Mortgage Rates at 6.23%: December Refinancing Analysis

With 30-year fixed mortgage rates at 6.23%, homeowners must rigorously analyze closing costs, break-even points, and the future trajectory of Federal Reserve policy before deciding if December is a strategically advantageous time to refinance.

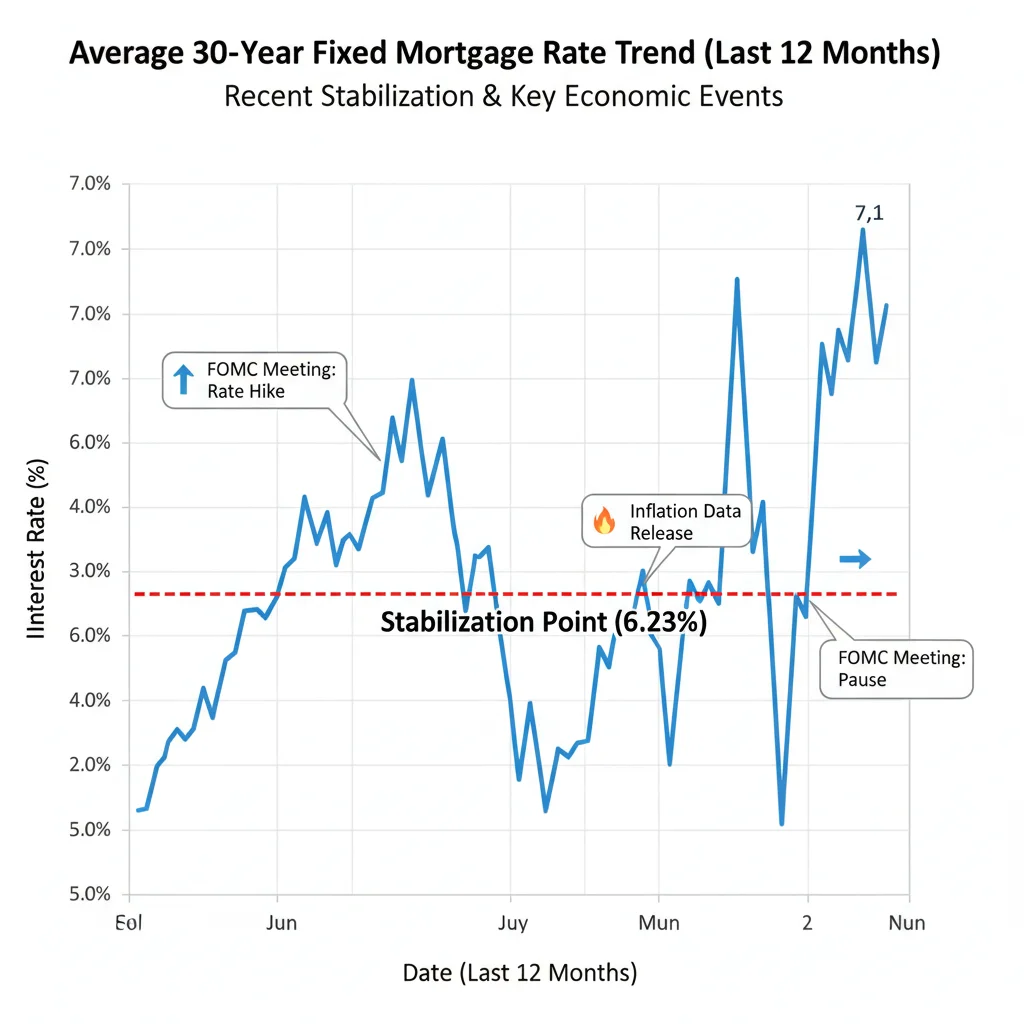

The average rate for a 30-year fixed-rate mortgage hovering at 6.23% presents a critical inflection point for millions of US homeowners evaluating their debt structure. This rate, recorded in early December, reflects the complex interplay between resilient economic data, persistent, albeit slowing, inflation, and the Federal Reserve’s hawkish stance on monetary policy. The central question for market participants and homeowners is whether this current stability offers a tactical window for refinancing, or if further patience is warranted, given the prevailing headwinds in the housing and credit markets.

