Inflation at 3%: Impact on Home Purchase Budgets and Mortgage Strategy

The persistent 3% inflation rate is not merely a headline; it is a structural headwind significantly eroding the purchasing power allocated for housing, mandating strategic shifts in mortgage planning and budget allocation for prospective homeowners in the US.

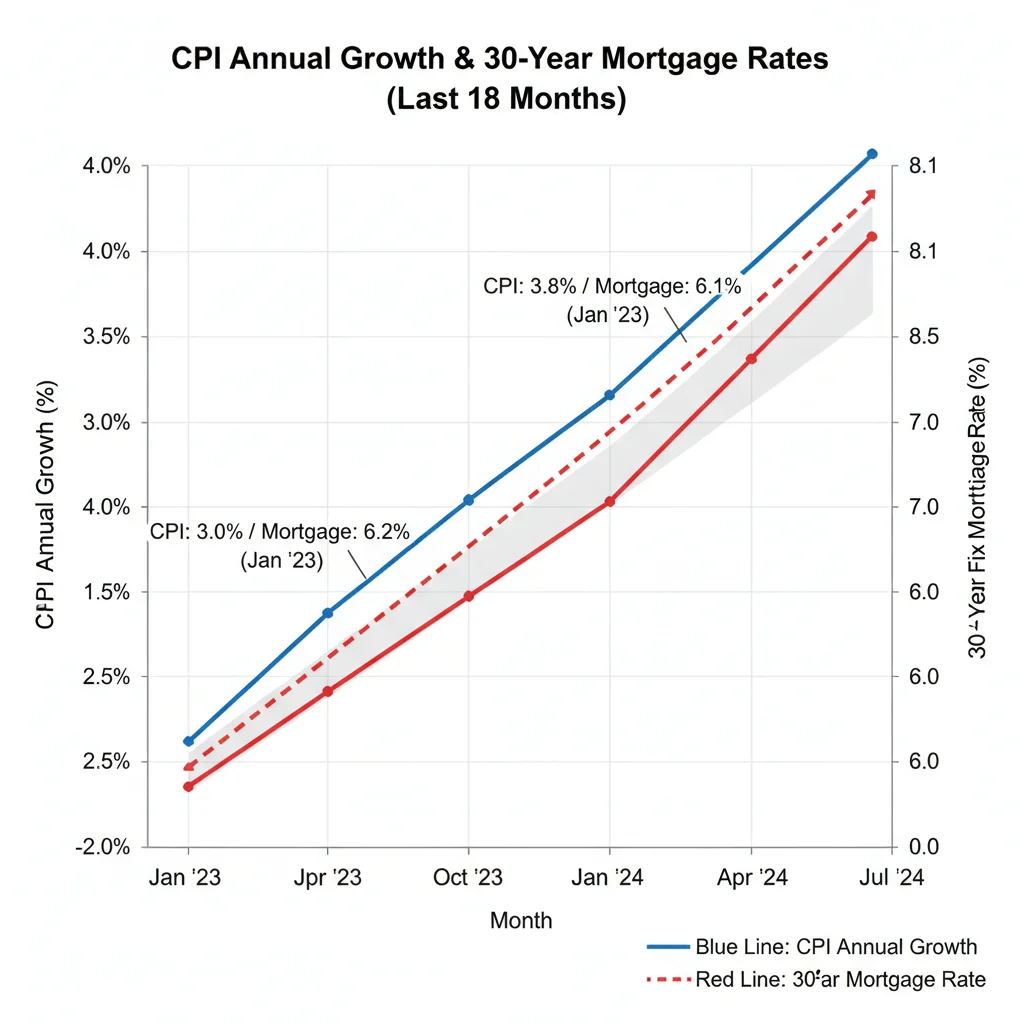

When the annual inflation rate hovers persistently around 3%, as measured by the Consumer Price Index (CPI), the impact extends far beyond the grocery aisle; it fundamentally reshapes the calculus for potential homeowners. The core issue of 3% inflation home purchase budgets is the simultaneous erosion of savings and the upward pressure on borrowing costs, creating a dual challenge for affordability that demands immediate strategic attention from buyers.

The mechanics of inflation and housing affordability

Inflation, even at a moderate 3% level, acts as a compounding factor in the housing market, influencing both the cost of acquiring property and the long-term expense of maintaining it. This environment forces central banks, like the Federal Reserve, to maintain a restrictive monetary policy stance, which directly translates into higher mortgage interest rates. Historically, periods of sustained inflation necessitate higher nominal returns on debt instruments, making the 30-year fixed mortgage a more expensive proposition for the buyer.

