AI Momentum Slows: When to Rotate From Tech to Healthcare Stocks

As the accelerated growth rates in key AI-driven technology stocks begin to moderate, institutional investors are strategically assessing a sector rotation, shifting capital from expensive tech valuations toward the defensive and historically stable tech healthcare rotation sector, particularly during periods of elevated interest rates and economic uncertainty.

The financial markets are signaling a critical inflection point where the extraordinary momentum that fueled the AI-driven technology sector for the past 18 months may be slowing, compelling investors to consider a strategic move. This emerging trend, known as the tech healthcare rotation, is not merely a cyclical shift but a response to macroeconomic pressures, decelerating tech earnings growth, and the defensive appeal of the healthcare sector. The surge in valuations for companies focused on generative AI has pushed forward price-to-earnings (P/E) multiples for the S&P 500 Technology Sector to levels not seen since the dot-com era, while the healthcare sector, often undervalued, offers stability and structural tailwinds driven by demographics and non-discretionary demand. Understanding when and how to execute this rotation is paramount for capital preservation and growth in the current economic environment.

The moderation of AI-driven technology earnings

The narrative surrounding artificial intelligence has been the dominant market theme since late 2022, driving spectacular gains in a handful of mega-cap technology stocks. However, recent earnings reports have provided early indications that the pace of growth, while still robust, is beginning to normalize. The sheer scale required to maintain 40% to 50% year-over-year revenue growth becomes exponentially challenging as the revenue base expands into the tens of billions of dollars. Analysts at Goldman Sachs noted in a Q3 2024 report that while AI capital expenditure remains high, the time from investment to realized revenue is lengthening, placing near-term pressure on profit margins for hardware providers. This deceleration is a crucial signal for investors who have priced in perpetual hyper-growth.

Key indicators of slowing AI momentum

Several quantifiable metrics suggest the AI momentum is transitioning from an explosive phase to a more mature, predictable cycle. The focus shifts from speculative investment to tangible, deployable returns. For instance, the year-over-year growth in cloud computing infrastructure spending, a proxy for AI foundational investment, dropped from 35% in Q1 2023 to 22% in Q3 2024, according to Synergy Research Group data. This 13 percentage point decline, while still representing growth, indicates a leveling off of the initial investment frenzy. Furthermore, the consensus earnings per share (EPS) growth projections for the ‘Magnificent Seven’ cohort for the fiscal year 2025 have been revised downward by an average of 4.5% since the beginning of the year, per FactSet data, reflecting a more cautious outlook on near-term monetization of AI investments.

- Capex Efficiency: Monitoring the shift from broad capital expenditure (Capex) on GPUs and servers to focused, application-specific deployment, indicating increasing maturity.

- Margin Compression: Observing the impact of intensified competition in AI services, which could lead to price reductions and subsequent gross margin compression for software providers.

- Valuation Multiples: The average forward P/E ratio for the Nasdaq 100 hit 31x in October 2024, significantly above its ten-year average of 22x, signaling vulnerability to earnings disappointments.

- Regulatory Headwinds: Increasing scrutiny from global regulators (e.g., EU’s AI Act, US antitrust reviews) introduces execution risk that was not fully priced into tech stocks during the initial boom.

The market capitalization of the largest AI beneficiaries now represents an outsized portion of major indices. As of Q4 2024, the top five S&P 500 companies account for roughly 28% of the index’s total weight. This concentration risk means that even a moderate slowdown in their growth trajectory can have a disproportionate drag on overall index performance. For institutional portfolio managers focused on risk-adjusted returns, rotating away from peak concentration and toward sectors with lower correlation to technology volatility becomes a prudent defensive measure.

Macroeconomic triggers favoring defensive sectors

The macroeconomic landscape in late 2024 and early 2025 is characterized by persistent inflation, elevated interest rates, and geopolitical uncertainty, elements that historically benefit defensive sectors like healthcare over growth-oriented technology. When the Federal Reserve maintains the Federal Funds Rate above 5%—as it has through much of this period—the discount rate used to value future cash flows rises, disproportionately penalizing stocks whose valuations rely heavily on earnings projected far into the future, a common characteristic of technology companies.

