Inflation at 3.0%: Protect Purchasing Power Now

As the Consumer Price Index (CPI) stabilizes near the 3.0% annual rate, investors must pivot strategies towards real assets and income-generating securities to effectively mitigate the corrosive effects of sustained inflation on long-term protect purchasing power.

The latest data from the Bureau of Labor Statistics (BLS) confirms that the annual inflation rate, as measured by the Consumer Price Index (CPI), remains anchored near 3.0% as of Q3 2024. While this rate is significantly lower than the peak of over 9% seen in mid-2022, it is substantially above the Federal Reserve’s long-term 2% target, signaling a persistent, structural challenge to financial stability.

This sustained 3.0% inflation means that the cost of goods and services is compounding, effectively eroding 3 cents of every dollar held in cash or low-yielding accounts each year. For individuals and institutions managing long-term capital, understanding how to protect purchasing power in this new economic regime is paramount, requiring strategic portfolio adjustments away from traditional fixed-income reliance toward inflation-sensitive assets.

The Economic Context of Sustained 3.0% Inflation

The persistence of the 3.0% inflation rate is not merely a statistical anomaly; it reflects underlying structural shifts in the global economy, including supply chain reconfigurations, tighter labor markets, and elevated geopolitical risk premiums on commodities. The Federal Reserve has clearly communicated that while it is committed to achieving the 2% target, the path is proving stickier than initially projected, largely due to resilient consumer demand and rising shelter costs, which account for roughly one-third of the CPI basket.

Analysts at Goldman Sachs project that core CPI will average 2.8% through 2025, suggesting that this 3.0% environment is likely to be the new baseline rather than a transient phase. This sustained level means that an investment portfolio must generate a nominal return of at least 3.0% just to break even in real terms, fundamentally altering the risk-reward calculus for capital preservation strategies.

Historically, a 3.0% inflation rate was considered manageable, but when combined with volatile market conditions and higher interest rates (the effective federal funds rate currently sits between 5.25% and 5.50%), the challenge of achieving real returns intensifies. The primary risk for long-term savers is the silent erosion of wealth.

A fixed income portfolio yielding 4.5% is only providing a 1.5% real return (4.5% nominal return minus 3.0% inflation), which is insufficient for many retirement and savings goals. Therefore, the strategic mandate is to identify and integrate assets that possess inherent inflation-hedging characteristics, focusing on tangible resources and businesses with strong pricing power. The ability of a company to pass on increased costs to consumers is a critical metric in this environment, differentiating potential winners from losers.

Analyzing Inflation Drivers Beyond Energy

While headline inflation often fluctuates with energy prices, the current 3.0% environment is increasingly driven by non-discretionary categories. The sticky nature of services inflation, particularly wages and housing, presents a long-term challenge for central banks. According to data from the Atlanta Fed’s Wage Growth Tracker, median wage growth remains elevated above 4.5%, sustaining upward pressure on business input costs. This suggests that the disinflationary forces seen elsewhere have not fully permeated the core service sector. Furthermore, fiscal policy remains expansionary in several key economies, adding demand-side pressure that counteracts the Fed’s monetary tightening efforts.

- Shelter Costs: Owner’s Equivalent Rent (OER) continues to lag real-time housing market data but is projected to keep core inflation elevated well into 2025, acting as a structural anchor near 3.0%.

- Labor Market Resilience: Low unemployment (currently near 3.8%) and high job openings maintain wage inflation, forcing companies to increase prices to maintain margin integrity.

- Geopolitical Risk: Ongoing conflicts and trade tensions introduce volatility into commodity and supply chain pricing, preventing a smooth return to pre-pandemic disinflationary trends.

The consequence of this sustained 3.0% inflation is a necessity for investors to move beyond passive asset allocation. The traditional 60/40 portfolio structure, heavily reliant on bonds for stability, is under severe stress because fixed-rate bonds lose real value rapidly in an inflationary environment. Protecting capital now requires active management and a deliberate tilt toward assets with either contractual or inherent linkage to price increases, ensuring that nominal returns outpace the 3.0% threshold. This sets the stage for the three core strategies detailed below, each designed to optimize returns when the cost of living persistently rises.