The ‘so what’ for prospective homeowners is that a 3% inflationary environment means that a $500,000 home today will effectively cost $515,000 next year in nominal terms, just to keep pace with general price increases, ignoring localized real estate appreciation. Furthermore, the Federal Reserve’s mandate to stabilize prices means that the higher the inflation, the less likely they are to cut the federal funds rate, keeping the floor high for everything from adjustable-rate mortgages to home equity lines of credit (HELOCs). This phenomenon creates a significant hurdle, as household incomes often lag behind the cumulative effect of rising housing prices, construction costs, and elevated borrowing rates.

Inflation’s dual impact on mortgage rates and home prices

The primary mechanism through which inflation affects affordability is via interest rates. The nominal interest rate on a mortgage is composed of the real rate plus an inflation premium. When inflation expectations rise to 3% or higher, lenders demand a greater premium to protect the real value of their future cash flows. This is reflected in the yield on the 10-year Treasury note, which serves as a benchmark for 30-year fixed mortgage rates.

- Increased Debt Service Burden: Higher rates mean a larger portion of the monthly payment goes toward interest, reducing the principal paid down, especially in the early years of the loan.

- Price Rigidity: Unlike many goods, housing prices in high-demand US markets exhibit downward rigidity; they rarely fall substantially, even under pressure from high rates, because inventory remains structurally low in many metropolitan areas.

- Erosion of Down Payment Savings: If a buyer is saving for a 20% down payment, and their savings earn 1% while housing prices and general inflation rise at 3%, their real purchasing power diminishes annually, extending the time needed to save.

Analysts at major institutions like Goldman Sachs noted in their Q3 2024 outlook that continued sticky inflation above the Fed’s 2% target translates to an average 30-year fixed mortgage rate staying above 6.5%, significantly reducing the maximum loan amount a buyer can qualify for while maintaining the same debt-to-income ratio (DTI). This rate environment demands that buyers either accept a smaller, less expensive home or allocate a far larger share of their pre-tax income to housing expenses.

Construction costs and the new home market supply shock

The 3% inflationary environment disproportionately impacts the supply side of the housing market, specifically new construction. While existing home prices are influenced by interest rates and local demand, new home prices are directly affected by the rising cost of raw materials, labor, and regulatory compliance, all of which inflate at or above the headline CPI rate. This cost escalation creates a supply shock, making it economically unfeasible for builders to deliver entry-level housing at prices that align with current affordability metrics.

Data from the National Association of Home Builders (NAHB) indicates that material costs, including lumber, concrete, and steel, have seen volatility but maintain elevated levels relative to pre-pandemic benchmarks. For example, the cost of drywall and insulation, critical components of residential construction, has risen approximately 4% year-over-year, outpacing the general 3% CPI. This inflation is compounded by labor shortages in skilled trades, where wage inflation often runs 4% to 5% annually, according to Bureau of Labor Statistics (BLS) data for the construction sector.

The margin squeeze for developers

Developers face a critical margin squeeze. They must pass these higher costs onto the consumer, resulting in higher list prices for newly constructed homes. If they cannot pass the costs on due to buyer resistance caused by high mortgage rates, they slow down production, which exacerbates the inventory shortage and puts upward pressure on existing home prices. This cycle demonstrates how sticky inflation creates a self-reinforcing loop of unaffordability.

- Material Cost Volatility: Unpredictable costs for commodities like copper and steel force builders to incorporate higher risk premiums into their planning, increasing the final sale price.

- Regulatory Compliance Costs: Increasing local and federal building codes, often related to energy efficiency, add fixed costs that inflate alongside general prices, further limiting the feasibility of low-cost housing.

- Delayed Projects: Inflationary pressure on financing costs (construction loans) can delay projects, reducing the immediate supply of new homes entering the market, a critical factor for price stability.

In Q2 2024, the median price of a newly constructed home in the US stood significantly higher than the median existing home price, a gap partially attributed to the compounding effect of 3%-plus inflation on construction inputs. Buyers entering the market must budget not only for the high purchase price but also for potential overruns if the home is under construction, a risk factor magnified by persistent inflation.

Strategic budgeting: recalibrating the buyer’s financial capacity

For buyers navigating an environment where 3% inflation home purchase costs are the baseline, the traditional 28%/36% DTI rule (Debt-to-Income) becomes exceptionally tight. Financial modeling must incorporate higher rates and future cost projections. A $500,000 mortgage at 4% results in a principal and interest payment of approximately $2,387; at 7%, that payment jumps to $3,326, an increase of nearly $1,000 per month, drastically reducing the loan amount a fixed income can support. This difference represents a significant reduction in eligible home price.

