ETF Inflows Hit Record $1.16 Trillion in 2025: Investment Trend Analysis

Projected data indicates that ETF inflows will reach an unprecedented $1.16 trillion globally in 2025, signaling a definitive structural shift toward passive investment vehicles and demanding a reevaluation of traditional asset allocation models by institutional and retail investors alike.

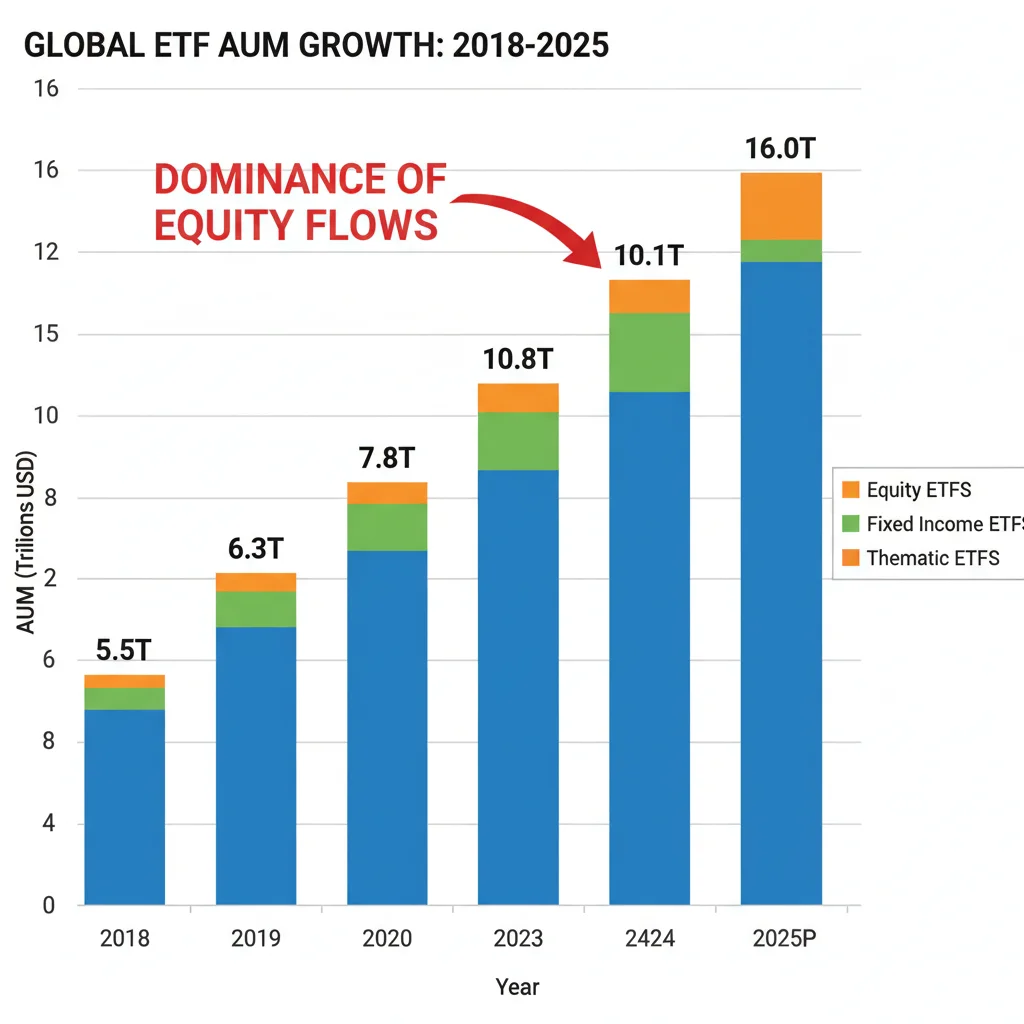

The financial landscape is experiencing a seismic shift, underscored by the projection that ETF Inflows Hit Record $1.16 Trillion in 2025: New Investment Trend Analysis confirms the definitive displacement of traditional active management by exchange-traded funds. This monumental capital flow, representing an approximate 20% increase over the previous peak observed in 2021, is not merely cyclical; it represents a fundamental, structural change in how capital is deployed across global markets. The implications stretch far beyond fund management fees, touching on market liquidity, price discovery mechanisms, and the long-term viability of high-cost investment structures.

