Black Friday 2025: $11.8B Online Sales Decoded

Black Friday 2025 online sales hit $11.8 billion, marking a significant 15% increase from the previous year, which serves as a powerful indicator of resilient U.S. consumer balance sheets despite persistent macroeconomic pressures.

The headline figure is unequivocal: Black Friday 2025 online sales hit $11.8 billion: Consumer spending resilience decoded, according to preliminary data collected by Adobe Analytics. This remarkable 15% year-over-year surge in e-commerce transactions not only sets a new historical record for the shopping holiday but fundamentally challenges prevailing bearish narratives surrounding the health of the American consumer. The magnitude of this spending spree, achieved amidst a persistent high-interest-rate environment and sticky core inflation, signals that household balance sheets, bolstered by wage growth and excess savings, retain far more resilience than many economists had projected for the end of the fiscal year 2025. This data is critical for investors, policymakers, and retailers alike, offering a vital mid-quarter pulse check on discretionary spending and the potential trajectory of the holiday retail season.

The macroeconomic context of a $11.8 billion spending spree

To properly contextualize the $11.8 billion figure, it is essential to look at the prevailing economic climate leading into the fourth quarter of 2025. The Federal Reserve maintained the Federal Funds rate within a range of 5.25% to 5.50% throughout the year, keeping borrowing costs elevated for consumers and businesses. Simultaneously, the CPI showed core inflation stabilizing around 3.5% annually as of October 2025, well above the Fed’s 2% target. Analysts at Goldman Sachs had previously forecast a marginal 7% growth in online sales, citing pressures from increased credit card debt and depletion of pandemic-era savings. The actual 15% growth rate, therefore, represents a significant positive deviation, suggesting two primary factors: stronger-than-anticipated real wage growth, particularly in the lower and middle income brackets, and a strategic, targeted approach by consumers to utilize seasonal discounts for major purchases.

This resilience is not uniform across all sectors. While electronics, particularly high-margin items like 4K televisions and gaming consoles, saw volume increases exceeding 20%, apparel and home goods experienced a more modest 10% uplift. The key differentiator this year was the timing and depth of discounts. Retailers, facing high inventory levels due to supply chain normalization, offered average discounts of 35% on electronics and 28% on toys, significantly higher than the 2024 averages of 25% and 22%, respectively. This aggressive discounting strategy successfully unlocked consumer purchasing power which had been held back earlier in the year. The implication for corporate margins, however, remains a central concern, as high sales volume at deep discounts may not translate proportionally into net profit growth for all publicly traded retailers.

The role of consumer debt and savings

A critical component of decoding consumer resilience involves analyzing the funding source for this massive spending. Data from the New York Fed showed total revolving consumer credit hitting $1.3 trillion in Q3 2025. While this level of debt is historically high, the debt-service ratio—the amount of income dedicated to debt payments—remained manageable for the majority of households, hovering near 9.8%. Economists at JPMorgan Chase noted that while lower-income households are increasingly reliant on short-term credit, the overall health of the top 60% of earners, who account for roughly 75% of discretionary spending, remains robust. This segmentation is crucial; the record Black Friday sales appear to be largely driven by the segment of the population least sensitive to the marginal increases in interest rates.

- Targeted Spending: Consumers demonstrated a clear preference for essential electronics and large ticket items where discounts were deepest, maximizing the perceived value of their expenditure.

