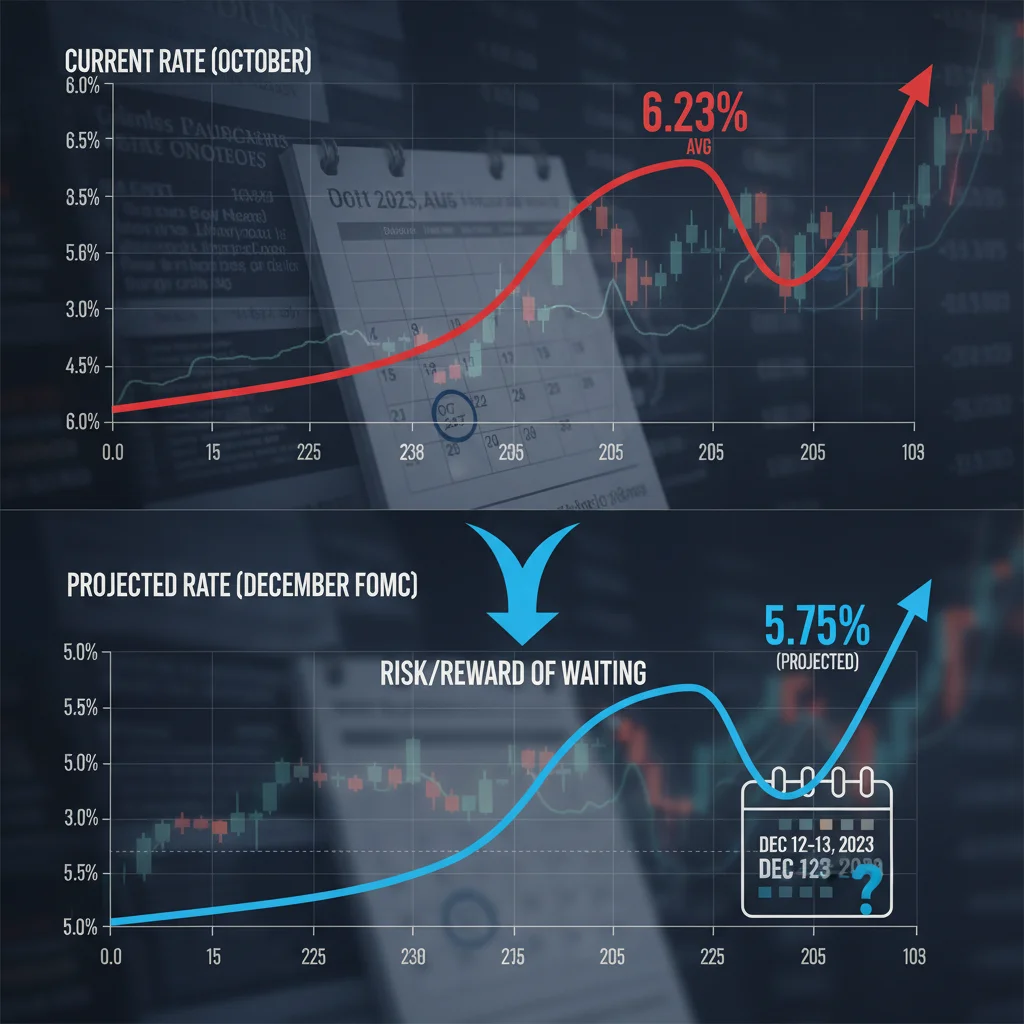

Mortgage Rates at 6.23%: Lock In Now or Wait for December?

The current environment of 6.23% fixed-rate mortgages requires borrowers to weigh the certainty of today’s payment against the high probability of short-term volatility driven by upcoming CPI reports and the Federal Reserve’s December meeting.

