Bitcoin Volatility: Should You Allocate More Than 2% to Crypto Now?

While Bitcoin’s year-to-date volatility has exceeded 65% annualized, strategic asset allocators are debating whether institutional adoption, driven by spot ETFs, justifies exceeding the traditional 1%-2% portfolio cap for high-net-worth clients, emphasizing risk-adjusted returns.

The question of optimal allocation to digital assets has become central to modern portfolio theory, especially given the extreme price swings observed in the asset class. Specifically, Bitcoin portfolio allocation limits are under scrutiny as institutional validation through the launch of U.S. spot exchange-traded funds (ETFs) fundamentally shifts market access and liquidity. Since the start of the current calendar year, Bitcoin has experienced multiple 20% drawdowns, yet its overall performance has frequently outpaced major indices like the S&P 500 and the Nasdaq 100. This combination of outsized returns and punishing volatility forces a critical reassessment of the conventional wisdom that dictates a maximum 1% to 2% exposure ceiling for most diversified portfolios.

The institutional validation and the 2% barrier

The traditional 1% to 2% allocation limit for high-risk, volatile assets—often including commodities or speculative emerging market equities—was historically applied to Bitcoin due to its nascent market structure, lack of regulatory clarity, and perceived tail risks. This conservative approach prioritized capital preservation, acknowledging that a small exposure could still provide asymmetric upside potential without jeopardizing the core portfolio. However, the regulatory landscape underwent a seismic shift with the approval of spot Bitcoin ETFs by the U.S. Securities and Exchange Commission (SEC) in early 2024. This move not only legitimized the asset class but also provided a streamlined, regulated pathway for institutional capital and retail investors alike.

The introduction of these ETFs, which collectively accumulated billions in assets under management (AUM) within months of launch, signals a maturation of the market infrastructure and significantly improves liquidity. This institutional validation challenges the premise of the 2% cap. When an asset transitions from being a fringe, crypto-native investment to one accessible via standard brokerage accounts and subject to established regulatory oversight, its risk profile, while still high, is perceived differently by capital committees.