The impact of higher-for-longer interest rates

The ‘higher-for-longer’ interest rate paradigm fundamentally alters the attractiveness of long-duration assets. Technology, particularly high-growth software and hardware firms, are highly sensitive to this environment. Conversely, healthcare companies—pharmaceuticals, managed care, and medical devices—often generate stable, predictable cash flows that are less sensitive to marginal shifts in economic growth. Their services are non-discretionary. During the last major cycle of sustained high rates (1970s and early 1980s), defensive sectors consistently outperformed growth sectors, according to historical S&P data.

Focusing on valuation disparity is key for the **tech healthcare rotation** strategy.

Furthermore, persistent core inflation, measured at 3.5% year-over-year as of the latest Consumer Price Index (CPI) report, pressures corporate operating costs. While technology companies struggle with rising labor costs and cloud service expenses, healthcare providers often possess greater pricing power due to regulated or essential service demand, allowing them to pass on some inflationary costs to payers, maintaining healthier operating profit margins.

- Real Yields: When real yields (nominal Treasury yields minus inflation) rise, the opportunity cost of holding expensive, non-dividend-paying growth stocks increases significantly.

- Economic Uncertainty: Surveys of corporate CEOs by the Conference Board show rising concern over geopolitical stability and supply chain resilience, driving capital toward resilient businesses like large-cap pharmaceuticals.

- Defensive Cash Flow: Healthcare operating cash flow typically exhibits a beta closer to 0.8 relative to the broader market, indicating superior stability during economic contractions compared to technology’s typically higher beta exposure.

The structural tailwinds powering healthcare growth

The appeal of the healthcare sector extends beyond its defensive qualities; it is underpinned by powerful, long-term structural tailwinds that guarantee demand regardless of the economic cycle. These factors include the aging demographic profile of the US population and accelerating innovation in biotechnology and personalized medicine. These drivers provide a compelling long-term foundation for the **tech healthcare rotation** strategy.

Demographics and non-discretionary spending

The US Census Bureau projects that the percentage of the population aged 65 and older will increase from 17% in 2020 to over 21% by 2030. This aging cohort requires substantially higher per-capita healthcare spending. According to CMS (Centers for Medicare & Medicaid Services) data, annual healthcare spending for individuals aged 65 and over is approximately three times higher than for those under 65. This demographic shift provides a predictable, multi-decade demand curve for managed care organizations, hospitals, medical device manufacturers, and pharmaceutical companies.

Moreover, healthcare spending is inherently non-discretionary. Unlike technology purchases, which can be deferred during recessions, medical needs are constant. This stability makes healthcare companies highly resilient in economic downturns. For example, during the 2008-2009 financial crisis, the S&P 500 Healthcare Sector saw earnings decline by only 4%, compared to a 28% decline for the S&P 500 overall, according to Bloomberg data.

The innovation pipeline within biotechnology is also exceptionally strong, fueled by advancements in gene editing (e.g., CRISPR), mRNA technology, and targeted therapies. These innovations, while requiring significant upfront R&D investment, promise blockbusters that can generate decades of protected intellectual property revenue. Companies successfully translating these scientific advancements into commercial products are poised for high, sustainable growth rates that justify robust valuations, differentiating them from the cyclical nature of some technology hardware businesses.

