AI Weakness Signals Rotation: Market Down 0.4% This Week

The stock market’s marginal 0.4% dip this week was primarily attributed to significant selling pressure within the artificial intelligence (AI) sector, indicating a critical shift in investor sentiment toward broader market diversification and away from concentrated tech leadership.

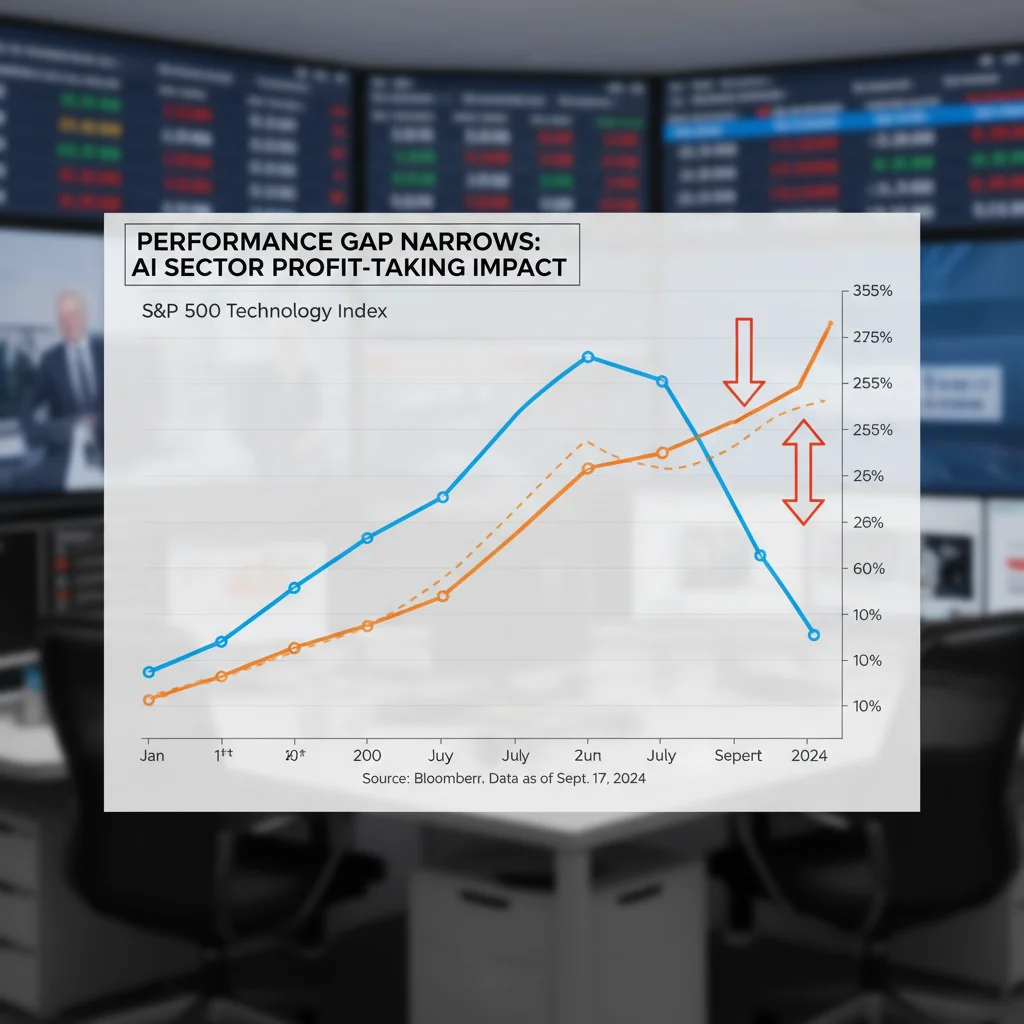

The broader equity market experienced a modest retreat this week, with the S&P 500 index closing down 0.4%, marking the first weekly decline in five periods, according to Bloomberg data. This seemingly negligible drop belies a significant shift in underlying market dynamics, primarily driven by a pronounced bout of profit-taking within the high-flying technology segment, where the narrative of artificial intelligence (AI) has dominated capital allocation for the preceding 18 months. The fact that the overall index fell only marginally while key AI bellwethers saw declines exceeding 3% suggests a strategic sectoral shift, where the market is witnessing the early stages of a rotation. This pattern—where the Stock Market Down 0.4% This Week: AI Sector Weakness Signals Broader Rotation—demands a detailed examination of capital flows, valuation compression, and the macroeconomic context influencing investor behavior.

