Palantir Stock Up 162% in One Year: Is it Too Late to Buy?

Palantir Technologies (PLTR) experienced a 162% stock surge over the past year, fueled by robust performance in its commercial segment and optimism surrounding its Artificial Intelligence Platform (AIP), leading institutional analysts to scrutinize whether the current valuation still offers a compelling entry point.

The question of whether it is too late to buy Palantir Stock Up 162% in One Year: Is it Too Late to Buy is dominating financial discourse among technology investors. Palantir Technologies (PLTR), the data integration and software company co-founded by Peter Thiel, has delivered extraordinary returns, driven primarily by the acceleration of its commercial business and the market’s enthusiasm for its Artificial Intelligence Platform (AIP). This explosive performance, while rewarding early investors, forces a rigorous re-evaluation of its current market capitalization relative to its intrinsic value and future growth trajectory, a critical exercise for any investor considering an entry point now.

The Anatomy of the 162% Surge: Catalysts and Performance Metrics

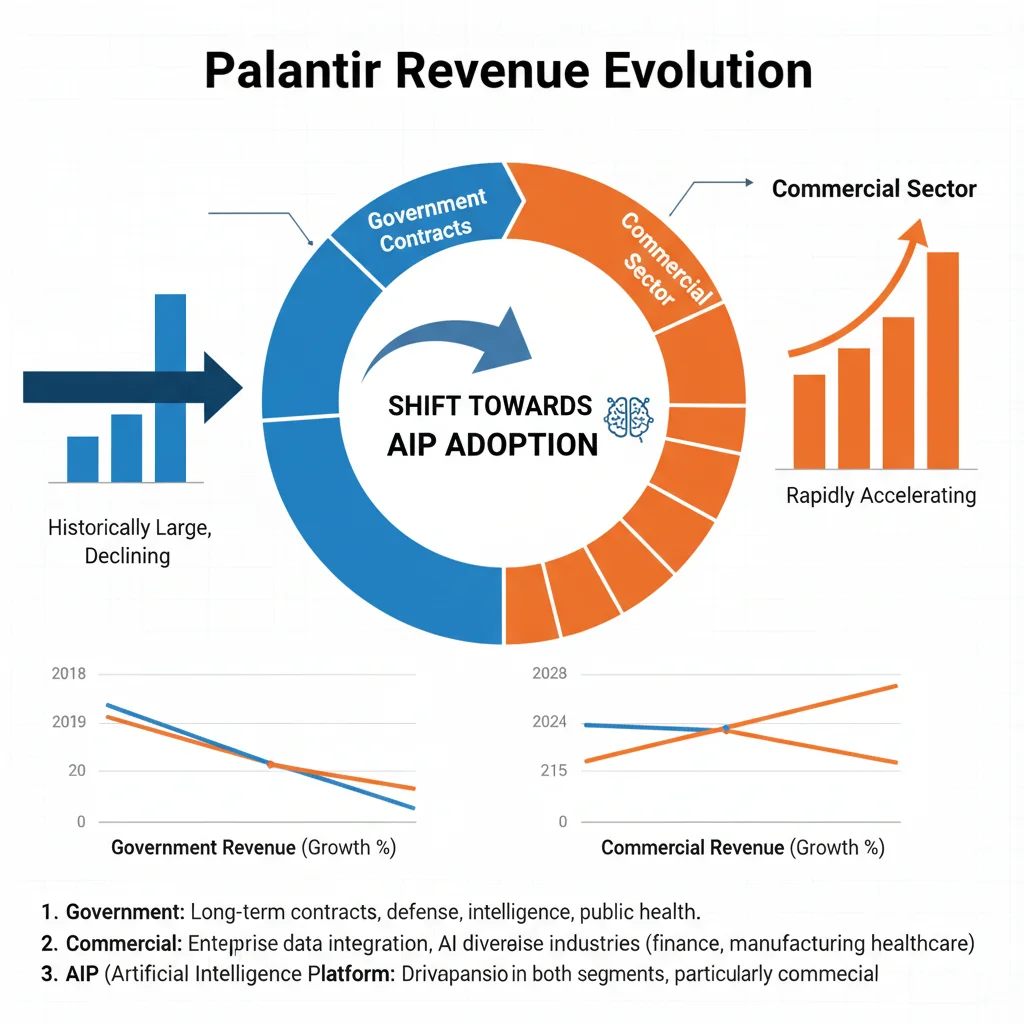

Palantir’s dramatic stock price movement did not happen in a vacuum; it was predicated on fundamental shifts in the company’s financial profile and market positioning. For much of its public life, Palantir was characterized by heavy reliance on slow-moving, high-margin government contracts. The recent surge, however, is fundamentally tied to the successful penetration of the commercial sector, particularly in the United States, coupled with a critical milestone: sustained profitability.

