Fed Rate Cut Odds at 87%: 401k Impact and Investor Strategy

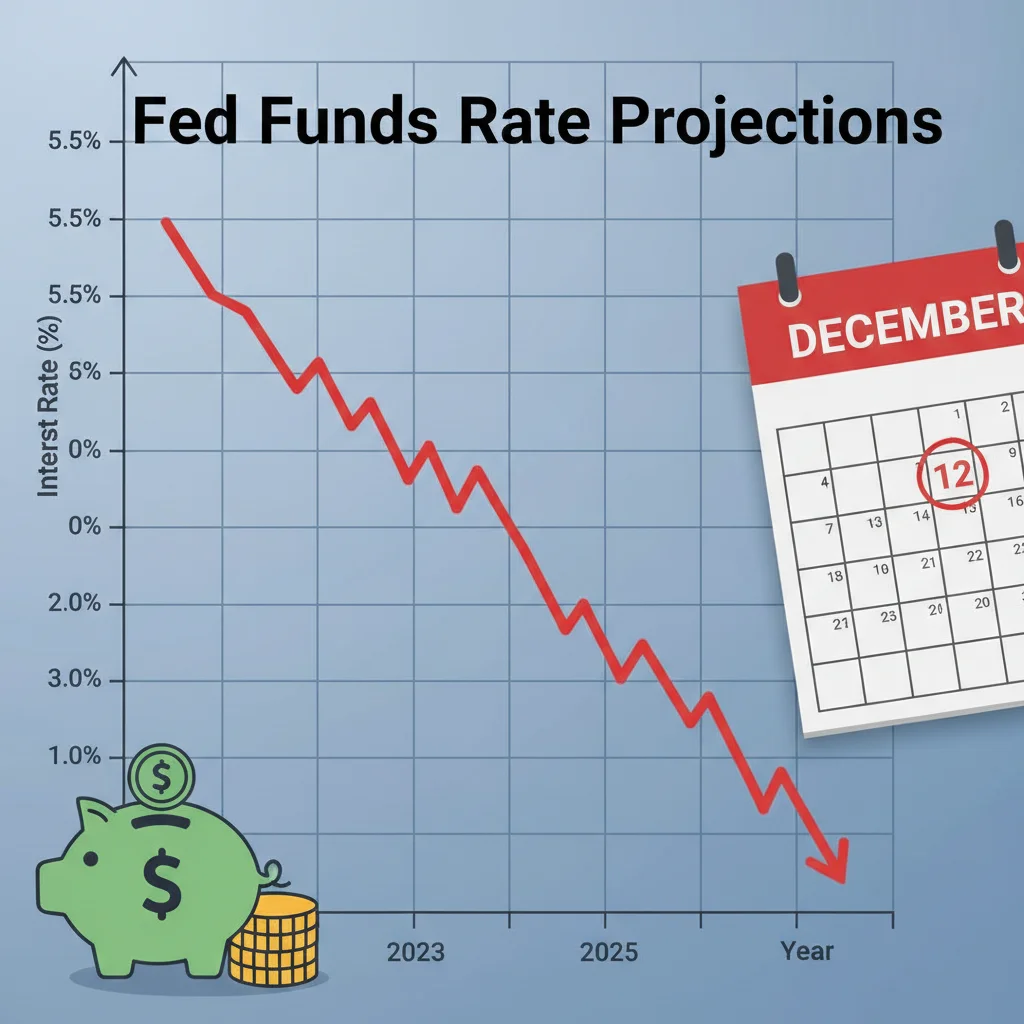

The 87% probability of a Federal Reserve rate cut by December signals a potential shift toward monetary easing, profoundly impacting fixed income, equity valuations, and the long-term growth trajectory of retirement accounts like the 401k.

The market consensus, based on the CME FedWatch Tool, placing the odds of a Federal Reserve interest rate reduction by December at an overwhelming fed rate cut odds at 87% in December: what it means for your 401k, represents a critical inflection point for monetary policy and investor strategy. This high probability reflects persistent economic data suggesting inflation is decelerating toward the Fed’s 2% target, coupled with mounting concerns about potential economic softening in late 2024 and early 2025.

