Federal Government Shutdown Impact: Delayed Income and Spending

The **government shutdown spending impact** immediately depresses consumer activity, as delayed paychecks for federal workers and contractors lead to reduced discretionary spending, potentially shaving basis points off quarterly Gross Domestic Product (GDP), according to preliminary estimates from the Congressional Budget Office (CBO).

The immediate fiscal consequence of a lapse in federal appropriations is the disruption of income for hundreds of thousands of government employees and contractors, a phenomenon known as the Federal Government Shutdown Impact: How Delayed Income Affects Spending. When paychecks are halted, the resulting loss of predictable consumer purchasing power acts as a sudden, localized shock to the national economy, immediately dampening retail sales and service sector revenues in high-density federal employment areas. This abrupt decline in income visibility necessitates a swift and often drastic adjustment in household financial behavior, significantly impacting macroeconomic stability and credit market dynamics.

Macroeconomic Contraction: Quantifying the GDP Drag

The primary concern for financial analysts during a federal shutdown is the contractionary effect on quarterly Gross Domestic Product (GDP). While the government eventually pays furloughed workers retroactively, the immediate cessation of spending has a tangible, non-recoverable impact on economic activity. The Congressional Budget Office (CBO) estimated that the 35-day shutdown (December 2018–January 2019) reduced real GDP by $3 billion, primarily due to delayed compensation and the loss of output from affected agencies. This figure, though small relative to the $28 trillion U.S. economy, represents a significant deceleration in momentum, often concentrated in the quarter in which the shutdown occurs.

Economists typically model the shutdown cost using two components: the direct cost (lost output from federal workers) and the indirect cost (reduced private-sector consumption). The indirect cost often exceeds the direct cost, as federal workers and contractors, facing zero income, immediately cut back on discretionary purchases, housing expenditures, and investments. This rapid reduction in demand creates a substantial headwind for consumer-facing industries, particularly retail and hospitality, which operate on tight margins and rely heavily on consistent cash flow.

The Multiplier Effect of Delayed Paychecks

The financial impact is amplified by the macroeconomic multiplier effect. When a federal employee postpones purchasing a new car or dining out, that lost revenue affects the income of the dealership owner or the restaurant server, who in turn reduces their own spending. Moody’s Analytics previously calculated that for every dollar of lost federal worker income, regional economic activity could decline by as much as $1.20 to $1.50, depending on the affected region’s reliance on government employment. This multiplier demonstrates how the shutdown quickly converts a temporary payroll issue into a broader economic malaise.

- Federal Payroll Volume: Approximately 2.1 million federal employees, plus hundreds of thousands of contractors, receive delayed income, injecting uncertainty into regional housing and consumption markets.

- Impact on Q4 GDP: Short shutdowns (under two weeks) typically shave 0.1 to 0.2 percentage points off annualized quarterly GDP growth, while longer shutdowns can double or triple this impact, creating significant volatility in financial forecasts.

