Tech communications divergence: why market split shocked investors

Test

The technology sector’s significant outperformance against communications stocks in 2025 reflects structural shifts in artificial intelligence adoption, divergent valuation dynamics, and contrasting interest rate sensitivity between growth-oriented and dividend-focused equity segments.

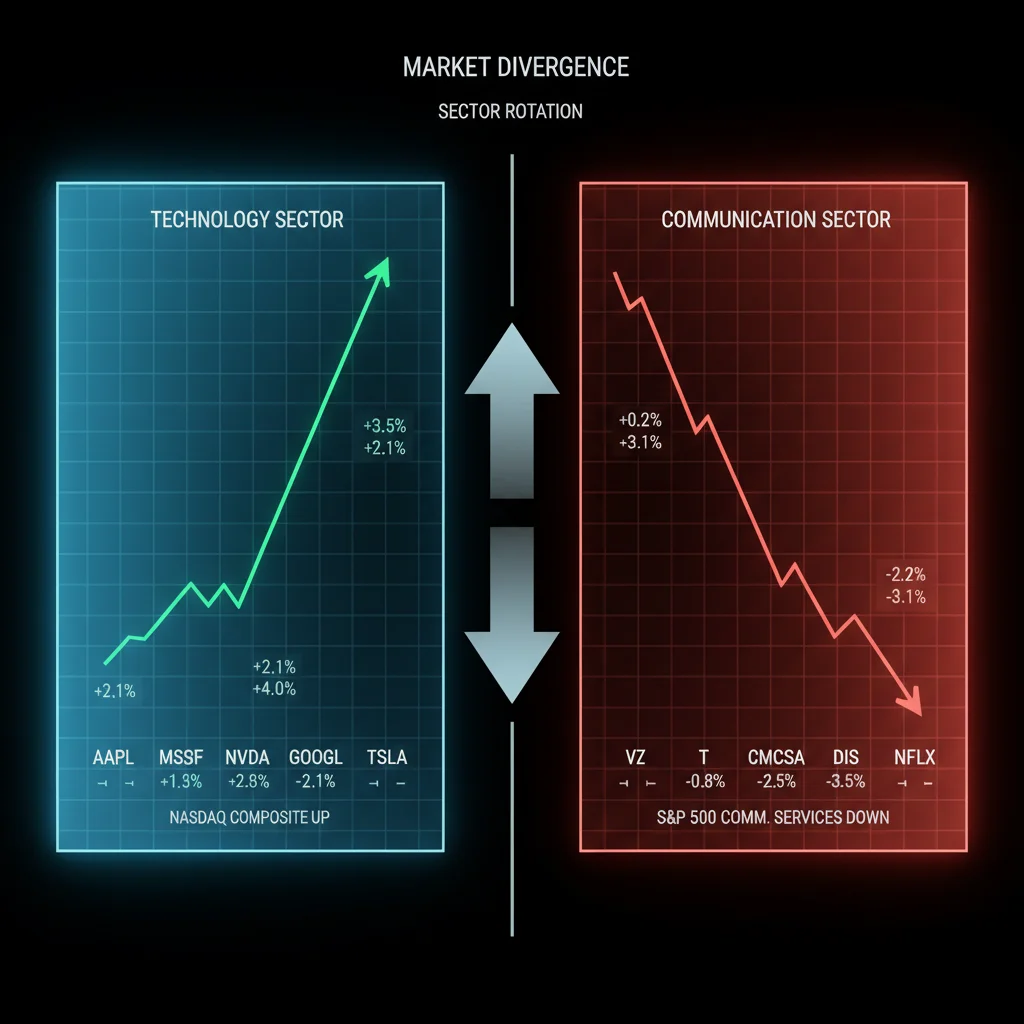

The market divergence between technology and communications stocks has emerged as one of 2025’s most pronounced sector rotations, challenging conventional portfolio wisdom and forcing investors to reconsider assumptions about market breadth and economic resilience. Technology-focused equity benchmarks have substantially outpaced communications sector indices, driven by concentrated exposure to artificial intelligence infrastructure, cloud computing, and semiconductor demand, while legacy telecommunications and media companies struggle with legacy business model pressures and elevated capital requirements. This divergence extends beyond typical cyclical patterns and reflects fundamental shifts in corporate profitability, growth trajectories, and investor capital allocation preferences that merit rigorous financial analysis.

