Consumer Confidence Declining 28%: Holiday Spending Drop Looms

The sharp 28% decline in US consumer confidence signals a challenging holiday shopping season, with forecasts indicating a significant drop in discretionary spending as households prioritize essential goods amid elevated inflation and constrained credit.

Recent economic indicators paint a stark picture for the crucial year-end retail period, with the latest data showing US consumer confidence declining by a dramatic 28% from its peak earlier this year. This steep drop, driven primarily by persistent inflation pressures and the cumulative impact of higher borrowing costs, suggests that holiday spending is expected to drop significantly this year. Retailers, analysts, and market participants are now bracing for one of the most subdued holiday seasons in recent memory, a marked contrast to the robust post-pandemic spending surges observed previously.

The 28% confidence plunge: underlying macroeconomic drivers

The 28% retraction in consumer confidence, measured by the Conference Board’s Consumer Confidence Index, is not merely a statistical anomaly; it reflects fundamental shifts in household financial sentiment. This index, which surveys consumers on current business and labor market conditions, as well as their short-term outlook on income, business, and job prospects, has historically been a reliable leading indicator for future consumption patterns. The current pessimism is deeply rooted in macroeconomic realities that have eroded real wages and increased debt service costs for the average American family.

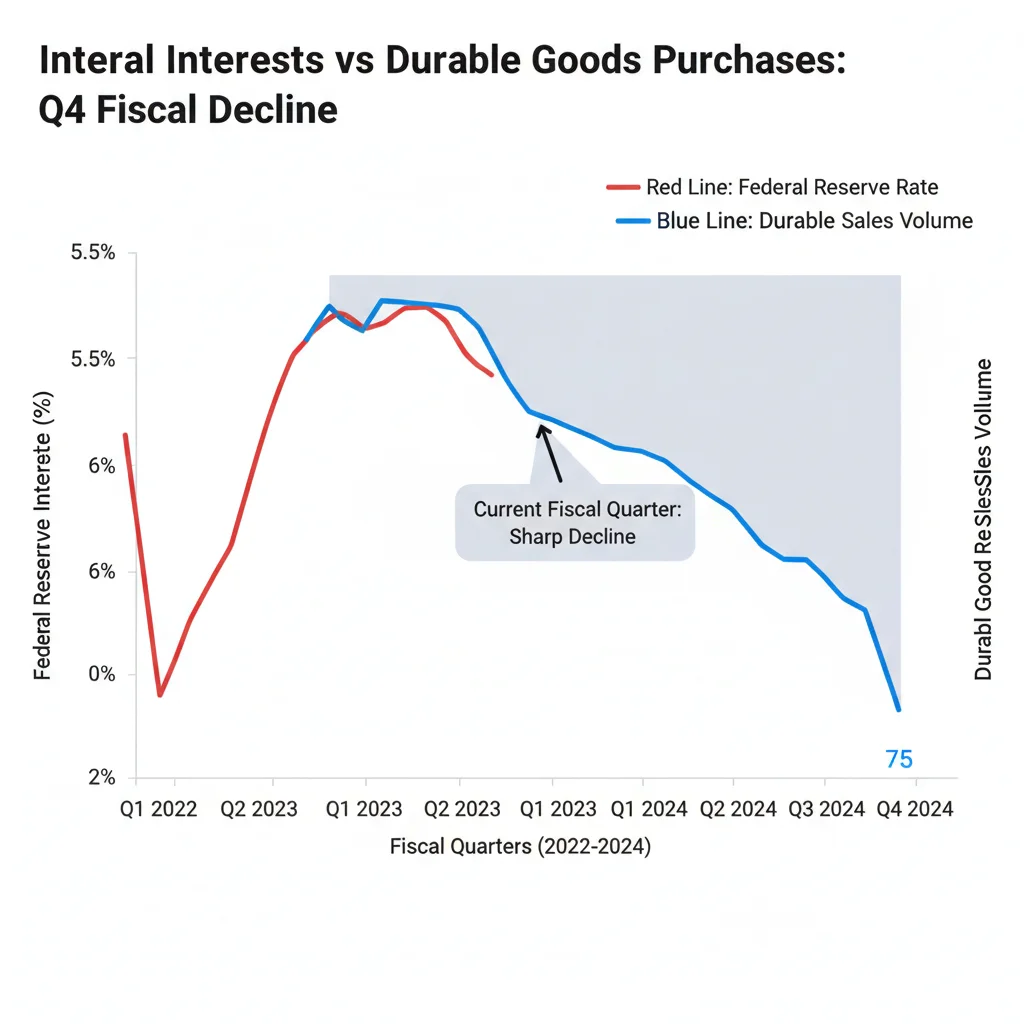

Specifically, two primary factors drive this bearish outlook. First, the persistent, above-target inflation in core service categories—such as housing, healthcare, and transportation—continues to squeeze household budgets. While headline inflation has moderated, the perceived cost of living remains high. Second, the Federal Reserve’s aggressive interest rate hiking cycle, which has pushed the federal funds rate to a multi-decade high, has severely impacted credit-dependent purchases, particularly for durable goods and large discretionary items typically associated with holiday splurges.

Inflation expectations and purchasing power erosion

Consumers are not just reacting to current prices; their inflation expectations are hardening, which influences their reluctance to spend. According to the New York Fed’s Survey of Consumer Expectations, the median one-year-ahead inflation expectation has remained stubbornly elevated at 3.7%, significantly higher than the Fed’s long-term 2% target. This expectation of sustained price pressure leads consumers to front-load essential purchases and postpone non-essential ones, directly impacting the holiday retail environment. The erosion of purchasing power is particularly acute for the bottom 50% of income earners, whose real wages, adjusted for inflation, have seen minimal growth or even contraction over the past 18 months.