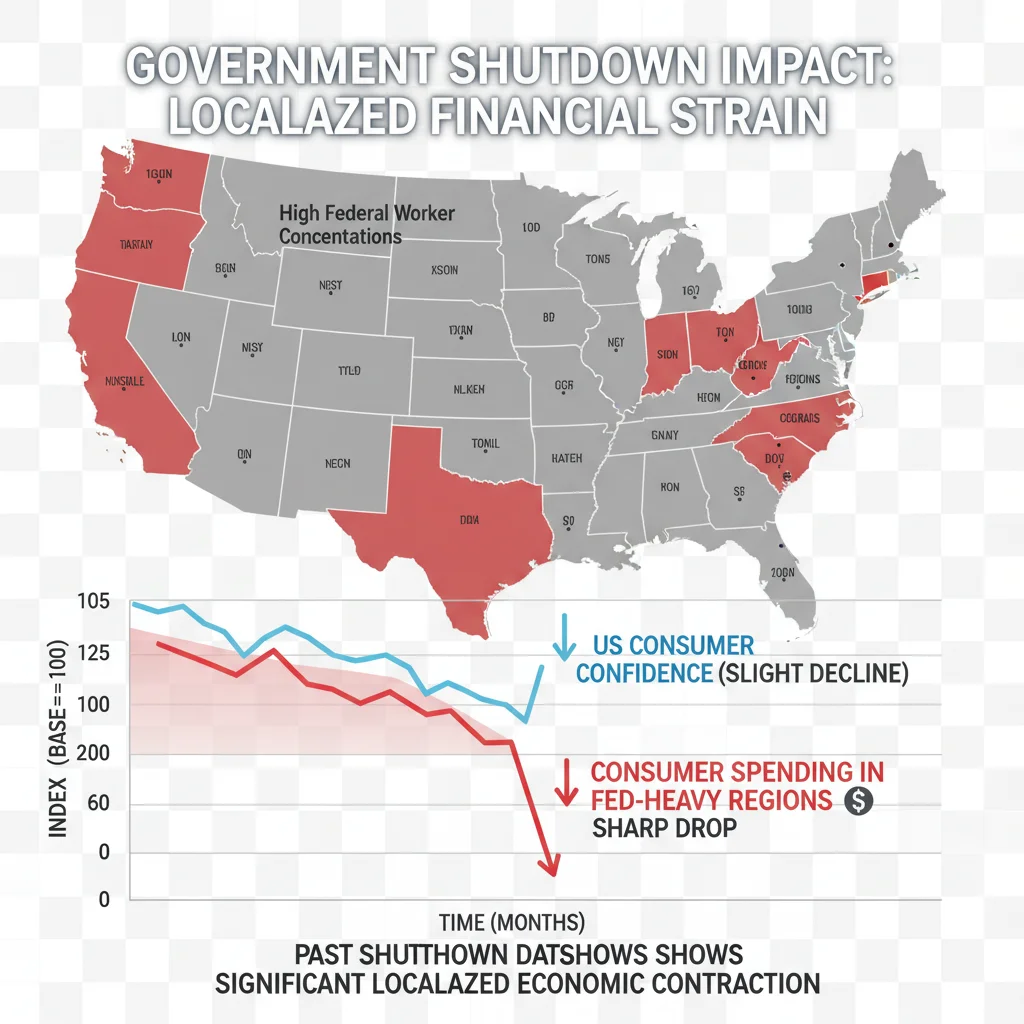

- Localized Strain: Regions heavily reliant on federal employment, such as Northern Virginia, Maryland, and Washington D.C., experience disproportionately severe economic shocks, with local retail sales sometimes dropping by more than 15% during prolonged income gaps.

The temporary nature of the income loss does not mitigate the immediate financial strain on households. Federal workers often rely on credit cards or short-term loans to bridge the gap, leading to higher consumer debt levels and increased stress on local banking institutions. This shift from spending to saving (or borrowing) fundamentally alters short-term market dynamics, forcing businesses to adjust inventory and staffing, thus perpetuating the cycle of reduced economic activity.

Consumer Behavior and Financial Resilience Under Strain

The behavioral response of federal workers to delayed income is critical for understanding the immediate economic fallout. Financial data consistently shows that the immediate priority for affected households is maintaining essential payments—mortgage, rent, and utilities—while eliminating all non-essential and discretionary spending. This immediate shift in priorities creates a sudden, sharp drop in demand for goods and services beyond the necessities.

Analysis of previous shutdown periods reveals that the average federal worker, even those with relatively high job security and an expectation of eventual back pay, exhibited extreme financial caution. According to a 2019 Federal Reserve survey, nearly 40% of Americans, including many federal workers, would struggle to cover an unexpected $400 expense. When faced with a multi-week loss of income, this financial fragility translates directly into reduced consumption. Spending on travel, entertainment, and durable goods (like appliances and electronics) often plummets by 50% or more in the affected regions.

