Tech Stock Valuations Compressed: When to Buy Quality Names

Amid rising rate uncertainty and sector rotation, quality growth companies in the technology sector are experiencing compressed valuations, creating strategic entry points for investors focused on durable earnings growth and strong free cash flow generation.

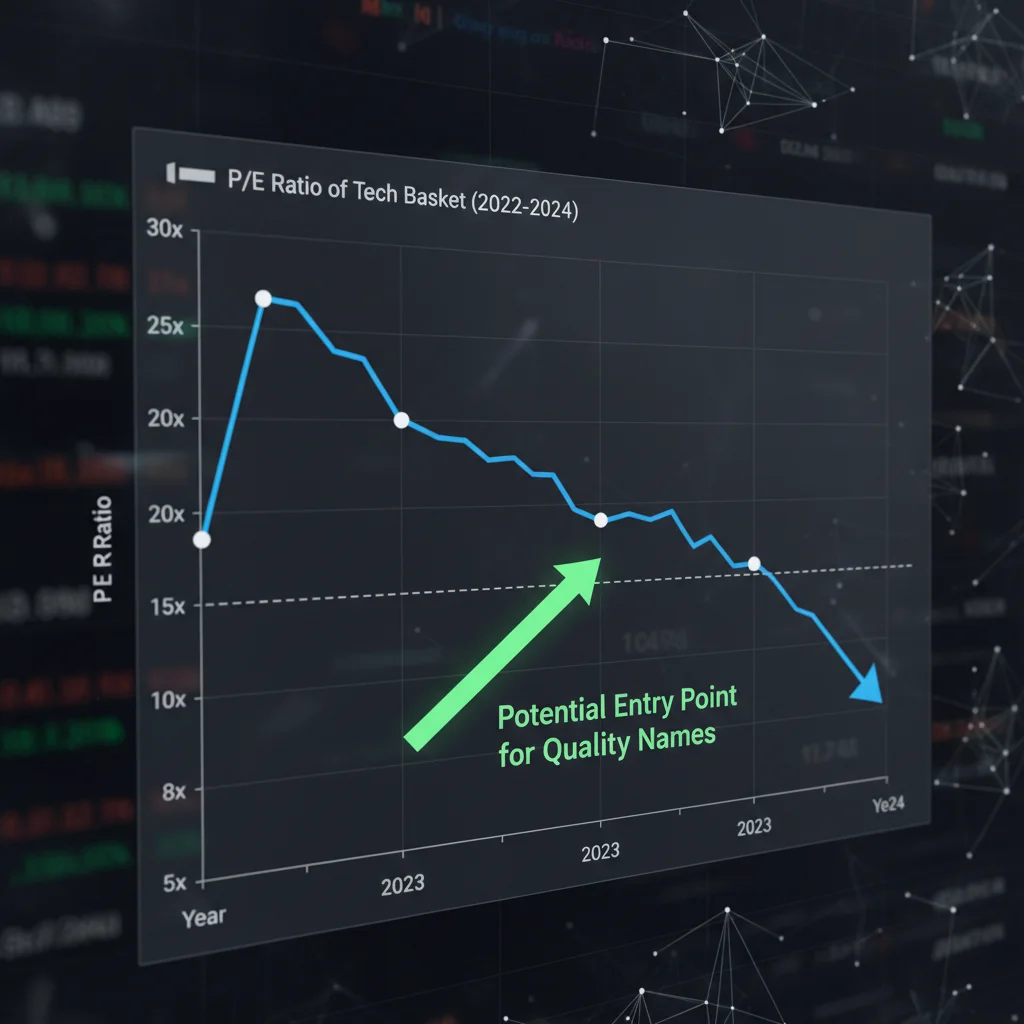

The recent market volatility, driven primarily by persistent inflation data and the Federal Reserve’s hawkish stance, has led to a significant repricing across the equity landscape. Specifically, the phenomenon of tech stock valuations compressed has provided a potent environment where high-quality technology names are trading substantially below their 2024 highs, decoupling from their underlying fundamental strength. This compression, often quantified by a reduction in the forward price-to-earnings (P/E) multiple across the Nasdaq 100 components, presents a crucial juncture for institutional and retail investors seeking asymmetrical risk-reward profiles in companies with defensible business models and robust balance sheets.

Understanding the Compression: Macroeconomic Headwinds and Duration Risk

The primary driver behind the current compression in tech stock valuations is the shift in global monetary policy. Following a decade of near-zero interest rates, which inflated growth valuations due to the lower discount rate applied to future earnings, the rapid increase in the Federal Funds Rate by the Federal Reserve has fundamentally altered the valuation calculus. As of Q3 2024, the 10-year Treasury yield hovered near 4.5%, a substantial increase from the 2% levels seen two years prior, directly increasing the cost of capital and reducing the present value of long-duration assets—the quintessential profile of high-growth technology stocks.

