Federal Government Shutdown Cost: Economic Impact and Portfolio Risks

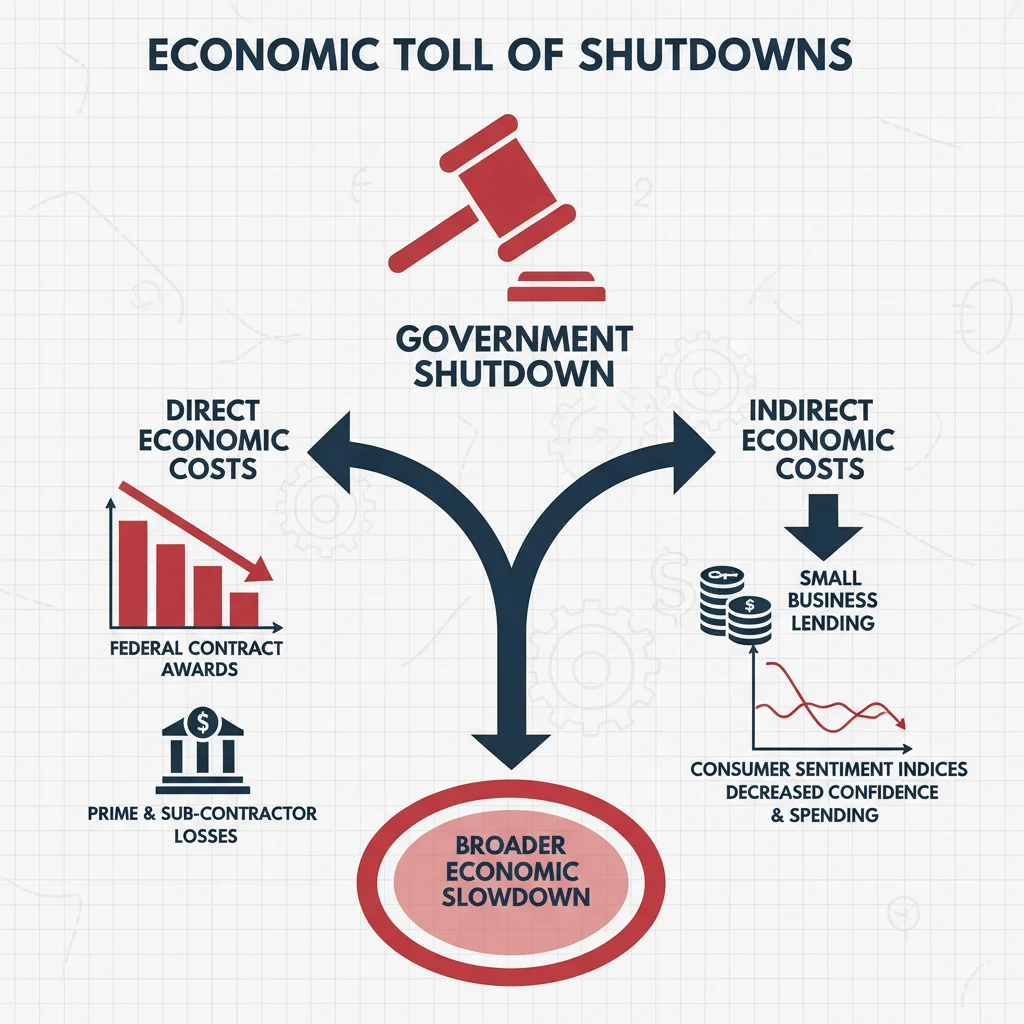

A federal budget impasse leading to a shutdown immediately introduces systemic risk, potentially shaving 0.1 to 0.2 percentage points off quarterly GDP for every week of closure, primarily affecting federal contractor earnings and market liquidity.

When Congress fails to pass appropriations bills or a continuing resolution, the resulting federal government shutdown cost is immediate and measurable, extending far beyond furloughed employee wages. This fiscal disruption creates a cascade of economic consequences, impacting everything from the availability of critical economic data to the operational capacity of regulatory bodies like the Securities and Exchange Commission (SEC) and the Food and Drug Administration (FDA). For investors, the shutdown represents a unique, albeit often temporary, form of political risk that necessitates a strategic assessment of portfolio vulnerabilities, especially within sectors heavily reliant on government contracts or regulatory oversight.

