US Consumer Debt at $18.33T: Overspending Risk into 2026

The unprecedented rise in total US consumer debt to $18.33 trillion, driven primarily by mortgages and credit card utilization, suggests that American households are leveraging future earnings to maintain current consumption, posing a significant solvency risk as borrowing costs remain elevated.

The latest data point, revealing that total consumer debt overspending risk has propelled the aggregate figure to $18.33 trillion, establishes a critical inflection point for the American economy. This historic level of leverage—a substantial increase from pre-pandemic norms—forces financial analysts and policymakers to scrutinize whether this accumulation reflects robust economic confidence or a deeper reliance on credit to offset persistent inflation and stagnant real wage growth. The trajectory of this debt, particularly its composition and the rising delinquency rates in non-housing consumer segments, dictates the potential severity of the economic landing as the Federal Reserve navigates the path toward 2026.

The anatomy of $18.33 trillion: Dissecting the debt components

Understanding the $18.33 trillion figure requires a granular examination of its constituent parts. According to the Federal Reserve Bank of New York’s Quarterly Report on Household Debt and Credit, the bulk of this liability remains concentrated in housing-related debt, primarily mortgages. However, the alarming trend lies in the non-housing segments, specifically credit card balances, auto loans, and student loans, which collectively demonstrate accelerating growth and deteriorating credit quality.

While mortgage debt naturally comprises the largest share, reflecting housing price appreciation and transaction volume, analysts are increasingly focused on revolving credit. Credit card balances have surged past previous peaks, often exceeding $1.2 trillion, driven by consumers using plastic to bridge the gap between necessary expenditures and income. This reliance is particularly pronounced among younger demographics and lower-income cohorts, who lack the savings buffer to absorb inflation-driven costs. This pattern suggests a shift from discretionary spending to reliance on high-interest credit for essential living expenses, a classic indicator of financial stress.

The resurgence of credit card and auto loan delinquencies

A key barometer of household financial health is the rate of transition into delinquency. As of the most recent reporting period, the percentage of credit card balances transitioning into 90-day delinquency status has climbed above 8%, significantly surpassing the average observed during the economic expansion phase of the mid-2010s. Auto loan delinquencies are also rising sharply, particularly among subprime borrowers. This rise is not merely a normalization post-pandemic but a structural signal of consumers struggling with higher payments coinciding with elevated interest rates.

- Subprime Auto Loans: Delinquency rates in this segment often serve as an early warning for broader consumer stress, currently showing levels not seen since the Global Financial Crisis (GFC), according to data compiled by Fitch Ratings.

- Revolving Credit Interest Rates: The average annual percentage rate (APR) on credit cards has persistently hovered near 21%, dramatically increasing the minimum payment burden and reducing the speed at which principal balances can be retired, trapping households in debt cycles.

- The Student Loan Factor: The resumption of mandatory student loan payments has reintroduced a significant fixed cost for millions of households, diverting income away from other debt repayment or savings, thereby exacerbating the overall debt strain.

The implication for the broader financial system is two-fold: increased charge-offs for lenders and a dampening effect on future consumer spending as debt servicing consumes a larger share of disposable income. This dynamic is central to evaluating the sustainability of the current consumption-led economic growth model heading into 2026.

