The Future of Savings: How Blockchain is Revolutionizing Finance

The Future of Savings: Exploring Blockchain-Based Financial Solutions reveals how blockchain technology is transforming traditional savings methods by offering enhanced security, transparency, and potentially higher returns through decentralized platforms and innovative financial instruments.

The traditional concept of saving is undergoing a significant transformation, thanks to the advent of blockchain technology. The Future of Savings: Exploring Blockchain-Based Financial Solutions delves into how this revolutionary technology is reshaping the financial landscape, offering new avenues for individuals to save, invest, and manage their assets with greater security and efficiency.

Blockchain and the Evolution of Savings

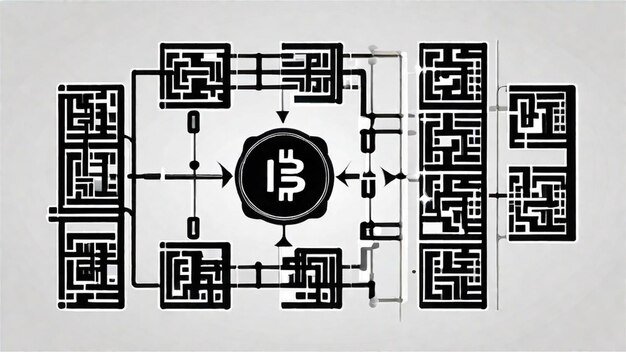

Blockchain technology, originally conceived as the backbone for cryptocurrencies like Bitcoin, is now finding applications far beyond its initial purpose. Its potential to revolutionize various industries, including finance, has become increasingly apparent. When it comes to savings, blockchain offers a paradigm shift from traditional methods, presenting opportunities for enhanced security, transparency, and accessibility.

Understanding Blockchain Basics

Before diving into the specifics of how blockchain is impacting savings, it’s crucial to understand the fundamental principles behind this technology. In essence, a blockchain is a distributed, decentralized, public ledger that records transactions across many computers. This decentralized nature makes it incredibly difficult for anyone to alter or tamper with the data, providing a high level of security.

- Decentralization: No single entity controls the blockchain, reducing the risk of censorship or manipulation.

- Transparency: All transactions are recorded on a public ledger, making them easily auditable.

- Security: Cryptographic techniques are used to secure the blockchain, making it highly resistant to hacking.

- Immutability: Once data is recorded on the blockchain, it cannot be altered or deleted.

These core features of blockchain technology make it an attractive alternative to traditional savings methods, which are often centralized, opaque, and vulnerable to security breaches.

In conclusion, blockchain technology offers a compelling alternative to traditional savings methods. Its decentralized, transparent, and secure nature presents opportunities for individuals to manage their finances with greater control and confidence.

Decentralized Finance (DeFi) and Savings Accounts

One of the most exciting applications of blockchain technology in the financial realm is Decentralized Finance (DeFi). DeFi aims to recreate traditional financial services, such as lending, borrowing, and savings, on a decentralized, permissionless platform. This has led to the emergence of innovative blockchain-based savings accounts that offer several advantages over traditional banking accounts.

Key Features of DeFi Savings Accounts

DeFi savings accounts operate on smart contracts, which are self-executing contracts written in code and stored on the blockchain. These smart contracts automate the process of earning interest on deposited funds, eliminating the need for intermediaries like banks. Here are some of the key features of DeFi savings accounts:

- Higher Interest Rates: DeFi platforms often offer significantly higher interest rates compared to traditional savings accounts due to reduced overhead costs and increased competition.

- Accessibility: DeFi savings accounts are accessible to anyone with an internet connection and a cryptocurrency wallet, regardless of their geographic location or credit history.

- Transparency: All transactions and interest rates are transparently recorded on the blockchain, allowing users to verify the legitimacy of the platform.

- Control: Users retain full control over their funds and can withdraw them at any time without penalties.

DeFi savings accounts are revolutionizing the way people save and earn interest on their money. By leveraging blockchain technology, these platforms offer a more efficient, transparent, and accessible alternative to traditional banking.

In summary, DeFi savings accounts provide a compelling alternative to traditional banking, offering higher interest rates, greater accessibility, and enhanced transparency. These features are attracting a growing number of users who are seeking to take control of their financial future.