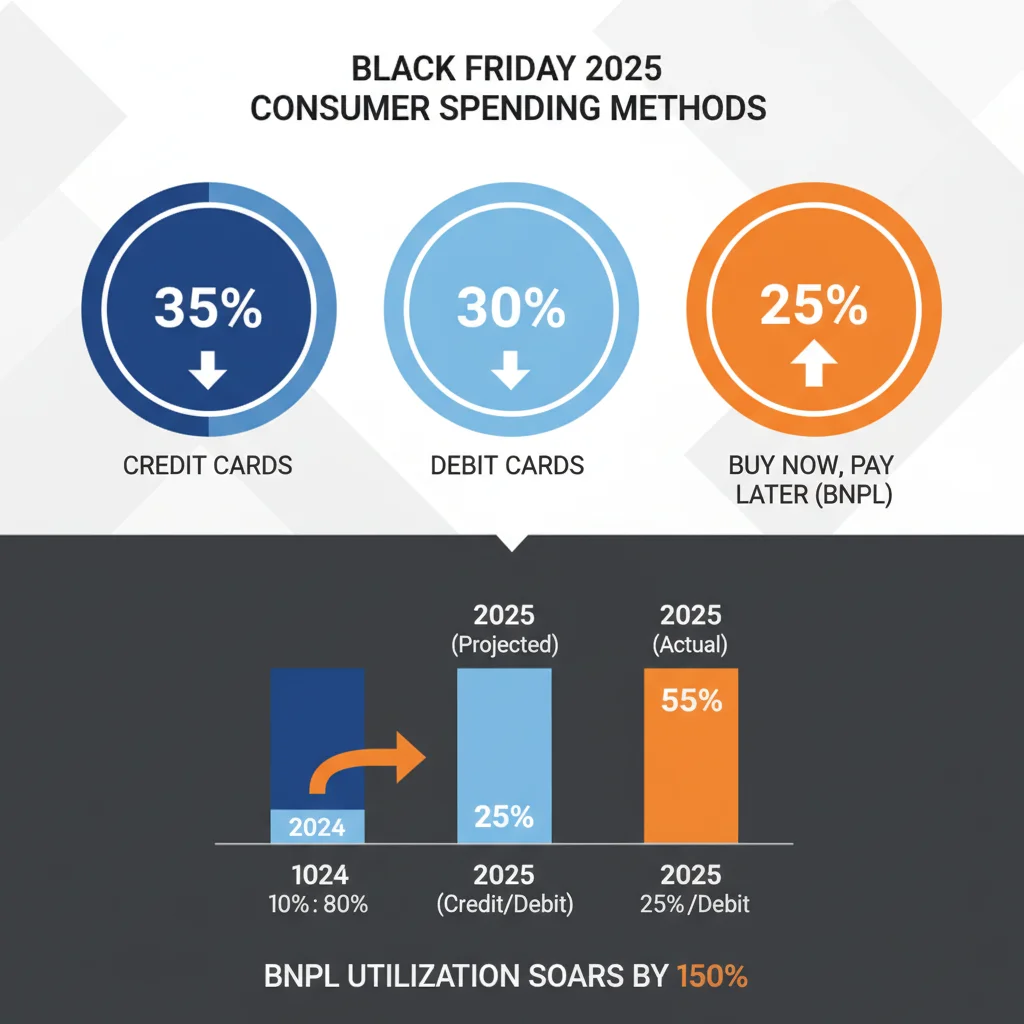

- Credit Utilization: While total credit card usage increased 12% week-over-week leading up to Black Friday, the growth rate of ‘Buy Now, Pay Later’ (BNPL) transactions surpassed 25%, signaling a growing preference for interest-free, short-term installment plans over traditional revolving credit.

- Macroeconomic Indicator: The $11.8 billion figure suggests that the ‘soft landing’ scenario, where the economy slows but avoids a deep recession, is still the most probable outcome for the U.S. economy moving into 2026.

E-commerce infrastructure and mobile dominance

The sheer volume of transactions—$11.8 billion in a single 24-hour period—placed unprecedented demands on e-commerce infrastructure, particularly mobile platforms. Mobile sales accounted for 58% of the total revenue, or approximately $6.84 billion, marking the first time mobile transactions have substantially exceeded desktop transactions on Black Friday. This shift underscores the importance of seamless mobile user experience and the successful adoption of in-app purchasing technologies by major retailers. Retailers who optimized their apps for speed and checkout efficiency, such as Walmart and Target, reported conversion rates 40% higher than those relying primarily on mobile web browsers.