The AI Sector Correction: Valuation and Profit-Taking Dynamics

The recent weakness in the AI sector was not uniform but concentrated among names that had achieved extraordinary valuation multiples based on projected, rather than realized, revenue streams from AI integration. Analysts at Goldman Sachs noted that the average forward price-to-earnings (P/E) ratio for the top five AI-leveraged stocks stood at 45.2x at the beginning of the week, substantially higher than the S&P 500’s average of 20.5x. This premium made these stocks acutely vulnerable to any negative news or, more fundamentally, to simple profit-taking after months of relentless ascent.

The selling pressure intensified following mixed guidance from a major semiconductor manufacturer heavily exposed to AI hardware, which projected slower-than-expected growth in enterprise AI spend for the second half of the fiscal year. This guidance adjustment provided the catalyst for hedge funds and institutional investors to lock in gains accumulated since the start of the year. The core challenge for AI stocks now is transitioning from a growth narrative—where future potential justifies high valuations—to a profitability reality, where earnings must validate the current stock prices. The market’s reaction suggests increasing scrutiny of capital efficiency and return on investment in AI infrastructure, a key factor in determining sustained growth.

Deconstructing the AI Valuation Premium

The gap between the expected future cash flows and the current valuation of AI leaders has widened considerably. Investors are now recalibrating discounted cash flow (DCF) models, applying higher discount rates due to persistent inflation and the Federal Reserve’s ‘higher for longer’ interest rate stance. This recalibration inherently reduces the present value of distant future earnings, disproportionately affecting high-growth, long-duration assets like many AI stocks. Furthermore, competitive pressures are mounting, threatening the monopolistic pricing power some AI leaders have enjoyed.

- Discount Rate Sensitivity: A 50 basis point increase in the long-term risk-free rate can reduce the intrinsic value of a stock with a 15-year growth horizon by 8% to 12%, according to JPMorgan Chase analysis.

- Earnings Quality Scrutiny: Investors are increasingly differentiating between revenue growth derived from initial AI infrastructure build-out (capital expenditure) and recurring revenue from actual AI service consumption (operational expenditure).

- Slowing Momentum Indicators: Technical indicators, such as the 14-day Relative Strength Index (RSI), had signaled overbought conditions for several mega-cap tech names for six consecutive weeks, priming the market for a reversal.

The immediate consequence of this valuation compression is a temporary cooling of the enthusiasm that characterized the AI rally. While the long-term structural tailwinds for AI adoption remain undisputed by most Wall Street strategists, the market is signaling that the pace of expected earnings growth may need moderation, paving the way for capital to seek opportunities elsewhere in the equity landscape.

The Broader Market Rotation: Shifting Capital Flows

The 0.4% decline in the S&P 500 was cushioned significantly by strength in sectors traditionally considered defensive or value-oriented. This dynamic confirms the thesis of a rotation, where capital liberated from AI and high-growth technology is being redeployed into segments offering better current yields, lower volatility, or more attractive P/E ratios relative to historical averages. Sectors such as Utilities (up 1.2% for the week) and Industrials (up 0.8%) absorbed much of the selling pressure from Technology (down 3.1%).

This movement is typical when market participants anticipate either an economic slowdown or a prolonged period of elevated interest rates. Defensive sectors, characterized by stable demand and predictable cash flows, tend to outperform in such environments. The rotation is less about a fundamental bearish view on the economy and more about optimizing portfolio construction in a higher-cost-of-capital world. Strategists at Bank of America estimate that approximately $7.5 billion flowed out of technology-focused exchange-traded funds (ETFs) and into value-focused and dividend-paying ETFs during the week ending Friday.