The core question facing prospective homebuyers and refinancing candidates in the fourth quarter of 2024 is whether to secure a loan at the prevailing rate, currently averaging near 6.23% for a 30-year fixed mortgage, or to speculate on market movements over the next 60 days. The decision to commit to mortgage rates lock in now or delay until after the critical December Federal Open Market Committee (FOMC) meeting involves a complex risk assessment, balancing personal financial stability against macroeconomic forecasts, particularly the trajectory of inflation and the Federal Reserve’s commitment to its dual mandate.

The macroeconomic drivers of 6.23% mortgage rates

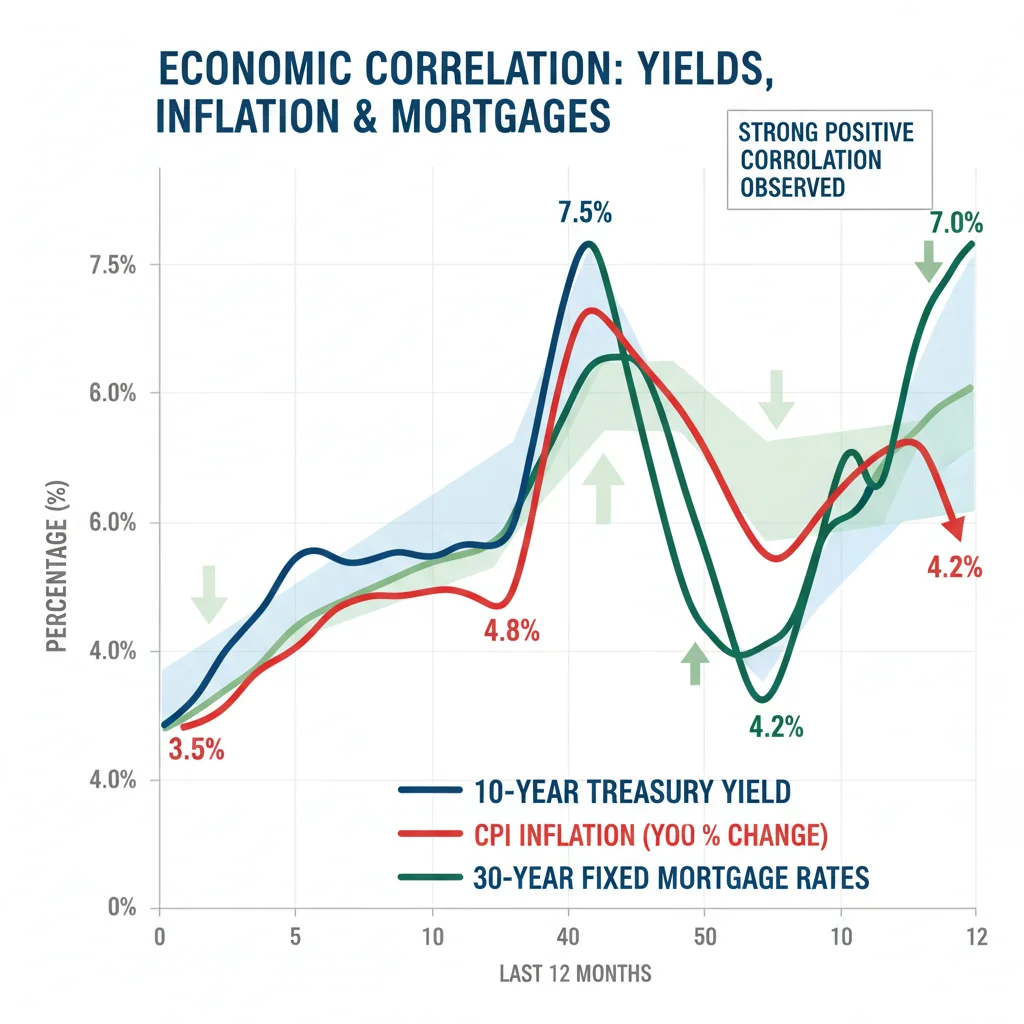

To understand the 6.23% figure, one must first analyze the fundamental mechanism linking monetary policy and the housing market. Mortgage rates are primarily driven by the yields on the 10-year Treasury note, which serves as the benchmark for long-term lending. When the 10-year yield rises, often in anticipation of higher inflation or increased government borrowing, mortgage rates typically follow suit. The current rate reflects not only the Federal Reserve’s elevated Federal Funds Target Rate (which influences short-term borrowing costs) but also market expectations regarding the future path of inflation and economic growth.

