Fed December Rate Cut Odds at 80%: Mortgage Implications

The surging 80% market probability for a Fed rate cut in December signals potential downward pressure on long-term interest rates, directly influencing US mortgage rate adjustments, potentially offering significant relief to prospective homebuyers and current homeowners considering refinancing, impacting housing affordability across the US.

The financial markets are signaling a decisive shift in monetary policy expectations. As of the latest trading data from the CME FedWatch Tool, the probability of the Federal Reserve implementing a rate cut during its December Federal Open Market Committee (FOMC) meeting has soared to approximately 80%. This dramatic repricing of forward expectations regarding the Fed rate cut mortgage landscape immediately brings into sharp focus the implications for US consumers, particularly those navigating the housing market. Why should homebuyers and current homeowners care about a seemingly technical shift in short-term rates? Because this probability directly influences the long-term Treasury yields to which mortgage rates are inextricably linked, setting the stage for potentially lower borrowing costs and a significant recalibration of housing market dynamics across the United States.

The mechanics of market expectations and mortgage rates

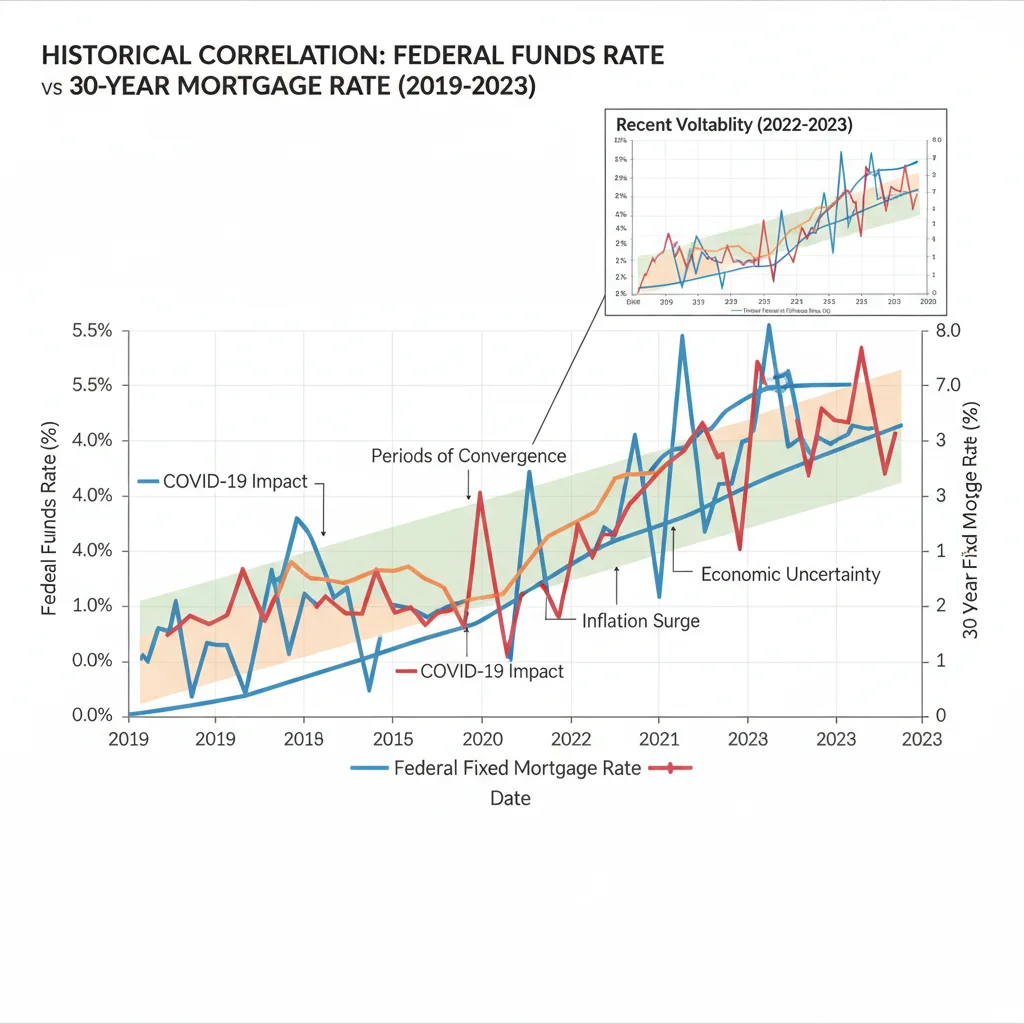

The Federal Reserve does not directly set mortgage rates; rather, it controls the Federal Funds Rate, an overnight lending rate for banks. However, market expectations regarding the Fed’s future actions—specifically, the anticipation of a rate cut—exert a powerful influence on longer-term interest rates, such as the 10-year Treasury yield. The 30-year fixed mortgage rate typically tracks this 10-year benchmark, often adding a spread based on factors like credit risk, market liquidity, and servicing costs. When the market prices in an 80% chance of a December cut, it effectively pulls down the entire curve of expected future rates, which is immediately reflected in current long-term yields.

This high probability stems from a confluence of recent economic indicators, including softening inflation data and signs of deceleration in the labor market. For instance, the Consumer Price Index (CPI) recently showed a monthly increase of 0.1%, falling short of the consensus forecast of 0.3%, according to the Bureau of Labor Statistics. Simultaneously, the latest Non-Farm Payrolls report indicated a net gain of 150,000 jobs, a marked slowdown from the previous six-month average of 210,000. These data points suggest that the Fed’s restrictive policy stance is successfully cooling demand, making a preemptive easing move more likely to avert an unnecessary economic contraction.

