Mortgage Points Strategy for First-Time Buyers: Navigating the Affordability Crisis

Amidst the deepening housing affordability crisis, first-time buyers should strategically analyze the cost-benefit of purchasing mortgage points to secure a lower interest rate, optimizing long-term housing costs against high upfront capital requirements.

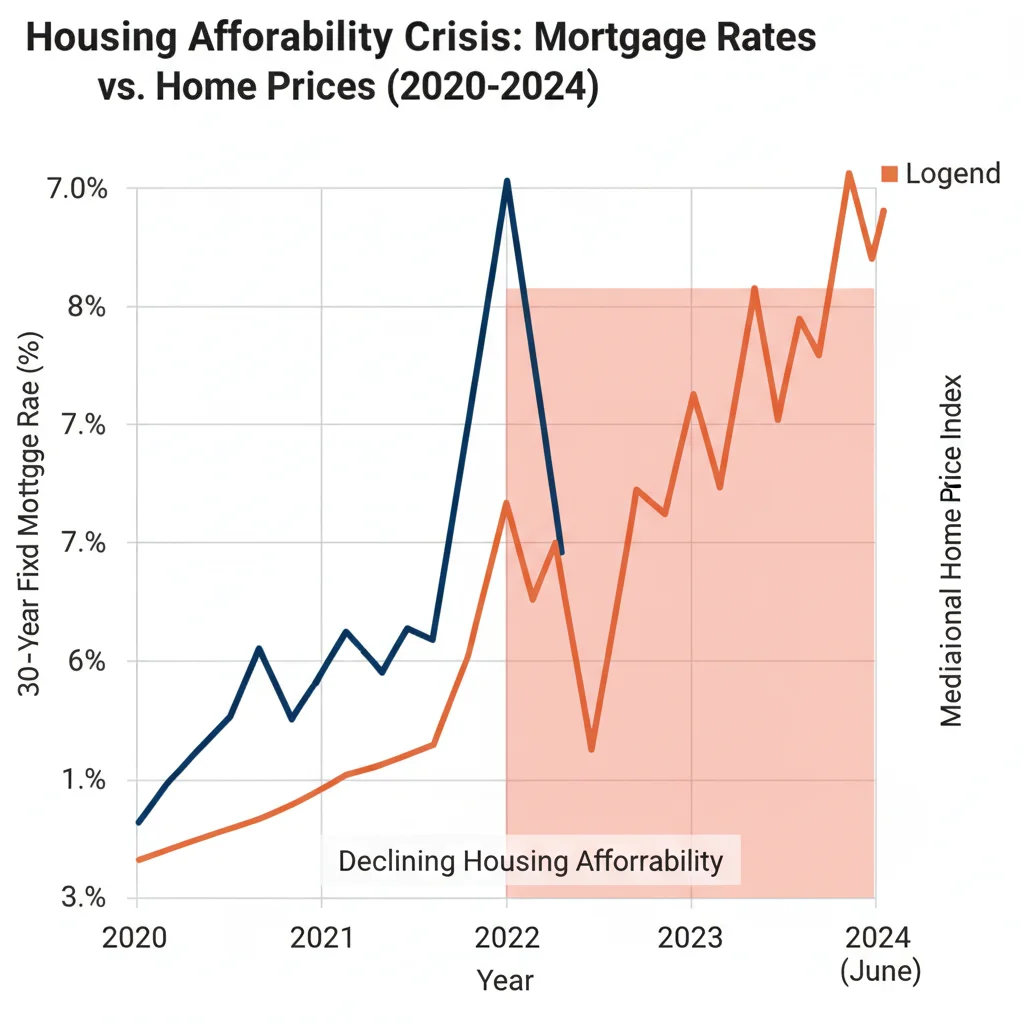

The convergence of elevated home prices and restrictive interest rates has intensified the challenge of homeownership, necessitating nuanced financial planning. The current Housing Affordability Crisis Deepens: Mortgage Points Strategy for First-Time Buyers is emerging as a critical mechanism for accessing the market, offering a tangible path to reduce lifetime borrowing costs, a necessity given the Federal Reserve’s sustained higher-for-longer monetary policy stance. Data from the National Association of Realtors (NAR) indicates that the median existing-home sale price reached $406,700 in Q2 2024, an increase of 5.8% year-over-year, while the 30-year fixed mortgage rate hovers consistently above 6.5%, pushing the monthly payment burden for a median-priced home to historically high levels.

