December FOMC Meeting: 87% Probability of 25 Basis Point Rate Cut

The 87% probability assigned by futures markets to a 25 basis point reduction at the December FOMC Meeting indicates a near-consensus expectation that the Federal Reserve will initiate monetary policy easing in response to sustained disinflationary trends.

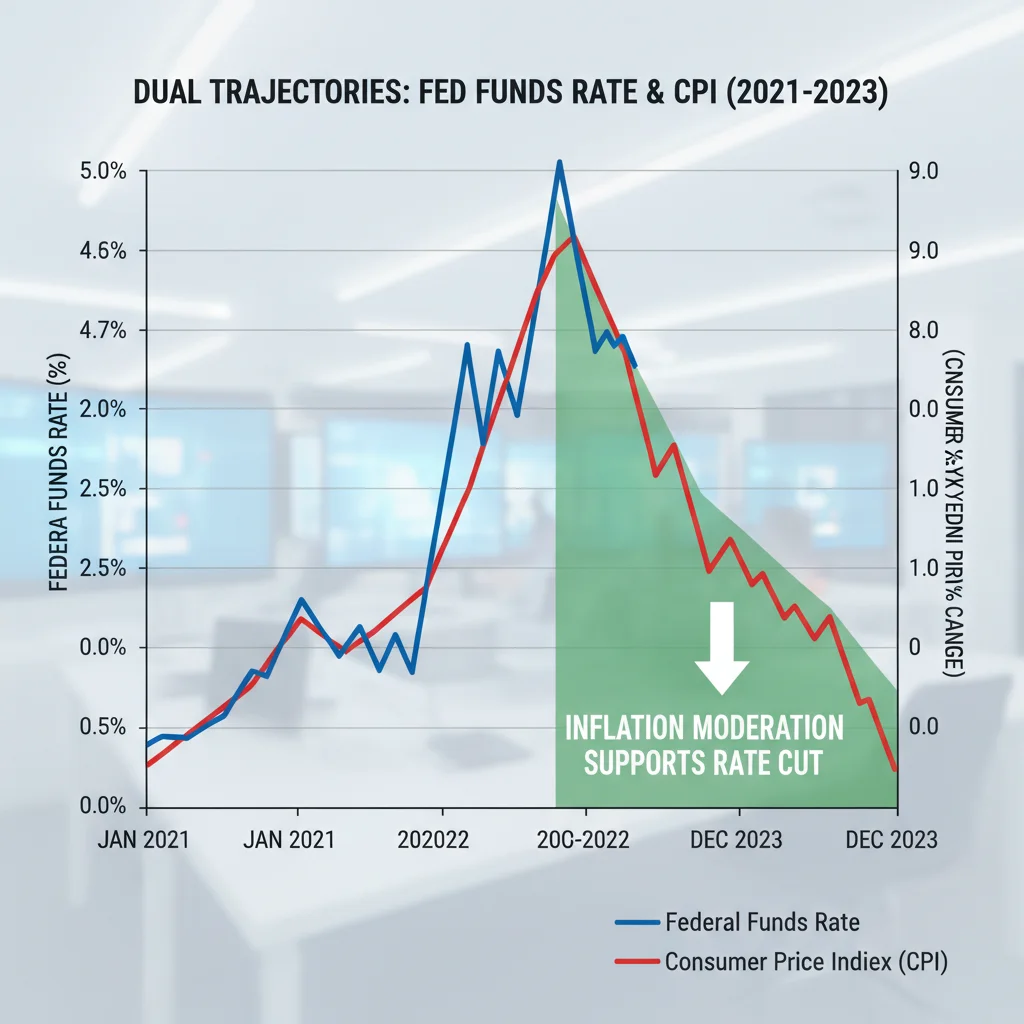

As financial markets approach the final Federal Open Market Committee (FOMC) meeting of the year, attention is laser-focused on the high likelihood—currently standing at an 87% Probability of 25 Basis Point Rate Cut for the December FOMC Meeting, according to CME Group’s FedWatch Tool data as of mid-November. This overwhelming market conviction signals a transformative pivot in the Federal Reserve’s strategy, moving away from the restrictive stance maintained for the preceding two years. The anticipated easing comes amid compelling evidence of cooling inflation and emerging cracks in the previously resilient U.S. labor market, posing critical implications for bond yields, corporate borrowing costs, and the overall trajectory of economic growth heading into the new year. Investors, corporate executives, and policymakers are now analyzing the data that underpins this probability, seeking clarity on the pace and magnitude of future easing cycles.