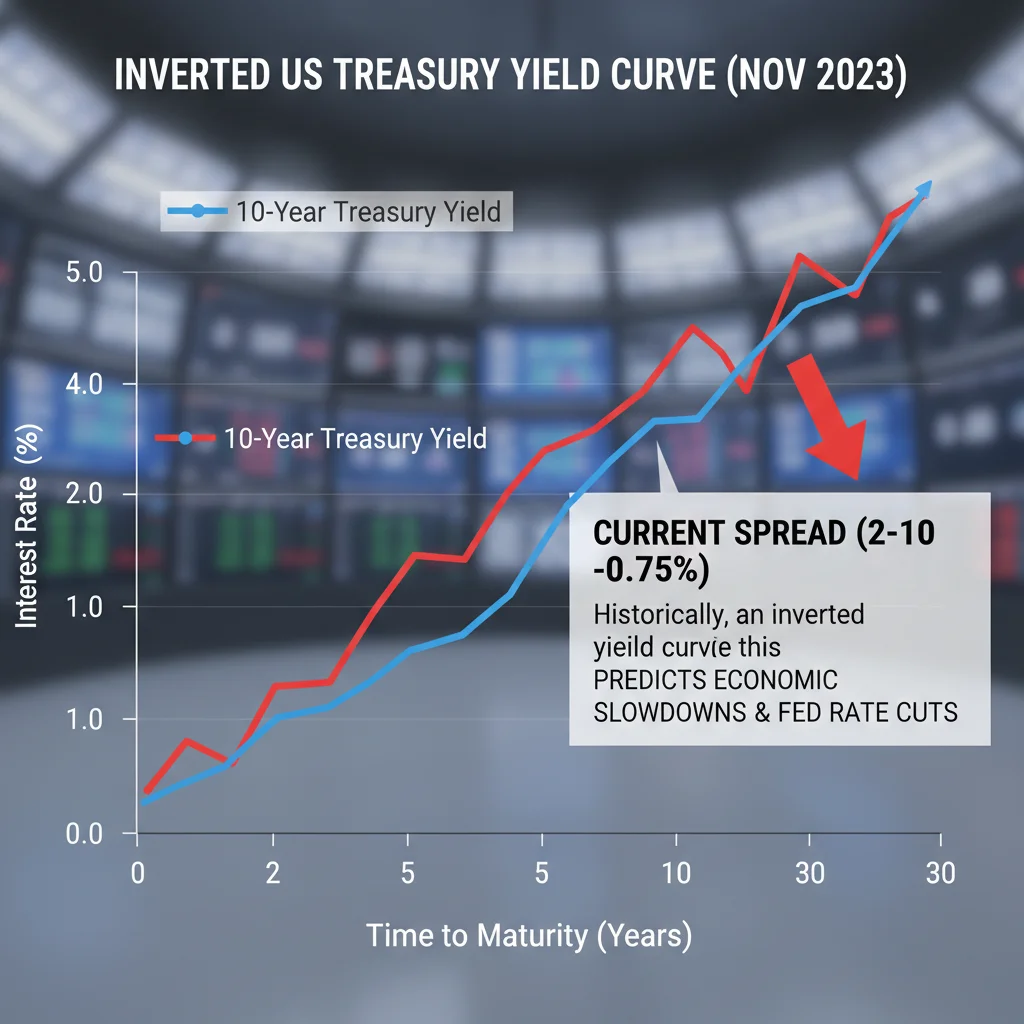

The yield curve interpretation

A critical signal frequently watched by market analysts is the relationship between short-term and long-term government bonds, known as the yield curve. When the curve is inverted—meaning short-term yields (like the 2-year Treasury) are higher than long-term yields (like the 10-year Treasury)—it historically signals an impending economic slowdown or recession, prompting the Fed to cut rates. The current deep inversion has persisted for over 18 months, reinforcing the market’s conviction that policy easing is imminent. This inversion is a primary driver behind the 80% expectation for a December cut, as bond traders are betting on lower inflation and slower growth in the near future.

- 10-Year Treasury Yield: The primary benchmark for 30-year fixed mortgage rates; a decline here directly lowers borrowing costs.

- Market Pricing: A high probability (80%) of a Fed cut is already partially factored into current mortgage rates, limiting the immediate drop but confirming the downward trajectory.

- Inflation Data: Continued cooling of the core Personal Consumption Expenditures (PCE) index below 2.5% annualized would solidify the case for a December cut.

- Economic Slowdown: Signs of weakening consumer spending or rising unemployment could push the probability even higher, forcing the Fed’s hand.

The immediate implication for the mortgage market is that lenders, anticipating lower funding costs ahead, are adjusting their offerings downward, albeit incrementally. While the Federal Funds Rate itself may not move until December, the forward-looking nature of the bond market ensures that the 80% expectation translates into tangible, though modest, rate relief now, preparing the ground for more substantial drops should the Fed follow through.

