House Prices Rose 2.2%: States Still Offering Value for Buyers

The 2.2% year-over-year increase in median house prices reflects sustained demand despite high interest rates, pushing buyers and investors toward secondary markets in states where economic fundamentals still support genuine long-term value creation.

The latest data from the Federal Housing Finance Agency (FHFA) confirms that the U.S. residential property market remains resilient, reporting that House Prices Rose 2.2% Year-Over-Year: Which States Still Offer Value? This measured appreciation, while far below the double-digit surges observed during the pandemic-era peak, signifies persistent demand juxtaposed against chronically low inventory. For investors and prospective homeowners, understanding this national average is merely the starting point; the critical analysis lies in dissecting the regional divergence. While coastal hubs continue to struggle with affordability challenges driven by high median incomes and constrained supply, a deeper look reveals specific states where economic fundamentals, demographic shifts, and lower entry costs still promise substantial, sustainable value.

The 2.2% Appreciation: Context and Economic Drivers

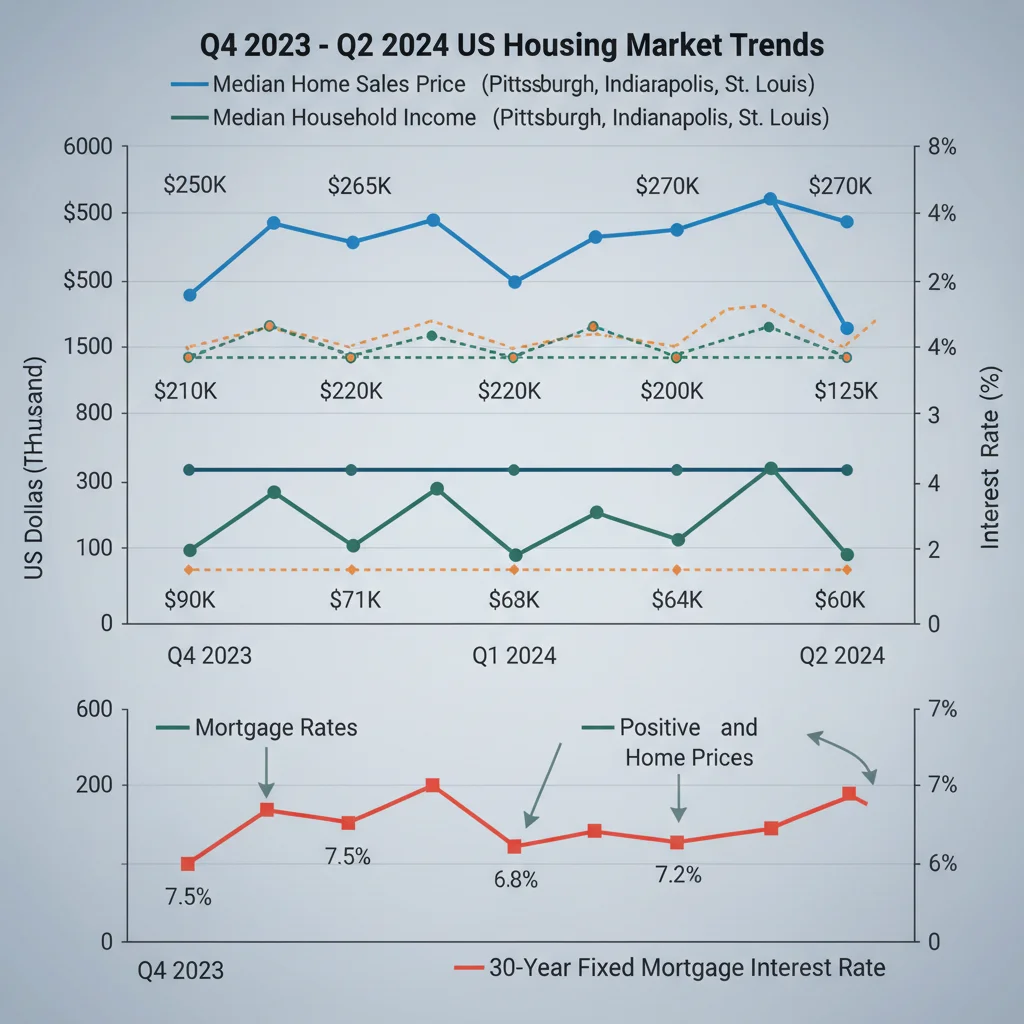

The 2.2% year-over-year increase, calculated as of the most recent quarterly data release, must be viewed through the lens of current monetary policy. With the Federal Reserve maintaining the Federal Funds Rate target range at levels designed to combat persistent inflation, the average 30-year fixed mortgage rate has fluctuated near the 7% threshold. Historically, such high borrowing costs would severely dampen housing market activity and lead to price corrections. However, two primary factors are underpinning this continued appreciation: the severe shortage of available housing stock and the ‘lock-in’ effect.