The mechanics of monetary policy and the 87% probability

The Federal Reserve’s interest rate decisions, specifically the target range for the federal funds rate, are the primary tool for influencing the broader economy. When the market assigns an 87% probability to a rate cut, it signifies that traders in the futures market have largely priced in this outcome, often preempting the official announcement. This pricing mechanism is driven by recent economic releases, including the Consumer Price Index (CPI) report, which showed year-over-year inflation dipping to 3.1% in the latest reading, and the slowing pace of job creation reported by the Bureau of Labor Statistics (BLS).

A rate cut, typically 25 basis points, is a direct signal of monetary easing. It lowers the cost of borrowing for banks, which percolates through the entire financial system, affecting everything from mortgage rates to corporate debt financing. The prevailing sentiment among economists at institutions like Goldman Sachs and JPMorgan Chase is that the Fed is shifting its focus from aggressively combating inflation to ensuring a soft landing for the economy, maintaining growth while managing price stability. This pivot is critical for investors, as it fundamentally changes the backdrop for asset valuation, particularly within retirement vehicles like the 401k.

Interpreting the CME FedWatch Tool Data

The CME FedWatch Tool derives its probabilities directly from trading activity in federal funds futures contracts. When the chance of a cut reaches 87%, it means the vast majority of market participants are betting on lower rates. This consensus often leads to a self-fulfilling prophecy in the short term, as financial institutions adjust their positioning in anticipation. Investors should view this high probability not as a guarantee, but as the dominant market expectation, which is already influencing current asset prices.

- Inflation Trajectory: Key driver for the cut, with core Personal Consumption Expenditures (PCE) inflation projected to hit 2.5% by Q4, according to the Congressional Budget Office (CBO).

- Labor Market Softening: Unemployment rate rising slightly above 4.0% suggests reduced wage pressure, allowing the Fed room to ease.

- Global Economic Headwinds: Slower growth in key trading partners, particularly in Europe and Asia, adds pressure on the Fed to support domestic economic momentum.