The macroeconomic context driving the 6.23% rate

To understand the current mortgage landscape, one must look beyond the immediate rate and examine the broader macroeconomic forces. The 6.23% figure is not an arbitrary number; it is a direct consequence of the Federal Reserve’s efforts to tame inflation, which peaked at 9.1% in mid-2022 and has since moderated toward the 3-4% range as of the latest consumer price index (CPI) release. Mortgage rates track the 10-year Treasury yield more closely than the Federal Funds rate, but both are influenced by the Fed’s signals regarding future rate cuts.

During the fourth quarter, market expectations shifted significantly, anticipating rate cuts in the latter half of the following year. This expectation put downward pressure on the 10-year Treasury, which briefly dipped below 4.5% in late November, pulling mortgage rates down from their peak near 8.0%. The 6.23% rate incorporates a substantial risk premium—the spread between the 10-year Treasury and the 30-year fixed mortgage rate—which widened considerably during periods of high rate volatility and reduced liquidity in the mortgage-backed securities (MBS) market. This widened spread, currently averaging around 170 to 180 basis points, suggests that lenders remain cautious about future economic uncertainty and prepayment risk.

Federal Reserve policy and forward rate expectations

The December Federal Open Market Committee (FOMC) meeting minutes are crucial for setting the tone for the coming months. If the Fed signals a definitive end to its rate hikes and maintains a patient stance, the 6.23% rate may represent a temporary floor before a more significant decline in the new year. Conversely, if economic data, particularly non-farm payrolls or core CPI, surprise to the upside, the Fed could push back against aggressive rate-cut expectations, potentially causing the 10-year yield and, consequently, mortgage rates, to rebound.

- Inflation Target: The Fed remains committed to the 2.0% inflation target, implying that rates will likely remain restrictive until clear evidence of sustained disinflation emerges.

- Yield Curve Inversion: The persistent inversion of the 2-year and 10-year Treasury yield curve continues to signal potential economic slowdown, which historically precedes lower long-term interest rates.

- Quantitative Tightening (QT): The ongoing reduction of the Fed’s balance sheet (quantitative tightening) drains liquidity from the financial system, maintaining upward pressure on long-term rates.

Analysts at Goldman Sachs project that the 30-year fixed rate could average 5.8% by mid-year, contingent on a moderate cooling of the labor market. However, economists at JPMorgan Chase maintain a more conservative outlook, suggesting rates will hold above 6.0% for the first two quarters due to persistent fiscal deficits and robust consumer spending. For homeowners, this divergence in expert opinion underscores the risk of waiting for a significantly lower rate.

Refinancing eligibility and the equity hurdle

The decision to refinance at 6.23% is intensely personal and dependent on the borrower’s specific financial profile and existing mortgage rate. For those who secured mortgages during the peak of the rate cycle (e.g., 7.5% or higher), a reduction to 6.23% offers tangible, immediate savings. However, the current environment imposes stricter eligibility requirements than the historically loose lending standards seen during the pandemic era.

Lenders are now scrutinizing the loan-to-value (LTV) ratio and the borrower’s credit profile with renewed rigor. Home price appreciation, while slowing, has generally supported sufficient home equity for many long-term owners. According to CoreLogic data from Q3, the average homeowner with a mortgage gained approximately $25,000 in equity year-over-year. This equity buffer is crucial for meeting the typical LTV requirement of 80% or less for a conventional rate-and-term refinance.