The primary strategy shift involves prioritizing the down payment and reducing pre-existing consumer debt. Every dollar used to increase the down payment reduces the principal subject to the high inflationary-era interest rate. Furthermore, lenders view lower DTI ratios more favorably, potentially leading to better interest rate offers, even in a restrictive rate environment.

Optimizing the down payment and debt profile

Instead of aiming for the standard 20%, buyers should assess whether a larger down payment (e.g., 25% or 30%) is feasible. While this requires more upfront capital, the long-term savings on interest, especially when prevailing mortgage rates are above 6.5%, can be substantial. For a $400,000 home, increasing the down payment from $80,000 (20%) to $120,000 (30%) can save tens of thousands in interest over the life of the loan.

- Aggressive Debt Reduction: Pay off high-interest consumer debt (credit cards, auto loans) before applying for a mortgage to lower the DTI ratio and improve credit scores, maximizing rate eligibility.

- Explore Localized Grants: Investigate state and municipal first-time homebuyer programs or grants that can supplement the down payment or cover closing costs, effectively increasing net purchasing power.

- Stress-Test the Budget: Financial advisors recommend stress-testing the monthly housing payment (PITI: Principal, Interest, Taxes, Insurance) at 10% above the current projected rate to ensure resilience against unexpected financial shocks or future rate increases on ARMs.

The analytical consensus from firms like Moody’s Analytics suggests that housing affordability, measured by the ratio of median home price to median household income, has reached its lowest point in decades, primarily due to the combined forces of high home prices and elevated interest rates driven by persistent inflation. Buyers must approach their budgets with exceptional scrutiny and conservative projections.

The impact on property taxes and insurance premiums

Beyond the principal and interest portion of the mortgage payment, the secondary components—property taxes and homeowner’s insurance—are also directly affected by the 3% inflation rate, often inflating even faster. Property taxes are typically based on the assessed value of the home, which tends to rise in tandem with market inflation and appreciation. Insurance premiums, meanwhile, are tied to the replacement cost of the structure, which is intrinsically linked to inflationary pressures on construction materials and labor.

In many US counties, property reassessments occur every few years, leading to sudden, significant jumps in tax liability. If the local housing market is appreciating rapidly alongside 3% general inflation, the effective tax increase can be substantial. For a buyer calculating their DTI, underestimating the growth rate of taxes and insurance can lead to payment shock within the first few years of ownership, especially when escrow accounts need adjustment.

Insurance costs driven by replacement value

Homeowner’s insurance premiums have risen sharply across the US, driven by increased catastrophic weather events and, crucially, the elevated replacement cost of homes. Since construction materials and labor are inflating at 3% or more, insurers must raise coverage limits and premiums to ensure they can cover the full cost of rebuilding in the event of a total loss. This is a non-negotiable cost that escalates with inflation.

Economists at the Federal Reserve Bank of St. Louis have highlighted that shelter costs, which include rent and owner’s equivalent rent (OER), constitute a significant portion of the CPI basket and tend to be stickier than other inflation components. This stickiness guarantees that housing-related expenses—including taxes and insurance, which are often correlated with OER—will continue to rise, requiring buyers to factor in an annual 3% to 5% increase in their PITI payment components outside of the fixed principal and interest.

- Escrow Account Management: Buyers should budget for potential escrow shortages, which can occur when taxes and insurance rise faster than anticipated, leading to lump-sum demands or significant monthly payment increases.

- Comparative Insurance Shopping: Given the volatility, obtaining multiple quotes for homeowner’s insurance is more critical than ever to mitigate the inflationary impact on premium costs.

- Tax Appeal Consideration: Understanding local tax assessment procedures can provide options for appealing property valuations if they appear disproportionately high compared to comparable sales, offering a rare opportunity to curb an inflation-driven expense.

Neglecting the inflation-driven increase in these non-interest components is a common budgeting error that can swiftly transform an affordable mortgage payment into a burdensome one. A conservative budget must explicitly forecast these auxiliary housing costs.

Adjustable-rate mortgages (ARMs) versus fixed-rate options in an inflationary period

The high interest rate environment fueled by 3% inflation has renewed interest in adjustable-rate mortgages (ARMs), particularly those with initial fixed periods (e.g., 5/1 or 7/1 ARMs). These products typically offer a lower introductory rate than the standard 30-year fixed mortgage, providing immediate relief to a constrained budget. However, ARMs introduce significant interest rate risk, which is amplified during periods of persistent inflation and monetary policy uncertainty.