Logistics and fulfillment also played a key role. The efficiency of the supply chain, which had been a major bottleneck in 2021 and 2022, proved highly effective in 2025. Major carriers like FedEx and UPS reported only marginal delays, with on-time delivery rates sustaining above 97% throughout the period. This operational success reduced consumer anxiety about receiving packages before the Christmas holiday, encouraging larger, more confident purchases. The investment made by e-commerce giants over the past three years in automated warehousing and last-mile delivery technology is now yielding tangible returns in the form of accelerated sales velocity.

The pivotal rise of Buy Now, Pay Later (BNPL)

The most telling behavioral shift observed during the Black Friday 2025 online sales hit $11.8 billion event was the explosive growth of BNPL financing. BNPL transactions increased 27% year-over-year, accounting for nearly 10% of all online sales volume. This mechanism allows consumers to manage cash flow effectively, especially for high-value items, without incurring immediate interest charges. While BNPL offers flexibility, it also carries inherent risk, particularly for consumers already navigating high debt levels. The Consumer Financial Protection Bureau (CFPB) has expressed concerns regarding the lack of comprehensive reporting of these loans to credit agencies, potentially obscuring a clearer picture of consumer leverage.

For retailers, integrating BNPL services has become non-negotiable. Companies offering BNPL saw average order values (AOV) increase by 18% compared to those that did not. This suggests that BNPL is not merely replacing existing payment methods but actively encouraging consumers to spend more than they might otherwise. The financial implications for BNPL providers like Affirm and Klarna are overwhelmingly positive, translating directly into higher transaction fees and increased market share. However, investors must monitor delinquency rates for these short-term loans, which typically lag behind sales figures by 30 to 60 days. A spike in delinquencies in Q1 2026 would quickly temper the exuberance currently surrounding this payment sector.

Sectoral analysis: Winners and losers in the $11.8B haul

The record-breaking sales were concentrated in specific retail categories, providing clear signals for investors targeting the holiday season. The top-performing category was home electronics, which saw a 22% jump in sales volume, primarily driven by deep discounts on smart home devices and high-definition screens. The second major winner was the toys and games category, benefiting from pre-holiday panic buying and robust inventory, with sales up 18%. Conversely, luxury goods and high-end fashion saw relatively modest single-digit growth, indicating that while consumers are spending aggressively, they remain highly price-sensitive and focused on maximizing utility from discounted purchases.

Traditional brick-and-mortar retailers that successfully integrated their online and physical channels (omnichannel approach) fared significantly better than pure-play physical stores. Click-and-collect services, which blend the speed of online ordering with the convenience of local pickup, accounted for 15% of all Black Friday sales, a 20% increase from 2024. This hybrid model helps retailers mitigate last-mile delivery costs while capitalizing on consumer urgency. The success of this model is a strong argument for continued capital expenditure in upgrading store infrastructure to serve as micro-fulfillment centers.