Risk-adjusted returns: the Sharpe ratio debate

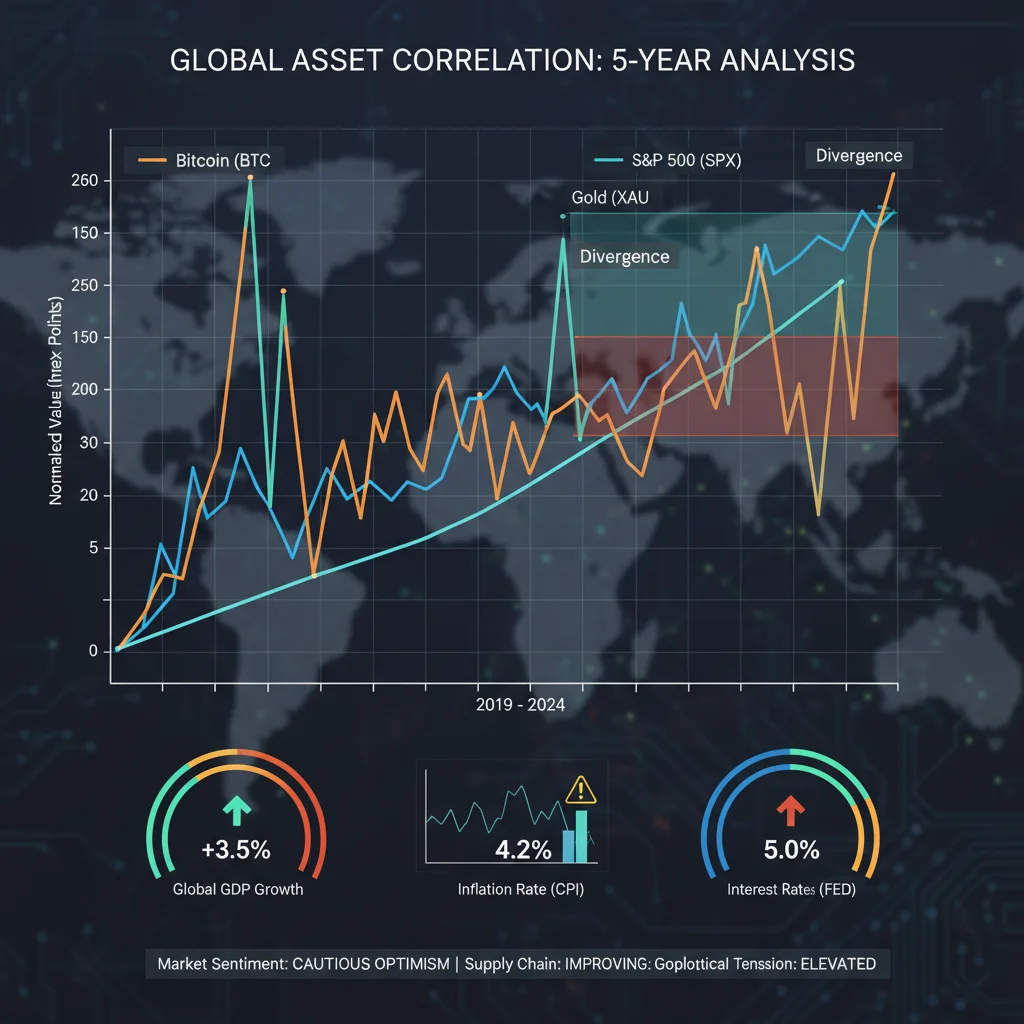

Asset allocation decisions are fundamentally driven by the trade-off between risk and return, often measured by the Sharpe ratio. The central argument for increasing Bitcoin portfolio allocation above 2% rests on the idea that its non-correlation with traditional asset classes—such as fixed income and large-cap equities—offers superior portfolio diversification benefits. Over the past five years, Bitcoin’s annualized volatility has consistently hovered above 60%, significantly higher than the S&P 500’s average closer to 15%. Yet, periods of explosive growth have often resulted in a Sharpe ratio that, for specific periods, rivals or even exceeds that of traditional assets, particularly during bull cycles.

- Diversification Benefit: Studies by major financial institutions, including Fidelity and BlackRock, suggest that adding a small, non-correlated asset like Bitcoin can potentially push the portfolio’s efficient frontier outward, optimizing the risk/return profile.

- The Drawdown Problem: Despite high returns, the depth and duration of Bitcoin’s drawdowns (e.g., the 73% drop in 2022) necessitate the low allocation cap to prevent excessive volatility drag on the overall portfolio performance.

- Liquidity Shift: The presence of regulated ETFs means that, unlike previous cycles, large-scale institutional buying and selling can be executed efficiently, reducing the risk of market fragmentation and improving price discovery.

For a high-net-worth individual (HNWI) operating under a conservative mandate, the 2% rule historically served as a behavioral guardrail. However, as of Q2 2024, if a portfolio with a 2% Bitcoin stake had outperformed its benchmark by 150 basis points over the trailing three years, the pressure to re-evaluate the cap becomes intense. Wealth managers are increasingly looking at client risk tolerance profiles to justify allocations up to 5%, provided the client possesses a high capacity for loss and a long-term investment horizon.

Analyzing Bitcoin’s inherent volatility mechanisms

To determine if a higher allocation is warranted, one must dissect the root causes of Bitcoin’s extreme volatility, which often stems from structural, technical, and psychological factors unique to the crypto market. The market capitalization of Bitcoin, while substantial, remains significantly smaller than the entire U.S. equity or bond markets. This relatively smaller size means that large capital flows, whether institutional purchases or major liquidation events, have an amplified impact on price discovery compared to movements in the S&P 500 or U.S. Treasuries.

Structural and technical drivers of price swings

One primary driver is the concentration of ownership. While public data is opaque, a substantial portion of circulating Bitcoin is held by long-term holders (‘whales’). When these entities move large amounts of BTC, the market interprets this as a significant shift in supply dynamics, leading to rapid price reactions. Furthermore, Bitcoin’s cyclical halving events, which reduce the supply of newly mined BTC every four years, introduce predictable supply shocks that are often front-run by speculative trading, creating volatility spikes in the months leading up to the event.

