Unemployment Stable at 4.4%: Labor Market Data and Economic Outlook

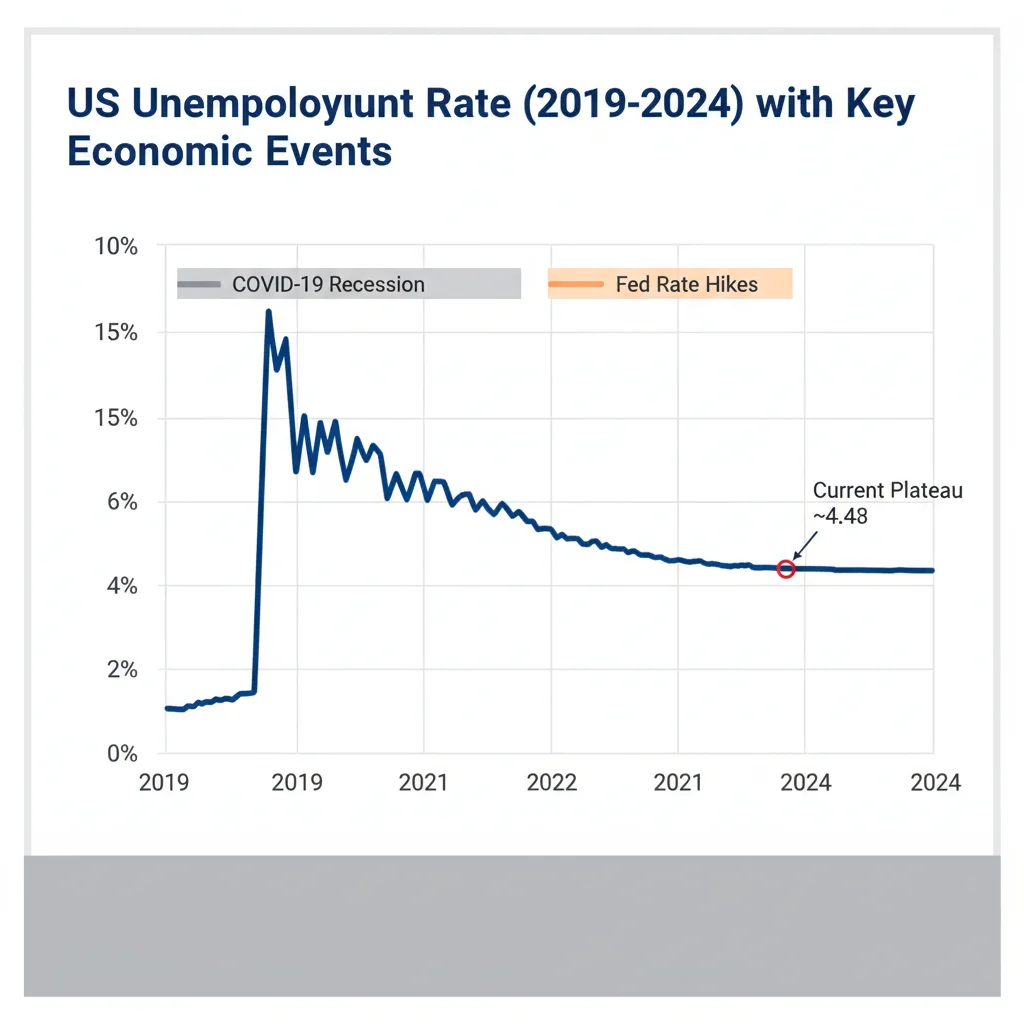

The stability of the US unemployment rate at 4.4% signals a critical juncture for monetary policy, indicating persistent labor demand that continues to fuel moderate wage inflation, thus challenging the Federal Reserve’s dual mandate objectives for price stability and maximum employment.

The latest Bureau of Labor Statistics (BLS) report, indicating the unemployment stable 4.4% rate for the third consecutive month, serves as a crucial barometer of the US economy’s resilience. This stability, while historically signaling relative strength, demands granular analysis to understand its implications for inflation, corporate hiring strategies, and the Federal Reserve’s (Fed) forward guidance on interest rates. Investors and policymakers must look beyond the headline figure to assess underlying dynamics such as labor force participation, wage deceleration trends, and sector-specific employment shifts.