The persistence of core inflation, particularly in the services sector, maintains upward pressure on long-term yields. Data released in October showed the Consumer Price Index (CPI) rising 3.7% year-over-year, slightly above consensus forecasts, reinforcing the market’s belief that the Fed will maintain a ‘higher for longer’ stance. This expectation is the primary anchor holding mortgage rates above the 6% threshold. Furthermore, robust employment figures, with the economy adding an average of 200,000 jobs per month in Q3, suggest economic resilience that reduces the urgency for the Fed to implement rate cuts prematurely. The 6.23% rate is, therefore, a reflection of a resilient, yet still inflationary, economic environment.

The 10-Year Treasury yield correlation

Historical analysis demonstrates a near-perfect correlation between the 10-year Treasury yield and 30-year fixed mortgage rates, typically maintaining a spread of 150 to 200 basis points. As of early November, with the 10-year yield oscillating between 4.4% and 4.7%, a 6.23% mortgage rate falls squarely within this historical band. Any significant move in the Treasury market—whether driven by geopolitical events, shifts in oil prices, or changes in the supply-demand dynamics of Treasury auctions—will directly impact the cost of borrowing for housing.

- Inflation Risk: If upcoming CPI data for November (released mid-December) shows an unexpected acceleration, the 10-year yield could push toward 5.0%, potentially driving mortgage rates closer to 6.5%.

- Economic Slowdown: Conversely, if leading indicators signal a sharp deceleration in economic activity, fixed-income investors might flock to Treasuries, lowering yields and providing a tailwind for mortgage rates.

- Fed Communication: The language used by Fed Chair Jerome Powell in the post-FOMC press conferences is crucial. Any hawkish signals—emphasizing the risk of cutting too soon—will reinforce higher rates, making the current 6.23% look relatively attractive.

The current 6.23% rate is effectively the market pricing in continued Fed vigilance against inflation, coupled with the inherent risk premium associated with long-term debt in an uncertain fiscal landscape. For borrowers, this means the opportunity cost of waiting is defined by the volatility of the 10-year note over the next six weeks, a period characterized by heightened sensitivity to economic data releases.

Analyzing the December FOMC meeting catalyst

The December FOMC meeting represents the most significant immediate catalyst for a change in rate outlook. While analysts overwhelmingly expect the Fed to hold the Federal Funds Target Rate steady at its current level, the focus will be squarely on the updated Summary of Economic Projections (SEP), specifically the ‘dot plot’ which outlines policymakers’ expectations for future rate cuts. The market is currently pricing in a high probability of the first rate cut occurring in the second quarter of the following year, but any shift in the December dot plot could drastically alter long-term yields and, consequently, mortgage rates.

If the Fed signals a more aggressive path toward easing in 2025 than previously indicated—perhaps due to softer employment or falling inflation expectations—this could trigger a preemptive rally in the bond market. Such a rally would lower the 10-year Treasury yield and provide immediate relief for mortgage rates. However, if the Fed maintains a restrictive posture, emphasizing that rates will remain high until inflation is sustainably at the 2% target, the current 6.23% rate could become the floor, not the ceiling, for the near-term. The decision to secure mortgage rates lock in now must incorporate this binary risk.

The implied volatility of waiting

Waiting until December introduces implied volatility. The period between now and the FOMC meeting includes two major data releases: the next CPI report and the Non-Farm Payrolls report. A strong job number combined with stubbornly high shelter inflation (a major component of CPI) could easily push the 30-year fixed rate up by 20 to 30 basis points, making the current 6.23% a lost opportunity. Conversely, a sharp deceleration in both metrics could offer a similar magnitude of decrease.

