NAR Settlement: Impact on Real Estate Agent Commissions and Housing Costs

The landmark NAR settlement mandates significant changes to buyer agent compensation rules, potentially driving down average commission rates from the historical 5.5% to 6% range, fundamentally reshaping transaction costs for US real estate consumers.

The landscape of residential real estate finance in the United States is undergoing its most profound structural shift in decades, driven by the National Association of Realtors (NAR) settlement agreement finalized in March 2024. This change directly addresses the long-standing practice of cooperative compensation, where sellers typically paid both their listing agent and the buyer’s agent, often leading to combined fees hovering between 5% and 6%. The resulting market disruption, encapsulated by the focus on NAR Settlement Commission Changes, has immediate and long-term financial consequences for buyers, sellers, agents, and the broader housing economy, valued at over $2 trillion annually.

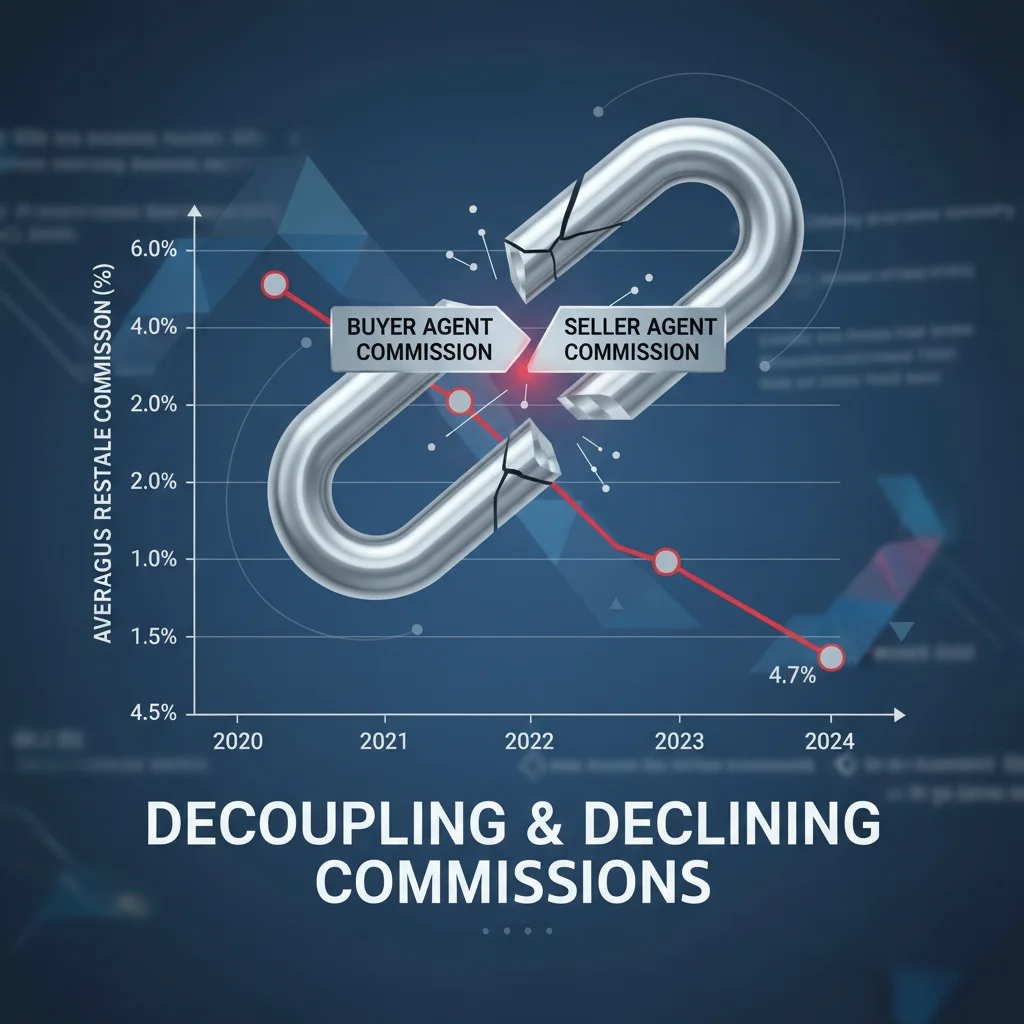

Decoupling of commissions: The structural change

The core of the NAR settlement centers on eliminating the mandatory requirement for listing agents to offer compensation to buyer agents on Multiple Listing Services (MLS). Historically, this mechanism effectively standardized commission rates, insulating them from competitive pressure. The settlement, which took effect in mid-2024, mandates that compensation offers cannot be displayed publicly on the MLS, forcing a decoupling of the buyer’s agent fee from the seller’s proceeds. The immediate financial implication is a move toward negotiated fees, potentially driving down the average effective commission rate from the historical 5.6% observed nationally in 2023, according to industry surveys.