Strategy 1: Leveraging Real Assets and Tangible Investments

The first and perhaps most historically reliable strategy to protect purchasing power against persistent inflation is the allocation to real assets. Real assets are tangible physical properties that typically maintain or increase their value as the cost of living rises because their replacement cost increases with inflation. This category includes physical commodities, real estate, infrastructure, and natural resources. Unlike financial assets like stocks or bonds, which represent claims on future cash flows, real assets offer a direct hedge against rising input costs and currency debasement. When the CPI increases by 3.0%, the value of the underlying materials—lumber, copper, oil, and land—often appreciates commensurately.

The Role of Real Estate and REITs in Inflation Hedging

Real estate, particularly income-producing property, is a highly effective inflation hedge. Land is a finite resource, and rising construction costs (labor, material) push up the values of existing structures. Crucially, commercial and residential leases often contain clauses that allow rents to be adjusted annually, either linked to the CPI or based on fixed annual escalators (typically 2% to 4%). This provides a predictable stream of cash flow that grows alongside or slightly above the inflation rate. For investors seeking liquidity, Real Estate Investment Trusts (REITs) offer diversified exposure without the direct management burden of physical property. Industrial and residential REITs, in particular, exhibit strong correlation with inflation movements.

Analysis by NCREIF (National Council of Real Estate Investment Fiduciaries) shows that private real estate returns have historically exceeded the CPI by an average of 1.5 to 2.0 percentage points over rolling 20-year periods. This outperformance is critical when protect purchasing power is the core objective. However, not all real estate segments behave identically; high-quality, essential infrastructure assets (e.g., cell towers, pipelines) tend to offer more stable, inflation-linked cash flows than highly cyclical sectors like retail or hospitality.

- Commodity Exposure: Direct investment in commodities (e.g., through futures contracts or commodity ETFs) provides immediate linkage to raw material price inflation, though volatility is high.

- Timberland and Farmland: These assets offer biological growth returns alongside inflationary appreciation of the underlying land, providing dual sources of real return.

- Infrastructure Funds: Many infrastructure projects (toll roads, utilities) have regulated pricing structures that are explicitly linked to the CPI, ensuring revenue automatically adjusts to inflation.

While real assets offer robust protection, investors must acknowledge the trade-off in liquidity. Direct property holdings are illiquid, and commodity investments are inherently volatile. The strategic use of REITs and infrastructure funds mitigates the liquidity risk while capturing the essential inflation-hedging benefits needed to sustain real wealth growth above the 3.0% inflation hurdle.

Strategy 2: Focusing on Dividend Growth and Pricing Power

The second essential strategy involves careful selection within the equity markets, specifically targeting companies that possess demonstrable pricing power and a history of robust dividend growth. In a 3.0% inflation environment, equity returns become bifurcated: companies that can absorb rising input costs without affecting margins will outperform those that cannot. Pricing power, the ability to raise prices without a significant drop in sales volume, is the key differentiator. This characteristic is typically found in firms with strong brands, essential services, or quasi-monopolistic market positions.

Identifying Companies with Durable Competitive Advantages

Companies with durable competitive advantages, often termed ‘wide-moat’ businesses, are best positioned to thrive. Consumer staples, healthcare providers, and certain technology platforms often fall into this category. When inflation pushes the cost of production up, these firms can implement price increases that preserve or even expand their profit margins. This margin protection is crucial because stock prices are fundamentally tied to future earnings. If earnings shrink in real terms, the stock price will likely suffer, even if the nominal price increases slightly.

Furthermore, focusing on dividend growth stocks—companies that consistently increase their dividend payments year over year—provides a growing income stream that can offset inflation’s effect on consumption expenditures. According to data tracked by S&P Global, companies that consistently grew their dividends outperformed the broader S&P 500 index during periods where inflation exceeded 2.5%. For example, a company increasing its dividend by 7% annually offers a 4% real income growth rate when inflation is 3.0%, effectively shielding the investor’s income stream.

- Free Cash Flow (FCF) Analysis: Prioritize companies generating high and stable FCF, as this is the raw material for sustained dividend increases and capital expenditures.

- Low Debt Ratios: Companies with manageable debt burdens are less sensitive to rising interest rates, which often accompany persistent inflation, safeguarding their ability to fund dividend payments.

