ACA Marketplace Premiums Doubling: Consumer Financial Risks Explained

The potential expiration of critical federal subsidies could lead to ACA Marketplace premiums doubling for millions of Americans, translating into sharp increases in household debt and significant budgetary strain for middle-income families across the United States.

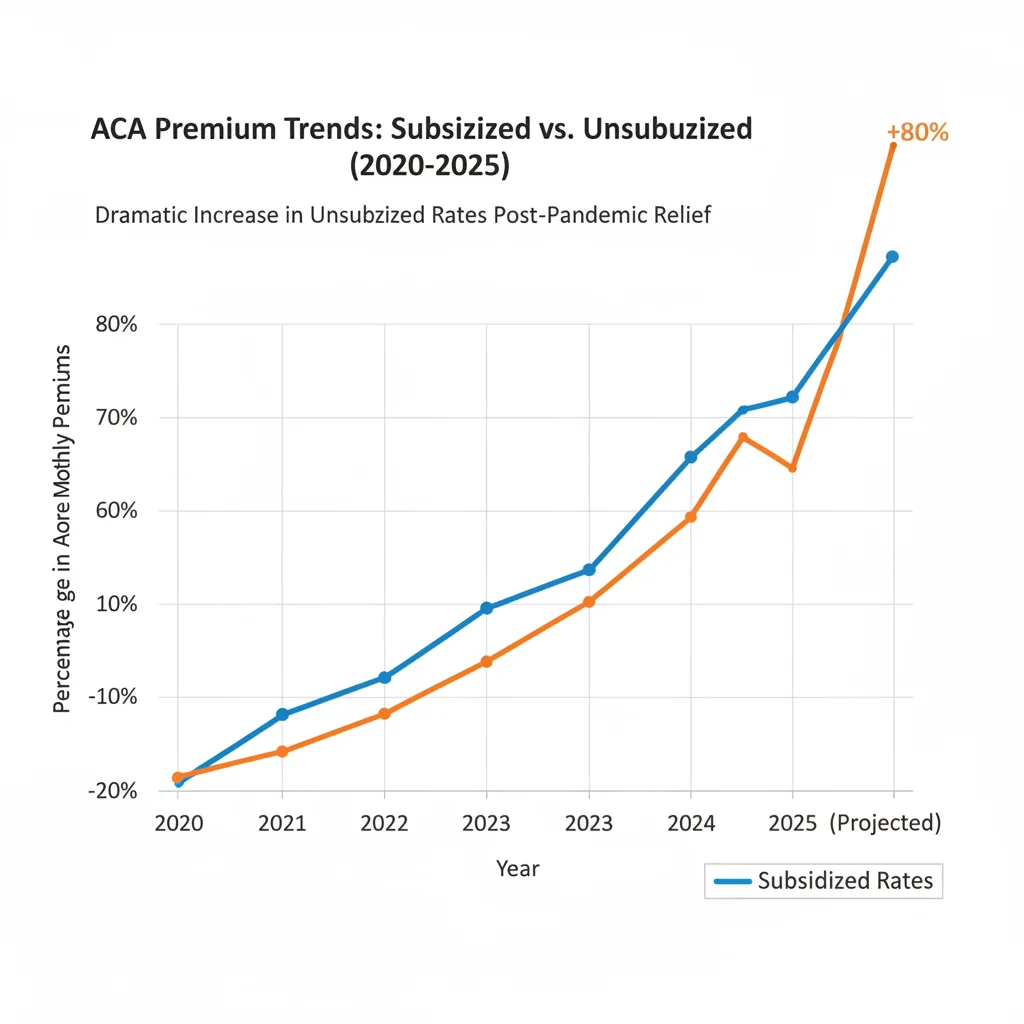

The looming expiration of enhanced premium tax credits under the Affordable Care Act (ACA) poses a significant financial shock to millions of American households. Projections indicate that ACA Marketplace Premiums Doubling without these critical subsidies could become a reality, fundamentally altering the calculus of health coverage affordability. This scenario, which would see average monthly premiums surge from manageable, subsidized rates to pre-pandemic levels or higher, demands immediate mitigation strategies from consumers and robust analysis from financial professionals regarding the macroeconomic implications for consumer spending and household balance sheets across the United States.

