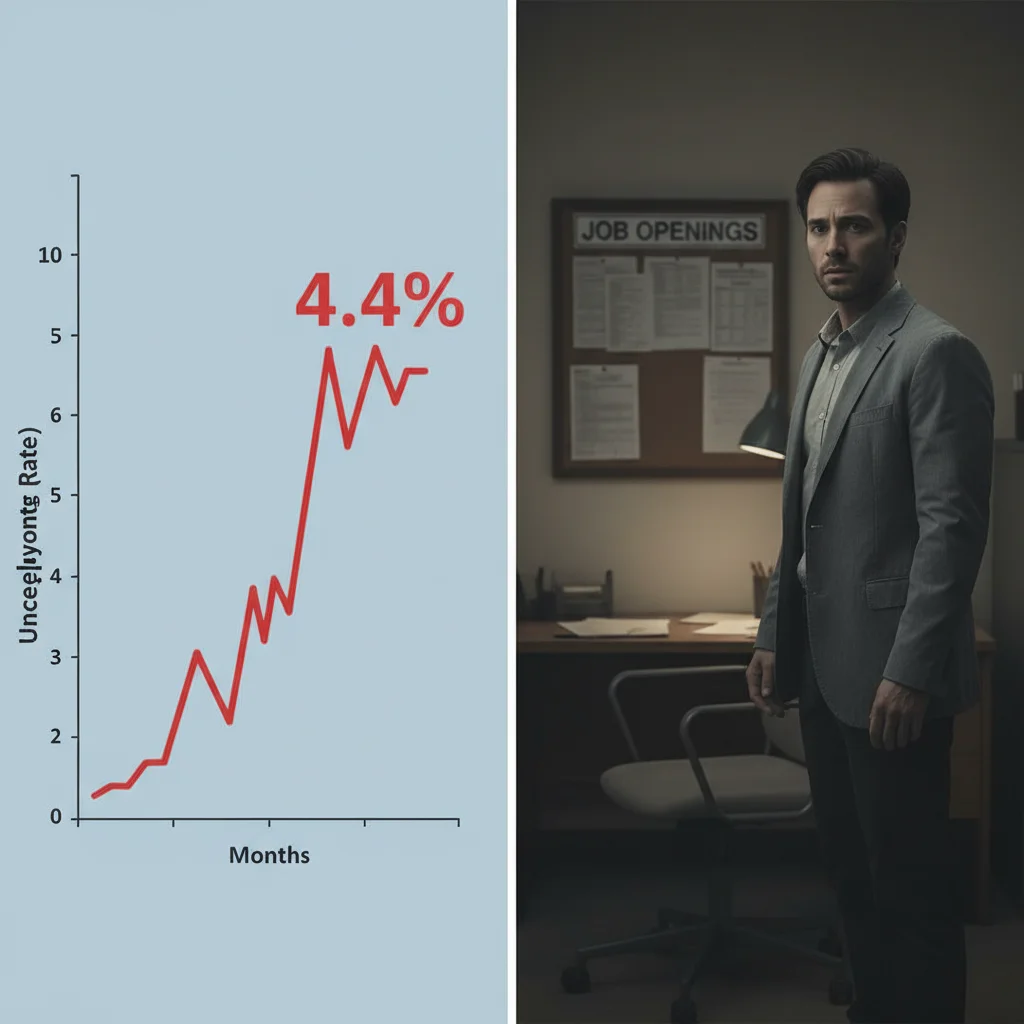

Unemployment Rises to 4.4% in September: Market and Earnings Impact

The unexpected jump in the US unemployment rate to 4.4% in September signals a potential cooling of the tight labor market, directly affecting corporate earnings forecasts and future Federal Reserve interest rate trajectory.

The latest release from the Bureau of Labor Statistics (BLS) indicating that Unemployment Rose to 4.4% in September: Impact on Job Market and Earnings has immediately recalibrated market expectations concerning the resilience of the U.S. economy. This 40 basis point increase from the previous month’s 4.0% reading is the largest single-month jump recorded outside of pandemic-related distortions since 2010, signaling a potential inflection point in the previously robust labor market.

