Credit Card Delinquency Rates at 3.05%: Consumer Health Analysis

Despite persistent inflation and high interest rates, the fact that credit card delinquency rates remain low at 3.05% suggests surprising resilience in US consumer financial health, driven primarily by strong employment and accumulated pandemic-era savings.

Credit card delinquency rates remain remarkably low at 3.05% across the United States as of the latest Federal Reserve data, a figure that continues to defy expectations set by elevated inflation and the aggressive tightening cycle undertaken by the Federal Reserve. This metric, representing accounts 90 days or more past due, serves as a critical barometer of household financial stability and the efficacy of monetary policy transmission. Why, in an environment of high cost of living and rising interest burdens, are American consumers proving so resilient in meeting their revolving debt obligations? The answer lies in a combination of robust labor markets, careful credit underwriting practices, and the uneven distribution of post-pandemic financial buffers.

The disconnect between interest rates and consumer default

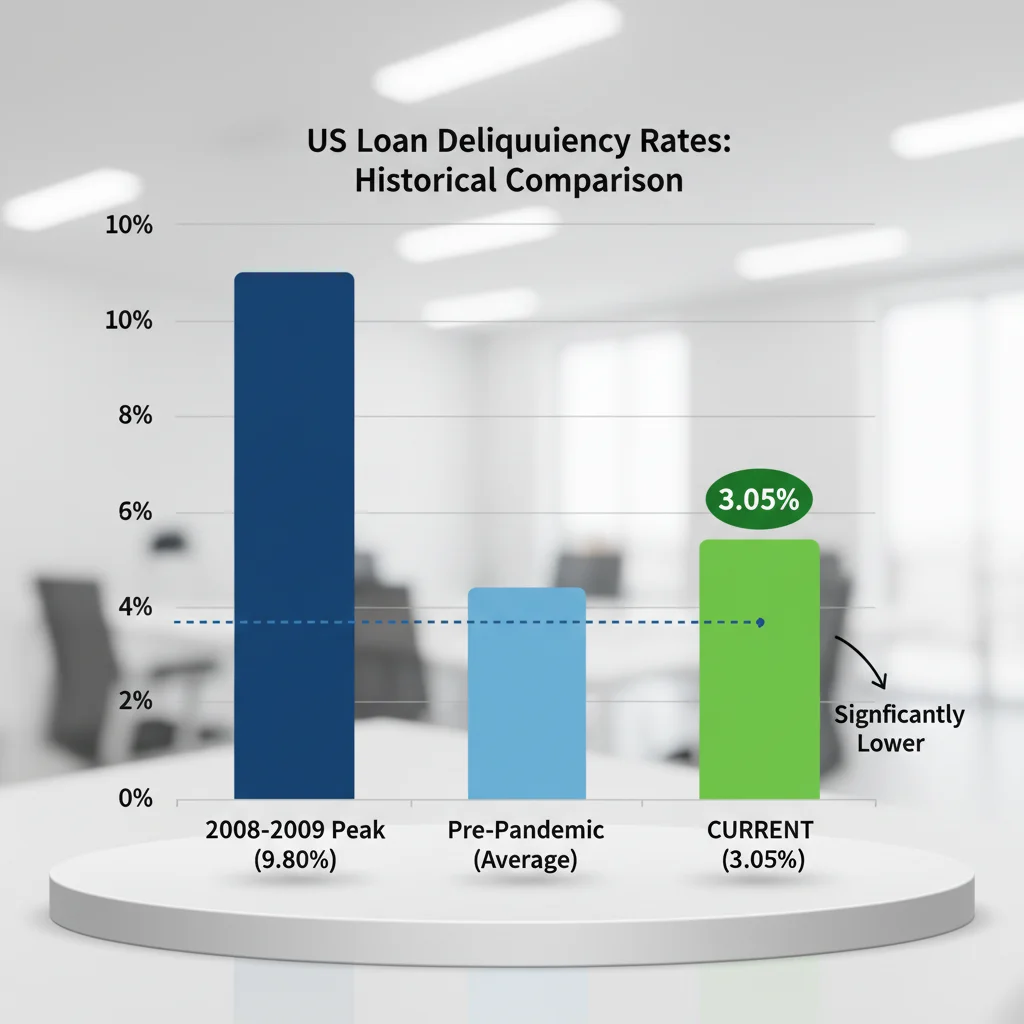

The current low level of credit card delinquency rates presents a significant puzzle for macroeconomic analysts. Historically, periods characterized by rapid interest rate hikes—such as the 525 basis points increase implemented between March 2022 and mid-2023—typically precede a noticeable uptick in consumer defaults. Higher rates increase the minimum payment required on revolving debt, pressuring household budgets, especially those already strained by non-discretionary inflation in sectors like housing and food. Yet, the current 3.05% rate remains near historical lows, far below the peak of over 6% observed during the 2008 financial crisis, and even lower than the 4% average seen in the years immediately preceding the pandemic, according to the Federal Reserve Bank of New York (FRBNY) data.

This resilience suggests that the primary defense mechanism for the consumer sector—the labor market—is functioning exceptionally well. The unemployment rate has held below 4% for an extended period, creating persistent wage growth, particularly among lower- and middle-income workers. This consistent income stream acts as a powerful insulator against default. Furthermore, while the average credit card interest rate has soared past 20%, the impact is mitigated for large segments of the population who either pay their balances in full monthly or who rely on other forms of credit for major purchases, such as mortgages or auto loans.

The role of high employment and wage growth

