Gen Z Credit Card Usage Surpasses Debit: Financial Shift Alert

The accelerated preference for credit utilization among Gen Z consumers, exceeding debit transaction volumes for the first time, reflects strategic responses to persistent inflation and the aggressive marketing of credit rewards, compelling financial institutions to reassess delinquency models.

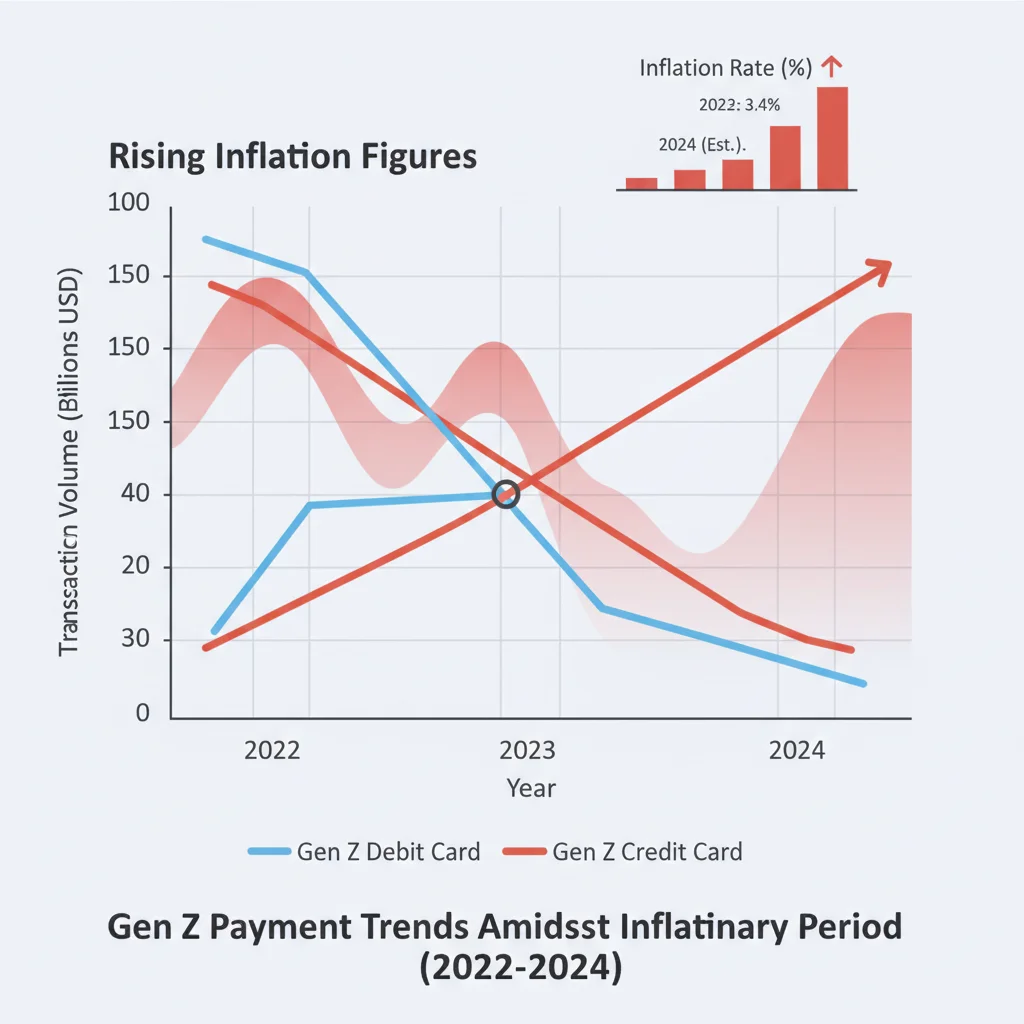

Recent proprietary data reveals a pivotal moment in American consumer finance: Gen Z credit card usage surpasses debit: Financial Behavior Shift Alert. This finding, based on aggregated transaction volumes through Q3 2024, signals a fundamental change in how the youngest working generation manages daily liquidity, moving away from immediate debit drawdown toward revolving credit. This behavioral pivot carries profound implications for the structure of consumer debt, the profitability models of issuing banks, and the overall macroeconomic resilience of the US household sector.

The macroeconomic drivers fueling the credit shift

The abrupt acceleration in Gen Z credit utilization is not random; it is deeply interwoven with current macroeconomic realities. Persistent inflation, which peaked near 9.1% in mid-2022 and remains elevated above the Federal Reserve’s 2% target, has significantly eroded the purchasing power of entry-level wages. For many in the 18-to-27 age demographic, credit has transitioned from a tool for convenience or building a credit history into a necessary buffer against rising costs of essentials like rent and groceries. This is a critical distinction from prior generations, who typically used credit primarily for large, discretionary purchases.

