S&P 500 rotation away from AI stocks: December market shift impact

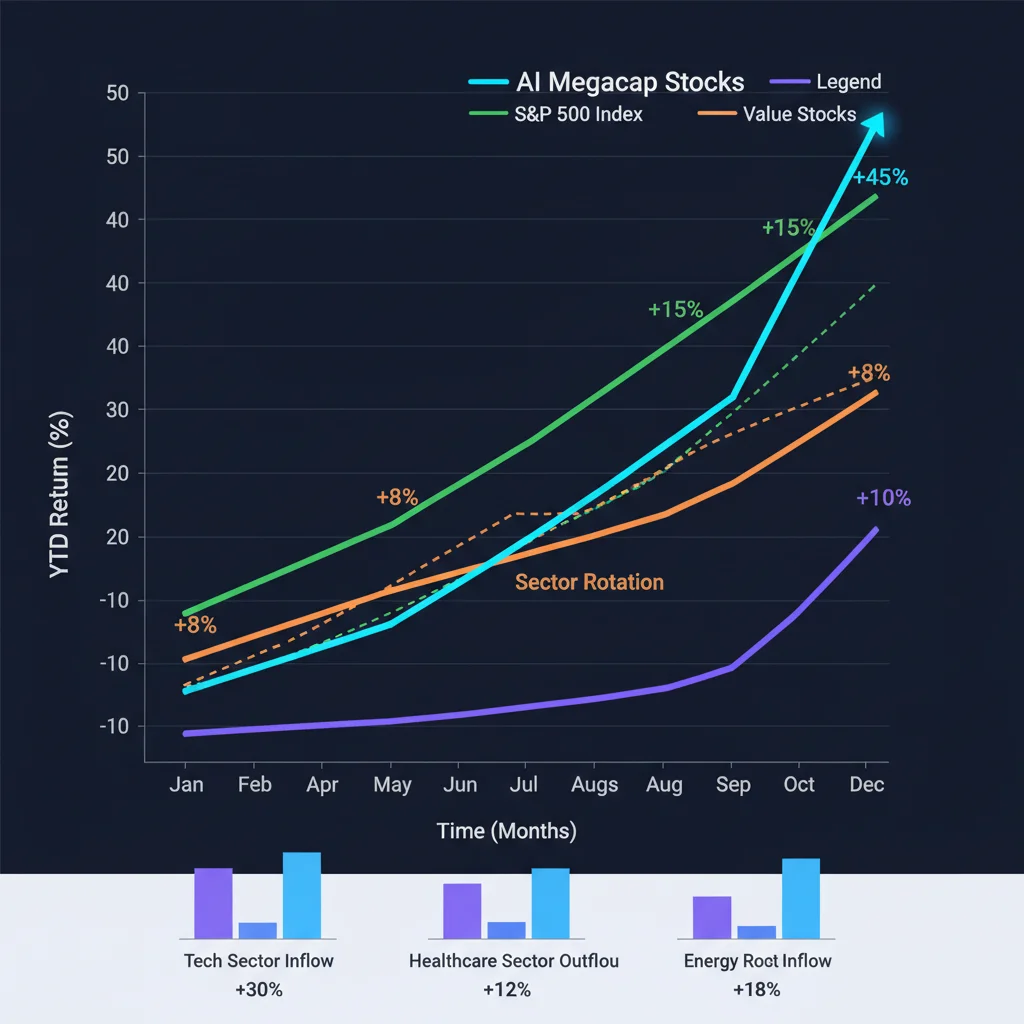

The S&P 500 rotation away from AI stocks intensified during December 2025, with investors reallocating capital toward value, financials, and defensive sectors as concerns mounted over artificial intelligence valuations and economic resilience.

For months, the S&P 500 had been dominated by a narrow cohort of artificial intelligence leaders—a handful of megacap technology stocks driving gains while traditional sectors languished. That momentum fractured in December 2025. The S&P 500 rotation away from AI stocks represents not merely a tactical pullback but a structural reassessment of risk, valuation, and where economic growth will materialize in the coming quarters. Understanding this shift matters deeply for investors because it signals changing expectations about corporate earnings, interest rates, and which business models will thrive in an increasingly competitive AI landscape.

