The 30% Housing Affordability Rule is Broken: New Reality for First-Time Buyers

The conventional 30% housing affordability threshold is structurally broken, forcing first-time buyers in major US metropolitan areas to allocate up to 45% of their pre-tax income to basic housing costs due to elevated interest rates and sustained home price appreciation.

The long-standing benchmark suggesting that a household should spend no more than 30% of its gross income on housing costs has been fundamentally shattered, signaling a severe crisis for the majority of aspiring homeowners. The reality of the housing affordability rule being broken is forcing first-time buyers to navigate a market defined by high interest rates, tight inventory, and significant price appreciation, fundamentally altering the economics of homeownership across the United States.

The erosion of the 30% benchmark: data and drivers

The traditional 30% affordability rule, initially popularized by the federal government in the 1980s, served as a crucial guideline for lenders and consumers to prevent housing cost overburden. This threshold dictated that the principal, interest, taxes, and insurance (PITI) should not exceed 30% of a household’s gross monthly income. However, recent macroeconomic shifts have rendered this figure obsolete, particularly for those entering the market today.

Data from the National Association of Realtors (NAR) and the Federal Reserve Bank of Atlanta confirm this dramatic shift. As of Q3 2024, the median monthly mortgage payment for a median-priced existing home, assuming a 20% down payment, required approximately 42.1% of the median household income in the United States. This ratio spikes significantly higher—often exceeding 50%—in high-demand coastal markets and major tech hubs like Seattle, San Diego, and Boston. The primary drivers are the combined effect of sustained home price inflation and the aggressive trajectory of the Federal Reserve’s rate hikes.