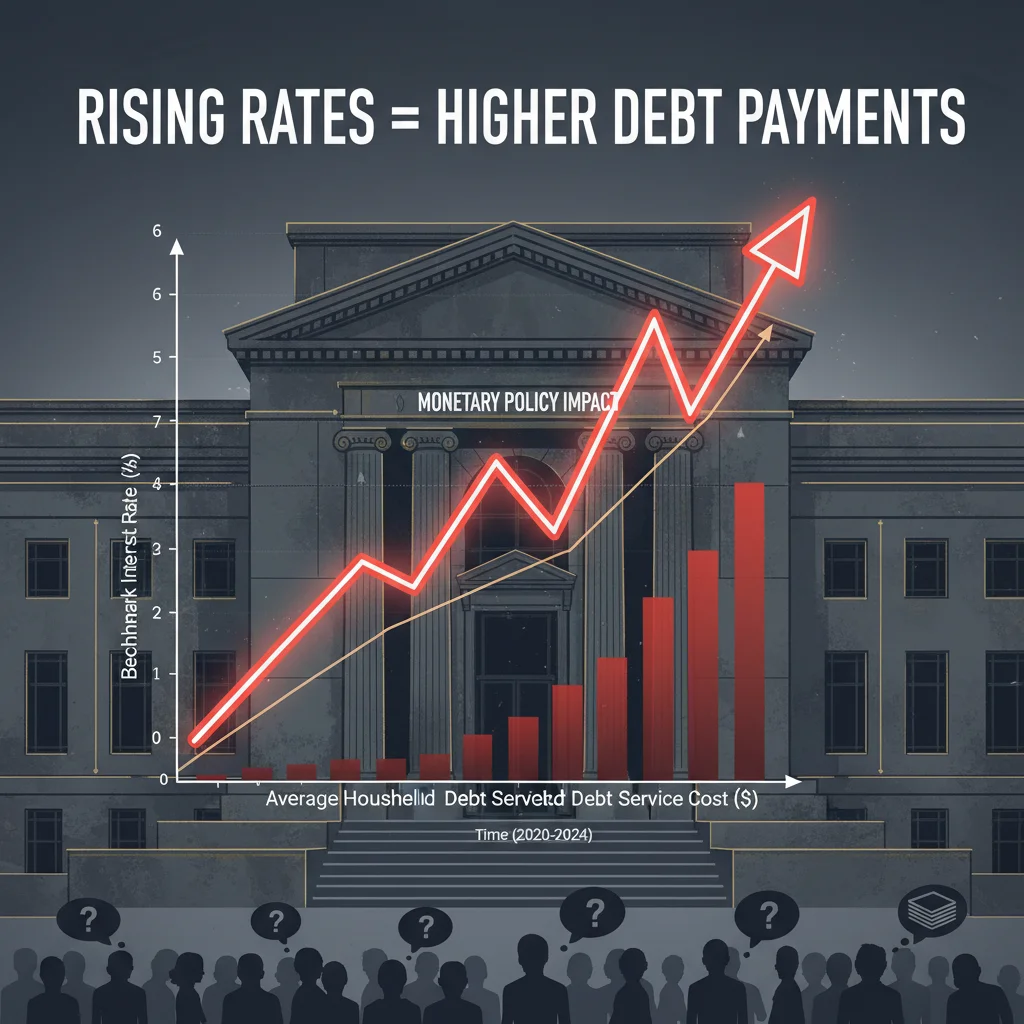

Inflation, interest rates, and the debt-income ratio squeeze

The macroeconomic environment of 2024 and 2025 has been a potent catalyst for the debt escalation. The Federal Reserve’s aggressive tightening cycle, initiated in early 2022 to combat decades-high inflation, successfully raised the benchmark federal funds rate. While effective in cooling core inflation, this policy simultaneously pushed borrowing costs across the spectrum—from 30-year mortgages to variable-rate credit cards—to multi-decade highs. For households carrying substantial debt, this translates directly into higher debt service payments.

Persistent core inflation, even as headline figures moderate, continues to erode the purchasing power of the dollar. The cost of essential goods and services, including housing (rents), food, and energy, remains elevated. Wages, while growing nominally, have often failed to keep pace with the cumulative inflationary effects observed since 2021. This confluence of high costs and high borrowing rates creates a severe squeeze on household finances, compelling many to rely on credit for necessities, inadvertently contributing to the $18.33 trillion total.

Debt service ratios signal vulnerability

The household debt service ratio (DSR), which measures the ratio of total required household debt payments to disposable personal income, is a critical metric monitored by the Fed. While the overall DSR remains below the peaks seen before the GFC, the trajectory is upward, and more importantly, the distribution of this burden is highly uneven. Data indicates that the lowest two income quintiles are experiencing DSRs that are disproportionately high, indicating acute vulnerability to economic shocks or job loss.

Economists at Goldman Sachs note that the rising DSR among lower-income groups suggests that a significant portion of the population is functionally overleveraged, even if the national average appears manageable. This hidden fragility means that even a modest downturn in the labor market could trigger a sharp spike in defaults, particularly in the unsecured consumer loan sector.

Furthermore, the shift toward higher-rate debt (credit cards and personal loans) rather than lower-rate secured debt (mortgages) means that the interest component of the debt service is consuming a larger share of income. This non-productive use of capital constrains future economic activity and investment, creating a drag on potential GDP growth in 2026.

The verdict on overspending: Necessity vs. exuberance

The central question posed by the $18.33 trillion debt figure is whether Americans are genuinely overspending, or if debt accumulation is a function of economic necessity. The answer, based on the segmentation of the debt, appears to be a combination of both, but with necessity playing a larger role for the average household.

Exuberance is evident in certain sectors. The high volume of auto loans, often for expensive vehicles, and the sustained growth in high-end retail spending financed by credit, suggests that some upper-income segments are engaging in discretionary overspending. However, the sharp rise in credit card utilization for daily expenses among middle and lower-income families points squarely to inflationary necessity. These households are not buying luxury items; they are covering groceries, utilities, and medical costs that have outpaced income gains.

The role of depleted pandemic savings

During 2020 and 2021, many American households accumulated excess savings due to fiscal stimulus and reduced spending opportunities. This buffer provided resilience against inflation initially. However, reports from the Federal Reserve indicate that these excess savings have been largely depleted across all but the wealthiest cohorts. Without this financial cushion, households are forced to revert to credit when faced with unexpected expenses or persistent inflationary pressures.

