Fixed Income Rally: Intermediate Bonds Return 7.5% Through 2025

The market consensus, bolstered by anticipated Federal Reserve rate cuts, positions the intermediate duration segment of the fixed income market for significant capital appreciation, projecting an aggregate return of 7.5% for intermediate bonds through November 2025 due to yield compression.

The long-awaited shift in the monetary policy cycle is catalyzing a powerful Intermediate Bonds Rally, with consensus forecasts from major financial institutions now projecting that intermediate bonds could yield an aggregate return of 7.5% through November 2025. This projection is not merely optimistic speculation but is grounded in the fundamental mechanics of fixed income pricing: as the market anticipates and prices in Federal Reserve rate cuts, bond yields fall, and bond prices—particularly those in the 3-to-7-year duration segment—experience significant capital appreciation. This dynamic represents a critical entry point for investors repositioning portfolios after two years of high-interest-rate volatility, seeking stability and growth in the fixed income landscape.

The mechanics of the 7.5% projection: yield compression and duration

The projected 7.5% return for the intermediate bond segment through November 2025 is primarily driven by the mechanism of yield curve normalization and the inherent duration risk of these assets. Duration, a measure of a bond’s price sensitivity to interest rate changes, is highest in the intermediate segment when compared to ultra-short duration assets like money market funds. The consensus forecast from institutions like Goldman Sachs and JPMorgan Chase relies heavily on the expectation that the 10-year Treasury yield, which peaked near 5.0% in late 2023, will compress closer to 3.8% or 4.0% by the end of 2025. This approximately 100-basis-point drop in yields translates directly into substantial capital gains for intermediate bonds.

To illustrate the impact, a bond with a Macaulay duration of 6.5 years would theoretically see its price increase by 6.5% for every 100-basis-point drop in yield, independent of the coupon income. When factoring in the current coupon yield, typically around 4.5% to 5.0% for newly issued intermediate-term corporate or Treasury debt, the total return projection of 7.5% becomes statistically plausible. This environment differs fundamentally from the capital preservation focus of 2023, shifting the investment thesis toward capital appreciation, a phenomenon central to the Intermediate Bonds Rally.

Monetary policy pivot: the catalyst for yield decline

The trajectory of the Federal Reserve’s monetary policy is the single most critical factor underpinning this fixed income forecast. Following an aggressive hiking cycle that pushed the Federal Funds Rate to a 23-year high, the market is now aggressively pricing in a series of rate cuts beginning in the first half of 2025. This anticipation is based on cooling inflation data and a slowing, though still resilient, labor market. The Consumer Price Index (CPI) has consistently moved toward the Fed’s 2% target, registering 3.2% year-over-year as of the latest reading, down from the 9.1% peak in mid-2022.

- Expected Rate Cuts: Analysts at Citigroup project three to four 25-basis-point cuts by the end of 2025, bringing the median Fed Funds Rate projection down to 4.25%.

- Inflation Deceleration: Core PCE (Personal Consumption Expenditures), the Fed’s preferred inflation metric, is expected to settle below 2.5% by Q4 2025, validating the easing cycle.

- Market Pricing: The bond market often moves ahead of the Fed. The current yield environment already reflects a significant portion of these anticipated cuts, but further compression is expected as cuts materialize, sustaining the Intermediate Bonds Rally.

The correlation between the Fed’s dovish pivot and intermediate bond performance is historically robust. During the 2019 easing cycle, following the peak of the hiking cycle, the intermediate sovereign bond index delivered an annualized return exceeding 6.0% over the subsequent 18 months. The current market setup, characterized by an inverted yield curve and high real yields, suggests an even stronger potential for capital gains as the curve steepens out of inversion, favoring the mid-section of the curve.

Comparing duration: why intermediate beats short and long

Choosing the optimal duration is crucial in a falling rate environment. While short-duration bonds (1-3 years) offer safety and liquidity, their total return potential is capped because their low duration limits capital appreciation. Conversely, long-duration bonds (15+ years) offer the highest duration but carry heightened sensitivity to unexpected inflation or economic growth surprises, making them significantly more volatile. The intermediate segment strikes a vital balance between capital appreciation potential and risk management.

Short-term bond funds, which currently yield around 5.0%, primarily derive their returns from coupon payments. If rates fall, these funds will immediately reinvest at lower yields, diminishing future income. They offer minimal capital gains. The intermediate segment, however, captures the majority of the capital appreciation benefit from falling yields without exposing investors to the extreme volatility associated with 30-year Treasuries. For instance, a sudden unexpected rise in inflation expectations could easily wipe out multiple quarters of coupon income for a long-duration bond, whereas the same unexpected event causes a less severe drawdown in the intermediate segment.