Stablecoins and Their Role in Savings

Stablecoins are a type of cryptocurrency designed to maintain a stable value relative to a traditional asset, such as the US dollar. This stability makes them an attractive option for savings, as they offer the benefits of cryptocurrencies without the extreme price volatility. By combining the stability of fiat currencies with the advantages of blockchain, stablecoins are transforming the way individuals save and manage their funds.

Advantages of Saving with Stablecoins

Stablecoins offer several advantages over traditional fiat currencies when it comes to saving. One of the most significant benefits is the potential to earn higher interest rates on stablecoin deposits.

Many DeFi platforms offer attractive interest rates on stablecoins, often exceeding those offered by traditional savings accounts. This is due to the efficiency of blockchain technology, which eliminates the need for intermediaries and reduces overhead costs. Here are some additional benefits:

- Reduced Volatility: Stablecoins offer the stability of fiat currencies, mitigating the risk of price fluctuations associated with other cryptocurrencies.

- Global Accessibility: Stablecoins can be easily transferred across borders, making them ideal for individuals who need to send or receive money internationally.

- Diversification: Stablecoins can be used to diversify a savings portfolio, reducing overall risk.

- Inflation Hedge: In countries with high inflation rates, stablecoins can serve as a hedge against currency devaluation.

Saving with stablecoins offers a unique blend of stability, accessibility, and potential for higher returns, making them an increasingly popular choice for individuals seeking to optimize their savings strategies.

In conclusion, stablecoins are emerging as a viable alternative to traditional savings methods. Their stability, global accessibility, and potential for higher returns make them an attractive option for individuals seeking to protect their capital and grow their wealth.

Risks and Challenges of Blockchain-Based Savings Solutions

While blockchain-based savings solutions offer numerous advantages, it’s essential to acknowledge the inherent risks and challenges associated with this emerging technology. Understanding these potential pitfalls is crucial for individuals looking to adopt blockchain-based savings strategies.

Navigating the Uncertainties

One of the primary concerns is the regulatory uncertainty surrounding cryptocurrencies and DeFi. Governments around the world are still grappling with how to regulate these technologies. This uncertainty can create legal and compliance challenges for platforms offering blockchain-based savings solutions.

Potential Pitfalls

- Security Risks: Despite the inherent security of blockchain technology, DeFi platforms are still vulnerable to hacking and smart contract vulnerabilities.

- Volatility: While stablecoins aim to maintain a stable value, they are not entirely immune to volatility. De-pegging events, where a stablecoin loses its peg to its underlying asset, can occur and lead to losses.

- Complexity: Understanding DeFi protocols and smart contracts can be challenging for the average user. This complexity can deter some individuals from adopting blockchain-based savings solutions.

- Custodial Risks: Some DeFi platforms require users to deposit their funds with a third-party custodian. This introduces custodial risks, as users are entrusting their funds to another entity.

By acknowledging these risks and challenges, individuals can make more informed decisions about whether to adopt blockchain-based savings solutions and how to mitigate potential losses.

In summary, while blockchain-based savings solutions offer many potential benefits, it’s crucial to be aware of the risks and challenges involved. Regulatory uncertainty, security vulnerabilities, and complexity are among the factors that individuals should carefully consider before adopting these innovative financial strategies.

The Role of Smart Contracts in Automated Savings

Smart contracts are self-executing contracts written in code and stored on the blockchain. They play a critical role in automating various aspects of blockchain-based savings solutions, making them more efficient, transparent, and secure. By automating processes such as interest distribution and withdrawal requests, smart contracts eliminate the need for intermediaries and reduce the risk of human error.

Automating Savings with Precision

One of the key benefits of smart contracts is their ability to automate the distribution of interest payments to users. These contracts can be programmed to automatically distribute interest based on predefined rules and conditions, ensuring that users receive their earned interest promptly and accurately.

Smart contracts also enhance security by ensuring that all transactions are executed according to the terms of the contract. This reduces the risk of fraud or manipulation, as the contract cannot be altered or tampered with once it has been deployed on the blockchain. Here’s how they enhance security and automation:

- Automated Interest Distribution: Smart contracts automatically distribute interest payments to users based on predefined rules.

