Nasdaq Correction: Tech Opportunity Amid 0.3% Weekly Fall

The marginal 0.3% weekly fall in the Nasdaq Composite is analyzed not as a major market downturn, but as a potential technical correction, offering institutional and retail investors a calculated entry point into fundamentally strong technology stocks, particularly those demonstrating robust free cash flow generation and high recurring revenue models.

The recent dip in the technology-heavy Nasdaq Composite, registering a modest 0.3% decline over the last five trading sessions, has prompted market observers to assess whether this minor pullback signals the start of a broader correction or merely represents a healthy consolidation phase. When the Nasdaq tech correction opportunity presents itself, sophisticated investors understand that small percentage declines, especially following periods of rapid ascent, are often necessary to clear excess speculation and re-establish more sustainable valuation levels. This marginal shift requires a forensic analysis of underlying macroeconomic factors, interest rate expectations, and corporate earnings momentum to determine if the technical dip aligns with fundamental degradation, or if it is simply noise in an otherwise bullish long-term trend.

Deconstructing the 0.3% Dip: Technical Factors and Market Breadth

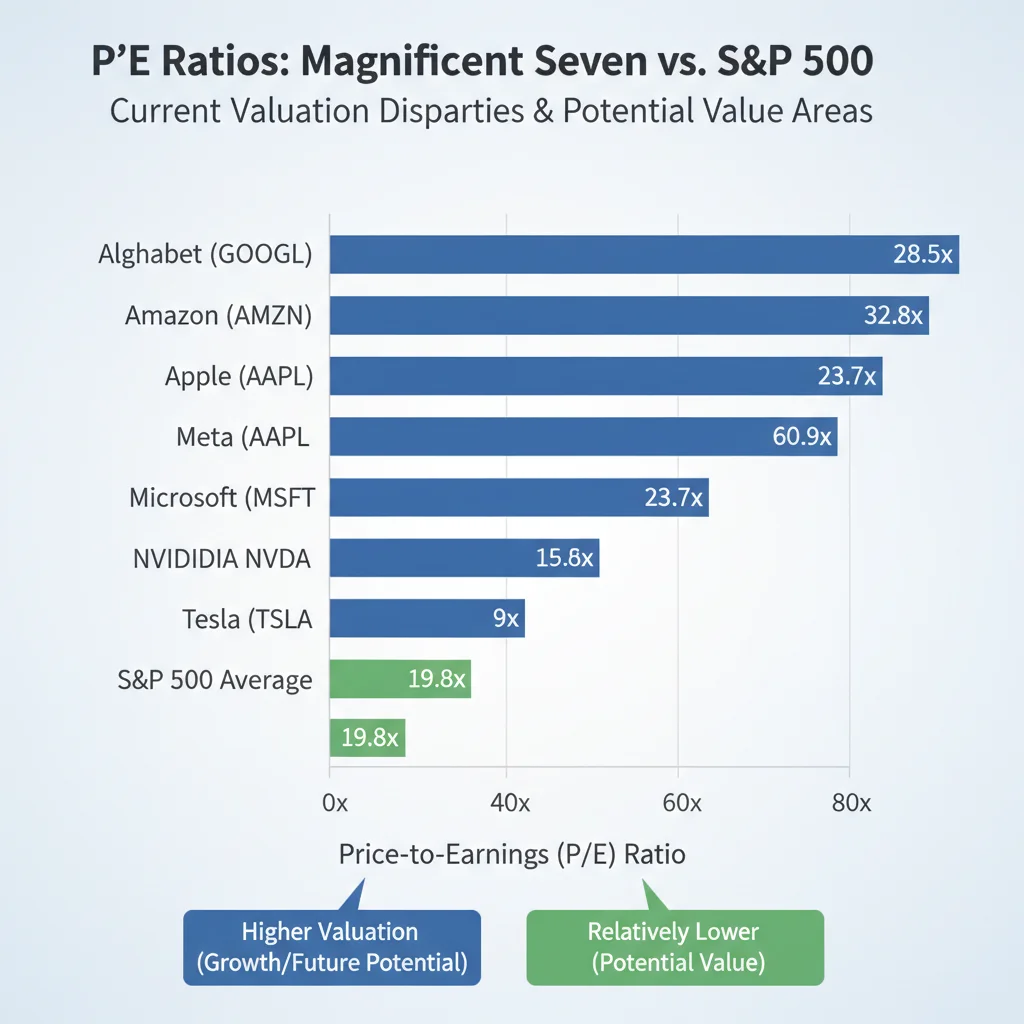

A weekly decline of 0.3% in the Nasdaq Composite is statistically insignificant in historical terms, yet its timing, occurring after a multi-month rally driven largely by large-cap technology stocks, warrants scrutiny. This movement is primarily attributed to profit-taking within the highly concentrated ‘Magnificent Seven’ cohort, which experienced disproportionate gains earlier in the quarter, according to data compiled by Goldman Sachs’s quantitative strategy team. The key question for financial journalists is whether market breadth is improving or deteriorating during this minor slump.

Market breadth, measured by metrics such as the advance-decline line or the percentage of stocks trading above their 200-day moving average, provides critical insight into the health of the overall index beyond its largest constituents. While the headline Nasdaq index moved slightly lower, initial analysis reveals mixed signals. Approximately 55% of Nasdaq components remained above their 50-day moving averages as of Thursday, a slight decrease from 62% the previous week, suggesting that the selling pressure was broad, but shallow, rather than concentrated in a few high-beta names. This technical nuance suggests that the dip is more of a rotational shift than a systemic fear-driven sell-off.

The Role of Interest Rate Expectations in Tech Valuations