Credit Market Pressure and Household Liquidity

Delayed income places immediate pressure on household liquidity reserves. Workers with limited savings are forced to tap into credit lines or seek alternative financing. Credit utilization ratios for federal employees often spike during shutdown periods. Financial institutions, anticipating this strain, sometimes offer forbearance or low-interest loans, but the overall increase in short-term borrowing costs still represents a financial burden on the individual. The risk of default on mortgages and auto loans also rises, though most major lenders have contingency plans to mitigate widespread delinquency.

- Increased Credit Card Reliance: Delayed income forces reliance on revolving credit, potentially increasing interest payments and lowering FICO scores for those who miss payment cycles.

- Housing Market Sensitivity: Federal employees often postpone major financial decisions, such as buying a home or refinancing a mortgage, leading to temporary stagnation in regional housing markets heavily dependent on government employment.

- Small Business Credit Risk: Government contractors, particularly smaller firms, face severe cash flow crises when federal payments stop, increasing their risk of defaulting on commercial loans and vendor payments.

The impact extends beyond the immediate worker to the ecosystem of small businesses that rely on their patronage. Local restaurants, dry cleaners, and childcare facilities near federal offices suffer immediate and significant revenue drops. These small enterprises often lack the capital reserves to withstand multi-week revenue droughts, leading to temporary layoffs or permanent closures, further exacerbating local unemployment figures, even if the federal workers are later compensated.

Impact on Local and Regional Economies

While the national economic impact of a shutdown is typically measured in basis points of GDP, the effect on localized economies is often measured in percentage points of revenue loss. The concentration of federal employment in specific metropolitan areas means that the spending shock is not evenly distributed across the country but is acutely felt in specific financial hubs. For example, the Washington D.C. metropolitan area has one of the highest concentrations of federal workers, making its economy exceptionally vulnerable to these income delays.

During the 2018-2019 shutdown, local businesses in the D.C. area reported revenue drops ranging from 10% to 40%. The hospitality sector, which includes hotels and restaurants often frequented by federal employees and business travelers visiting federal agencies, was particularly hard hit. This localized financial distress forces immediate operational changes, including reduced hours, temporary staff reductions, and deferred capital expenditures, creating a micro-recessionary environment within these geographic pockets.

The Role of State and Local Fiscal Policy

State and local governments, while not directly affected by the federal appropriation lapse, often face increased pressure to provide social safety net services to affected residents. Furthermore, reduced economic activity leads to a temporary decline in local sales tax revenues. While short shutdowns may not critically impair state budgets, prolonged disruptions require state and local authorities to consider emergency measures, such as offering bridge loans or tax deferrals, to stabilize the local economic environment. This unexpected fiscal strain competes with other budgetary priorities, diverting resources during the shutdown period.

The immediate financial pressure on local economies is a crucial element that analysts examine. Investment banks often issue detailed reports analyzing the exposure of regional stocks and real estate investment trusts (REITs) to the federal payroll. Companies with significant revenue streams tied to federal contracts or government worker consumer bases may see their stock valuations temporarily depressed as the market discounts future earnings potential during the period of uncertainty. This market reaction underscores the financial community’s recognition of the immediate government shutdown spending impact.

The Effect on Consumer Confidence and Forward Spending Plans

Beyond the immediate income loss, a federal government shutdown introduces significant uncertainty, which is a powerful deterrent to consumer confidence and long-term financial planning. Consumer confidence indices, such as those published by the Conference Board or the University of Michigan, often register a downturn during periods of political and fiscal instability. This decline is not solely attributable to federal workers but reflects broader public anxiety about the stability of the government and the economy.

High uncertainty causes households to adopt a precautionary saving stance. Even consumers whose income is not directly affected may postpone large purchases—such as vehicles, home improvements, or major vacations—due to concerns about the broader economic outlook. This postponement of durable goods purchases has a disproportionate impact on manufacturing and large-scale retail sectors, where sales cycles are often longer and reliant on stable economic sentiment.