The role of the inverted yield curve in fixed income rally

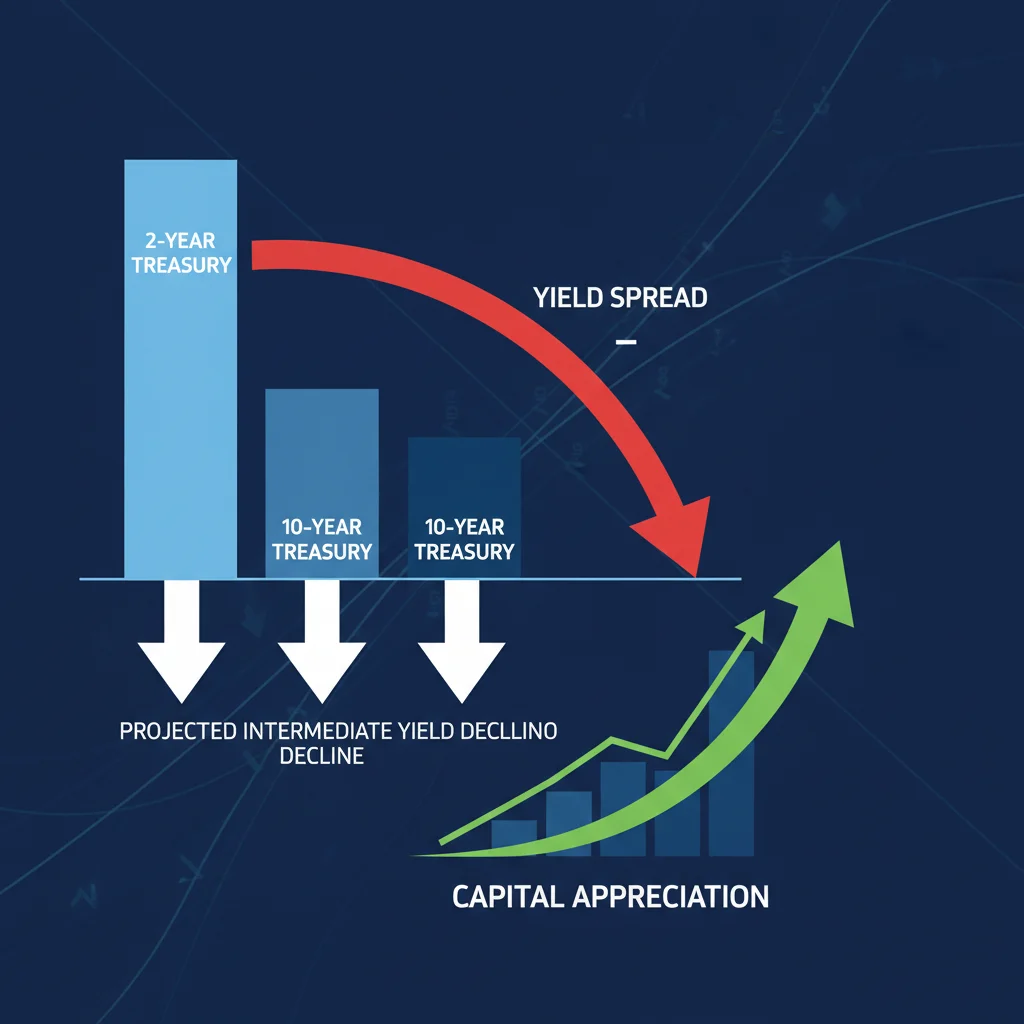

The currently inverted yield curve—where shorter-term yields (e.g., 2-year Treasury yields at 4.7%) are higher than longer-term yields (e.g., 10-year Treasury yields at 4.2%)—is a classic precursor to a fixed income rally focused on intermediate duration. Historically, when the yield curve steepens out of inversion, the intermediate and longer segments see the most dramatic yield declines, leading to price surges. This steepening typically occurs because the market begins to anticipate future Fed cuts, pulling down short-term rates, while long-term rates remain relatively stable or decline modestly, a pattern that strongly favors the Intermediate Bonds Rally thesis.

- Steepening Mechanism: The front end (short duration) falls sharply as the Fed cuts rates; the intermediate section follows, generating capital gains.

- Historical Precedent: Data from the three previous major yield curve inversions (2000, 2007, 2019) show that intermediate bond indices generated 12-month returns averaging 8.1% immediately following the initiation of the Fed’s easing cycle.