The dual pressure of rates and prices

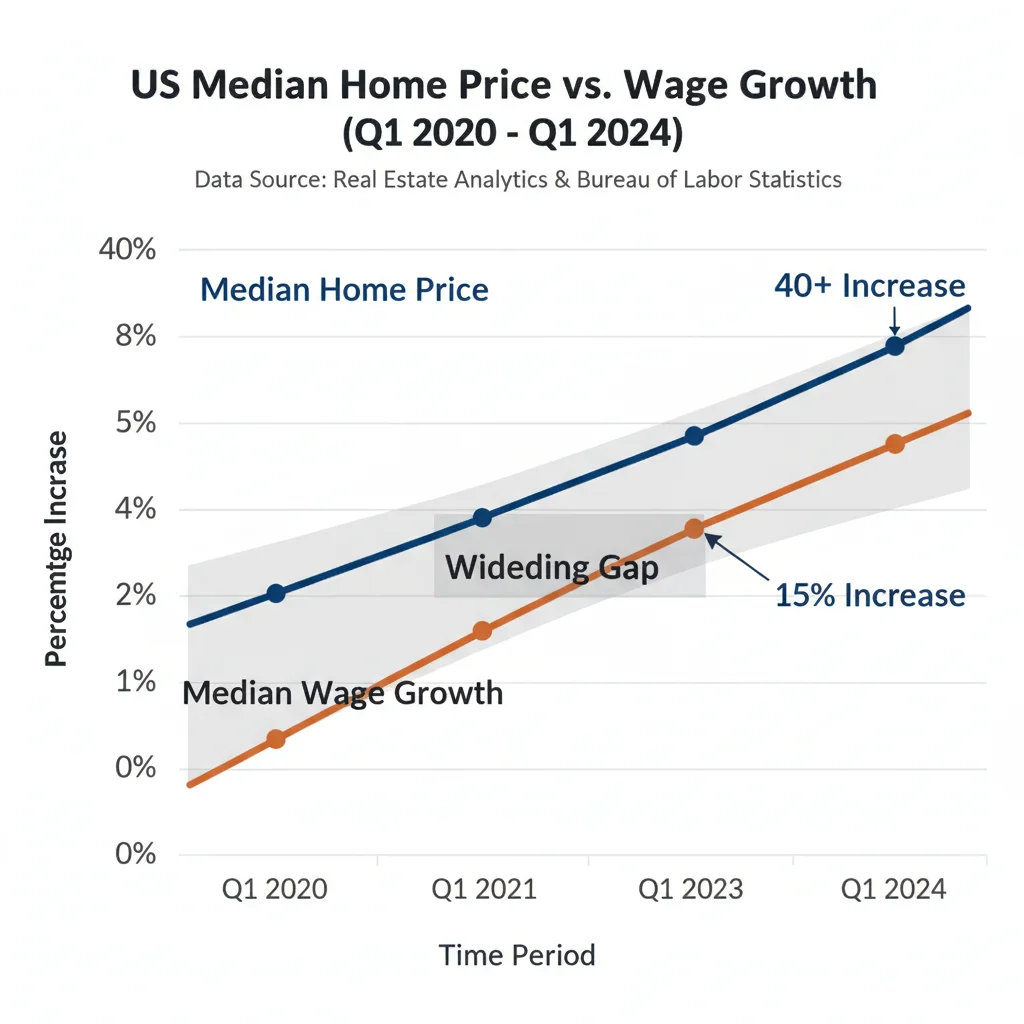

The confluence of two major factors has accelerated the crisis: home price appreciation and elevated mortgage rates. While the Federal Reserve maintained near-zero policy rates between 2020 and early 2022, home prices surged. According to the Federal Housing Finance Agency (FHFA), US home prices have risen more than 40% since the beginning of 2020. Simultaneously, the rapid tightening of monetary policy pushed the average 30-year fixed mortgage rate from sub-3% levels in 2021 to hovering near 7% in late 2024, according to Freddie Mac data.

- Mortgage Rate Impact: A $400,000 mortgage at 3.0% yields a principal and interest payment of roughly $1,686. At 7.0%, that payment jumps to $2,661, representing a 58% increase in monthly debt service without any change in the home’s price.

- Price Appreciation: Median home prices hit approximately $415,000 in mid-2024, compared to roughly $290,000 in early 2020. This requires a significantly larger loan amount, compounding the rate effect.

- Income Stagnation: While wages have grown, they have not kept pace. Real median household income growth has been substantially outstripped by housing cost increases, leading to the current affordability gap.

The result is a market where the entry barrier for a starter home has drastically increased. Financial models previously relied upon to ensure sustainable debt levels are now failing to protect first-time buyers, who are often forced to stretch their budgets significantly further, increasing their financial fragility in the face of economic uncertainty.

The first-time buyer dilemma: navigating scarcity and competition

First-time buyers traditionally rely on the lowest tier of the housing market—starter homes—to begin building equity. However, this segment is now characterized by intense competition, chronic under-supply, and pricing that often exceeds the financial capacity of median-income households. This demographic is also disproportionately affected by the need for larger down payments and higher debt-to-income (DTI) ratios.

The inventory crunch for homes priced below $300,000 remains severe. Many current homeowners, locked into mortgages secured at rates below 4% (often referred to as the ‘golden handcuffs’ effect), are reluctant to sell, thereby reducing the supply of existing homes. This low turnover disproportionately impacts first-time buyers, who often lack the capital or equity to compete for higher-priced properties. Furthermore, institutional investors and all-cash buyers often dominate the lower end of the market, sidelining conventional financed buyers.

Debt-to-income ratio pressures

Lenders traditionally cap DTI ratios around 43% to qualify for conventional loans, though exceptions exist. However, as the housing component of that ratio approaches 40% (the PITI component), the borrower has minimal remaining capacity for other debt obligations, such as student loans, auto loans, or credit card debt. According to the New York Fed, student loan debt remains a significant hurdle, with outstanding balances reaching $1.77 trillion in Q2 2024, heavily concentrated among younger generations who represent the core first-time buyer pool.

The high DTI resulting from increasing mortgage payments limits the financial flexibility necessary for unexpected expenses, maintenance, or economic downturns. This situation creates a class of ‘house-poor’ homeowners—individuals who successfully purchase a home but are left with minimal disposable income, compromising their ability to save for retirement or future financial goals. This systemic risk is what the 30% rule was designed to mitigate, and its failure suggests growing systemic vulnerability within the household finance sector.

Geographic disparities and the metropolitan bifurcation

While the national average for the housing-to-income ratio is alarming, the crisis is acutely felt in specific metropolitan statistical areas (MSAs), creating a stark bifurcation in the US housing market. Affordability metrics in cities like San Jose, California, and Austin, Texas, show median PITI percentages well over 50% for median income earners. Conversely, certain Midwest and Southern markets maintain ratios closer to 30% or 35%, though even those areas are experiencing upward pressure.

This geographic pressure is directly tied to job market dynamics. High-paying tech and finance jobs are concentrated in high-cost areas, attracting workers whose salaries are often insufficient to cover local housing costs, despite being high on a national scale. The phenomenon is driving migration patterns, with younger workers increasingly moving to lower-cost secondary cities, altering local economic landscapes and transferring affordability pressures to previously accessible markets.