This movement is not uniform. The compression is most acute in companies where a significant portion of expected earnings lies far into the future, a concept known as duration risk. For instance, companies projected to achieve profitability only in 2027 or 2028 have seen their valuations plummet by 40% or more from peak levels, even if operational execution remains sound. Conversely, mature tech giants with substantial current free cash flow (FCF) generation have proven more resilient, though they too have experienced multiple contraction as market participants demand a higher risk premium.

The Role of Rising Real Yields in De-rating Growth Stocks

Real yields—nominal yields adjusted for inflation expectations—are the market’s truer indicator of the cost of capital. When real yields rise, the market becomes less tolerant of high valuations based purely on growth potential without corresponding current profitability. Data from the St. Louis Federal Reserve indicates that the 10-year Treasury Inflation-Protected Securities (TIPS) yield has moved into positive territory, reaching levels not seen since 2011. Analysts at Goldman Sachs estimate that every 50 basis point increase in the 10-year real yield translates, on average, to a 15% de-rating in the Price-to-Sales multiple for the top quartile of non-profitable technology stocks.

- Discount Rate Impact: Higher real yields necessitate a higher discount rate, mathematically lowering the intrinsic value derived from discounted cash flow (DCF) models, particularly affecting companies with long growth runways.

- Capital Allocation Shift: Investors pivot toward value stocks and companies with strong near-term earnings stability, reducing demand for high-multiple growth equities.

- Debt Cost Escalation: Companies relying on debt financing for expansion face sharply higher interest expenses, eroding future profit margins and further justifying lower valuations.

This macroeconomic backdrop confirms that the market is not necessarily questioning the technological trajectory of these firms, but rather the price paid for that future growth in the current rate environment. The compression is a systemic, rate-driven phenomenon, distinguishing it from company-specific operational failures.

Defining ‘Quality Names’ in a Compressed Valuation Environment

In a market where volatility reigns and capital is expensive, the definition of a ‘quality name’ shifts away from hyper-growth and toward financial resilience and efficiency. Quality tech names are characterized by metrics that demonstrate durability, pricing power, and superior capital management, making them less susceptible to cyclical downturns or sustained high interest rates. These are the companies that, despite falling below their 2024 trading peaks, maintain robust operational metrics and continue to execute on their strategic plans.

Key Financial Metrics for Quality Tech Stocks

When assessing companies whose tech stock valuations compressed, financial journalists focus on verifiable, recurring metrics. The old adage of ‘revenue at any cost’ is replaced by a focus on profitable growth. According to data compiled from SEC filings for the S&P 500 Technology Sector, quality names typically exhibit Gross Margins exceeding 65% and operating margins above 20%, indicating strong pricing power and controlled operational leverage.

- Free Cash Flow (FCF) Conversion: The percentage of net income converted into FCF should ideally be above 80%. FCF demonstrates genuine, deployable capital, unlike accounting net income which can be influenced by non-cash charges.

- Return on Invested Capital (ROIC): Quality companies consistently generate an ROIC significantly above their Weighted Average Cost of Capital (WACC), signaling efficient use of shareholder funds. An ROIC consistently above 15% is often the benchmark for elite performers.

- Balance Sheet Strength: Low leverage (Net Debt to EBITDA below 2.0x) and substantial cash reserves provide a buffer against economic shocks and allow for opportunistic mergers and acquisitions or share buybacks during market downturns.

Furthermore, the quality of earnings is paramount. Revenue streams should be largely recurring, such as subscription models (SaaS), which offer predictability and visibility. Companies with high reliance on volatile, transactional revenue models are generally discounted more heavily in periods of economic uncertainty.

The Disconnect: Why Quality Names Trade Below 2024 Highs

The market often exhibits ‘overshooting’ behavior during periods of high fear or forced liquidation. This overshooting is the primary reason why fundamentally sound technology companies are currently trading at multiples significantly below their 2024 peaks, even when their 2025 earnings estimates remain largely intact or have been slightly raised. This disconnect is caused by a confluence of technical market factors and behavioral biases, rather than a deterioration of the underlying business fundamentals.

One technical factor is forced selling by passive funds or momentum traders exiting positions en masse when price targets are breached. When the broader technology index, such as the ARK Innovation ETF or the Nasdaq Composite, experiences heavy outflows, even blue-chip components are sold indiscriminately to meet redemption demands. This creates temporary, but acute, pricing inefficiencies. For example, if a company’s stock dropped 30% from its high, yet its projected 2025 earnings only decreased by 5%, the P/E multiple contraction is disproportionate, signaling a potential opportunity.