- Core PCE Inflation: Remains elevated, hovering near 3.5% year-over-year, keeping the pressure on household budgets, especially for services.

- Real Wage Growth: Stagnant or negative for many income brackets, limiting the ability to absorb higher holiday prices without drawing down savings or incurring debt.

- Savings Rate Decline: The personal savings rate has fallen back toward pre-pandemic lows (around 3.5%), suggesting less buffer for unexpected expenses or discretionary holiday spending.

- Credit Card Utilization: Credit card balances hit a record high of $1.15 trillion in Q3, according to the Federal Reserve Bank of New York, signaling increased reliance on high-interest debt to maintain current consumption levels.

The consequence of this macroeconomic environment is a shift from optimistic forward guidance to extreme caution. When consumers feel less secure about their future income and face higher debt costs, the first budget line item to be reduced is discretionary spending, making the projected drop in holiday retail sales a logical outcome of the current financial landscape.

Retail sector risk assessment: forecasting the holiday slump

Retail analysts are systematically revising down their projections for the November-December holiday period, traditionally accounting for over 20% of annual retail sales. The National Retail Federation (NRF) initially projected growth in the 3% to 4% range, but current consensus among investment banks like Goldman Sachs and Morgan Stanley suggests growth will likely be closer to 1% to 2% in nominal terms. Crucially, when adjusted for inflation, this nominal growth translates into a real contraction in sales volume, confirming the expected drop in holiday spending.

The risk is not uniformly distributed across the retail landscape. Luxury goods and necessity retailers (groceries, discount stores) are expected to show greater resilience. The most vulnerable segments are mid-tier apparel, electronics (excluding must-have new releases), and home furnishings—categories highly dependent on consumer discretionary income and confidence. Companies like Macy’s, Gap, and certain big-box electronics retailers face significant inventory overhangs and margin compression as they resort to deeper discounting to clear seasonal stock, a direct consequence of the consumer confidence declining trend.

Inventory management and margin compression

Retailers entered Q4 with generally bloated inventories, anticipating a stronger consumer than materialized. This mismatch between supply and demand, exacerbated by the sharp decline in confidence, forces aggressive promotional activity. While beneficial for price-sensitive consumers, this discounting strategy severely compresses gross margins for retailers. For example, analysis of Q3 earnings reports showed average gross margins across the S&P 500 retail sector contracting by 120 basis points year-over-year. This margin pressure, coupled with rising labor costs and elevated logistics expenses, creates a challenging operating environment.