The depletion of savings acts as a direct link between inflation and debt accumulation. When a household faces a $500 car repair and lacks sufficient liquid savings, the immediate solution is often a credit card, further contributing to the aggregate debt total. This mechanism transforms temporary inflationary shocks into long-term debt obligations at high interest rates.

- Savings Rate Decline: The personal saving rate has fallen significantly from its pandemic highs, settling near pre-COVID levels, but doing so in an environment of much higher prices and borrowing costs.

- Emergency Fund Shortfalls: Surveys suggest that a majority of Americans would struggle to cover a $1,000 emergency expense without resorting to debt, highlighting the underlying fragility despite strong headline employment figures.

- The Wealth Effect vs. Debt Effect: While housing and equity values have increased for asset holders, the majority of the population feels the immediate weight of debt payments more acutely than the abstract benefit of rising asset values.

Therefore, while some overspending exists, the structural economic pressures of inflation and high rates are compelling debt accumulation for a substantial portion of the population, making the $18.33 trillion figure a complex indicator of both choice and constraint.

Market implications for 2026: Economic headwinds and banking exposure

The elevated consumer debt level carries significant implications for the economic outlook of 2026. High debt servicing costs act as a natural brake on economic activity. Every dollar spent on interest payments is a dollar not spent on new goods, services, or investments. This effect translates into slower aggregate demand growth, potentially pushing the economy toward a recessionary environment, even if soft-landing conditions are currently projected.

For the financial sector, the risk is concentrated in portfolios exposed to unsecured consumer credit. While major money center banks generally maintain robust capital buffers and diversified portfolios, regional banks with higher concentrations of auto loans and credit card receivables face increased pressure from rising charge-offs. Historically, increases in consumer debt delinquency precede broader economic slowdowns by three to six quarters.

Analyst divergence on systemic risk

There is a notable divergence among analysts regarding the systemic risk posed by the $18.33 trillion debt load. Analysts at JPMorgan Chase suggest that while delinquencies are rising, the overall leverage compared to income (LTV) remains manageable, especially when accounting for the robust equity in the housing market. They argue that the US banking system is far better capitalized than before 2008, mitigating systemic collapse risk.

Conversely, economists at the Brookings Institution express concern that the rapid velocity of debt growth, combined with the concentration of high-rate debt among vulnerable borrowers, creates significant cyclical risk. They project that if the unemployment rate rises by even 100 basis points, the resulting amplification of defaults could necessitate a sharp tightening of lending standards, creating a credit crunch that further slows the economy.

The market is closely monitoring the performance of asset-backed securities (ABS) tied to auto loans and credit card debt. Any significant deterioration in these markets would signal a crisis of confidence in consumer solvency, potentially impacting broader credit markets and corporate bond issuance. The path to 2026 will be defined by the delicate balance between stable employment and the consumer’s capacity to manage this burgeoning debt pile.

Policy responses and potential interventions

Given the scale of the debt, policymakers face a complicated challenge. Monetary policy, controlled by the Federal Reserve, is primarily focused on price stability. While a cut in the federal funds rate would alleviate some debt pressure by lowering variable loan costs, the Fed is constrained by the need to ensure inflation is firmly anchored at the 2% target. Premature rate cuts could reignite inflation, further undermining purchasing power and forcing consumers back onto credit.

Fiscal policy options, though politically challenging, could include targeted relief programs. Direct fiscal aid, however, risks being inflationary. More effective, less inflationary interventions might involve regulatory changes aimed at the high-interest credit market or measures to support real wage growth.

Regulatory scrutiny on credit card pricing

- Durbin Amendment Expansion: Legislative proposals have surfaced to expand regulations on interchange fees and credit card interest rate caps, aiming to reduce the cost of credit for consumers, thereby freeing up disposable income for principal repayment.

- Student Loan Forgiveness/Refinancing: Ongoing debates surrounding targeted student loan relief could offer immediate financial breathing room for millions, although the long-term economic efficacy and fairness of such measures remain hotly contested.

- Focus on Financial Literacy: Regulatory bodies like the Consumer Financial Protection Bureau (CFPB) are emphasizing increased disclosure and transparency requirements for high-cost debt products, aiming to empower consumers to make informed choices and avoid predatory lending practices.

The critical policy balancing act is avoiding a moral hazard—where interventions encourage future imprudence—while preventing a systemic economic contraction due to widespread consumer insolvency. The path forward requires surgical precision rather than broad, blunt policy instruments.