- Risk of Re-inversion: If the economy proves more resilient than expected, the Fed might delay cuts, prolonging the inversion and potentially delaying the full extent of the 7.5% return, though not negating the overall positive outlook.

This structural dynamic is why portfolio managers are actively moving capital from cash equivalents and short-term instruments into the 4-to-7-year maturity range. The movement is a strategic bet on mean reversion, where the yield curve returns to its normal upward slope, delivering disproportionate gains to the intermediate segment relative to the short end.

Credit risk assessment: treasuries versus investment-grade corporates

The 7.5% return projection is an aggregate figure, meaning it encompasses both high-quality sovereign debt (US Treasuries) and investment-grade corporate bonds. While Treasuries offer zero credit risk and serve as the benchmark for duration exposure, investment-grade corporates offer higher starting yields (spread) but introduce credit risk. The spread between the average investment-grade corporate yield and the equivalent Treasury yield (the credit spread) is currently tighter than historical averages, suggesting that investors are already comfortable with corporate credit quality.

For instance, as of Q4 2024, the average yield on the Bloomberg US Intermediate Corporate Index stood at approximately 5.2%, about 100 basis points higher than the intermediate Treasury index. If interest rates fall, both components benefit from duration-driven capital appreciation, but corporate bonds offer superior income generation. Analysts at BlackRock suggest that in a soft-landing scenario—the base case for the 7.5% projection—credit spreads are unlikely to widen materially, making intermediate corporate bonds a highly attractive component of the Fixed Income Rally.

The role of deleveraging and corporate health

Corporate balance sheets, while stressed by high borrowing costs in 2023, remain generally robust across the investment-grade spectrum. Companies have largely managed to refinance debt or utilize cash reserves, limiting widespread default risk. This fundamental health provides a solid foundation for corporate bond performance even as economic growth moderates. The focus for investors should be on maintaining high credit quality (A-rated or higher) within the intermediate corporate space to maximize yield while minimizing exposure to cyclical downturns.

- Rating Migration: Monitoring credit ratings is paramount. Downgrades from BBB to junk status could dampen returns, making rigorous credit analysis essential.

- Sector Preference: Defensive sectors such as healthcare, utilities, and high-quality technology names are generally favored for their stable cash flows, which underpin their ability to service debt regardless of minor economic fluctuations.

- Liquidity Premium: Intermediate corporate bonds often trade with sufficient liquidity, though slightly less than Treasuries, necessitating careful execution in large institutional portfolios.

Given the favorable risk-reward profile, a balanced portfolio allocation within the intermediate segment might involve a 60/40 split between Treasuries and investment-grade corporate debt, capturing both the safety of sovereign debt and the enhanced yield of corporate credit to achieve the targeted 7.5% return.

Global demand and quantitative tightening dynamics

Global capital flows play a significant, often overlooked, role in driving the Intermediate Bonds Rally. International investors, particularly central banks and sovereign wealth funds seeking highly liquid, safe-haven assets, are increasingly drawn to US Treasuries, especially as the dollar remains strong relative to other major currencies. This external demand acts as a persistent buyer, helping to suppress yields and support prices in the intermediate segment.

Simultaneously, the Federal Reserve’s ongoing policy of Quantitative Tightening (QT)—reducing its balance sheet by allowing bonds to mature without reinvestment—remains a counterbalancing force. QT technically adds supply to the market, which can exert upward pressure on yields. However, the market impact of QT has been less severe than initially feared, largely because the anticipated rate cuts (Quantitative Easing’s opposite) dominate the narrative. The net effect is a high-stakes tug-of-war between strong global demand and Fed supply reduction.

The influence of central bank reserves and geopolitical stability

Central banks globally continue to hold large reserves, and US Treasuries remain the benchmark risk-free asset. Geopolitical uncertainty, evident in ongoing conflicts and trade tensions, often drives a flight to quality, increasing demand for intermediate Treasuries. This dynamic provides a floor for prices, preventing yields from spiking unexpectedly, barring a major inflation shock. The demand is particularly acute in the intermediate segment, as long-term bonds are viewed as too sensitive to inflation, and short-term bills offer insufficient duration for long-term reserve management.

Furthermore, analysts at the Bank for International Settlements (BIS) highlight that the sheer volume of global savings seeking positive real yields—yields that exceed inflation—will continue to funnel capital into the US fixed income market. With US inflation expected to stabilize around 2.5%, the current 4.5% intermediate yields offer a compelling real return, a rarity among developed market sovereign debt.