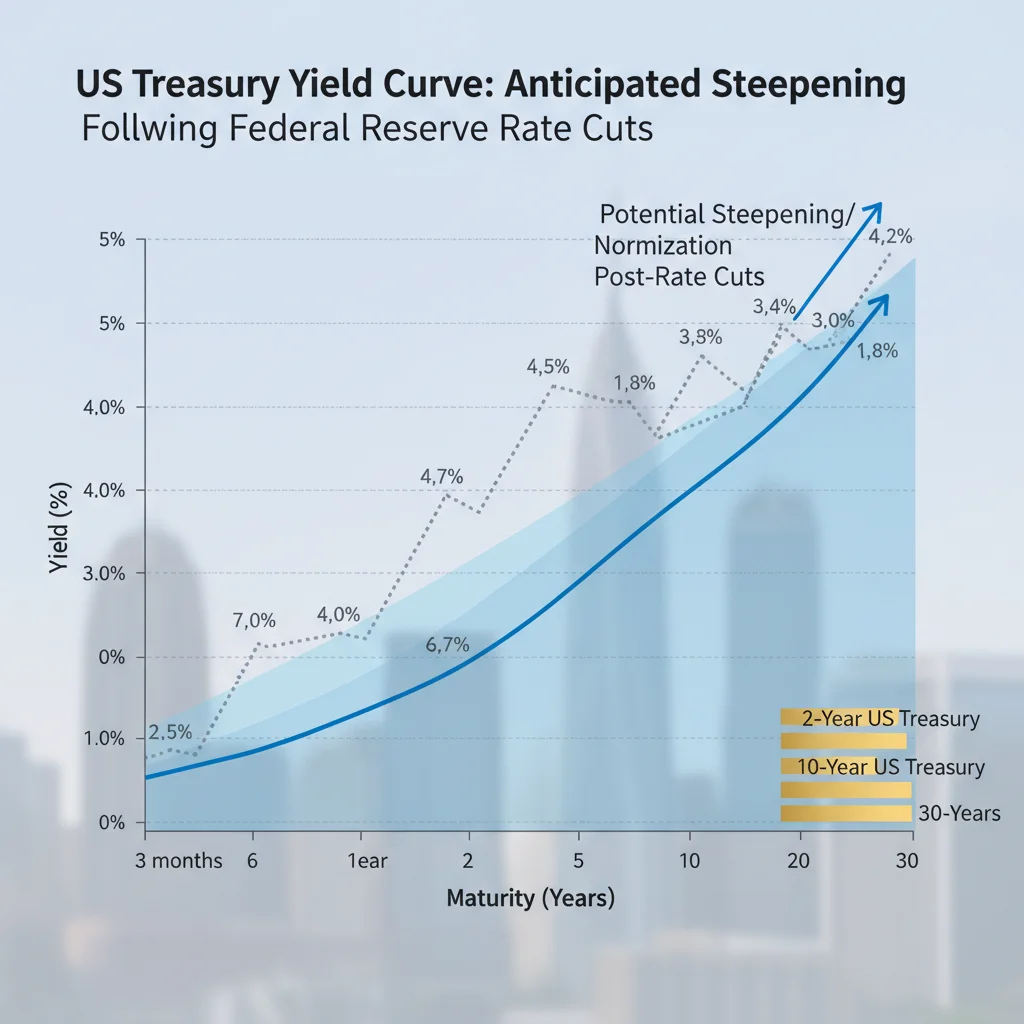

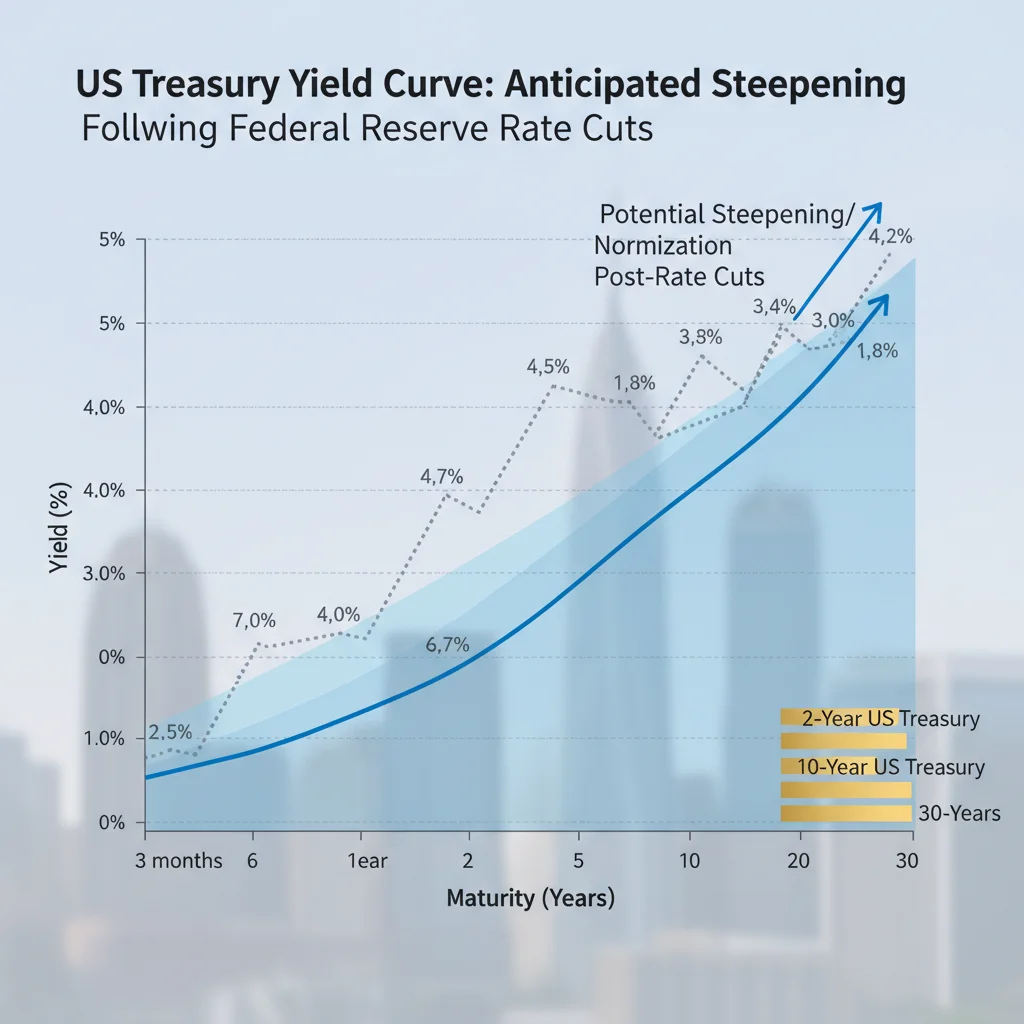

- Yield Curve Inversion: Persistent inversion of the two-year and ten-year Treasury yields continues to signal recessionary risks, which rate cuts aim to mitigate.

The implications of an 87% probability are immediate for fixed-income markets. Bond prices typically move inversely to yields; thus, anticipation of lower rates has already fueled a rally in longer-duration Treasuries. However, the true impact on the 401k depends on the specific mix of assets held within the retirement portfolio, requiring a nuanced understanding of how easing impacts equities versus bonds.

Impact on equities and the 401k growth trajectory

For most Americans, the 401k is heavily weighted toward equities, making the stock market’s reaction to anticipated rate cuts paramount. Historically, a Federal Reserve easing cycle is generally positive for stock valuations, especially for growth sectors. Lower interest rates reduce the cost of capital for corporations, boosting profit margins and making future earnings streams more valuable when discounted back to the present. This phenomenon is particularly beneficial for companies that rely heavily on debt financing or those in high-growth, technology-intensive sectors.

The S&P 500 index has demonstrated resilience in periods leading up to rate cuts, often driven by optimism regarding improved economic conditions or avoided recessions. However, the market’s response is not uniform. Analysts at Morgan Stanley point out that a rate cut driven by concerns over a sharp economic slowdown—rather than proactive policy normalization—could lead to initial volatility, particularly affecting cyclical stocks that are sensitive to economic contraction. Conversely, defensive sectors like healthcare and consumer staples might provide relative stability.

Sectoral winners and losers under monetary easing

The anticipated rate cut creates distinct winners and losers within the equity landscape. High-multiple growth stocks, particularly those in the technology and communication services sectors, typically benefit most. Their valuations are highly sensitive to the discount rate used to calculate the present value of their long-term projected cash flows. A lower rate significantly increases this present value.