The structural acceleration of passive dominance

The $1.16 trillion inflow projection for 2025 solidifies the trend of passive investment vehicles capturing an ever-increasing share of investor capital. This acceleration is driven by several converging factors: sustained fee compression, regulatory changes promoting transparency, and the continued underperformance of a significant portion of actively managed funds, particularly within large-cap U.S. equities. Data from Morningstar indicates that over a 10-year period ending December 2024, approximately 75% of actively managed U.S. equity funds failed to outperform their passive benchmarks after accounting for fees.

The appeal of ETFs centers on their low expense ratios and tax efficiency. The average expense ratio for passive equity ETFs currently sits below 0.15%, a stark contrast to the 0.80% or higher common among traditional actively managed mutual funds. This cost differential provides a measurable, compounding advantage for long-term investors. Furthermore, the creation/redemption mechanism inherent to the ETF structure minimizes capital gains distributions, enhancing their attractiveness in taxable brokerage accounts.

Fee compression and the zero-cost frontier

The competitive pressure among major fund providers, including Vanguard, BlackRock, and State Street Global Advisors, has pushed expense ratios towards zero for core index products. This trend forces active managers to justify their existence through demonstrable alpha generation, a hurdle many consistently fail to clear. The availability of broad-market exposure at virtually no cost acts as a powerful gravitational pull for assets.

- Core Equity Flows: Approximately 65% of the projected 2025 inflows are expected to target broad-based U.S. and global equity indices (e.g., S&P 500, MSCI World), confirming the preference for market-cap weighted exposure.

- Fixed Income Growth: Fixed income ETFs are projected to account for nearly 25% of the total inflows, driven by their superior liquidity and lower transaction costs compared to trading individual bonds, especially in less liquid segments like high-yield and municipal debt.

- Thematic and Active ETFs: While still a smaller portion, thematic and newly launched actively managed ETFs are capturing niche interest, benefiting from the ETF wrapper’s efficiency and transparency, even as they carry slightly higher fees than pure index funds.

The sheer scale of the 2025 inflows—$1.16 trillion—illustrates that this is no longer a debate between active and passive; it is a clear choice based on cost and reliability of strategy execution. Institutional adoption, particularly by pension funds and endowments seeking efficient beta exposure, is a significant contributor to this record growth, validating the product structure.

Dissecting the $1.16 trillion allocation: where is the capital going?

To understand the market impact, it is essential to analyze the composition of the projected record inflows. While U.S. large-cap equity remains the foundational pillar, emerging trends in fixed income and specialized thematic sectors are gaining momentum, reflecting sophisticated investor strategies in an evolving economic cycle.

Equity ETFs are expected to dominate, capturing approximately $750 billion of the total inflows. Within this segment, the shift is highly concentrated. U.S. technology and growth sectors, often accessed through sector-specific or growth-tilted ETFs, continue to attract capital, driven by the perceived long-term dominance of mega-cap technology firms.

The fixed income revolution in the ETF wrapper

The growth in fixed income ETFs is arguably the most transformative aspect of the current trend. For decades, bond markets were the exclusive domain of active managers due to the complexity and fragmentation of over-the-counter trading. ETFs have democratized access and dramatically improved liquidity. The $290 billion projected inflow into bond ETFs in 2025 reflects their utility as transparent, tradable alternatives to primary bond market transactions.

- Treasury Focus: Demand is high for short-duration Treasury ETFs, which serve as cash equivalents, capturing higher yields without significant interest rate risk, especially as the Federal Reserve maintains a data-dependent stance on monetary policy.

- Credit Exposure: Investment-grade corporate bond ETFs are favored for their yield pickup and ease of trading, allowing investors to adjust credit exposure quickly in response to economic data releases or corporate earnings reports.