Impact on 30-year fixed mortgage rates and housing affordability

The most direct beneficiary of the reduced rate expectation is the 30-year fixed mortgage rate, the backbone of the US housing market. During periods of peak inflation fighting, rates briefly touched highs near 8.0% in late 2023, severely restricting housing affordability. With the December cut odds high, analysts are projecting a sustained decline in the average 30-year rate, potentially moving it into the mid-6% range by year-end, and possibly into the low-6% or high-5% range by mid-2025, assuming a series of follow-up cuts.

To illustrate the significance, a drop from 7.5% to 6.5% on a $400,000 mortgage translates to a reduction of approximately $250 in the monthly payment, or over $90,000 saved over the life of the loan. According to data from the National Association of Realtors (NAR), this level of rate reduction could increase the pool of eligible homebuyers by an estimated 5 million households who were previously priced out due to debt-to-income ratio constraints. This restoration of affordability is precisely what the housing market needs after two years of suppressed transaction volumes.

The refinancing wave potential

Current homeowners who purchased or refinanced when rates were significantly higher (e.g., above 7.0%) are closely monitoring the situation. A sustained rate environment in the mid-6% range or lower unlocks a massive refinancing opportunity. Mortgage servicers and financial institutions are already preparing for a surge in applications. However, analysts at Wells Fargo caution that the refinancing surge will primarily target those with lower loan balances and higher existing rates, as many homeowners who secured rates below 4.0% prior to 2022 will remain locked in.