- Global Diversification: Companies with broad international revenue streams can sometimes benefit from currency fluctuations or different regional inflation dynamics, diversifying risk.

Investors should look beyond simple dividend yield and scrutinize the dividend growth rate and the payout ratio (dividends as a percentage of earnings). A high yield with no growth is a static income stream that will lose 3.0% of its real value annually. Conversely, a lower current yield combined with aggressive, sustainable growth is superior for long-term real wealth accumulation. This approach ensures that the equity portion of the portfolio is actively contributing to the effort to protect purchasing power, rather than being passively exposed to inflationary pressures.

Strategy 3: Dynamic Fixed Income and Inflation-Linked Securities

While conventional wisdom suggests bonds suffer most during inflation, Strategy 3 involves a nuanced, dynamic approach to fixed income, focusing on securities explicitly designed to counter inflation or those with shorter durations that allow for faster reinvestment at higher rates. Given the current 3.0% inflation rate, holding long-duration fixed-rate Treasury bonds yielding only 4.2% (as of recent data) guarantees a modest real return, but locks the investor into a low real-rate environment. The key is flexibility and direct linkage to the CPI.

Utilizing Treasury Inflation-Protected Securities (TIPS)

Treasury Inflation-Protected Securities (TIPS) are the quintessential instrument for hedging against unexpected inflation. The principal value of a TIPS bond is adjusted semi-annually based on changes in the CPI. If inflation is 3.0%, the principal value of a $1,000 TIPS bond increases to $1,030 over the year, and the fixed coupon rate is paid on this adjusted principal. This feature makes TIPS a powerful tool for preserving the real value of capital. While the real yield on TIPS (the stated interest rate) may be low or even negative in some market conditions, the total return, including the inflation adjustment, is explicitly designed to keep pace with the cost of living.

Beyond TIPS, dynamic fixed income strategies involve actively managing duration. Shorter-duration bond funds (average maturity under 3 years) are less sensitive to interest rate hikes and allow capital to be reinvested more frequently as the Federal Reserve potentially raises rates further to combat persistent inflation. This maneuverability is crucial in an environment where inflation expectations are volatile. Furthermore, floating-rate notes, where the coupon payment adjusts periodically based on a benchmark rate like SOFR (Secured Overnight Financing Rate), can provide protection, as the income stream rises alongside general interest rates, which often correlate with inflation.

- Short-Duration Bonds: Minimize interest rate risk and maximize reinvestment opportunities, ensuring capital is not locked into suboptimal yields.

- Floating-Rate Securities: Income streams automatically adjust upwards in response to higher benchmark rates, offering a degree of inflation defense through income growth.

- High-Quality Corporate Credit: Selectively investing in short-to-intermediate term investment-grade corporate bonds can provide a higher yield buffer against 3.0% inflation compared to government bonds, provided the issuer’s credit quality is robust.

The goal of this strategy is not necessarily to generate high nominal returns but to ensure the fixed-income allocation fulfills its primary mandate: preserving capital’s real value. By incorporating TIPS and maintaining low duration, the fixed-income portion of the portfolio acts as a resilient buffer, helping the overall strategy protect purchasing power effectively against the ongoing 3.0% inflationary pressure.

Assessing Risk and Portfolio Diversification

Effective wealth management in a sustained 3.0% inflation environment requires not just identifying the right assets, but also managing the inherent risks associated with these inflation hedges. While real assets and dividend growers offer strong protection, they introduce new volatilities and liquidity concerns. Commodities are notoriously volatile, and real estate markets can suffer from cyclical downturns or abrupt changes in local zoning laws. Therefore, diversification across the three strategies is essential to smooth out returns and mitigate idiosyncratic risks.