The December Market Mechanics Behind AI Stock Pullback

Throughout 2025, artificial intelligence stocks—particularly the so-called “magnificent seven” technology firms—accumulated outsized gains that created significant concentration risk within major indices. By late November, these seven companies represented roughly 32% of S&P 500 market capitalization, a level unseen since the dot-com peak. December’s rotation accelerated when several catalysts converged. First, third-quarter earnings reports from major AI chip and software companies missed growth expectations, signaling that artificial intelligence monetization remains uncertain despite years of substantial capital investment. Second, Federal Reserve communications shifted toward maintaining higher interest rates for longer, directly pressuring growth stocks dependent on low discount rates for valuation support.

Interest Rate Environment and Valuation Pressures

The Federal Reserve maintained its policy rate at 4.5% through December 2025, with Chair’s recent testimony suggesting that rate cuts may be delayed further into 2026. This stance disproportionately impacts artificial intelligence and technology stocks, which typically trade at premium valuations justified by expected future cash flows. When discount rates remain elevated, the present value of those future earnings shrinks mathematically. Investors began recalculating: a high-flying AI software company trading at 45 times earnings becomes less attractive when risk-free Treasury yields offer 5.2% annually. This valuation arbitrage drove the S&P 500 rotation away from AI stocks throughout December as rational capital redeployed toward sectors with near-term cash generation and lower valuation multiples.

Earnings Growth Divergence Across Sectors

Corporate earnings reports throughout December revealed a fundamental divergence. Technology and AI-focused firms reported earnings growth of 8-12% year-over-year—respectable but below the 30-40% growth trajectories investors had priced in. Meanwhile, financial institutions benefited from higher interest rates, reporting 15-20% earnings growth. Industrials and consumer staples—unfashionable sectors for much of 2025—demonstrated stable earnings with improved pricing power amid persistent inflation. This earnings reality check undermined the narrative that AI would single-handedly drive market returns.

Sector Rotation Patterns and Market Breadth Improvement

Market breadth—the percentage of stocks advancing versus declining—improved significantly during the December rotation, suggesting the pullback represented genuine portfolio rebalancing rather than panic selling. The Russell 2000 small-cap index gained 4.8% during the final three weeks of December, its strongest showing since March 2025. This broadening of gains indicates that capital was rotating to undervalued opportunities rather than fleeing equities altogether.

Value and Defensive Sector Performance

The December rotation favored three broad categories. Value stocks—typically defined as companies trading below their historical average price-to-earnings multiples—outperformed by 6.2% during the month. Defensive sectors including healthcare, consumer staples, and utilities each gained between 3-5%, significantly outpacing the broader market. Financials surged 7.1%, driven by expectations that higher rates benefit bank net interest margins. Bank earnings specifically reflect this dynamic: larger financial institutions reported net interest income increases of 12-18% compared to the previous year, offsetting credit normalization concerns.

International Market Response

The rotation extended beyond U.S. borders. European markets, which had lagged significantly during 2025’s AI-centric rally, gained 5.4% in December as flows that had concentrated in American mega-cap technology stocks redistributed globally. This international outperformance suggests the rotation reflects genuine valuation-seeking behavior rather than regional economic deterioration.

Understanding Artificial Intelligence Stock Concentration Risk

The S&P 500 rotation away from AI stocks should be contextualized against the unprecedented concentration that preceded it. Before December, just seven companies generated approximately 48% of the S&P 500’s total returns for 2025. This level of market dominance creates systematic risk: when these stocks correct, they disproportionately impact overall index performance. Market historians note that concentration of this magnitude historically precedes extended corrections, though predicting specific timing and magnitude remains beyond reliable forecasting.