Investment banks are specifically monitoring the inventory-to-sales ratio. A rising ratio indicates that inventory is piling up relative to the speed at which it is sold, a sign of impending distress. Retailers that successfully navigated supply chain challenges earlier in the year now face demand destruction. The focus for investors has shifted from revenue growth to cash flow management and inventory optimization as protection against the projected holiday slump. Analysts at JPMorgan Chase note that retailers with strong omnichannel capabilities and flexible pricing strategies are best positioned to mitigate the worst effects of the expected spending drop.

- Discounting Depth: Expected to exceed 2023 levels across non-essential categories (e.g., apparel, toys), leading to lower average selling prices (ASPs).

- E-commerce Channel: While resilient, growth is decelerating, projected to rise 8% year-over-year versus 12% in the previous period, according to Adobe Analytics.

- Small Business Retailers: Highly exposed to reduced foot traffic and tightening local credit conditions, potentially facing higher rates of closure in Q1 2025.

- Profit Warnings: Increased likelihood of Q4 and Q1 profit warnings from mid-market retailers due to lower volumes and margin erosion from aggressive promotions.

The credit crunch: high interest rates and consumer debt limits

The Federal Reserve’s sustained commitment to keeping rates “higher for longer” is the primary monetary policy mechanism tightening the consumer purse strings. The effective cost of credit has surged across the board. The average interest rate on credit cards currently sits near 21.5%, a record high, making revolving debt exponentially more expensive. This is crucial because many consumers rely on credit during the holiday season. When the cost of borrowing is prohibitive, marginal spending decisions—like an extra gift or a large appliance purchase—are deferred or abandoned.

The impact of high rates extends beyond credit cards. Auto loan rates and personal loan rates have also increased, diverting more of the consumer’s monthly income toward debt servicing rather than discretionary consumption. Data from the Bureau of Economic Analysis (BEA) shows that the debt service ratio for households, the percentage of disposable personal income allocated to debt payments, is rising steadily, approaching levels last seen just before the 2008 financial crisis. This mounting financial obligation strongly supports the prediction that holiday spending is expected to drop.

Student loan repayments resume and their effect on spending

Compounding the credit crunch is the resumption of federal student loan payments, which restarted in Q4 after a multi-year pause. This single event represents a significant, non-discretionary shock to the budgets of tens of millions of US households. Estimates suggest that the resumption of payments could withdraw between $8 billion and $10 billion per month from the consumer economy. For younger, middle-income consumers—a key demographic for electronics and experiences—this new monthly expense directly displaces potential holiday expenditure. Economists at the Brookings Institution estimate that the negative multiplier effect from this payment resumption could shave off up to 0.2 percentage points from Q4 GDP growth.

Furthermore, the tightening of lending standards by commercial banks, as documented in the Fed’s Senior Loan Officer Opinion Survey (SLOOS), restricts access to new credit, particularly for subprime borrowers. This reduction in available liquidity means that even consumers who might be willing to take on debt for holiday purchases are finding it harder to do so. The combination of higher rates on existing debt and restricted access to new credit creates a powerful headwind against a strong retail season, ensuring the continued negative trend of consumer confidence declining.