- Bull Case for Waiting: Requires significant negative economic surprises (e.g., Q4 GDP slowing below 1.0%, unemployment rising above 4.5%) that force the Fed to acknowledge a heightened risk of recession and signal earlier rate cuts.

- Bear Case for Waiting (Risk of Higher Rates): Driven by continued strong consumer spending (retail sales data), renewed geopolitical risk driving up energy prices, or a surprisingly hawkish December dot plot.

For a typical $400,000 mortgage, a 30 basis point increase (from 6.23% to 6.53%) translates to an additional $75 per month in payment, or over $27,000 over the life of the loan. This quantifiable risk is the cornerstone of the decision-making process. Financial institutions like JPMorgan and Goldman Sachs have published divergent forecasts for year-end mortgage rates, highlighting the genuine uncertainty in the market, with some projecting a dip below 6.0% and others warning of a temporary spike toward 6.75% before year-end.

The borrower profile and financial certainty

The optimal strategy—to lock in or wait—is highly dependent on the individual borrower’s financial profile, transaction timeline, and risk tolerance. For borrowers who are highly sensitive to monthly payment fluctuations, or those who need to close on a property within the next 45 days, locking in the current 6.23% rate provides crucial certainty. This certainty allows for precise budgeting and eliminates the risk of a market-driven spike that could jeopardize loan qualification.

Defining risk tolerance for homebuyers

The choice often boils down to whether the potential savings from a rate drop (the reward) outweigh the guaranteed cost increase from a rate hike (the risk). If a borrower has only a small buffer in their debt-to-income (DTI) ratio, a sudden rate increase could render them ineligible for the loan amount they need. Conversely, a borrower with a substantial down payment (over 20%) and a low DTI has greater flexibility and may be better positioned to absorb short-term rate volatility or utilize sophisticated products like rate-float-down options.

For those considering a refinance, the calculus is slightly different. Refinancers are typically less constrained by closing deadlines and can afford to monitor the market more patiently. However, they must also consider the cost of waiting in terms of pre-payment penalties on existing loans or the loss of equity gains if property values stagnate. The current 6.23% rate is still substantially lower than the peak rates observed earlier in the year (which briefly touched 7.5% in some markets), suggesting that for many, this rate represents a favorable entry point compared to recent history.

A key consideration for both buyers and refinancers is the cost of a rate lock extension. If a borrower locks in now and rates fall in December, they would typically need to pay a fee to extend the lock or potentially re-lock at the lower rate, often incurring additional charges. Conversely, many lenders offer float-down options, allowing the borrower to secure a rate while retaining the right to drop it once if market rates fall significantly before closing, albeit usually for an upfront fee.

The impact of housing supply and demand dynamics

While macroeconomic factors dictate the cost of money, local housing market dynamics influence the urgency of the lock-in decision. In competitive markets with limited inventory (a persistent issue in many metropolitan areas in the United States, according to the National Association of Realtors data), securing a pre-approval with a locked rate can be a critical negotiating tool. Sellers prefer certainty, and a locked mortgage rate demonstrates the buyer’s financial commitment and stability.

High rates like 6.23% typically dampen buyer demand, leading to less competition and potentially more favorable pricing negotiations. This phenomenon, known as the ‘affordability squeeze,’ means that while the cost of borrowing is high, the cost of the asset itself might be stabilizing or even declining in some overheated regions. Buyers must evaluate whether the potential rate drop in December, if it materializes, would be offset by renewed competitive bidding and higher home prices.

Inventory constraints and the lock-in decision

Data from the Census Bureau indicates that new housing starts remain constrained, particularly in the single-family segment, contributing to persistently low inventory levels. This scarcity means that even if rates fall in December, the immediate surge in demand could erase any savings by driving up home prices. This is the central trade-off for current buyers: accept the 6.23% borrowing cost now to capitalize on potentially softer home prices and less competitive bidding, or wait for lower rates but face a potentially more aggressive housing market.