Risk factors and bearish scenarios for the 7.5% forecast

While the 7.5% return projection is the consensus base case, prudent financial analysis requires acknowledging the significant risks that could derail the Fixed Income Rally. The primary risk centers on the path of inflation and the subsequent reaction of the Federal Reserve. If inflation unexpectedly reaccelerates—perhaps due to a sharp rebound in energy prices or a tight labor market preventing wage growth from moderating—the Fed would be forced to delay or even reverse its planned rate cuts. This scenario is the most potent threat to the duration trade.

A “no-landing” economic scenario, where the US economy avoids recession and accelerates growth significantly faster than expected (e.g., Q1 2025 GDP growth exceeding 3.0%), would also be bearish for intermediate bonds. Strong growth would likely keep long-term yields elevated, potentially causing the intermediate segment to sell off as the market discounts fewer rate cuts. In this environment, the yield curve might flatten rather than steepen, neutralizing the capital appreciation expected by the 7.5% target.

Modeling the impact of delayed rate cuts

Modeling by Fidelity Investments suggests that if the Fed delays the first rate cut by six months (from Q1 2025 to Q3 2025), the projected return for intermediate bonds through November 2025 could drop from 7.5% to approximately 4.5% or 5.0%. This reduction is entirely attributable to the loss of capital appreciation from the yield compression effect, leaving investors reliant primarily on coupon income. This sensitivity underscores the importance of the Fed’s timing.

- Inflation Surprise: If core PCE remains stubbornly above 3.0% through mid-2025, the rate cut narrative falters, leading to yield stabilization or increases.

- Fiscal Policy Risk: High levels of US government debt issuance, driven by persistent fiscal deficits, could flood the market with supply, pushing intermediate and long-term yields higher independent of Fed action.

- Geopolitical Shock: A major global event forcing a massive flight to extreme liquidity (cash or ultra-short T-bills) could temporarily destabilize the intermediate market.

Investors must maintain flexibility and use risk management tools, such as bond ladders or active duration management, to mitigate these risks. The 7.5% projection is predicated on a measured, gradual descent in inflation and a soft landing; deviations from this path warrant immediate portfolio review.

Strategic positioning: implementing the intermediate bonds rally thesis

For investors seeking to capitalize on the anticipated Intermediate Bonds Rally, strategic positioning involves shifting duration exposure and selecting appropriate vehicles. Moving out of money market funds and short-term certificates of deposit (CDs) into intermediate bond exchange-traded funds (ETFs) or mutual funds is the most accessible method. These funds offer diversified exposure and professional management of the yield curve transition.

Key metrics to monitor in fund selection include the effective duration (ideally between 4.5 and 7.0 years to maximize sensitivity to the expected yield drop) and the credit quality (maintaining an average rating of A or higher). Active management funds may outperform passive index funds in this environment if they can dynamically adjust duration based on evolving Fed communication, although passive, low-cost index ETFs tracking the 5-7 Year Treasury Index offer a highly efficient way to capture the bulk of the 7.5% capital appreciation.

Direct bond purchases and laddering strategies

Sophisticated investors may choose to purchase individual intermediate bonds (Treasuries or high-grade corporates) to construct a custom bond ladder. A laddering strategy involves buying bonds with staggered maturity dates (e.g., 3-year, 5-year, and 7-year maturities). As the shorter bonds mature, the proceeds can be reinvested into the longest maturity, effectively maintaining a consistent average duration and locking in current attractive yields before the full weight of the rally compresses them further.

- Tax Efficiency: Municipal bonds (munis) in the intermediate segment are particularly attractive for high-net-worth individuals, offering tax-exempt income that, when calculated on a Tax Equivalent Yield (TEY) basis, often surpasses the after-tax yield of corporate bonds.

- Inflation-Protected Securities (TIPS): While the base case is disinflation, a small allocation to intermediate-duration Treasury Inflation-Protected Securities (TIPS) can provide an essential hedge against unexpected inflation spikes, maintaining portfolio resilience.

- Liquidity Management: Ensure that the chosen instruments, especially corporate bonds, trade in liquid markets to allow for flexible portfolio adjustments if the economic outlook shifts dramatically.

Ultimately, the strategy is about maximizing duration exposure without incurring excessive volatility. The intermediate segment provides the sweet spot for capturing capital gains as the monetary cycle turns, making it the focal point for achieving the projected 7.5% return through November 2025.