Assessing the break-even point for refinancing costs

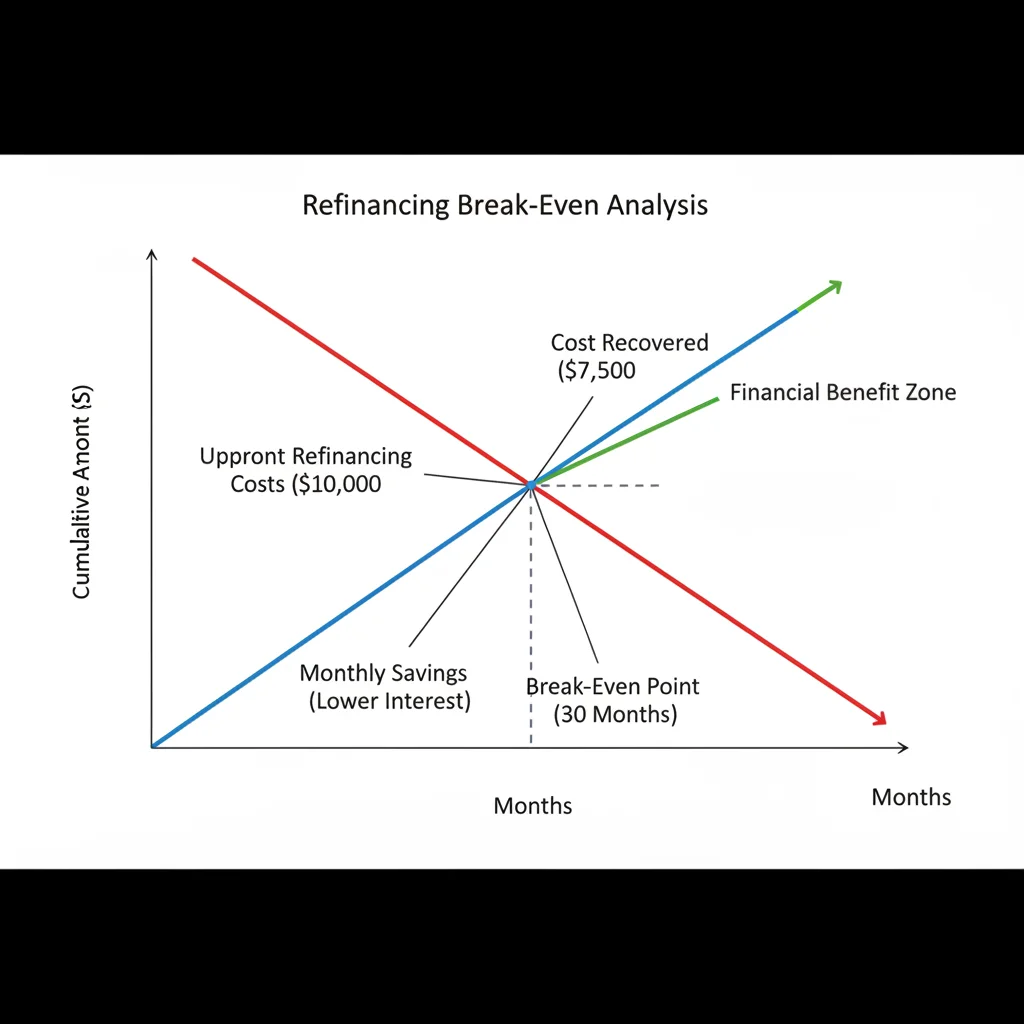

A critical metric for any refinancing decision is the break-even point. This is the period required for the cumulative monthly savings from the lower interest rate to offset the upfront closing costs. Closing costs typically range from 2% to 5% of the loan principal. For a $300,000 mortgage, costs could easily exceed $9,000.

Consider a homeowner with a $350,000 balance at 7.5% interest. Refinancing to 6.23% reduces the monthly principal and interest payment by approximately $290 (excluding taxes and insurance). If the closing costs are $10,000, the break-even point is calculated as $10,000 / $290, resulting in roughly 34.5 months, or almost three years. If the homeowner plans to sell the property or refinance again before this period, the current refinancing may not be financially sound.

The cost structure includes various fees:

- Origination Fees: Paid to the lender for processing the loan. These are often negotiable.

- Appraisal Fees: Required to verify the current market value of the property, influencing the LTV.

- Title Insurance and Escrow Fees: Legal and administrative costs associated with transferring the title to the new lender.

The decision tree for refinancing must prioritize the length of intended home ownership. If the term is short (under five years), the 6.23% rate may not offer sufficient savings to justify the upfront capital outlay. Conversely, for long-term homeowners, securing a rate below 6.5% provides significant accrued interest savings over the full 30-year term, regardless of marginal rate fluctuations in the coming months.

The impact of December timing: liquidity and processing

December is often characterized by lower market liquidity and reduced operational capacity within the lending industry due to holiday schedules. While the absolute rate of 6.23% might be attractive, the timing can affect the speed and efficiency of the refinancing process, an element often overlooked by borrowers.

Historically, the end of the year sees a slowdown in the processing of applications, appraisals, and legal documentation. This delay can introduce risks, particularly if the borrower has a rate lock that expires before the loan closes. Mortgage rates are guaranteed by a rate lock, typically lasting 30 to 60 days. If the closing extends beyond this period, the borrower risks being subjected to a higher prevailing rate if the market moves against them. Lenders may also charge a fee to extend the rate lock, adding to the total closing costs.

Negotiating lender credits and points

At 6.23%, borrowers have a renewed opportunity to negotiate the structure of their loan. Borrowers can opt to pay points—an upfront fee equal to 1% of the loan amount—to lower the stated interest rate. For instance, paying one point might reduce the rate from 6.23% to 6.00%.

