LA Rents Soar: One-Bedroom Alternatives to $2,800 Crisis

The dramatic escalation of Los Angeles one-bedroom apartment rents, now averaging between $2,300 and $2,800, is accelerating migration to peripheral markets, forcing a significant re-evaluation of household budgeting and housing location arbitrage strategies.

The financial gravity of housing costs in the Southern California metropolis has reached a critical inflection point. Data from Q3 2024 indicates that median monthly rents for a one-bedroom apartment in Los Angeles now fluctuate between $2,300 and $2,800, depending on the submarket, intensifying the pressure on household budgets and driving the search for viable Los Angeles Rent Alternatives. This steep cost, often consuming over 40% of the median Angeleno’s income, necessitates a deep, data-driven analysis of the economic implications and the rising viability of exurban and peripheral housing options.

The economic catalyst: why Los Angeles rents have spiked

The recent surge in Los Angeles rental prices is not merely a product of demand but a complex nexus of inflationary pressures, constrained supply, and specific municipal regulations. The Federal Reserve’s aggressive rate hikes, designed to combat broad inflation, have simultaneously elevated the cost of capital for developers, slowing new construction projects. This supply constraint, coupled with sustained population growth and a low vacancy rate hovering near 3.5% as of mid-2024, creates a structural imbalance that favors landlords.

According to the USC Lusk Center for Real Estate, construction starts for multi-family units fell by 18% year-over-year between Q2 2023 and Q2 2024. This reduction in future supply directly impacts current pricing power. Furthermore, the robust labor market in key Los Angeles sectors—technology, entertainment, and professional services—continues to attract high-earning individuals, insulating the top end of the rental market from broader economic slowdowns and placing upward pressure on median rents across the board.

The role of interest rates and investor behavior

Higher interest rates (the 30-year fixed mortgage rate averaged 7.05% in October 2024, per Freddie Mac data) have effectively locked many potential first-time homebuyers out of the purchase market. These individuals remain renters, increasing demand and reducing the natural churn that typically eases rental market tensions. Institutional investors, recognizing housing as an inflation hedge, continue to acquire multi-family properties, often raising rents to maximize yield on their invested capital. This behavior is quantified by CoreLogic data, which shows a 5.1% annual increase in single-family rental acquisition by investment firms in Southern California during the first half of the year.

- Supply-Side Constraints: Reduced developer access to affordable credit due to elevated Fed funds rate limits new unit delivery.

- Demand Persistence: A strong regional job market maintains high demand, particularly for centrally located one-bedroom units.

- Mortgage Lockout Effect: High mortgage rates convert potential buyers into persistent renters, exacerbating competition.

- Inflationary Pass-Through: Increased property taxes, insurance, and maintenance costs are systematically transferred to tenants through rental price adjustments.

The economic consequence of a $2,800 one-bedroom rent is profound: it requires an annual pre-tax income exceeding $95,000 for the rent to consume less than 35% of income—a standard financial health benchmark. For those earning the median LA household income of approximately $76,000 (Census Bureau, 2023 estimate), a $2,800 rent represents nearly 44% of gross income, pushing many into a state of housing cost burden and accelerating the necessity of finding cost-effective Los Angeles Rent Alternatives.