The Data Driving the 87% Probability: Inflation and Disinflationary Trends

The foundation of the 87% probability rests squarely on the pronounced deceleration of inflation metrics. The Fed’s primary inflation gauge, the Personal Consumption Expenditures (PCE) price index, has consistently moved closer to the 2% long-run target, driven by easing supply chain pressures and a moderation in core services inflation. Recent data released by the Bureau of Economic Analysis (BEA) showed the core PCE index rising at an annualized rate significantly lower than the peak levels observed in previous quarters. This sustained disinflation provides the necessary cover for the Fed to consider a rate reduction without jeopardizing its price stability mandate.

While headline inflation has moderated, the Fed remains acutely focused on the persistence of core metrics. The high conviction for a December cut suggests that market participants believe the lagging effects of previous rate hikes are now sufficiently impacting economic activity to warrant preemptive action against a potential slowdown. Analysts at Goldman Sachs project that the six-month annualized rate of core PCE will be near 2.3% by the end of Q4, a trajectory that aligns perfectly with a policy shift.

Core PCE and Services Sector Moderation

The sticky component of inflation—services excluding housing and energy—has been a major concern for policymakers. However, recent employment cost index (ECI) data suggests wage growth is cooling, which directly influences services inflation. A softening ECI reduces the risk of a wage-price spiral, bolstering the case for a rate cut.

- Core PCE Index: Projected annualized rate near 2.3% by Q4, down from peak readings above 5%.

- Shelter Inflation: Lagging indicator, but new lease data suggests significant deceleration is forthcoming in early 2025.

- Goods Deflation: Continued price declines in durable goods are acting as a powerful counterweight to persistent service sector inflation.

The market’s confidence is further reinforced by the Federal Reserve’s dual mandate. With inflation seemingly under control, attention shifts to the employment side. Should the Fed delay easing, the risk of overtightening and triggering an unnecessary recession increases. Therefore, the December meeting is viewed as a crucial juncture to recalibrate policy to achieve a soft landing. The consensus view, reflected in the 87% probability, is that the balance of risks has tipped toward supporting employment rather than solely battling inflation.

The Labor Market’s Evolving Narrative and Recessionary Signals

The labor market, once characterized by historic tightness, is showing unmistakable signs of cooling, a development that strongly supports the 87% rate cut probability. While the unemployment rate remains historically low, the pace of job creation has slowed consistently over the past three quarters. Furthermore, metrics such as job openings (JOLTS data) and average weekly hours worked have declined, indicating reduced employer demand for labor.

The shift is not catastrophic, but it is perceptible. The monthly nonfarm payroll additions have averaged below 150,000 recently, a marked difference from the 250,000+ pace seen a year prior. This deceleration suggests the Fed’s policy is finally filtering through the economy, dampening aggregate demand and easing pressure on wages. The critical distinction for the Fed is whether this is a healthy normalization or the precursor to a sharper downturn.

JOLTS Data and Hiring Slowdown

The ratio of job openings to unemployed persons has fallen significantly, moving closer to pre-pandemic levels. This normalization reduces the bargaining power of workers, thereby easing upward pressure on wages—a key input to core inflation. Data from the Bureau of Labor Statistics (BLS) shows the quits rate is also declining, suggesting workers are less confident in finding better employment opportunities, a classic sign of a softening market.

- Job Openings: Decreased from a peak of 12 million to roughly 8.5 million, easing labor market tightness.

- Unemployment Rate: Expected to tick up marginally towards 4.1% by year-end, signaling increasing slack.

- Average Hourly Earnings: Annual growth has moderated from 5.5% to below 4.0%, lessening inflationary wage pressures.

Firms like Morgan Stanley and JPMorgan Chase have revised their Q4 GDP forecasts downward, citing tighter lending standards and slowing consumer spending, both of which are direct consequences of high interest rates. These forecasts strengthen the argument that the Fed needs to ease policy to prevent an unnecessary recession, aligning with the strong market expectation of a December cut.

Impact on Financial Markets: Bonds, Equities, and the Dollar

The market’s conviction regarding a rate cut has already priced in significant shifts across asset classes. The 87% probability of easing has immediate, tangible consequences for fixed income, equity valuations, and currency movements. A 25 basis point reduction, or even the forward guidance accompanying it, signals the beginning of a dovish cycle, typically translating into lower Treasury yields and a weaker U.S. dollar, while boosting interest-sensitive equity sectors.

Bond markets are the most sensitive barometers of Fed expectations. The yield on the benchmark 10-year Treasury note has generally decreased in anticipation of the December move. Lower yields reduce the cost of capital for corporations and governments, stimulating investment. However, the curve remains an area of concern; while the 2-year yield has reacted strongly to the near-term policy expectations, the inversion between the 2-year and 10-year yields persists, reflecting lingering recession fears.

