those considering a purchase, waiting for rates to fall further may be tempting, but this strategy carries the risk that increased demand, driven by lower rates, will push up housing prices, potentially offsetting interest rate savings. Financial advisors at Vanguard suggest that locking in a rate upon finding a suitable property, rather than trying to time the absolute bottom of the rate cycle, is generally the most prudent approach.

Refinancing strategies and breakeven analysis

Existing homeowners with high mortgage rates (e.g., above 7.0%) should prepare for refinancing opportunities. The key is performing a detailed breakeven analysis, comparing the monthly savings from a lower interest rate against the closing costs associated with the refinance. If the breakeven period—the time required for savings to recoup closing costs—is shorter than the anticipated remaining time in the home, refinancing is generally advisable.

- Rate Lock Strategy: Be prepared to secure a rate lock immediately following subsequent positive economic data releases (e.g., lower CPI prints) that reinforce the Fed’s dovish pivot.

- Cash-Out Refinancing: Lower rates make cash-out refinancing more attractive for accessing home equity, but borrowers must be mindful of maintaining a conservative loan-to-value (LTV) ratio, ideally below 80%.

- Lender Shopping: Analysts stress that rates can vary by as much as 50 bp between different lending institutions; aggressive shopping for the best rate remains paramount.

- Debt Consolidation: Utilize the lower HELOC rates to consolidate high-interest consumer debt, such as credit card balances, which typically carry APRs far exceeding the prime rate.

The December rate cut marks a shift from a defensive strategy to an opportunistic one. Borrowers should use the ensuing stability to solidify their financial plans, leveraging the anticipated drop in long-term rates to either enter the housing market or optimize their current debt structure.

Risks and caveats to the optimistic outlook

While the market is pricing in a favorable outcome, several risks could undermine the anticipated positive effect of the December rate cut on mortgage rates. The primary risk is persistent inflation. If core Consumer Price Index (CPI) data remains sticky above 3.5% in the months following the cut, the Federal Reserve might be forced to reverse course or pause the easing cycle sooner than anticipated. Such a scenario would lead to a sharp sell-off in the Treasury market, causing long-term mortgage rates to spike, potentially negating any December gains.

Furthermore, global economic instability presents a caveat. Unexpected geopolitical events or a significant downturn in major trading partners could trigger a flight to safety, ironically driving down Treasury yields but simultaneously widening the risk premium demanded by MBS investors, leading to stable or even slightly higher mortgage rates despite the Fed’s action. The housing market is also susceptible to unexpected shifts in unemployment; a sharp rise in joblessness would dampen housing demand, regardless of interest rates.

The velocity of housing price response

A critical risk for homebuyers is that lower rates catalyze demand faster than expected, leading to renewed acceleration in home price appreciation. If prices rise by 5% or more annually, the benefit of a 50 bp rate reduction is effectively nullified in terms of overall debt burden and affordability. This phenomenon, where rate relief fuels price inflation, has historically been observed in supply-constrained metropolitan areas.

According to the latest economic projections from the Congressional Budget Office (CBO), the US economy is expected to slow but avoid a deep recession. This ‘soft landing’ scenario is what allows the Fed to cut rates. Any deviation from this path—either a surprisingly resilient economy forcing the Fed to hike again, or a sudden, severe recession—would introduce significant volatility into the mortgage market, rendering current forecasts unreliable. Market participants must maintain appropriate epistemic humility; the December rate cut is a directional signal, not a guaranteed outcome for sustained low rates.

The overall risk profile suggests that while the trajectory is downward, the path to sustained lower mortgage rates remains highly sensitive to incoming inflation data and the Fed’s commitment to its projected easing schedule.

| Key Factor/Metric | Market Implication/Analysis |

|---|---|

| Federal Funds Rate Cut (25 bp) | Directly lowers short-term rates (HELOCs, ARMs). Indirectly influences 30-year fixed rates by signaling future easing path. |

| 10-Year Treasury Yield | Primary determinant for 30-year mortgage rates. Anticipated decline of 10-15 bp, assuming market consensus. |

| Mortgage-Treasury Spread | Increased stability post-cut could narrow the spread, offering additional rate relief (potential 30-50 bp tightening). |

| Housing Affordability | Modest rate relief improves qualifying ratios, potentially boosting existing home sales volume by 3-5% in Q1 2025. |

Frequently Asked Questions about the Fed Rate Cut and Mortgage Rates

Not directly or immediately, as 30-year fixed rates track the 10-year Treasury yield, which responds to market expectations. The rate cut reinforces the trend of lower yields, but the effect is indirect and often partially priced in before the announcement, typically resulting in a gradual decline over several weeks.

Economists project that if the December cut is the start of a sustained easing cycle, 30-year fixed rates could potentially decrease by 50 to 80 basis points from their current peak levels by the third quarter of 2025, provided inflation successfully moderates toward the 2% target.

Waiting for a specific rate risks being counterproductive. If rates drop significantly, increased buyer demand will likely accelerate home price appreciation, potentially negating savings. Financial prudence suggests buying when you are financially ready and can afford the payment, regardless of predicting the exact rate bottom.

Yes, ARMs are more directly and immediately affected. Since ARMs are often indexed to short-term rates like SOFR or the prime rate, a 25 basis point cut in the federal funds rate translates almost instantly into a 25 basis point reduction in the index component of the ARM, offering faster relief.

The main risk is persistent core inflation. If inflation data following the December cut proves to be unexpectedly strong, the Fed may halt the easing cycle. This would cause bond yields to rise, leading institutional investors to demand a higher risk premium, thus pushing 30-year fixed mortgage rates back up.

The bottom line

The Federal Reserve’s anticipated December rate cut is more than a technical adjustment; it represents a pivotal transition in US monetary policy, moving from aggressive inflation containment to strategic economic normalization. While the direct effect on the 30-year fixed mortgage rate is mediated through the 10-year Treasury yield, the psychological and directional signal is potent. Borrowers with variable-rate debt will see immediate, tangible benefits, while prospective homebuyers should anticipate a gradual but sustained easing of long-term rates throughout 2025, assuming inflation continues its downward trajectory toward the 2% target.

The true impact hinges on sustained evidence of core disinflation and the Fed’s forward guidance regarding future cuts. Market participants should monitor the spread between the 30-year mortgage rate and the 10-year Treasury, as its normalization will be the clearest indicator of improving liquidity and reduced risk premiums in the housing finance system. While the path ahead is subject to geopolitical and inflation risks, the December action initiates a necessary shift that will ultimately improve housing affordability and stimulate transaction volume, albeit potentially at the expense of renewed, modest price appreciation in key metropolitan areas.