The key metric for refinancing is the ‘refinancing incentive rate,’ which typically means a homeowner can save at least 50 basis points (0.50%) on their current rate. If 30-year rates consistently settle around 6.5%, the eligible population for refinancing, currently estimated at less than 10% of outstanding mortgages, could expand dramatically. This potential wave of refinancing provides a significant boost to consumer spending by reducing monthly housing costs, acting as a secondary stimulus to the broader economy, which is another reason the Fed may pursue easing.

Furthermore, the expectation of lower rates eases the pressure on adjustable-rate mortgages (ARMs) that are scheduled to reset. Borrowers facing resets in 2025 will find more favorable fixed-rate options available, mitigating the risk of payment shock and reducing systemic risk within the banking sector linked to potential mortgage defaults. The 80% certainty of a December cut is, therefore, a positive factor for housing stability and consumer financial health.

The diverging views: Why some analysts remain cautious

While the futures market has priced in a near certainty of a December rate cut, not all economic analysts are convinced the Fed will act so quickly or aggressively. Skeptics, particularly those at Goldman Sachs Research, point to the continued resilience of the US consumer and sticky services inflation as reasons for caution. They argue that the labor market, while cooling, remains fundamentally strong, with the unemployment rate holding below 4.0%.

Risks to the 80% forecast

One primary risk is a sudden reversal in inflation trends. A spike in global energy prices or unexpected supply chain disruptions could reignite inflationary pressures, forcing the Fed to maintain, or even resume, its hawkish stance. If the next two CPI reports show core inflation accelerating back toward 4.0% annualized, the 80% probability will evaporate rapidly. The Fed’s dual mandate prioritizes price stability, and policymakers, including Chairman Jerome Powell, have repeatedly stated they need convincing evidence that inflation is sustainably moving toward the 2.0% target.

- Services Inflation: This segment, driven by wages and shelter costs, remains stubbornly high, providing upward momentum that standard rate cuts might not entirely suppress.

- Geopolitical Risk: Escalation of global conflicts could trigger spikes in commodity prices, directly offsetting the domestic cooling achieved by Fed policy.

- Consumer Resilience: Strong household balance sheets, supported by excess savings from the pandemic era, continue to fuel demand, potentially delaying the full impact of restrictive monetary policy.

- Policy Lag: Monetary policy operates with a significant lag (typically 12 to 18 months). Cutting rates too soon risks undoing the progress made on inflation before the full effect of previous hikes has been realized.

Economists at Morgan Stanley maintain a more conservative forecast, suggesting the Fed may delay the first cut until Q1 2025, preferring to wait for more definitive evidence of a sustained inflation downtrend, rather than reacting solely to the market’s high expectation. This divergence highlights the inherent uncertainty in forecasting monetary policy, even when market probabilities are elevated. For mortgage applicants, this means maintaining flexibility and considering rate lock periods carefully.

Adjustable-rate mortgages (ARMs) and the short-term rate effect

While the 30-year fixed rate tracks long-term Treasury yields influenced by future expectations, adjustable-rate mortgages (ARMs) are more directly tethered to short-term benchmarks like the Secured Overnight Financing Rate (SOFR) or the Constant Maturity Treasury (CMT) indices, which are highly sensitive to the Federal Funds Rate. A December rate cut would immediately lower the floor for these short-term indices, providing immediate relief for new ARM borrowers and those whose initial fixed period is expiring.

The prevalence of ARMs has increased during the high-rate environment, as borrowers sought initial lower payments. For example, the share of mortgage applications for ARMs rose from under 5% in 2021 to over 12% in mid-2023, according to the Mortgage Bankers Association (MBA). The 80% probability of a rate cut provides a crucial safety net for these borrowers, reducing the risk that their rate will reset significantly higher when the fixed period ends. This is a vital stabilization factor for the US housing market.

Strategic implications for ARM holders

For current ARM holders, the projected December cut offers two primary strategic options. First, if the initial fixed period is expiring soon, the lower expected indices should result in a more favorable reset rate. Second, the anticipation of a series of cuts throughout 2025 makes refinancing into a new fixed rate more attractive, potentially locking in a lower rate than what their ARM might reset to later in the year. Financial advisors are recommending that ARM holders model their potential payments under various Fed scenarios to determine the optimal timing for a transition.