The appeal of the ARM is the lower initial payment, which allows buyers to qualify for a larger loan or reduce their immediate monthly outlay. However, the Federal Reserve’s reaction function to 3% inflation is critical. If inflation remains elevated, the Fed is unlikely to cut rates by the time the ARM adjusts, potentially leading to a sharp payment increase (a ‘payment shock’) when the fixed period expires. This risk is precisely why financial analysts urge extreme caution.

Analyzing the risk-reward tradeoff

Market participants who choose an ARM are essentially betting that interest rates will be significantly lower when the adjustment period arrives, typically five or seven years later. If the 3% inflation proves sticky, or even accelerates, the Fed may be forced to hike rates further, or at least keep them elevated, making the adjustment catastrophic for the unprepared borrower.

For high-net-worth individuals who anticipate selling or refinancing before the adjustment period, an ARM might be a calculated risk. For first-time homebuyers with thin financial cushions, the fixed-rate mortgage, despite its higher initial cost, offers crucial protection against the unpredictable nature of inflation and monetary policy cycles. The certainty of the payment shields the household budget from external economic shocks.

- Fixed-Rate Security: Provides immunity from future interest rate hikes, offering predictable long-term housing costs regardless of future inflation spikes.

- ARM Payment Shock: The risk of dramatically higher payments after the initial fixed period, a risk magnified by the current 3% inflationary outlook and the resulting restrictive Fed stance.

- Refinancing Strategy: Choosing an ARM requires a clearly defined refinancing or exit strategy contingent on interest rate movements, a strategy that is inherently difficult to execute successfully in a volatile market.

The decision between fixed and adjustable rates is a trade-off between immediate affordability and long-term financial stability. In an inflationary climate where the cost of money remains high, the premium paid for the certainty of a fixed rate is often justified as an essential hedge against macroeconomic volatility.

The role of income growth versus housing cost inflation

A critical, often overlooked, dimension of the 3% inflation home purchase challenge is the relative pace of wage growth. While 3% inflation increases the nominal cost of housing, if household incomes are rising at 5% or 6%, real affordability improves. However, BLS data suggests that while nominal wages have grown, real average hourly earnings have often struggled to keep pace with the cumulative inflation experienced since 2021, especially when factoring in the disproportionate increase in shelter and energy costs.

For many professionals, job security and steady, inflation-beating wage growth are essential prerequisites for safely entering the current housing market. Without a strong expectation of real income gains, locking into a high-rate mortgage in an inflationary environment means that the mortgage payment consumes an ever-larger share of real disposable income over time, even if the nominal payment remains fixed.

Sectoral wage disparities and housing access

The impact of inflation on housing access is unevenly distributed across the labor market. Sectors experiencing robust productivity gains and high demand (e.g., technology, specialized healthcare) may see wage growth that outpaces the 3% inflation rate. Workers in more stagnant or non-unionized sectors, however, often see their real earnings erode, pushing homeownership further out of reach.

Analysis by financial services firms indicates that the income threshold required to afford a median-priced home in major US metropolitan areas has increased by over 40% since 2020. This spike is attributable not just to price appreciation but also to the higher debt service cost associated with elevated interest rates, which are a direct consequence of the Fed’s fight against inflation.

- Real Income Erosion: Calculate the growth of net income relative to the combined growth of mortgage payments, property taxes, and insurance to assess true long-term affordability.

- Career Trajectory Planning: Buyers should align their home purchase budget with a realistic projection of future income growth, not just current earnings, especially if they are early in their careers.

- Geographic Arbitrage: Some buyers are forced to consider moving to lower-cost-of-living areas where local wages, combined with lower housing prices, can offset the national pressure from 3% inflation and high interest rates.

Ultimately, sustained income growth that exceeds the 3% inflation rate is the single most powerful tool a buyer possesses for maintaining or improving housing affordability in the current economic climate. Without it, the financial strain of high housing costs becomes a long-term burden.

Forecasting future monetary policy and the housing outlook

The trajectory of the housing market over the next 12 to 24 months remains intrinsically linked to the Federal Reserve’s success in bringing inflation sustainably down to its 2% target. As long as inflation remains near 3%, the market consensus suggests that significant interest rate cuts are unlikely. This expectation dictates a continuation of tight financial conditions, keeping upward pressure on mortgage rates and challenging buyer budgets.