The opportunity cost of inaction: avoiding cash drag

One of the most significant investment errors in an anticipated fixed income rally is the opportunity cost of remaining overly allocated to cash or cash equivalents. While money market funds and high-yield savings accounts currently offer attractive yields around 5.0%, these nominal yields do not factor in the potential for capital appreciation that intermediate bonds offer. As the Fed cuts rates, money market yields will decline almost immediately, causing investors to realize negative real returns if inflation remains above 2.5%.

If the 7.5% return projection for intermediate bonds materializes, an investor holding cash yielding 5.0% would effectively underperform by 250 basis points over the period, excluding taxes. This underperformance highlights the concept of ‘cash drag’—the diminishing purchasing power and lost capital gain potential when rates are falling. The current environment necessitates a proactive move from capital preservation (cash) to capital appreciation (duration).

Realizing the full potential of fixed income

The transition from a high-rate regime to an easing cycle marks a fundamental shift in investment strategy. In 2023, the goal was high income with low duration; in 2025, the goal shifts to maximizing total return through duration exposure. This change in focus is essential for institutional and retail investors alike. Institutions are currently rebalancing portfolios, moving allocations from equities (which may face margin pressure in a slowing economy) into duration-sensitive fixed income to lock in the capital gains associated with the Intermediate Bonds Rally.

Furthermore, the yield curve structure itself presents a clear signal. The inversion suggests that the short-term high yields are transient, whereas the opportunity for capital gains in the intermediate segment is structural, driven by the inevitable normalization of monetary policy. Investors who delay shifting duration risk missing the initial and most significant price appreciation phase of the rally, which typically occurs immediately before and during the first few rate cuts.

| Key Factor/Metric | Market Implication/Analysis |

|---|---|

| Projected Return (Nov 2025) | 7.5% aggregate return driven by capital appreciation and coupon income in intermediate bonds (3-7 year duration). |

| Yield Compression Target | 10-year Treasury yield expected to drop from ~4.2% (Q4 2024) to 3.8%–4.0% by late 2025, driving price gains. |

| Key Risk Factor | Sticky inflation forcing the Federal Reserve to delay or reduce anticipated rate cuts, halting the rally’s capital gains component. |

| Optimal Duration Strategy | Shift from short-term cash to intermediate duration (4.5 to 7.0 years) to maximize duration-driven appreciation potential. |

Frequently asked questions about the Intermediate Bonds Rally

In the context of the fixed income rally, intermediate bonds typically refer to securities with maturities ranging from 3 to 10 years, though the sweet spot for maximizing duration benefit is generally considered to be 4 to 7 years. This range offers the best balance between price sensitivity to falling rates (capital appreciation) and managing volatility compared to long-duration instruments.

The inverted yield curve signifies that short-term rates are abnormally high. The 7.5% projection relies on the curve steepening out of inversion, which means short-term rates fall sharply as the Fed cuts. This process causes intermediate bond prices to surge, delivering significant capital gains on top of the regular coupon payments, essential for hitting the target.

A diversified approach is recommended. US Treasuries provide pure duration exposure and zero credit risk, vital for capital appreciation. Investment-grade corporate bonds offer a higher starting yield (around 100 basis points more than Treasuries) but carry minimal credit risk in a soft-landing scenario, enhancing the total return component of the 7.5% forecast.

The main risk is persistent, elevated inflation (e.g., core PCE above 3.0% through mid-2025). This would compel the Federal Reserve to maintain higher interest rates for longer, drastically reducing the yield compression effect, thereby lowering the capital appreciation component and potentially capping the total return closer to the coupon yield.

ETFs offer superior diversification and liquidity, making them ideal for capturing the broad market rally efficiently. Individual bonds are suited for investors implementing laddering strategies or those seeking specific tax advantages (like municipal bonds) or custom credit exposure, but they require more active management and credit analysis.

The bottom line: capitalizing on the duration play

The projected 7.5% return for the intermediate bond segment through November 2025 signals a pivotal moment in the fixed income cycle, moving the focus from income preservation to duration-driven capital gains. This forecast is robustly supported by the anticipation of Federal Reserve rate cuts and the historical behavior of the yield curve post-inversion. For investors, the critical decision is no longer whether to move out of cash, but how quickly and strategically to shift duration exposure to the 4-to-7-year maturity range. While risks persist, particularly related to the inflation trajectory and fiscal policy, the structural tailwinds of yield compression and strong global demand position the intermediate segment as one of the most compelling risk-adjusted opportunities in the current market environment. Monitoring the core PCE data and the tone of FOMC statements will be essential metrics for investors looking to execute this duration trade successfully in the coming quarters.