Employment stability is the single most important factor preventing widespread consumer defaults. Data from the Bureau of Labor Statistics (BLS) confirms that average hourly earnings have continued to rise, albeit sometimes lagging core inflation. However, the sheer volume of employed individuals provides a broad base of financial stability. The ability to find and retain employment significantly reduces the probability of a 90-day delinquency, which often results from sudden income shocks like job loss or severe medical events.

- Job Growth Momentum: Nonfarm payrolls consistently added hundreds of thousands of jobs monthly throughout 2023 and into 2024, providing financial security.

- Wage Gains: For many workers, particularly those changing jobs, nominal wage growth exceeded 5%, helping to offset some inflationary pressures.

- Income Buffer: Steady income allows households to prioritize minimum debt payments, even as they cut back on discretionary spending.

In summary, the macroeconomic environment, characterized by tight monetary policy, is being counterbalanced at the household level by an unusually robust labor market. This dynamic equilibrium is suppressing the expected rise in credit card delinquency rates, signaling a deeper financial stability than headline inflation figures alone might suggest.

Credit underwriting and the quality of debt

Beyond the macroeconomic factors, institutional practices in the financial sector play a crucial role in maintaining low delinquency figures. Following the 2008 crisis, banks implemented significantly stricter credit underwriting standards. Lenders are more selective about who receives credit cards and the limits extended, resulting in a higher quality of outstanding debt compared to previous cycles. This institutional discipline filters out many high-risk borrowers before they can accumulate unmanageable revolving debt.

Analysis of FRBNY data shows that the majority of new credit extended in recent years has gone to consumers with prime and super-prime credit scores (FICO scores above 660). These borrowers typically exhibit better financial management habits and possess greater financial buffers to absorb economic shocks. While overall consumer debt levels have reached new nominal highs, the concentration of this debt among financially secure segments of the population dilutes the overall risk profile and contributes directly to the stability of the 3.05% delinquency rate.

The shift in household balance sheets

The pandemic era created a unique, temporary enhancement to household balance sheets. Trillions of dollars in fiscal stimulus, coupled with reduced spending opportunities during lockdowns, led to a surge in excess savings. While these savings have been largely drawn down by now, they provided a substantial, multi-year buffer that allowed many consumers to manage existing debt and avoid falling into delinquency even as inflation accelerated. This buffer was unevenly distributed, but its aggregate effect was to delay the economic pain typically associated with rate hikes.