Conversely, the financial sector, including banks and insurance companies, often faces margin compression. Banks typically profit from the spread between their short-term borrowing costs and their long-term lending rates. When the Fed cuts short-term rates, this spread can shrink, potentially reducing net interest margins (NIMs). Investors should scrutinize the holdings within their equity funds, particularly large-cap index funds, to understand their exposure to these sectoral shifts.

- Technology (Growth): Expected to see valuation boosts due to lower discount rates and improved access to cheap capital for expansion.

- Real Estate (REITs): Lower rates reduce mortgage costs, stimulating housing demand and increasing the profitability of Real Estate Investment Trusts (REITs).

- Utilities (Defensive): Often treated as bond proxies; they become more attractive as their high dividend yields stand out against falling bond yields.

- Financials (Banks): May face challenges due to compressed net interest margins, requiring careful selection of banks with strong fee-based income streams.

For the average 401k participant, the net effect is likely positive, contingent on a successful soft landing. If the rate cut helps stabilize growth and avoids a severe recession, the equity portion of the 401k should continue to appreciate, compounding returns over the long term. Data from the Investment Company Institute (ICI) shows that over 60% of 401k assets are allocated to equities, underscoring the importance of this positive market dynamic.

Fixed income implications: bonds and money market funds

The fixed-income component of a 401k, which includes bond funds and stable value funds, experiences the most direct and predictable impact from Federal Reserve rate cuts. As the 87% probability suggests lower rates are imminent, investors holding existing bonds benefit from price appreciation. When new bonds are issued at lower coupon rates, older bonds with higher coupons become more valuable in the secondary market.

This effect is magnified in long-duration bonds (those maturing in 10 years or more). The Bloomberg US Aggregate Bond Index typically rallies significantly as rate expectations shift down. Therefore, individuals nearing retirement, who often hold a larger percentage of their 401k in bonds for capital preservation, are likely seeing a temporary boost in the value of these holdings. However, this capital appreciation is a one-time event; the future reinvestment risk increases.