Understanding the market divergence framework

Market divergence between sectors typically occurs when investors reassess risk-return profiles, growth outlooks, or macroeconomic sensitivities. The current technology-communications split reflects a more complex dynamic than simple growth-versus-value rotation. Technology companies have concentrated their investment strategies around artificial intelligence monetization, cloud infrastructure scaling, and software-as-a-service expansion, while communications firms continue managing mature revenue bases tied to wireless subscriber growth, cable television subscriptions, and legacy wireline services.

As of November 2025, the technology sector has delivered approximately 28-32% year-to-date returns across major U.S. indices, while communications stocks have produced mid-single-digit gains or modest declines depending on company-specific factors. This 20-25 percentage point performance gap has materialized despite relatively benign macroeconomic conditions and stable interest rate environments compared to 2022-2023 volatility. The persistence of divergence through multiple market cycles suggests structural rather than cyclical drivers.

Defining sector performance metrics

- Technology sector includes semiconductors, software, internet services, and hardware manufacturers with substantial artificial intelligence exposure

- Communications sector encompasses integrated telecommunications providers, cable operators, and media distribution companies

- Performance measurement uses total return including dividends, weighted by market capitalization

- Divergence quantified through relative strength indices comparing sector momentum and correlation breakdowns

Artificial intelligence adoption as primary performance driver

The acceleration of artificial intelligence implementation across enterprise and consumer applications has created a concentrated demand shock for technology infrastructure that communications companies are poorly positioned to monetize directly. While technology firms have captured investment flows related to AI chip manufacturing, model training infrastructure, and software development tools, communications companies have struggled to articulate compelling artificial intelligence profit narratives beyond network optimization and infrastructure efficiency.

Major technology companies reported substantial capital expenditure increases dedicated to data center construction, graphics processing unit procurement, and AI software development. Nvidia alone projected 2025 capital intensity increases related to AI infrastructure deployment. These investments signal market recognition that artificial intelligence represents a multi-year structural growth opportunity rather than cyclical technology spending.

Capital allocation divergence

Technology companies have directed capital toward growth investments and shareholder returns simultaneously, demonstrating confidence in earnings expansion potential. Communications firms have maintained elevated capital expenditure requirements for network modernization while facing margin pressures from intensifying wireless competition and secular streaming service adoption. This capital allocation gap translates into divergent earnings growth trajectories and return-on-invested-capital performance.

Monetization pathway clarity

- Technology companies possess established artificial intelligence monetization models through enterprise software licensing, cloud services pricing power, and advertising optimization

- Communications firms continue developing artificial intelligence applications with uncertain near-term revenue impact or customer willingness to pay premiums

- Software margins typically exceed 40-60%, while telecommunications margins remain constrained at 20-35% despite scale advantages

- Investor confidence in technology artificial intelligence narratives supported by quarterly earnings accretions and guidance improvements

Communications sector structural challenges and competitive dynamics

The communications sector confronts multiple headwinds that have accumulated over the past decade, creating a challenging backdrop for valuation expansion. Wireless competition intensified dramatically through aggressive pricing by discount carriers, compressing average revenue per user metrics. Traditional cable television subscribers continued migrating toward streaming services, eroding video revenue bases that historically generated 40-50% of operator margins.

Fixed broadband expansion faced limits as rural deployment economics deteriorated and wireless fixed access alternatives proliferated. These structural factors created cumulative pressure on cash flow growth and return on capital deployment, ultimately constraining share price appreciation potential despite historically attractive dividend yields.

Subscriber dynamics and revenue pressure

Wireless carriers experienced modest net adds but faced average revenue per unit pressure of 2-4% annually through the period. Video subscribers continued declining at 4-6% annual rates. Business services growth partially offset consumer weakness, but high-margin enterprise connectivity experienced competitive pressure from alternative providers. The combination of subscriber losses and pricing pressure created challenging total revenue growth environments.