Analyzing the Valuation Gap: P/E Ratios vs. Growth Rates

A critical tool for identifying undervalued quality is the PEG ratio (P/E divided by Growth Rate). While many speculative high-growth stocks still trade at elevated P/E multiples despite slowing growth, the best quality names are often seeing their P/E multiples compress faster than their earnings growth rates are decelerating. According to analysis by Morgan Stanley, several large-cap software companies with projected long-term earnings growth (three to five years) of 18-22% are now trading at forward P/E multiples of 25x, down from 35x earlier in 2024. This PEG ratio near 1.2 suggests a much more reasonable valuation entry point than the speculative 2.0+ PEG ratios observed during the market peak.

Investors must focus on the implied long-term growth rate embedded in the current stock price. If the current valuation implies a growth rate significantly lower than the company’s proven historical performance and analyst consensus, a valuation gap exists. This is particularly true for companies dominating niche, high-barrier-to-entry markets, such as specialized cloud infrastructure providers or critical cybersecurity firms, whose pricing power is insulated from broader economic fluctuations.

Strategic Entry Points: Timing the Market vs. Time in the Market

While the concept of ‘timing the bottom’ is often futile in financial markets, identifying strategic entry points when tech stock valuations compressed is crucial. Elite investors rarely attempt to catch the exact low; instead, they focus on accumulating shares of quality companies when valuation metrics fall below historical averages or when the risk of macro-driven multiple contraction appears to have largely subsided.

The consensus among leading portfolio managers at institutions like BlackRock and Fidelity suggests a phased, or dollar-cost averaging, approach is optimal during periods of high volatility. This strategy mitigates the risk of deploying large amounts of capital before a potential final leg down, capitalizing instead on the average low price during the compression phase. The focus remains on establishing a long-term position in a quality asset whose intrinsic value is expected to rise regardless of short-term market noise.

Catalysts for Reversion to Higher Multiples

The reversion of compressed valuations back toward historical norms typically requires specific catalysts. These catalysts are usually fundamental or macroeconomic shifts that reduce uncertainty or validate future earnings potential. The two most critical catalysts currently being monitored are the stabilization of interest rate expectations and the delivery of strong, guidance-beating earnings reports.

- Fed Pivot/Rate Pause: A confirmed pause or, eventually, a cut in the Federal Funds Rate would immediately lower the discount rate, providing a mechanical boost to long-duration growth valuations.

- Strong Q4 Earnings and 2025 Guidance: Companies that outperform expectations and provide robust, conservative forward guidance can unilaterally force a re-rating, as the market gains confidence in their ability to grow profitably despite macro headwinds.

- AI Monetization Proof: For AI-leveraged companies, clear evidence of meaningful revenue generation and margin expansion from new AI products (e.g., enterprise software adoption) acts as a powerful catalyst.

Investors should look for companies where management has consistently demonstrated operational discipline and a commitment to shareholder returns, such as through increased share repurchase authorizations announced during periods of depressed stock prices. This signals management’s belief that their stock is fundamentally undervalued.

The Crucial Distinction: Quality vs. Speculative Tech

Not all stocks trading below their 2024 highs are equal. The significant risk in the current environment lies in mistaking a temporary valuation compression in a quality name for a permanent impairment in a speculative, structurally challenged business. Quality companies, even with compressed valuations, retain strong market positions, high switching costs for customers, and sustainable competitive advantages (moats).

Speculative tech companies, in contrast, often rely on aggressive spending to capture market share, resulting in negative or minimal free cash flow. When capital markets tighten, these firms face existential funding risks. The market’s discount for these names is often justified, reflecting the high probability of dilution or failure to meet long-term profitability targets. For example, a software company with a negative 15% operating margin and less than two years of cash runway deserves its steep discount, irrespective of its revenue growth rate.

The Importance of Pricing Power and Moats

Warren Buffett’s concept of the ‘economic moat’ is particularly relevant when assessing quality in technology. Companies with strong moats—such as network effects (e.g., social platforms, dominant marketplaces), high customer switching costs (e.g., mission-critical enterprise software), or intangible assets (e.g., patents, brand recognition)—are better positioned to pass rising input costs onto customers without losing significant volume.

During the Q3 2024 earnings season, companies like Microsoft and Adobe demonstrated this pricing power, successfully implementing price increases for their cloud and enterprise software subscriptions, thereby defending their gross margins even as labor and infrastructure costs rose. This ability to maintain or expand margins during inflationary periods is the hallmark of a true quality technology business and justifies a premium valuation once macro pressures abate.