Should the Fed achieve a ‘soft landing’—reducing inflation without triggering a severe recession—mortgage rates might gradually decline by 50 to 100 basis points. However, if inflation proves stickier (e.g., returning to 4%), the Fed might be forced to consider more aggressive action, potentially leading to a temporary spike in unemployment and a severe economic slowdown, which, while putting downward pressure on home prices, introduces significant job market risk for homeowners.

Expert perspectives on rate movements

Economists at Bank of America project that the 30-year fixed mortgage rate will likely remain in the 6.0% to 7.0% range throughout 2025, reflecting persistent core inflation and the Fed’s caution. They argue that structural factors, such as tight labor markets and geopolitical risks, will prevent a rapid return to the ultra-low rates seen pre-2022. This scenario means buyers should not rely on a near-term dramatic drop in rates to make their purchase affordable.

Conversely, some analysts, particularly those focused on the long end of the yield curve, suggest that if the economy slows faster than expected, the flight to safety could push Treasury yields down, offering temporary relief to mortgage rates. However, this relief would come at the cost of broader economic weakness, which is detrimental to the overall financial health of a prospective buyer.

- Monitoring Core CPI: Buyers should track core inflation metrics (excluding volatile food and energy) closely, as these are the primary drivers of the Fed’s long-term policy decisions regarding interest rates.

- Rate Lock Strategy: In a volatile rate environment, securing a rate lock that allows for a ‘float down’ option (if rates drop before closing) provides protection against sudden hikes while offering flexibility if the market improves slightly.

- Economic Indicators: Pay attention to leading indicators like unemployment claims and manufacturing indices, as these signal the broader health of the economy and the likely path of future monetary policy.

The key takeaway for buyers is that the current 3% inflation rate has effectively shifted the goalposts: affordability must be calculated based on today’s elevated rates, with any future rate decreases viewed as a bonus rather than an expectation. This conservative planning approach is essential for long-term financial security in the face of ongoing economic uncertainty.

| Key Financial Factor | Market Implication/Analysis |

|---|---|

| 3% Core Inflation Rate | Supports Federal Reserve’s restrictive monetary policy, keeping 30-year fixed mortgage rates elevated (likely above 6.5%). |

| Rising Construction Costs | Inflation in materials and labor (often >3% YoY) increases new home prices, exacerbating the supply shortage in entry-level housing. |

| Eroding Purchasing Power | Savings for down payments are devalued by inflation, while higher interest rates reduce the maximum loan amount a buyer can qualify for. |

| Property Tax/Insurance Inflation | PITI components increase faster than general inflation due to rising replacement costs and assessed home values, straining long-term budgets. |

Frequently Asked Questions about Inflation and Housing Budgets

Persistent 3% inflation pushes mortgage rates higher, reducing the principal amount lenders are willing to extend while maintaining your optimal Debt-to-Income (DTI) ratio. For every 100 basis point rate increase, your purchasing power can shrink by 8% to 10% on the same monthly payment.

Waiting is a risk. While rates might fall, home prices continue to appreciate, potentially offsetting any rate savings. Analysts suggest buying when financially ready and planning to refinance if rates decline, rather than timing the unpredictable market.

ARMs offer initial savings but carry high risk. If 3% inflation persists, the Federal Reserve will keep rates high, leading to significant payment shock when the ARM adjusts. Only consider an ARM with a clear, short-term exit strategy.

The most crucial adjustment is forecasting higher PITI components. Budget for property taxes and insurance premiums to increase annually by 4% to 5%, significantly outpacing the general 3% inflation due to rising replacement costs and valuation increases.

To combat inflation erosion, maximize savings in high-yield savings accounts or short-term Treasury bills that offer returns closer to the 3% inflation rate, ensuring your down payment maintains its real purchasing power until closing.

The bottom line: navigating constrained affordability

The sustained presence of 3% inflation has fundamentally altered the economics of homeownership, shifting the market from a focus on price appreciation to one dominated by interest rate sensitivity and cost management. This environment requires a disciplined, data-driven approach, where every aspect of the purchase—from the size of the down payment to the selection of the mortgage instrument—must be stress-tested against the reality of elevated borrowing costs and rising auxiliary expenses. Buyers must accept that the era of historically low rates is over, and consequently, a greater percentage of household income must be allocated to housing debt service. The current climate rewards prudence, aggressive debt minimization, and a conservative financial outlook, ensuring that the dream of homeownership remains financially sustainable, even as costs continue their upward trajectory.