The company achieved its fifth consecutive quarter of GAAP profitability in the most recent reporting period, a key requirement for inclusion in major indices like the S&P 500. This shift from consistently posting losses to delivering positive earnings per share (EPS) signaled maturity and fiscal discipline to the market. Furthermore, the company’s Q1 2024 results revealed a 27% year-over-year revenue increase to $634 million, exceeding market expectations. Critically, U.S. commercial revenue grew by 40% year-over-year to $150 million, demonstrating the successful pivot away from almost exclusive dependence on government spending.

The Rise of the Artificial Intelligence Platform (AIP)

The primary driver of the commercial acceleration is the adoption rate of Palantir’s Artificial Intelligence Platform (AIP). Unlike its legacy platforms (Gotham for government and Foundry for commercial use), AIP is designed to integrate large language models (LLMs) with enterprise data, enabling rapid deployment of AI-driven solutions. Palantir has aggressively marketed AIP through its ‘Bootcamps,’ intensive workshops designed to onboard new clients quickly.

- AIP Adoption Rate: Management reported a substantial increase in the number of U.S. commercial customers, growing 69% year-over-year (as of the Q1 2024 earnings call), directly linking this growth to AIP implementation.

- Contract Value Expansion: Average contract value (ACV) for U.S. commercial clients is showing early signs of expansion, suggesting that initial AIP deployments are leading to broader, more lucrative contracts within client organizations.

- Market Narrative Shift: The narrative surrounding Palantir has shifted from a defense contractor to a leading enterprise AI player, a sector currently commanding a premium valuation in the public markets.

While the 162% gain is impressive, investors must distinguish between momentum and sustainable growth. The current valuation reflects high expectations for AIP’s continued dominance. Analysts at Morgan Stanley noted that the speed of commercial onboarding is unprecedented for Palantir, but caution that maintaining this hyper-growth rate mandates consistently executing on large-scale enterprise deployments against increasing competition from established cloud providers and specialized AI startups.

Valuation Concerns: Price-to-Sales and Future Growth Discounting

A stock price increase of 162% naturally leads to questions about valuation, particularly in the tech sector where future growth is often heavily discounted into the present price. As of the latest market data, Palantir trades at a premium multiple when assessed against traditional software metrics. The company’s forward price-to-sales (P/S) ratio currently hovers significantly above 20x, a metric that far surpasses the median P/S ratio for the S&P 500 technology sector, which typically ranges between 8x and 10x.

This elevated multiple implies that the market is anticipating annual revenue growth exceeding 30% for the next several years, a challenging feat as the revenue base expands. For context, Salesforce (CRM) and Oracle (ORCL), mature enterprise software giants, trade at considerably lower P/S multiples, often below 6x, reflecting their more moderate growth projections. The premium assigned to Palantir is a direct reflection of the market’s belief in its AI moat and the scalability of AIP.

Analyzing the Bull and Bear Cases on Valuation

The bull case, frequently articulated by analysts at Wolfe Research, centers on the idea that Palantir is not merely a software company but an essential infrastructure layer for AI within governments and complex enterprises. They argue that traditional P/S ratios fail to capture the long-term, sticky nature of Palantir’s contracts and the massive total addressable market (TAM) for enterprise AI solutions. Furthermore, the shift to GAAP profitability removes a major overhang for institutional investors who adhere to strict investment mandates.

Conversely, the bear case, often highlighted by firms like Needham & Company, focuses on the inherent risks associated with high-multiple stocks. They point out that a P/S ratio above 20x leaves little margin for error. Any slowdown in commercial growth, delayed government contract renewals, or increased competition could trigger a sharp correction. The bear perspective emphasizes that a significant portion of the current valuation relies on the successful monetization of AIP, which is still in its nascent stages of enterprise adoption. The high stock-based compensation (SBC) expense, although trending down as a percentage of revenue, remains a concern, diluting shareholder value.

- Valuation Metric: Forward P/S ratio exceeding 20x, demanding sustained hyper-growth.

- Risk Factor: Sensitivity to interest rates; higher rates disproportionately penalize stocks valued primarily on distant future cash flows.