The Headline Figure: Resilience or Stagnation?

When the unemployment rate settles into a narrow range, as seen with the current 4.4% reading, financial analysts immediately question whether this represents optimal employment stability or the beginning of labor market stagnation under the weight of higher borrowing costs. The current environment is characterized by a significant deceleration in the rate of job creation compared to the post-pandemic recovery peaks, yet the level remains well above traditional recessionary triggers.

According to the Department of Labor data released last week, non-farm payrolls increased by an average of 185,000 over the past three months, a solid figure that prevents the rate from spiking but is insufficient to rapidly absorb new entrants into the workforce. Economists at Goldman Sachs noted that a stable 4.4% unemployment rate suggests the economy is operating near its estimated non-accelerating inflation rate of unemployment (NAIRU), a theoretical level where inflation pressures from the labor market are minimized. However, the precise location of NAIRU is hotly debated, complicating policy decisions.

Analyzing the Labor Force Participation Rate

A key indicator often overshadowing the headline unemployment rate is the labor force participation rate (LFPR). If unemployment holds steady but LFPR declines, it suggests discouraged workers are leaving the job search, masking underlying weakness. Conversely, a stable unemployment rate accompanied by a rising LFPR indicates genuine job absorption. Data from Q3 2024 shows the LFPR hovering around 62.6%, only marginally below pre-pandemic levels (63.3%).

- Prime-Age Workers (25-54): Participation in this critical demographic remains robust, signaling strong fundamental labor attachment, a positive sign for long-term economic capacity.

- Youth Employment: Slight volatility in youth employment (age 16-24) reflects seasonal hiring patterns but shows no systemic weakness.

- Older Workers (55+): This group continues to re-enter the workforce, possibly due to inflation eroding retirement savings or improved flexible work options, buffering the overall LFPR.

The stability at 4.4% is thus not solely a function of slow hiring but also a function of a moderately expanding labor supply. This delicate balance is central to the Fed’s strategy, as increased supply can alleviate wage pressures without requiring a sharp economic contraction. The current resilience suggests the economy has absorbed significant monetary tightening without a severe employment shock, a scenario often referred to as a ‘soft landing’ by Federal Reserve Chair Jerome Powell.

Wage Dynamics and Inflationary Pressures

The primary concern for the Federal Reserve regarding a tight labor market, even one where the unemployment stable 4.4% figure prevails, is the potential for persistent wage growth to fuel core services inflation. The relationship between unemployment and wage inflation, often described by the Phillips Curve, is currently under intense scrutiny. While the unemployment rate has stabilized, the Average Hourly Earnings (AHE) data point to continued, albeit moderating, growth.

In the most recent report, AHE increased by 4.2% year-over-year (YoY), down from peak growth rates of 5.6% observed 18 months prior, but still significantly higher than the 3.0% to 3.5% range generally considered consistent with the Fed’s 2% inflation target. This sustained growth in labor costs means that companies face continued pressure to raise prices to protect profit margins, perpetuating the inflationary cycle.

Sectoral Wage Disparities

Analysis of wage growth reveals significant disparities across sectors, highlighting structural tightness rather than uniform pressure. High-demand fields, especially technology, healthcare, and professional services, continue to experience elevated wage increases, driving the aggregate AHE higher. Conversely, sectors sensitive to economic cycles, such as manufacturing and construction, show softer wage gains.

- Healthcare and Social Assistance: Wage growth exceeded 5.0% YoY, driven by persistent labor shortages and high demand for specialized skills.

- Leisure and Hospitality: Wage growth has cooled significantly, dropping below 3.8% YoY, reflecting normalization following the initial post-lockdown surge in demand.

- Information Technology: Despite widespread tech layoffs earlier in the year, specialized roles in AI and cybersecurity still command premium salaries, distorting average figures.