Evaluating the financial viability of suburban migration

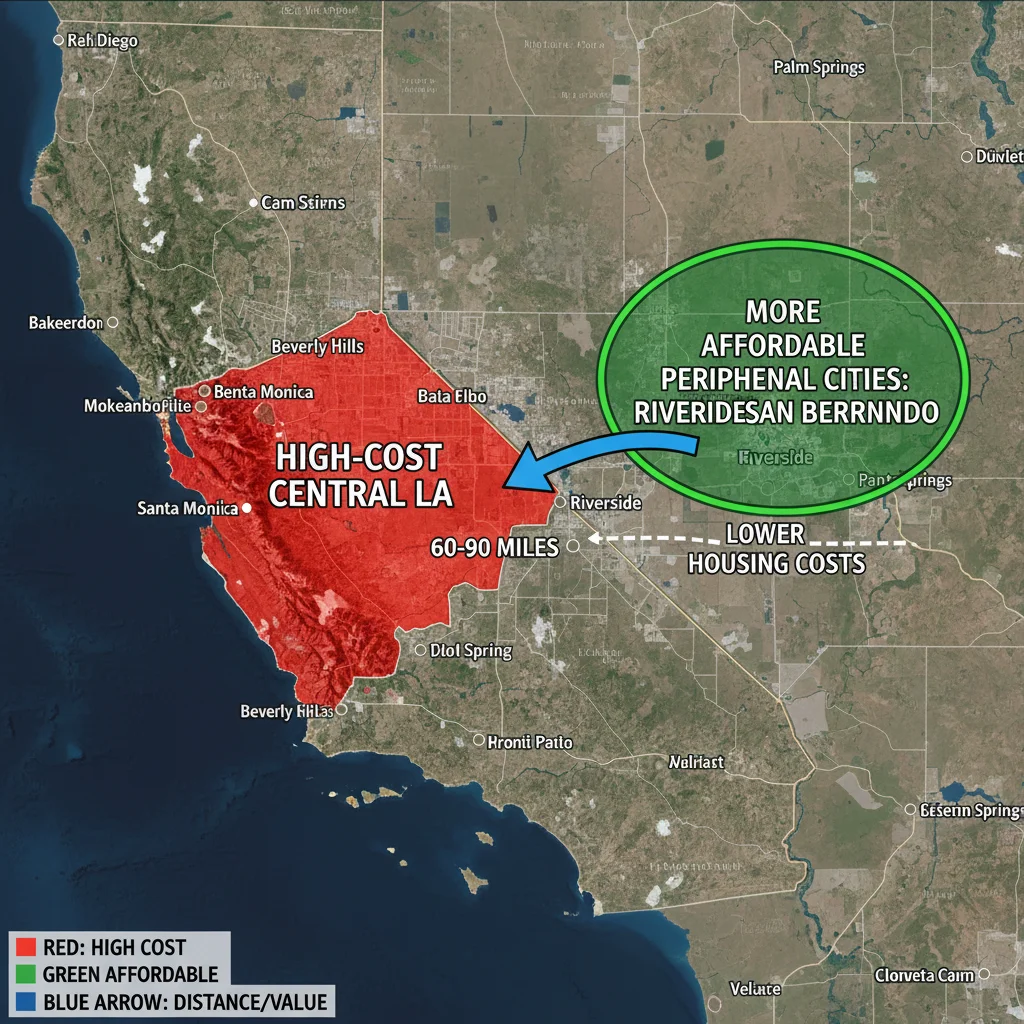

As the central Los Angeles rental market becomes prohibitively expensive, financial analysis points compellingly toward the outer rings of the Southern California megalopolis. The strategy of moving to the Inland Empire (Riverside and San Bernardino counties) or parts of Ventura County represents a significant cost-of-living arbitrage opportunity, especially for remote or hybrid workers. This shift requires a detailed calculation of reduced housing costs versus increased transportation expenses.