Conversely, borrowers can choose a no-closing-cost refinance, where the lender pays the closing costs in exchange for a higher interest rate (e.g., 6.45% instead of 6.23%). This strategy is advisable for those with shorter time horizons or those who wish to preserve cash liquidity. The financial sophistication of the borrower dictates the optimal strategy at this rate level.

The effective interest rate, or the annual percentage rate (APR), provides a more accurate comparison than the nominal rate (6.23%) because it incorporates the cost of fees and points. A diligent financial analysis always compares the APRs of competing offers, especially when considering the seasonal variability of lender operations in December.

Cash-out versus rate-and-term refinancing at 6.23%

The decision to refinance is further compartmentalized by the loan type: rate-and-term refinancing, which solely aims to reduce the interest rate or change the loan term, or cash-out refinancing, which involves borrowing against accumulated home equity. At a 6.23% rate, the viability of a cash-out refinance depends heavily on the intended use of the funds and the alternative cost of capital.

If a homeowner seeks to consolidate high-interest consumer debt, such as credit card balances carrying rates of 20% or more, a cash-out refinance at 6.23% provides a substantial arbitrage opportunity. The interest paid on the cash-out portion of the mortgage remains tax-deductible (subject to IRS rules), offering an additional financial benefit compared to non-deductible personal loans. Conversely, pulling cash out at 6.23% to fund discretionary spending or non-essential investments is generally discouraged by financial planners, as it converts short-term needs into long-term secured debt.

Comparative cost of capital analysis

- Home Equity Lines of Credit (HELOCs): Often feature variable rates tied to the prime rate, which is currently high. A fixed-rate cash-out refinance at 6.23% offers superior payment predictability compared to a variable-rate HELOC.

- Personal Loans: Unsecured personal loans for large expenditures often range between 9% and 15%, making the 6.23% mortgage rate significantly cheaper for those with substantial equity.

- Investment Risk: Using cash-out funds for investment purposes must yield a return significantly higher than 6.23% to be justified, factoring in the inherent risk of the investment portfolio.

For borrowers with existing mortgage rates in the mid-5% range or lower, the 6.23% rate is unequivocally unattractive for rate-and-term refinancing. However, for those specific individuals who need to access liquidity and face significantly higher interest rates on alternative debt, the 6.23% rate represents a competitive cost of secured capital.

The opportunity cost of waiting for lower rates

One of the most persistent dilemmas in the current market is the opportunity cost associated with waiting for mortgage rates to fall further. The consensus among financial journalists is that rates will eventually decline as inflation recedes and the global economy slows, but the timing and magnitude of this decline are highly uncertain.

If a homeowner waits for rates to drop to 5.5% and the decline takes 18 months, the forgone interest savings during that waiting period must be factored into the decision. For our earlier example (saving $290 per month), waiting 18 months means sacrificing $5,220 in savings. If the rate eventually drops to 5.5%, the additional savings might not fully compensate for the cumulative loss incurred during the waiting period, especially if the homeowner’s current rate is substantially higher than 6.23%.

Furthermore, locking in a rate now provides payment stability and eliminates the risk of an unexpected economic event—such as a geopolitical crisis or a sudden spike in oil prices—that could push Treasury yields and mortgage rates higher again. The 6.23% rate acts as a hedge against future rate volatility, a form of insurance in an unpredictable market.

Hedging strategies and future refinancing options

Market participants often employ a “refinance twice” strategy. This involves securing the current favorable rate (6.23%) now to realize immediate savings, followed by a second, cheaper refinance if rates drop significantly (e.g., below 5.0%) in the next two to three years. This strategy is only viable if the cumulative closing costs of two refinances can be offset by the combined interest savings over the projected ownership period.

The key financial consideration is the cost of the second refinance. If the borrower can secure a streamlined or low-cost refinance option for the second transaction, the “refinance twice” approach can mitigate the risk of waiting. However, if the closing costs for the second refinance are substantial, the economic benefit diminishes rapidly.

According to Moody’s Analytics, the probability of 30-year fixed rates falling below 5.5% within the next 12 months is approximately 65%, but this prediction is highly conditional on the Fed avoiding a hard landing. Homeowners should treat 6.23% as a strategically advantageous rate if their current mortgage rate is 100 basis points or more above this figure.