The Macroeconomic Backdrop: Elevated Rates and Constrained Supply

The root of the current affordability crisis is twofold: supply constraints and the monetary policy response to inflation. Following the aggressive rate hikes initiated by the Federal Reserve starting in 2022 to combat inflation—which peaked at 9.1% year-over-year in June 2022—mortgage rates surged from historical lows near 3% to current levels. This rapid increase significantly eroded purchasing power. For a buyer securing a $320,000 mortgage, moving from a 3.5% rate to a 7.0% rate increases the monthly principal and interest payment by approximately 47%, or over $600 monthly, according to calculations based on standard amortization schedules. This context makes every fractional reduction in the interest rate immensely valuable, particularly for budget-sensitive first-time buyers.

Furthermore, the housing supply remains critically low. Many existing homeowners, having secured mortgages at ultra-low rates (sub-4%) during the 2020–2021 period, are reluctant to sell, a phenomenon economists often refer to as the “lock-in effect.” This market friction limits inventory, keeping upward pressure on prices despite reduced transaction volume. Analysts at Goldman Sachs noted in their latest housing report that inventory levels remain 30% below pre-pandemic norms, suggesting that pricing relief is unlikely in the near term. Therefore, first-time buyers must focus on mitigating the cost of debt, which is where the strategic use of mortgage discount points becomes paramount.

