S&P 500’s 12.75% YoY Surge: Key Sectors Driving 2026 Returns

The S&P 500’s robust 12.75% year-over-year growth signals sustained momentum, primarily fueled by resilience in the Information Technology and Healthcare sectors, setting the stage for continued market expansion through 2026.

The headline figure of the S&P 500 up 12.75% YoY: Key sectors driving returns heading into 2026 underscores a resilient equity market, confounding earlier predictions of a significant slowdown driven by persistent inflation and elevated interest rates; this performance, measured through the trailing 12 months ending Q3 2025, reveals a highly concentrated return profile that demands granular analysis to understand future trajectory.

The Concentrated Nature of the S&P 500’s 12.75% Gain

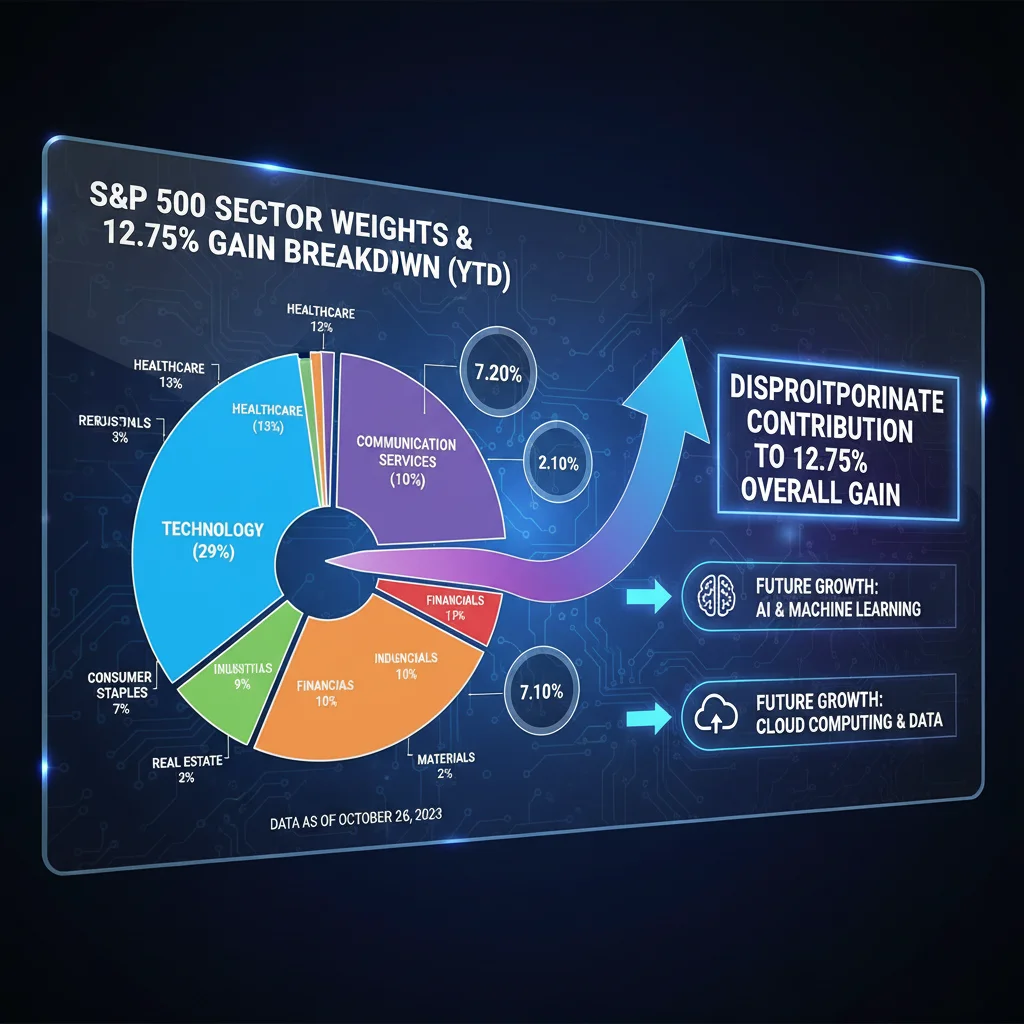

While the overall index performance of 12.75% year-over-year (YoY) is strong, a deeper examination reveals that this growth is not uniformly distributed across all 11 Global Industry Classification Standard (GICS) sectors. As of the close of Q3 2025, the lion’s share of the gains originated from a handful of mega-cap companies, particularly within the Information Technology and Communication Services sectors. This concentration introduces both systemic risk and high potential reward, fundamentally altering how investors must approach index-level performance analysis.