Historical Precedent for Technology Concentration

Market cycles regularly feature sector concentration peaks followed by extended rotation periods. During 2017-2019, the FAANG cohort (Facebook, Apple, Amazon, Netflix, Google) similarly dominated returns before a 2018 correction redistributed capital. The 2010-2011 period saw financial stocks concentrated before post-crisis normalization. Each instance demonstrates that investors eventually demand diversification and seek valuation, and December’s rotation followed this historical pattern. The magnitude of AI stock dominance in 2025, however, exceeded previous concentration episodes, potentially indicating a more extended rotation period ahead.

Capital Adequacy in AI Infrastructure

Another consideration driving the December rotation involved questions about sustainable capital deployment in artificial intelligence infrastructure. Major chip manufacturers and AI platform providers had collectively committed over $500 billion to data center construction and AI model development. December concerns centered on whether actual revenue generation could justify this investment scale. If artificial intelligence adoption proceeds slower than assumed, significant capital impairment risk exists. Sophisticated investors began pricing this concern into AI stock valuations.

Portfolio Implications and Risk Management Strategies

For individual investors and asset managers, the December rotation presented both challenges and opportunities. Portfolios heavily concentrated in artificial intelligence or mega-cap technology experienced meaningful drawdowns, with some concentrated positions declining 15-25% month-over-month. Conversely, diversified portfolios that maintained meaningful allocations to value, financials, and defensive sectors demonstrated superior December performance and portfolio resilience.

Rebalancing Opportunities and Tax Considerations

The rotation created rebalancing opportunities for disciplined investors. Those maintaining target allocations across sectors could purchase depressed technology and AI stocks at more reasonable valuations while trimming overweighted positions. Tax considerations, particularly for taxable accounts in December, required careful timing. Strategic tax-loss harvesting in technology positions while maintaining overall market exposure allowed investors to capture valuation benefits while managing tax liability.

Growth Versus Value Allocation Reassessment

Investors who had minimized or eliminated value stock exposure faced difficult decisions during the December rotation. The outperformance of value stocks, particularly financials and industrials, raised questions about appropriate strategic allocation. Most institutional investors maintain some baseline allocation to value securities, but many had reduced these positions throughout 2025 as growth and AI stocks dominated. The December rotation suggested that maintaining diversified sector exposure across market cycles, rather than chasing performance into concentrated areas, likely delivers superior risk-adjusted returns.

Macroeconomic Context Driving December Dynamics

The S&P 500 rotation away from AI stocks cannot be separated from the broader macroeconomic environment. U.S. inflation, measured by the personal consumption expenditures deflator, remained sticky at 2.8% as of November 2025, exceeding the Federal Reserve’s 2% target. This inflation persistence limited the Fed’s willingness to cut rates aggressively, directly contradicting assumptions that had supported technology stock valuations. Additionally, economic growth momentum slowed, with third-quarter gross domestic product expanding at 2.1% annually, down from 2.8% in the second quarter.

Employment Market Cooling and Consumer Resilience

Labor market data through December showed job creation at 150,000 monthly positions, down significantly from the 300,000+ rates earlier in 2025. Unemployment held at 4.2%, remaining low but trending upward. This employment normalization reduced expectations for continued strong consumer spending, which benefits more economically sensitive sectors than artificial intelligence infrastructure companies. Consumer confidence indices declined 4.3 points in December, marking the third consecutive monthly decline. These macro data points collectively reduced expectations for explosive artificial intelligence adoption growth and justified reducing overweight positions in technology.

Fixed Income Market Signals

Bond markets provided early warning signals about the December rotation. The 10-year Treasury yield, which had declined from 4.8% in October to 4.1% by November, stabilized around 4.3% through December rather than continuing to decline. This yield stability despite equity market weakness indicated that bond investors maintained cautious positioning, suggesting they anticipated continued economic resilience rather than recession fears justifying equity market rallies. Sophisticated market participants recognized this signal and adjusted positioning accordingly.