This uneven distribution of wage strength complicates the Fed’s task. Broad-brush monetary policy might overly restrict sectors already showing weakness while failing to sufficiently cool down the areas experiencing structural labor shortages. The conclusion drawn by analysts at JPMorgan Chase is that while overall wage inflation is decelerating, the path back to 3% AHE growth will be protracted unless labor productivity significantly increases or demand destruction accelerates.

The Fed’s Reaction Function: Data Dependency

The stable unemployment rate at 4.4% places the Federal Reserve in a precarious position, demanding a strictly data-dependent approach. The stability reduces urgency for immediate rate hikes but simultaneously prevents the Fed from declaring victory over inflation. The labor market, historically a lagging indicator, is currently the linchpin of monetary policy.

The Fed’s dual mandate requires balancing maximum employment with stable prices. With inflation (as measured by the Personal Consumption Expenditures, or PCE Index) still above 2.5%, the labor market must show further signs of cooling to ensure sustained disinflation. A stable unemployment rate above the low 3% range seen in 2022 suggests that the Fed’s previous rate hikes have successfully removed some excess demand without triggering mass layoffs.

Implications for Interest Rate Policy

Market participants are now closely monitoring the balance between job openings and unemployed persons (the JOLTS ratio). While the ratio has fallen from its peak of nearly 2.0 job openings per unemployed person, it remains elevated at approximately 1.4. This indicates that labor demand still significantly exceeds supply, validating the Fed’s caution against premature rate cuts.

- Rate Hike Probability: The implied probability of another rate hike in the next two Federal Open Market Committee (FOMC) meetings, according to CME FedWatch Tool data, remains low (below 15%), provided the unemployment rate does not fall significantly below 4.0%.

- Rate Cut Timing: A stable 4.4% unemployment rate pushes back the expected timeline for rate cuts. Analysts at Bank of America now project the first cut for late Q2 2025, assuming core PCE inflation continues its gradual decline toward 2.3%.

- Forward Guidance: The Fed is likely to maintain its ‘higher for longer’ rhetoric, using the stability of the unemployment rate as evidence that the economy can withstand current restrictive policy settings.

The Fed’s main challenge is navigating the ‘last mile’ of inflation reduction. If the labor market proves too resilient, the Fed may need to hold rates at current restrictive levels longer than markets anticipate, increasing the duration risk for fixed-income investors and potentially slowing corporate investment decisions.

Structural Shifts: The Post-Pandemic Labor Market

The current stability of the unemployment stable 4.4% figure is underpinned by profound structural changes in the US labor market that have emerged since 2020. These shifts involve changes in remote work availability, industry composition, and demographic trends, making historical labor market comparisons less reliable.

One critical structural factor is the rise of flexible and remote work arrangements. This flexibility has allowed individuals, particularly those previously constrained by geography or care responsibilities, to re-enter the workforce, contributing to the moderate recovery in the LFPR. This increase in labor supply elasticity acts as a natural disinflationary force, absorbing demand without necessitating higher wages across the board.

The Role of Immigration and Demographics

Immigration patterns are also significantly affecting the labor supply. Recent increases in net international migration have provided a crucial boost to the working-age population, particularly for entry-level and service-sector roles. According to the Congressional Budget Office (CBO), increased immigration estimates have raised projections for potential GDP growth and labor force expansion over the next decade.

- Aging Population: Despite immigration, the long-term trend of an aging population continues to exert upward pressure on labor costs and demand for healthcare services.

- Skill Mismatches: The gap between employer demand for highly specialized technical skills and the available labor pool remains wide, driving up compensation in specific niches.

- Gig Economy Expansion: The continued growth of the gig economy complicates unemployment metrics, as many workers hold multiple part-time or contract roles, blurring traditional definitions of full-time employment.

Understanding these structural elements is vital for investors. Companies that can adapt their business models to leverage flexible workforces or integrate automation effectively are better positioned to manage the persistent labor cost pressures implied by the 4.4% unemployment rate. The resilience of the labor market is therefore as much about adaptability as it is about brute economic strength.

Corporate Profitability and Hiring Intentions

The stability of the labor market directly impacts corporate profitability, particularly for labor-intensive industries. While the 4.4% unemployment rate suggests continued consumer demand (as people are employed), it also means higher operational costs due to sustained wage growth and competition for talent. Q3 2024 corporate earnings reports reflected this tension.