Another technical factor is the global, 24/7 nature of the market. Unlike traditional exchanges that operate within specific hours, Bitcoin markets are continuously trading, meaning price discovery never pauses. This constant activity can exacerbate volatility during periods when traditional financial markets are closed, such as weekends or holidays, leading to significant gaps when equity markets reopen. According to data from CoinMetrics, weekend volatility has historically been 10-15% higher than weekday volatility, reflecting thinner liquidity during those periods.

The rise of high-leverage derivatives trading also contributes substantially to volatility. Cryptocurrency exchanges offer perpetual futures contracts with leverage often exceeding 50x or 100x. When prices move sharply in one direction, these leveraged positions are liquidated en masse (the ‘long squeeze’ or ‘short squeeze’), which forces further selling or buying, creating cascading price movements. This feedback loop is a key reason why Bitcoin can see 15% moves in a single day, a rarity in established asset classes like sovereign bonds or large-cap tech stocks.

The macroeconomic narrative and correlation risk

For years, Bitcoin was touted as ‘digital gold’—an inflation hedge and a non-correlated store of value independent of central bank policies. However, during the monetary tightening cycles initiated by the Federal Reserve starting in 2022, Bitcoin’s correlation with technology stocks, particularly the Nasdaq 100, surprisingly increased. This dynamic suggests that, in the current environment, Bitcoin behaves more like a high-duration technology growth asset than a pure safe-haven commodity.

Correlation dynamics in high-interest rate environments

When global central banks, including the Federal Reserve, embark on aggressive interest rate hikes to combat inflation, risk assets across the board tend to suffer. Bitcoin, due to its speculative nature and dependency on future expectations of growth and liquidity, is often the first to be sold off in a flight to safety. Data from Refinitiv shows that during the peak of the rate hiking cycle in 2022, the 90-day rolling correlation between Bitcoin and the Nasdaq 100 briefly exceeded 0.70, a level indicating a strong positive relationship. This high correlation undermines the core diversification argument for increasing Bitcoin portfolio allocation.

- Monetary Policy Sensitivity: Bitcoin’s price often reacts sharply to FOMC meeting minutes and changes in the Treasury yield curve, reflecting its status as a risk-on asset sensitive to global liquidity conditions.

- The Dollar Index Factor: A strengthening U.S. Dollar Index (DXY), frequently driven by higher U.S. interest rates, typically places downward pressure on non-fiat assets, including Bitcoin, further linking it to traditional macroeconomic variables.

- Inflation Hedge Paradox: While Bitcoin performed well during the initial phase of rising inflation, its performance during extreme monetary tightening suggests its primary function, for now, is as a speculative asset rather than a reliable hedge against sustained high inflation.

Financial analysts at JPMorgan Chase maintain that until Bitcoin demonstrates sustained low correlation (below 0.20) during periods of economic stress, the risk premium associated with a higher allocation remains too significant. They argue that the 2% cap is appropriate not just because of Bitcoin’s internal volatility, but because it often fails to provide the necessary downside protection when traditional equity markets are struggling.