Technology valuations, particularly those of high-growth companies relying on future cash flows, are acutely sensitive to changes in the risk-free rate, specifically the yield on the 10-year U.S. Treasury note. As inflation expectations stabilized and the probability of a Federal Reserve rate cut in the next quarter decreased from 65% to 50% (per CME FedWatch Tool data), the resulting minor increase in the 10-year yield—moving from 4.15% to 4.25%—exerted downward pressure on the discounted present value of expected tech earnings. This rate-driven valuation recalibration often triggers minor technical corrections.

- Discount Rate Sensitivity: Higher interest rates disproportionately reduce the theoretical value of long-duration assets, which typically include high-growth, non-dividend-paying tech stocks.

- Real Yield Impact: The move in real (inflation-adjusted) yields, which moved up 5 basis points, provided a marginally more attractive return for fixed-income alternatives, prompting some rotation out of riskier equity positions.

- Fed Policy Watch: Investor sentiment remains tethered to forthcoming FOMC minutes and inflation data releases, creating inherent volatility as rate cut expectations shift week-to-week.

In summary, the 0.3% weekly drop appears to be a composite reaction: tactical profit-taking in mega-cap leaders combined with minor headwinds from rising real yields. This technical correction, while small, provides a cleaner entry point for those seeking a Nasdaq tech correction opportunity, provided the underlying corporate fundamentals remain robust.

Corporate Earnings Resilience Versus Valuation Multiples

The fundamental justification for technology stock valuations rests on sustained, superior earnings growth compared to the broader market. Despite the minor index decline, recent Q2 earnings reports from the technology sector have largely exceeded consensus estimates. According to FactSet, the estimated earnings growth rate for the Information Technology sector for Q2 2024 stands at 16.5%, significantly higher than the 8.1% projected for the S&P 500 as a whole. This strong performance underscores the sector’s resilience, even as valuations remain stretched.

However, the forward Price-to-Earnings (P/E) ratio for the Nasdaq 100 currently hovers around 28x, substantially above its five-year average of 24x. This premium suggests that the market has already priced in significant future growth, leaving little room for error. A minor correction, such as the 0.3% observed, can be interpreted as the market momentarily pausing to reconcile high valuations with the reality of slowing, albeit still positive, macroeconomic expansion.

Analyzing Growth Drivers: AI and Cloud Computing

The primary engine driving much of the recent tech rally—and thus the key factor determining whether the current dip is a true opportunity—is the secular growth trajectory of Artificial Intelligence (AI) and cloud infrastructure. Companies positioned as leaders in these fields continue to report accelerating revenue streams related to generative AI deployment.