Economic analysis from Keefe, Bruyette & Woods suggests that a successful transition could reduce total commissions paid in the U.S. by 20% to 30% over the next two years. This translates to billions in potential savings for sellers, who have traditionally absorbed the full cost. However, the true impact hinges on how buyer compensation is structured going forward, shifting the burden of negotiation and payment transparency to the buyer-side transaction.

The end of blanket compensation offers

The pre-settlement system often meant that the seller paid the fee, but the cost was embedded into the home’s purchase price. This lack of transparency obscured who was truly paying the buyer agent. Now, buyer agents must secure compensation through direct negotiation with the buyer, potentially through a buyer-broker agreement that specifies a fixed fee, an hourly rate, or a percentage of the purchase price. This introduces unprecedented fee flexibility.

- Increased Buyer-Side Cost Visibility: Buyers are now explicitly aware of their agent’s compensation, fostering greater scrutiny of the value provided.

- Pressure on Commission Rates: Agents who cannot clearly articulate their value proposition face significant pricing pressure from lower-cost models, including flat-fee services.

- Seller Savings Potential: Sellers may see immediate reductions in their closing costs, provided they negotiate lower listing agent fees and the buyer does not demand equivalent concessions.

While the initial market reaction saw volatility in publicly traded real estate stocks, the long-term consensus among housing economists is that this change will enhance market efficiency, albeit with significant short-term disruption. The focus shifts from standardized percentage fees to value-based compensation, a common structure in other complex service industries.

Financial implications for sellers: immediate cost reduction

For decades, sellers bore the brunt of commissions, typically paying 5% to 6% of the sale price. In a median-priced home sale of $400,000, this amounted to $24,000 in transaction costs. The settlement fundamentally alters this dynamic by removing the requirement to pay the buyer’s agent. Sellers now have the power to negotiate their listing agent’s fee independently, without the inherent pressure of covering two parties.

Analysts at Goldman Sachs estimate that the average total commission rate could fall to 4% or below within three years. If the rate drops from 5.6% to 4.0%, the seller of a $400,000 home saves $6,400. This saving is critical in a high-interest-rate environment where every dollar of equity retention matters. However, this potential saving is not guaranteed; it relies heavily on the seller’s ability to negotiate effectively with their listing agent.

Negotiating the listing agreement

The new environment favors sellers who are proactive in questioning the scope of services and the corresponding fee structure. Listing agents, facing increased competition and pressure on their traditional revenue streams, must justify their percentage or fixed fee. This shift elevates the importance of the listing agreement as a core financial document.

- Itemized Services: Sellers should demand itemized lists of services included in the listing fee (e.g., professional photography, marketing spend, open houses) to assess value objectively.

- Variable Commission Models: Expect more agents to offer tiered commission structures, where the fee varies based on the level of service provided or the speed of the sale.

- Risk of Reduced Buyer Traffic: A major risk for sellers is that if they offer no compensation to the buyer’s agent, they might inadvertently discourage agents from showing the property, potentially lengthening the time on market (DOM) and necessitating a price reduction. This trade-off must be carefully weighed against the commission savings.

The market is likely to bifurcate: high-demand, low-inventory areas might see sellers successfully eliminating buyer agent compensation entirely, while slower, less competitive markets might still require some level of compensation offer to attract buyer agents and ensure liquidity. The financial outcome for sellers is thus highly localized and dependent on market dynamics.

The new cost structure for homebuyers

Historically, homebuyers assumed their agent’s services were free, a misconception perpetuated by the seller-paid commission model. Post-settlement, the buyer faces the reality of paying for representation, either directly or indirectly. This creates a significant liquidity challenge, especially for first-time buyers who already struggle with down payments and closing costs.

There are three primary ways a buyer might compensate their agent under the new regime: (1) paying out-of-pocket at closing, (2) negotiating a concession from the seller to cover the fee, or (3) financing the fee through the mortgage. The third option, while appealing for liquidity, increases the total interest paid over the life of the loan. The median buyer agent fee is projected to stabilize around 1.5% to 2.5% of the transaction value, down from the previous 2.5% to 3%.

Financing agent compensation and impact on affordability

For a buyer purchasing a $350,000 home with a 2% agent fee ($7,000), finding that capital upfront is challenging. If the buyer is forced to finance this fee at the prevailing 30-year fixed mortgage rate (e.g., 6.8% as of Q3 2024), the total cost of that $7,000 fee over three decades exceeds $17,000. This calculation underscores the importance of negotiating seller concessions.

- FHA/VA Loan Restrictions: Many government-backed loan programs (e.g., FHA, VA) have specific rules regarding what costs can be folded into the mortgage or covered by seller concessions. Buyers must consult their lenders immediately regarding fee structures.