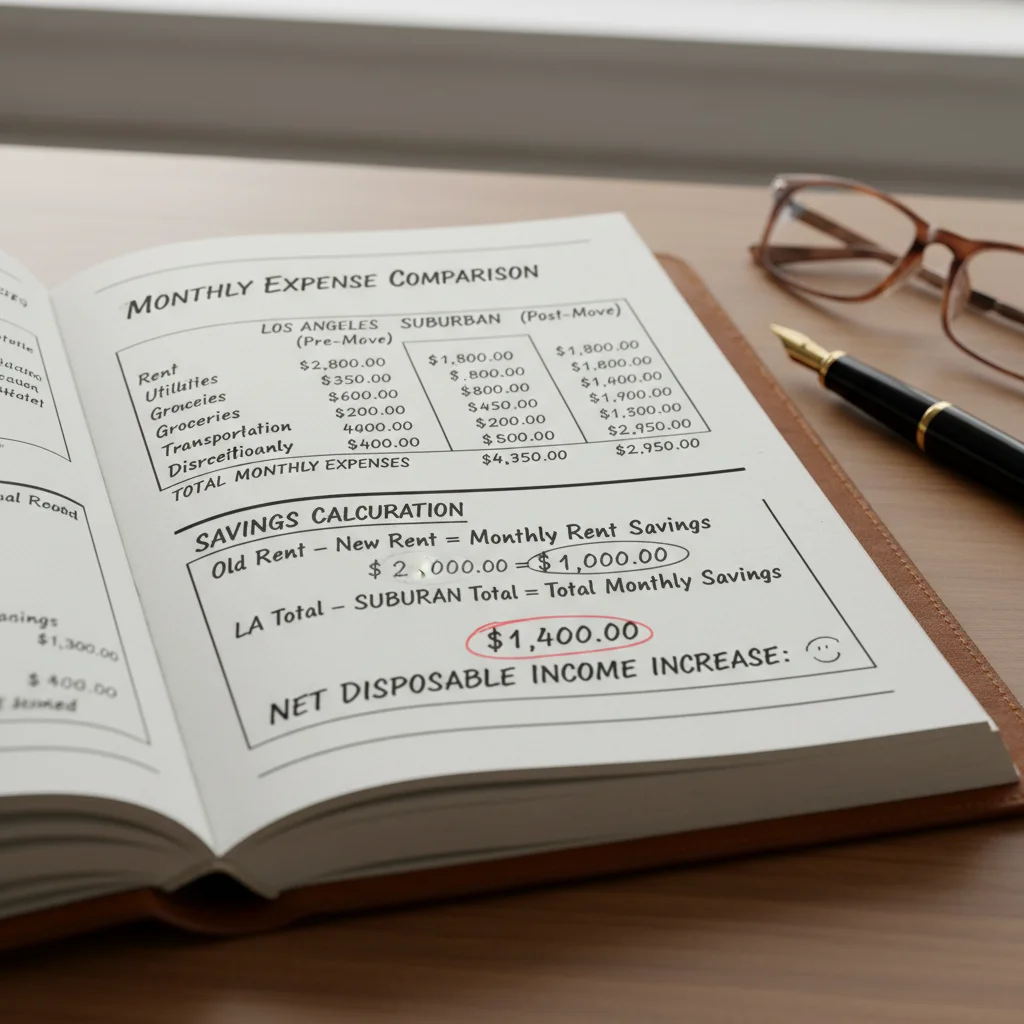

For example, while a one-bedroom in Santa Monica or West Hollywood commands $2,750, comparable units in the Riverside-Corona area average closer to $1,850, representing a potential annual housing saving of $10,800. This saving must be weighed against the non-monetary cost of commuting time and the explicit financial cost of gasoline, vehicle maintenance, and parking. However, with approximately 45% of professional service jobs in Southern California now offering at least a hybrid work schedule (Pew Research, 2024), the daily commute cost is often mitigated.

Inland Empire: the primary arbitrage destination

The Inland Empire (IE) has emerged as the most statistically significant alternative. The IE’s rent-to-income ratio remains substantially lower than Los Angeles County’s, making it a critical escape valve for middle-income earners. The median rent in the IE has risen, but the baseline remains considerably lower, providing a substantial buffer. Analysts at the Milken Institute highlight that the relative affordability in the IE, coupled with significant logistical and warehousing job growth (a 12% increase in logistics employment over the past three years), supports a sustainable economic ecosystem separate from the high-cost LA core.

- Riverside County Savings: Average one-bedroom rent of $1,800 reduces housing expenditure by 34% compared to a $2,750 LA core rental.

- Transportation Cost Offset: Assuming a hybrid work model (3 days/week) and a 60-mile round trip, the annual commuting cost (fuel, maintenance) is estimated at $3,500, still yielding a net annual saving of over $7,000.

- Quality of Life Trade-off: The arbitrage is most favorable when the increased commute time is minimized through flexible work arrangements, maximizing the financial benefit of the lower rent.