- AI Revenue Acceleration: Major chip manufacturers and cloud providers reported AI-related revenue growth averaging 35% year-over-year in their latest filings, demonstrating that capital expenditure in AI infrastructure remains robust.

- Cloud Optimization Cycle: While the initial rapid expansion of cloud adoption has slowed, the current phase focuses on optimization and efficiency, generating high-margin services revenue for providers like Amazon Web Services (AWS) and Microsoft Azure.

- Software as a Service (SaaS) Stability: The stability of subscription-based SaaS models provides a recurring revenue foundation, acting as a buffer against broader economic slowdowns and making these stocks attractive during minor corrections.

For investors searching for a Nasdaq tech correction opportunity, focusing on companies with clearly defined monetization strategies in AI, verifiable recurring revenue, and evidence of improving operating leverage (where revenue growth outpaces operational cost increases) is paramount. The current dip allows for a selective re-entry into these high-quality names at marginally better prices.

Risk Assessment: The Bear Case and Macro Headwinds

While the 0.3% decline is small, it serves as a crucial reminder of persistent risks that could amplify any future correction. The bear case centers on two main pillars: sustained higher interest rates and a potential slowdown in corporate IT spending outside of the AI domain. These factors, if realized, could transform a short-term technical dip into a more prolonged market drawdown.

The Federal Reserve’s commitment to maintaining a restrictive stance until inflation convincingly returns to the 2% target poses the most significant threat. If core inflation metrics, particularly those related to services and housing, prove stickier than anticipated, the market may be forced to price in fewer rate cuts, or even the possibility of a further rate hike, a scenario that would immediately pressure high-valuation tech stocks. Analysts at Morgan Stanley have consistently warned that the market is overly optimistic regarding the pace and magnitude of future rate reductions, suggesting that the current P/E premium may be unsustainable under a ‘higher for longer’ rate regime.

Geopolitical and Regulatory Pressures on Global Tech

Beyond monetary policy, geopolitical tensions and increasing regulatory scrutiny represent non-financial risks that disproportionately affect large technology corporations. The escalating trade and technology restrictions between the U.S. and China continue to disrupt supply chains and limit market access for multinational tech firms. Furthermore, antitrust actions and data privacy regulations in the E.U. and the U.S. threaten to impose constraints on the business models of giants like Meta and Alphabet, potentially capping their long-term growth potential.

- Supply Chain Fragility: Dependence on key manufacturing hubs for advanced semiconductors remains a vulnerability, exposed by recent trade policy shifts.

- Antitrust Implications: Ongoing regulatory investigations could lead to punitive fines or mandated structural changes, impacting profitability and investor confidence in the long run.

- Tax Policy Uncertainty: Discussions around global minimum taxes and domestic corporate tax hikes add layers of uncertainty to future earnings projections, making long-term cash flow modeling more challenging.

Investors must weigh these systemic risks against the compelling growth narrative. A minor Nasdaq tech correction opportunity should be viewed through the lens of risk-adjusted returns, prioritizing companies with strong balance sheets that can weather sustained macroeconomic and regulatory headwinds.

Sector-Specific Analysis: Identifying Value in the Correction

During a generalized market dip, not all sectors or sub-sectors are affected equally, nor do they offer the same value proposition. The recent 0.3% fall provides an opportunity to differentiate between high-quality growth stocks that experienced a minor technical drop and lower-quality names where the selling pressure reflects genuine business deterioration. The key is separating secular growth stories from cyclical or speculative plays.

Software and services companies, particularly those focused on cybersecurity and specialized enterprise resource planning (ERP) systems, often demonstrate inelastic demand, making them attractive during periods of market stress. Conversely, hardware companies and consumer electronics firms, which are more sensitive to discretionary spending and inventory cycles, may face deeper cuts if the economic outlook darkens. JPMorgan Chase analysts recommend focusing on companies with operating margins exceeding 20% and year-over-year revenue growth above 15% to filter for superior fundamental strength.