The role of property taxes and insurance

Housing costs extend beyond the principal and interest payments. The ‘TI’ in PITI—taxes and insurance—are non-discretionary costs that are also escalating rapidly. Property taxes, which fund local services, often rise in tandem with home values, creating a self-reinforcing affordability challenge. Furthermore, climate-related risks have significantly increased the cost of homeowners insurance, particularly in coastal states (Florida, California) and regions prone to severe weather (Texas, the Midwest).

- Insurance Premium Hikes: According to the Insurance Information Institute, average annual home insurance premiums have increased by approximately 20% to 30% nationally over the last three years, with much higher spikes in high-risk zones.

- Tax Burden: In states like New Jersey and Illinois, which have some of the highest effective property tax rates in the nation (often exceeding 2.0% of home value), the tax component alone can significantly push the PITI ratio above the 30% threshold, even for moderately priced homes.

- Escrow Account Volatility: Rising PITI components often lead to unexpected increases in monthly escrow payments, catching new homeowners off guard and further straining already tight budgets.

Policymakers face the challenge of balancing necessary local revenue generation (through property taxes) with the need to maintain housing accessibility. The rising cost of risk (insurance) is an external factor that further complicates the financial equation for first-time buyers, demanding deeper analysis of regional climate resilience and its impact on household finance.

Alternative financing strategies and the risk landscape

In response to the broken 30% rule, first-time buyers are increasingly turning to alternative financing strategies and non-traditional mortgage products to bridge the affordability gap. These strategies, while offering a path to homeownership, often introduce heightened financial risks, particularly variable-rate mortgages or loans requiring less than 5% down.

Federal Housing Administration (FHA) loans, requiring as little as 3.5% down, remain crucial but often carry mandatory mortgage insurance premiums (MIP) for the life of the loan, adding to the monthly PITI burden. Furthermore, the rise of adjustable-rate mortgages (ARMs), which offer lower initial rates but expose borrowers to future interest rate hikes, suggests that some buyers are making calculated bets on future rate declines or income increases—a strategy reminiscent of pre-2008 risks, though current underwriting standards are significantly stricter.

The role of extended amortization periods

To reduce monthly payments, some lenders are experimenting with loan terms longer than the traditional 30 years, extending to 40-year mortgages. While a 40-year term can lower the monthly PITI payment, making the initial DTI acceptable, it substantially increases the total interest paid over the life of the loan and slows the rate of equity accumulation. For example, extending a $350,000 loan from 30 to 40 years at 7.0% reduces the monthly payment by only about 10% but adds over $200,000 in total interest expense.

Analysts at major rating agencies like Moody’s are closely monitoring the proliferation of these extended terms. While they help qualify borrowers under current DTI limits, they necessitate careful consideration of long-term financial planning. The trade-off involves immediate affordability versus delayed financial independence, a critical factor for younger buyers focused on retirement savings.

Policy responses and structural market adjustments

The structural breakdown of the 30% affordability rule necessitates policy interventions that address both supply-side constraints and demand-side pressures. Policy discussions currently revolve around zoning reform, tax incentives for builders, and targeted assistance for first-time buyers, though implementation remains fragmented across jurisdictions.

Supply-side solutions focus on increasing density and reducing regulatory hurdles that inflate construction costs. The National Bureau of Economic Research (NBER) suggests restrictive zoning laws in high-growth areas contribute significantly to high housing costs. Relaxing single-family zoning rules to allow for multi-unit dwellings (duplexes, townhouses) could gradually increase inventory in desirable locations, potentially easing price appreciation pressure.

Targeted financial assistance programs

On the demand side, state and local governments are expanding programs offering down payment assistance (DPA) or low-interest second mortgages to help first-time buyers. While DPA addresses the initial capital requirement, it does not solve the underlying issue of high monthly PITI payments driven by current rates and prices. Therefore, the efficacy of DPA as a sole solution is limited in the current high-rate environment.

- Federal Home Loan Banks (FHLB): These institutions often provide grants for down payment and closing cost assistance, which can be critical for low-to-moderate-income families.

- Tax Credits: Proposals for federal tax credits for first-time buyers aim to offset closing costs or initial interest payments, providing immediate financial relief, though these measures can also inadvertently boost demand and prices if not carefully structured.

- Infrastructure Investment: Investing in transportation and utility infrastructure in secondary markets can make these areas more attractive and economically viable, diverting demand away from overheated primary MSAs.