The Re-Emergence of Value and Cyclical Stocks

Cyclical sectors, particularly Industrials and Materials, benefited from renewed optimism regarding government infrastructure spending and stable commodity prices. Companies with significant operational leverage and exposure to core economic activity are now being viewed as undervalued compared to their technology counterparts. This shift reflects a cautious optimism that the U.S. economy can manage a soft landing, maintaining moderate growth without triggering a deep recession. The relative performance of the Russell 1000 Value Index versus the Russell 1000 Growth Index reached its narrowest spread in three months, underscoring the shift in preference.

This rotation is fundamentally driven by a search for sustainable earnings yield. As interest rates remain elevated, the opportunity cost of holding non-yielding growth stocks increases. Value stocks, often paying dividends and trading at lower multiples of current earnings, become more appealing on a risk-adjusted basis. This trend is amplified by institutional mandates requiring diversification after the concentrated gains of the AI rally.

- Industrial Resilience: Key industrial players reported strong order backlogs in their Q2 earnings, defying earlier recessionary fears and justifying multiple expansion.

- Utility Stability: Utilities are benefiting from their regulated monopolies and the perception of safety, especially as 10-year Treasury yields stabilize near 4.3%.

- Financial Sector Headwinds: While financials are generally seen as value plays, they remain sensitive to net interest margin compression, limiting their upside in the immediate rotation.

The immediate takeaway for portfolio managers is that market leadership is broadening. Relying solely on the ‘Magnificent Seven’ for market returns is becoming less viable, necessitating a deeper dive into sector fundamentals and traditional valuation metrics across the entire S&P 500 universe.

Macroeconomic Headwinds: Interest Rates and Inflation Persistence

The backdrop to the market’s 0.4% dip and subsequent rotation is the persistent macroeconomic uncertainty surrounding inflation and monetary policy. The Federal Reserve’s commitment to achieving its 2% inflation target remains the dominant factor influencing long-term asset allocation decisions. Despite recent moderation in the Consumer Price Index (CPI), core inflation metrics, particularly in the services sector, have proven sticky.

The minutes from the last Federal Open Market Committee (FOMC) meeting, released midweek, indicated that while the majority of members anticipate no further rate hikes, they also stressed that maintaining the current restrictive stance for longer than previously expected is necessary to fully dampen inflationary pressures. This ‘higher for longer’ narrative directly impacts the cost of capital for all corporations, but especially for high-growth tech firms reliant on cheap financing for expansion.

The Yield Curve and Recession Indicators

The inversion of the Treasury yield curve—where short-term yields exceed long-term yields—continues to signal potential economic stress, even if a hard landing has been avoided so far. This inversion, historically a reliable predictor of recession, adds an element of caution to equity markets, prompting investors to favor businesses with strong balance sheets and less sensitivity to economic cyclicality. The 2-year/10-year spread remained inverted by approximately 50 basis points throughout the week.

Furthermore, rising oil prices, spurred by geopolitical tensions and OPEC+ production cuts, reintroduced concerns about a renewed inflationary impulse. West Texas Intermediate (WTI) crude futures approached $90 per barrel, a level that historically pressures corporate margins and household disposable income. This inflationary pressure reinforces the Fed’s cautious stance and acts as a drag on risk appetite across equity asset classes.

- Fed’s Dual Mandate: Persistent labor market strength, evidenced by the latest non-farm payroll report exceeding expectations, gives the Fed flexibility to maintain high rates without immediately risking job market collapse.

- Corporate Debt Refinancing: Companies with significant debt maturing in the next 18 months face substantially higher refinancing costs, potentially compressing future earnings per share (EPS).

- Global Growth Divergence: While the U.S. economy shows resilience, weaker growth outlooks in Europe and China introduce export headwinds for multinational corporations, impacting overall global earnings forecasts.

The current macro environment mandates a defensive posture for tactical investors, focusing on companies that can pass through higher input costs to consumers and maintain resilient margins, regardless of minor fluctuations in GDP growth.

Earnings Season Takeaways Beyond AI

While the spotlight remained on AI-related performance, the ongoing earnings season provided crucial insights into the health of non-tech sectors, reinforcing the rotation thesis. Reports from major consumer staples, healthcare providers, and heavy machinery manufacturers delivered generally positive surprises on the bottom line, often attributable to aggressive cost control and successful price increases.