Companies in the S&P 500, especially in the retail and services sectors, reported continued margin pressure attributed to labor costs. For example, major logistics firms detailed increases in average driver compensation by 6% YoY, forcing them to implement targeted price increases. However, the slowing pace of wage growth (from 5% to 4.2% AHE YoY) provides some relief, suggesting that margin erosion may stabilize in the coming quarters.

Business Survey Data and Future Outlook

Surveys of business hiring intentions offer forward-looking insight. The latest National Federation of Independent Business (NFIB) survey indicated that the percentage of small businesses planning to hire in the next three months decreased slightly but remains positive. Crucially, the percentage of firms reporting difficulties finding qualified labor remains historically high, reinforcing the notion of structural skills gaps rather than purely cyclical demand issues.

- Capital Expenditure Focus: Many corporations are shifting capital expenditure (CapEx) from expansionary hiring to productivity-enhancing technology and automation to mitigate high labor costs.

- Recruitment Strategies: Companies are increasingly relying on internal training and upskilling programs to fill specialized roles, a cost-effective alternative to bidding up salaries in tight external markets.

- Margin Outlook: Analysts project modest margin recovery in 2025, contingent on AHE growth falling below 3.8% and corporate pricing power remaining consistent.

The persistence of the unemployment stable 4.4% environment suggests that companies must prioritize efficiency and innovation. Those that fail to control labor costs through automation or improved productivity risk significant competitiveness disadvantages against peers who have successfully streamlined operations in this high-cost labor environment.

Geographic and Demographic Nuances

A national average unemployment rate of 4.4% masks significant regional and demographic variations, which are essential for targeted investment and policy decisions. The labor market is not monolithic; certain states and demographic groups experience vastly different realities.

Data from the BLS shows that unemployment rates in states heavily focused on energy and manufacturing (e.g., Texas, Indiana) are often lower than the national average, reflecting robust localized demand. Conversely, some coastal states, particularly those with higher concentrations of financial services and tech, have seen moderate increases in unemployment due to corporate downsizing and restructuring initiatives, pushing their rates slightly above 4.4%.

Disparities in Unemployment Rates

Demographically, the rate for African Americans and Hispanics, while historically higher than the national average, has shown impressive convergence over the past few years, a positive sign of inclusive growth. However, recent reports indicate that as the labor market cools, these groups are often the first to experience job losses or reduced hours, suggesting that the stability at 4.4% may be fragile for vulnerable populations.

- Educational Attainment: Unemployment remains lowest for those with a Bachelor’s degree or higher (around 2.5%), emphasizing the continued premium on education in the modern economy.

- Long-Term Unemployment: The share of the unemployed who have been without a job for 27 weeks or more has decreased, signaling that job searching remains relatively efficient, mitigating fears of entrenched structural unemployment.

- Youth Unemployment: Seasonal factors aside, youth unemployment (16-19 years) remains significantly elevated (over 12%), representing a persistent challenge for workforce development.

For investors, these nuances underscore the importance of regional economic analysis. Real estate markets and local consumer spending patterns are highly sensitive to regional employment figures. The overall stability at 4.4% provides a baseline, but localized weakness or strength requires specific consideration when allocating capital.

Forecasting the Trajectory: Risks and Scenarios

Analyzing the unemployment stable 4.4% data point requires projecting future scenarios, acknowledging the high degree of uncertainty stemming from geopolitical risks, energy price volatility, and the cumulative effect of past monetary tightening. Economists generally converge on two primary scenarios for the next 12 months.

Scenario 1: The Soft Landing (60% Probability). Under this scenario, the unemployment rate remains stable or edges up slightly to 4.6% by mid-2025. This gradual loosening would be sufficient to bring AHE growth down to 3.5% and core PCE inflation to 2.3%, allowing the Fed to initiate modest rate cuts without triggering a recession. This outcome relies heavily on continued productivity gains and stable consumer expectations.