Strategic frameworks for exceeding the 2% threshold

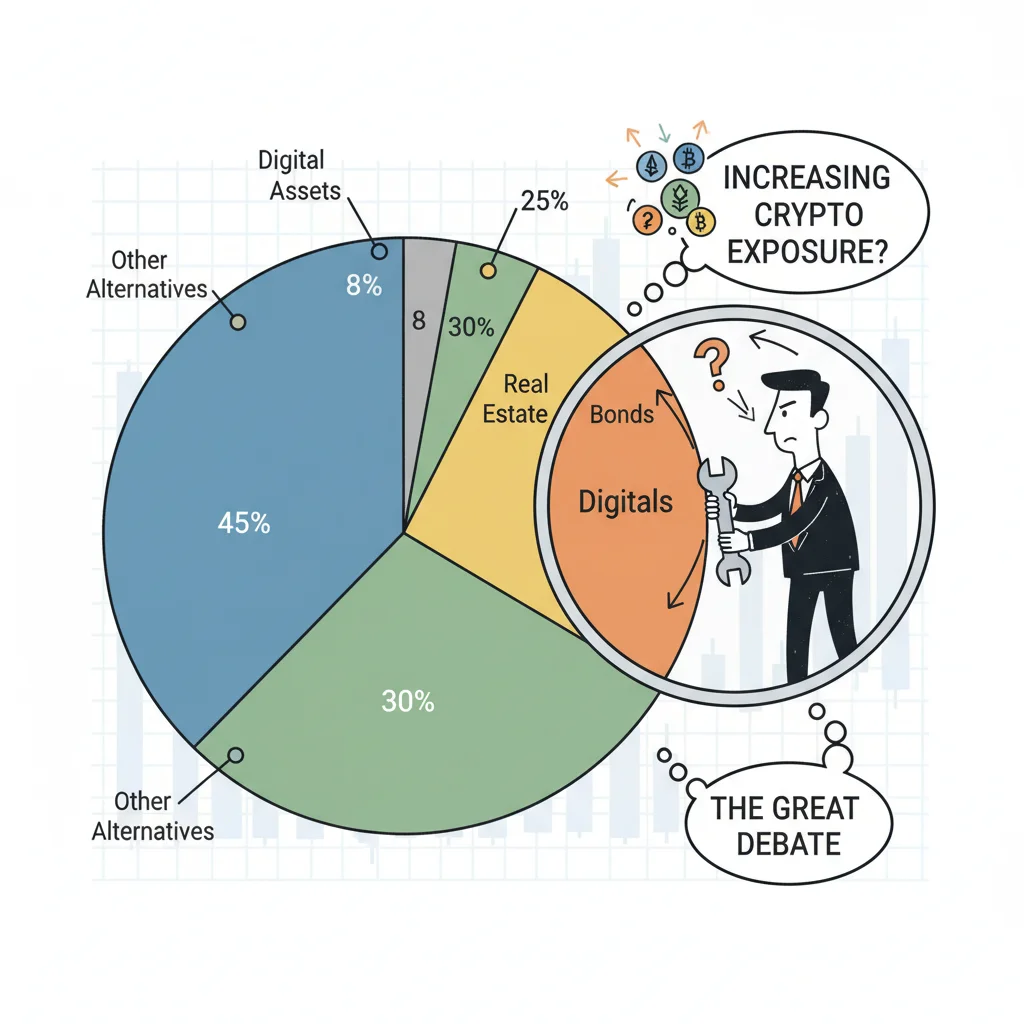

Despite the risks, some forward-thinking asset managers are developing frameworks that justify exceeding the traditional 2% limit. These strategies move beyond simple market capitalization and volatility metrics, incorporating factors such as network effects, adoption rates, and technological innovation within the broader decentralized finance (DeFi) ecosystem. The decision to allocate 3% or even 5% is not made arbitrarily; it is rooted in a deep understanding of the client’s financial goals and the potential long-term technological disruption represented by the asset.

The ‘Venture Capital’ approach to crypto allocation

For investors comfortable with venture capital-style risk—those seeking moonshot returns knowing that the probability of total loss is non-zero—a higher allocation might be suitable. This approach views Bitcoin portfolio allocation not as a currency or commodity investment, but as an early-stage investment in a transformative technology. Firms specializing in digital asset management often use a multi-pronged approach:

- Client Risk Profiling: Only clients with a high-risk tolerance score (e.g., 8 or above on a 1-10 scale) and significant net worth are considered for allocations exceeding 3%.

- Tranche Investing: Instead of a lump sum, the allocation is often phased in over several quarters (dollar-cost averaging) to mitigate entry point risk associated with extreme volatility.

- Active Management Overlay: Unlike passive 2% allocations, higher exposures are often actively managed, employing strategies like covered calls or dynamic rebalancing to harvest volatility and manage downside risk, requiring specialized expertise.