For instance, a leading consumer packaged goods company reported adjusted EPS 8% above consensus, citing effective supply chain management and inelastic demand for core products. This performance starkly contrasts with the capital expenditure uncertainty plaguing some AI hardware suppliers. These results validate the move toward companies demonstrating operational efficiency and dependable earnings quality in a high-rate environment.

The Resilience of Healthcare and Consumer Staples

Healthcare, in particular, demonstrated its defensive qualities. Large pharmaceutical companies exceeded revenue expectations, driven by demand for newly approved specialty drugs and robust performance in their generics divisions. This sector tends to be less correlated with the economic cycle, making it an attractive destination for capital seeking shelter from volatility.

The market’s appreciation for these stable earnings streams suggests that investors are prioritizing near-term financial safety over the exponential, but uncertain, growth promised by the most aggressive AI plays. This measured approach may lead to a sustained period where the market breadth—the number of stocks participating in the rally—improves significantly, ultimately leading to a healthier overall market structure than the highly concentrated leadership seen earlier in the year.

- Margin Stability: Companies able to maintain or expand gross margins despite persistent labor and energy costs are being rewarded with multiple expansion.

- Dividend Growth: Defensive companies with a track record of increasing dividends, funded by stable cash flow, are attracting income-focused institutional funds.

- Cyclical Rebound Potential: Select cyclical names, particularly in capital goods, are seeing upgrades based on a strong forward outlook for infrastructure renewal, supported by government mandates.

The divergence in earnings performance between the AI leaders and the broader market underscores the necessity of granular stock selection. General assumptions about sector performance are being replaced by rigorous analysis of individual company financial statements.

Technical Analysis and Market Breadth Indicators

From a technical perspective, the S&P 500’s 0.4% pullback was accompanied by several indicators suggesting a necessary cooling period rather than the start of a deep correction. The index successfully tested its 50-day moving average (DMA) support level before bouncing back on Friday’s close, a sign of underlying buyer interest at key technical junctures. However, the internal metrics of the market, known as market breadth, painted a more cautious picture.

The NYSE Advance/Decline Line, which measures the difference between the number of advancing and declining stocks, showed deterioration throughout the week, even before the major index began its descent. This divergence suggests that fewer stocks were participating in the market’s overall momentum, even during previous weeks of gains, highlighting the narrowness of the AI-driven rally. The recent weakness in AI stocks now allows this breadth metric to normalize, potentially setting the stage for a broader, more sustainable advance if the rotation holds.

Key Technical Levels to Monitor

Market technicians are closely watching the 4,400 level on the S&P 500, which represents a critical psychological and technical support zone. A sustained break below this level could trigger further systematic selling. Conversely, the ability of the index to consolidate above the 50-DMA, currently near 4,510, would confirm that the recent decline was merely a healthy consolidation phase. The volume profile during the selling also suggests profit-taking rather than panic liquidation, as volume spike was moderate compared to previous major downturns.

- Relative Strength: The relative strength index (RSI) for the NASDAQ 100 dropped below 50, moving from overbought territory toward neutral, indicating that the immediate technical pressure has eased.

- Volatility Index (VIX): The CBOE VIX, often referred to as the market’s fear gauge, remained relatively subdued, fluctuating between 14.5 and 16.0, suggesting that systemic fear remains low despite the rotational volatility.

- Sector Rotation Confirmation: The rotation is technically confirmed by the outperformance of the S&P 500 Equal Weight Index (RSP) relative to the cap-weighted S&P 500 (SPX) over the last two weeks, indicating broader participation.

The technical evidence suggests that while the momentum trade in AI has cooled, the underlying structure of the market is absorbing the selling pressure effectively, facilitating a transition rather than a collapse. Investors should prioritize risk management and maintain diversified exposure rather than attempting to predict the exact bottom of the AI correction.

Risk Management and Portfolio Strategy in a Rotational Market

The observed market dynamics—a marginal index decline masking significant internal rotation—underscore the crucial role of active risk management. In a market environment where high-multiple assets face pressure from elevated interest rates, investors must reassess their exposure to concentration risk, particularly within the technology sector.