Risk management and borrower profile analysis

The final layer of analysis involves rigorous risk management tailored to the borrower’s income stability and credit risk profile. Lenders are particularly sensitive to debt-to-income (DTI) ratios in the current economic climate, often requiring a DTI below 43% for the best rates. An employment reduction or reduction in income shortly after refinancing can severely impact the borrower’s ability to service the new debt.

For self-employed individuals or those with significant variable income, December’s 6.23% window requires meticulous documentation of income history (typically two years of tax returns). This meticulous process is essential because the cost of capital at 6.23% is secured by the home; default carries the ultimate consequence of foreclosure.

Furthermore, borrowers must consider prepayment penalties on their existing mortgage. While less common on conventional 30-year fixed mortgages, some non-QM (non-qualified mortgage) loans or specialized products may carry substantial penalties for paying off the loan early. A thorough review of the existing mortgage terms is a mandatory prerequisite for any refinancing decision at 6.23%.

Key indicators to monitor post-refinancing

Once a borrower locks in the 6.23% rate, their focus shifts to monitoring indicators that signal potential future refinancing opportunities:

- Core CPI Trends: Sustained monthly declines in core inflation will cement the Fed’s dovish pivot, leading to lower rates.

- Unemployment Rate: A sharp increase (e.g., above 4.5%) indicates economic weakness that necessitates lower rates to stimulate activity.

- 10-Year Treasury Yield: A sustained drop below 4.0% would be a strong indication that mortgage rates will follow suit, signaling a potential second refinance opportunity.

In summary, the 6.23% mortgage rate in December offers a compelling opportunity for specific subsets of the market—primarily those locked into rates above 7.0% or those needing access to low-cost secured capital. The decision hinges not merely on the number 6.23%, but on the personalized calculation of the break-even point and the borrower’s long-term housing strategy, viewed through the lens of cautious economic optimism regarding future rate cuts.

| Key Factor/Metric | Market Implication/Analysis |

|---|---|

| Current Rate (30-Yr Fixed) | 6.23%. Favorable for existing mortgages above 7.0%, but less so for rates below 6.5%. Represents a temporary stability point. |

| Refinancing Closing Costs | Typically 2% to 5% of the loan amount. Must calculate the break-even point to ensure positive net benefit over the ownership horizon. |

| 10-Year Treasury Yield | Primary driver of mortgage rates. Recent dip suggests market anticipation of Fed rate cuts, supporting the 6.23% level. |

| Cash-Out Viability | Highly viable for high-interest debt consolidation (e.g., 20% credit card debt), less so for discretionary spending. |

Frequently Asked Questions about Mortgage Rates at 6.23%: Is December a Good Time to Refinance Your Home

Borrowers currently holding mortgages with rates above 7.25% benefit most, as the 102 basis point reduction offers substantial monthly savings that quickly offset typical closing costs, which usually range from 2% to 5% of the loan principal.

The break-even point is typically between 24 and 48 months, depending on the closing costs and the magnitude of the rate reduction. For a $300,000 loan with $8,000 in costs, a $250 monthly saving yields a 32-month break-even period.

The Fed’s indication of future rate stability or reduction (dovish pivot) puts downward pressure on the 10-year Treasury yield, which in turn influences mortgage rates. The 6.23% rate reflects current market confidence that the hiking cycle is complete.

Paying points to reduce the rate below 6.0% is often advisable only for borrowers who plan to remain in the home for significantly longer than the break-even period for the points, often seven to ten years, maximizing long-term interest savings.

The primary risk is processing delays due to vendor and lender holiday schedules, potentially causing the rate lock to expire. Borrowers should secure a 60-day rate lock and ensure all documentation, especially appraisals, are completed early in the month.

The bottom line

The 6.23% mortgage rate in December represents a stabilization in the credit market following a period of extreme volatility, making it a viable, albeit narrowly defined, window for refinancing. This rate is not a historic low, but it is substantially lower than the peak rates of the preceding quarters. For the homeowner, the decision to refinance now is a calculated risk assessment that weighs immediate, tangible savings against the highly speculative promise of future, lower rates. Key financial indicators, specifically the trajectory of core inflation and the 10-year Treasury yield, suggest that rates may dip further in the first half of the new year, but the cost of waiting—the lost monthly savings—must be rigorously quantified. Ultimately, securing the 6.23% rate provides certainty and a strategic reduction in long-term debt servicing costs for those currently over-leveraged, aligning with sound risk management principles in an economy still navigating a challenging path toward normalization.