According to a survey of registered investment advisors (RIAs) conducted by PIMCO in late 2023, approximately 15% of RIAs serving clients with over $10 million in liquid assets reported considering or implementing allocations between 3% and 5% for digital assets, reflecting a slow but measurable shift in institutional comfort levels. This trend suggests that the 2% limit is becoming a soft ceiling, rather than a hard constraint, for sophisticated investors who view Bitcoin as an integral part of the future financial infrastructure.

The regulatory and geopolitical risk landscape

While the U.S. regulatory environment has improved with the ETF approvals, significant regulatory uncertainty persists globally, which must be factored into any decision to increase Bitcoin portfolio allocation. Regulatory crackdowns, unexpected tax treatments, or outright bans in major economies could trigger severe market dislocations. Furthermore, the geopolitical dimension of Bitcoin—its use in circumventing sanctions or capital controls—introduces risks that traditional assets generally do not face.

Regulatory clarity vs. geopolitical headwinds

In the U.S., the ongoing legal and legislative battles over classifying cryptocurrencies (security vs. commodity) continue to cast a shadow. A definitive ruling that subjects major tokens to strict securities laws could necessitate significant restructuring or liquidation of existing positions. Internationally, countries like China have maintained strict prohibitions on crypto trading and mining, demonstrating the capacity of sovereign nations to severely impact the global ecosystem.

Geopolitical risk is particularly acute. For instance, if a major G7 nation were to impose stringent capital controls that restrict the movement of funds into or out of crypto exchanges, the resulting panic would rapidly increase volatility. Financial stability reports published by the Bank for International Settlements (BIS) consistently warn that the fragmented and highly interconnected nature of the crypto market means that a crisis in one area could quickly spill over, justifying a conservative allocation approach.

The operational risk associated with custodianship and cybersecurity also remains a key concern. While regulated ETFs mitigate some of these risks by utilizing institutional-grade custodians, direct ownership of Bitcoin requires sophisticated security protocols. The history of exchange hacks and operational failures, although decreasing in frequency among top-tier institutions, still underscores the need for caution. Therefore, any allocation above 2% demands meticulous due diligence on the chosen investment vehicle and custodian.

Implementing a dynamic allocation strategy

For investors considering moving beyond the fixed 2% cap, a dynamic allocation strategy—one that adjusts exposure based on market conditions, volatility metrics, and correlation shifts—offers a more prudent approach than a static increase. This strategy acknowledges that Bitcoin’s risk profile changes dramatically depending on the stage of the economic cycle and the prevailing monetary policy environment.

Key metrics for dynamic rebalancing

Portfolio managers employing dynamic allocation monitor several key indicators to determine whether to temporarily increase or decrease Bitcoin exposure:

- Volatility Index (VIX) Comparison: If Bitcoin’s implied volatility falls significantly relative to the CBOE VIX (a measure of S&P 500 expected volatility), it may signal a period of relative stability, warranting a temporary increase in allocation from 2% to, say, 3.5%.

- Correlation Thresholds: When the 90-day rolling correlation between Bitcoin and the S&P 500 drops below a pre-defined threshold (e.g., 0.30), the diversification benefit is maximized, providing a rationale for increasing exposure. Conversely, correlation spikes necessitate trimming the position.

- Momentum Indicators: Utilizing technical analysis, managers may temporarily increase exposure when Bitcoin demonstrates strong, confirmed upward momentum, provided the overall risk budget is not exceeded. This strategy captures upside during bull markets while ensuring strict stop-loss measures are in place.

Pioneering hedge funds in the digital asset space often use proprietary models that incorporate on-chain data—metrics such as realized price, miner capitulation indicators, and long-term holder supply—to inform allocation adjustments. These advanced techniques provide insights into fundamental supply and demand dynamics that are unavailable in traditional financial markets. However, these complex models require specialized expertise and are typically out of reach for the average retail investor or smaller RIA firm, reinforcing the necessity of caution for those without dedicated research teams.