Market Indicators of Reduced Confidence

Financial markets often reflect this reduced confidence. Volatility indices, such as the VIX, may tick up, and sectors highly sensitive to discretionary consumer spending, such as leisure and retail, may underperform the broader S&P 500 index. Furthermore, the yield curve may flatten slightly as investors seek the safety of short-term Treasury securities amid political risk, signaling heightened caution across fixed-income markets. Data from the Bureau of Economic Analysis (BEA) often shows a noticeable dip in personal consumption expenditures (PCE) during the month of a shutdown, reinforcing the link between political stability and consumer activity.

- Durable Goods Orders: Delayed government contracts and dampened consumer sentiment lead to reduced orders for durable goods, impacting industrial output figures.

- Housing Market Sentiment: Uncertainty surrounding federal agencies (like the Federal Housing Administration or USDA loan programs) temporarily slows down pending home sales and new mortgage applications.

- Retail Sales Volatility: Major retailers in affected areas report significant day-to-day sales volatility, making inventory management and short-term forecasting exceptionally difficult.

The erosion of confidence is particularly damaging because it is often self-fulfilling. If enough consumers postpone spending due to anxiety, the resulting economic slowdown validates the initial fears, potentially requiring more aggressive monetary policy intervention once the shutdown is resolved. The Federal Reserve closely monitors these indicators, noting that political gridlock acts as a non-monetary constraint on economic growth.

Sector-Specific Vulnerabilities: Federal Contractors and Small Businesses

While furloughed federal employees receive retroactive pay, federal contractors—who often constitute a significant portion of the government workforce—do not have the same guarantee. This distinction creates a severe, often permanent, financial shock to the contracting ecosystem. Small businesses that secure government contracts for services ranging from IT support to facilities management face immediate cessation of payments and often lack the financial cushion to cover multi-week payrolls without revenue.

The immediate consequence is a wave of temporary layoffs among contractor staff. Unlike federal employees, these individuals often do not receive back pay, leading to a permanent loss of income and a direct increase in regional unemployment figures. The financial vulnerability of these contractors extends to their suppliers and subcontractors, initiating a cascading effect of non-payment and financial stress throughout the supply chain.

Financing Challenges for Contractors

During a shutdown, contractors often turn to commercial banks for short-term working capital loans to cover essential expenses like rent and utility payments. However, banks become increasingly cautious, viewing the risk profile of government contractors as elevated due to the unpredictable nature of federal funding. Interest rates on these short-term loans can spike, adding to the financial burden even if the shutdown is brief. This constrained access to liquidity forces a rapid reduction in overhead and, invariably, staff.

The long-term impact on the contracting industry involves talent retention. Highly skilled technical personnel, wary of the repeated financial uncertainty associated with federal work, may seek more stable employment in the private sector. This brain drain can impair the government’s ability to execute essential functions efficiently once funding is restored, representing a productivity loss that is difficult to quantify but strategically significant, especially in specialized areas like cybersecurity and defense technology. The financial community views this sector as particularly sensitive to budget impasses, often discounting the valuation of publicly traded contracting firms during periods of heightened shutdown risk.

Mitigation Strategies and Financial Resilience Measures

For federal workers and affected contractors, financial resilience is paramount during periods of delayed income. Financial planners consistently recommend building a robust emergency fund, ideally covering six months of living expenses. However, recognizing that many Americans lack this buffer, alternative mitigation strategies become necessary to navigate the immediate financial crisis imposed by the government shutdown spending impact.

One key strategy involves immediate communication with creditors. Mortgage lenders, utility companies, and credit card issuers often have established protocols for assisting federal employees during shutdowns, including offering short-term payment holidays or reduced minimum payments. Proactive communication can prevent late fees, negative credit reporting, and the accrual of excessive interest charges. Furthermore, many credit unions and local banks offer low-interest or zero-interest bridge loans specifically designed for federal employees awaiting back pay.

The Role of Financial Institutions and Policy Response

The policy response to mitigate the economic drag involves both commercial banks and, potentially, the Federal Reserve. While the Fed does not directly intervene in fiscal impasses, it monitors liquidity conditions to ensure that regional banks, particularly those in federal employment centers, have sufficient reserves to manage increased demand for short-term borrowing. Commercial banks, aiming to preserve customer relationships and manage reputational risk, typically relax lending standards temporarily for affected individuals.