- Municipal Bonds: Tax-exempt municipal bond ETFs offer diversification and essential liquidity for high-net-worth investors, bypassing the traditionally cumbersome process of sourcing individual municipal issues.

This flow into fixed income exacerbates the liquidity issues for traditional bond brokers, as more price discovery and trading activity moves onto exchange platforms. The standardization offered by the ETF structure is providing critical resilience to the bond market, particularly during periods of volatility, such as the interest rate hikes of 2023 and 2024.

Implications for market structure and price discovery

The record ETF record inflows 2025 raise profound questions regarding market efficiency and structure. When a vast amount of capital is channeled through vehicles that mechanically track indices, the process of price discovery—the mechanism by which individual security prices reflect all available information—can become distorted. This phenomenon is often referred to as the ‘passive paradox.’

As index funds automatically buy and sell based on index rebalances rather than fundamental analysis, they can amplify momentum effects. When a stock is added to a major index, the mandated buying by trillions of dollars in passive funds can temporarily inflate its price, disconnected from immediate underlying value. Conversely, removal leads to forced selling. This market mechanic creates opportunities for active traders who anticipate these index flows, but it also increases short-term volatility around rebalancing dates.

The concentration risk in mega-cap equities

The market-cap weighting of dominant indices, such as the S&P 500, means that ETF inflows disproportionately benefit the largest companies. By late 2024, the top five stocks in the S&P 500 accounted for over 25% of the index’s total capitalization, a concentration level not seen since the dot-com bubble. When $750 billion flows into equity ETFs, a substantial portion of that capital is allocated to these already massive firms, potentially exacerbating valuation disparities between mega-caps and smaller, fundamentally sound companies.

Analysts at Goldman Sachs estimate that every $100 billion inflow into broad-market ETFs results in an approximately $25 billion capital injection into the top ten index constituents. This concentration of capital movement necessitates careful monitoring of market breadth and potential contagion risk should these highly weighted stocks face sector-specific downturns or regulatory challenges. The liquidity provided by ETFs is generally positive, but the underlying concentration risk is a crucial element for investors to recognize.

The rise of actively managed and thematic ETFs

While passive index tracking dominates the sheer volume of inflows, the ETF structure itself is being adapted to house more sophisticated, active strategies. The regulatory approval of semi-transparent and fully transparent active ETFs has opened the door for traditional mutual fund managers to transition their strategies into the more efficient ETF wrapper. This segment, though smaller in flow volume (estimated at $120 billion for 2025), represents the future battleground for alpha generation.

Thematic ETFs, which target specific megatrends like artificial intelligence, clean energy infrastructure, or genomics, are also attracting significant retail and institutional capital seeking targeted growth exposure. These funds often exhibit higher volatility and expense ratios (frequently exceeding 0.50%) but offer focused access to nascent or rapidly expanding sectors.

Evaluating the active ETF wrapper

Active ETFs offer the potential benefit of manager skill combined with the operational advantages of ETFs, such as intra-day trading and tax efficiency. However, investors must scrutinize the actual performance of these funds. Simply being in an ETF wrapper does not guarantee outperformance; the manager’s ability to consistently generate alpha remains the primary determinant of success.

- Performance Scrutiny: Investors should demand a minimum three-year track record for active ETFs, focusing on risk-adjusted returns (e.g., Sharpe ratio) relative to relevant benchmarks, not just gross returns.

- Transparency Models: Understanding the mechanics of non-transparent active ETFs, such as those using the NYSE’s ActiveShares model, is vital, as they shield the manager’s daily portfolio holdings from front-running while maintaining market-maker efficiency.

- Skill vs. Trend: Distinguishing between a manager capitalizing on a short-term trend (beta) and one generating genuine value through stock selection (alpha) is critical for assessing the long-term viability of an active ETF.

The move by active managers into the ETF space acknowledges the irreversible shift in investor preference for the structure. It is an adaptation driven by competition, where the product wrapper is now as important as the underlying strategy. This segment contributes to the overall ETF Inflows Hit Record $1.16 Trillion in 2025: New Investment Trend Analysis by broadening the utility of the vehicle beyond pure index replication.