Understanding Mortgage Points: Cost vs. Benefit

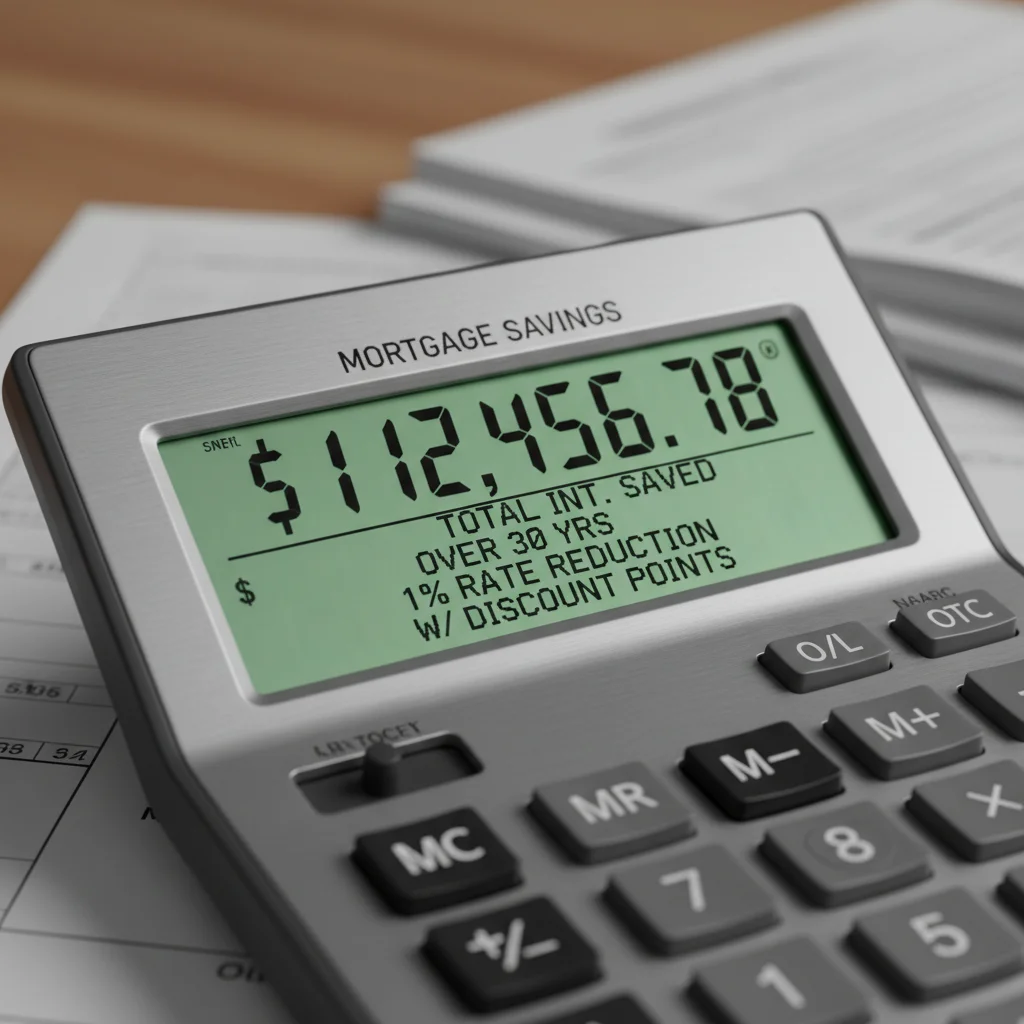

Mortgage points, also known as discount points, are essentially prepaid interest. One point typically costs 1% of the total loan amount and generally lowers the interest rate by 0.25%. For a $300,000 mortgage, one point costs $3,000 and could reduce the rate from 7.00% to 6.75%. This upfront investment requires careful calculation, as the benefit only materializes over time. The fundamental question for the buyer is determining the break-even point—the time it takes for the savings in monthly interest payments to equal the cost of the points.

Lenders also offer origination points, which are fees paid to the lender for processing the loan, distinguished from discount points that specifically reduce the interest rate. It is crucial for first-time buyers to differentiate between these two types when reviewing the Loan Estimate document, per Consumer Financial Protection Bureau (CFPB) guidelines. The strategic imperative is to evaluate discount points as a trade-off between immediate cash outflow and long-term debt efficiency.

- Point Cost Calculation: One point equals 1% of the loan amount (e.g., $3,000 on a $300,000 loan).

- Rate Reduction: Typically 0.25% reduction per point purchased, though this is subject to market conditions and lender discretion.

- Break-Even Analysis: Divide the total cost of the points by the monthly payment savings to determine the number of months required to recoup the initial investment.

Economists at Fannie Mae suggest that the optimal strategy for first-time buyers planning to stay in the home for seven years or more should heavily favor buying down the rate, especially when rates are above 6.5%. Conversely, if the buyer anticipates refinancing within two to three years due to projected Fed rate cuts, the cost of points may not be recouped, making a no-points loan more financially prudent. The decision hinges entirely on the buyer’s expected tenure and future rate environment predictions.

The current market dictates that first-time buyers must engage in sophisticated financial modeling before commitment. The median break-even period for one point on a typical mortgage in Q3 2024 is approximately 48 to 60 months, depending on the loan size and starting interest rate. This substantial window demands a long-term commitment to the property to realize the full economic benefit of the strategy.

Evaluating the Financial Impact: Break-Even Analysis and Opportunity Cost

The core of a successful mortgage points strategy lies in a robust break-even analysis contrasted with the opportunity cost of the capital used for the points. If a buyer has $10,000 in available cash, should they allocate $5,000 to buy points to reduce the rate, or should that $5,000 be reserved for emergency funds, home maintenance, or furnishing the property? This is a crucial capital allocation decision.

Consider a $400,000 loan at 7.0% for 30 years. The monthly payment is $2,661. If the buyer pays $4,000 (one point) to reduce the rate to 6.75%, the monthly payment drops to $2,594, a savings of $67 per month. The break-even point is $4,000 / $67, which equals approximately 59.7 months, or just under five years. If the buyer is certain they will own the home for longer than five years, this is a positive net present value decision.