- Institutional Holdings: Despite the rally, large institutional funds are closely monitoring the rate of commercial customer acquisition, viewing it as the primary justification for the elevated price.

For investors entering the market now, the key consideration is whether Palantir can maintain a growth rate that justifies its current premium. If growth decelerates even slightly below the market’s high expectations (e.g., falling below 25% revenue growth), a significant re-rating of the stock could occur, irrespective of overall profitability.

The Government Backbone: Stability vs. Growth Dependence

Historically, the government sector, particularly U.S. defense and intelligence agencies, provided the financial bedrock for Palantir. This segment, while growing slower than the commercial side, offers stability, high margins, and long-term contracts. In Q1 2024, government revenue totaled $335 million, representing a substantial portion of the company’s total revenue.

The stability of the government business acts as a crucial buffer. These contracts are generally insulated from immediate economic downturns and provide predictable cash flow. Palantir’s Gotham platform is deeply embedded in the operational technology stacks of key agencies, creating significant switching costs and a technological moat.

Geopolitical Catalysts and Government Spending

Current global geopolitical tensions serve as an indirect catalyst for Palantir’s government segment. Increased defense spending globally, particularly among NATO allies and the U.S., translates into higher potential demand for advanced data integration and decision-making tools like Gotham. For instance, the Department of Defense’s continued focus on Joint All-Domain Command and Control (JADC2) initiatives requires robust data fusion capabilities, a core competency of Palantir.

However, the government segment also presents unique challenges:

- Contract Lumps and Delays: Government contracts are often large but awarded sporadically, leading to quarter-to-quarter volatility that can mask the underlying commercial momentum.

- Slower Sales Cycle: The procurement process is notoriously slow, contrasting sharply with the rapid, scalable deployment of AIP in the commercial sector.

- Political Risk: Changes in administration or budgetary priorities can impact multi-year contract renewals or new program funding.

While the commercial segment is the engine for the stock’s recent appreciation, the government segment provides essential stability and validation of Palantir’s technology effectiveness in mission-critical environments. A key monitoring point for investors is the pace of government contract diversification beyond traditional U.S. agencies into international defense and civilian sectors, mitigating reliance on any single governmental entity.

Commercial Expansion and the AIP Flywheel Effect

The commercial segment is the primary focus for growth investors. The strategy here is not just about acquiring new customers but creating a ‘flywheel effect’ where initial small deployments rapidly expand across an organization. Palantir has adopted a unique sales model, often starting with low-cost, high-impact consulting engagements (AIP Bootcamps) to prove value quickly, thereby securing larger, recurring software contracts.

The U.S. commercial customer count growth of 69% year-over-year in Q1 2024 is highly significant because it demonstrates successful market penetration in the highly competitive American enterprise landscape. This segment is characterized by higher scalability and potentially faster revenue acceleration than the government sector, provided Palantir can sustain its competitive edge in AI deployment.

Competitive Landscape in Enterprise AI

Palantir operates in a fiercely competitive environment. Its main rivals are not just other pure-play AI firms but also the hyperscale cloud providers—Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP)—each of which is heavily investing in their own enterprise AI and data integration services. Palantir differentiates itself by offering a platform that works across clouds and focuses specifically on integrating disparate, complex data sources to drive operational decisions, rather than just offering foundational models.

Analysts at Goldman Sachs suggest that Palantir’s competitive advantage lies in its decade-plus experience handling highly sensitive, complex data sets for government clients, an expertise that translates well to regulated commercial industries like finance, manufacturing, and healthcare. However, the commercial market demands speed and flexibility. Palantir must continually prove that AIP offers a superior return on investment (ROI) compared to building in-house solutions or leveraging existing cloud infrastructure tools.

- Customer Acquisition Cost (CAC): Investors are scrutinizing whether the aggressive bootcamp strategy yields sustainable customer relationships with acceptable CAC levels.

- Net Revenue Retention (NRR): A high NRR metric (ideally above 120%) in the commercial segment would confirm that existing customers are expanding their use of Palantir’s software, a crucial indicator of product value.

- Go-to-Market Strategy: The focus must remain on expanding sales capacity and streamlining the deployment process to maintain the current growth trajectory in commercial bookings.

The success of the 162% rally hinges on the continued rapid growth and monetization of the commercial segment. If Palantir can consistently deliver 40%+ year-over-year growth in U.S. commercial revenue, it will satisfy the market’s high growth expectations and potentially justify the current high valuation multiple.