- Market Stabilization: The current 6.23% rate has normalized the market after extreme volatility, leading to a more rational pricing environment for homes.

- Seller Concessions: Higher rates increase the likelihood of sellers offering concessions (rate buydowns, closing cost credits) to offset the high cost of financing, effectively lowering the true cost of the transaction.

- Rate Buydowns: Borrowers can use seller concessions to temporarily or permanently ‘buy down’ the 6.23% rate, often achieving an effective first-year rate in the mid-5% range, providing immediate payment relief while retaining the option to refinance later.

The strategic use of buydowns is a sophisticated alternative to speculating on future rate cuts. By accepting the 6.23% rate as the nominal figure but using credits to lower the effective rate, borrowers mitigate immediate payment shock and hedge against the possibility that rates remain elevated well into the next year.

Forecasting the path to December and beyond

The market’s expectation for the December rate environment is heavily influenced by the Fed’s dual mandate: maximizing employment and stabilizing prices. While employment remains robust, inflation remains sticky. The Fed needs compelling evidence that inflation is not just falling but is on a clear and sustainable path back to 2%. This evidence is unlikely to fully materialize before the December meeting, suggesting that any rate relief will likely stem from forward guidance rather than immediate action.

Analyst consensus on year-end rates

The consensus among fixed-income desks at major Wall Street firms is divided. Analysts at Bank of America project that 30-year fixed rates will average 6.1% to 6.3% through year-end, citing persistent fiscal deficits and strong Treasury supply as ongoing upward pressures on the 10-year yield. Conversely, economists at Morgan Stanley suggest that a softening labor market in Q4, coupled with decelerating shelter inflation, could push rates toward 5.8% by mid-December, creating a compelling argument for waiting.

However, the risk of a ‘false signal’ from the Fed is high. Policymakers have repeatedly emphasized that they are data-dependent, not time-dependent. If the economic data released in early December is mixed—for example, weak manufacturing data but strong retail sales—the market may react with uncertainty, leading to increased volatility rather than a clear downward trend in rates. This uncertainty favors the security of locking in the 6.23% rate now.

Furthermore, the structure of the yield curve, which remains inverted (short-term Treasury yields higher than long-term yields), continues to signal potential economic stress, yet it also keeps longer-term rates lower than they might otherwise be. The normalization of the yield curve, which typically precedes a period of economic recovery, could paradoxically lead to a temporary spike in mortgage rates as the long end adjusts upward. Therefore, the immediate benefit of waiting is predicated on continued yield curve inversion and softening economic data.

Strategies for mitigating rate risk

For borrowers determined to wait for December, or for those who need to close before year-end but fear missing a potential rate drop, several strategies can mitigate risk associated with mortgage rates lock in decisions.

Utilizing lock-and-shop and float-down options

The ‘lock-and-shop’ program allows borrowers to lock in a rate before finding a specific property, typically for 60 to 90 days. This provides protection against rate hikes while the buyer searches. If rates fall, the borrower may be able to utilize a float-down option, which contractually allows the lender to adjust the rate downward by a set amount (e.g., 12.5 basis points) if market rates improve significantly. While these options usually cost an additional fee (often 0.125% to 0.250% of the loan amount), they serve as a valuable insurance policy against adverse market movements.

- Extended Lock Periods: Consider paying for a 75-day or 90-day lock period instead of the standard 30-day lock. This bridges the gap to the December FOMC meeting and provides closure certainty.

- Adjustable-Rate Mortgages (ARMs): For buyers confident in refinancing within 5 to 7 years, a 7/1 or 10/1 ARM offers a significantly lower initial rate (often 50 to 100 basis points below the 6.23% fixed rate). This assumes that refinancing at a lower fixed rate will be feasible before the adjustment period begins.