The financial decision to pursue Los Angeles Rent Alternatives increasingly hinges on a worker’s specific employment flexibility. For those requiring daily physical presence in the LA central business district, the opportunity cost of the commute often erodes the savings. However, for the majority operating on a remote or hybrid model, the shift presents a tangible, immediate boost to disposable income, a critical factor in a high-inflation environment.

The rise of co-living and micro-units in the urban core

For individuals determined to remain within the Los Angeles urban perimeter, the financial pressure of conventional one-bedroom units has spurred innovation in housing models. Specifically, co-living arrangements and purpose-built micro-units are gaining traction as structured compromises to mitigate the $2,300–$2,800 price tag.

Co-living spaces, where tenants rent an individual bedroom within a shared, furnished apartment, often with communal amenities, offer a price point that is typically 20% to 30% lower than a private one-bedroom unit in the same location. For instance, a co-living bedroom in Downtown LA might rent for $1,600 to $1,900. This model appeals strongly to younger professionals prioritizing location and convenience over private square footage.

Micro-units: maximizing density and minimizing cost

Micro-units, typically under 350 square feet, are designed to maximize urban density while adhering to building codes. These units, though small, often include high-end finishes and access to extensive building amenities. While they do not offer the significant savings of suburban migration, they provide a path to urban residency at a discounted rate. A newly constructed micro-unit in a desirable area might rent for $2,000 to $2,200, representing a $500–$600 monthly saving compared to a standard one-bedroom.

Real estate private equity firm CIM Group notes that the demand for these high-density, lower-cost urban solutions is structurally sound. Their internal projections indicate that the micro-unit market share in new LA construction could double by 2027 as high land and construction costs make larger, conventional units economically unfeasible for developers to build at accessible price points. This trend represents a market response to the affordability crisis, providing structural Los Angeles Rent Alternatives within the city limits.

The trade-off here is space for location. The financial benefit is derived from accepting less personal space in exchange for proximity to employment, cultural centers, and reduced reliance on personal transportation. This strategy is an income-optimization play for those whose professional success is intrinsically tied to the density and networking opportunities of the urban core.

The impact on regional economic inequality and labor mobility

The escalating cost of housing in Los Angeles, particularly the high barrier to entry for one-bedroom rentals, has significant macroeconomic consequences, primarily affecting regional economic inequality and labor mobility. When housing costs consume an excessive share of income, it reduces consumer spending on non-essential goods and services, acting as a drag on local economic growth outside of the housing sector itself.

Furthermore, the necessity of seeking Los Angeles Rent Alternatives in distant counties introduces significant frictional costs into the labor market. Essential service workers, who often cannot work remotely and depend on lower wages, are particularly impacted. Their forced migration to the Inland Empire lengthens commutes, increasing fatigue and potentially reducing productivity. This geographical mismatch between affordable housing and employment centers creates a structural inefficiency in the regional labor supply chain.

Wage stagnation versus rental acceleration

The disparity between rental inflation and wage growth is central to the crisis. While the Consumer Price Index (CPI) for Shelter in the Los Angeles-Long Beach-Anaheim area rose by 7.1% year-over-year as of September 2024 (BLS data), median wage growth for non-supervisory employees lagged at 4.5% over the same period. This gap means that real disposable income, after accounting for housing, is shrinking for a large segment of the population.

- Consumer Spending Reduction: High rent obligations diminish discretionary income, potentially slowing retail and hospitality sectors.

- Labor Market Friction: Long-distance commutes increase turnover rates and absenteeism, particularly in low-wage sectors.

- Human Capital Flight: Highly educated professionals may opt to relocate to more affordable metropolitan areas (e.g., Phoenix, Dallas), leading to a brain drain in non-entertainment industries.

Economists at Moody’s Analytics project that if LA rental inflation continues to outpace wage growth by 2 percentage points annually, the county could see a net outflow of 50,000 residents per year by 2026, primarily driven by affordability issues. This demographic shift underscores the critical nature of the current housing environment and the long-term structural challenges facing the LA economy.