The lock-in effect refers to current homeowners, many of whom secured mortgages below 4% in previous years, being reluctant to sell and forfeit their low rates. This dynamic keeps existing inventory tight. According to the National Association of Realtors (NAR), the supply of homes for sale remains critically constrained, often hovering near a 3-month supply nationally—far below the 6-month supply considered indicative of a balanced market. This scarcity forces buyers to compete for limited properties, sustaining the upward pressure on prices, even in the face of elevated financing costs.

Analyzing Regional Disparity in Price Growth

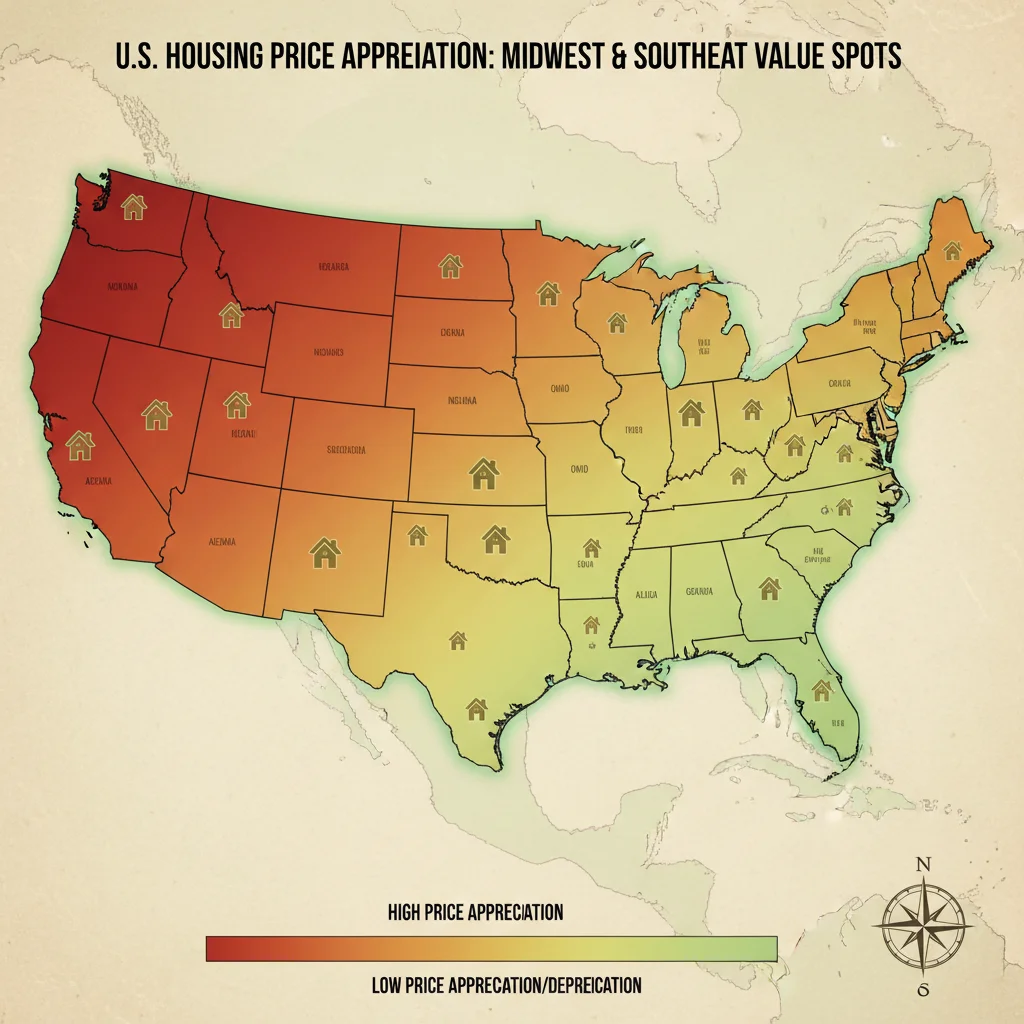

While the national average is 2.2%, the reality on the ground is highly segmented. Metropolitan areas in the Northeast and California, which saw massive price gains between 2020 and 2022, are experiencing slower growth or even modest contractions in some high-cost segments. Conversely, high-growth states in the Southeast and certain areas of the Midwest are driving the national average. For instance, data from CoreLogic indicates that states like Florida and Texas continue to see significant inbound migration, fueling localized price appreciation well above the 2.2% national figure, often exceeding 5% in specific metro areas like Miami and Dallas.