The Importance of Correlation and Non-Traditional Assets

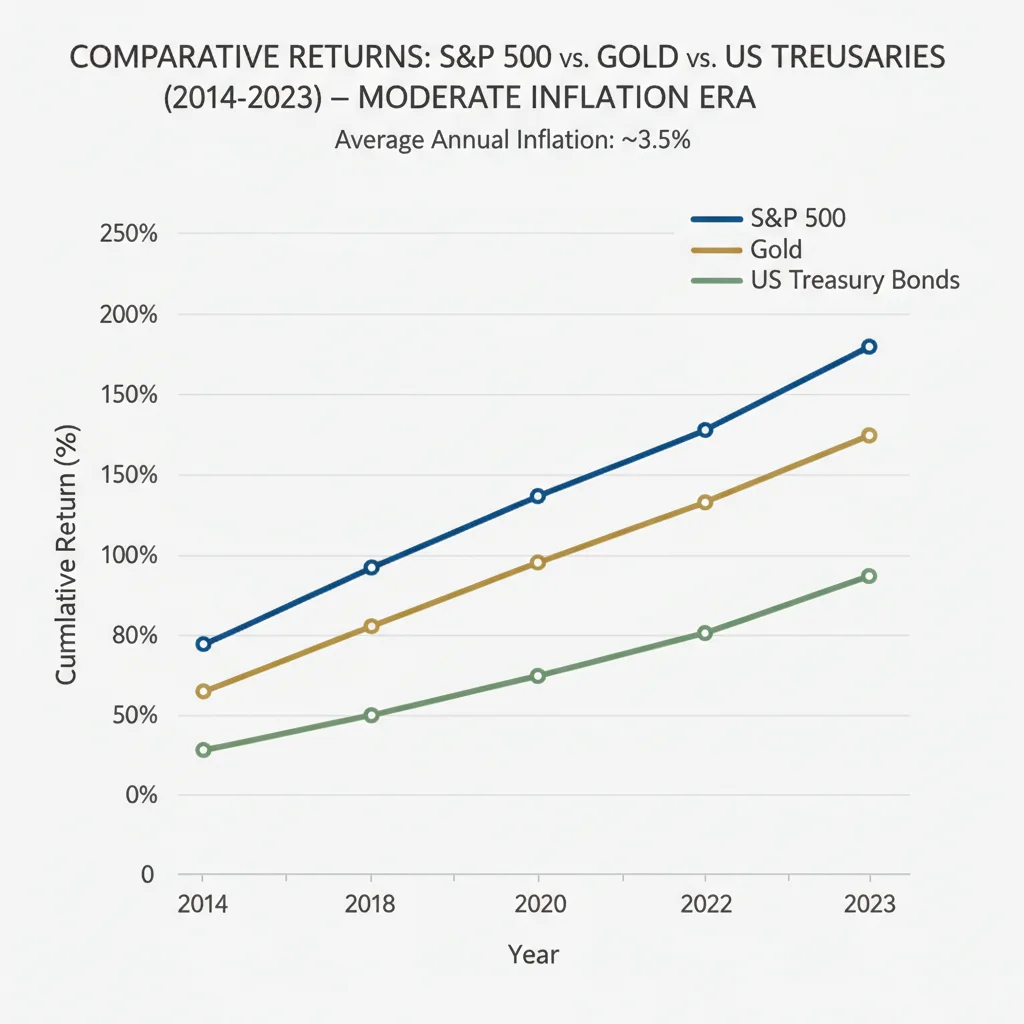

When constructing an inflation-resilient portfolio, investors must examine the correlation between their chosen assets. Gold, often viewed as the ultimate inflation hedge, historically exhibits a low or negative correlation with both equities and bonds, making it valuable for diversification. However, gold’s performance is driven more by real interest rates and dollar strength than by current inflation rates, meaning its returns can be inconsistent. Data from the World Gold Council confirms that while gold performed well during high inflation shocks (e.g., the 1970s), its utility is primarily as a tail-risk hedge rather than a consistent 3.0% inflation protector.

Analysts at BlackRock suggest maintaining a 5% to 10% allocation to non-traditional assets, including precious metals and certain alternative strategies (e.g., long/short equity funds designed for absolute returns), to provide convexity when traditional assets fail to perform. This small allocation acts as portfolio insurance, ensuring that the overall strategy remains robust even if one component, such as the dividend growth sector, faces unexpected margin compression. The balanced application of all three strategies—Real Assets (Strategy 1), Dividend Growth (Strategy 2), and Dynamic Fixed Income (Strategy 3)—creates a comprehensive defense structure, reducing reliance on any single asset class to achieve the goal of preserving real wealth.