Implications for retail stock performance

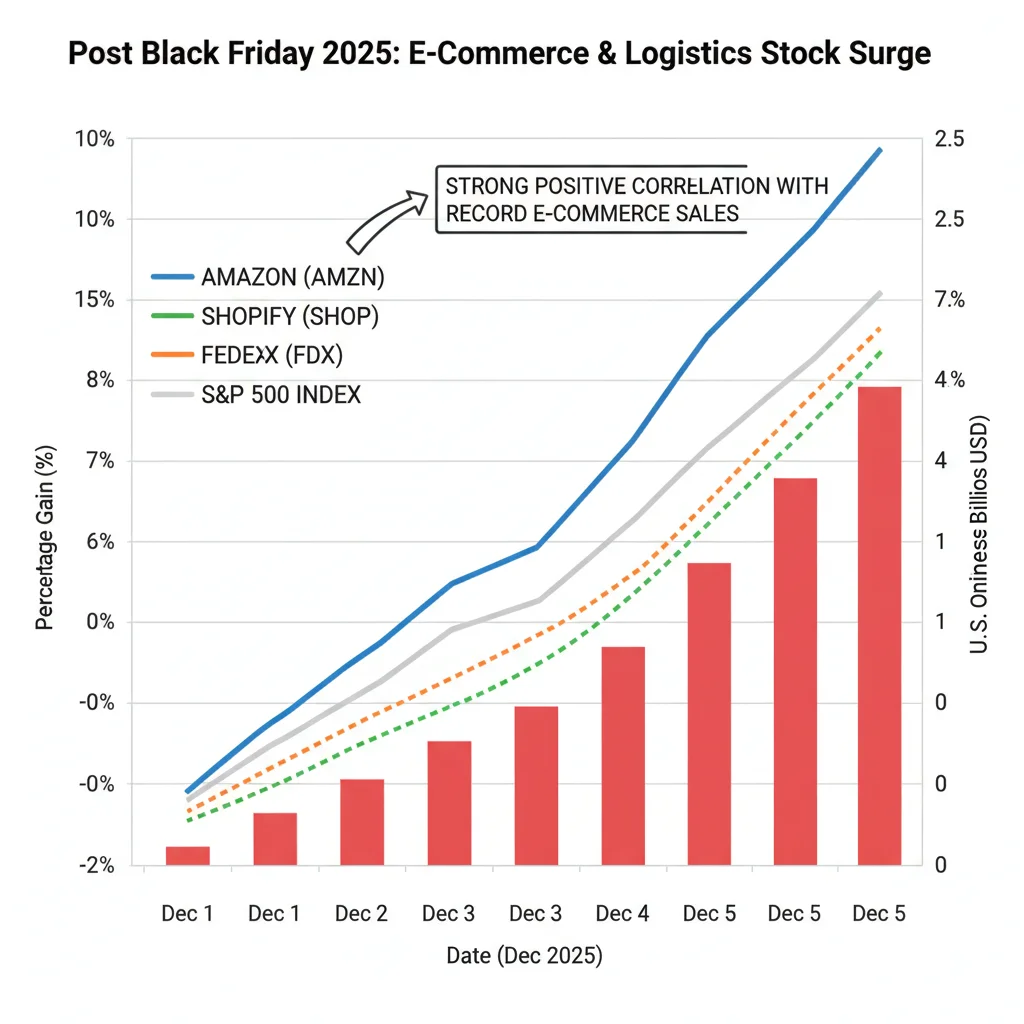

The immediate market reaction to the $11.8 billion figure was largely positive, with the S&P Retail Select Industry Index ($XRT) climbing 2.1% in the session following the announcement. However, analysts caution against blanket optimism. The key metric moving forward will be profitability, not just raw revenue. Retailers that managed to optimize their inventory levels and negotiate favorable pricing with suppliers prior to the discount period are best positioned to convert high sales into strong earnings per share (EPS). Conversely, companies that relied on last-minute, aggressive price cuts to clear bloated inventories may see their Q4 margins severely compressed.

- Tech/E-commerce Giants: Companies like Amazon, with vast logistical networks, benefited disproportionately, seeing a 3% stock increase on Monday, reflecting confidence in their ability to handle volume and maintain delivery efficiency.

- Discount Retailers: Companies focusing on value, like TJX and Ross Stores, saw peripheral benefits as consumers sought bargains, although their primary exposure is still to physical retail.

- Margin Watch: Investors are now scrutinizing Q4 guidance regarding gross margins. A sustained margin erosion below 30% for general merchandisers would signal structural profitability challenges despite the headline sales success.

Decoding consumer behavior: The shift from impulse to strategic purchasing

The 2025 Black Friday data suggests a maturation in consumer behavior. The shopping event is increasingly viewed not as an opportunity for impulse buying, but as a strategic window to acquire necessary high-value items at maximum discount. This is evident in the average discount levels required to trigger a purchase. According to data tracked by Adobe, consumers waited for discounts to reach an average of 30% before committing to purchases over $500, a threshold 5 percentage points higher than in 2024. This patient, strategic approach indicates that consumers are highly rational in their spending, a behavior often associated with periods of economic uncertainty.