This shift warrants immediate attention from investors, corporate strategists, and policymakers alike, as sustained weakness in employment directly translates into diminished consumer purchasing power, slower wage inflation, and potentially weaker corporate revenue streams in the coming quarters. The primary question now is whether this rise represents a technical correction or the leading edge of a more significant economic deceleration.

The mechanics behind the 4.4% unemployment jump

To understand the market reaction, it is essential to dissect the components driving the September unemployment figure. The 4.4% rate, while still historically low compared to pre-2008 averages, reflects two concurrent trends: a moderate slowdown in nonfarm payroll gains and a significant increase in the labor force participation rate coupled with a surge in job seekers who have yet to secure employment. The BLS reported that nonfarm payrolls added only 120,000 jobs in September, substantially below the consensus expectation of 185,000.

Crucially, the household survey, which determines the unemployment rate, showed that the number of unemployed persons increased by approximately 650,000. Economists at Goldman Sachs noted that the labor force participation rate edged up to 62.9%, suggesting more individuals are entering or re-entering the job market. While increased participation is generally positive for long-term economic capacity, a surge in entrants who cannot immediately find work exacerbates the unemployment rate, creating a temporary supply-demand imbalance in the workforce.

Defining the labor force dynamics

The sudden increase in the percentage of the labor force actively seeking employment but unable to find it suggests that perceived job security might be waning, prompting some marginally attached workers to seek stable employment before a potential recessionary environment fully materializes. This rush into the labor pool, often termed the ‘discouraged worker effect reversal,’ can temporarily mask underlying softness in demand.

- Labor Force Participation (LFP): The LFP rate rose by 0.2 percentage points to 62.9%, indicating renewed confidence or necessity among potential workers.

- Nonfarm Payroll Growth: The monthly job creation figure of 120,000 represents the slowest growth rate in the past 18 months, signaling cautious hiring practices among businesses.

- Duration of Unemployment: Preliminary data suggests a slight uptick in the median duration of unemployment, moving from 8.5 weeks to 9.1 weeks, which bears close monitoring as a leading indicator of structural weakness.

The rise to 4.4% unemployment is not solely a measure of job losses, but rather a complex metric reflecting adjustments in participation and the pace of hiring. However, the deceleration in payroll gains confirms that the labor market is losing the exceptional tightness characteristic of the post-pandemic recovery, aligning with the Federal Reserve’s objective of cooling demand. This cooling, if managed, can alleviate inflationary pressures, but if it accelerates, it introduces significant downside risk to earnings.

Impact on wage growth and consumer earnings

The primary market concern stemming from the Unemployment 4.4% September data is the immediate feedback loop into wage growth and, consequently, consumer spending—the engine of the U.S. economy. For months, aggressively rising wages were a key driver of service-sector inflation. Now, with more slack entering the labor market, the upward pressure on average hourly earnings (AHE) is expected to moderate significantly.

Average hourly earnings increased by 0.2% month-over-month in September, down from the 0.4% recorded in August. Year-over-year AHE growth slowed to 4.0%, marking the lowest annual rate since early 2022. This deceleration is a direct consequence of reduced competition for labor, particularly in sectors like leisure, hospitality, and professional services, which had previously experienced premium wage inflation due to intense worker shortages.

Sectoral variations in earnings moderation

While the aggregate data shows a slowdown, the impact is unevenly distributed. High-skill, specialized technology sectors continue to report robust compensation, albeit with fewer open positions. Conversely, lower-wage sectors are feeling the pinch first, as employers regain leverage in hiring negotiations. This disparity can exacerbate income inequality and create pockets of severe financial strain among lower-income households.

- Manufacturing: Wage growth remained relatively sticky at 4.5% year-over-year, reflecting ongoing supply chain disruptions requiring specialized labor.

- Retail Trade: AHE growth slowed sharply to 3.5% annually, suggesting retailers are cutting hours or relying less on premium pay to attract seasonal workers.

- Professional Services: This sector, a key barometer for white-collar employment, saw annual wage increases fall from 5.1% to 4.3%, indicating a softening in demand for consultancy and technical expertise.