The high likelihood of a December cut also revitalizes the market for hybrid ARMs, such as 5/1 and 7/1 products. These offer an initial fixed period (five or seven years) followed by annual adjustments. Lenders can offer more competitive introductory rates on these products because they are confident that the short-term index rates used for future adjustments will be lower than current levels. This flexibility can be a strategic advantage for younger homebuyers who anticipate moving or refinancing within the initial fixed period, capitalizing on the expected policy shift.

The effect on housing inventory and home prices

Lower mortgage rates, driven by the strong anticipation of a Fed cut, have a complex dual effect on the housing market: they boost demand but can also exacerbate the persistent inventory shortage. Historically, a drop in rates stimulates buyer demand, leading to increased competition and upward pressure on home prices. However, the current situation is unique due to the ‘lock-in’ effect.

The persistent ‘lock-in’ phenomenon

Millions of existing homeowners currently hold mortgages with rates below 4.0%, secured during the ultra-low rate environment of 2020-2021. Even if the 30-year fixed rate drops to 6.5%, it remains substantially higher than their current rate. This disparity discourages them from selling and purchasing a new home at a higher rate, consequently keeping existing home inventory exceptionally tight. Data from Fannie Mae suggests that a rate drop below 5.5% would be required before a significant number of these ‘locked-in’ homeowners feel comfortable re-entering the market as sellers.

Therefore, the December cut, while boosting buyer demand, may not immediately solve the inventory crisis. This imbalance suggests that home price appreciation, which had moderated in 2023, could reaccelerate through 2025, particularly in high-demand metropolitan areas. CoreLogic data indicates that US home prices could see a 4.5% year-over-year increase by Q3 2025, driven primarily by the affordability gains from lower rates colliding with chronically low housing supply.

- Demand Surge: Lower rates increase the purchasing power of buyers, stimulating market activity and reducing the time homes spend on the market.

- Inventory Constraint: The ‘lock-in’ effect persists; homeowners with sub-4% rates are unlikely to sell, keeping supply limited.

- Price Pressure: The combination of increased demand and limited supply will likely lead to renewed home price inflation, offsetting some of the affordability gains from lower borrowing costs.

- New Construction: Lower commercial financing costs (also affected by the Fed’s stance) may encourage builders to accelerate new housing starts, providing eventual relief to inventory, though this takes time.

The net effect is a delicate balance. While the Fed rate cut mortgage environment is clearly beneficial for affordability, the structural issues of housing supply mean that rapid price increases remain a distinct possibility, requiring prospective buyers to remain agile and potentially look toward new construction or less competitive markets.

Navigating the pre-cut environment: Strategies for prospective buyers and refinancers

For individuals planning to transact in the housing market, the current environment—characterized by high certainty of a future rate cut but modest current rate movement—demands strategic planning. The primary challenge is balancing the risk of waiting for a lower rate against the risk of missing out on a desirable property due to increasing competition and rising prices.

Rate lock strategies

Prospective homebuyers should leverage lender programs that offer a ‘float-down’ option. A float-down provision allows the borrower to lock in a current rate but provides the option to secure a lower market rate should rates fall further before closing. Given the 80% probability of a December cut, this strategy mitigates the risk of locking in a rate just before the market shifts downward. Lenders often charge a small fee (typically 0.125% to 0.25% of the loan amount) for this protection, but it can be a worthwhile insurance policy in a volatile market anticipating policy easing.

For refinancers, the strategy is slightly different. Instead of locking immediately, they might wait until the Fed officially executes the December cut. Historically, mortgage rates often experience their most significant drops immediately following a definitive monetary policy action, rather than in the anticipation phase. However, waiting too long risks an unexpected economic data point derailing the cut or leading to a ‘buy the rumor, sell the news’ scenario where rates briefly rebound after the announcement. Analysts suggest monitoring the 10-year Treasury yield closely; once it breaches a key technical support level (e.g., 4.0%), that may signal the optimal time to lock.