The mechanics of the subsidy cliff: quantifying the cost shock

The current framework of the ACA Marketplace relies heavily on the expanded financial assistance established initially through the American Rescue Plan Act (ARPA) and subsequently extended. These enhancements dramatically lowered the net cost of coverage by eliminating the income cap for eligibility and increasing the generosity of subsidies across all income levels. However, as the legislative window for these enhanced credits approaches closure, the financial environment for unsubsidized and newly unsubsidized consumers is set for a dramatic shift. This change is not merely an incremental increase; for many, it represents a ‘subsidy cliff’ where costs could leap by 100% or more, directly impacting household discretionary income.

According to analysis from the Kaiser Family Foundation (KFF), approximately 14.5 million people in the U.S. currently receive premium tax credits. For a 40-year-old earning $55,000 annually, the unsubsidized benchmark silver plan premium might average $650 per month. Under the enhanced subsidies, that individual might pay $180 to $250. If the subsidies revert to pre-ARPA levels, the premium could easily jump back to the full $650, representing a cost increase of over 160%. This quantification illustrates the severity of the potential financial burden on middle-income households, which are already grappling with persistent inflation in housing and food costs.

Impact on middle-income households and the coverage gap

The enhanced subsidies were specifically designed to prevent middle-income families—those earning above 400% of the federal poverty level (FPL)—from paying more than 8.5% of their income toward the benchmark plan premium. Removing this cap means that individuals earning $60,000 or families earning $120,000 could face the full, unmitigated premium. Economists at the Center for Budget and Policy Priorities (CBPP) project that as many as three million Americans could become uninsured if the enhanced credits expire, primarily due to the sudden unaffordability of coverage.

- Income Threshold Strain: Households marginally above the 400% FPL threshold will experience the most acute financial stress, as their eligibility for any subsidy vanishes, forcing them to absorb the full cost of the premium.

- Benchmark Premium Spike: The national average premium for the second-lowest cost silver plan (SLCSP), the basis for premium tax credit calculations, is projected to rise significantly, compounding the loss of subsidy generosity.

- Discretionary Income Erosion: A premium increase of $400 per month translates to $4,800 annually, directly reducing the capital available for consumption, savings, or debt servicing, thus exerting downward pressure on overall economic activity.

The potential for ACA Marketplace Premiums Doubling is not just a healthcare issue; it is an economic shock that financial analysts must integrate into their consumer spending models for the coming fiscal year. The primary risk is a contraction in non-essential spending among the affected demographic, which could dampen retail sales and services sector growth.

Analyzing the macroeconomic ripple effects of higher premiums

A sudden, substantial increase in mandatory household expenses, such as health insurance premiums, functions similarly to a tax hike on middle-income earners. This immediate draw on capital reduces the effective disposable income of millions of consumers. Given that consumer spending accounts for roughly 70% of U.S. GDP, any significant constraint on household budgets warrants close attention from macroeconomic forecasters.

The expiration of the enhanced premium tax credits could trigger several macroeconomic ripple effects. First, it could accelerate the already visible trend of increasing consumer debt. Households facing the choice between maintaining health coverage and paying down high-interest credit card debt may opt for the latter, or, conversely, utilize credit to cover the rising premium costs, increasing systemic leverage. Second, it shifts the composition of household budgets toward non-discretionary spending (healthcare), away from discretionary categories like travel, durable goods, and entertainment, sectors that rely heavily on middle-class consumption.

The role of medical inflation and insurer pricing strategies

Even without the subsidy expiration, underlying medical inflation continues to push standard premiums higher. The Bureau of Labor Statistics (BLS) reported that medical care services component of the CPI has shown persistent growth, although often masked by temporary factors. Insurers, anticipating rising utilization rates and higher costs for specialty drugs and complex care, are already filing for premium increases for the upcoming plan year. This baseline inflation, coupled with the subsidy removal, creates a perfect storm for consumers.