Ultimately, the decision to raise Bitcoin portfolio allocation above 2% is a highly individualized choice that reflects a conviction in the long-term disruptive potential of decentralized technology, balanced against an immediate and quantifiable volatility risk. Investors must be prepared for the possibility of short-term losses that far exceed those of traditional asset classes, even with the structural improvements brought by regulated ETFs. The 2% threshold remains a robust starting point for diversified caution, and any move beyond it should be conducted with the same rigor and risk management applied to illiquid private equity or highly speculative derivatives.

| Key Factor/Metric | Market Implication/Analysis |

|---|---|

| Annualized Volatility (Q2 2024 Est.) | Exceeds 65%. High volatility necessitates strict risk budgeting; supports maintaining a small allocation (1%-2%) for most conservative portfolios. |

| Spot ETF AUM Growth | Institutional validation and improved liquidity. Reduces market fragmentation risk, potentially justifying a slight increase above 2% for aggressive portfolios. |

| Correlation with Nasdaq 100 | Often spikes above 0.50 during monetary tightening. Undermines diversification benefits, reinforcing caution against exceeding the 2% cap in high-rate environments. |

| Maximum Drawdown Risk | Historically 70%+. The potential for catastrophic loss requires allocations to be small enough to be survivable without impacting core financial stability. |

Frequently Asked Questions about Bitcoin Portfolio Allocation

The limit is a risk management strategy, acknowledging Bitcoin’s high historical volatility (often 60%+ annualized) and concentration risk. A small allocation provides exposure to potential asymmetric returns while ensuring that a catastrophic drawdown, historically exceeding 70%, does not materially damage the overall portfolio’s capital base or stability.

ETF approval increases regulatory certainty and provides institutional-grade custody, which reduces operational and counterparty risk. While the inherent market volatility remains, the improved accessibility and liquidity, according to BlackRock analysis, may slightly raise the comfort level for sophisticated investors to consider allocations up to 3%.

Investors should primarily monitor the 90-day rolling correlation of Bitcoin with the S&P 500 and the Nasdaq 100. If this correlation rises significantly (e.g., above 0.60), the diversification benefit diminishes, making a larger allocation less appealing from a risk-adjusted return perspective, particularly in bear markets.

While often marketed as an inflation hedge, Bitcoin’s performance during the Federal Reserve’s aggressive rate-hiking cycle (2022-2023) showed it often traded more like a high-duration risk asset, exhibiting sensitivity to liquidity and policy rates. Analysts suggest it has not yet proven to be a reliable, low-correlation inflation hedge comparable to physical gold or Treasury Inflation-Protected Securities (TIPS).

The primary risk is volatility drag and the failure of diversification. With volatility often three to four times higher than major equity indices, a 5%+ allocation means Bitcoin’s performance can overwhelm the stable returns of the core portfolio, potentially leading to excessive drawdowns and failure to meet long-term financial objectives, especially for retirees.

The Bottom Line: Navigating the New Frontier of Risk

The debate over whether to increase Bitcoin portfolio allocation beyond the entrenched 2% benchmark reflects the tension between the asset’s undeniable growth potential and its persistent, structural volatility. The shift to institutional acceptance, exemplified by the success of spot ETFs, has certainly lowered barriers to entry and improved market infrastructure. However, this regulatory maturation does not eliminate the fundamental risks associated with a relatively small, highly leveraged, and geopolitically sensitive asset class. For the vast majority of diversified investors, particularly those with moderate risk tolerances or short-to-medium time horizons, maintaining a conservative 1% to 2% exposure remains the most mathematically sound approach to capturing upside while minimizing volatility drag.

For investors with high capacity for loss and a long-term conviction in the disruptive potential of decentralized technology, a dynamic allocation strategy that temporarily pushes exposure to 3% or 4% during periods of low correlation and strong momentum may be justifiable. This strategic move, however, must be underpinned by sophisticated risk management tools, including defined stop-loss limits and continuous monitoring of macroeconomic indicators, particularly Federal Reserve policy and liquidity metrics. As the asset class evolves, the 2% rule should be viewed as a baseline for caution, not a permanent ceiling on opportunity. The future trajectory of Bitcoin’s correlation with traditional assets—whether it continues to act as a growth stock proxy or truly diverges as digital gold—will ultimately dictate whether the institutional comfort level justifies a permanent shift in standard allocation models.