- Liquidity Management: Balance illiquid real assets (e.g., private equity real estate) with highly liquid instruments (e.g., TIPS ETFs, large-cap dividend stocks) to ensure portfolio accessibility.

- Tax Efficiency: Consider the tax implications of inflation-linked securities; TIPS adjustments are often taxable in the year they occur, even if the cash is not received until maturity.

- Rebalancing Discipline: Inflation hedges can become overvalued during market upswings. Regular rebalancing back to target allocations ensures risk exposure remains appropriate and captures profits from outperforming sectors.

Ultimately, managing a portfolio against sustained 3.0% inflation is a continuous process of calibration. It requires moving capital into assets whose intrinsic value or cash flow streams naturally rise with the cost of living, while simultaneously ensuring that the portfolio remains diversified and aligned with long-term risk tolerance and liquidity needs.

The Impact on Retirement Planning and Long-Term Goals

The enduring 3.0% inflation rate poses a significant, often underestimated, threat to retirement security and long-term financial goals. For a 30-year-old planning to retire in 35 years, 3.0% annual inflation means that the cost of living at retirement will be approximately 2.8 times higher than today. A retirement income goal of $100,000 today would require nearly $281,000 annually in nominal terms in 35 years just to maintain the same purchasing power. This stark reality underscores why passive acceptance of low real returns is unacceptable.

Adjusting Savings Rates and Withdrawal Strategies

Financial modeling must be updated to reflect this higher inflation baseline. Whereas planners previously used a 2.0% inflation assumption, the new 3.0% benchmark necessitates either higher expected investment returns or, more realistically, increased savings rates. According to Fidelity’s retirement planning models, increasing the assumed inflation rate from 2.0% to 3.0% can require an individual to increase their annual savings contribution by 10% to 15% to hit the same real wealth target. This is the quantifiable cost of persistent inflation.

Furthermore, retirement withdrawal strategies must also adapt. The traditional ‘4% rule’—withdrawing 4% of the portfolio value in the first year, indexed by inflation thereafter—becomes riskier in a high-inflation, high-interest-rate environment. Elevated inflation means the nominal withdrawal amounts rise faster, placing greater strain on the portfolio’s longevity, particularly in early retirement years. Analysts at Morningstar suggest that a more conservative initial withdrawal rate, potentially closer to 3.5%, coupled with a dynamic withdrawal strategy tied to market performance, may be necessary to mitigate sequence-of-returns risk when inflation remains stubbornly high.

- Healthcare Costs: Medical expenses, which typically inflate faster than the general CPI, require specific planning. The average medical inflation rate has often exceeded 5.0% annually, demanding higher allocations to health savings accounts (HSAs) or dedicated healthcare savings vehicles.

- Pension Erosion: Fixed pension and annuity payments that lack explicit CPI adjustments will suffer severe real value degradation, necessitating supplementary investment strategies focused on growth.

- Longevity Risk: Higher inflation accelerates the need for capital growth, increasing the risk tolerance required in earlier years of saving to ensure the portfolio can sustain itself over potentially longer lifespans.

In essence, the 3.0% inflation rate transforms long-term planning from a simple accumulation exercise into a complex balancing act between growth, capital preservation, and inflation mitigation. The strategies outlined—real assets, dividend growth, and dynamic fixed income—are not just investment choices; they are fundamental requirements for safeguarding the eventual success of long-term financial independence.

Monitoring Key Economic Indicators and Federal Reserve Policy

For investors implementing strategies to protect purchasing power, continuous monitoring of key economic indicators and Federal Reserve communications is critical. The 3.0% inflation rate is a target, not a guarantee, and shifts in monetary policy or global economic conditions could rapidly alter the required investment response. The Fed’s dual mandate—maximum employment and price stability—means that policy decisions often balance competing risks, leading to nuanced guidance that requires careful interpretation by market participants.

Indicators Requiring Immediate Attention

Investors should focus on leading indicators that signal whether inflation is accelerating or decelerating away from the 3.0% baseline. The Producer Price Index (PPI), which measures input costs for businesses, often provides an early warning signal for future consumer price changes. A sustained increase in PPI, particularly in core manufacturing inputs, suggests businesses will soon pass those costs onto consumers, potentially pushing CPI above 3.0% and demanding a heavier allocation to real assets.