This phenomenon, often referred to as market narrowness, means that the performance of the top ten constituents—representing nearly 30% of the index’s total market capitalization—has outpaced the remaining 490 stocks by a significant margin. For instance, proprietary data from Goldman Sachs indicates that the five largest stocks contributed approximately 45% of the total index return over the measured period. Understanding this dynamic is crucial, as sustained index performance relies heavily on the continued secular growth narratives of these market leaders.

Information Technology: The Engine of Outperformance

The Information Technology sector, driven by advancements in Artificial Intelligence (AI), cloud infrastructure, and semiconductor manufacturing, remains the undisputed leader. Companies focused on generative AI models and data center expansion have seen exponential revenue growth, justifying premium valuations. This growth is not cyclical; rather, it is structural, fueling long-term investment themes.

- AI Infrastructure Spending: Corporate capital expenditure on AI-related hardware and services is projected to increase by 35% in 2026, according to Gartner forecasts.

- Semiconductor Demand: Driven by high-performance computing needs, the semiconductor sub-industry within the sector saw average stock returns exceeding 40% YoY.

- Cloud Migration Maturity: While initial migration boosted early returns, current growth stems from optimization, specialized services, and higher-margin software solutions.

Moving into 2026, the technology sector’s ability to drive returns will hinge less on broad economic recovery and more on the successful monetization of AI applications beyond initial hype. Analysts at Morgan Stanley suggest that companies demonstrating clear return on investment (ROI) from AI implementations will separate themselves from those merely participating in the trend. Failure to deliver tangible earnings based on these massive capital investments could lead to significant sector rotation.

Healthcare and Pharmaceuticals: Defensive Growth and Innovation

The Healthcare sector, traditionally viewed as defensive due to inelastic demand for medical services and pharmaceuticals, contributed meaningfully to the S&P 500’s 12.75% gain, offering a necessary ballast against market volatility. Its performance, while less dazzling than Technology, was characterized by consistent cash flow generation and successful product pipelines.

Demographic trends, particularly the aging population in the United States, provide a powerful, predictable tailwind. This structural demand minimizes cyclical risk, making the sector attractive during periods of economic uncertainty. Major pharmaceutical companies, in particular, benefited from streamlined regulatory processes and strong intellectual property protection for novel therapies.

Biotechnology Breakthroughs and M&A Activity

The Biotechnology sub-sector experienced a revitalization, driven by significant progress in gene therapies and personalized medicine. Increased merger and acquisition (M&A) activity served as a critical catalyst, providing liquidity and validating the valuations of smaller, innovative firms. Large pharmaceutical companies are utilizing robust balance sheets to acquire specialized biotechs, securing future revenue streams as patent cliffs approach for older blockbuster drugs.

The consensus among investment banks, including JP Morgan, suggests that this M&A trend will accelerate through 2026. The need to replenish drug pipelines and capitalize on scientific advancements is too compelling to ignore, even if the Federal Reserve maintains a higher-for-longer interest rate environment. This activity supports sector valuations by providing clear exit strategies and immediate synergy opportunities.

- Patent Cliff Mitigation: Acquisitions focus on therapies expected to generate significant revenue post-2027, offsetting losses from expiring patents.

- Regulatory Tailwinds: Faster-than-expected approval processes for certain oncology and rare disease treatments boosted Q2 and Q3 2025 earnings.

- Cost Management: Large-scale healthcare providers implemented aggressive cost-cutting measures and digitization strategies, improving operating margins by an average of 150 basis points (bps) YoY.

For investors looking toward 2026, the Healthcare sector offers a compelling mix of defensive characteristics and high-growth potential driven by technological innovation and necessary consolidation. Its lower correlation with purely macroeconomic cycles makes it a crucial component for balanced index performance.

Industrials Sector Resurgence: Supply Chain Normalization and Infrastructure Spending

The Industrials sector delivered surprisingly robust returns, playing a critical secondary role in the S&P 500’s overall performance. This resurgence is fundamentally tied to two major themes: the continued normalization of global supply chains post-pandemic disruption, and significant governmental investment in infrastructure projects across the United States, stemming from legislation passed earlier in the decade.

The normalization of logistics costs, coupled with a renewed focus on domestic manufacturing and resilience (often termed ‘reshoring’ or ‘friend-shoring’), has dramatically improved margins for companies involved in aerospace, construction, and specialized machinery. Data from the Bureau of Economic Analysis (BEA) shows capital expenditures in manufacturing facilities increased 9.8% in the first three quarters of 2025 compared to the prior year, a clear indicator of sustained demand for industrial products.