Sectoral Equity Performance

Equity markets typically welcome rate cuts, as lower discount rates increase the present value of future earnings, particularly for long-duration growth stocks. Technology and consumer discretionary sectors, often heavily reliant on borrowing for expansion and sensitive to consumer credit costs, tend to outperform in the early stages of an easing cycle.

- Technology Stocks: Expected to benefit from lower cost of capital and improved valuation multiples.

- Housing Sector: Mortgage rates should decline, potentially unlocking demand in the residential real estate market.

- Financials: Banks may face pressure on net interest margins (NIM) initially but benefit from increased lending volume later.

Conversely, a rate cut generally pressures the U.S. dollar (USD). A lower interest rate differential makes USD-denominated assets less attractive to global investors, leading to capital flows toward higher-yielding or faster-growing economies. This USD weakness can be advantageous for U.S. multinational corporations, as it boosts the reported value of their foreign earnings. Market participants are closely watching the Fed’s projections (the ‘Dot Plot’) for 2025 to gauge the full extent of the anticipated easing cycle beyond December.

The Federal Reserve’s Communication Challenge: Managing Expectations

The Federal Reserve faces a delicate balancing act in the run-up to the December meeting. With 87% of the market pricing in a cut, the primary risk is not whether they cut, but how they communicate the future pace of easing. Any communication perceived as overly cautious or hawkish could lead to a sharp market correction, particularly in risk assets that have rallied on the dovish outlook.

Chairman Jerome Powell and the FOMC must thread the needle: validate the market’s expectation of a 25 basis point move while maintaining flexibility to react to unforeseen economic shifts. The language used in the official statement and in Powell’s subsequent press conference will be scrutinized for clues regarding the ‘higher for longer’ narrative’s demise and the establishment of a new policy regime. The consensus among economists at firms like Bank of America suggests the Fed will emphasize that future decisions remain data-dependent, even as they initiate the first cut.

The Importance of the Dot Plot

The updated Summary of Economic Projections (SEP), including the highly anticipated ‘Dot Plot,’ will be instrumental. This projection chart indicates where each FOMC member expects the federal funds rate to be at the end of 2025 and 2026. A significant downward shift in the median dot would confirm a commitment to a sustained easing path, potentially unlocking further market rallies.

The challenge is to guide markets without creating a runaway easing expectation that could prematurely reignite inflationary pressures. If the Fed signals five or six cuts in 2025, it risks easing financial conditions too aggressively. Conversely, if the Dot Plot suggests only one or two cuts, it could contradict the market’s current 87% conviction and lead to a significant repricing of risk.

Global Macroeconomic Context and Policy Divergence

The decision at the December FOMC meeting does not occur in a vacuum; it is heavily influenced by the global economic landscape. The anticipated U.S. rate cut contrasts sharply with the policy stances of other major central banks, creating significant policy divergence that impacts global capital flows and trade dynamics. For instance, while the European Central Bank (ECB) and the Bank of England (BoE) are also grappling with slowing growth, their inflation battles have been slightly more protracted in core services, potentially limiting their immediate easing flexibility.

A U.S. rate cut, particularly if followed by a sustained easing cycle, could alleviate financial stress globally. Many developing economies, which borrowed heavily in U.S. dollars, would benefit from a weaker USD and lower U.S. interest rates, reducing their debt servicing costs. This global transmission mechanism is a critical consideration for the FOMC, as instability abroad can quickly impact the domestic economy.

Central Bank Policy Synchronization

Historically, central banks often move in concert. However, the current environment is marked by asynchronous post-pandemic recoveries. The high probability of a U.S. cut suggests the U.S. economy might be further along in its disinflationary cycle than peers. This divergence can lead to volatile currency markets and shifts in commodity pricing.

- ECB Policy: Likely to lag the Fed’s easing due to persistent wage inflation pressures in the Eurozone.

- Emerging Markets: Expected to gain capital inflows as the risk-free rate in the U.S. declines.

- Commodity Prices: A weaker dollar resulting from easing policy tends to support price appreciation for dollar-denominated commodities like crude oil and gold.

The global economic context reinforces the necessity of the Fed’s move. By easing policy, the Fed provides a necessary cushion for the global economy, indirectly supporting demand for U.S. exports and mitigating the risk of a severe global downturn. This interconnectedness makes the December decision a global market event, not just a domestic policy adjustment.

Investment Considerations and Risk Management Post-Cut

For investors, the 87% probability of a rate cut mandates a reassessment of portfolio allocation strategies. The shift from a high-interest-rate environment to an easing cycle requires adjusting duration exposure in fixed income and re-evaluating equity risk profiles. Active risk management becomes paramount, especially considering the potential for market volatility surrounding the Fed’s forward guidance.