- Inventory Constraint: Low housing inventory nationwide (under 3.5 months supply) is the primary structural support for continued price appreciation despite economic headwinds.

- Mortgage Rate Impact: High interest rates (near 7% for a 30-year fixed mortgage) disproportionately affect first-time buyers and markets reliant on transaction volume, yet inventory scarcity cushions the impact on prices.

- Regional Migration Patterns: Continued population shifts toward lower-tax, warmer climate states (Sun Belt) are creating pockets of intense demand and above-average price growth, altering the traditional landscape of housing value.

The implication for financial analysts is clear: general market conditions do not apply uniformly. Investors must look past the aggregate appreciation rate and focus on specific state economies, employment growth rates, and local permitting activity to accurately gauge future market stability and potential return on investment (ROI).

Identifying States with Sustainable Housing Value

The search for true housing value in the current economic climate requires moving beyond mere low prices. Sustainable value is defined by a confluence of low entry cost, positive long-term economic outlook, strong employment diversity, and a favorable income-to-home-price ratio. Many states that historically offered cheap housing are now experiencing rapid price catch-up, diminishing their attractiveness. The real opportunity lies in markets where prices are stable, but economic growth indicators suggest future appreciation.

The Midwest region, often overlooked by institutional investors focused on the coasts, presents several compelling cases. States like Ohio, Michigan, and Pennsylvania possess large, diversified economies, stable populations, and significantly lower median home prices compared to the national average ($348,000 as of Q2 2024, per Census Bureau data). In cities like Cleveland or Pittsburgh, the median home price can be 40% to 50% lower than the national median, offering substantially better affordability ratios for local wage earners.

The Affordability Index and Investor Focus

The Affordability Index, tracked by organizations like the National Association of Home Builders (NAHB), measures the ability of a median-income family to qualify for a mortgage on a median-priced home. While national affordability has plummeted to decade lows due to high rates, certain states maintain an index reading above 100, indicating that the median family can still afford the median home. These markets typically exhibit lower volatility and higher rental yield potential for buy-and-hold investors.

- Midwestern Stability: States such as Indiana and Missouri offer stable, moderate appreciation rates (often 1.5% to 3.0% annually) combined with low property taxes, enhancing long-term holding value.

- Southeastern Secondary Markets: Beyond the major hubs of Florida and Texas, states like Alabama and Mississippi show strong relative value. These markets are attracting businesses seeking lower operating costs, suggesting future job growth that will eventually underpin housing demand.

- Income-to-Price Ratio: A key metric for value is the median home price divided by the median household income. Markets where this ratio is below 4.0 are generally considered healthy and sustainable. Many states in the Great Plains (e.g., Oklahoma, Kansas) fall into this category.

Investors should prioritize markets demonstrating positive net migration and employment growth in sectors less prone to cyclical downturns, such as healthcare, education, and advanced manufacturing, ensuring sustained demand for housing irrespective of short-term interest rate fluctuations.

The Role of Interest Rates and Buyer Behavior

The current high-rate environment has fundamentally altered buyer behavior, pushing demand lower down the price curve and into geographically less dense areas. The 2.2% price rise is skewed towards properties where buyers can afford higher monthly payments or those who are paying cash. Data from Redfin indicates that cash sales accounted for nearly 30% of all transactions in early 2024, disproportionately affecting the luxury and second-home markets but also illustrating the difficulty faced by rate-sensitive conventional buyers.

This suppression of rate-sensitive demand creates an opportunity in value-oriented states. When the Federal Reserve eventually signals a sustained path toward rate cuts—a scenario projected by many economists for late 2024 or 2025—the pent-up demand currently constrained by 7% mortgages will re-enter the market. States with lower median home prices will see the most immediate and pronounced surge in affordability once rates drop, potentially leading to accelerated appreciation in those overlooked value markets.

Analyzing the Mortgage Rate Sensitivity

A $500,000 mortgage at 7.5% results in a monthly principal and interest payment of approximately $3,496. The same mortgage at 5.5% results in $2,838—a savings of $658 per month. This sensitivity explains why buyers are increasingly priced out of high-cost areas like Seattle or Boston. However, in a state like Arkansas, where the median home price is closer to $200,000, the interest rate burden is significantly less onerous, maintaining a higher level of underlying demand.