Data from the Federal Reserve Bank of New York indicates that total consumer debt for borrowers under 30 years old has grown by approximately 15% year-over-year as of the third quarter of 2024, with credit card balances accounting for the largest share of that increase. This rate of growth significantly outpaces that observed in older cohorts. The ‘so what’ for financial markets is clear: this generation is accumulating debt earlier in their financial lifecycle, potentially magnifying future credit default risks, especially as interest rates remain elevated following the Fed’s tightening cycle.

The impact of high interest rates on revolving debt

The Federal Funds Rate, maintained within a target range of 5.25% to 5.50% since mid-2023, translates directly into high Annual Percentage Rates (APRs) for credit cards, often exceeding 20%. While high APRs benefit issuers, they rapidly increase the cost of maintaining revolving debt for consumers. Gen Z consumers, many of whom are navigating their first serious encounter with high-rate debt, face a steep learning curve regarding minimum payments and compounding interest.

- Interest Rate Exposure: The average credit card APR hit a record high of 21.47% in September 2024, according to central bank data, making reliance on credit exceptionally costly.

- Real Income Stagnation: Despite nominal wage growth, real wages (adjusted for inflation) have struggled to keep pace with the cost of living, forcing many to use credit to bridge monthly budget gaps.

- Student Loan Repayments: The resumption of federal student loan payments in late 2023 further strained Gen Z budgets, diverting cash flow that might otherwise have been used for day-to-day spending towards mandatory debt service, thereby increasing reliance on credit cards for discretionary spending.

The confluence of inflation and high interest rates creates a precarious financial environment. If economic conditions deteriorate or the labor market softens, this rapidly accumulated Gen Z credit usage could turn into a significant drag on consumer spending, potentially leading to higher delinquency rates and charge-offs for credit card issuers over the next 18 to 24 months. Analysts at JPMorgan Chase & Co. have flagged the under-30 demographic as a key risk area to monitor for early signs of consumer financial stress.

Credit rewards and the strategic consumer choice

Beyond necessity, a strategic element drives the preference for credit over debit. Gen Z is demonstrably more rewards-sensitive than Millennials or Gen X were at the same age. The proliferation of sophisticated mobile banking apps and financial literacy content on platforms like TikTok and YouTube has empowered this cohort to view credit cards not just as debt instruments but as tools for optimization, specifically leveraging sign-up bonuses, cash-back programs, and travel points.

Financial technology (FinTech) companies and established banks have aggressively marketed credit products tailored to this demographic, emphasizing digital integration, seamless rewards redemption, and personalized spending analytics. This has normalized the concept of using credit for all transactions to maximize rewards, with the intent (though not always the execution) of paying off the balance in full each month. This strategy, often referred to as ‘credit cycling,’ requires stringent financial discipline, which, if lacking, quickly leads to accrued interest that negates any reward benefits.

The allure of modern credit perks

The modern credit card ecosystem offers immediate gratification and tangible value that debit cards simply cannot match. This is particularly true for younger consumers focused on maximizing every dollar spent. The competitive landscape among issuers has driven up the value proposition, specifically targeting high-frequency, low-value transactions typical of Gen Z spending patterns.

- Cash-Back Optimization: Many Gen Z consumers are adept at rotating cards to maximize 5% or 6% cash-back categories on groceries, streaming services, or gas.

- Credit Score Building: The awareness around credit scores and their importance for future large purchases (mortgages, car loans) is higher than in previous generations, driving proactive credit utilization.

- Purchase Protection: Credit cards offer enhanced fraud protection and extended warranty benefits, a subtle but increasingly valued feature over standard debit card protection.

This calculated use of credit represents a duality: strategic optimization for the disciplined few versus dangerous overextension for the majority. While the rewards are attractive, the underlying data confirms that a growing portion of Gen Z is carrying a balance, meaning the cost of the rewards is often far outweighed by the interest paid. This behavioral nuance is what makes the current surge in Gen Z credit usage a point of concern for regulatory bodies and credit risk officers.

Implications for financial institutions and credit risk models

The dramatic shift in Gen Z’s payment preference necessitates a re-evaluation of traditional credit risk models. Historically, young consumers represented a lower volume of revolving debt, making their default risk statistically manageable. However, the sheer volume of new credit accounts opened by Gen Z, coupled with the rising average balance, changes the risk profile significantly. Credit issuers must now grapple with a large cohort that is highly levered, often without the established income stability of older generations.