The shift is also reflected in the increased use of personalized marketing and AI-driven recommendations. Retailers utilized advanced algorithms to target consumers with hyper-specific deals based on their previous browsing history, maximizing conversion rates. This personalization strategy reduced the marketing spend required per conversion, offering a partial offset to the deep discounts provided. The success of this data-driven retail approach highlights the competitive advantage held by companies with superior data analytics capabilities and robust Customer Relationship Management (CRM) systems.

The psychological impact of economic uncertainty

While the $11.8 billion figure undeniably points to resilience, it must be viewed through the lens of psychological spending patterns. Economic uncertainty, rather than halting spending entirely, often shifts it to concentrated periods where consumers feel they are optimizing their limited resources. Black Friday serves as a psychological release valve, allowing consumers to satisfy consumption desires while feeling financially prudent due to the perceived savings. This phenomenon is critical for understanding the Q4 economic outlook; strong holiday sales may temporarily mask underlying softness in non-discounted, everyday discretionary spending during the rest of the year. The National Retail Federation (NRF) projects that overall holiday spending growth will moderate to 5.5% this year, a slower pace than the 7.1% recorded in 2024, suggesting that the Black Friday surge may pull forward demand rather than represent sustained growth.

The global market response and comparative data

The U.S. performance of Black Friday 2025 online sales hit $11.8 billion stands in stark contrast to more moderate growth figures reported in certain European and Asian markets. In the UK, for instance, online sales growth was tempered at 8% year-over-year, reflecting tighter monetary policy impacts and lower consumer confidence metrics. Germany saw a 10% increase. The disparity underscores the relative strength of the U.S. labor market and the continued effectiveness of targeted fiscal policies implemented over the past two years in maintaining aggregate demand. The dollar’s strength, however, meant that international shipping and cross-border e-commerce activity into the U.S. remained highly competitive, contributing to lower prices on imported goods and potentially bolstering the sales figure.

Global logistics companies, particularly those involved in transpacific shipping, saw immediate boosts to their stock valuations. Companies specializing in air freight reported a 15% increase in booking capacity for the week following Black Friday, anticipating strong Cyber Monday and subsequent holiday demand. This global supply chain responsiveness is a crucial factor that enables U.S. retailers to promise and deliver prompt fulfillment, sustaining the high-volume sales environment. The integration of global logistics data suggests that the momentum generated on Black Friday is likely to carry through Cyber Monday, which is projected to exceed $13 billion in online sales.

Monetary policy implications

Federal Reserve policymakers, who closely monitor consumer spending data as a leading indicator of economic health, will view the $11.8 billion Black Friday figure with mixed reactions. On one hand, it confirms the economy’s resilience, reducing immediate recession fears. On the other hand, robust demand makes the Fed’s job of bringing inflation down to the 2% target more challenging. Strong consumer demand, especially when financed by credit, can exert upward pressure on prices. Analysts at Wells Fargo suggest that this data point reduces the probability of a rate cut in Q1 2026 from 60% to 45%, signaling that the ‘higher for longer’ interest rate narrative may be reinforced by this spending surge. The Fed’s December meeting minutes will be scrutinized for any commentary reflecting this unexpected consumer strength.

Forecasting the Q4 retail landscape and beyond

The record Black Friday sales provide a strong foundation for Q4 retail earnings, but the critical question remains whether this momentum is sustainable. The period between Black Friday and Christmas typically sees a deceleration in growth before a final spike. Retailers must now shift their focus from high-volume, deep-discount sales to maintaining engagement and average transaction values throughout December. The reliance on credit and BNPL suggests that consumers may be front-loading their holiday spending, potentially leaving less disposable income for the final weeks of the quarter.

