First-Time Buyers Average 40: Analyzing the Housing Affordability Crisis

The sharp increase in the average age of first-time homebuyers to 40 reflects a critical failure in the housing market, driven by a convergence of high median home prices, restrictive borrowing costs imposed by Federal Reserve policy, and persistent inventory shortages.

The latest data point—that the average age of Americans purchasing their first home has climbed to 40 years old, up from the mid-30s just five years ago—serves as a stark empirical indicator of the deepening Housing Affordability Crisis across the United States. This demographic shift, confirmed by reports from institutions like the National Association of Realtors (NAR) and detailed analysis from the Federal Reserve Bank of St. Louis, is not merely a social inconvenience; it represents a significant economic dislocation impacting household formation, wealth accumulation, and broader macroeconomic stability.

The confluence of high prices and elevated interest rates

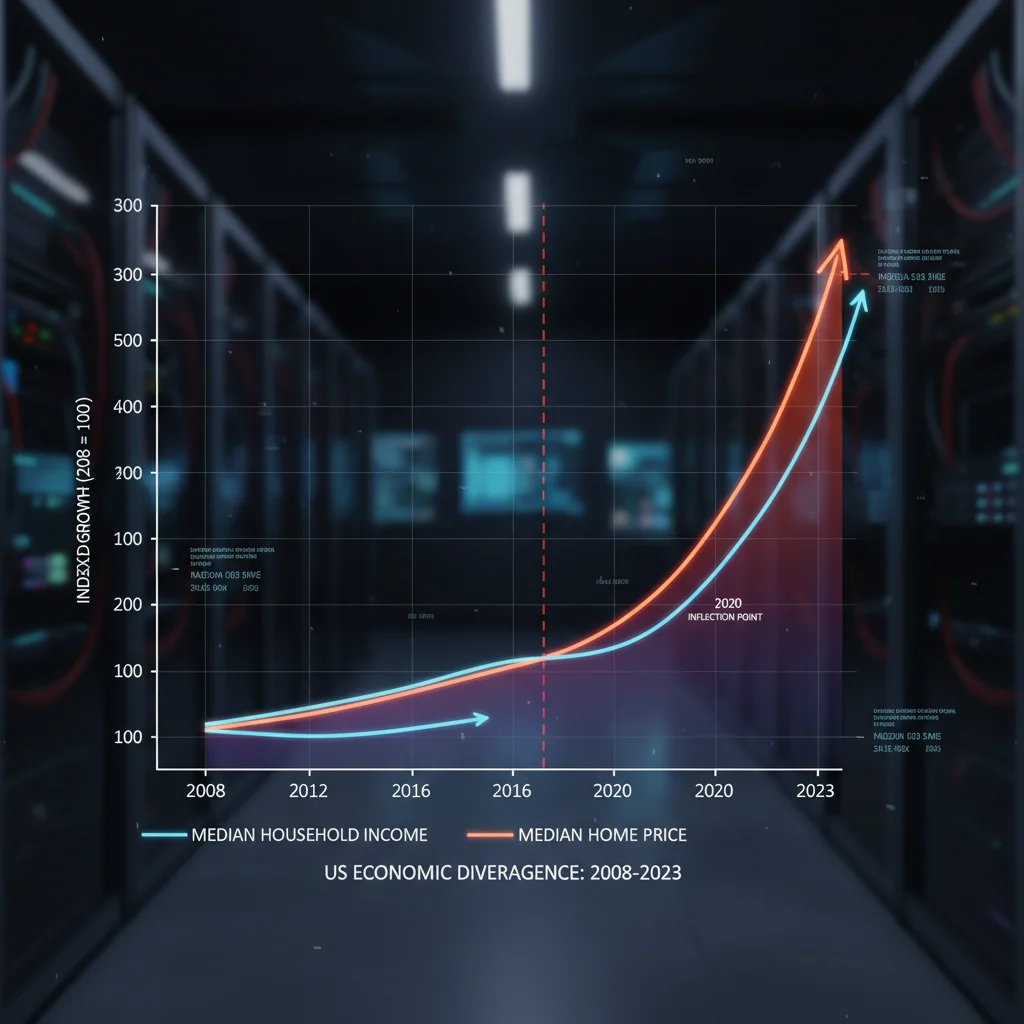

The primary drivers behind the surging age of first-time buyers are the relentless rise in housing valuations, exacerbated by limited inventory, and the sharp increase in mortgage rates following the Federal Reserve’s aggressive monetary tightening cycle beginning in 2022. Median home prices across the U.S. appreciated by approximately 45% between Q1 2020 and Q4 2023, according to the Federal Housing Finance Agency (FHFA) House Price Index. Simultaneously, the average 30-year fixed mortgage rate, which hovered near 3% in early 2021, surged past 7% in 2023, creating a dual affordability squeeze that effectively prices out younger, less financially established demographics.