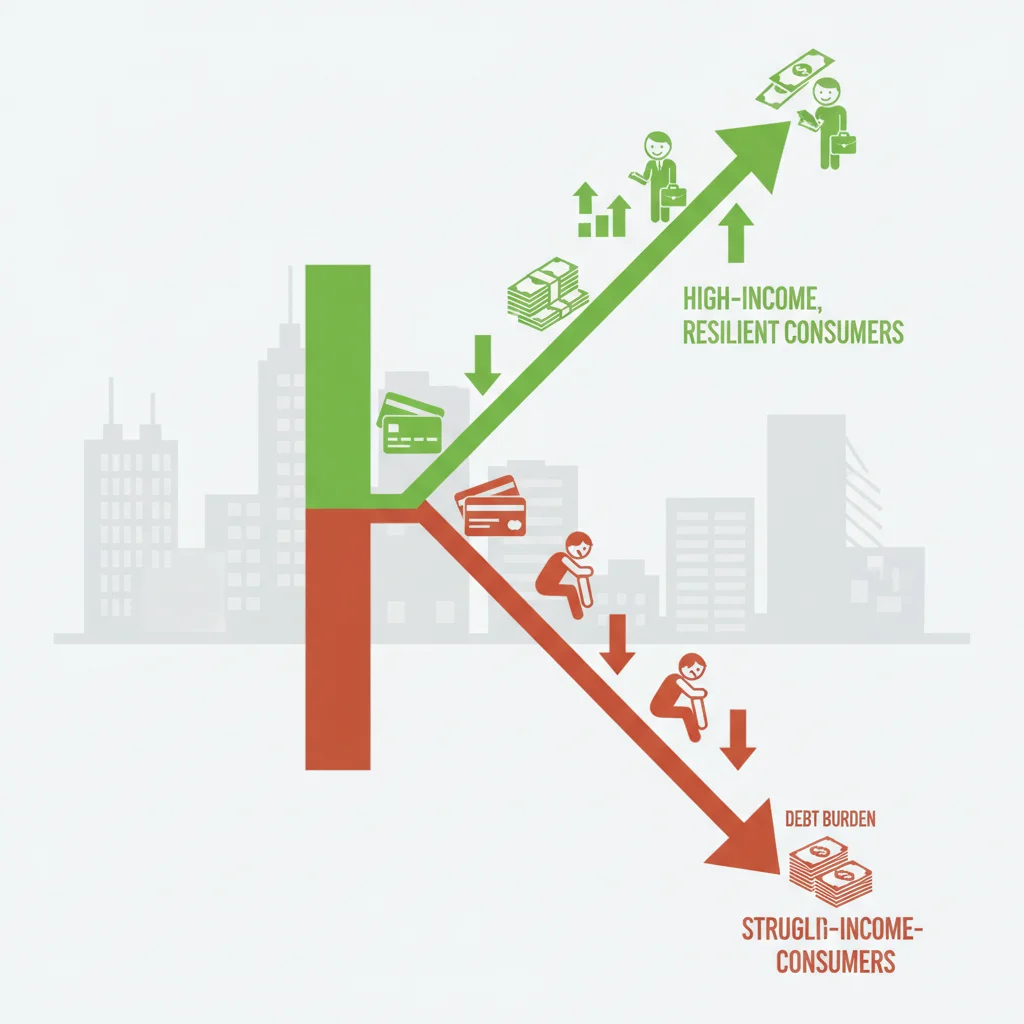

Divergence in consumer behavior: the k-shaped spending pattern

The overall drop in average consumer confidence masks a significant divergence in spending power, often referred to as a “K-shaped” recovery. High-income consumers (top quartile of earners) have largely retained their wealth, benefited from strong equity markets, and are less sensitive to incremental price increases or higher interest rates. Their spending remains relatively robust, focusing on luxury goods, high-end travel, and premium experiences. This segment is expected to continue spending, albeit perhaps more selectively than in previous boom cycles.

Conversely, low- and middle-income consumers are experiencing severe financial stress. They are depleting pandemic-era savings, facing higher debt costs, and disproportionately feeling the impact of inflation on necessities like food and energy. This divergence means that retailers targeting the mass market or relying heavily on impulse purchases from financially strained demographics will suffer the most significant sales declines. This dichotomy explains why luxury brands like LVMH and Hermès may post resilient earnings while mass-market retailers struggle with volume.

Shift from goods to services deceleration

While the post-lockdown spending shift favored services (travel, dining, entertainment), recent data suggests even this segment is slowing, especially among the middle class. The rapid rise in airfare and hotel costs has led to a plateau in travel demand, and restaurant traffic, while still positive, is showing deceleration. High-income households continue to drive the premium services market, but the overall volume growth is tempered by the withdrawal of lower-income participants. This deceleration in the services sector removes a potential offset for the expected contraction in goods spending.