Macroeconomic drivers fueling the inflow surge

The macroeconomic environment plays a crucial role in directing the flow of the $1.16 trillion. Persistent, albeit moderating, inflation combined with the Federal Reserve’s cautious approach to interest rate adjustments creates a climate where investors prioritize cost efficiency and liquid access to diversified markets. In a low-to-moderate growth environment, minimizing expense leakage becomes paramount to maximizing net returns.

Furthermore, global political and economic uncertainty, particularly surrounding geopolitical tensions and upcoming national elections, increases the demand for simplicity and diversification. Broad-market ETFs provide a straightforward way for investors to maintain exposure to global growth while mitigating single-stock or single-region risks. The ease of use appeals to the growing demographic of self-directed retail investors utilizing commission-free platforms.

Interest rate policy and fixed income flows

The trajectory of U.S. interest rates remains a primary driver for fixed income ETF flows. As of early 2025, market expectations suggest a gradual reduction in the Federal Funds rate following the peak tightness cycle. This expectation drives capital into longer-duration bond ETFs seeking capital appreciation as yields fall. Conversely, uncertainty keeps significant funds parked in ultra-short duration and money market ETFs, which are included in the overall inflow calculations due to their high liquidity and convenience.

The availability of high-yield savings accounts and money market funds offering competitive rates acts as a temporary brake on some equity flows, but low-cost core ETFs remain the default choice for long-term strategic allocations. The ETF record inflows 2025 data confirms that investors view these products as essential building blocks regardless of the short-term rate cycle.

Challenges and risks associated with massive ETF growth

While the growth of ETFs is largely viewed as positive for investor costs and market access, the sheer velocity and volume of the $1.16 trillion inflow introduce systemic risks that regulators and market participants must address. The primary concern revolves around liquidity mismatch, particularly in less liquid asset classes like certain fixed income segments or specialized commodity ETFs.

In a severe market downturn, if a large volume of ETF shares are sold rapidly, the authorized participants (APs) responsible for maintaining the ETF’s price integrity must redeem those shares by selling the underlying assets. If the underlying market is illiquid—for example, high-yield corporate bonds—the APs may struggle to sell the bonds quickly enough without significantly impacting prices, potentially creating a decoupling between the ETF market price and its net asset value (NAV). While this risk has been managed effectively in past crises, the exponentially increasing AUM magnifies the potential systemic impact.

Regulatory scrutiny and market stability

U.S. regulatory bodies, including the Securities and Exchange Commission (SEC), are actively monitoring the operational risks associated with massive ETF growth. Specific attention is being paid to the use of derivatives and leverage within certain complex ETFs, as well as the resilience of the AP ecosystem under stress. The objective is to ensure that the liquidity promise of the ETF wrapper can withstand extreme market conditions without compromising broader financial stability.

- Stress Testing: Regulators require periodic stress tests on large ETF providers to assess their ability to manage simultaneous creation and redemption requests across multiple asset classes during volatile market events.

- Transparency Demands: There is ongoing regulatory pressure to enhance disclosure requirements for active and specialized thematic ETFs, ensuring investors fully understand the underlying strategies and associated risks.

- Market Impact: Studies continue on the long-term impact of passive flows on corporate governance. Since index funds rarely engage in active management, the increasing concentration of voting power in a few large passive managers raises concerns about accountability and stewardship.

The record inflows confirm investor confidence in the ETF mechanism, but sustainable growth requires robust regulatory oversight and careful risk management by the providers themselves. The industry must prove that its operational efficiency scales effectively with the trillions of dollars it now commands.

Strategic asset allocation in the age of the ETF

For financial advisors and self-directed investors, the ETF Inflows Hit Record $1.16 Trillion in 2025: New Investment Trend Analysis mandates a strategic reassessment of asset allocation. The primary takeaway is the normalization of low-cost beta as the default foundation of any diversified portfolio. Alpha generation is now relegated to tactical overlays and specialized asset classes where active management can truly demonstrate value.