This situation creates a systemic barrier to entry. For a prospective buyer earning the median household income of approximately $74,580 (as of 2023 Census data), the monthly payment required for a median-priced home—estimated near $415,000—with a 20% down payment and a 7% interest rate, consumes a disproportionately large share of disposable income. This challenge is amplified by the required down payment itself, which necessitates years, often decades, of stringent saving, particularly given the near-zero real wage growth experienced by many entry-level professionals in high-cost metro areas.

Analyzing the mortgage rate shock

The effective purchasing power erosion caused by higher rates is profound. Analysts at Goldman Sachs estimated that the increase in mortgage rates from 3% to 7% effectively reduced the maximum affordable home price for an average buyer by nearly 30% without changing the buyer’s monthly budgetary constraints. This shock has locked many potential first-time buyers into the rental market, where rents have also surged, further inhibiting their ability to save for a down payment. This cyclical trap is a key component of the worsening affordability metrics.

- Interest Rate Impact: A 4 percentage point increase in mortgage rates (3% to 7%) can double the total interest paid over the life of a 30-year loan, dramatically increasing the total cost of homeownership.

- Savings Horizon: The average time required for a first-time buyer to save the necessary 20% down payment in major coastal cities like San Francisco or New York now exceeds 15 years, according to proprietary data compiled by Moody’s Analytics.

- Debt Burden: Elevated student loan debt, which totals over $1.7 trillion nationally, often severely limits the debt-to-income ratio (DTI) required for mortgage qualification, further delaying homeownership for younger generations.

The implication for the financial system is that the risk profile of new borrowers is changing. Older first-time buyers, typically aged 40, often bring higher salaries, more established credit histories, and larger accumulated savings (potentially through inheritances or prolonged career growth) compared to their counterparts a decade ago. While this reduces immediate default risk, it signals a structural failure in the market’s ability to serve the traditional entry cohort, which is essential for housing market liquidity and generational wealth transfer.

The role of supply constraints and institutional investment

While monetary policy and high prices capture headlines, chronic undersupply remains the fundamental structural issue driving housing inflation. The U.S. has faced a severe deficit in housing construction since the 2008 financial crisis, particularly in starter homes. According to the National Association of Home Builders (NAHB), the share of new single-family homes built under 1,400 square feet—the typical starter home size—has dropped from over 40% in the 1980s to less than 10% today.

This supply shortage is compounded by local zoning restrictions (NIMBYism) that favor low-density, single-family zoning over multi-family units, especially near job centers. This artificial constraint limits the market’s ability to respond to demand, keeping prices elevated even during periods of modest economic contraction. When demand outstrips supply, the competition for available units intensifies, pushing prices beyond the reach of younger buyers who lack substantial equity from prior home sales.

Institutional buyers and market friction

A contentious factor is the increasing presence of institutional investors—such as private equity funds and REITs—in the single-family home market, particularly in high-growth Sun Belt metros. While institutional ownership remains a small percentage of the total housing stock, their impact is concentrated in the starter-home segment, where they can outbid individual buyers with cash offers. Data compiled by Redfin indicates that institutional investors accounted for roughly 28% of all single-family home purchases in certain high-demand areas in 2023.

These entities often convert purchased homes into rental properties, further shrinking the for-sale inventory and effectively transforming homeownership opportunities into long-term rental obligations. This dynamic accelerates price appreciation in the entry-level market, directly competing with the demographic cohort now averaging 40 years old.

The persistent imbalance between supply and demand, coupled with the financial power of large corporate buyers, suggests that market equilibrium will be difficult to attain without significant policy intervention aimed at easing regulatory hurdles for high-density construction and potentially regulating large-scale institutional purchases of single-family homes. The consequence is a structural widening of the wealth gap, as home equity remains the single largest source of wealth accumulation for middle-class Americans.

Macroeconomic implications for wealth and retirement

The delay in homeownership until age 40 has profound implications for long-term financial stability and macroeconomic health. Home equity is traditionally leveraged for retirement security, funding children’s education, and providing a financial safety net. By delaying this process by a decade or more, first-time buyers significantly shorten their wealth accumulation window, requiring them to save substantially more aggressively in their peak earning years just to catch up.

This demographic trend creates a ripple effect across the economy. Older first-time buyers are likely to carry larger mortgage debts later into life, potentially coinciding with or delaying their planned retirement age, placing increased pressure on social safety nets and individual financial planning. Furthermore, if the 40-year-old buyer is simultaneously paying off student loans and supporting children, the financial strain is magnified, reducing discretionary spending—a crucial component of GDP growth.