- Points vs. Rate: Analyze the cost of buying down the 6.23% rate with mortgage points versus the implied savings of waiting. If a borrower plans to stay in the home for less than five years, paying points upfront may not reach the break-even point, making waiting or using a temporary buydown more financially prudent.

The decision to accept the 6.23% rate should be viewed through the lens of optionality. By locking in, the borrower is sacrificing the option to benefit from lower rates but gaining the priceless option of certainty and closing on time. By waiting, the borrower is paying for the option of lower rates with the potential penalty of a higher monthly payment if the market moves against them. Given the Fed’s continued commitment to inflation control, the risks of waiting appear to be marginally higher than the risks of locking in now, especially for time-sensitive transactions.

| Key Financial Metric | Market Implication/Analysis |

|---|---|

| Current Mortgage Rate (30-yr Fixed) | 6.23%. Reflects sticky core inflation and the 150-200 basis point spread above the 10-year Treasury yield. |

| December FOMC Meeting Focus | The ‘dot plot’ is key. A dovish shift signals lower 2025 rates, potentially dropping current mortgage rates; hawkish stance affirms 6.23% as the floor. |

| Inflation Data (CPI) Risk | An unexpected rise in November CPI could push 10-year yields higher, possibly increasing mortgage rates to 6.5%+ before the year-end. |

| Rate Lock Alternative | Float-down options and rate buydowns offer a hedge, securing the 6.23% rate while retaining the ability to benefit from minor declines, usually for a fee. |

Frequently Asked Questions about Mortgage Rates at 6.23%: Should You Lock In Now or Wait for December

Focus primarily on the November Consumer Price Index (CPI) report, due mid-December, and the Non-Farm Payrolls report. Stronger-than-expected inflation or job growth will likely push the 10-year Treasury yield higher, increasing mortgage rates above 6.23%. Weak data offers the best chance for a rate decrease.

Based on historical volatility surrounding key Fed meetings and data releases, 30-year fixed rates could move by 20 to 30 basis points in either direction. While a drop to 5.9% is possible with extremely favorable data, a spike toward 6.5% is equally plausible if inflation proves stickier than expected by the market.

Yes, but typically only if you purchased a ‘float-down’ option from your lender when you initially locked. This feature, which carries an upfront fee, allows you to re-lock at a lower rate (subject to a minimum decrease threshold) before closing, mitigating the risk of locking too early.

No, the Fed directly controls the Federal Funds Rate (short-term). The 30-year mortgage rate is indirectly influenced by the Fed through its impact on inflation expectations and the yield of the 10-year Treasury note. Mortgage rates generally track long-term Treasury yields, maintaining a spread of approximately 1.5% to 2.0%.

First-time homebuyers, who often operate with tighter budgets and higher DTI ratios, should generally prioritize locking in. The certainty of the 6.23% rate ensures loan qualification and predictable budgeting. The risk of a rate hike jeopardizing the entire transaction typically outweighs the potential savings from a modest December rate cut.

The Bottom Line

The current 6.23% mortgage rate stands at a critical juncture, reflecting a finely balanced market where inflation risk and potential economic deceleration are pulling yields in opposite directions. For borrowers with an imminent closing date or a low risk tolerance, the analytical conclusion favors securing the rate now. Locking in provides immediate financial certainty, hedges against potential inflation surprises in the November CPI data, and secures a position in a housing market that, while expensive, may offer better inventory and pricing leverage before a potential surge in demand following any December rate relief signals. Speculating on a meaningful rate drop below 6.0% before the year-end requires betting against the Federal Reserve’s stated commitment to maintaining tight financial conditions until inflation is definitively vanquished. While the possibility of a rate cut signal in December exists, the quantifiable risk of rates rising by 20-30 basis points outweighs the uncertain reward of a similar-sized drop. Borrowers should monitor the 10-year Treasury yield closely; sustained movement below 4.3% would be the only clear signal to hold off on locking in the current 6.23% rate.