The Risk of Refinancing and Short-Term Ownership

The primary financial risk associated with buying points is early termination of the loan, either through sale or refinancing. If the buyer sells the home after three years (36 months) in the scenario above, they would have spent $4,000 upfront but only realized $67 * 36 = $2,412 in savings. This results in a net loss of $1,588 on the point investment. This risk is amplified in a high-rate environment where many buyers hold out hope for future rate cuts that would enable them to refinance.

Experts at Moody’s Analytics suggest that while refinancing probability is high if the 30-year fixed rate drops below 6.0%, the timing remains highly uncertain, tied directly to the Federal Reserve’s inflation data and subsequent policy adjustments. First-time buyers must factor in the potential for refinancing costs ($3,000 to $6,000 typically) when calculating the total cost of ownership under various interest rate scenarios. The strategic purchase of points is most effective when the buyer intends to maximize the duration of the lower rate, making it a defensive measure against prolonged high-rate periods.

- High Rates: Points offer maximum benefit when starting rates are high (above 6.5%), as the absolute dollar savings per basis point reduction is greater.

- Low Rates: When rates are low (below 4%), the impact of points is diminished, and the capital might be better utilized elsewhere.

- Opportunity Cost: Evaluate if the upfront cash used for points could generate a higher return (e.g., in high-yield savings or short-term Treasury bills) than the interest saved.

Furthermore, the opportunity cost must be quantified. If the $4,000 required for the points could have been invested in a diversified index fund yielding an average annual return of 8%, the buyer foregoes potential investment gains. However, the guaranteed, tax-deductible reduction in housing debt risk often outweighs speculative investment returns, especially for risk-averse first-time buyers focused on stabilizing their largest monthly expense.

The Intersection of Points, Down Payments, and Cash Constraints

A significant challenge for first-time buyers is the tension between accumulating enough cash for a substantial down payment and reserving funds to purchase points. With median home prices elevated, even a minimal 3% to 5% down payment represents a significant capital outlay. According to J.P. Morgan research, 45% of first-time buyers cite insufficient savings for the down payment and closing costs as their primary barrier to entry.

The Federal Housing Administration (FHA) and conventional loan programs offer flexibility regarding down payments, but closing costs, which include points, can easily add 2% to 5% of the loan amount. Buyers who are severely cash-constrained may need to opt for a higher interest rate (taking lender credits instead of paying points) to minimize immediate cash requirements. Lender credits, which cover closing costs, effectively increase the interest rate, but preserve liquidity.

Creative Financing and Assistance Programs

First-time buyer assistance programs, state-level grants, and specialty financing often address down payment gaps but may have restrictions on how funds can be used for discount points. Buyers should investigate programs that allow for ‘gift funds’ or ‘seller concessions’ to cover closing costs, including points. Seller concessions, where the seller agrees to pay a portion of the buyer’s closing costs, can be a powerful tool in a buyer’s market or a cooling market segment, effectively transferring the cost of buying down the rate to the seller.

For example, if a seller offers a 3% concession on a $400,000 home ($12,000), the buyer can use a portion of that $12,000 to purchase two points ($8,000), reducing their rate by 0.50% without depleting their personal savings allocated for the down payment. This arrangement is financially optimal: the buyer secures a lower rate for 30 years using the seller’s capital, thereby mitigating the initial cash constraint.

The ability to negotiate seller concessions is critical for maximizing the effectiveness of a mortgage points strategy. In the slower transaction environment of late 2024, data from Redfin indicates that the percentage of sellers offering concessions has increased from 25% in Q4 2023 to 38% in Q3 2024, providing a window of opportunity for savvy first-time buyers to leverage this mechanism. This shifts the focus from simply minimizing cash outlay to strategically deploying third-party funds to optimize the debt structure.

Tax Implications of Mortgage Discount Points

The Internal Revenue Service (IRS) provides specific guidelines regarding the deductibility of mortgage points, which can significantly enhance the financial appeal of purchasing them. Generally, points paid to acquire a principal residence mortgage are considered prepaid interest and may be fully deductible in the year they are paid, provided certain criteria are met. This immediate tax benefit reduces the effective cost of the points.