The core strategic insight here is to invest in states where the price point is low enough that a modest decline in interest rates translates into a substantial increase in the pool of qualified buyers. This effect provides a margin of safety for investors buying now, anticipating a future boost in demand driven by macro-monetary policy shifts. Furthermore, the lack of speculative fervor in these value markets reduces the risk of sharp corrections, a concern that still lingers in overheated coastal markets.

Economic Fundamentals: Job Growth and Supply Dynamics

Sustainable housing value is ultimately tied to localized economic strength. States that are successfully attracting corporate relocations and fostering job growth in high-wage sectors are best positioned for long-term appreciation, even if current prices are modest. The shift towards remote work has lessened the necessity of living near major urban centers, allowing workers to move to areas offering a better cost-of-living balance.

Consider the contrast between California and Tennessee. California continues to see net out-migration due to cost-of-living pressures, despite its strong tech base. Tennessee, however, benefits from zero state income tax and significant investments from major corporations like Ford and Volkswagen. This influx of high-quality jobs in Tennessee creates organic, sustainable housing demand. While Tennessee’s prices have risen faster than the 2.2% national average in recent years, its relative affordability compared to coastal peers still places it in the value category for relocating professionals.

Supply-Side Responsiveness in Value Markets

Another crucial factor is the responsiveness of local zoning and construction industries to new demand. Coastal areas often have restrictive zoning laws and high regulatory burdens that prevent new supply from keeping pace with demand, exacerbating price increases. Conversely, many value states possess less restrictive regulatory environments, allowing developers to bring new housing units online more quickly. This supply elasticity helps moderate runaway price growth, ensuring that appreciation, while steady, remains tethered to economic reality rather than speculative bubbles.

- Permitting Efficiency: States with streamlined permitting processes (often found in the Mountain West and certain parts of the South) are better positioned to meet housing demand without explosive price spikes.

- Job Diversity: Markets reliant on a single industry (e.g., oil in certain Texas regions) carry higher risk. Value states with diversified employment bases (e.g., healthcare, logistics, manufacturing) offer greater stability.

- Infrastructure Investment: Federal and state investments in infrastructure (roads, broadband, public transit) in value states can significantly increase the desirability and long-term valuation of properties in those areas.

The states offering the best long-term value are those balancing robust employment growth with a regulatory landscape that permits sufficient new housing construction, mitigating the risk of future affordability crises.

Deep Dive: The Best Value States for 2024-2025

Based on affordability metrics, economic outlook, and regulatory environment, specific states stand out as offering the most compelling value proposition in the wake of the 2.2% national price increase. These are the markets where the potential for steady, inflation-beating returns is highest over the next five to ten years, without the extreme volatility associated with cyclical boom-and-bust regions.

Oklahoma: Oklahoma City and Tulsa consistently rank high in affordability indexes. The state has a stable energy sector and growing aerospace and technology industries. The median home price remains significantly below the national average, making it highly attractive to remote workers and first-time buyers. Appreciation here is modest but predictable (around 1.8% to 2.5% annually), indicating a healthy, non-speculative market.

Kentucky: Louisville and Lexington offer strong regional economies anchored by logistics, manufacturing (especially automotive), and healthcare. Kentucky’s housing market benefits from lower taxes and a central U.S. location. Investors find strong cash flow potential due to favorable rent-to-price ratios, particularly in multi-family units near urban cores.

Case Study: Indianapolis, Indiana

Indianapolis exemplifies the ideal value market. It boasts a diverse economy (pharmaceuticals, tech, finance), significant corporate investment, and a median home price that is roughly 25% lower than the national figure. Unlike many Sun Belt cities, Indianapolis has not experienced the massive influx of speculative cash, leading to more rational price growth. According to Zillow data, while appreciation has been solid, the market remains balanced, offering buyers a greater chance of securing a property without bidding wars. The city’s investment in infrastructure and focus on revitalizing its downtown core suggest that the current value proposition has significant runway.

- Indiana’s Fiscal Health: The state maintains strong fiscal health, which translates to stable public services and manageable property tax burdens for homeowners.

- Logistics Hub Advantage: Central U.S. location and extensive logistics infrastructure support sustained job growth in distribution and e-commerce, ensuring a consistent tenant base for rental properties.

- Educational Institutions: A robust network of universities and colleges provides a steady stream of renters and high-skilled labor, stabilizing local economies.

These value states are not characterized by explosive short-term gains but by the potential for steady, compounding returns driven by fundamental economic improvements and superior affordability metrics relative to the rest of the nation. This approach appeals to long-term investors seeking capital preservation and reliable cash flow.