Investment banks like Goldman Sachs and Morgan Stanley have issued research notes highlighting the exposure of certain consumer-facing sectors to potential spending cutbacks. If ACA Marketplace Premiums Doubling forces 10% of affected households to cut $500 per month from discretionary spending, the aggregate annual reduction in consumer demand could exceed $5 billion, impacting earnings projections for retail and leisure companies.

Moreover, the anticipated reduction in enrollment among healthier, younger individuals who might drop coverage due to high costs could lead to adverse selection in the Marketplace risk pool. This ultimately forces insurers to raise premiums further in subsequent years, creating a feedback loop of escalating costs and reduced affordability. This long-term trend poses a structural risk to the stability of the non-group market.

Consumer strategies for mitigating the premium shock

For consumers facing the prospect of significantly higher premiums, proactive financial planning and strategic plan selection are essential. The goal is to minimize the out-of-pocket costs while maintaining adequate coverage. This requires moving beyond simply re-enrolling in the previous year’s plan and engaging in a detailed analysis of all available metal tiers (bronze, silver, gold).

Revisiting the metal tiers: the bronze plan calculation

Bronze plans, while offering the lowest monthly premiums, come with the highest deductibles. For healthy individuals who anticipate minimal medical utilization, switching to a bronze plan could offset a large portion of the premium increase. However, this strategy requires a careful assessment of emergency fund liquidity, as the high deductible (often exceeding $7,000 for individuals) must be readily coverable in case of a catastrophic medical event. Financial advisors often recommend that clients maintain cash reserves equivalent to the full annual deductible if they opt for a bronze plan.

- Deductible vs. Premium Trade-off: Calculate the total annual cost (premium + maximum out-of-pocket) for both the current plan and a potential bronze plan to determine true savings.

- Health Savings Accounts (HSAs): Enrollment in a high-deductible health plan (HDHP)—often synonymous with bronze plans—allows eligibility for an HSA, offering triple tax advantages (contributions, growth, and withdrawals for qualified medical expenses are tax-free).

- Off-Marketplace Options: Investigating direct enrollment plans outside the ACA Marketplace may reveal slightly lower rates, though individuals must confirm the network coverage and understand that tax credits are only applicable to Marketplace plans.

The key financial takeaway is that the potential for ACA Marketplace Premiums Doubling necessitates a shift from convenience-based enrollment to a rigorous, data-driven cost-benefit analysis of health plan options. Consumers must treat health insurance selection as a critical component of their annual budget, similar to mortgage refinancing or retirement contribution adjustments.

The importance of income verification and subsidy eligibility optimization

For individuals whose income hovers near the 400% FPL threshold, meticulous income planning is vital. Small fluctuations in modified adjusted gross income (MAGI) can determine whether a household receives substantial subsidies or faces the full, unsubsidized premium cost. This involves strategic use of tax-advantaged retirement accounts and other deductions.

Contributions to traditional 401(k)s, traditional IRAs, and health savings accounts (HSAs) all reduce MAGI, potentially pushing an income-borderline household below the 400% FPL, thereby regaining access to the enhanced tax credits. For a single individual, the 400% FPL threshold in 2024 was approximately $58,320. If their MAGI is $59,000, contributing an additional $700 to an HSA could save them thousands in annual premium costs by making them subsidy-eligible.

Tax planning strategies to adjust MAGI

The confluence of tax policy and health policy creates a unique opportunity for financial optimization. Tax-advantaged retirement vehicles are not just tools for future security; they are immediate levers for controlling current healthcare expenses. This is a crucial, often overlooked, planning point for high-earning freelancers, small business owners, and those with fluctuating incomes.

- Retirement Contribution Maximization: Prioritize contributions to pre-tax retirement accounts to lower taxable income, thus increasing the likelihood of qualifying for premium tax credits.