Deductibility Rules and Amortization

The IRS requires that the charging of points must be an established business practice in the area, and the points paid must not exceed the amount generally charged. Crucially, the points must be paid solely to obtain the mortgage and not for other services. If the points are used to refinance a mortgage, they must generally be amortized and deducted over the life of the loan, rather than being deducted in the year of payment.

For first-time buyers purchasing their primary residence, the ability to deduct the full cost of the points in year one provides an immediate cash flow benefit via reduced tax liability. For a buyer in the 24% tax bracket, a $4,000 point expenditure translates to a $960 immediate tax reduction. This effectively reduces the net cost of the points from $4,000 to $3,040, shortening the break-even period significantly.

- Primary Residence: Points are generally fully deductible in the year paid.

- Refinancing: Points must be spread out and deducted over the life of the new loan.

- Tax Bracket Impact: Higher tax brackets yield greater immediate savings, making the point strategy more attractive for higher-earning first-time buyers.

The tax treatment reinforces the long-term benefit of the strategy. While the monthly cash savings begin immediately, the tax savings are realized when filing the annual return, providing a significant lump sum that can be reinvested or used to replenish savings. Financial planners often advise maximizing this deduction, particularly in the first year of homeownership when other large, non-recurring expenses are common.

Future Rate Projections and Strategy Adjustments

The decision to buy points is inherently a bet on the future trajectory of interest rates and inflation. As of Q4 2024, the consensus among Federal Reserve watchers suggests that while the Fed may have reached its terminal rate, significant rate cuts are unlikely until inflation sustainably hits the 2% target. Analysts at Bank of America project only modest rate cuts (75 basis points) throughout 2025, which would translate to a potential 30-year fixed mortgage rate drop of roughly 50 basis points.

If rates drop significantly, say from 7.0% to 5.5%, the buyer who paid points will likely refinance, potentially negating the full benefit of their initial investment. However, if rates remain elevated (the “higher-for-longer” scenario), the buyer who purchased points benefits immensely, locking in savings for years to come. This makes the point strategy a form of interest rate insurance.

The Higher-for-Longer Scenario and Defensive Strategy

In a scenario where the 30-year fixed rate averages 6.5% for the next five years, the buyer who secured a 6.25% rate by paying one point has made a successful defensive move. They have effectively insulated themselves from prolonged high borrowing costs. Conversely, the buyer who took lender credits for a 7.25% rate will endure substantially higher monthly payments during this period, eroding household cash flow.

The strategic adjustment for first-time buyers should be dynamic. If the initial loan rate is exceptionally high (e.g., 7.5% or more), purchasing 1.5 to 2 points to bring the rate closer to 7.0% is often advisable, as the savings are substantial and the psychological benefit of a lower headline rate is significant. However, if the market offers a competitive rate (e.g., 6.0%), the marginal benefit of buying points diminishes, and the buyer should prioritize cash reserves.

The current volatility in the Treasury market, driven by fluctuating inflation expectations and geopolitical risk, means the cost of borrowing (mortgage rates) can change weekly. First-time buyers must lock in their rate and point structure quickly after determining the break-even point. Delaying the decision by even a few weeks can result in a higher starting rate, requiring more points to achieve the desired monthly payment level, ultimately increasing the upfront cost of entry.

The Role of Mortgage Points in Long-Term Wealth Accumulation

While the immediate focus of a mortgage points strategy is reducing monthly housing expenses, the long-term implication is the preservation of capital and acceleration of equity accumulation. A lower interest rate means a larger portion of the monthly payment is allocated to principal reduction, thereby increasing the speed at which the buyer builds equity in the home.

Consider the total interest paid over the life of a 30-year, $300,000 loan. At 7.0%, the total interest paid is approximately $419,000. At 6.5% (achieved by paying two points, or $6,000), the total interest paid drops to about $386,000. The long-term interest savings of $33,000 far outweigh the initial $6,000 investment, representing a substantial return on investment over three decades. This comparison highlights the powerful leverage of small rate reductions over extended periods.