Strategies for navigating the high-debt, high-rate environment

For investors and financial managers, the $18.33 trillion consumer debt figure dictates caution and strategic positioning. The sectors most sensitive to squeezed consumer spending—non-essential retail, discretionary travel, and certain consumer technology—may face revenue headwinds in 2026 as households prioritize debt service over purchases. Conversely, companies providing essential, low-cost services or those specializing in debt management and recovery might see increased demand.

Prudent investors are advised to focus on corporations with resilient balance sheets, strong free cash flow generation, and high pricing power, which allows them to pass on inflationary costs without significantly impacting demand. The high yield bond market, particularly those bonds issued by companies heavily reliant on consumer spending, warrants careful risk assessment due to potential default risks downstream from consumer insolvency.

Portfolio adjustments for consumer solvency risk

Managing risk involves acknowledging the possibility of a hard landing driven by consumer deleveraging. A defensive allocation might favor sectors less exposed to the domestic consumer cycle, such as healthcare, certain utilities, and established technology firms with global revenue streams. Additionally, fixed-income investors may seek higher credit quality, moving away from lower-rated corporate debt that is highly sensitive to economic contraction.

For individual Americans, the emphasis must shift from debt accumulation to aggressive principal reduction, particularly on high-interest credit card debt. The high-rate environment makes minimum payments economically punitive. Financial advisors universally recommend prioritizing debt with APRs exceeding 15% before maximizing investments in lower-yielding instruments.

The accumulation of consumer debt overspending risk to $18.33 trillion is not merely a headline; it is a structural challenge that will shape monetary policy decisions and corporate earnings projections through 2026. The coming quarters will test the resilience of the American consumer and the stability of the financial system against this historic level of leverage.

| Key Factor/Metric | Market Implication/Analysis |

|---|---|

| Total Debt Level ($18.33T) | Represents a historic peak, increasing the overall sensitivity of the economy to interest rate changes and unemployment spikes. |

| Credit Card APR (Average ~21%) | High borrowing costs accelerate debt service ratios, constraining household disposable income and future consumption capacity. |

| Rising Delinquency Rates | Signals deteriorating credit quality, particularly in subprime auto and revolving credit, increasing charge-off risks for lenders and reducing aggregate demand. |

| Depleted Excess Savings | Removal of the financial buffer forces consumers to rely on credit for unexpected expenses, accelerating debt growth in the face of persistent inflation. |

Frequently Asked Questions about US Consumer Debt and Overspending Risk

The high debt burden creates a sensitivity to interest rate hikes. While the Fed prioritizes controlling inflation, the risk of triggering widespread consumer defaults and a credit crunch acts as a constraint, making future rate adjustments highly data-dependent and cautious. Analysts suggest this debt level increases the potential severity of any economic slowdown.

Revolving credit, primarily credit card balances, is the most alarming component. Although smaller than mortgage debt, credit card balances are growing rapidly at high interest rates (averaging near 21% APR), and delinquency rates are rising sharply, indicating immediate financial strain on households struggling to meet minimum payment obligations.

Analysis suggests debt growth is driven by a mix, but necessity dominates for lower and middle-income groups. Persistent inflation on essentials (food, housing) combined with depleted pandemic savings forces these households to leverage credit for basic needs, a sign of structural economic pressure rather than pure financial exuberance.

The primary risks are reduced aggregate demand and increased financial instability. High debt service costs will constrain future consumer spending, acting as an economic drag. Furthermore, rising defaults could lead banks to tighten lending standards, potentially causing a credit crunch that deepens any cyclical downturn.

Investors may consider defensive positioning, favoring sectors less dependent on discretionary consumer spending, such as utilities, healthcare, and high-quality technology stocks with global exposure. Focus on companies with low debt-to-equity ratios and strong cash reserves to weather potential economic turbulence and reduced consumer appetite.

The Bottom Line: Navigating Leverage Toward 2026

The $18.33 trillion consumer debt milestone is a clear signal that the American household, the traditional engine of US growth, is operating under significant leverage. This debt is not uniformly distributed, masking acute financial distress among specific cohorts who are utilizing high-interest credit not for luxury, but for survival against the backdrop of sustained inflation and elevated interest rates. Heading into 2026, the central economic dilemma will be whether the labor market can remain robust enough to service this debt without triggering a wave of defaults that necessitates a sharp contraction in lending and spending.

For market participants, the resilience of corporate earnings, particularly those tied to the consumer cycle, will be increasingly fragile. We project that debt service costs will continue to divert capital away from discretionary purchases, forcing companies to compete fiercely for a shrinking share of disposable income. Policymakers must tread carefully, balancing the need to achieve price stability with the necessity of maintaining financial stability. The risk of a hard landing, though not guaranteed, is amplified by the sheer scale of the consumer debt overspending risk now embedded in the US financial structure. Monitoring delinquency rates in unsecured loans will be the most critical forward-looking indicator over the next 18 months.