Risk Assessment and Forward-Looking Analysis

While value markets offer compelling opportunities, investors must remain cognizant of inherent risks. The primary risk factor is the potential for a localized economic downturn, particularly in areas heavily reliant on a single industry. For example, a sudden contraction in manufacturing or energy prices could disproportionately affect Midwestern or Plains states, even if their housing markets are fundamentally undervalued nationally.

Furthermore, while the affordability index is currently favorable in many value states, rapid, unexpected migration could quickly erode that advantage. If large numbers of high-wage earners from coastal areas flood a market like Boise, Idaho (which was recently a value market but has since seen massive appreciation), the price-to-income ratio can quickly become unsustainable, leading to affordability challenges for local residents and increased volatility for investors.

Mitigating Risks in Value Investments

To mitigate these risks, investors should focus on diversification across different value markets and maintain stringent due diligence on local economic indicators, specifically job growth, unemployment rates, and local government fiscal stability. A key indicator of market resilience is the depth of the rental market; strong rental demand suggests that even if home sales slow, property owners can maintain positive cash flow.

Analysts at Goldman Sachs suggest that while the national housing market faces headwinds from high rates, the structural under-supply of housing means that significant price corrections (10% or more) are unlikely outside of highly localized, speculative areas. The 2.2% national increase provides a floor for the market, suggesting that price stability will be the norm, even if transaction volumes remain low through 2025.

- Inflation Hedge: Real estate in value markets continues to act as an effective inflation hedge, as rental income and property values generally track or exceed the Consumer Price Index (CPI) over the long term.

- Macroeconomic Uncertainty: The possibility of a delayed recession means investors should favor markets with robust non-cyclical employment sectors (e.g., healthcare, education) for higher stability.

- The Fed’s Stance: Future housing appreciation in value states is heavily dependent on the Federal Reserve’s timeline for interest rate normalization. A sooner-than-expected rate cut would provide a significant tailwind.

In conclusion, the 2.2% national price rise confirms that structural demand persists. The astute investor, however, must pivot their focus from high-cost, high-risk appreciation markets to stable value states offering superior affordability and stronger long-term economic fundamentals.

| Key Metric/Factor | Market Implication/Analysis |

|---|---|

| National Price Appreciation (YOY) | 2.2% rise indicates persistent demand and inventory shortage, masking significant regional variations in growth stability. |

| 30-Year Fixed Mortgage Rate | Rates near 7% suppress transaction volume but create a ‘lock-in’ effect, keeping existing inventory off the market. |

| Median Home Price to Income Ratio | Markets with ratios below 4.0 (e.g., Oklahoma, Indiana) offer superior long-term value and affordability for local residents. |

| Midwest Housing Inventory | Generally more balanced supply compared to coastal markets, leading to stable, non-speculative price growth and higher rental yields. |

Frequently Asked Questions about Housing Market Value

The national rate is an average; investors should focus on local appreciation rates and economic indicators. States like Ohio and Michigan, while contributing less to the national average, offer stronger affordability ratios and lower entry costs, which is crucial in a high-interest rate environment.

Sustainable value is indicated by consistent job growth (above 2% annually), positive net migration, and low price-to-income ratios (ideally below 4.0). Focus on markets with diversified economies not reliant on cyclical sectors, according to Moody’s Analytics data.

High-appreciation states (e.g., parts of Florida) carry higher risk and require significant capital. Value states (e.g., Indiana, Kentucky) typically offer better cash flow through rental yields, providing a more reliable return in uncertain economic periods.

Rate cuts will disproportionately boost demand in value states by making lower median home prices significantly more affordable. This pent-up demand, currently suppressed by high rates, is expected to drive accelerated, though still moderate, price appreciation in Midwestern markets.

The main risk is localized economic contraction, often tied to reliance on a single major employer or industry. Diversification across multiple value markets and rigorous assessment of local job diversity are essential mitigants against this specific risk.

The Bottom Line

The 2.2% year-over-year rise in national house prices underscores a housing market defined by structural undersupply and high cost of capital. Yet, this aggregate figure obscures the genuine opportunities available in states where affordability remains intact. Investors and homebuyers must pivot their strategy from chasing explosive appreciation in overheated coastal markets to seeking stability and sustainable growth in value states—particularly those in the Midwest and select areas of the South. These regions, characterized by strong economic fundamentals, favorable income-to-price ratios, and a higher degree of supply elasticity, are positioned to deliver reliable, inflation-beating returns over the next cycle. Monitoring Federal Reserve policy and local job market resilience will be critical to capitalizing on the enduring value proposition these markets offer as the national housing landscape continues its slow, uneven normalization.