Capital intensity challenges

- Wireless carriers required sustained capital investment of 15-18% of revenue annually for 5G network deployment and maintenance

- Broadband operators needed infrastructure investment to compete with fiber-based providers entering traditional cable footprints

- Capital intensity limits free cash flow growth despite stable operating income, reducing shareholder return flexibility

- Return on invested capital metrics trended downward throughout the cycle despite scale and operational efficiency improvements

Interest rate sensitivity and valuation implications

The relative interest rate environment creates substantial divergence in valuation mechanics between sectors. Communications stocks trade at high dividend yield multiples (4-6% yields), making them extremely sensitive to discount rate changes. If interest rates move higher, communications valuations face particularly acute pressure due to bond-like characteristics and limited growth optionality. Technology stocks, by contrast, generate growth narratives that partially offset rising discount rates through earnings per share expansion expectations.

Communications stocks trading below historical average price-to-earnings multiples reflect investor concerns about structural revenue challenges and return-on-capital limitations rather than temporary cyclical weakness. Technology valuations, conversely, have expanded as artificial intelligence growth narratives justify premium multiples relative to historical precedent.

Valuation metric divergence

Technology sector median price-to-earnings multiples expanded to 28-32x, while communications firms traded in the 8-12x range. This valuation divergence widened throughout 2025 despite stable interest rate environments, suggesting growth narrative differences rather than pure discount rate dynamics. Price-to-sales multiples diverged similarly, with technology commanding 8-12x sales multiples versus communications at 1.5-2.5x sales.

Dividend yield considerations

- Communications stocks offered 4-6% dividend yields, attractive relative to 10-year Treasury yields around 4.2-4.5%

- Technology sector delivered primarily capital appreciation returns with minimal dividend contributions to total return

- Dividend safety concerns emerged for certain communications carriers dependent on refinancing environments and competitive pressures

- Dividend growth limitations constrained income investor appeal despite elevated starting yield levels

Macroeconomic and monetary policy context

The broader macroeconomic environment provided supportive conditions for technology investment while creating challenges for cyclical and capital-intensive communications operators. Economic growth estimates remained in the 2-2.5% range for 2025, sufficient to support enterprise technology spending but challenging for communications earnings expansion. Inflation pressures moderated, allowing the Federal Reserve to maintain steady policy rates, creating a relatively stable backdrop without significant refinancing or discount rate shocks.

Enterprise customer spending on technology infrastructure continued accelerating, driven by artificial intelligence implementation requirements, cybersecurity investments, and cloud migration strategies. Communications carriers benefited modestly from business services growth but struggled with consumer segment weakness and competitive intensity.

Corporate spending priorities

Chief financial officers continued prioritizing artificial intelligence and data analytics investments ahead of traditional telecommunications infrastructure spending. Budget allocation surveys indicated 35-40% of organizations increased technology spending dedicated explicitly to artificial intelligence applications, while communications infrastructure spending increments remained modest at 5-10% annually.

Investor positioning and flow implications

The market divergence reflects genuine investor capital reallocation rather than temporary sentiment swings. Evidence indicates institutional fund flows accelerated into technology equities throughout 2025 while communications sector flows remained modest or negative. Growth-oriented investment strategies substantially overweighted technology exposures, while value-oriented mandates maintained communications allocations but faced pressure from contrarian positioning risks.

Passive index funds mechanically increased technology weightings as companies appreciated, creating self-reinforcing positive momentum. Communications sector index weightings compressed, reducing passive fund allocations and potentially creating valuation pressure independent of fundamental factors. Active managers generally maintained technology overweights and modest communications underweights, indicating broad institutional recognition of divergent fundamentals and outlook.