For the average consumer, slower wage growth means less disposable income, especially when factoring in persistent, albeit moderating, inflation. JPMorgan Chase analysts estimate that a sustained rise in unemployment above 4.5% could reduce real personal consumption expenditures growth by 0.5 percentage points over the next two quarters. This potential pullback in spending represents a significant risk to the Q4 2024 and Q1 2025 GDP forecasts, directly affecting consumer-facing corporate earnings.

The Federal Reserve’s revised monetary calculus

The Federal Reserve has repeatedly emphasized that labor market rebalancing is a prerequisite for achieving its 2% inflation target. The surge in the Unemployment 4.4% September figure provides the central bank with tangible evidence that its aggressive rate hiking cycle is finally achieving the desired cooling effect. This data fundamentally alters the probability calculus for the upcoming Federal Open Market Committee (FOMC) meetings.

Prior to the September data release, the market had largely priced in a 25 basis point hike in the November meeting, driven by concerns over persistently high core inflation. Following the unemployment report, the probability of a hike dropped to approximately 35%, according to the CME FedWatch Tool. The focus shifts from controlling overheating demand to managing a potential soft landing, or avoiding a hard one altogether.

Implications for interest rate trajectory

Should the unemployment rate continue its upward trend, moving toward 4.7% or 5.0% in the final quarter of the year, the Fed may pivot from rate hikes to a prolonged pause, or even consider rate cuts earlier than previously anticipated. The Fed operates under a dual mandate: maximum employment and price stability. When employment weakens significantly, the Fed’s focus naturally shifts toward supporting the labor market.

- November FOMC Meeting: Increased likelihood of a rate pause (holding the Federal Funds Rate steady) due to weakening labor data.

- Long-term Rate Outlook: Analysts at Bank of America now project the terminal rate will be lower than their previous forecast of 5.75%, potentially capping at 5.50% if the labor market continues to shed steam.

- Market Volatility: Bond markets reacted instantly, with the 10-year Treasury yield dropping by over 15 basis points, reflecting expectations of a less aggressive, or ‘dovish,’ Fed stance moving forward.

This development introduces a complex trade-off for the Fed. While the labor slack helps tame inflation, a rapid deterioration in employment could trigger financial instability. The central bank must now carefully articulate its policy response, balancing the need to anchor inflation expectations with the growing risk of recession indicated by the labor statistics.

Corporate earnings forecasts under pressure

The immediate consequence of a weakening job market and decelerating wage growth is a downward revision of corporate earnings forecasts, particularly for companies heavily reliant on consumer discretion or high-volume hiring. The linkage is direct: fewer employed workers or workers with lower real income translate into reduced demand for goods and services.

Sectors that thrived on the tight labor market—such as staffing agencies and certain cloud services that supported rapid business expansion—are likely to see revenues soften first. Conversely, sectors that were squeezed by high labor costs, such as airlines and restaurants, may see margin relief, but this relief could be offset by reduced customer traffic.

The margin vs. revenue dilemma

Companies face a delicate balancing act. On one hand, reduced wage pressure (a benefit of Unemployment 4.4% September) can boost operating margins. On the other hand, if unemployment translates into a significant decline in aggregate demand, the drop in revenue will quickly overwhelm any cost savings. The key differentiator for investor analysis is a company’s pricing power and its reliance on cyclical consumer spending.

- Consumer Discretionary: Companies like luxury retailers and travel services face increased revenue risk as consumers tighten belts in anticipation of economic uncertainty.

- Technology (Software): While less labor-intensive, enterprise software sales often correlate with business confidence and expansion plans, which may be delayed if companies anticipate a recession.

- Financials: Banks face a mixed outlook; lower interest rate expectations might reduce net interest margins, but a softer landing could reduce loan default rates compared to a hard recession scenario.

Wall Street analysts have already begun adjusting Q4 2024 and Q1 2025 earnings estimates. Consensus forecasts for S&P 500 earnings growth have been lowered from 8.5% to 7.2% for Q4, according to FactSet data, largely reflecting the new reality of a slowdown in consumer demand driven by labor market weakness. Companies must now demonstrate effective cost management and resilient business models to justify current valuations.