Risk Assessment and Due Diligence in Compressed Markets

While the opportunity to buy quality names at discounted prices is compelling, investors must conduct rigorous due diligence, acknowledging the inherent risks. The primary risk remains a deeper-than-expected economic recession, which could curb enterprise IT spending, even for essential software. Analysts at JP Morgan have modeled a scenario where a severe recession could lead to a 10% decline in corporate IT budgets, impacting even the most resilient tech providers.

Furthermore, competitive risks are constant. Rapid technological change, particularly in AI, means that today’s market leader could be tomorrow’s laggard if they fail to innovate quickly enough. Due diligence must therefore extend beyond traditional financial metrics to include strategic positioning, research and development (R&D) spend relative to peers, and management’s adaptability.

Scenario Planning and Position Sizing

For assets where tech stock valuations compressed significantly, prudent position sizing is essential. Investors should model three scenarios: a base case (soft landing, rates stabilize), a bull case (rapid disinflation, rate cuts), and a bear case (hard landing, deep recession). If the company remains profitable, cash-flow positive, and maintains its strategic advantage even in the bear case, it meets the requirement for a resilient quality investment.

- Monitor Inventory and Receivables: Look for signs of stress in corporate customers, such as rising days sales outstanding (DSO) or unexpected inventory build-up, which could signal future demand weakness.

- Track Insider Buying: Significant purchases by company executives and directors can be a strong signal that those closest to the business believe the stock is undervalued relative to future prospects.

- Evaluate Debt Maturity Profile: Companies with significant debt maturing in the next 12-24 months may face high refinancing risk at current elevated interest rates, regardless of operational quality.

In conclusion, the current environment of compressed tech stock valuations offers a rare window to acquire high-quality companies at prices that reflect macro fear rather than fundamental reality. The key is forensic analysis, prioritizing free cash flow, ROIC, and durable competitive advantages over mere revenue growth rates.

| Key Factor/Metric | Market Implication/Analysis |

|---|---|

| 10-Year Real Yield | Higher real yields increase the discount rate, mechanically compressing P/E multiples for long-duration growth assets. |

| Free Cash Flow (FCF) Conversion | Quality names maintain FCF conversion above 80%. This metric validates earnings quality and financial durability during market stress. |

| PEG Ratio | Quality tech trading near a PEG of 1.2 or below suggests valuation is attractive relative to proven long-term earnings growth potential. |

| Economic Moat/Pricing Power | Companies with high switching costs or network effects can maintain gross margins by passing on costs, a sign of investment quality. |

Frequently Asked Questions about Compressed Tech Stock Valuations

The primary driver is the rapid increase in interest rates by the Federal Reserve, which elevates the discount rate used to value future earnings. This macro shift disproportionately affects long-duration growth assets, causing their P/E and price-to-sales multiples to contract sharply, even if corporate earnings remain robust.

Focus on financial durability: quality names exhibit high free cash flow conversion (over 80%), Gross Margins above 65%, and positive Return on Invested Capital (ROIC) significantly exceeding their cost of capital. Speculative stocks often rely on external funding due to persistent negative free cash flow.

The PEG ratio (P/E divided by long-term growth rate) is highly relevant. Quality tech companies trading with a PEG ratio near or below 1.2 suggest that the valuation is reasonable relative to the expected durable earnings growth, indicating a potential undervaluation.

Optimal accumulation occurs when the valuation compression is driven by market fear rather than fundamental impairment. A phased, dollar-cost averaging strategy is often preferred to mitigate timing risk, focusing on periods when the P/E multiple falls significantly below the company’s five-year historical average.

A confirmed stabilization or reduction in the Federal Funds Rate, often referred to as a Fed pivot or pause, would be the most powerful catalyst. This would lower the risk-free rate, instantaneously reducing the discount rate applied to future earnings and supporting a mechanical re-rating of growth multiples.

The Bottom Line: Navigating Valuation Dislocation

The current market environment, characterized by persistent inflation and elevated borrowing costs, has created a significant valuation dislocation in the technology sector. While the systemic de-rating caused by rising real yields is unavoidable, it has created a situation where high-quality technology franchises, defined by superior profitability, strong free cash flow, and defensible market positions, are trading at historically attractive multiples relative to their long-term growth prospects. Investors must exercise disciplined analysis, prioritizing fundamental metrics over market noise, to differentiate between cyclical pressure and structural weakness. The window to capitalize on these tech stock valuations compressed below 2024 highs is open, but success hinges on rigorous due diligence focused on the balance sheet strength and the sustainability of earnings power, positioning portfolios for substantial recovery once macroeconomic certainty returns. Prudence dictates a focus on companies that can thrive even if interest rates remain ‘higher for longer,’ ensuring resilience regardless of the Federal Reserve’s next move. The emphasis remains on quality at a reasonable price, a timeless principle amplified by today’s volatile capital markets.