Portfolio construction now requires a balanced approach that captures the long-term potential of AI while incorporating the stability and lower volatility offered by value and defensive segments. Analysts at BlackRock suggest maintaining a barbell strategy: overweighting both high-quality secular growth names (including select AI leaders) and resilient cyclical value stocks that benefit from infrastructure spending and margin stability. The key is quality, regardless of the sector.

The Role of Quality and Cash Flow

In the current environment, ‘quality’ is defined by strong free cash flow generation, low debt-to-equity ratios, and consistent return on invested capital (ROIC). These metrics provide a buffer against macroeconomic shocks and higher borrowing costs. Companies that rely heavily on external financing or aggressive accounting standards for growth are likely to underperform as market scrutiny increases.

Furthermore, the volatility in the AI sector serves as a reminder of the importance of disciplined rebalancing. Portfolios that became inadvertently overweight in AI stocks due to their exponential run-up should be brought back to target allocations to manage portfolio risk effectively. This rebalancing process naturally feeds the market rotation, providing capital to undervalued areas.

- Focus on Free Cash Flow: Prioritize businesses where free cash flow covers capital expenditures and debt obligations comfortably, ensuring operational independence.

- Diversification Beyond Market Cap: Consider mid-cap and small-cap value stocks, which often trade at steeper discounts and offer higher growth potential outside the crowded large-cap space.

- Hedge Against Rate Risk: Incorporate assets that perform well in a high-rate environment, such as floating-rate corporate debt or short-duration fixed income, to mitigate the impact of persistent inflation.

Ultimately, the 0.4% market dip is a signal to investors to shift focus from chasing headline momentum to embracing fundamental analysis and prudent diversification, ensuring portfolios are resilient to the evolving economic landscape.

| Key Factor/Metric | Market Implication/Analysis |

|---|---|

| S&P 500 Weekly Change | -0.4%, masking significant internal volatility and sectoral divergence. |

| AI Sector Decline | Key AI stocks dropped >3%, driven by profit-taking and valuation compression against higher interest rates. |

| Defensive Sector Performance | Utilities and Industrials gained, confirming capital rotation into value and stability plays. |

| Market Breadth | Improving, suggesting a healthier, less concentrated market structure post-AI correction. |

Frequently Asked Questions about AI Sector Weakness and Market Rotation

The weakness is primarily driven by significant profit-taking after massive year-to-date gains, coupled with increasing scrutiny over high valuations. Elevated interest rates reduce the present value of long-term projected AI earnings, making current multiples less sustainable for companies not yet delivering peak profitability.

A broader rotation means that market returns are no longer concentrated in a few mega-cap tech names. Average investors should see improved performance in diversified portfolios, particularly those with exposure to high-quality value stocks, financials, and defensive sectors like healthcare and utilities.

No, analysts generally recommend caution against panic selling. AI remains a secular growth trend. Instead, consider trimming overweight positions back to target allocations and reallocating capital to sectors offering current stability and attractive valuations, adhering to disciplined risk management principles.

Sectors benefiting the most include Utilities and Industrials, which offer lower volatility and stable cash flows. These sectors are seen as defensive havens and value plays, providing better earnings visibility in an uncertain macroeconomic environment marked by persistent inflation and high rates.

Investors should closely monitor the trajectory of core inflation and the Federal Reserve’s communications regarding the duration of high interest rates. A sustained decline in core inflation would alleviate pressure on growth stock valuations and potentially slow the pace of the current market rotation.

The Bottom Line

The stock market’s marginal weekly dip of 0.4% serves as a critical inflection point, signaling a necessary and healthy recalibration of risk across the equity landscape. The weakness concentrated in the AI sector weakness is less a reflection of failed technology and more a result of valuation fatigue in a higher-for-longer interest rate regime. This has initiated a broader rotation, driving capital into undervalued, cash-flow-rich segments of the market, including Industrials and defensive stocks. Going forward, market participants should monitor corporate guidance on capital expenditure, particularly the transition from AI infrastructure build-out to actual deployment and monetization of AI services. Furthermore, the market’s ability to maintain support above key technical levels, coupled with the behavior of the VIX, will determine whether this rotation evolves into a sustained, healthy broadening of the rally or simply a temporary pause before another concentrated push. Prudent investors will emphasize quality, diversification, and disciplined rebalancing in the months ahead.