The Importance of GAAP Profitability and S&P 500 Inclusion

A significant milestone achieved in the past year was Palantir’s attainment of sustained Generally Accepted Accounting Principles (GAAP) profitability. This is more than just an accounting victory; it is a structural change that affects the company’s investor base and market perception. Achieving GAAP profitability for four consecutive quarters made Palantir eligible for inclusion in the S&P 500 index, a major institutional benchmark.

Index inclusion is a powerful, non-fundamental catalyst. When a stock enters the S&P 500, index funds and exchange-traded funds (ETFs) tracking the index are mandated to purchase shares, creating automatic, sustained demand. This passive buying pressure can provide a floor for the stock price and reduce volatility. Furthermore, it validates the company’s financial stability and operating model for a broad swath of conservative institutional investors who previously avoided the stock due to its lack of profitability.

Stock-Based Compensation (SBC) and Free Cash Flow (FCF)

While GAAP profitability is crucial, investors must also assess the quality of earnings. Palantir has historically been criticized for high stock-based compensation (SBC), which, while non-cash, dilutes existing shareholders. In recent quarters, management has made progress in controlling SBC relative to revenue, but it remains a key metric to monitor. High SBC can inflate non-GAAP earnings figures, making GAAP profitability a necessary litmus test for true financial health.

The company’s Free Cash Flow (FCF) generation has also been robust, demonstrating the efficiency of its business model in converting revenues into usable cash. In the last fiscal year, Palantir reported strong FCF margins, primarily due to the upfront nature of some of its software contracts. Strong FCF provides the company with the flexibility to invest aggressively in AIP development, strategic acquisitions, or potential share buybacks, further supporting the stock price.

- Profitability Quality: Focus remains on reducing SBC as a percentage of revenue (currently around 15-20%) to improve net income quality.

- FCF Margin: Sustained high FCF margins confirm the operating leverage inherent in the software platform business model.

- Index Impact: Potential S&P 500 inclusion is a near-term catalyst that could drive significant passive inflows, irrespective of short-term earnings fluctuations.

The transition to sustained GAAP profitability is perhaps the most fundamental reason institutional money began flowing into Palantir, validating the thesis that the company could move beyond its investment phase and become a consistently profitable enterprise software player.

Assessing Risk: Execution, Competition, and Concentration

While the narrative is overwhelmingly positive following the 162% rise, a balanced financial analysis requires a sober assessment of inherent risks. The primary risk facing Palantir is execution risk. The rapid scaling of AIP requires flawless deployment, effective integration with complex client systems, and continuous innovation ahead of competitors.

If the AIP Bootcamps fail to convert into large, multi-year contracts consistently, or if the technology proves less adaptable to diverse commercial needs than advertised, the high valuation could quickly unravel. Furthermore, the reliance on a few large government contracts, while providing stability, introduces concentration risk. Loss of a major government client—such as the U.S. Army or a key intelligence agency—would materially impact revenue and market sentiment, despite the commercial growth.

Technological Obsolescence and Competitive Moats

In the rapidly evolving field of artificial intelligence, technological obsolescence is a constant threat. Palantir’s moat relies heavily on the stickiness of its data integration layer and the specialized nature of its operating system (Gotham and Foundry). However, advancements in open-source AI models and simplified data warehousing solutions could erode this advantage over time. Competitors are actively trying to replicate Palantir’s capabilities at a lower cost or with greater flexibility.

Moreover, regulatory and ethical concerns surrounding AI deployment, particularly in sensitive government and financial sectors, pose an external risk. Any adverse regulatory ruling regarding data privacy or algorithmic bias could force costly platform modifications or restrict market access for certain applications.

The current price demands near-perfect execution. Analysts at Bank of America maintain a neutral rating, citing the difficulty in modeling the precise monetization curve for AIP and the potential for increased customer acquisition costs as the company moves beyond early adopters. They emphasize that investors must be comfortable with the volatility inherent in a stock whose valuation primarily reflects future, rather than current, earnings power.

The Institutional Perspective: Is There Still an Entry Point?

For large institutional investors, the decision to enter a stock that has already appreciated 162% revolves around the long-term growth potential and the concept of relative valuation within the high-growth AI sector. The question is not whether the stock is cheap, but whether it is reasonably priced for 30%+ compounded annual growth over the next five years.