Quantifying the Immediate GDP Damage and Fiscal Drag

The primary economic cost of a government shutdown manifests as a direct reduction in gross domestic product (GDP). This reduction occurs because federal government output, which includes the services provided by non-essential employees, is immediately curtailed. The Congressional Budget Office (CBO) analysis of the 35-day shutdown from December 2018 to January 2019 estimated a permanent loss of $3 billion in real GDP, primarily due to delayed spending and reduced business investment, despite the eventual back pay for federal workers. The immediate fiscal drag stems from two sources: the halt of federal spending on goods and services, and the loss of productivity from furloughed employees.

The Mechanics of GDP Reduction During a Shutdown

The methodology for calculating shutdown costs is precise. Federal agencies are mandated to cease non-essential operations, which stops activities that are counted in the GDP figures. According to Moody’s Analytics estimates, a typical two-week shutdown could reduce annualized fourth-quarter GDP growth by approximately 0.5 percentage points. While this impact is often reversed in the subsequent quarter due to delayed spending catching up, the permanent loss of economic activity, such as missed inspections or halted research projects, remains. Financial journalism demands that we focus on the verifiable metrics of this drag:

- Lost Federal Output: The CBO calculates that for every week of full shutdown, the US government loses approximately $12 billion in immediate purchasing power and services, which directly subtracts from GDP.

- Contracting Freeze: Federal procurement, which drives billions into private sector companies, especially in defense and technology, effectively stops. This immediately affects the earnings visibility of major government contractors.

- Furloughed Productivity: Although federal employees receive back pay, the economic output they would have generated during the shutdown period—processing loans, conducting research, issuing permits—is permanently lost.

The disruption to cash flow for private businesses, particularly small and mid-sized contractors reliant on timely federal payments, further amplifies the negative economic feedback loop. These companies often struggle to cover operating expenses during payment delays, potentially leading to immediate layoffs or deferral of capital expenditures, factors that contribute to reduced overall business confidence and activity.

Impact on Financial Markets: Volatility and Flight to Quality

Financial markets react to government shutdowns primarily through increased volatility, particularly in equities, and a typical flight-to-quality trade in fixed income markets. The core issue is the increased political uncertainty surrounding the US fiscal commitment, even if the Treasury Department continues debt servicing operations.

Equity Market Sensitivity and Sectoral Stress

Historically, the S&P 500‘s reaction to short-term shutdowns (less than two weeks) has been minimal, often recovering quickly once a resolution is reached. However, prolonged shutdowns introduce systemic uncertainty, as seen in late 2018. During that period, the market was already grappling with Federal Reserve interest rate hikes, and the shutdown exacerbated bearish sentiment. Analysts at Goldman Sachs noted that the defense, aerospace, and IT services sectors, which derive significant portions of their revenue from federal contracts, often see immediate sell-offs due to frozen procurement pipelines.

The real market risk is less about the immediate fiscal cost and more about the perceived dysfunction in Washington. This perception can erode investor confidence, particularly among foreign investors who view US political stability as a premium advantage. A sustained shutdown can lead to:

- Delayed IPOs and M&A: The SEC becomes severely limited during a shutdown, halting the review of initial public offering (IPO) applications and merger filings. This regulatory bottleneck can freeze capital markets activities, directly affecting investment banking earnings and private equity exit strategies.

- Housing Market Slowdown: Federal Housing Administration (FHA) and Department of Veterans Affairs (VA) loan processing generally slows or stops entirely, chilling the mortgage origination market and impacting the earnings of major financial institutions and mortgage servicers.

- Data Blindness: Key economic indicators, such as the monthly jobs report from the Bureau of Labor Statistics (BLS) or retail sales data from the Census Bureau, are often delayed or suspended. This ‘data blindness’ forces investors to rely on less timely information, exaggerating existing market fears and contributing to volatility.