Investment implications: capitalizing on the suburban shift

For investors, the sustained high cost of core Los Angeles rents and the corresponding search for Los Angeles Rent Alternatives signal a fundamental shift in real estate investment focus. Capital allocation is increasingly favoring multi-family development and acquisition in peripheral and secondary markets that benefit from the influx of LA residents.

The investment thesis centers on the concept of ‘rent convergence.’ While rents in the Inland Empire (IE) are lower than LA, the rate of appreciation in the IE is projected to exceed that of the LA core over the next five years as demand pressure builds. Real estate funds specializing in tertiary markets are demonstrating strong returns. For example, institutional ownership of rental properties in San Bernardino County has increased by 40% since 2020, according to public transaction records.

Financing the sprawl: infrastructure and REITs

Investing in the infrastructure supporting this sprawl also presents opportunities. The increased commuting demands place pressure on public transportation and road networks. Investors may look at municipal bonds tied to regional transportation projects or Real Estate Investment Trusts (REITs) focused on logistics and warehouse facilities in the Inland Empire, which support the region’s expanding employment base.

Furthermore, the developers who successfully navigate the complex entitlement processes in these peripheral cities stand to benefit significantly. The emphasis is on building high-density, mid-market rental products ($1,600–$2,000 range) that directly serve the demographic moving out of the LA core. This is a defensive investment strategy based on demographic and economic necessity, rather than speculative growth.

The elevated cost environment in Los Angeles is essentially creating a forced redistribution of demand. Investors who position themselves in markets receiving this displaced demand—such as Riverside, Palmdale, or even parts of Bakersfield—are likely to capture superior risk-adjusted returns compared to those remaining focused solely on the saturated, highly-priced core LA market.

Beyond the one-bedroom: alternative ownership models

The rental crisis is simultaneously fueling a renewed interest in alternative ownership models, particularly for those seeking to build equity without the prohibitive down payments required for a traditional single-family home in LA County. The high cost of renting makes the monthly payment on a starter home or condominium, even with higher mortgage rates, increasingly competitive on a net-worth accumulation basis.

One increasingly popular option is fractional ownership or tenancy-in-common (TIC) structures, especially for multi-unit properties. While TICs carry regulatory complexity and financing challenges, they allow individuals to pool resources to acquire a larger property, effectively dividing the purchase price and property tax burden. This approach is prevalent in neighborhoods like Echo Park and Silver Lake, where entry-level condos remain scarce.

The condominium market resurgence

The median price for a single-family home in LA County exceeded $950,000 in Q3 2024 (California Association of Realtors), placing it out of reach for most first-time buyers. However, the median price for a condominium is often 20% to 30% lower. The monthly payment on a $650,000 condo, assuming a 7% interest rate and 10% down, might result in a monthly housing expense of approximately $4,500 (including HOA and property tax). While higher than rent, the equity accumulation offsets the cost, making it a viable long-term strategy for high-earning individuals seeking a permanent alternative to perpetually high rents.

The financial rationale is clear: a $2,800 monthly rent yields zero equity, whereas a $4,500 monthly mortgage payment contributes significantly to household net worth. This differential is forcing a segment of the rental population to stretch their finances for homeownership, viewing it as a necessary defense against rental market volatility. The market for smaller, older condominiums is therefore seeing increased competition, reflecting the desire to escape the rental trap.

Policy responses and future rent trajectory analysis

The long-term trajectory of Los Angeles rents depends heavily on policy interventions and macroeconomic factors. Local politicians face increasing pressure to address the affordability crisis through rent stabilization measures and accelerated permitting for new construction. However, these policies often carry unintended consequences, which financial analysts must carefully consider.

Rent control measures, while providing short-term relief for existing tenants, are frequently cited by developers and economists (e.g., Stanford University’s research on local controls) as disincentivizing new multi-family construction, thereby exacerbating the long-term supply shortage. A more effective, yet politically challenging, solution involves streamlining the state and municipal permitting process, reducing the time and cost associated with bringing new units to market.