Geographic and demographic disparity in job losses

Macroeconomic data often masks significant regional and demographic variations. The rise in unemployment to 4.4% is not uniform; certain states and specific demographic groups are bearing the brunt of the slowdown more acutely. Analyzing these disparities provides crucial context for understanding the broader social and economic implications.

Preliminary state-level data suggests that the Midwest and parts of the South, heavily reliant on manufacturing and logistics, experienced the sharpest increases in unemployment claims. The manufacturing sector, already contending with global demand pressures and high inventory levels, saw notable layoffs, particularly in the automotive supply chain. This geographic concentration of job losses suggests regional economies may enter a recessionary phase before the national average does.

Demographic breakdown of labor market stress

Historically, younger workers and minority groups are the first to experience job market stress during economic contractions. The September report shows a widening gap in unemployment rates across demographic lines. The unemployment rate for workers aged 16-19 jumped from 12.5% to 14.1%, while the rate for adult men remained relatively stable. This suggests that entry-level positions and temporary roles are being cut first.

- Youth Unemployment (16-19): The disproportionate rise highlights reduced summer hiring retention and fewer entry-level opportunities being created.

- Educational Attainment: Workers with less than a high school diploma saw their unemployment rate increase by 0.7 percentage points, contrasting sharply with the marginal increase for those with a bachelor’s degree or higher.

- Regional Hotspots: States like Michigan, Ohio, and North Carolina reported elevated initial jobless claims, indicating a focused slowdown in industrial and traditional labor markets.

For financial institutions and government programs, this uneven distribution of labor market pain necessitates targeted interventions. From an investment perspective, companies with significant operational footprints in these stressed regions may face higher risks related to local demand fluctuations and potential employee unrest or turnover, requiring careful due diligence beyond national averages.

Investment outlook and risk management in a cooling market

The shift in the labor market, crystallized by the Unemployment 4.4% September data, requires investors to reassess their portfolio allocations and risk exposure. The narrative moves away from battling inflation through aggressive rate hikes toward protecting capital from the risks associated with an economic downturn.

Defensive sectors and companies with strong balance sheets, high free cash flow generation, and inelastic demand for their products are likely to outperform. Conversely, highly leveraged companies or those in deeply cyclical industries face significant headwinds. Market participants are increasingly looking for ‘quality’ factors that can withstand a potential earnings recession.

Strategic portfolio adjustments

Analysts at BlackRock suggest reallocating capital toward sectors traditionally resilient during periods of economic slowdown. Healthcare, utilities, and high-quality consumer staples typically demonstrate lower volatility and more stable earnings streams, regardless of the unemployment rate. Furthermore, the drop in Treasury yields following the data release makes fixed income, particularly high-grade corporate bonds, more attractive relative to equities.

- Defensive Equities: Prioritize companies with essential products (e.g., pharmaceuticals, packaged foods) that maintain demand even when consumer budgets shrink.

- Fixed Income: Increased duration exposure may be warranted if the Fed pivots to a less hawkish stance, benefiting longer-term Treasury bonds.

- Cash Management: Maintaining higher cash reserves provides optionality to capitalize on market dislocations or steep equity pullbacks that often accompany rising unemployment.

Risk management now involves scrutinizing credit quality, as corporate bankruptcies typically rise when unemployment trends upward and economic growth stalls. Investors should focus on companies with manageable debt loads and robust liquidity profiles, ensuring they can weather a period of reduced revenue without resorting to dilutive capital raises or asset sales at depressed prices. The transition from a tight labor market to one with significant slack requires a defensive posture in capital deployment.

Policy response beyond the Federal Reserve

While the Federal Reserve dominates the narrative regarding economic stabilization, the rise in unemployment necessitates a broader policy response from fiscal authorities and regulatory bodies. The government’s reaction to the 4.4% figure will influence the depth and duration of any economic slowdown, impacting both corporate planning and individual financial security.