While the overall market impact is often muted for short shutdowns, the sustained inability to govern effectively signals underlying risks to the US sovereign credit rating, a concern amplified during periods of high national debt. This brings the focus back to the fixed-income markets.

Fixed Income Dynamics: Treasury Yields and Credit Ratings

In the fixed income arena, government shutdowns present a complex dynamic. Since the Treasury continues to service existing debt obligations, there is typically no immediate default risk. Instead, the market focuses on the short-term liquidity and the long-term political signal.

During a shutdown, the demand for US Treasury securities often increases, counterintuitively, as they are still viewed as the ultimate safe haven, especially when compared to corporate bonds or volatile equities. This ‘flight to quality’ pushes Treasury prices up and yields down, particularly for short-duration instruments. However, if the shutdown is coupled with a looming debt ceiling crisis—a distinctly separate, but often co-occurring, risk—the calculus changes dramatically.

The Specter of Rating Downgrades

The primary long-term threat is the potential for rating agencies like S&P, Moody’s, and Fitch to downgrade the US sovereign credit rating. The 2011 debt ceiling crisis, though not a shutdown, resulted in S&P downgrading the US rating from AAA to AA+. While a shutdown alone may not trigger a downgrade, an extended period of fiscal instability, combined with high debt levels (currently exceeding $34 trillion), raises serious concerns about the nation’s long-term financial management.

According to research from JPMorgan Chase, even the threat of a downgrade can temporarily widen credit default swap spreads and increase the borrowing costs for US corporations, as the baseline risk-free rate is compromised. Investors should monitor the spread between the 10-year Treasury yield and the spread on investment-grade corporate bonds (the TED spread), as widening indicates heightened credit risk perception.

The yield curve itself also provides clues. During periods of fiscal stress, the short end of the curve (T-bills) may exhibit extreme volatility as investors wrestle with immediate funding and policy uncertainty. A flattening or inversion of the curve, already a recession indicator, can be exacerbated by the political uncertainty inherent in a shutdown event.

Sector-Specific Vulnerabilities: Defense, Housing, and Technology

While the broader market might show resilience, the impact of a government shutdown cost is highly uneven across sectors. Investors focused on active management must identify the specific industries that suffer immediate and measurable earnings hits.

Defense and Government Services Contractors

The defense and government services sector is arguably the most exposed. Companies like Lockheed Martin, Raytheon Technologies, and numerous smaller IT systems integrators rely on continuous federal funding and contract awards. A shutdown halts new contract awards and can delay payments on existing contracts. Although essential personnel usually continue working, the vast infrastructure of non-essential services, R&D, and administrative work stops. For companies where 50% or more of revenue is federal, the immediate impact on quarterly earnings forecasts can be significant.

Investors should look specifically at the ‘unfunded backlog’ metrics reported by these firms. A shutdown means the pipeline of new, funded projects freezes, potentially delaying revenue recognition and forcing analysts to revise downwards the near-term earnings per share (EPS) estimates. This vulnerability is not uniform; contractors supporting classified or military operations deemed ‘essential’ fare better than those focused on civilian agency IT modernization projects.

The Regulatory and Housing Bottleneck

The shutdown of the FDA slows drug approvals, directly impacting the revenue timelines for pharmaceutical and biotech companies awaiting regulatory clearance. Similarly, the Environmental Protection Agency (EPA) halts permitting processes, delaying major infrastructure and energy projects. This regulatory friction imposes an invisible cost on corporate America—the rising cost of delay—which is hard to quantify but directly affects future earnings.

In the housing sector, the slowdown in FHA, VA, and USDA loan processing disproportionately affects first-time buyers and rural markets. Lenders such as Wells Fargo and JPMorgan Chase, while diversified, see reduced mortgage origination volume, impacting their non-interest income streams. The result is a temporary, but sharp, contraction in transaction volumes, which weighs heavily on real estate investment trusts (REITs) focused on residential mortgages and services.