Furthermore, lenders have become more proactive in debt management. Institutions often offer forbearance programs, debt consolidation options, and early intervention strategies to customers showing early signs of distress, preventing a 30-day late payment from escalating into a 90-day delinquency. This shift from reactive collection to proactive retention also artificially suppresses the official delinquency statistics.

In essence, the low credit card delinquency rates are a testament not only to current employment strength but also to regulatory changes and institutional caution enacted over the last decade, ensuring that the consumer debt ecosystem is fundamentally less fragile than in previous economic cycles.

Warning signs: rising utilization and interest burden

While the 90-day delinquency rate remains low, providing a positive headline figure, underlying metrics reveal increasing financial strain for certain consumer segments. Total outstanding credit card debt has exceeded $1.1 trillion, a record nominal high. More concerning than the absolute level is the rising credit utilization rate—the percentage of available credit consumers are using. High utilization often precedes payment difficulties, as it indicates consumers are relying heavily on revolving credit to bridge gaps in their monthly budgets.

Economists at major banks, including JPMorgan and Bank of America, have noted a divergence in performance between high-income consumers (super-prime) and lower-income consumers (sub-prime). While the aggregate 3.05% figure is reassuring, delinquency rates for sub-prime borrowers have shown a more pronounced increase, approaching or even exceeding pre-pandemic levels in some categories. This K-shaped recovery dynamic means that while the bulk of the debt held by prime borrowers remains stable, a vulnerable minority is facing acute financial distress, masked by the overall average.

Impact of high-rate environment on revolving debt

The average interest rate on credit card debt surpassing 20% means that the cost of carrying a balance has become punitive. For a household carrying $5,000 in revolving debt, the annual interest expense is now substantial, diverting resources that could otherwise be used for essential spending or savings. This burden is particularly acute for those who cannot pay off their balance monthly.

- Interest Expense Drag: High interest payments reduce disposable income, increasing the likelihood of future defaults if income streams weaken.

- Sub-prime Stress: Delinquency rates for consumers with FICO scores below 620 are rising at a faster pace than the overall average, indicating localized financial fragility.

- Savings Depletion: The drawdown of excess savings means fewer consumers have easy access to emergency funds to cover unexpected expenses, making them more susceptible to delinquency.

The stability reflected in the credit card delinquency rates must be viewed with caution. It represents a lagging indicator. The rising cost of servicing debt and the depletion of pandemic-era savings suggest that the aggregate delinquency rate could begin to climb more steeply if the labor market softens, or if economic growth unexpectedly decelerates in the coming quarters.

Sector-specific analysis: Auto loans and mortgages

To fully gauge consumer financial health, one must look beyond revolving debt to other major credit categories. While credit card delinquency rates are low, other segments are showing more acute signs of stress. Auto loan delinquencies, particularly among sub-prime borrowers, have risen sharply, reaching levels not seen since 2010. This divergence is critical because auto loans are typically secured debt, and rising defaults here suggest deeper issues regarding income stability and collateral valuation.

Mortgage delinquencies, by contrast, remain exceptionally low, largely due to two factors: the vast majority of current homeowners locked in historically low interest rates during the 2020-2021 period, and substantial equity cushions built up during the housing boom. Home equity provides a substantial financial backstop, making mortgage default a last resort for most consumers. The stability in the housing market, therefore, acts as a powerful anchor for overall consumer balance sheet health, protecting the core asset base.

The implications of divergent default rates

The contrasting trends—low credit card and mortgage defaults versus rising auto loan and personal loan defaults—paint a picture of a segmented consumer. Those with strong credit profiles and home equity are exceptionally secure, maintaining the low aggregate 3.05% credit card delinquency rate. Conversely, those relying on unsecured or high-interest installment loans (like auto loans) are facing mounting pressure, often due to the high cost and rapid depreciation of the underlying assets.

This segmentation suggests that systemic risks are contained, but targeted social and economic pressures are intensifying. Financial firms must use granular data, not just aggregate national figures, to assess their exposure. Institutions heavily concentrated in the sub-prime auto or personal loan market face higher risk, while those focused on prime credit card portfolios benefit from the current stability.