Credit reporting agencies are closely monitoring early-stage delinquency rates (30-59 days past due) among this demographic. While overall credit performance remains relatively robust, early indicators suggest a slight but persistent uptick in these early-stage delinquencies for Gen Z compared to pre-pandemic levels. This is often an early warning sign of broader financial distress. Banks are adjusting their underwriting criteria, focusing more heavily on debt-to-income (DTI) ratios and less on traditional credit history length, which is naturally short for this group.

The paradox of early credit access

The ease with which Gen Z can access credit today—often facilitated by digital-only application processes and pre-approved offers—is both enabling and risky. While early access helps establish credit history, it also provides an opportunity for overextension before fundamental financial management skills are fully developed. Financial institutions face a trade-off: capture market share now or maintain conservative risk exposure.

- Increased Charge-Off Reserves: Major credit card issuers like Capital One and Discover are likely increasing their loan loss provisions, anticipating higher future charge-off rates stemming from elevated consumer debt exposure, particularly in the younger demographic.

- Data-Driven Underwriting: Issuers are relying heavily on alternative data sources, such as cash flow analysis via open banking protocols, to gain a more holistic view of a Gen Z applicant’s financial stability beyond the traditional FICO score. This attempts to mitigate the risk posed by the rapid increase in Gen Z credit usage.

- Regulatory Scrutiny: Regulators, including the Consumer Financial Protection Bureau (CFPB), are intensifying scrutiny on credit card marketing practices targeting young adults, particularly concerning transparency around interest rates and fees.

The immediate consequence for financial institutions is the need for enhanced portfolio stress testing. A moderate recession could expose substantial vulnerabilities if the current trend of high Gen Z credit usage carrying balances continues unchecked. The profitability derived from high APRs must be weighed against the potential cost of future defaults.

Buy Now, Pay Later (BNPL) and the evolving debt landscape

The discussion of Gen Z’s debt habits is incomplete without addressing the significant role of Buy Now, Pay Later (BNPL) services. While technically not traditional credit cards, BNPL platforms often function as short-term, interest-free installment loans, primarily used by Gen Z for retail purchases. The adoption of BNPL has conditioned this generation to embrace debt as a routine transaction mechanism, blurring the line between immediate spending and deferred payment.

BNPL transactions, which often bypass traditional credit checks and do not always show up on standard credit reports, mask the true extent of Gen Z’s leverage. If a consumer simultaneously utilizes high-interest credit cards for necessities and multiple BNPL services for discretionary items, the cumulative effect can be overwhelming. Experian data suggests that nearly 40% of Gen Z consumers have used BNPL services in the past six months, a rate significantly higher than older cohorts.

The integration challenge for credit reporting

The integration of BNPL data into standard credit reporting remains fragmented. This lack of comprehensive visibility creates systemic risk, as lenders struggle to accurately assess the total debt obligations of applicants relying heavily on BNPL structures. This ‘invisible debt’ contributes to the overall financial instability of the cohort and complicates risk management for traditional creditors.

The growing overlap between heavy credit card use and frequent BNPL utilization suggests a generation that is highly comfortable with leverage, perhaps dangerously so. Economists at the Brookings Institution suggest that this comfort stems from witnessing years of low interest rates and easy access to capital, creating a potentially misplaced sense of financial security. The shift to credit card dominance over debit is merely the most visible symptom of a broader cultural acceptance of consumer debt as a primary financial tool.

The long-term impact on financial independence and wealth accumulation

The trajectory of early-life debt accumulation profoundly affects long-term financial independence and wealth accumulation. High interest payments on revolving credit reduce the capacity for saving and investing, delaying key milestones such as purchasing a home or funding retirement accounts. If Gen Z enters their 30s with substantial, high-cost credit card debt, their ability to participate in wealth-building markets, like equities or real estate, will be severely curtailed.

The compounding effect of high APRs means that a significant portion of their income is spent servicing non-productive debt rather than generating returns through investments. For instance, carrying an average credit card balance of $4,000 at a 21% APR could cost over $800 annually in interest alone, funds that could otherwise be directed towards a Roth IRA or a high-yield savings account. This is the opportunity cost inherent in high Gen Z credit usage.

Bridging the financial literacy gap

While Gen Z is digitally savvy, a critical gap exists in practical financial literacy, particularly concerning the mechanics of compounding interest and the strategic use of credit limits. While they understand credit scores, they often underestimate the financial penalty associated with carrying a balance. Educational initiatives from employers and financial institutions are becoming essential to mitigate future financial crises.

- Budgeting Tools: Demand is surging for digital tools that automatically categorize spending and project interest costs based on current balances, providing real-time feedback on debt management.

- Credit Counseling: Early intervention and access to non-profit credit counseling services are vital for those who quickly find themselves overwhelmed by the high cost of revolving debt.