Valuation gap analysis: Tech vs. healthcare

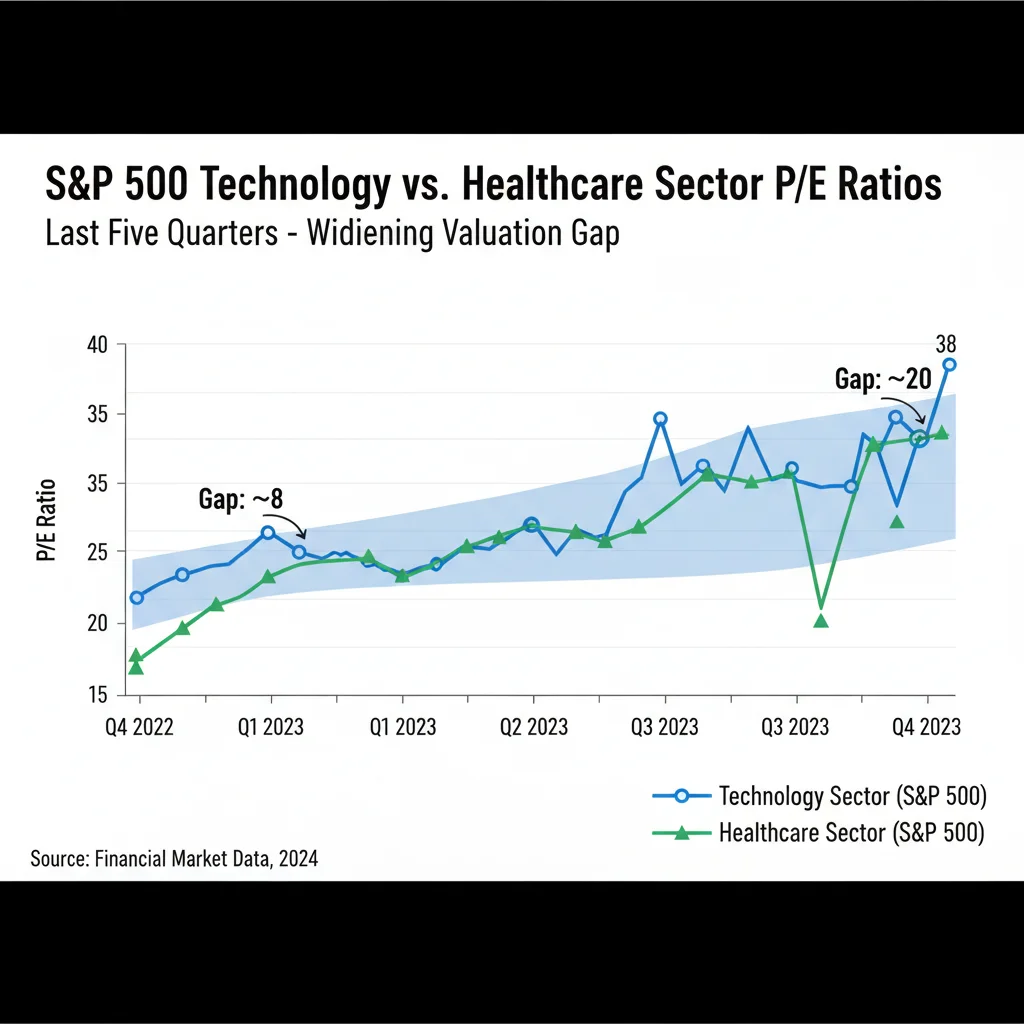

A core component of any sector rotation strategy is the relative valuation disparity between the sectors involved. As of Q4 2024, the S&P 500 Technology Sector is trading at a forward P/E ratio of approximately 27x, while the S&P 500 Healthcare Sector trades at roughly 18x. This 9-point spread is near the highest level observed in the past five years, excluding the peak of the 2020 pandemic rally, according to LSEG data.

Identifying mispriced opportunities

The market’s current pricing suggests that investors are paying a substantial premium for technology growth that may not fully materialize, while the steady, defensible growth of healthcare is being discounted due to perceived regulatory risks and relative lack of excitement compared to AI. This disparity creates a classic opportunity for a rotation. Analysts at Morgan Stanley recently upgraded the healthcare sector to ‘Overweight,’ citing the attractive free cash flow yield of major pharmaceutical companies, which averages 4.8%, compared to the 2.5% average for the large-cap technology cohort.

- Free Cash Flow Yield: High FCF yield in healthcare provides a buffer against volatility and supports dividend growth, appealing to income-focused investors.

- Enterprise Value to EBITDA (EV/EBITDA): Healthcare companies, particularly managed care and large pharmaceuticals, currently trade at an average EV/EBITDA multiple of 12x, significantly below the 18x average for high-growth tech firms.