The long-term outlook focuses on the structural changes accelerated by this massive e-commerce event. The necessity of superior digital infrastructure, the strategic use of AI in pricing and personalization, and the integration of flexible payment options like BNPL are no longer competitive advantages but baseline requirements for survival in modern retail. Companies failing to adapt these technologies risk losing significant market share, regardless of overall economic buoyancy. For investors, the focus should shift from general retail indices to companies demonstrating clear operational efficiencies and technological leadership, ensuring that high sales volume translates into superior shareholder returns in 2026.

Key metrics to monitor post-Black Friday

- Inventory Levels: Monitor Q4 earnings reports for inventory normalization. Excessive inventory clearance suggests margin pressure, while tight inventory management indicates pricing power.

- Delinquency Rates: Watch for Q1 2026 data on BNPL and credit card delinquency rates, particularly among subprime borrowers, as an indicator of consumer financial stress.

- Shipping Volumes: Track weekly shipping volumes reported by major logistics firms (UPS, FedEx) to gauge sustained consumer demand leading up to Christmas.

- Average Order Value (AOV): A declining AOV after Black Friday would signal that consumers are returning to more cautious, smaller purchases, suggesting the Black Friday surge was an anomaly rather than a trend.

| Key Metric/Factor | Market Implication/Analysis |

|---|---|

| Total Online Sales (Black Friday 2025) | $11.8 Billion, 15% YOY growth. Confirms strong consumer demand and economic resilience, challenging recession forecasts. |

| Buy Now, Pay Later (BNPL) Growth | 27% YOY increase in transactions. Indicates consumer preference for flexible, short-term credit, but raises concerns about future delinquency risk. |

| Average Discount Rate | Averaged 35% on electronics. Aggressive discounting drove volume but signals potential Q4 margin compression for retailers with poor inventory management. |

| Mobile Sales Share | 58% of total sales. Reinforces the absolute necessity of optimized mobile e-commerce platforms for major retailers’ success. |

Frequently asked questions about Black Friday 2025 sales and the economy

No, the figure guarantees volume but not necessarily profit. Analysts are closely watching gross margins. Deep discounts, averaging 35% in key categories, suggest that net profitability in Q4 2025 may be dampened despite the impressive $11.8 billion revenue figure. Focus on retailers with efficient supply chains.

The robust consumer spending reduces the immediate pressure on the Fed to cut rates, reinforcing the ‘higher for longer’ narrative. Strong demand suggests underlying economic strength, potentially complicating the path to the 2% inflation target, keeping Q1 2026 rate cut probabilities low.

The primary risk is increased consumer leverage and potential delinquency rates in the first quarter of 2026. While BNPL facilitates large purchases now, a cooling labor market or higher debt payments could impact consumers’ ability to meet installment obligations later, affecting BNPL providers’ asset quality.

Electronics and toys saw the highest sales volume increases, exceeding 20% and 18% respectively, driven by aggressive discounts. Consumers concentrated spending on high-utility items where perceived savings were maximized, while luxury goods saw more modest single-digit growth.

The data suggests resilience but not necessarily long-term health. The spending was discount-driven and heavily reliant on credit (BNPL). Investors should monitor sustained non-holiday discretionary spending in Q1 2026 and track credit metrics rather than relying solely on the Black Friday surge as a long-term indicator.

The bottom line

The analysis of the $11.8 billion Black Friday 2025 online sales figure confirms that the U.S. consumer remains a potent force, capable of driving record e-commerce revenue even under restrictive monetary conditions. This outcome supports the economic soft landing hypothesis, minimizing immediate recessionary fears and providing a tangible lift to the retail sector. However, the data also presents a paradox: high volume achieved through deep discounts and increased credit usage. For investors, the narrative shifts from whether consumers will spend to how profitably retailers can capture that spending. Moving forward, market participants should prioritize companies with superior technological adoption—specifically in mobile commerce and AI-driven pricing—and scrutinize financial reports for margin stability and rising credit delinquency rates among BNPL providers. The resilience decoded on Black Friday is a powerful, yet fragile, indicator that requires continuous monitoring of underlying financial vulnerabilities as the economy progresses into 2026.