- Deduction Review: Ensure all eligible above-the-line deductions are claimed, as these directly reduce the MAGI used for subsidy calculations.

- Forecasting Fluctuations: Individuals with variable income (e.g., gig workers, commission-based sales) must provide the most accurate possible income estimate to the Marketplace to avoid large reconciliation payments or under-utilization of subsidies at tax time.

The financial impact of ACA Marketplace Premiums Doubling underscores the value of integrated financial guidance. Consumers should consult with both tax professionals and licensed insurance brokers to model multiple scenarios, ensuring that they maximize subsidy eligibility while minimizing overall out-of-pocket healthcare expenditures.

The political and legislative outlook: monitoring renewal prospects

The fate of the enhanced premium tax credits is intrinsically tied to the political landscape in Washington, D.C. The current extensions are temporary, requiring Congressional action to become permanent. The uncertainty surrounding the renewal date adds complexity to long-term financial planning for millions of Americans, forcing consumers to plan for a worst-case scenario while hoping for legislative relief.

Market analysts are closely monitoring legislative negotiations. A permanent extension would stabilize the Marketplace, maintaining low out-of-pocket costs and high enrollment. Conversely, a failure to act would trigger the subsidy cliff, leading to widespread premium shocks and potential market instability. The Congressional Budget Office (CBO) estimates that making the enhanced subsidies permanent would cost several hundred billion dollars over the next decade, a significant fiscal commitment that faces political headwinds.

Expert perspectives on market stability

Economists at the Brookings Institution suggest that the high enrollment achieved under the enhanced subsidies (reaching over 21 million in 2024) demonstrates the efficacy of the policy in achieving near-universal coverage. They argue that allowing ACA Marketplace Premiums Doubling would reverse these gains, increasing uncompensated care costs and shifting financial burdens back onto hospitals and taxpayers indirectly.

However, proponents of fiscal restraint argue that the temporary nature of the subsidies was intended to be fiscally responsible, and that permanent extension represents unsustainable federal spending. This debate creates volatility in the health policy environment, forcing insurers to hedge risk in their pricing strategies. Analysts anticipate that premium filings for the upcoming year will incorporate a risk premium reflecting the uncertainty around federal funding, potentially pushing baseline rates higher even before the subsidy calculation.

Financial planners should advise clients to assume the subsidies will expire for budgetary purposes, creating a buffer. If the subsidies are renewed, the household will benefit from unexpected savings; if they expire, the household will have already budgeted for the higher premium, minimizing financial distress.

Evaluating alternatives: employer-sponsored vs. individual coverage

For many Americans, the ACA Marketplace serves as a critical bridge—particularly for early retirees, self-employed individuals, or those working for small businesses without employer-sponsored coverage (ESC). The rise in Marketplace premiums forces a re-evaluation of the financial attractiveness of individual coverage relative to ESC, where available.

Historically, employer-sponsored plans have been the gold standard, benefiting from employer contributions that significantly reduce the employee’s premium share. However, as the cost of ESC also rises, the affordability gap between the two markets changes. When considering the potential for ACA Marketplace Premiums Doubling, an ESC plan, even with high employee contributions, may become the more financially prudent choice, especially if the employer contribution is substantial.

Calculating the total cost of ownership (TCO)

Consumers must calculate the TCO for both options: the annual premium plus the expected out-of-pocket costs (deductibles, co-pays, co-insurance). For unsubsidized Marketplace consumers, the ESC option, even with a high deductible, often provides better protection against catastrophic costs and lower overall administrative complexity.

- Employer Contribution Factor: Quantify the exact dollar amount the employer contributes to the premium. This is essentially tax-free income offsetting the cost of insurance.

- Network Consistency: Compare provider networks. ESC networks are often broader than those available through the Marketplace, which is a non-monetary but significant factor in TCO.