Reinvestment risk and yield environment

While current bondholders benefit, those who rely on interest income face reinvestment risk. As their existing bonds mature, they must reinvest the principal at the new, lower prevailing interest rates. This is a crucial consideration for retirees who depend on fixed-income payouts for living expenses. The yield on high-quality corporate bonds and municipal bonds will decrease in tandem with Treasury yields, translating to lower income generation over time.

Furthermore, the anticipation of rate cuts drastically changes the appeal of cash equivalents and money market funds. These funds, which have offered yields exceeding 5% in the restrictive rate environment, will see their returns rapidly diminish. According to Federal Reserve data, the yield on three-month T-bills often tracks the Fed funds rate closely. As the Fed cuts, these short-term yields fall, reducing the effective return on cash held within the 401k or outside of it.

- Duration Sensitivity: Longer-duration bond funds will experience greater price appreciation but higher sensitivity to any unexpected rate hikes.

- Credit Quality: Lower rates often encourage investors to seek higher yields in lower-quality corporate bonds (junk bonds), increasing credit risk within portfolios.

- Money Market Returns: Expect yields on money market accounts and short-term CDs to drop proportionally to the Fed’s cuts, potentially falling below 4% rapidly.

- Stable Value Funds: These funds, common in 401ks, aim for capital preservation and moderate returns, but their crediting rates will face downward pressure from the lower interest rate environment.

Investors should reassess their fixed-income allocation, perhaps considering slightly higher credit risk or moving some capital toward inflation-protected securities (TIPS) if inflationary pressures are expected to remain elevated even after the cut.

The housing market and real estate exposure in 401k

Although most 401k plans do not allow direct investment in residential property, participants often gain exposure through Real Estate Investment Trusts (REITs) or mutual funds specializing in real estate assets. The correlation between Federal Reserve policy and the housing market is strong: lower interest rates directly translate to lower mortgage rates, stimulating demand and supporting property values.

The average 30-year fixed mortgage rate, which peaked near 8% during the height of the inflation fight, is expected to retreat significantly following the December rate cut. Economists at the National Association of Realtors (NAR) project that a 100 basis point drop in the federal funds rate could potentially bring 30-year mortgage rates below 6.5%, significantly improving housing affordability and transaction volume. This surge in activity benefits equity REITs focused on residential and commercial properties.

REIT performance and leverage sensitivity

REITs, which are legally required to distribute at least 90% of their taxable income to shareholders, often utilize significant leverage. Lower borrowing costs directly improve their profitability and dividend sustainability. This makes REITs a compelling asset class in a rate-cutting environment, offering both potential capital appreciation and high dividend yields that can boost overall 401k returns.

However, investors must differentiate between equity REITs (which own properties) and mortgage REITs (mREITs), which invest in mortgage-backed securities. MREITs are highly sensitive to yield curve movements and can face volatility if the yield curve steepens too quickly. Due diligence is essential; a diversified real estate fund within the 401k, focused on high-quality properties, is generally the preferred approach for retirement savers seeking exposure to this sector during monetary easing.

The infrastructure sector, often accessed via specialized funds, also benefits. Companies managing essential services like pipelines, toll roads, and utilities often carry large debt loads. Reduced financing costs enhance the profitability of these long-term assets, providing stable, inflation-hedged returns that can fortify a balanced 401k portfolio against market turbulence.

Currency dynamics and international diversification

A rate cut by the Federal Reserve, especially one that precedes similar moves by other major central banks, typically weakens the U.S. dollar (USD). This currency dynamic has profound implications for the international component of a 401k portfolio, which is often composed of emerging market and developed international equity funds.

A weaker dollar makes U.S. goods and services cheaper for foreign buyers, boosting the earnings of multinational U.S. companies (which constitute a large portion of the S&P 500). Furthermore, it increases the dollar value of returns generated by foreign investments. For example, if a U.K. equity fund returns 5% in pound sterling, and the dollar weakens against the pound, the dollar-based return for the U.S. investor will exceed 5%.