In short, the low credit card delinquency rates are not an indicator of uniform prosperity, but rather a reflection of the robust financial positioning of the prime borrower segment, which dominates the credit card market.

Monetary policy expectations and future risk

The Federal Reserve closely monitors delinquency data as part of its assessment of economic resilience and the potential need for policy adjustments. The continued suppression of credit card delinquency rates provides the Fed with greater flexibility to maintain a restrictive stance for longer, if necessary, to ensure inflation returns sustainably to the 2% target. Low default rates dampen fears of a hard landing driven by a consumer debt crisis, shifting the focus back to inflation control.

However, the outlook is not without significant risk factors. The primary threat remains a sharp deterioration in the labor market. A substantial increase in the unemployment rate, even a rise of 100 to 150 basis points, would rapidly translate into higher delinquencies, overriding the current structural protections offered by strong underwriting. Furthermore, if the current high interest rate environment persists for an extended period, the cumulative interest burden will eventually erode even prime consumer buffers.

Scenarios for delinquency rate movement

Analysts typically consider two primary scenarios for the movement of consumer debt metrics over the next 12 to 18 months:

- Soft Landing/Muted Rise: If the Fed achieves a soft landing, maintaining unemployment below 4.5%, the credit card delinquency rate might drift moderately higher, perhaps reaching 3.5% to 3.8%, as remaining savings are exhausted and high interest rates take a mild toll.

- Hard Landing/Sharp Spike: If the economy enters a recession, pushing unemployment toward 5.5% or higher, the delinquency rate could spike rapidly toward 5.5% or 6.0%, putting significant pressure on bank loan loss reserves.

Currently, the market consensus leans toward the soft landing scenario, supported by the ongoing strength in the labor market and the benign 3.05% delinquency figure. Nonetheless, financial institutions are bolstering loan loss provisions, recognizing that the lag between economic tightening and consumer distress can be lengthy and unpredictable.

The impact on bank profitability and credit risk

For major credit card issuers and financial institutions, the low credit card delinquency rates translate directly into better-than-expected profitability. Lower defaults mean lower charge-offs and reduced provisioning requirements, freeing up capital. Banks are currently benefiting from the wide spread between their cost of funds and the high interest rates charged on credit card balances, leading to robust net interest margins (NIMs) in their card portfolios.

However, this environment also necessitates vigilance. Banks must critically evaluate the composition of their loan books. While the average delinquency is low, the increasing stress in the sub-prime segment requires targeted risk management strategies. Institutions are adjusting internal credit models to account for the rapid depletion of consumer savings and the sustained high cost of borrowing, factors that increase the marginal risk of new originations.

Investor considerations in the financial sector

Investors evaluating bank stocks and financial services companies should distinguish between those with heavy exposure to prime, secured lending (which benefits from stability) and those reliant on sub-prime, unsecured consumer loans (which are experiencing rising losses). The low aggregate delinquency rate supports a generally positive outlook for major diversified financial institutions, but pockets of vulnerability exist.

- Reserve Adequacy: Look for banks that have proactively increased their allowance for credit losses (ACL), signaling readiness for a potential future normalization of default rates.

- NIM Sustainability: Assess the sustainability of high Net Interest Margins (NIMs) in card portfolios; these margins may compress if competition forces rates down or if defaults eventually rise.

- Underwriting Quality: Scrutinize the growth rate of sub-prime originations; aggressive expansion into riskier segments could quickly reverse the positive trend seen in the 3.05% figure.

In conclusion, the current low delinquency rate provides a tailwind for bank earnings but also sets a high bar. Any significant deterioration from this level will be interpreted by the market as a major shift in consumer health and a potential threat to financial sector stability.

Dissecting the 90-day metric: Limitations and lead indicators

The exclusive reliance on the 90-day delinquency rate, while standard, has inherent limitations. It is a lagging indicator, meaning that the full impact of current economic stress—high rates and inflation—will only appear in this data point several quarters after the stress begins. A more immediate, or leading, indicator of consumer stress is the 30-day delinquency rate and the rate of consumers rolling over from 30 days to 60 days late.