- Tax Implications: ESC premiums are often paid pre-tax, reducing taxable income, whereas Marketplace premiums (if unsubsidized) are paid post-tax, unless the consumer qualifies for a specific tax deduction.

The decision to move between the individual and group markets should be based on a clear, documented comparison of TCO, risk exposure, and tax efficiency. The specter of ACA Marketplace Premiums Doubling without tax credits tilts the financial scales strongly back toward employer-sponsored coverage for those who have access to it.

| Key Financial Factor | Market Implication/Analysis |

|---|---|

| Subsidy Expiration Risk | Premiums for middle-income households (400%+ FPL) could rise by 100% to 160%, constituting a severe budgetary shock. |

| MAGI Optimization | Pre-tax contributions (401k, HSA) are crucial for lowering Modified Adjusted Gross Income (MAGI) to retain subsidy eligibility near the FPL threshold. |

| Discretionary Spending Contraction | Increased mandatory premium costs reduce consumer spending capacity, potentially impacting GDP growth and retail sector earnings. |

| Adverse Selection Risk | Higher unsubsidized costs may drive healthier individuals away from the Marketplace, leading to higher average claims and future premium hikes. |

Frequently Asked Questions about ACA Marketplace Premiums Doubling Without Tax Credits: What Consumers Need Now

The most vulnerable group is individuals and families earning between 400% and 500% of the federal poverty level (FPL). For these households, the premium cost constraint of 8.5% of income vanishes, forcing them to pay the full, unsubsidized benchmark rate, often leading to cost increases exceeding $4,000 annually. Analysts project up to three million individuals may lose coverage due to this affordability shock.

Consumers should strategically increase pre-tax contributions to retirement accounts (401k, IRA) and Health Savings Accounts (HSA). These contributions reduce the Modified Adjusted Gross Income (MAGI), which is the metric used for subsidy determination. Lowering MAGI below the 400% FPL threshold can reinstate eligibility for substantial premium tax credits, saving thousands in annual health costs.

The ‘subsidy cliff’ refers to the sharp increase in premium costs when a household’s income crosses the 400% FPL line. Under enhanced subsidies, the cost increase was gradual. Without them, crossing that line means going from a heavily subsidized premium (e.g., $200/month) to the full market rate (e.g., $600/month) overnight, a 200% price shock, hence the term ‘doubling’.

Switching to a lower-premium Bronze plan is a viable strategy for healthy individuals, but only if they have sufficient emergency savings. Bronze plans typically have the lowest premiums but the highest deductibles, often over $7,000. Consumers must ensure their liquidity can cover this maximum deductible exposure before committing, turning health insurance selection into a liquidity management decision.

A sudden increase in mandatory healthcare costs acts as a drag on consumer discretionary spending. Economic models suggest that if millions of households must allocate an additional $400 monthly to premiums, non-essential spending (retail, travel, leisure) will contract. This constraint on middle-income budgets could modestly dampen overall U.S. GDP growth projections for the subsequent fiscal year.

The bottom line: navigating financial uncertainty in healthcare

The potential for ACA Marketplace Premiums Doubling represents one of the most significant near-term risks to middle-income household finances in the United States. This is not a theoretical threat but a legislative deadline that requires immediate, proactive financial and tax planning. The core message for consumers is clear: assume the subsidies will expire and budget accordingly. This involves meticulous review of household Modified Adjusted Gross Income (MAGI), aggressive utilization of tax-advantaged savings vehicles like HSAs and 401(k)s to optimize subsidy eligibility, and a rigorous cost-benefit analysis of all available health plans, including a serious consideration of high-deductible Bronze options.

The broader macroeconomic implication is that the sudden removal of federal support could introduce volatility into consumer spending patterns, constraining the primary engine of U.S. economic expansion. Financial market participants must monitor Congressional action closely, as the ultimate decision on the enhanced premium tax credits will serve as a key determinant of both healthcare sector stability and consumer financial resilience in the coming years. Uncertainty remains the dominant variable; therefore, financial agility and robust contingency planning are paramount for all affected stakeholders.