- Savings Rate Correlation: Studies show a strong inverse correlation between high credit card balances and low personal savings rates, reinforcing the drag on long-term wealth creation for this cohort.

The financial services industry must pivot from simply offering credit products to integrating robust financial education within those products. The long-term stability of the consumer credit market depends on ensuring that Gen Z uses credit responsibly, rather than viewing it as an unlimited extension of their current income.

Forecasting future credit market stabilization

Forecasting the future trajectory of Gen Z credit usage requires analyzing several key economic indicators. Stabilization in the credit market hinges on two primary factors: a sustained cooling of inflation, which would alleviate pressure on real income, and a potential pivot by the Federal Reserve towards rate cuts, which would reduce the cost of existing revolving debt.

Analysts at Moody’s Analytics project that if inflation returns to the Fed’s target by mid-2025 and unemployment remains below 4.5%, the stress on Gen Z consumer finances may moderate. However, a ‘higher for longer’ interest rate environment, coupled with a slowdown in the job market, presents a significant downside risk, potentially pushing delinquency rates for the under-30 demographic past 10%—a level not seen since the Great Financial Crisis.

Key indicators to monitor

Investors and financial risk managers should focus on specific metrics that provide early insight into the health of this consumer segment. These indicators serve as leading signals for broader consumer credit performance.

- Subprime Auto Loan Defaults: Often the first indicator of financial stress in younger borrowers, any sharp increase here suggests cash flow problems extending beyond credit cards.

- Revolving Utilization Rates: Monitoring the percentage of available credit being used by Gen Z. A sustained climb above 30% indicates reliance on credit for basic liquidity needs.

- Wage Growth vs. CPI: Real wage growth that consistently exceeds the Consumer Price Index (CPI) is necessary to reduce the need for credit as an inflationary buffer.

The current shift in payment behavior marks a critical transition point. While credit cards offer undeniable benefits, the speed and scale of Gen Z’s adoption, driven partly by economic necessity, introduce a layer of systemic risk that requires careful monitoring. The financial stability of this generation is inextricably linked to the stability of the entire consumer debt market over the next decade.

| Key Financial Metric | Market Implication/Analysis |

|---|---|

| Gen Z Credit Balance Growth (YoY) | Increased by 15% in Q3 2024, signaling high leverage accumulation early in the financial lifecycle, increasing issuer risk exposure. |

| Average Credit Card APR | Exceeds 21%, maximizing the cost of revolving debt for Gen Z borrowers, potentially negating the value of rewards programs. |

| BNPL Adoption Rate (Gen Z) | Used by nearly 40% of the cohort, creating ‘invisible debt’ that complicates traditional credit risk assessment and total debt-to-income modeling. |

| Early-Stage Delinquency (30-59 days) | Showing a persistent uptick, serving as a leading indicator of cash flow stress and potential future charge-offs for credit card portfolios. |

Frequently Asked Questions about Gen Z Credit Usage

The primary drivers are macroeconomic: sustained inflation erodes purchasing power, forcing reliance on credit for liquidity. Additionally, aggressive marketing of credit card rewards and the desire to quickly establish a strong credit score incentivize credit utilization over debit transactions.

High utilization combined with high APRs (over 21%) leads to significant interest payments, diverting capital away from crucial wealth-building activities like saving for retirement or investing in equities. This delays financial independence and magnifies debt servicing costs.

Yes. Issuers are increasing loan loss provisions and refining underwriting, focusing more on real-time cash flow and debt-to-income ratios instead of relying solely on short, traditional credit histories. The goal is to better price the heightened risk of early leverage.

BNPL normalizes deferred payment, conditioning Gen Z to use debt frequently. Since BNPL often isn’t fully reported, it creates ‘invisible debt’ that complicates lenders’ ability to accurately assess total financial obligations, potentially leading to overextension.

Consumers should prioritize paying off high-APR balances monthly to avoid interest charges. Monitoring revolving credit utilization (keeping it below 30%) and tracking real wage growth against inflation are crucial metrics for maintaining financial control and avoiding debt spirals.

The bottom line

The definitive crossover where Gen Z credit usage surpasses debit marks an inflection point in US consumer finance, driven by a complex interplay of economic necessity and strategic rewards maximization. While the rewards environment encourages credit use, the persistent high inflation and elevated interest rates transform that convenience into a costly burden for those carrying balances. Financial institutions must react proactively, not only by adjusting risk models and increasing loss reserves but also by investing in integrated financial education to foster responsible credit stewardship within this highly leveraged cohort. The long-term macroeconomic stability of the consumer sector will increasingly depend on Gen Z’s ability to manage this early surge in debt, a factor that market participants and policymakers must continue to monitor closely as we move into 2025.