- Seller Concessions as Strategy: Savvy buyers will demand a concession in the purchase contract to cover their agent’s fee, effectively shifting the cost back to the seller, who is already saving on the listing side. This becomes a core negotiation point, replacing the traditional commission offer on the MLS.

- Rise of Limited-Service Agents: Buyers seeking cost savings may opt for limited-service or purely transactional agents, reducing their representation but significantly lowering the compensation required.

The net effect for buyers is a trade-off: potentially lower home prices due to reduced seller costs versus increased transparency and direct responsibility for agent compensation. Navigating this new financial terrain requires professional advice and a clear understanding of the buyer-broker agreement before house hunting begins.

Macroeconomic impact on housing supply and prices

The settlement’s impact extends beyond individual transaction costs to the macro dynamics of the US housing market. If the overall cost of selling a home decreases substantially (e.g., by 1.5 percentage points), it lowers the friction cost of moving. This could potentially unlock inventory, particularly among older homeowners who were previously deterred by high selling costs.

The consensus from the National Association of Home Builders (NAHB) suggests that even a modest increase in existing home inventory could temper price appreciation, which has been robust despite high interest rates. However, the price impact is complex. While lower transaction costs theoretically allow sellers to accept lower prices, the current scarcity of housing supply continues to exert upward pressure on valuations. The Federal Reserve’s stance on interest rates remains the dominant factor influencing overall affordability.

Market efficiency and competition

The introduction of greater price competition among agents is expected to weed out less productive or less experienced professionals. Data from the Bureau of Labor Statistics (BLS) indicates that there were over 1.6 million active real estate agents in the US as of early 2024. A significant consolidation is anticipated as agents must demonstrate quantifiable value to justify their fees in a competitive, transparent market. This efficiency gain is a positive long-term economic outcome.

- Agent Productivity Metrics: The industry will shift toward measuring agent performance based on client satisfaction and net financial benefit delivered, rather than solely on transaction volume.

- Technology Adoption: Increased pressure on fees will accelerate the adoption of technology platforms that automate basic tasks (e.g., scheduling, paperwork), allowing agents to focus on high-value advisory services.

- Capital Inflow: Venture capital investment in real estate technology (proptech) focused on commission alternatives and digital brokerage models is expected to surge, driving further systemic change.

The settlement acts as a deflationary force on housing transaction costs, but its effect on primary home prices will be moderated by the persistent supply deficit and macroeconomic factors like inflation and employment figures.

The evolving role of the real estate agent

The traditional role of the real estate agent, compensated largely through opaque, standardized commissions, is obsolete. The future model demands specialization, transparency, and quantifiable expertise. Agents must transition from being transaction facilitators to specialized financial advisors who guide clients through complex negotiations, financing options, and market analysis.

The requirement for a written buyer-broker agreement before touring homes—a key provision stemming from the settlement—formalizes the fiduciary relationship and forces agents to articulate their value proposition upfront. This transparency benefits consumers by ensuring they understand what they are paying for and what services they can expect.

Specialization and fee structures

The market is already showing signs of segmentation based on fee structure and service level. Economists predict the emergence of several distinct agent models:

- Full-Service Advisory: High-fee, high-value agents specializing in complex transactions (e.g., luxury, commercial, investment properties), justifying rates through superior negotiation and market access.

- A La Carte Services: Agents offering unbundled services (e.g., only listing on MLS, only contract review) for a fixed, lower fee, appealing to highly engaged or experienced clients.

- Salaried Agents: Brokerages employing agents on salaries, reducing the direct commission burden on clients and focusing on team efficiency rather than individual sales pressure.

This structural shift necessitates new training and compliance standards for agents. Brokerages must invest heavily in ensuring their agents understand the legal and financial ramifications of the new compensation rules, especially concerning disclosure and negotiation practices, to mitigate potential litigation risks.

Legal and regulatory compliance: navigating the transition

The NAR settlement is not an isolated event; it is part of a broader regulatory movement toward transparency in financial transactions. Regulatory bodies, including the Department of Justice (DOJ) and the Federal Trade Commission (FTC), have signaled continued scrutiny of residential real estate practices to ensure competitive markets.

Compliance requirements are immediate and strict. Brokerages must implement new policies to prohibit agents from suggesting or implying that commission rates are non-negotiable or fixed by law. Furthermore, the mandatory written buyer-broker agreement must clearly define the compensation method and amount, ensuring consumers provide informed consent regarding their financial commitments. Failure to comply exposes firms to significant legal and financial penalties.

State-level variations and potential conflicts

While the NAR settlement establishes a national baseline, state-level regulations governing real estate practice still apply. Certain states, such as Washington and New York, already had stringent disclosure laws in place. The harmonization of these state laws with the new national standards presents an administrative challenge for national brokerages. For instance, some states may impose stricter requirements on the timing or format of compensation disclosures.