Equity Acceleration and Financial Stability

For first-time buyers, homeownership is often the primary vehicle for wealth creation. By accelerating the build-up of equity, the buyer gains financial flexibility, including the potential for a home equity line of credit (HELOC) or the ability to sell the property with a larger profit margin sooner. The reduced monthly payment also improves the household’s debt-to-income (DTI) ratio, strengthening their overall financial profile for future credit needs.

Furthermore, locking in a lower rate provides greater stability against future economic shocks. Should the buyer face job market uncertainty or unexpected expenses, the lower, fixed mortgage payment acts as a financial anchor. This long-term stability is a non-monetary benefit that financial analysts often categorize as risk mitigation, crucial in the volatile post-pandemic economic environment. The strategic use of discount points is therefore not just a cost-saving measure, but a robust component of long-term financial planning for stability and optimized wealth accumulation.

In summary, the deepening affordability crisis demands that first-time buyers move beyond simple rate shopping. They must treat the purchase of discount points as a sophisticated capital expenditure, one that requires rigorous break-even analysis, consideration of tax benefits, and alignment with their expected tenure in the home. Amidst sticky inflation and a ‘higher-for-longer’ rate outlook from the Federal Reserve, the calculated payment of points offers a defensible, data-driven path to make homeownership financially sustainable for the next generation of buyers.

| Key Factor/Metric | Market Implication/Analysis |

|---|---|

| Median Home Price (Q2 2024) | At $406,700 (NAR data), high capital requirement necessitates optimizing long-term debt cost. |

| 30-Year Fixed Mortgage Rate | Rates above 6.5% increase the value proposition of discount points; savings are substantial. |

| Typical Break-Even Period for Points | 48–60 months; requires long-term ownership commitment (5+ years) to realize net savings. |

| Seller Concession Rate (Q3 2024) | Increased to 38% (Redfin); buyers can utilize concessions to fund points and preserve liquidity. |

Frequently Asked Questions about Mortgage Points Strategy

Calculate the monthly interest savings resulting from the rate reduction, then divide the total cost of the points by that monthly saving. This determines the break-even period in months. If you plan to own the home beyond this period, the points offer a positive net return.

Prioritize meeting the minimum down payment threshold (e.g., 20% to avoid Private Mortgage Insurance or PMI). Once that threshold is met, allocate remaining capital to points if the projected ownership tenure exceeds the break-even period (typically 5 years), optimizing debt cost.

Yes, points paid to acquire a mortgage for a primary residence are generally fully deductible as prepaid interest in the year they are paid, according to IRS guidelines, provided the cost reflects local established business practice.

If you refinance before the break-even point, you lose the unrecouped portion of the investment. For example, if the break-even is 60 months and you refinance at 36 months, you effectively absorb a loss, making early refinancing financially detrimental to the points strategy.

Seller concessions are funds provided by the seller to cover the buyer’s closing costs. These funds can be explicitly directed towards purchasing discount points, allowing the buyer to secure a lower interest rate without using their personal cash reserves for the upfront expenditure.

The Bottom Line

The intensifying housing affordability crisis, characterized by high prices and persistent elevated interest rates, requires first-time buyers to adopt sophisticated financial strategies. The calculated application of a mortgage points strategy moves beyond simple cost calculation to become a vital risk management tool. By pre-paying interest, buyers secure lower, more stable monthly payments, accelerating equity build-up and providing essential insulation against a potentially prolonged period of high borrowing costs, as projected by Federal Reserve commentary and bond market pricing. While the upfront cash requirement is a constraint, leveraging tax deductibility and negotiating seller concessions can mitigate this barrier. Moving forward, first-time buyers must continuously monitor the 10-year Treasury yield and inflation data—key indicators influencing long-term mortgage rates—to ensure their point strategy remains aligned with evolving macroeconomic conditions and their personal financial horizon. The decision is ultimately a time-value-of-money analysis, demanding precision and a commitment to long-term homeownership.