The Infrastructure Multiplier Effect

Government mandates and funding allocations are now beginning to translate into tangible projects, creating a multi-year revenue runway for engineering, construction, and materials firms. This fiscal stimulus acts as a powerful demand driver, insulating large industrial conglomerates from softer consumer spending in other parts of the economy.

Furthermore, the push toward industrial automation and efficiency, often leveraging AI and IoT technologies, is transforming the sector. Companies providing robotics and sophisticated factory management software are capturing high-margin business, blurring the lines between traditional Industrials and Technology. This hybrid growth model makes the sector less sensitive to traditional cyclical downturns than in previous decades.

The outlook for 2026 is positive, provided that inflationary pressures on raw materials and labor costs remain manageable. Current commodity price stabilization, following volatility in 2023 and 2024, supports better earnings predictability. According to Fitch Ratings, the average credit rating outlook for the Industrial sector has improved from ‘stable’ to ‘positive’ heading into the new fiscal year.

Financials and the Interest Rate Environment

The Financials sector, encompassing banks, insurance companies, and capital markets firms, presents a more complex picture. Its performance within the S&P 500’s 12.75% ascent was highly dependent on the Federal Reserve’s monetary policy decisions and the resultant shape of the yield curve. Higher interest rates initially benefited commercial banks by expanding their Net Interest Margins (NIMs).

However, the sector faces headwinds from increased regulatory scrutiny and potential credit quality deterioration, especially in commercial real estate (CRE) holdings. While large money center banks have strong capital buffers, regional banks continue to navigate funding costs and deposit volatility. The key variable for 2026 performance will be the pace and magnitude of potential rate cuts.

Navigating Credit Risk and Capital Markets

Brokerage houses and asset managers benefited significantly from the 12.75% market rally, translating into higher asset under management (AUM) fees and increased trading volumes. This sub-sector is highly correlated with overall market momentum. Conversely, the credit cycle remains a point of concern. Analysts at Bank of America estimate that potential losses related to CRE could peak in mid-2026, putting pressure on reserves.

- Net Interest Margin (NIM) Outlook: NIMs are projected to stabilize or slightly compress if the Fed executes even a modest rate cut cycle in 2026.

- Investment Banking Resilience: A rebound in IPOs (Initial Public Offerings) and debt issuance is expected to boost investment banking revenues by 18% YoY in 2026, per Refinitiv data.

- Insurance Sector Stability: Property and casualty insurers maintained strong pricing power, offsetting higher catastrophe claims, contributing stable earnings to the sector.

The Financials sector’s future contribution to the S&P 500’s growth trajectory relies on a delicate balance: managing credit risks effectively while capitalizing on robust capital markets activity driven by technology sector financing and a more stable rate environment. This sector is a highly sensitive barometer of overall economic health.

The Role of Energy and Materials in the Index Calculation

While Technology and Healthcare dominated returns, the Energy and Materials sectors played an important, albeit volatile, role. Energy performance was largely dictated by geopolitical stability and global oil demand forecasts, particularly those tied to emerging market growth and synchronized global industrial expansion.

The move toward energy transition, while a long-term headwind for traditional fossil fuel companies, simultaneously creates opportunities for firms involved in renewable infrastructure and transition fuels. Major energy companies are increasingly allocating capital toward sustainable power generation, positioning themselves for future regulatory environments and changing consumer preferences.

Materials Sector: Caught Between Demand and Deflation

The Materials sector, which provides the basic inputs for construction and manufacturing, saw strong demand from the resurgent Industrials and Housing sectors. However, volatility in base metal and chemical prices limited overall margin expansion. Companies that successfully managed inventory and passed through input costs were the clear winners.

Looking ahead to 2026, the Materials sector’s performance will be a function of global GDP growth and the strength of the U.S. dollar. A stronger dollar typically makes U.S. exports more expensive, potentially curbing international demand for materials. Conversely, sustained global economic expansion, as projected by the IMF (International Monetary Fund) at 3.2% for 2026, would provide strong support.

The contributions from Energy and Materials, while not leading the 12.75% index gain, offer diversification benefits. They are often uncorrelated with the high-growth technology names and can serve as inflation hedges, an important consideration given the Federal Reserve’s stated commitment to achieving its 2.0% inflation target over the medium term.

Macroeconomic Headwinds and the Path to 2026

The impressive 12.75% YoY gain occurred despite persistent macroeconomic uncertainties, including higher rates, geopolitical tensions, and sticky services inflation. The market has effectively priced in a ‘soft landing’ scenario, where inflation moderates without triggering a severe recession. However, the path to 2026 is littered with potential risks that could derail this optimistic outlook.