- Secure Transactions: Smart contracts ensure that all transactions are executed according to the terms of the contract, reducing the risk of fraud.

- Transparent Operations: The code of the smart contract is publicly auditable, allowing users to verify its legitimacy.

- Reduced Intermediary Risk: Smart contracts eliminate the need for intermediaries, reducing the risk of counterparty failure.

Smart contracts are essential for automating and securing blockchain-based savings solutions. Their ability to execute transactions and distribute interest payments without the need for intermediaries makes them a cornerstone of the DeFi ecosystem.

In conclusion, smart contracts are fundamental to the operation of blockchain-based savings solutions. Their ability to automate processes, enhance security, and ensure transparency makes them an indispensable tool for creating efficient and reliable financial platforms.

The Future Outlook: Blockchain and Mainstream Savings

As blockchain technology continues to mature and gain wider acceptance, its integration into mainstream savings solutions is becoming increasingly likely. The potential for blockchain to enhance security, transparency, and accessibility in the financial sector is undeniable, and a growing number of institutions are exploring ways to leverage this technology for the benefit of their customers.

Looking Ahead

One potential development is the creation of blockchain-based savings accounts offered by traditional banks. These accounts could offer higher interest rates, lower fees, and greater transparency compared to traditional savings accounts. Additionally, the use of blockchain technology could streamline processes such as KYC (Know Your Customer) and AML (Anti-Money Laundering), reducing the costs and complexities associated with regulatory compliance.

Increased adoption of blockchain-based savings solutions could lead to greater financial inclusion, particularly for individuals who are unbanked or underbanked. Here are a few future outlooks:

- Increased Adoption: Mainstream financial institutions may integrate blockchain technology into their savings products, offering customers enhanced security and transparency.

- Financial Inclusion: Blockchain-based savings solutions could provide access to financial services for individuals who are unbanked or underbanked.

- Regulatory Clarity: As governments develop clearer regulatory frameworks for cryptocurrencies and DeFi, adoption of blockchain-based savings solutions is likely to accelerate.

- Innovation: The continued development of DeFi protocols and smart contracts will lead to new and innovative savings solutions that offer higher returns and greater flexibility.

Blockchain technology has the potential to transform the financial landscape, making savings more accessible, efficient, and secure. As the technology continues to evolve, its integration into mainstream savings solutions is likely to become increasingly prevalent.

In conclusion, the future of savings is intertwined with the continued development and adoption of blockchain technology. Its potential to enhance security, transparency, and accessibility makes it a compelling force for innovation in the financial sector.

| Key Point | Brief Description |

|---|---|

| 🔐 Blockchain Security | Blockchain offers enhanced security through decentralization and cryptography. |

| 💰 DeFi Savings | DeFi savings accounts provide higher interest rates and greater accessibility. |

| 💲 Stablecoins | Stablecoins combine the stability of fiat with the benefits of blockchain. |

| 🤖 Smart Contracts | Smart contracts automate savings processes, enhancing efficiency and security. |

[FAQ]

What is blockchain technology?

▼

Blockchain is a decentralized, distributed, and public digital ledger used to record transactions across many computers, making it difficult to alter or hack the system.

How do DeFi savings accounts work?

▼

DeFi savings accounts operate on smart contracts that automate interest earnings on deposited funds, eliminating intermediaries and providing higher interest rates.

What are stablecoins and how are they used?

▼

Stablecoins are cryptocurrencies designed to maintain a stable value, typically pegged to a traditional asset like the US dollar, making them suitable for saving without high volatility.

What are the risks of blockchain-based savings?

▼

Risks include regulatory uncertainty, security vulnerabilities in DeFi platforms, potential volatility of stablecoins, and the complexity of understanding DeFi protocols.

How do smart contracts automate savings?

▼

Smart contracts automate interest distribution, ensure secure transactions, and provide transparent operations, reducing the need for intermediaries and lowering the risk of human error.

Conclusion

In conclusion, blockchain technology is poised to revolutionize the world of savings, offering enhanced security, transparency, and accessibility through DeFi platforms, stablecoins, and smart contracts. While risks and challenges remain, the potential benefits of blockchain-based savings solutions are undeniable, making them an increasingly attractive option for individuals seeking to optimize their financial future.