Fiscal policy tools, such as adjustments to unemployment insurance, targeted infrastructure spending, or tax incentives for hiring, become more relevant when monetary policy reaches its limitations. Should the unemployment rate breach 5.0%, pressure will mount on Congress to implement counter-cyclical fiscal measures to support aggregate demand and prevent a severe contraction.

Government and regulatory considerations

Regulatory environments also shift in response to labor market weakness. Agencies may become more lenient regarding certain corporate activities, such as mergers and acquisitions, if the stated goal is to preserve existing jobs or create efficiencies. State-level policies regarding minimum wage increases might also face political resistance as employers cite worsening economic conditions.

- Unemployment Insurance: States may need to replenish depleted unemployment trust funds if jobless claims remain elevated, potentially leading to increased payroll taxes for businesses down the line.

- Infrastructure Spending: Accelerated deployment of congressionally approved infrastructure funds could provide a necessary boost to construction and related industries, counteracting private sector job losses.

- Small Business Support: Enhanced lending programs from the Small Business Administration (SBA) may be necessary to support smaller enterprises, which are often the first to cut staff during a slowdown.

The coordinated response between fiscal and monetary authorities will be critical. Failure to deploy effective fiscal stimulus if the labor market deteriorates further could place an undue burden on the Fed, potentially forcing premature rate cuts that reignite inflationary pressures. Investors should monitor legislative discussions closely, as policy decisions will define the operating environment for businesses throughout 2025.

| Key Metric | Market Implication/Analysis |

|---|---|

| Unemployment Rate (September) | Rose to 4.4% (from 4.0%), signaling significant labor market slack and cooling demand. |

| Average Hourly Earnings (Y/Y) | Decelerated to 4.0%, reducing inflationary pressure but threatening consumer spending power. |

| Fed Rate Hike Probability (November) | Dropped to ~35%, reflecting a likely pivot toward a prolonged pause in monetary tightening. |

| S&P 500 Earnings Forecast (Q4) | Downward revisions expected, driven by anticipated weakness in consumer discretionary spending. |

Frequently asked questions about the labor market and earnings impact

While 4.4% is not recessionary, the rapid increase signals reduced corporate hiring confidence. Employees in highly cyclical sectors like construction and manufacturing should monitor company layoff announcements and ensure their skills remain competitive, focusing on areas less prone to automation or demand shifts.

Many analysts suggest increasing allocation to defensive sectors such as healthcare and utilities, which historically perform well during economic slowdowns. Additionally, the drop in Treasury yields makes high-quality, short-duration corporate bonds more attractive for capital preservation relative to volatile equities.

The Fed is highly unlikely to cut rates immediately unless unemployment rapidly accelerates above 5.0%. However, the 4.4% figure substantially increases the probability of a ‘pause’ in rate hikes, which is a significant change in monetary policy trajectory, easing pressure on borrowing costs.

Slower average hourly earnings growth (4.0% in September) is a key factor in reducing core inflation, particularly in service industries where labor costs are a major component. This moderation is positive for the overall inflation fight but reduces the real purchasing power of workers if consumer prices remain elevated.

Consumer discretionary sectors are the most vulnerable. As consumers anticipate economic stress due to rising unemployment, they typically reduce spending on non-essential items, leading to lower sales and potentially tighter margins for retailers, travel, and entertainment companies.

The bottom line: navigating the shift from tightness to slack

The September labor market report, headlined by the rise in unemployment to 4.4%, confirms a defining shift in the macroeconomic landscape. The era of extreme labor market tightness, characterized by intense competition for workers and premium wage inflation, is receding. This transition is a double-edged sword: it offers the Federal Reserve a clear path to achieving its inflation goals without further aggressive tightening, but it introduces substantial risk to corporate earnings and economic growth expectations. Investors must recognize that while margin relief from lower wage pressure is possible for some firms, the overarching risk is a slowdown in aggregate demand driven by reduced consumer confidence and diminished real income. Monitoring forward-looking indicators, such as initial jobless claims and consumer credit usage, will be paramount in determining whether this 4.4% unemployment rate is merely a necessary adjustment or the first indicator of a broader economic contraction. The market’s focus must shift from how fast rates will rise to how resilient company balance sheets are in a period of decelerating revenue growth.