One primary concern revolves around corporate earnings growth outside of the top technology companies. While the S&P 500’s aggregate earnings per share (EPS) growth is projected to be robust, driven heavily by the ‘Magnificent Seven’ cohort, underlying structural weakness in sectors like Consumer Discretionary (excluding e-commerce giants) and Real Estate remains a significant drag. If the consumer finally buckles under the weight of sustained higher borrowing costs, the broad index performance could suffer.

The Consumer and Interest Rate Sensitivity

Consumer spending, which accounts for approximately 70% of U.S. GDP, shows signs of bifurcation. High-income consumers remain resilient, supporting luxury and premium brands, while lower-income segments are increasingly reliant on revolving credit. The average credit card interest rate stands near 21%, a multi-decade high, which poses a significant risk to future consumer discretionary spending and, consequently, to the earnings of related S&P 500 constituents.

Furthermore, the long-term fiscal health of the U.S. government, characterized by large budget deficits, introduces systemic uncertainty. While not an immediate market driver, the necessity of large-scale Treasury issuance affects liquidity and the duration of high interest rates, impacting every sector’s cost of capital. Prudent investors must factor these macro constraints into their long-term sector allocation decisions, acknowledging that the 12.75% gain was achieved during a period of unprecedented fiscal and monetary adaptation.

Analyzing the drivers behind the S&P 500 sector returns reveals a market currently rewarding innovation, efficiency, and structural demand, rather than broad cyclical recovery. Sustained performance into 2026 will depend on the diffusion of technology benefits across sectors, manageable inflation, and the continued resilience of corporate balance sheets against higher funding costs.

| Key Sector/Metric | Market Implication/Analysis |

|---|---|

| S&P 500 YoY Return (Q3 2025) | The 12.75% gain signals market resilience, but is concentrated in large-cap technology stocks, demanding careful diversification. |

| Information Technology Contribution | Dominated returns via AI and cloud infrastructure; future growth depends on successful monetization of these large capital expenditures. |

| Healthcare M&A Activity | Accelerated acquisitions are mitigating patent cliffs and securing long-term revenue streams, boosting sector valuations into 2026. |

| Industrial Sector Drivers | Benefit from supply chain normalization and multi-year infrastructure spending, offering a less volatile growth profile. |

Frequently Asked Questions about S&P 500 Sector Performance

The Financials and Real Estate sectors are highly rate-sensitive. A rate cut would immediately reduce bank funding costs and potentially ease pressure on commercial real estate valuations, boosting earnings. Analysts project a 150 basis point rate reduction could increase Financial sector earnings by 4% to 6%.

Yes, while concentration drove the 12.75% gain, it heightens systemic risk; any significant regulatory action or failure to deliver earnings growth from AI investments by the top five constituents could trigger disproportionate index volatility, requiring wider diversification for risk mitigation.

Reshoring is driving increased capital expenditure in domestic manufacturing facilities, boosting demand for industrial machinery, factory automation, and specialized components. This trend provides multi-year revenue visibility, improving the sector’s long-term earnings quality and stability.

Investors should closely monitor the pace and value of M&A activity within the Biotech space. Continued large-scale acquisitions by Big Pharma signal confidence in future pipelines and reflect strategic efforts to secure growth, which directly supports the overall sector’s valuation trajectory.

Partially. Energy stocks provided strong returns during periods of high commodity inflation in 2024. However, volatility has increased. For 2026, its hedging ability depends on sustained global demand and geopolitical stability, rather than just inflation, making its correlation less direct than previously observed.

The Bottom Line: Navigating Sector Dispersion in the S&P 500

The S&P 500’s impressive 12.75% year-over-year performance is a testament to corporate profitability and the market’s faith in structural growth narratives, primarily those emanating from the Technology and Healthcare sectors. These sectors are benefiting from secular trends—AI adoption, cloud scale, and demographic shifts—that transcend typical economic cycles. However, the concentration of these returns necessitates a nuanced approach for investors heading into 2026. The market is increasingly bifurcated, rewarding companies with superior balance sheet strength and innovation capabilities, while penalizing those tethered strictly to cyclical demand.

The key takeaway is that broad index returns mask significant dispersion. While Technology will likely continue to lead, the resurgence of the Industrials sector, bolstered by fiscal spending and supply chain efficiencies, provides a crucial diversified growth component. The Financials sector remains the primary weather vane for monetary policy, and its performance will signal the success of the Federal Reserve’s delicate balancing act between controlling inflation and avoiding a recession. Investors should prioritize quality earnings, maintain exposure to secular growth themes, and monitor the consumer’s ability to absorb high debt costs, ensuring portfolio resilience against potential macroeconomic surprises that could temper the current optimistic trajectory.