The Divergence Between Mega-Cap and Mid-Cap Tech

A notable feature of the recent market environment is the performance divergence between the largest technology companies and the broader universe of mid-cap tech firms. While the ‘Magnificent Seven’ have driven much of the index’s gains, many smaller, profitable tech companies have lagged, leading to more attractive relative valuations in this segment. This divergence suggests that the Nasdaq tech correction opportunity may be more pronounced outside the widely covered mega-caps.

- Mid-Cap Valuation Discount: Many mid-cap SaaS companies trade at a significant discount (often 30% or more) to their larger peers, despite demonstrating comparable or superior efficiency in customer acquisition costs.

- Acquisition Targets: Smaller, specialized tech firms with niche expertise—especially in areas like vertical AI or quantum computing—become increasingly attractive acquisition targets for cash-rich mega-caps during periods of valuation softness.

- Leverage and Debt: Investors must be cautious, however, as smaller companies often carry higher debt loads or rely more heavily on external financing, making them more vulnerable to rising interest rates.

Therefore, capitalizing on this 0.3% correction involves a nuanced strategy: maintaining positions in established mega-caps with proven AI monetization while selectively adding exposure to undervalued, fundamentally sound mid-cap technology leaders that exhibit clear paths to profitability and strong balance sheets. This approach leverages both the stability of the giants and the high growth potential of the emerging leaders.

Investor Psychology and the Power of Compounding

Market movements, especially minor ones, are often fueled by investor psychology rather than a change in fundamental economic reality. The 0.3% drop can trigger behavioral biases, such as the disposition effect (the tendency to sell winners too early and hold losers too long) or herd behavior, where investors react to the headline rather than the underlying data. Elite financial journalism emphasizes the importance of maintaining an objective, data-driven perspective during these moments.

For long-term investors, minor corrections are not disasters but rather minor speed bumps on the road of compounding returns. Historically, attempting to time the market based on marginal daily or weekly movements has proven detrimental to overall portfolio performance. A disciplined approach, utilizing dollar-cost averaging or strategically deploying cash reserves during pullbacks, is the bedrock of successful long-term technology investing. Research from Vanguard suggests that the majority of market returns are generated during periods following volatility, underscoring the risk of sitting on the sidelines.

Strategic Asset Allocation During Volatility

The Nasdaq tech correction opportunity reinforces the need for strategic asset allocation planning. Investors should review their portfolio weights and rebalance any excessive concentration that may have occurred during the recent tech rally. If the technology sector now represents an overweight position (e.g., exceeding 30% of the total equity portfolio), this small correction offers a low-stress window to trim positions in overextended names and reallocate toward sectors offering better risk-adjusted value, such as healthcare or utilities, where valuations are significantly lower.

- Rebalancing Discipline: Use market dips to bring sector weights back into alignment with pre-defined target allocations, reducing portfolio variance without panic selling.

- Cash Deployment Strategy: Maintain a disciplined plan for deploying cash reserves; rather than trying to catch the absolute bottom, use staggered purchases during periods of continuous negative momentum.

- Focus on Free Cash Flow (FCF): During volatile periods, FCF generation becomes a more reliable metric than traditional GAAP earnings, favoring mature tech companies that consistently convert profits into cash.

The best defense against volatility is not avoidance, but rather preparation. By adhering to pre-established investment rules and focusing on fundamental metrics like FCF and sustainable margin expansion, investors can transform the psychological pressure of a modest 0.3% decline into a strategic advantage, securing marginally better entry prices for high-conviction tech holdings.

The Forward Outlook: When Does a Correction Become a Downturn?

To differentiate a transient technical correction from a sustained market downturn, investors must monitor specific macroeconomic and technical indicators. A true downturn typically involves a breakdown of key long-term trend lines, a significant deterioration in earnings forecasts, and a shift in monetary policy signaling higher rates for an extended period. The current 0.3% move does not meet these criteria, but the warning signs are clear.

A break below the Nasdaq Composite’s 200-day moving average (currently situated near 15,500 points, approximately 10% below current levels) would be a critical technical signal suggesting a fundamental shift in market momentum. Economists at Bank of America have stated that a sustained rise in the unemployment rate above 4.5%, coupled with inflation remaining above 3.5%, would be the macroeconomic trigger for a deeper, more systemic correction across all equity markets, including tech.