The role of the Federal Reserve’s communication

The Fed’s forward guidance remains paramount. Even if a December cut occurs, the accompanying Summary of Economic Projections (SEP) and the ‘dot plot’ will reveal the expected path of future rate cuts in 2025 and beyond. If the Fed signals a shallow cutting cycle (e.g., only one or two cuts in 2025), the mortgage rate decline may be muted. Conversely, a signal for three or more cuts would send long-term yields significantly lower. Buyers must analyze the Fed’s communication for the ‘future word,’ not just the immediate action, to inform their long-term financial decisions.

In summary, the 80% odds of a December cut provide a strong directional signal: rates are heading lower. However, market participants must employ sophisticated locking and monitoring strategies to capitalize on this expectation without succumbing to the risks of market volatility or increased competition in the housing market.

Financial Summary: Key Factors and Mortgage Implications

| Key Financial Metric | Market Implication for Mortgages |

|---|---|

| Fed December Cut Odds (80%) | High expectation already priced into 10-year Treasury, ensuring downward pressure on 30-year fixed rates. |

| 10-Year Treasury Yield | Projected to continue declining toward 4.0%, potentially bringing 30-year mortgage rates into the mid-6% range. |

| Housing Inventory (‘Lock-in’ Effect) | Supply remains tight despite lower rates, meaning increased buyer competition and continued home price appreciation. |

| Refinancing Eligibility | A drop to 6.5% rate substantially increases the pool of homeowners with rates above 7.0% who can benefit from refinancing. |

Frequently Asked Questions about the Fed Rate Cut and Your Mortgage

The decrease is often immediate but gradual. The market has already priced in much of the expected 25 basis point cut. The primary impact will be felt on the 10-year Treasury yield, which should drop further, leading to mortgage rate reductions within days of the FOMC announcement, potentially stabilizing in the mid-6% range.

Waiting carries risk. If inflation data reverses, the cut might be delayed. A better strategy is to apply now and utilize a float-down rate lock option offered by lenders. This protects you from rate increases while allowing you to benefit if rates drop following the anticipated December policy change.

Lower rates improve affordability by reducing monthly payments, but the crisis is also driven by low inventory. Increased demand from lower rates, combined with the ‘lock-in’ effect limiting sellers, risks accelerating home price growth, offsetting some of the payment relief gained from the lower interest rates.

The Fed Funds Rate is a short-term benchmark for bank lending, controlled by the Fed. The 30-year mortgage rate is a long-term rate tied mainly to the 10-year Treasury yield, reflecting market expectations of long-term inflation and economic growth, which are heavily influenced by the Fed’s expected future path.

The expected December rate cut is beneficial for ARM holders. It helps lower the short-term indices (like SOFR) used to calculate future reset rates, potentially mitigating payment shock for those whose fixed periods expire in 2025. It also makes refinancing into a favorable fixed rate more accessible.

The bottom line: Policy pivot and the real estate landscape

The 80% market certainty concerning a Federal Reserve rate cut in December marks a pivotal moment, signaling the end of the most aggressive monetary tightening cycle in decades. This near-consensus expectation provides a clear directional signal for the US housing market: borrowing costs are set to decline. While the immediate drop in the 30-year fixed mortgage rate may be modest, primarily because the market has already factored in the probability, the sustained trajectory is definitively downward. This shift promises significant relief for prospective buyers struggling with affordability and unlocks a substantial refinancing opportunity for homeowners currently locked into rates above 7.0%.

However, the analysis must be tempered by the recognition of countervailing forces. The benefit of lower rates, if not accompanied by a loosening of housing inventory, risks fueling renewed home price inflation. The ‘lock-in’ effect, where existing homeowners are reluctant to trade their low-rate mortgages for higher new ones, continues to suppress supply, meaning the housing market may transition from an affordability crisis driven by high rates to one driven by escalating prices. For financial institutions and consumers alike, the key takeaway is that the monetary policy pivot is underway, demanding a flexible and data-driven approach to mortgage planning. Market participants must monitor not just the December action, but the Fed’s subsequent guidance on the pace of easing in 2025, which will ultimately dictate the long-term cost of housing finance.