Additionally, tracking inflation expectations is crucial. The University of Michigan’s Survey of Consumers and the Treasury’s five-year and ten-year break-even inflation rates (derived from TIPS yields versus Treasury yields) reveal how consumers and bond markets anticipate future price increases. If break-even rates rise significantly above 2.5%, it confirms market belief in persistent inflation and reinforces the need for hedges. Conversely, if they dip, it may signal an environment where nominal growth stocks become more attractive than pure inflation plays.

- Core PCE vs. CPI: The Fed favors the Core Personal Consumption Expenditures (PCE) index. Monitoring the gap between Core PCE and CPI provides insight into the Fed’s likely reaction function regarding interest rates.

- Labor Participation Rate: Increases in the labor participation rate could ease wage pressure, potentially leading to disinflation in service costs, easing the 3.0% challenge.

- Global Commodity Inventories: Tracking the inventory levels of key industrial commodities (e.g., copper, crude oil) provides a leading indicator of future supply-driven inflation shocks.

The ultimate success of any inflation-protection strategy hinges on timely adjustments based on data. If the Fed signals a successful return to 2.0% inflation, the capital allocated to TIPS or commodities may need to be rotated back into growth-oriented equities or nominal corporate bonds. If inflation accelerates toward 4.0%, the defensive posture must be strengthened further. This necessitates an analytical, rather than passive, approach to portfolio construction and management.

| Key Factor/Metric | Market Implication/Analysis |

|---|---|

| Sustained 3.0% CPI | Requires nominal portfolio returns exceeding 3.0% just to maintain the real value of capital; cash holdings guarantee real losses. |

| Real Assets Allocation | Tangible assets (REITs, commodities) offer inherent inflation hedging, as their value or cash flows (rents) adjust with rising costs. |

| Dividend Growth Stocks | Companies with strong pricing power can pass on cost increases, ensuring their earnings and dividend payments grow faster than the 3.0% inflation rate. |

| TIPS and Short Duration | Fixed income must be dynamically managed; TIPS principal adjusts with CPI, while short duration allows timely reinvestment at higher yields. |

Frequently Asked Questions about Protecting Purchasing Power

A 3.0% inflation rate means the real value of cash held in a standard checking or low-yield savings account declines by 3.0% annually. To mitigate this, emergency funds should ideally be housed in high-yield savings accounts or short-term Treasury bills currently yielding above 5.0%, ensuring a positive real return.

No. While all real assets generally hedge inflation, those with direct contractual links, like infrastructure assets with CPI-indexed fees, are superior to highly cyclical commodities. Diversification across real assets is key to balancing volatility and protection.

Value stocks, especially those with strong free cash flow and low debt (often associated with Strategy 2’s dividend growth focus), typically outperform during moderate inflation cycles because their near-term earnings are less discounted by higher interest rates than long-duration growth stocks.

The primary risk is that TIPS only protect against *unexpected* inflation. If the actual CPI is 3.0% as expected, the returns may be low. Furthermore, TIPS are still sensitive to changes in real interest rates, meaning their market price can fluctuate significantly before maturity.

Inflation erodes the real value of fixed-rate debt. Prioritize locking in fixed-rate mortgages or loans, as the real burden of repayment decreases over time. Avoid high-interest variable-rate debt, which may increase further if the Fed raises rates to combat inflation.

The Bottom Line

The anchoring of the US inflation rate near 3.0% represents a decisive shift from the disinflationary decades that preceded the pandemic. This persistent level of price increase demands a proactive, multi-faceted investment approach focused explicitly on preserving real wealth. The three strategies—allocating to real assets, selecting equities based on dividend growth and pricing power, and utilizing dynamic fixed income tools like TIPS and short-duration bonds—provide a robust framework for navigating this new economic reality. Investors who fail to adjust their portfolios risk compounding real capital losses over time, severely jeopardizing long-term financial objectives. Going forward, market participants must closely monitor core inflation metrics and Federal Reserve guidance, prepared to recalibrate their allocations if CPI trends show sustained movement above or below the 3.0% threshold. The era of passive reliance on traditional asset classes to deliver inflation-beating returns is over; active, data-driven defense is now the mandate to successfully protect purchasing power.