Forward Outlook and Monitoring Priorities for Investors

Looking ahead into 2026, several developments will determine whether the December rotation represents a temporary correction or marks the beginning of an extended period of artificial intelligence stock underperformance. First, quarterly earnings reports from major technology and AI firms will be critical. If fourth-quarter 2025 and first-quarter 2026 results demonstrate accelerating artificial intelligence adoption and revenue growth, valuations may recover and reduce rotation pressure. Conversely, if earnings growth remains modest, the rotation could extend significantly. Second, Federal Reserve policy direction will prove crucial. Any indication that rate cuts might accelerate would benefit technology stocks, while sustained higher rates maintain pressure on growth valuations.

Artificial Intelligence Competitive Dynamics

The artificial intelligence competitive landscape became increasingly crowded during 2025. While dominant firms maintained leadership positions, new competitors and open-source alternatives reduced the monopolistic characteristics that supported premium valuations. Investors should monitor whether competitive intensity pressures pricing power and margins for artificial intelligence platform providers. Additionally, regulatory scrutiny around artificial intelligence safety, data privacy, and algorithmic transparency could impose cost burdens that reduce profitability.

Key Metrics to Track

- S&P 500 earnings revisions trajectories for technology versus other sectors

- Federal Reserve policy communications regarding rate path expectations

- Corporate artificial intelligence spending growth rates as capital allocation shifts

- Valuation spreads between technology stocks and market averages

- Market breadth indicators showing whether gains distribute broadly or concentrate

| Market Factor | December 2025 Implications |

|---|---|

| AI Stock Valuations | Compressed multiples reflect valuation normalization and reduced monetization certainty |

| Interest Rate Environment | Maintained 4.5% policy rate pressures growth stock discount rates and benefits financials |

| Sector Performance Divergence | Value and defensive sectors gain 3-7% while technology underperforms, demonstrating rotation breadth |

| Market Concentration Risk | Improved breadth and diversification reduce systematic risk from concentrated mega-cap dominance |

Frequently asked questions about S&P 500 rotation away from AI stocks

No. The rotation reflects valuation adjustment rather than fundamental artificial intelligence viability collapse. Long-term investors should evaluate individual company quality, competitive positioning, and earnings growth prospects separately from short-term rotation trends. Consider rebalancing to target allocations rather than abandoning sectors.

Diversified allocation across value, growth, defensive, and cyclical sectors would have reduced concentration risk significantly. Maintaining 5-15% in financial stocks and 10-20% in value and defensive sectors while limiting technology to 25-30% of equity allocation would have provided meaningful downside cushioning during the rotation.

Outperformance could resume if technology earnings accelerate significantly, Federal Reserve signals imminent rate cuts, or competitive artificial intelligence products achieve breakthrough adoption rates. Monitoring first-quarter 2026 earnings guidance and Fed communications provides key signals for potential rotation reversal timing.

Not necessarily. Market breadth improved during the rotation, with small-cap and defensive stocks gaining strength. This pattern suggests healthy portfolio rebalancing rather than systematic risk-off sentiment. However, slowing economic growth and sticky inflation warrant defensive positioning in cyclically sensitive sectors.

Consider selectively adding artificial intelligence stocks at reduced valuations through dollar-cost averaging rather than deploying capital immediately. Maintain core positions in highest-conviction names while using weakness to improve portfolio diversification and reduce concentration risk exposure systematically.

The bottom line

The S&P 500 rotation away from AI stocks during December 2025 reflects market maturation rather than fundamental economic deterioration. Years of concentrated gains in a narrow cohort of megacap technology firms created valuation extremes and concentration risk that rational capital eventually addresses. The rotation redistributed gains across value, financials, and defensive sectors, improving overall market breadth and reducing systematic risk. For investors, this environment rewards disciplined diversification, tactical rebalancing, and selective artificial intelligence exposure at more reasonable valuations. The question for 2026 centers not on whether artificial intelligence matters—it clearly does—but on which business models will generate sustainable earnings and whether valuations have normalized to sustainable levels. Monitoring Federal Reserve policy, technology earnings growth, and competitive artificial intelligence dynamics will provide critical signals about whether the rotation extends or reverses.