Many institutional investors employ a dollar-cost averaging strategy or look for pullbacks to establish positions. They are likely benchmarking Palantir against other high-multiple software-as-a-service (SaaS) companies like Snowflake (SNOW) or CrowdStrike (CRWD), assessing which company offers the most durable competitive advantage and the clearest path to $10 billion in annual revenue. Palantir’s unique blend of government stability and commercial AI hyper-growth makes direct comparison challenging.

The institutional consensus suggests that while the easy money from the initial profitability surge is gone, a long-term investment thesis remains intact if, and only if, the commercial AIP expansion continues its current trajectory. Key indicators for institutional monitoring include:

- Guidance Revisions: Consistent upward revisions to annual revenue guidance, signaling management confidence in AIP monetization.

- Margin Expansion: Evidence of operating leverage, where revenue growth outpaces growth in operating expenses (excluding SBC).

- International Commercial Growth: Successful expansion of the AIP model into Europe and Asia, diversifying the commercial revenue base beyond the U.S.

Ultimately, the decision for any new investor must be grounded in their own risk tolerance and time horizon. The current valuation prices in substantial future success. A disciplined financial approach requires modeling scenarios where growth is slower than expected, ensuring the investor is prepared for potential volatility or a significant drawdown if earnings reports fail to meet the elevated expectations set by the 162% rally.

| Key Metric/Factor | Market Implication/Analysis |

|---|---|

| 162% One-Year Stock Gain | Reflects high expectations for AIP and sustained GAAP profitability; valuation is stretched. |

| Forward P/S Ratio > 20x | Requires Palantir to maintain 30%+ annual revenue growth to justify the premium over peers. |

| U.S. Commercial Growth 40% Y/Y | Primary growth engine; continued acceleration is mandatory to support the current stock price. |

| Sustained GAAP Profitability | Key factor for S&P 500 eligibility and attracting conservative institutional investment funds. |

Frequently Asked Questions about Palantir Stock Analysis

The primary driver is the accelerating U.S. commercial segment, specifically the adoption and deployment of Palantir’s Artificial Intelligence Platform (AIP). This segment reported 40% year-over-year growth in Q1 2024, successfully diversifying the revenue base away from its historical reliance on the government sector.

Palantir trades at a significant premium, with a forward price-to-sales (P/S) ratio exceeding 20x, substantially higher than the 6x to 10x range typical for mature enterprise software firms like Oracle or SAP. This premium reflects aggressive market expectations for its future AI-driven growth.

Sustained GAAP profitability is crucial because it validates the business model’s long-term viability and makes the stock eligible for inclusion in major indexes like the S&P 500. Index inclusion generates mandatory passive demand from ETFs and index funds, providing structural support to the share price.

Key risks include execution failure in scaling AIP, intense competition from hyperscale cloud providers, and the high valuation leaving little margin for error if commercial growth rates decelerate. Concentration risk in large government contracts also remains a factor.

Investors should primarily monitor the U.S. commercial customer count growth and the Net Revenue Retention (NRR) rate in the commercial segment. These metrics indicate both successful customer acquisition via AIP and the expanding value derived from existing relationships, justifying the growth premium.

The Bottom Line: Balancing Momentum and Fundamentals

The 162% surge in Palantir stock analysis over the last year is a testament to the power of a successful strategic pivot combined with the market’s insatiable demand for exposure to credible Artificial Intelligence players. The company has successfully navigated the transition to sustained GAAP profitability and established its Artificial Intelligence Platform (AIP) as a potent commercial growth engine. This operational success has fundamentally changed Palantir’s narrative from a niche government contractor to a potential enterprise AI behemoth.

However, the current valuation, trading at a significant premium to the broader software sector, transparently prices in aggressive future success. The price point dictates that Palantir must continually exceed expectations, particularly in converting AIP Bootcamps into large, recurring commercial contracts. For investors considering an entry now, the investment thesis must shift from capitalizing on a turnaround to betting on impeccable execution and continued market share gains against formidable competitors like Microsoft and Google.

Future monitoring should focus less on the absolute share price and more on the underlying financial health: sustained expansion of commercial segment margins, consistent acceleration in U.S. commercial bookings, and management’s ability to control stock-based compensation relative to revenue growth. If Palantir can maintain a growth trajectory that supports its current P/S multiple, the stock may still offer long-term value, albeit with significantly higher volatility. If growth falters, institutional investors are prepared to re-rate the stock, making disciplined risk management essential for new capital deployment.