Emerging markets and dollar debt

Emerging markets (EM) are particularly sensitive to dollar strength. Many EM governments and corporations issue debt denominated in U.S. dollars. When the dollar weakens as a result of Fed easing, the local currency cost of servicing this debt decreases. This improves the financial health of these economies and typically leads to a rally in emerging market equities and bonds. Strategists at BlackRock have advised increasing allocations to EM debt and equities in anticipation of a prolonged period of dollar weakness driven by Fed rate cuts.

Conversely, a strong dollar environment, characteristic of the recent period of restrictive monetary policy, created headwinds for these investments. The shift implied by the 87% fed rate cut odds in December suggests a reversion of this trend, making international diversification within the 401k more rewarding. Investors should review their portfolio’s international allocation, ensuring it reflects the potential tailwinds from currency depreciation.

- Multinational Earnings: U.S. companies with significant overseas revenue will report higher dollar-denominated profits.

- Emerging Market Debt: Reduced burden of dollar-denominated debt improves sovereign and corporate balance sheets in developing nations.

- Foreign Equity Returns: Dollar weakness acts as a tailwind, converting foreign currency gains into greater U.S. dollar returns for 401k investors.

- Commodities: As commodities like oil and gold are priced in USD, a weaker dollar often makes them cheaper for foreign buyers, pushing prices higher, benefiting commodity-linked funds.

The global market context, shaped by the Fed’s actions, underscores the value of maintaining a globally diversified portfolio, ensuring that the 401k captures returns from easing cycles both domestically and internationally.

Strategic 401k adjustments for the new rate environment

While the core principle of long-term retirement saving remains unchanged—consistent contributions and diversification—the high probability of a rate cut warrants a strategic review of 401k allocations. This review should focus on adjusting the portfolio’s sensitivity to interest rates (duration) and its exposure to sectors that thrive in a lower-rate environment.

For younger investors with lengthy time horizons, the focus should remain heavily on equities, potentially tilting toward high-quality growth stocks that benefit most from cheaper capital. For those closer to retirement, the challenge is balancing capital preservation with the need for income that combats inflation. The traditional 60/40 portfolio (60% equities, 40% bonds) may require modification, given the lower prospective returns on fixed income.

Considering active management versus index funds

In a rapidly changing rate environment, active management funds may have an advantage over passive index funds. Active bond managers can adjust duration quickly, moving into different segments of the yield curve or shifting credit quality to optimize returns as the Fed moves. Similarly, active equity managers can selectively target companies with strong pricing power and low debt loads that are positioned to outperform even if the economy slows slightly post-cut.

However, the higher fees associated with active funds must be justified by demonstrable outperformance. For the majority of 401k participants, adhering to low-cost, broadly diversified index funds remains the most reliable strategy, perhaps supplemented by a modest increase in exposure to specialized funds like REITs or international equities, which are poised to benefit from the easing cycle. The primary actionable step is ensuring the current allocation aligns with the investor’s risk tolerance, particularly regarding fixed income duration risk.

- Review Duration: Assess bond fund duration; longer duration means higher price appreciation potential but greater volatility if rate expectations change.

- Check Cash Weighting: Reduce oversized positions in money market or cash funds, as yields will decline significantly post-cut.

- Rebalance Equities: Ensure equity allocation hasn’t over-concentrated in defensive stocks during the high-rate phase; rebalance toward growth and international exposure.

- Utilize Employer Match: Regardless of market conditions, maximizing the employer matching contribution remains the highest guaranteed return for any 401k participant.

The economic reality is that lower rates are designed to stimulate borrowing and investment. 401k participants should position their accounts to capture this cyclical upswing, focusing on assets that provide leverage to economic recovery and declining financing costs.

Scenario analysis: what if the Fed doesn’t cut?

While the 87% probability strongly favors a rate cut, prudent financial planning requires considering the alternative scenario: the Federal Reserve maintains rates or, less likely, hikes them further. This could occur if the upcoming month’s inflation data proves stubbornly high, or if the labor market shows unexpected strength, contradicting the current softening trend.

If the Fed holds rates steady in December, it would constitute a significant surprise, likely leading to immediate market turbulence. Bond prices would fall sharply as yields spike, punishing investors who positioned for lower rates. The stock market, having priced in the benefit of cheaper capital, would likely experience a sell-off, particularly in interest-rate-sensitive sectors like technology and real estate.