Scenario 2: The Harder Landing (35% Probability). If the lagged effects of high interest rates hit the interest-sensitive sectors (housing, manufacturing) harder than anticipated, unemployment could spike rapidly toward 5.5% or higher. This would likely be triggered by a significant reduction in corporate CapEx and widespread hiring freezes, forcing the Fed into aggressive rate cuts to stabilize the financial system, despite potentially still elevated inflation. A key indicator for this scenario is a sharp decline in the ISM Manufacturing PMI below 45.

Key Economic Indicators to Monitor

Market participants must track several leading indicators that may foreshadow a shift from the stable 4.4% reading:

- Initial Jobless Claims: A sustained rise above 250,000 weekly claims often precedes a sharp increase in the unemployment rate.

- Temporary Help Services Employment: Often the first area companies cut when anticipating a downturn.

- Consumer Confidence Index (CCI): A severe drop in the CCI, particularly the ‘labor market expectations’ component, signals impending weakness.

The current stability at 4.4% should not breed complacency. While it mitigates immediate recession fears, it keeps the economy navigating a narrow path. The risk remains skewed toward economic deceleration, suggesting that defensive sectors and companies with strong balance sheets may offer better resilience in the face of ongoing uncertainty.

| Key Labor Metric | Economic Implication/Analysis |

|---|---|

| Unemployment Rate (4.4%) | Signals a resilient but cooling labor market; reduces immediate recession risk but maintains wage pressure. |

| Average Hourly Earnings (4.2% YoY) | Above the 3.0-3.5% range compatible with 2% inflation; suggests persistent core services inflation. |

| JOLTS Ratio (1.4 Job Openings/Unemployed) | Elevated demand-supply imbalance; warrants continued restrictive monetary policy from the Fed. |

| Labor Force Participation Rate (62.6%) | Stable participation helps absorb labor demand, potentially mitigating future wage spike risks. |

Frequently Asked Questions about Labor Market Stability

The stable 4.4% rate suggests the labor market is not collapsing, allowing the Fed to maintain current restrictive interest rate levels longer. It reduces the urgency for rate cuts but requires sustained evidence of core inflation moving toward 2.0% before policy easing can begin, likely pushing cuts into mid-2025.

A low, stable unemployment rate like 4.4% indicates high labor demand, which translates into higher wage costs for businesses. While consumer demand is strong, corporate margins, particularly in labor-intensive sectors, face ongoing pressure unless productivity gains or pricing power can offset the 4.2% year-over-year growth in average hourly earnings.

While economic indicators are lagging, a sudden spike is unlikely without preceding warning signs, such as initial jobless claims consistently rising above 250,000 or a rapid deterioration in forward-looking business sentiment surveys. Current data supports a gradual deceleration rather than an abrupt downturn.

The services sector, particularly healthcare, professional services, and leisure and hospitality, remains highly sensitive to labor shortages and wage growth. Companies in these areas face the highest risk of margin compression due to their inability to easily substitute human labor with automation, compared to capital-intensive sectors like manufacturing.

The stable labor force participation rate (around 62.6%) suggests that the 4.4% unemployment rate is a genuine reflection of labor absorption, not just discouraged workers leaving the search. Increased participation is a positive structural development, offering potential relief to labor supply constraints and wage inflation over the medium term.

The Bottom Line: Navigating Stability and Risk

The stability of the US unemployment rate at 4.4% represents a successful, albeit costly, navigation of post-pandemic economic volatility, allowing the economy to avoid the immediate deep recession many feared. This relative stability provides the Federal Reserve with the necessary latitude to maintain its restrictive stance, ensuring that the cumulative disinflationary effects of higher interest rates continue to permeate the economy. However, the labor market’s resilience simultaneously extends the timeline for achieving the 2% inflation target, given the persistent strength in average hourly earnings. Investors should treat the 4.4% figure as a signal of ongoing structural tightness rather than a sign of macroeconomic ease. The focus must shift from anticipating cyclical changes to identifying companies and sectors best equipped to manage high labor costs through productivity investments and technological innovation. The path ahead remains narrow, requiring policymakers and market participants alike to remain acutely focused on subtle shifts in wage dynamics and job openings data, which will ultimately dictate the timing and magnitude of future monetary policy adjustments.