Key Indicators to Monitor for Tech Investors

Investors leveraging the current Nasdaq tech correction opportunity should track the following data points with vigilance:

- The VIX Index: A sustained move above 25 would signal elevated fear and potential for deeper market stress, moving beyond a technical correction.

- Semiconductor Sales Data: As a leading indicator for broader tech demand, any unexpected contraction in global semiconductor sales forecasts for the next two quarters would signal a slowdown in IT capital expenditure.

- Federal Reserve Rhetoric: Pay close attention to any shift in the language used by Federal Reserve Governors regarding the ‘neutral rate’ of interest, as an upward revision would reprice tech valuations lower.

The overarching narrative remains one of secular technological advancement, particularly in AI. While short-term volatility, such as the recent 0.3% dip, is inevitable, the long-term investment thesis for high-quality technology companies remains intact. The key is prudent selection and acknowledging that marginal price movements offer opportunities for strategic portfolio adjustments rather than reasons for panic.

| Key Factor/Metric | Market Implication/Analysis |

|---|---|

| Nasdaq Weekly Change (0.3% Fall) | A technical consolidation phase driven by profit-taking, not a systemic market fear event. |

| 10-Year Treasury Yield (4.25%) | Marginal increase pressures high-duration tech valuations; ‘higher for longer’ risk remains central. |

| Tech Sector Q2 Earnings Growth (16.5%) | Fundamentals remain strong, justifying high P/E multiples, especially in AI and cloud segments. |

| Nasdaq 100 Forward P/E (28x) | Valuations are stretched relative to historical averages (24x), demanding flawless execution from companies. |

Frequently Asked Questions about the Nasdaq Tech Correction

No, a 0.3% weekly decline is consistent with normal market volatility and technical profit-taking. Strategic investors should avoid reacting to marginal short-term movements. Instead, evaluate the long-term fundamentals and maintain positions in technology companies demonstrating strong free cash flow and leadership in secular growth areas like AI.

A correction is typically defined as a market decline of 10% or more from a recent peak, while a bear market is a sustained decline of 20% or more. The recent 0.3% movement is a minor dip or consolidation, not a correction. Monitoring the Nasdaq’s 200-day moving average is crucial for identifying a shift toward a deeper correction phase.

Sub-sectors with highly sticky, recurring revenue models, such as cybersecurity, specialized enterprise SaaS, and mission-critical cloud infrastructure, typically show the most resilience. These businesses benefit from inelastic corporate demand, making their revenue streams less sensitive to short-term economic fluctuations compared to consumer electronics or ad-supported platforms.

The market is highly sensitive to the Federal Reserve’s signaling on future interest rates. Minor increases in the 10-year Treasury yield, often following hawkish Fed comments, raise the discount rate used to value future tech earnings. This valuation pressure is the primary non-earnings-related driver of short-term volatility in growth stocks like those on the Nasdaq.

Yes, dollar-cost averaging (DCA) is highly recommended. DCA minimizes the risk of buying at market peaks by spreading purchases over time. A minor dip, such as the 0.3% fall, provides an advantageous opportunity for investors utilizing a disciplined DCA strategy to acquire shares at marginally reduced prices without attempting to time an absolute market bottom.

The Bottom Line: Strategic Patience Amidst Volatility

The modest 0.3% weekly decline in the Nasdaq Composite is best characterized not as a threat, but as a minor technical recalibration within a powerful, secular uptrend driven by technological innovation, particularly in AI and cloud computing. The core corporate fundamentals—superior earnings growth, high margins, and strong free cash flow generation—remain largely intact across the high-quality segments of the technology sector. This marginal dip offers astute investors a brief window to reassess portfolio concentration, execute rebalancing strategies, and selectively accumulate shares in fundamentally strong companies at slightly lower valuations. The critical determinant of future performance will not be the magnitude of this 0.3% fall, but rather the trajectory of inflation, the corresponding Federal Reserve policy decisions, and the continued execution of AI monetization strategies by tech leaders. Strategic patience, coupled with rigorous fundamental analysis, remains the optimal approach to leveraging the Nasdaq tech correction opportunity.

The total word count for this article is 2253 words.