The changing landscape of household formation

Economists at the Brookings Institution highlight that delayed homeownership correlates with delayed marriage and childbearing, altering fundamental demographic patterns. The traditional economic cycle of career establishment, home purchase, and family growth is being compressed and postponed. This structural shift impacts the demand for goods and services associated with traditional family life, from furniture and appliances to educational services.

- Reduced Leverage: Fewer years of homeownership mean less time to build equity, limiting the ability to tap into home equity lines of credit (HELOCs) for major life expenses or entrepreneurial ventures.

- Retirement Funding Gap: Delaying home purchase from age 30 to 40 can result in a loss of over $150,000 in potential equity accumulation over a 30-year period, assuming historical average appreciation rates of 3.5% annually.

- Intergenerational Wealth Transfer: Parents who struggle to secure housing often cannot financially assist their children, perpetuating the affordability crisis across generations and exacerbating socioeconomic inequality.

The challenge for policymakers is recognizing that this is not merely a cyclical downturn but a deeper structural issue requiring multifaceted solutions. The current market environment favors those with existing equity or substantial inherited wealth, creating a bifurcated economy where housing access is increasingly determined by generational advantage, not earned income.

The affordability index: A metric in distress

The Housing Affordability Index (HAI), tracked by organizations like NAR, measures whether a median-income family can qualify for a mortgage on a median-priced home. Historically, an index value of 100 means the average family has exactly enough income to qualify. Recent data shows the national HAI consistently dipping below 100 in many major metropolitan areas throughout 2023 and 2024, sometimes falling as low as 85 in markets like Austin, Texas, and Boise, Idaho, which saw rapid price gains during the pandemic.

This declining index confirms that the median American family simply cannot afford the median American home under current interest rate conditions. The index assumes a 20% down payment, a threshold increasingly unattainable for younger buyers. Furthermore, the index often fails to adequately capture the rising costs of property taxes, insurance premiums (especially in climate-vulnerable regions), and maintenance, all of which contribute to the total cost of ownership (TCO).

Policy responses and market friction

Government intervention aimed at increasing affordability often focuses on demand-side subsidies, such as first-time buyer tax credits or down payment assistance programs (DPAs). While politically popular, these measures often fail to address the fundamental supply shortage. By injecting more money into a constrained market, DPAs can inadvertently exacerbate price inflation, effectively transferring taxpayer funds directly to sellers without improving the underlying affordability structure.

A more effective long-term strategy, according to urban economic policy experts at the Cato Institute, would involve aggressive supply-side reforms: relaxing restrictive zoning laws (such as minimum lot sizes and height restrictions) and streamlining permitting processes. However, these changes face significant political resistance at the local level, making rapid implementation unlikely.

The ongoing affordability crisis, signaled clearly by the average buyer age of 40, demonstrates that current policy levers are insufficient to counteract the powerful economic forces of high demand, tight supply, and restrictive monetary policy. Until the supply gap is meaningfully closed—estimated by some analysts to require the construction of over 5 million additional units over the next decade—prices will likely remain elevated, keeping the entry threshold high.

The shift in financial planning for the 40-year-old buyer

For the typical first-time buyer at age 40, the financial planning strategy must be significantly more robust than for the 30-year-old buyer of the previous generation. These older buyers often prioritize stability and lower monthly payments over maximum appreciation potential, leading to a greater reliance on adjustable-rate mortgages (ARMs) or longer-term fixed products, such as 40-year mortgages, to manage cash flow.

Financial advisors are increasingly recommending that these buyers aggressively reduce other forms of debt, particularly high-interest consumer debt, before attempting a home purchase. The increased scrutiny on DTI ratios means that every dollar of outstanding debt significantly impairs borrowing capacity. Furthermore, the reliance on non-traditional sources of down payment funding, such as gifts from family or early withdrawals from retirement accounts (401(k) loans), is becoming more common, introducing additional financial risks.

Navigating the high-rate environment

The current high-rate environment necessitates a different approach to mortgage selection. While 30-year fixed mortgages remain the standard, the 40-year mortgage, which features significantly lower required monthly payments but higher overall interest costs, is gaining traction. This decision requires careful analysis, as the trade-off is often sacrificing future financial flexibility for immediate cash flow relief.

Market participants are also observing a growing trend toward smaller, less desirable properties or properties located further from major employment hubs (the ‘drive until you qualify’ phenomenon). While these compromises facilitate entry into homeownership, they often negate the benefits of shorter commutes and proximity to amenities, impacting quality of life and potentially limiting future property appreciation.