In fixed income, investors may consider increasing duration exposure to benefit from anticipated further declines in long-term rates. However, credit risk also becomes relevant. As the economy slows, the default risk for lower-rated corporate bonds (high-yield) increases, even with lower borrowing costs. Analysts at BlackRock suggest a barbell strategy—combining short-term liquidity with long-term, high-quality duration—may be optimal.

Portfolio Adjustments for the Easing Cycle

In equities, investors should look beyond the immediate boost to growth stocks. Sectors that have been severely suppressed by high rates, such as utilities and real estate investment trusts (REITs), may see significant recoveries. These sectors are highly interest-rate sensitive, and a sustained decline in borrowing costs improves their profitability and dividend sustainability.

However, the key risk remains. If the Fed cuts rates because the economy is deteriorating faster than expected—a ‘hard landing’ scenario—the initial market optimism could quickly dissipate. Investors must distinguish between a ‘soft landing’ cut (proactive easing) and a ‘recessionary cut’ (reactive easing). The current 87% probability assumes the former, but the possibility of the latter cannot be ignored.

- Fixed Income Strategy: Focus on high-quality corporate bonds and extended duration Treasuries.

- Equity Strategy: Overweight rate-sensitive sectors (Tech, Utilities, Real Estate) and maintain exposure to defensive, high-free-cash-flow companies.

- Currency Risk: Hedge against potential USD depreciation if holding significant international assets.

Ultimately, the December FOMC meeting serves as the formal transition point. Investors should use the high probability of a cut not as a signal to blindly chase the rally, but as confirmation of a structural shift in monetary policy that requires disciplined portfolio realignment focused on mitigating downside risks while capturing the upside potential of lower rates.

| Key Financial Metric | Market Implication/Analysis |

|---|---|

| 87% Rate Cut Probability | Near certainty of policy easing; focus shifts to the pace of future cuts in 2025. |

| Core PCE Moderation | Sustained disinflation provides the necessary economic justification for the Fed’s pivot. |

| Labor Market Deceleration | Slowing job growth and lower JOLTS data mitigate wage-price spiral risks, supporting dovish stance. |

| 10-Year Treasury Yield | Yields expected to stabilize or decrease further, improving borrowing conditions for corporations and housing. |

Frequently Asked Questions about the December FOMC Rate Cut

While the Federal Funds Rate directly influences short-term rates, mortgage rates (tied to 10-year Treasury yields) usually react to the Fed’s forward guidance. A cut confirms a dovish trend, potentially leading to a gradual decline in 30-year fixed mortgage rates, which could stimulate housing market activity.

The primary risk is a severe market shock and repricing of risk assets. Given the 87% probability, a decision to hold rates steady would be interpreted as aggressively hawkish, likely causing a sharp sell-off in equities and a significant spike in short-term Treasury yields, reflecting overtightening fears.

Beyond the initial cut, the ongoing trajectory of the monthly core PCE index will be most crucial. Sustained readings below 2.5% on an annualized basis in Q1 2025 will solidify the Fed’s commitment to further easing, while any re-acceleration could prematurely halt the cutting cycle.

Investors holding substantial cash in money market accounts should anticipate lower yields as the Fed eases policy. It is advisable to evaluate transitioning some cash into longer-duration fixed income assets, such as high-quality intermediate-term bonds, to lock in current yields before further cuts occur.

Yes, a rate cut, especially if followed by dovish guidance, typically weakens the USD as it reduces the attractiveness of dollar-denominated assets relative to other currencies. This trend is amplified if other major central banks, like the ECB or BoE, maintain higher rates longer than the Fed.

The Bottom Line: Navigating the Policy Pivot

The high market confidence surrounding the December FOMC Meeting: 87% Probability of 25 Basis Point Rate Cut marks a definitive end to the most aggressive tightening cycle in decades. The Federal Reserve is pivoting, driven by tangible success in bringing core inflation down and a desire to insure against a sharp downturn in the labor market. This pivot is not just a technical adjustment; it represents a fundamental shift in the macro landscape, moving from policy restraint to policy accommodation. For investors, the implication is clear: the focus shifts from capital preservation against rising rates to strategic positioning for an environment of declining borrowing costs and potentially revived economic growth. While the 87% probability suggests certainty for the December move, the true challenge lies in decoding the FOMC’s commitment to the subsequent easing path. Market participants must remain vigilant, scrutinizing every nuance of the Dot Plot and Chairman Powell’s rhetoric, as the speed of future cuts, rather than the initial December action, will ultimately determine the economic trajectory for 2025.