Consumer Sentiment and Small Business Lending Freeze

Beyond the direct financial costs, government shutdowns inflict damage on consumer and business confidence, which are crucial drivers of future economic activity. The uncertainty created by political instability prompts both consumers and small businesses to defer major purchasing and investment decisions.

The Consumer Confidence Contraction

Consumer sentiment indices, such as those published by the University of Michigan and The Conference Board, typically show a noticeable dip during prolonged shutdowns. Furloughed federal employees, even with the promise of back pay, face immediate cash flow constraints, leading to reduced discretionary spending. This reduction hits local economies hardest, particularly those surrounding Washington D.C., where a high concentration of federal workers resides. Retailers and hospitality businesses in these areas experience an immediate, quantifiable drop in sales, which can impact regional earnings reports.

Furthermore, the general population interprets the shutdown as a sign of economic instability. This psychological effect leads to a precautionary saving motive, wherein households postpone large purchases like automobiles or furniture, slowing consumer-driven GDP components.

Disruption to Small Business and Lending

Small businesses face two critical challenges: delayed payments from federal contracts and the immediate cessation of Small Business Administration (SBA) loan guarantees. The SBA, which facilitates billions in loans annually, largely ceases processing new applications during a shutdown. This lending freeze starves small businesses of necessary capital for expansion, payroll, and inventory management, potentially leading to immediate solvency issues for the most fragile firms.

According to data compiled by regional Federal Reserve banks, the lack of SBA loan processing during the 2018-2019 shutdown was cited by community banks as a significant impediment to local economic growth. This freeze in lending contributes to a tightening of credit conditions in the short term, irrespective of the Federal Reserve’s monetary policy stance.

Investment Portfolio Strategies for Fiscal Uncertainty

While the long-term impact of a shutdown is typically negligible for a diversified portfolio, the short-term market volatility necessitates tactical adjustments and a review of exposure to sensitive sectors. Prudent investors and fund managers adopt specific strategies to mitigate the risks associated with the federal government shutdown cost.

Defensive Positioning and Liquidity Focus

During periods of heightened fiscal uncertainty, the classic defensive playbook involves increasing portfolio liquidity and reducing exposure to highly cyclical stocks. Analysts suggest increasing allocations to short-term, high-quality fixed income assets, such as short-duration Treasury bills (0-3 month), which benefit from the flight-to-quality trade and face minimal duration risk. Cash reserves should be maintained at higher-than-average levels to capitalize on potential market dips.

Specific portfolio adjustments may include:

- Reducing Defense/Aero Exposure: Temporarily trimming positions in companies with high reliance on discretionary federal spending or non-essential contracts, focusing instead on firms with diversified international revenue streams.

- Healthcare Emphasis: Shifting towards healthcare sub-sectors that are less reliant on immediate FDA approvals and more focused on basic services or non-discretionary medical devices, as healthcare spending remains relatively inelastic.

- Utility and Staples: Increasing exposure to consumer staples and regulated utilities, which provide stable earnings and dividends regardless of macroeconomic volatility or political upheaval, offering a defensive buffer.

It is crucial to differentiate between a temporary political skirmish and permanent systemic risk. A shutdown is almost always temporary, meaning broad-based selling often presents a buying opportunity for high-convidity stocks that are unduly penalized by short-term sentiment.

Historical Precedents and Forward-Looking Analysis

Examining historical instances provides crucial context for estimating the potential market reaction to future shutdowns. Since 1976, there have been 22 funding gaps, though the structure and impact of these have varied significantly. The longer the duration, the more severe the economic damage and market reaction.

The 1995-1996 shutdown (21 days) and the 2018-2019 shutdown (35 days) serve as the most relevant modern examples. In both cases, the immediate market reaction was characterized by a brief spike in volatility, but the overall equity market trend—driven by long-term corporate earnings and Federal Reserve policy—was largely unaffected once the crisis passed. The key takeaway from these precedents is that the political uncertainty tends to be priced in quickly, and the market generally recovers any losses within weeks of a resolution, reinforcing the view that these are temporary liquidity events rather than fundamental economic crises.