The long-term solution requires a fundamental market re-calibration, likely involving sustained residential construction growth and a moderation of interest rate volatility. Until then, policymakers must recognize that the 30% rule is functionally defunct and base assistance programs on the current economic reality of 40%+ housing burdens.

The future of homeownership: equity and economic mobility

The inability of first-time buyers to enter the housing market at sustainable cost levels poses significant risks to broader economic equity and social mobility. Homeownership remains the primary wealth-building tool for middle-class Americans. If access is restricted to those who can afford 40% or more of their income for housing, wealth concentration will likely accelerate.

The widening gap between homeowners (who benefit from tax deductions, inflation protection, and equity growth) and renters (who face rising rent costs with no corresponding asset accumulation) exacerbates existing wealth disparities. The Federal Reserve often monitors this wealth gap, recognizing its implications for long-term economic stability. A healthy housing market must offer pathways for entry-level buyers to translate labor income into asset wealth.

Economists suggest that a structural shift in housing consumption may be necessary. This could involve a permanent move toward smaller units, higher density living, or a delayed entry into homeownership. For many young professionals, the decision is now a calculation between maximizing retirement savings (e.g., 401k contributions) and accumulating the necessary capital for a down payment, a choice that was less acute when the 30% rule held sway.

The current market requires buyers to optimize every aspect of their finances, demanding rigorous budgeting and a higher degree of financial literacy than previous generations needed to achieve the same milestone. The new affordability threshold, realistically hovering near 40% for many, mandates a re-evaluation of personal financial tolerance for debt and risk.

| Key Metric | Market Implication/Analysis |

|---|---|

| Median PITI Ratio (US) | Exceeds 42% of median gross income, confirming the obsolescence of the 30% rule for new buyers. |

| 30-Year Fixed Mortgage Rate | Near 7.0%, increasing monthly debt service by over 50% compared to 2021 rates for the same principal amount. |

| Home Price Appreciation (2020-2024) | Over 40% increase, significantly outpacing real wage growth and escalating the required down payment. |

| Starter Home Inventory | Chronically low, exacerbating competition and forcing first-time buyers into higher-priced or riskier financing options. |

Frequently asked questions about the new affordability reality

While the 30% rule is obsolete, the realistic PITI-to-income ratio often falls between 38% and 45% in major metropolitan areas, according to economic data. Lenders may approve DTI ratios up to 43% or higher, but this level of debt service significantly reduces financial flexibility and savings capacity for the household.

High rates mean a larger portion of the monthly payment goes toward interest rather than principal reduction, especially in the early years of the mortgage. This slows down equity build-up compared to the low-rate environment of 2020-2021, delaying the accumulation of household wealth.

ARMs offer lower initial payments, making them attractive for DTI qualification. However, they introduce significant risk if rates rise after the introductory period. Financial prudence dictates using ARMs only if the borrower is highly confident in future income growth or plans to sell or refinance before the adjustment period ends.

Inflation drives up the cost of construction materials and labor, contributing to higher home prices. Crucially, the Federal Reserve’s response to inflation—raising the federal funds rate—is the direct cause of the high mortgage rates that make borrowing prohibitively expensive for first-time buyers today.

Focus on maximizing down payment savings, reducing high-interest consumer debt to lower the overall DTI ratio, and exploring state or local down payment assistance programs. Buying in secondary or tertiary markets where the housing-to-income ratio is still closer to 35% can also significantly ease the financial burden.

The bottom line: recalculating the cost of entry

The demise of the 30% housing affordability rule is not merely a statistical anomaly; it is a structural shift that redefines the American dream of homeownership. The combination of sustained elevated home prices, driven by chronic supply shortages, and high interest rates, mandated by monetary policy aimed at curbing inflation, has established a new, painful reality for first-time buyers. They are now required to dedicate an unprecedented share of their income—often exceeding 40%—just to secure a basic asset, placing substantial strain on household budgets and potentially compromising long-term financial security.

Investors and market participants should monitor two key indicators: the Federal Reserve’s path toward rate normalization and legislative efforts in high-cost states to introduce meaningful zoning reform. A sustained drop in the 10-year Treasury yield, which influences mortgage rates, could provide temporary relief, but only increased housing supply can fundamentally address the price component of the crisis. Until these dynamics shift, first-time buyers must operate with extreme financial discipline, recognizing that the cost of entry into the housing market has been permanently reset higher, requiring meticulous planning and a tolerance for higher debt loads than previous generations faced.