Legislation ensuring retroactive pay for furloughed federal employees is a critical mitigation factor, as it guarantees that the income loss is temporary. However, the lack of guaranteed back pay for contractors remains a structural vulnerability in the system, suggesting that future policy measures might need to address this disparity to fully cushion the economy from the shock of delayed federal payments. The enduring lesson for financial preparedness is the necessity of maintaining robust liquidity to absorb non-monetary shocks originating from political volatility. Analysts at major institutions like Goldman Sachs often factor the probability and duration of a shutdown into their quarterly economic forecasts, quantifying the risk premium associated with political uncertainty.

| Key Financial Metric | Market Implication/Analysis |

|---|---|

| GDP Contraction Estimate | A 3-week shutdown can reduce annualized quarterly GDP growth by 0.1% to 0.5%, primarily through reduced consumer spending and lost government output (CBO data). |

| Consumer Spending Decline | Discretionary spending in federal-heavy regions can drop by over 20% immediately, affecting retail and hospitality revenues disproportionately. |

| Credit Utilization Rate | Federal workers often show a temporary spike in credit card utilization and demand for bridge loans to cover essential expenses during income gaps. |

| Contractor vs. Employee Pay | Furloughed federal employees typically receive retroactive pay; contractors often do not, leading to non-recoverable income loss and higher business failure risk. |

Frequently Asked Questions about Government Shutdown Spending Impact

The impact is nearly instantaneous, particularly in regions with high federal employment. Data from past shutdowns indicate that national retail sales figures can show a measurable deceleration within the first two weeks, driven by the abrupt halt of approximately $1.2 billion in weekly federal payroll disbursements, according to BEA calculations.

Furloughed federal employees (civil servants) are typically guaranteed retroactive pay through subsequent legislation. However, third-party contractors and their employees generally are not guaranteed back pay, creating a significant and often permanent income shock for this segment of the workforce and their affiliated small businesses.

Primary risks include severe cash flow disruption due to halted federal payments, increased difficulty securing short-term commercial loans due to elevated risk, and the necessity of immediate, non-recoverable layoffs to conserve capital, potentially impairing long-term operational capacity.

Investors should track regional economic indicators, specifically retail sales data in the D.C. metropolitan area and Northern Virginia. Additionally, monitor consumer confidence indices and the stock performance of publicly traded government contracting firms, which often serve as leading indicators of sector-specific financial strain.

The Federal Reserve does not typically adjust the federal funds rate solely based on a shutdown, but it incorporates the resulting economic drag and uncertainty into its overall assessment of economic conditions. The Fed focuses on ensuring adequate liquidity in the banking system to manage temporary financial stress points, rather than using rate changes as a fiscal solution.

The Bottom Line: Political Risk as an Economic Factor

The analysis of the Federal Government Shutdown Impact: How Delayed Income Affects Spending confirms that political volatility is a quantifiable economic risk, moving beyond mere political theater to impose tangible costs on households and businesses. While the national recovery is typically swift once funding is restored, the immediate financial pain is significant, particularly for local economies and non-furloughed contractors. The core takeaway for financial analysts is the necessity of incorporating political risk into forward-looking economic models, recognizing that even temporary fiscal lapses can erode consumer confidence and depress regional economic activity through the mechanism of delayed income.

The recurring nature of these shutdowns compels financial institutions and households to build greater resilience against income interruption. Moving forward, market participants will continue to monitor the legislative calendar with the same vigilance as monetary policy announcements. The ability of the U.S. economy to absorb these shocks is high, given its size and diversification, but the localized and sector-specific consequences—especially the non-recoverable losses faced by small contractors—underscore a structural vulnerability that policymakers must address to ensure smoother fiscal operations and greater overall economic stability. Analysts project that without structural spending reforms, the risk of intermittent, growth-dampening shutdowns will persist, creating a permanent, albeit small, political risk premium in U.S. financial markets.