The modern portfolio is increasingly built using a ‘Core-Satellite’ approach: a large, low-cost core of broad-market index ETFs (the beta component) supplemented by ‘satellite’ allocations to active ETFs, thematic funds, or individual securities where higher risk is justified by potential asymmetric returns. This strategy maximizes cost efficiency for the majority of the portfolio while allowing for strategic tilts based on market views.

Portfolio construction considerations

Investors should utilize the efficiency of ETFs to streamline rebalancing. The ability to trade entire baskets of securities instantly simplifies the process of bringing portfolio weights back to target allocations without incurring high transaction costs or significant tax events (when utilizing ETFs that minimize distributions). Furthermore, the wide array of sector and factor-based ETFs allows for precision in tactical weighting—for example, tilting toward value or quality factors during late-cycle economic phases.

The record inflows projected for 2025 underscore that capital is migrating to efficiency. Investors who fail to incorporate cost-effective ETFs into the foundation of their portfolios risk significant drag on long-term net returns. The focus must shift from selecting the ‘best’ fund manager to optimizing structural efficiency and maintaining disciplined adherence to a long-term strategic plan, leveraging the transparent and cost-effective nature of the ETF vehicle.

The total projected inflow figure is a powerful metric reflecting global investor consensus: the ETF is the dominant investment vehicle of the current era, demanding that all market participants adapt their strategies accordingly.

| Key Metric | Market Implication/Analysis |

|---|---|

| Total Projected ETF Inflows (2025) | $1.16 trillion, confirming a structural shift toward low-cost passive investment and away from traditional high-fee mutual funds. |

| Equity ETF Dominance | Expected to capture approximately $750 billion, increasing concentration risk in market-cap weighted mega-cap stocks. |

| Fixed Income ETF Flows | Projected $290 billion flow, enhancing liquidity and transparency in historically fragmented bond markets, particularly for corporate credit and Treasuries. |

| Average Passive ETF Expense Ratio | Below 0.15%, driving sustained competitive pressure on active managers who must consistently justify higher fees through alpha generation. |

Frequently asked questions about record ETF inflows

The record inflows signify that market access is becoming cheaper and more efficient. For the average investor, it confirms the long-term benefit of prioritizing low-cost, diversified index funds as the foundation of their portfolio, maximizing potential net returns by minimizing expense ratio drag.

While ETFs generally provide liquidity, large passive flows can amplify short-term volatility during index rebalancing periods. Since index funds buy and sell mechanically, they can cause temporary price fluctuations for securities being added or removed, creating opportunities for high-frequency traders.

Fixed income ETFs offer superior liquidity and diversification compared to individual bonds but carry duration and credit risk. Unlike holding a bond to maturity, an ETF’s price fluctuates with market interest rates and credit conditions; they are not guaranteed to return principal.

The main risk is market concentration. Because index ETFs are market-cap weighted, massive inflows disproportionately boost the valuations of the largest companies, potentially creating systemic risk should those mega-cap holdings face a sharp, simultaneous correction.

Many analysts recommend the transition due to the structural advantages of ETFs, including lower expense ratios, greater tax efficiency in taxable accounts, and intra-day trading flexibility. However, investors should consult a financial advisor regarding potential tax implications of selling existing mutual fund holdings.

The bottom line

The projected $1.16 trillion in ETF inflows for 2025 is more than a headline number; it is empirical proof of a completed paradigm shift in global asset management. The market has definitively voted in favor of efficiency, low cost, and transparency, cementing the ETF as the preferred vehicle for both beta exposure and increasingly, specialized alpha strategies. For investors, the takeaway is clear: the foundation of any long-term portfolio must be built upon these cost-effective instruments.

Going forward, market participants must monitor two key areas: first, the regulatory response to potential systemic risks posed by overwhelming concentration and liquidity mismatches in fixed income and complex products; and second, the performance trajectory of the new generation of active, transparent ETFs. These funds represent the last stand for active management, attempting to leverage the structural benefits of the wrapper without sacrificing the potential for outperformance. The trend confirms that the future of finance is about optimizing the delivery mechanism of investment strategy, and the ETF is currently the undisputed champion of that optimization.