Macroeconomic outlook and rental forecasts

Looking forward to 2025, rental inflation is expected to moderate slightly, but not reverse, primarily due to the anticipated stability in interest rates and a modest increase in multi-family completions. Oxford Economics forecasts that LA rental growth will slow to 4.0% in 2025, down from the 6.5% peak observed in 2024. However, even a 4.0% increase means a $2,800 unit will cost $2,912, sustaining the need for Los Angeles Rent Alternatives.

The key risk factor remains the labor market. A significant softening of the LA job market could lead to higher vacancies and some rental price concessions. Conversely, continued strong employment growth will maintain the upward pressure. The consensus among financial institutions like Wells Fargo and JPMorgan Chase is that the structural housing shortage in Southern California is too deep to be solved quickly, suggesting that high rents, even if the rate of increase slows, will remain a defining feature of the LA financial landscape for the foreseeable future.

| Key Factor/Metric | Market Implication/Analysis |

|---|---|

| LA One-Bedroom Rent Range | $2,300–$2,800; requires over $95,000 annual income to maintain a 35% rent-to-income ratio. |

| Inland Empire Rent Savings | Potential annual savings of $10,800 compared to LA core, facilitating significant cost-of-living arbitrage. |

| LA Shelter CPI vs. Wage Growth | Shelter CPI (7.1%) significantly outpaces median wage growth (4.5%), eroding real disposable income for renters. |

| Micro-Unit/Co-Living Discount | Offers 20%–30% discount on core LA rents, trading personal space for urban proximity and lower absolute cost. |

Frequently Asked Questions about Los Angeles Rent Alternatives

For an individual earning the LA median income of $76,000, and assuming a $2,800 one-bedroom rent, the rent-to-income ratio is approximately 44%. This exceeds the recommended 30% threshold, classifying the household as severely cost-burdened according to HUD standards, compelling many to seek cheaper Los Angeles Rent Alternatives.

The annual rent savings of relocating can exceed $10,000. For hybrid workers commuting three times per week, the estimated annual driving costs are around $3,500. This leaves a net financial benefit of over $6,500, demonstrating a clear positive arbitrage, especially for those with flexible work schedules.

Micro-units address the immediate high cost of core urban residency by maximizing density. While they are a sustainable short-to-medium- term solution for single professionals, they do not alleviate the structural housing shortage for families or larger households. They function primarily as a niche market solution.

Investors should monitor population growth rates, employment diversity (especially in logistics and tech), and vacancy rates in peripheral areas like Riverside and Ventura. Crucially, track the ratio of new permits issued versus population inflow, as supply constraints will drive future rent appreciation in these alternative markets.

The primary risk is a sustained erosion of the region’s competitive labor advantage. If high housing costs continue to force middle-income and essential workers out, it creates labor shortages and inefficiencies, potentially slowing overall regional economic growth and disproportionately impacting service industries dependent on local labor pools.

The bottom line: strategic housing decisions in a high-cost environment

The sustained escalation of one-bedroom rents in Los Angeles, now firmly anchored in the $2,300 to $2,800 range, mandates a strategic re-evaluation of housing logistics. This is no longer merely a lifestyle choice but a material financial decision impacting cash flow, disposable income, and long-term wealth accumulation. The data unequivocally supports the economic viability of seeking Los Angeles Rent Alternatives, particularly in the Inland Empire, where the housing cost arbitrage outweighs the frictional costs of commuting, especially for the substantial segment of the workforce operating under hybrid or remote models.

For market participants, the trend implies a necessary shift in capital allocation toward secondary and tertiary markets that are structurally benefiting from this demographic displacement. Developers and investors should focus on providing mid-market rental housing in these peripheral areas, anticipating continued demand pressure. For residents, the choice is clear: either accept reduced financial flexibility for the sake of urban proximity or leverage the suburban shift to secure substantial annual savings, effectively turning a housing crisis into a personal financial opportunity. As long as supply remains constrained and the cost of capital remains elevated, the pressure on LA’s core rental prices, and the corresponding demand for alternatives, will persist as a dominant feature of the Southern California economic landscape.