- Luxury Retail Outlook: Projected for low single-digit growth (1%-3%), driven by resilient high-net-worth individuals, according to Bain & Company analysis.

- Necessity Spending: Expected to remain stable, shifting consumer funds towards essential food and utility payments, away from discretionary items.

- Experience Spending: Decelerating, particularly in mid-tier travel and entertainment, as high prices deter budget-conscious consumers.

- Used Goods Market: Expected to see increased activity, with consumers turning to resale platforms for gifts to manage tighter budgets, further suppressing new retail sales.

The K-shaped spending pattern underscores the necessity for retailers to fine-tune their segmentation strategies. Those who attempt a one-size-fits-all approach are likely to be caught between high operating costs and softening demand from the majority of the population whose consumer confidence declining is most pronounced.

Investor response: implications for q4 earnings and market sectors

Financial markets have already begun pricing in a weaker consumer outlook, with the S&P 500 Retail Index (SPSIRE) underperforming the broader index in the latter half of the year. Investors are displaying a clear preference for defensive sectors and companies with strong balance sheets that can weather a downturn in consumer demand. The perceived risk associated with consumer discretionary stocks has risen significantly, leading to multiple expansion in staples and healthcare sectors.

Q4 earnings reports for the retail sector will be critical. Analysts are focusing on several key metrics beyond simple revenue: gross margin performance (indicating the severity of discounting), inventory levels (signaling future markdown risk), and guidance for the fiscal year 2025. Any indication of sustained margin pressure or unexpected weakness in the high-income consumer segment could trigger sharp sell-offs. Conversely, companies that demonstrate effective cost control and successful inventory reduction strategies may see a positive re-rating, even if sales volumes are flat.

Defensive positioning and credit risk monitoring

In this environment of weakening consumer demand, many institutional investors are adopting defensive positioning. Portfolios are being rebalanced toward consumer staples (e.g., Procter & Gamble, Walmart—which benefit from necessity spending) and away from cyclical discretionary names. Furthermore, the financial sector is being carefully monitored for signs of rising credit risk, particularly within portfolios exposed to unsecured consumer debt.

Banks and credit card issuers are reporting a measurable uptick in delinquency rates, particularly among subprime and near-prime borrowers. While overall credit quality remains manageable, the trend is concerning. If the projected drop in holiday spending materializes, leading to job market deterioration in early 2025, credit losses could accelerate. This is a critical factor for investors in financial institutions, as rising loan loss provisions could significantly impact Q1 and Q2 2025 earnings. Analysts at Bank of America have highlighted that the trajectory of credit card charge-offs will be a more important indicator than retail sales figures for the broader health of the US economy in the first quarter of next year.

- Retail Stock Performance: Underperformance expected from mid-tier and specialty retailers; relative strength in discount and luxury segments.

- Lender Delinquency Rates: Monitoring Q4 and Q1 data for increases in credit card and auto loan charge-offs as consumer stress mounts.

- Defensive Sector Outperformance: Expected continued rotation into consumer staples, utilities, and healthcare due to their non-cyclical revenue streams.

- Valuation Compression: Discretionary stocks facing lower P/E multiples as earnings uncertainty grows and growth forecasts are cut.

Policy outlook and the federal reserve’s dilemma

The sharp decline in confidence and the anticipation of a retail slump complicate the Federal Reserve’s monetary policy path. While the Fed’s primary mandate is price stability (controlling inflation), evidence of severely weakening demand—such as the projected drop in holiday spending—raises concerns about potential over-tightening leading to a deeper economic contraction. The Fed is caught between persistent inflation in services and clear signs of fragility in the consumer sector.

If Q4 data confirms the substantial drop in consumption, pressure will mount on the Federal Open Market Committee (FOMC) to halt further rate hikes and potentially signal rate cuts sooner than anticipated. However, core inflation metrics must show a convincing downward trajectory before the Fed can pivot. For the time being, the market is pricing in a high probability of a rate pause at the next meeting, reflecting the dual pressures of inflation and slowing growth caused by the steep consumer confidence declining trend.