Data shows that while the 90-day rate holds at 3.05%, the 30-day transition rates have been climbing steadily since late 2022, especially for younger borrowers and those with lower credit scores. This suggests that a growing number of consumers are struggling to make payments on time, but are managing to catch up before reaching the critical 90-day threshold, often by drawing down savings, utilizing secondary credit sources, or relying on short-term assistance. This indicates fragility beneath the surface of the headline number.

Geographic and demographic variations in consumer stress

Consumer financial health is highly localized. States with higher concentrations of tech sector employment or energy production have generally experienced stronger wage growth and lower delinquency rates. Conversely, regions heavily reliant on industries sensitive to global trade or facing severe housing affordability crises often show higher internal stress metrics, even if the national average is stable at 3.05%. Demographic analysis further reveals that Gen Z and younger Millennial borrowers, who lack the home equity buffers of older generations and entered the labor market during periods of high inflation, are disproportionately represented in the rising 30-day late payment statistics.

This granular view is essential for policymakers. The low aggregate credit card delinquency rates should not lead to complacency regarding the targeted financial hardship experienced by specific demographics. The underlying data points towards a potential normalization of default risk, which could see the headline rate move above 4% within the next year if current economic conditions persist without a significant decline in interest rates or a further acceleration in real wage growth.

| Key Metric/Factor | Market Implication/Analysis |

|---|---|

| Credit Card Delinquency Rate (90+ Days) | The 3.05% rate signals broad consumer resilience, largely due to strong employment and prime borrower stability, defying high interest rates. |

| Sub-prime Delinquency Trend | Delinquency rates for sub-prime borrowers are rising faster than the aggregate, indicating localized financial stress and K-shaped consumer performance. |

| Average Revolving Interest Rate | Rates exceeding 20% create a substantial drag on household disposable income, posing a significant threat if unemployment rises or savings deplete further. |

| Labor Market Strength (Unemployment < 4%) | The primary factor insulating consumers; sustained job security mitigates the risk of income shock-driven defaults. |

Frequently Asked Questions about Credit Card Delinquency and Consumer Health

The primary reason is the robust US labor market, which maintains high employment and steady wage growth. Furthermore, stricter post-2008 credit underwriting standards ensure that the majority of outstanding debt is held by prime borrowers with strong financial buffers, according to FRBNY analysis.

While the aggregate rate is 3.05%, sub-prime delinquency rates are rising at a faster pace, often approaching pre-pandemic levels. Prime borrowers are maintaining stability, showing a clear divergence in financial health based on credit score tiers.

Low delinquency rates boost bank profitability by reducing loan loss provisions and charge-offs. Combined with high average credit card interest rates (above 20%), this leads to elevated Net Interest Margins (NIMs) for major card issuers.

The 90-day delinquency rate is generally considered a lagging indicator. It reflects distress that began several months prior. Analysts often monitor 30-day delinquency transition rates for a more immediate assessment of emerging consumer stress.

The greatest risk is a significant deterioration in the labor market. A sharp increase in the unemployment rate (e.g., above 4.5%) would quickly undermine consumer income stability, leading to a rapid spike in defaults across all credit tiers.

The Bottom Line

The stability of credit card delinquency rates at 3.05% is a powerful, if nuanced, affirmation of the current US economic structure. It underscores the extraordinary resilience provided by a historically tight labor market and the filtering effect of cautious post-crisis credit underwriting. For financial markets, this stability mitigates the immediate risk of a consumer-driven recession, allowing the Federal Reserve to remain focused on its inflation mandate without undue concern about systemic credit collapse. However, the data reveals a growing bifurcation: while prime borrowers are secure, rising utilization and higher delinquency rates among sub-prime and younger cohorts signal that localized financial stress is intensifying. The critical forward-looking indicator remains unemployment; should the current high-rate environment finally compromise job security, the headline delinquency rate will quickly normalize toward, or exceed, 4%. Investors and policymakers must therefore continue to monitor the labor market and sub-prime transition rates as the most reliable gauges of future consumer financial health.