- Increased Documentation: The need for meticulous documentation of client discussions related to compensation and service expectations is paramount for legal protection.

- Antitrust Scrutiny: The DOJ continues to monitor the industry for any signs of collusion or attempts to revert to standardized pricing models, maintaining downward pressure on commissions.

- Consumer Education Mandates: Brokerages are increasingly responsible for educating consumers about the new negotiation environment, ensuring buyers understand they are responsible for their representation costs unless otherwise negotiated.

This regulatory environment ensures that the shift toward transparent, negotiated compensation is permanent. Financial institutions and mortgage lenders are also adapting their underwriting criteria to accommodate potential changes in closing cost structures, particularly when buyer agent fees are financed through seller concessions or integrated into the loan.

Strategic planning for buyers and sellers in the new era

The fundamental takeaway for consumers is that real estate transactions are now overtly financial negotiations on all fronts—price, repairs, and agent compensation. The passive approach of accepting standard commission rates is no longer viable. Strategic planning requires detailed financial modeling before entering the market, whether buying or selling.

Sellers must model their net proceeds under various scenarios: 1% listing agent fee with no buyer agent contribution, versus 2.5% listing fee with 1.5% buyer agent contribution. Buyers, conversely, must secure pre-approval for the total cost of ownership, including the agent fee, and develop a negotiation strategy to secure seller concessions, mitigating the need to pay the fee out-of-pocket.

Key financial considerations for consumers

Consumers must prioritize financial literacy regarding transaction costs. The move away from the standardized 6% model means that the difference between a poorly negotiated deal and an optimized one could easily exceed $10,000 on a median-priced home, representing significant retained equity or reduced debt.

- Buyer-Broker Agreement Review: Buyers should thoroughly review the compensation clauses, termination conditions, and scope of services outlined in the agreement with their agent before signing.

- Total Cost Analysis: Sellers should calculate the effective commission rate (total fees paid divided by the sale price) and benchmark it against regional averages, which are expected to decline rapidly post-settlement.

- Leveraging Data: Both parties should use publicly available market data (e.g., average time on market, price reductions) to inform their negotiation strategy regarding agent compensation and listing prices.

The financial environment post-settlement rewards informed, proactive participation. The shift is less about eliminating agents and more about establishing a market where commissions reflect genuine competition and value delivered, ultimately lowering the overall cost of housing transactions for the American consumer.

| Key Financial Factor | Market Implication/Analysis |

|---|---|

| Average Commission Rate | Projected decline from 5.6% nationally to potentially 4.0% or lower; driven by competitive pressure and transparency. |

| Buyer Agent Compensation Disclosure | Mandatory written agreement before home tours, shifting compensation responsibility and negotiation burden to the buyer. |

| Seller Closing Cost Reduction | Potential savings of 1.5% to 2.5% of sale price, depending on local market dynamics and ability to negotiate listing fees. |

| Homebuyer Liquidity Risk | Buyers must secure $5,000–$10,000 for agent fees, potentially requiring financing or successful negotiation of seller concessions. |

Frequently asked questions about the NAR settlement financial impact

The primary change is the removal of mandatory commission offers to buyer agents on the MLS. This allows sellers to negotiate their total commission liability down, potentially saving thousands, but requires careful negotiation of the listing agent’s fee and strategy regarding buyer agent compensation.

Homebuyers will generally pay their agents through one of three methods: directly out-of-pocket at closing, negotiating seller concessions to cover the cost, or, in limited cases, financing the fee through the mortgage, which increases long-term interest costs.

While reduced transaction costs act as a deflationary pressure, the persistent shortage of housing supply and high demand are expected to temper any immediate, massive drop in median home prices. Price moderation, rather than a crash, is the likely outcome, according to economic forecasts.

A buyer-broker agreement is a contract detailing the agent’s services, duration of representation, and compensation structure. It is mandatory before touring homes to ensure transparency and formalize the financial relationship, aligning with consumer protection and antitrust compliance standards.

Major financial institutions project a potential reduction in total real estate commissions paid in the U.S. of 20% to 30% over the next few years. This translates to average effective commission rates falling from approximately 5.6% to a range between 3.5% and 4.5%.

The bottom line

The NAR Settlement Commission Changes represent a watershed moment for the US housing market, shifting billions of dollars in transaction costs and fundamentally redefining the value proposition of real estate professionals. For consumers, the era of standardized, opaque commissions is over, replaced by a market demanding financial literacy, rigorous negotiation, and clear contracts. While the immediate transition presents complexities, particularly for first-time homebuyers grappling with new out-of-pocket expenses, the long-term economic outlook suggests enhanced market efficiency and significant cost savings for sellers. Market participants must monitor the speed and extent of commission rate compression and the subsequent impact on agent retention and overall housing inventory, recognizing that local market conditions will dictate the pace of change throughout 2025 and beyond.