However, the current environment of high inflation, elevated interest rates, and significant national debt adds a layer of complexity. Unlike past shutdowns, where the Fed had more flexibility, the present monetary policy environment is constrained. An economic shock, even a temporary one from a shutdown, could influence the Federal Reserve’s decision-making regarding interest rate cuts or hikes, potentially complicating the market’s path forward. Financial professionals must track not just the duration of the shutdown, but also the rhetoric coming from the Federal Reserve regarding its potential impact on the dual mandate—full employment and price stability—to gauge the true long-term consequences.

The forward-looking analysis suggests that while investors should remain cautious about sector-specific risks, especially in government contracting, the broader market typically views the federal government shutdown cost as a transient political risk. The emphasis should be on maintaining a diversified portfolio and using any market dip as a potential entry point, rather than engaging in panic selling.

| Key Metric Affected | Market Implication/Analysis |

|---|---|

| Quarterly GDP Growth | Temporary reduction of 0.1-0.2 percentage points per week of closure; often recovered in the subsequent quarter, but permanent productivity loss remains. |

| Federal Procurement (Contracts) | Immediate freeze on new awards and payment delays; negative earnings pressure on defense, aerospace, and IT services contractors. |

| SEC/FDA Operations | Halts IPO reviews and drug approvals; creates regulatory bottlenecks that delay corporate revenue recognition and M&A activity. |

| Treasury Yields (Short-Term) | Increased demand for short-duration Treasuries (flight to quality), pushing yields lower despite overall fiscal uncertainty. |

Frequently Asked Questions about Federal Government Shutdown Cost: Economic Impact and Your Investment Portfolio

While a shutdown does not immediately trigger a downgrade, an extended period of fiscal dysfunction, especially if coupled with debt ceiling concerns, increases the perceived risk of US debt. Rating agencies, such as S&P, monitor this instability, which could potentially lead to a rating revision, increasing long-term borrowing costs for the Treasury.

Sectors most vulnerable are those with direct financial reliance on federal appropriations: defense contractors, IT services companies with large government contracts, and the housing industry due to the slowdown or cessation of FHA and VA loan processing. These firms often face payment delays and frozen procurement.

Historically, broad market indices like the S&P 500 have shown minimal sustained damage from shutdowns; the impact is often temporary and short-lived. Financial experts advise against panic selling. Instead, investors should review their exposure to high-risk federal contractor stocks and utilize defensive sectors or increased cash liquidity.

Social Security payments and interest on the national debt are generally considered mandatory spending and continue during a shutdown. While military personnel are deemed essential, their paychecks may be delayed initially until Congress passes specific legislation or the government reopens. Essential services are prioritized.

The suspension of BLS and Census Bureau reports creates ‘data blindness,’ hindering accurate economic modeling and forecasting. This lack of timely information increases market uncertainty and volatility, forcing analysts to rely on less precise private sector indicators until official data releases resume, potentially weeks later.

The Bottom Line: Navigating Transient Political Risk

The federal government shutdown cost is a defined, temporary economic drag, characterized by immediate reductions in GDP output and heightened market volatility, particularly affecting companies reliant on federal procurement and regulatory processing. While the CBO estimates quantify the direct fiscal damage—billions in lost output—the lasting impact on investor portfolios is generally confined to specific, highly exposed sectors such as defense, housing finance, and biotech awaiting FDA clearance. For the broader market, shutdowns represent a transient political risk rather than a fundamental economic crisis, often leading to a quick rebound once a continuing resolution is passed.

Prudent financial management during such periods focuses on tactical liquidity management and maintaining diversification. Investors should monitor key indicators—the spread between corporate and Treasury yields, and the performance of government contractor equity—as proxies for market stress. The ultimate risk is not the shutdown itself, but the signal it sends about the long-term fiscal stability and governance capacity of the United States. Should frequent shutdowns become the norm, the cumulative erosion of global confidence and the threat of sovereign rating downgrades would translate into permanently higher borrowing costs, a far more significant issue than the temporary hit to quarterly earnings. Market participants must remain vigilant, distinguishing between short-term noise and structural economic deterioration.