- Growth at a Reasonable Price (GARP): Many healthcare companies offer EPS growth rates in the low double digits (10%-12%) at a P/E multiple below 20x, fitting the GARP investment profile often sought when market uncertainty rises.

This valuation gap is particularly pronounced in sub-sectors. For example, major pharmaceutical companies with strong patent protection and diversified revenue streams are trading at P/E multiples of 14x to 16x, while comparable large-cap technology infrastructure providers are often trading above 35x, despite facing cyclical demand fluctuations and higher capital intensity. The **tech healthcare rotation** seeks to exploit this relative undervaluation before market sentiment corrects.

Navigating complexity: Sub-sector selection in healthcare

The healthcare sector is highly heterogeneous, spanning pharmaceuticals, biotechnology, medical devices, and health services. A successful rotation requires precise sub-sector selection, focusing on areas with the best combination of pricing power, low regulatory risk, and clear growth catalysts. Not all healthcare stocks offer the same defensive qualities or growth trajectory.

Pharmaceuticals and managed care: Defensive pillars

Large-cap pharmaceutical companies (Big Pharma) are often the first port of call for defensive investors. Their robust balance sheets, global reach, and diversified product portfolios offer protection. Furthermore, the Managed Care Organizations (MCOs), which operate health insurance plans, benefit directly from the consistent growth in enrollment in government programs like Medicare Advantage, which provides predictable, recurring revenue streams largely insulated from general economic cycles. According to CBO projections, Medicare enrollment is expected to increase by 2% annually through 2035.

Demographics provide a strong, non-cyclical driver for the **tech healthcare rotation** thesis.

Conversely, smaller, pure-play biotechnology companies carry higher binary risk related to clinical trial outcomes and FDA approvals. While offering explosive growth potential, they are less suitable for a defensive rotation strategy focused on stability. Similarly, certain health service providers reliant on elective procedures may face cyclical pressures if consumer finances tighten significantly. Investors executing the **tech healthcare rotation** should prioritize companies with inelastic demand curves and strong pricing power.

- Medical Devices: Focus on companies offering essential, minimally invasive surgical tools that benefit from technological integration but maintain stable, established sales channels.

- Biopharma R&D: Favor firms with late-stage pipelines and recent FDA approvals, reducing the regulatory uncertainty associated with early-stage biotech.

- Payer Landscape: Managed care organizations (MCOs) provide exposure to the stable, growing health insurance market, acting as a crucial defensive counterbalance.

In the context of the rotation, the goal is to shift capital from high-beta, high-valuation technology names to stable, lower-beta healthcare companies that offer comparable or superior risk-adjusted returns in a decelerating growth environment. This requires careful consideration of individual company balance sheets and specific drug or device pipeline strength.

Risk factors and counter-arguments to the rotation thesis

While the case for a **tech healthcare rotation** is compelling based on valuation and macro trends, investors must acknowledge significant counter-arguments and inherent risks within the healthcare sector itself. No rotation is without friction, and continued unexpected strength in AI earnings could quickly reverse the trend.

Technology resilience and healthcare regulation

The primary risk to the rotation thesis is the possibility of a renewed acceleration in AI monetization. If major technology platforms successfully transition from spending on infrastructure to generating high-margin AI software revenue faster than current projections, the valuation premium could be sustained or even increase. Furthermore, technology companies have demonstrated superior ability to cut costs and innovate rapidly, potentially overcoming margin pressures more effectively than anticipated.

Conversely, the healthcare sector faces continuous, pervasive regulatory risk, particularly in the US. Legislative actions aimed at controlling prescription drug prices, such as those included in the Inflation Reduction Act (IRA), introduce uncertainty for pharmaceutical revenue streams. While large companies have adapted, the potential for further government intervention remains a persistent overhang on valuations. Litigation risk, especially in the medical device and opioid spaces, also poses a disproportionate threat to certain healthcare sub-sectors.

Moreover, large pharmaceutical companies face the ‘patent cliff’ risk, where key blockbuster drugs lose exclusivity, leading to sharp revenue declines that must be offset by new pipeline successes. Analysts at UBS estimate that drugs generating over $200 billion in annual sales globally will lose patent protection between 2025 and 2030, presenting a substantial headwind that technology companies generally do not face to the same degree.