The forward path for monetary policy

Should the holiday season prove weaker than even the most conservative estimates, the narrative will quickly shift from a “soft landing” to a potential recessionary scenario. This would force the Fed to consider its options, potentially prioritizing economic stability over the final push to 2% inflation. However, Fed Chair Jerome Powell has consistently emphasized that premature easing risks re-igniting inflation, suggesting a cautious approach even in the face of slowing growth. The market will be analyzing the minutes from the December FOMC meeting for any subtle shifts in the committee’s forward guidance regarding the trade-off between growth and inflation control.

Furthermore, fiscal policy remains a wild card. With high government debt levels and political gridlock, major fiscal stimulus to offset weak consumer demand is unlikely in the short term. Therefore, the immediate burden of managing the economic slowdown falls primarily on monetary policy, making the Fed’s communication throughout Q4 and Q1 2025 paramount to market stability. The confluence of high debt service costs, student loan repayments, and reduced optimism means that the consumer is unlikely to be the engine of growth in the near future, reinforcing the need for policy vigilance.

| Key Factor/Metric | Market Implication/Analysis |

|---|---|

| Consumer Confidence Index Drop (28%) | Leading indicator for reduced discretionary spending; forecasts real contraction in holiday retail volumes. |

| Credit Card APR (Average 21.5%) | Record-high borrowing costs severely limit credit-dependent holiday purchases and increase consumer debt service burdens. |

| Retail Inventory Overhang (Q4 Start) | Forces aggressive discounting, leading to significant margin compression for mid-tier and specialty retailers. |

| Student Loan Payment Restart | Removes $8B-$10B monthly from the consumer economy, disproportionately impacting younger, middle-income shoppers. |

Frequently Asked Questions about Consumer Confidence Declining and Holiday Spending

A decline in confidence directly signals lower future sales expectations, particularly for cyclical consumer discretionary stocks. This leads to reduced price-to-earnings (P/E) valuations, increased short interest, and investor rotation into defensive sectors like consumer staples and utilities, which are buffered from spending volatility.

Mid-tier apparel, electronics (outside of major new product launches), and home goods face the highest risk. These sectors rely heavily on discretionary spending funded by credit or excess savings, two resources currently under significant strain due to high rates and inflation.

Analysts are closely monitoring the household debt service ratio, which measures debt payments relative to disposable income. A rising ratio confirms that more income is diverted to interest, leaving less for holiday shopping, reinforcing the expected drop in discretionary consumption.

Investors should favor companies catering to the high-income consumer (luxury goods) or the necessity shopper (discount retailers and staples). Avoid companies overly reliant on the squeezed middle-income demographic unless they demonstrate superior operational efficiency and strong pricing power to offset lower volumes.

A sustained decline in confidence and sharp drop in spending increases pressure on the Fed to pause or eventually cut rates to support growth. However, cuts are unlikely until core inflation metrics convincingly move toward the 2% target, indicating the Fed’s focus remains dual-mandate driven.

The bottom line: navigating constrained consumer demand

The confluence of a 28% drop in consumer confidence, record-high credit costs, and the reintroduction of student loan payments has fundamentally altered the outlook for the US economy, ensuring that holiday spending is expected to drop significantly this year. This is not merely a cyclical slowdown but a structural shift driven by persistent inflation and restrictive monetary policy. For corporations, the coming quarters will heavily test operational resilience, demanding aggressive inventory management, cost control, and a sharp focus on retaining pricing power without alienating increasingly budget-constrained consumers. Investors must acknowledge the K-shaped nature of the current economy, favoring defensive positions and companies with robust balance sheets that can navigate a period of constrained demand. While the Federal Reserve hopes for a soft landing, the steep decline in confidence suggests that the path ahead for consumption, the largest component of US GDP, is fraught with risk, requiring market participants to maintain vigilance regarding credit risk and margin erosion throughout Q4 and into the first half of 2025.