Fund flow patterns

- Technology-focused exchange-traded funds attracted $45-55 billion in net inflows through November 2025

- Communications sector funds experienced modest net outflows of $8-12 billion, suggesting investor skepticism about sector outlook

- Artificial intelligence-specific investment vehicles became fastest-growing category, skewing flows toward technology concentration

- Dividend-focused strategies maintained communications allocations but faced relative performance headwinds versus growth-oriented approaches

Forward-looking market dynamics and sector trajectory

The divergence between technology and communications sectors appears unlikely to reverse significantly in the near term based on structural factors and investment narratives. Technology companies continue demonstrating earnings growth acceleration, return-on-capital improvements, and strategic optionality around artificial intelligence monetization. Communications carriers face persistent structural challenges requiring business model evolution rather than cyclical cyclical recovery.

Market observers should monitor several key indicators for divergence persistence or compression signals. Slowing artificial intelligence capital expenditure could pressure technology valuations while reducing growth expectations. Communications carriers introducing innovative service offerings or demonstrating accelerated revenue growth could gradually rebuild investor confidence. Energy-intensive artificial intelligence operations might eventually increase demand for specialized communications infrastructure, creating opportunities for sector convergence.

The divergence reflects rational capital allocation based on growth prospects, profitability trajectories, and return-on-invested-capital potential. Until communications companies successfully execute business model transformation or artificial intelligence monetization strategies materialize, the performance gap appears likely to persist through 2026 despite periodic market reassessments.

| Key market factor | Impact on divergence |

|---|---|

| AI infrastructure spending | Technology companies capture concentrated benefits; communications firms positioned peripherally |

| Valuation multiples | Technology 25-32x earnings versus communications 8-12x; divergence reflects growth expectations |

| Capital allocation efficiency | Technology shows 15-25% incremental returns; communications constrained at 8-12% on elevated capital intensity |

| Investor positioning | Institutional overweighting technology supports continued outperformance through mechanical index rebalancing |

Frequently asked questions about technology communications divergence

Technology companies captured artificial intelligence infrastructure monetization opportunities with 28-32% year-to-date returns, while communications carriers faced structural subscriber pressures and capital intensity constraints, producing single-digit returns. Valuation expansion for technology reflected growth acceleration versus compressed communications multiples.

Communications stocks offer 4-6% dividend yields attractive relative to Treasury alternatives, though dividend growth remains constrained. Risk-adjusted returns depend on individual stock credit quality and business model resilience. Portfolio positioning and risk tolerance merit assessment before avoiding sector entirely.

Rising rates would pressure both sectors through higher discount rates, but technology growth optionality provides partial offset versus communications bond-like characteristics. Communications valuations would face acute pressure as dividend yields face refinancing pressure, potentially widening divergence rather than compressing it.

Communications firms could monetize network optimization artificial intelligence, predictive customer churn models, and dynamic spectrum management. However, these applications generate limited revenue premium potential compared to software-based artificial intelligence, explaining investor skepticism about communications artificial intelligence narratives.

Divergence appears likely to persist absent significant business model breakthroughs by communications companies or substantial artificial intelligence spending slowdown. Structural factors supporting technology outperformance remain intact, though periodic compression could occur through tactical profit-taking or artificial intelligence sentiment shifts.

The bottom line

The market divergence between technology and communications stocks reflects fundamental differences in growth prospects, capital allocation efficiency, and artificial intelligence monetization potential rather than temporary sentiment swings. Technology companies have positioned themselves to capture concentrated benefits from enterprise artificial intelligence spending acceleration, while communications carriers continue managing mature business models with structural revenue pressures. Valuations reflect these structural differences appropriately, with technology commanding growth premiums justified by earnings trajectory acceleration and communications compressed multiples reflecting limited return-on-capital potential. Investors monitoring this divergence should track communications carrier artificial intelligence implementation successes, wireless subscriber stabilization efforts, and broadband revenue acceleration as potential inflection points. Technology sector valuation sustainability depends on execution against ambitious artificial intelligence earning expectations and maintenance of capital discipline despite investor enthusiasm. The sector divergence signals healthy market discrimination between growth and value factors rather than mispricing opportunity, supporting the probability that divergence persists through 2026 barring significant macroeconomic disruption or unexpected artificial intelligence spending deceleration.