Market reaction to a surprise hold

A surprise decision to hold rates would signal the Fed’s commitment to fighting inflation is stronger than anticipated, prioritizing price stability over growth concerns. The immediate impact would be a repricing of risk across all assets. Banks and financial institutions might benefit from higher net interest margins, but the overall economic outlook would darken, increasing the probability of a harder economic landing in 2025.

Investors who have moved aggressively into long-duration bonds or high-multiple growth stocks based on the 87% odds would face the greatest losses. This emphasizes the importance of diversification and maintaining a strategic, rather than tactical, approach within the long-term structure of a 401k. The risk management strategy should always account for the possibility that the market consensus is wrong, even when the odds are heavily skewed.

A key metric to watch in the event of a hold would be the movement in the two-year Treasury yield, which is highly sensitive to Fed expectations. A sharp rise in the two-year yield above the ten-year yield would deepen the yield curve inversion, reinforcing recession signals. This scenario underscores the need for 401k participants to ensure their portfolios have sufficient defensive exposure, such as high-quality corporate bonds or funds with low volatility characteristics, to withstand sudden shifts in monetary policy expectations.

| Key Factor/Metric | 401k Investment Implication |

|---|---|

| 87% Rate Cut Probability | Market prices in lower borrowing costs; favors growth equities and long-duration bonds. |

| Fixed Income Yield Decrease | Money market and cash returns diminish; increases reinvestment risk for bondholders. |

| Weaker USD Outlook | Provides tailwinds for international and emerging market equity funds within the 401k. |

| Corporate Cost of Capital | Lower rates boost corporate profit margins, supporting higher equity valuations, especially in leveraged sectors like real estate. |

Frequently Asked Questions about Fed Rate Cut Odds at 87% in December: What It Means for Your 401k

A rate cut typically causes existing bond prices to rise, generating immediate capital gains for your bond fund. However, as bonds mature, the fund must reinvest the principal at lower yields, subsequently reducing the income generated by the fixed-income portion of your 401k over the long term.

Lower rates favor growth stocks because their future earnings are discounted less heavily. While a complete shift is risky, analysts suggest ensuring adequate exposure to high-quality growth sectors, such as technology, which tend to outperform during monetary easing cycles, potentially boosting 401k performance.

The primary risk is opportunity cost and declining yield. Money market funds currently yielding over 5% will see returns fall sharply following the Fed cut, potentially eroding purchasing power over time. Experts recommend minimizing cash holdings unless liquidity is needed within the next 12 months.

The rate cut strengthens the case for maximizing contributions, especially if it leads to a stock market rally fueled by cheaper credit. Consistent dollar-cost averaging remains the optimal strategy, ensuring you benefit from potential equity appreciation and compounding returns during the easing cycle.

Yes, strategically. Consider slightly increasing exposure to international equities and real estate (via REITs), which benefit from a weaker dollar and lower borrowing costs. Avoid drastic, tactical shifts, but ensure your long-term allocation is positioned to capture the benefits of the anticipated lower rate environment.

The bottom line

The overwhelming 87% market expectation for a Federal Reserve rate cut in December is not merely a statistical curiosity; it represents a fundamental shift in the macro-financial landscape that retirees and active 401k participants must acknowledge. The transition from a restrictive monetary policy to an easing stance will reprice assets globally, favoring long-duration bonds, growth-oriented equities, and international investments. While the near-term outlook for portfolio appreciation is generally optimistic, driven by reduced borrowing costs and enhanced corporate profitability, investors must grapple with the long-term challenge of reduced fixed-income yields and increased reinvestment risk.

The key takeaway for 401k investors is the necessity of strategic vigilance. This is not the time for panic, but for precision. Review your fixed-income duration, check your international diversification, and ensure that your exposure to cash is appropriately minimized, given the imminent decline in short-term yields. While the 87% probability provides a strong directional signal, market participants must remain prepared for potential volatility if unexpected economic data forces the Fed to deviate from the consensus path. Ultimately, those who align their 401k allocations with the realities of a lower interest rate environment will be best positioned to maximize their retirement savings growth trajectory into 2025 and beyond.