The rotation must therefore be executed with discernment. It is not a broad-brush shift from ‘Tech’ to ‘Healthcare,’ but a selective move from overvalued, high-risk tech names to under-appreciated, high-quality healthcare franchises with strong intellectual property and resilient business models. The timing of this shift is heavily contingent on Federal Reserve policy; any unexpected pivot toward aggressive rate cuts could reignite enthusiasm for long-duration growth assets, putting the rotation on hold.

| Key Market Metric | Market Implication/Analysis |

|---|---|

| S&P Tech Forward P/E (27x) | Indicates high valuation risk; prices in aggressive, sustained growth that may moderate. |

| S&P Healthcare Forward P/E (18x) | Attractive relative valuation; offers growth at a reasonable price (GARP) profile. |

| US 10-Year Treasury Yield (>4.5%) | Sustained high rates penalize long-duration tech assets, favoring stable healthcare cash flows. |

| Medicare Advantage Enrollment Growth | Structural demographic tailwind driving predictable revenue growth for Managed Care Organizations. |

Frequently Asked Questions about Tech Healthcare Rotation

Key signals include a sustained flattening or decline in forward earnings guidance for major chip and cloud providers, coupled with a deceleration in corporate capital expenditure growth on AI infrastructure. For instance, a drop in quarter-over-quarter growth rates for high-performance computing components below the 20% threshold, as reported by industry surveys, often confirms a shift.

High interest rates increase the cost of capital and raise the discount rate used in valuation models. This disproportionately deflates the present value of future earnings, which is critical for high-growth tech stocks. Healthcare companies, with nearer-term, stable cash flows and lower debt dependence, are relatively shielded from this effect, making their current valuations more appealing.

The most defensive sub-sectors are large-cap pharmaceuticals (Big Pharma) due to patent-protected revenue, and Managed Care Organizations (MCOs), which benefit from stable, government-backed revenue streams like Medicare. These segments provide inelastic demand and robust free cash flow generation, crucial elements during market volatility.

The main risk is regulatory uncertainty, particularly concerning US drug pricing reforms and potential legislative changes affecting reimbursement rates for MCOs. While tech faces regulatory scrutiny, healthcare’s core revenue streams are more directly impacted by political and legislative decisions, requiring careful tracking of policy developments in Washington.

A full liquidation is generally ill-advised. The rotation should be strategic and gradual, focusing on trimming positions in highly valued, non-earning tech companies and reallocating toward high-quality healthcare franchises. Technology remains vital for long-term growth, but the allocation should reflect the current macroeconomic reality, favoring defensive stability.

The bottom line: Sector rotation as portfolio management

The accelerating shift in market focus from hyper-growth technology, driven largely by the initial excitement surrounding AI, toward the defensive stability of healthcare represents a classic example of sector rotation driven by macroeconomic reality. As the Federal Reserve maintains a restrictive monetary stance, demanding higher risk premiums, the lofty valuations of the technology sector become increasingly difficult to sustain without flawless execution and accelerating earnings. Data shows that the valuation gap between the S&P 500 Technology Sector and the S&P 500 Healthcare Sector reached a significant disparity in late 2024, presenting a clear entry point for investors prioritizing risk-adjusted returns.

The **tech healthcare rotation** is supported by the structural tailwinds of an aging population, which guarantees inelastic demand for medical services, and the inherent stability of defensive cash flows typical of large-cap pharmaceutical and managed care companies. While the risk of regulatory headwinds in healthcare and the potential for a renewed surge in AI profitability remain, the current environment favors resilience. Portfolio managers should monitor quarterly earnings reports from key AI leaders for signs of margin pressure or deceleration, coupled with the trajectory of the 10-year Treasury yield. A sustained period of high rates and decelerating tech momentum strongly suggests that defensive capital preservation and stable growth can be best achieved by strategically increasing exposure to high-quality healthcare franchises, ensuring portfolios are positioned for volatility and economic normalization rather than relying solely on the continuation of the AI investment boom.