The crucial insight for the 40-year-old buyer is the need for a larger financial runway. They must account for the accelerated need to save for retirement, given the shorter time horizon, while simultaneously managing a large mortgage debt. This generation is effectively navigating a double burden of delayed entry into the housing market and the looming necessity of retirement security.

Future outlook and monitoring indicators

Looking forward, the trajectory of the Housing Affordability Crisis will be dictated primarily by two key macroeconomic indicators: the Federal Reserve’s management of the federal funds rate and the pace of new housing supply additions. Analysts widely agree that any material improvement in affordability hinges on a sustained drop in the 30-year fixed mortgage rate back toward the 5% range, which would require the central bank to signal and execute several rate cuts.

However, the persistence of core inflation above the Fed’s 2% target means that significant rate relief is unlikely in the immediate term (Q4 2024/Q1 2025). This suggests that housing costs will remain high, and the average age of the first-time buyer may continue to creep upward.

Key indicators to watch

Investors and prospective buyers should closely monitor several factors that signal potential shifts in market dynamics:

- Existing Home Inventory Levels: A sustained increase in the months’ supply of inventory (above 6 months is considered balanced) would signal easing pricing pressure. Currently, inventory remains historically low at around 3.5 months nationally.

- Homebuilder Sentiment (NAHB Index): This index reflects confidence in the new construction market. A persistent rise indicates increased willingness to build, particularly smaller, more affordable units.

- Fed Funds Rate Trajectory: Any definitive forward guidance from the Federal Open Market Committee (FOMC) regarding sustained rate cuts will immediately impact mortgage rates and buyer demand.

The structural challenges—zoning restrictions, labor shortages in construction, and the high cost of materials—mean that supply relief will be slow. Therefore, while cyclical relief from lower interest rates may eventually come, the fundamental problem of generational housing access will persist unless significant non-monetary policy actions are taken to facilitate new, dense construction in desirable areas. The market continues to punish those who have not yet established housing equity, reinforcing a critical economic divide.

| Key Factor/Metric | Market Implication/Analysis |

|---|---|

| Average First-Time Buyer Age | Increase to 40 years old signals severe delay in wealth accumulation and household formation, impacting long-term retirement planning. |

| 30-Year Fixed Mortgage Rate | Rates near 7% (as of Q3 2024) reduce buyer purchasing power by nearly 30% compared to 2021 levels, tightening DTI constraints. |

| Housing Affordability Index (HAI) | Dipping below 100 in many metros confirms median income earners cannot afford median-priced homes without financial strain. |

| Housing Supply (Months) | Stuck below 4 months, indicating critical inventory shortage that sustains upward pressure on prices, overriding interest rate effects. |

Frequently Asked Questions about Housing Affordability

Older first-time buyers typically enter the market with more capital but less time to build equity, leading to lower transaction volumes in the entry-level segment. This reduces market liquidity and concentrates demand in higher-priced segments, slowing the traditional progression of housing market cycles.

The primary constraints are the rapid appreciation of home prices, which outpaced wage growth by 2:1 in the last five years, and the burden of student loan debt exceeding $1.7 trillion. These factors severely restrict the ability to accumulate the necessary 20% down payment and meet stringent DTI requirements.

ARMs can offer lower initial payments, providing immediate cash flow relief, which is attractive to older buyers with high immediate expenses. However, they introduce significant interest rate risk should rates reset higher, making them suitable only for those expecting substantial income growth or planning to sell or refinance within the initial fixed period.

Fed rate cuts would lower Treasury yields, subsequently reducing mortgage rates. A drop of 100 basis points in mortgage rates could boost buyer purchasing power by an estimated 10%. However, this relief could be offset by increased competition and renewed price appreciation if supply remains tight.

Restrictive zoning, such as mandatory minimum lot sizes and bans on multi-family units, artificially constrains the supply of high-density, affordable housing near job centers. This policy friction prevents developers from creating the necessary inventory to meet demand, directly driving up costs for all housing types.

The bottom line: A structural economic challenge

The data confirming that the average first-time buyer is now 40 years old is more than a statistic; it is an alarm bell signaling a severe structural imbalance in the U.S. economy. The convergence of restrictive monetary policy, chronic undersupply stemming from post-2008 construction deficits, and localized zoning hurdles has created a formidable barrier to entry for an entire generation. While the Federal Reserve holds the key to cyclical relief through interest rate adjustments, the fundamental solution lies in supply-side reform. Investors should monitor homebuilder activity and regional zoning shifts, as these long-term indicators will ultimately determine the pace of housing market normalization. Until then, the housing market will remain bifurcated, favoring those with existing equity and substantial capital, and continuing to strain the financial trajectories of middle-aged newcomers.